Microencapsulated Pesticides Market by Type (Herbicides, Insecticides, Fungicides, and Rodenticides), Technology (Physical, Physico-chemical, and Chemical), Application Sector (Agricultural and Non-agricultural), and Region - Global Forecast to 2022

[131 Pages Report] The microencapsulated pesticides market was estimated to reach USD 312.5 Million in 2017, and is projected to reach 539.5 Million by 2022, at a CAGR of 11.54% from 2017 to 2022.

The years considered for the study are as follows:

- Base year: 2016

- Estimated year: 2017

- Projected year: 2022

- Forecast period: 2017 to 2022

The objectives of the report

- Determining and projecting the size of microencapsulated pesticides market with respect to the core material types, technologies, application sectors, and regional markets, over the period ranging from 2017 to 2022

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share.

- Secondary research was conducted to find the value of microencapsulated pesticides market for regions such as North America, Europe, Asia Pacific, and RoW.

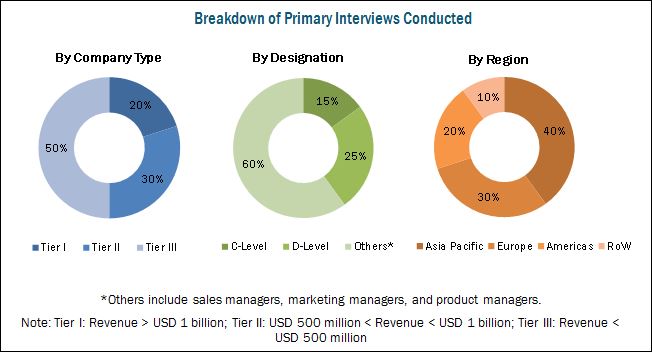

- The key players have been identified through secondary sources such as the United States Department of Agriculture (USDA), United States Environmental Protection Agency (EPA), Food and Agriculture Organization (FAO), and Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), while their market share in respective regions has been determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the microencapsulated pesticides market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the market include raw material suppliers, R&D institutes, microencapsulated pesticides manufacturing companies as Syngenta, BASF, Bayer AG, FMC Corporation, and Monsanto, and government bodies & regulatory associations such as the United States Department of Agriculture (USDA) and US Environmental Protection Agency (EPA).

Target Audience

The stakeholders for the report are as follows:

- Microencapsulated pesticides manufacturers and formulators

- Pesticide product traders, distributors, and suppliers

- Technical ingredient suppliers and technology providers to manufacturers

- Associations and research organizations

- Agricultural institutes and universities

- Consumers, including farmers

- Government, legislative, and regulatory bodies

- Pest control service providers

Scope of the Report:

This research report categorizes the global market based on type, technology, application sector, and region.

Based on Type, the market has been segmented as follows:

- Herbicides

- Insecticides

- Fungicides

- Rodenticides

- Others (nematicides, termiticides, acaricides, fumigants, and petroleum oils)

Based on Technology, the market has been segmented as follows:

- Physical

- Physico-chemical

- Chemical

Based on Application Industry, the market has been segmented as follows:

- Agricultural

- Non-agricultural

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW (South America, the Middle East, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of service portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific microencapsulated pesticides market into Australia, India, and Thailand.

- Further breakdown of the Rest of Asia Pacific microencapsulated pesticides market into the UK, Portugal, and the Netherlands.

- Further breakdown of the regions in the RoW microencapsulated pesticides market by Brazil, Argentina, Chile, Israel, Turkey, and South Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The microencapsulated pesticides market was estimated at USD 312.5 Million in 2017, and is projected to reach USD 539.5 Million by 2022, at a CAGR of 11.54%. The market is influenced by the adoption of integrated pest management (IPM) practices, along with the regulatory support for sustainable approach to limit excessive agrochemical application.

The market, based on type, has been segmented into herbicides, insecticides, fungicides, and rodenticides. The research & development of microencapsulated pesticides has been mainly concentrated on insecticides. Due to this trend and the registration & commercialization of new varieties of microencapsulated insecticides, the insecticide segment was estimated to account for a large share in the market in 2017.

The market, by technology, has been segmented into physical, physico-chemical, and chemical. The interfacial polymerization technology is widely being used for encapsulation of highly toxic pesticides such as insecticides and herbicides; owing to these reasons, chemical processes accounted for the largest share, in terms of value, in 2016.

The microencapsulated pesticides market, by application, has been segmented into agricultural and non-agricultural sectors. The agricultural industry dominated market in 2016, due to the increasing demand for microencapsulated pesticides, which help to reduce the application rate by 10-15 times as compared to traditional formulations such as emulsifiable concentrates and suspension concentrates.

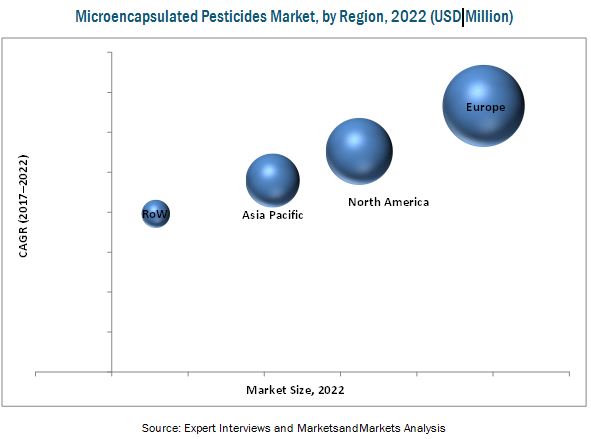

Europe accounted for the largest market share in 2016, and is also projected to be fastest-growing in the microencapsulated pesticides market in the next five years. The dominant share of the European region is attributed to the increasing ban on the usage of certain harmful chemicals in European countries, such as France and Germany.

The high production costs and farmers reluctance to adopt these novel methods in order to gain effective crop yield have been important restraining factors for the market growth.

The global market for microencapsulated pesticides is dominated by large-scale players such as BASF (Germany), Bayer AG (Germany), Syngenta (Switzerland), FMC Corporation (US), Monsanto (US), and ADAMA (Israel). BotanoCap (Israel), Arysta LifeScience (US), GAT Microencapsulation (Austria), Reed Pacific (Australia), and Belchim (Belgium) are a few other key market players that also have a significant share in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Market

4.2 Market, By Region

4.3 Europe: Microencapsulated Pesticides Market

4.4 Microencapsulated Pesticides Market, By Application Sector & Region

4.5 Market Share: Key Countries

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 Influence of Ipm Practices in the Application of Insecticides

5.2.2 Growth in Urban Population Density A Severe Risk on Public Health & Sanitation

5.2.3 Growth of Organized Livestock Farming & Pet Care Industry

5.2.4 Export-Import Scenario

5.2.4.1 Export Scenario for Insecticides

5.2.4.2 Import Scenario for Insecticides

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Sustainable Approach to Mitigate Environmental and Health Risks

5.3.1.1.1 Effective Way to Tackle Insecticide Resistance Among Pests

5.3.1.1.2 Assured Safety to Farmer Health

5.3.1.2 Controlled Release Technique to Enhance the Efficiency of Agricultural Operations

5.3.1.2.1 Implementation in No-Tillage Farming Systems

5.3.1.3 Issues Regarding Pesticide Mrls in Exported Agro-Commodities Resolved Through Microencapsulation Technology

5.3.2 Restraints

5.3.2.1 High Costs Involved in the Microencapsulation Process

5.3.2.2 Reluctance of Farmers to Adopt Microencapsulation

5.3.3 Opportunities

5.3.3.1 Technology Collaboration to Develop Cost-Effective Technologies

5.3.3.2 Increase in Growth of Professional Pest Control Management

5.3.4 Challenges

5.3.4.1 Technical Constraints Such as Storage and Localized Release of Pesticides

5.4 Regulatory Landscape

5.4.1 Us

5.4.1.1 Inert Ingredient Regulations and Guidance

5.4.1.2 Product Registration for Pesticides in the Us

5.4.2 Canada

5.4.2.1 Categorization of Formulants Currently in Use in Canada

5.4.2.2 Regulatory Action on Pest Control Products That Contain List 4b Formulants

5.4.2.3 Pesticide Regulation in Canada

5.4.3 Europe

5.4.3.1 Data Requirements for Plant Protection Products

5.4.3.2 Authorization of Biocidal Products

5.4.4 China

5.4.5 Australia

5.4.5.1 Regulation Process for Excipients in Australia

5.4.5.2 Approval of Active Constituents for Use in Australia

5.4.6 India

5.4.6.1 Data Requirements for Technical Ingredients

5.4.7 Brazil

5.5 Patent Analysis

6 Microencapsulated Pesticides Market, By Type (Page No. - 55)

6.1 Introduction

6.2 Insecticides

6.3 Herbicides

6.4 Fungicides

6.5 Rodenticides

6.6 Others

6.6.1 Nematicides

6.6.2 Termiticides, Acaricides, Fumigants, and Petroleum Oils

7 Microencapsulated Pesticides Market, By Application Sector (Page No. - 64)

7.1 Introduction

7.2 Agricultural

7.2.1 Crop Type

7.2.1.1 Cereals & Grains

7.2.1.2 Oilseeds & Pulses

7.2.1.3 Fruits & Vegetables

7.2.1.4 Other Crop Types

7.3 Non-Agricultural

7.3.1 Residential

7.3.2 Livestock

7.3.3 Industrial & Commercial

8 Microencapsulated Pesticides Market, By Technology (Page No. - 72)

8.1 Introduction

8.2 Physical

8.2.1 Spray Drying

8.2.2 Others

8.3 Physico-Chemical

8.3.1 Coacervation

8.3.2 Others

8.4 Chemical

8.4.1 Interfacial Polymerization

8.4.2 Others

9 Microencapsulated Pesticides Market, By Region (Page No. - 79)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 France

9.3.2 Italy

9.3.3 Spain

9.3.4 Germany

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 Rest of Asia Pacific

9.5 Rest of the World

9.5.1 South America

9.5.1.1 Brazil

9.5.1.2 Chile

9.5.1.3 Argentina

9.5.2 The Middle East & Africa

9.5.2.1 The Middle East

9.5.2.2 Africa

10 Competitive Landscape (Page No. - 102)

10.1 Overview

10.2 Company Ranking

10.3 Competitive Scenario

10.3.1 New Product Launches

10.3.2 Agreements, Partnerships, and Collaborations

10.3.3 Investments and Expansions

11 Company Profiles (Page No. - 105)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View)*

11.1 BASF

11.2 Bayer

11.3 Monsanto

11.4 Syngenta

11.5 ADAMA

11.6 FMC Corporation

11.7 Arysta Lifescience

11.8 GAT Microencapsulation

11.9 Botanocap

11.10 Mclaughlin Gormley King Company

11.11 Belchim

11.12 Reed Pacific

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

12 Appendix (Page No. - 125)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (71 Tables)

Table 1 USD Exchange Rates, 20142016

Table 2 Microencapsulation Methods, Cores, and Sizes of Capsules

Table 3 List of Important Patents for Microencapsulated Pesticides, 20112017

Table 4 Microencapsulated Pesticides Market Size, By Type, 20152022 (USD Million)

Table 5 Microencapsulated Pesticides Market Size, By Type, 20152022 (Tons)

Table 6 Insecticides: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 7 Insecticides: Market Size, By Region, 20152022 (Tons)

Table 8 Herbicides: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 9 Herbicides: Market Size, By Region, 20152022 (Tons)

Table 10 Fungicides: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 11 Fungicides: Market Size, By Region, 20152022 (Tons)

Table 12 Rodenticides: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 13 Rodenticides: Market Size, By Region, 20152022 (Tons)

Table 14 Other: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 15 Other: Market Size, By Region, 20152022 (Tons)

Table 16 Microencapsulated Pesticides Market Size, By Application Sector, 20152022 (USD Million)

Table 17 Microencapsulated Pesticides Market Size, By Application Sector, 20152022 (Tons)

Table 18 Agricultural Sector: Microencapsulated Pesticides Market Size, By Crop Type, 20152022 (USD Million)

Table 19 Agricultural Sector: Market Size, By Crop Type, 20152022 (Tons)

Table 20 Agricultural Sector: Market Size, By Region, 20152022 (USD Million)

Table 21 Agricultural Sector: Market Size, By Region, 20152022 (Tons)

Table 22 Non-Agricultural Sector: Microencapsulated Pesticides Market Size, By Subtype, 20152022 (USD Million)

Table 23 Non-Agricultural Sector: Market Size, By Subtype, 20152022 (Tons)

Table 24 Non-Agricultural Sector: Market Size, By Region, 20152022 (USD Million)

Table 25 Non-Agricultural Sector: Market Size, By Region, 20152022 (Tons)

Table 26 Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 27 Physical: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 28 Physical: Market Size, By Region, 20152022 (USD Million)

Table 29 Physico-Chemical: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 30 Physico-Chemical: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 31 Chemical: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 32 Chemical: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 33 Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 34 Market Size, By Region, 20152022 (Tons)

Table 35 North America: Microencapsulated Pesticides Market Size, By Country, 20152022 (USD Million)

Table 36 North America: Market Size, By Country, 20152022 (Tons)

Table 37 North America: Market Size, By Type, 20152022 (USD Million)

Table 38 North America: Market Size, By Type, 20152022 (Tons)

Table 39 North America: Market Size, By Technology, 20152022 (USD Million)

Table 40 US: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 41 Canada: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 42 Mexico: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 43 Europe: Microencapsulated Pesticides Market Size, By Country, 20152022 (USD Million)

Table 44 Europe: Market Size, By Country, 20152022 (Tons)

Table 45 Europe: Market Size, By Type, 20152022 (USD Million)

Table 46 Europe: Market Size, By Type, 20152022 (Tons)

Table 47 Europe: Market Size, By Technology, 20152022 (USD Million)

Table 48 France: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 49 Italy: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 50 Spain: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 51 Germany: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 52 Rest of Europe: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 53 Asia Pacific: Microencapsulated Pesticides Market Size, By Country, 20152022 (USD Million)

Table 54 Asia Pacific: Market Size, By Country, 20152022 (Tons)

Table 55 Asia Pacific: Market Size, By Type, 20152022 (USD Million)

Table 56 Asia Pacific: Market Size, By Type, 20152022 (Tons)

Table 57 Asia Pacific: Market Size, By Technology, 20152022 (USD Million)

Table 58 China: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 59 Japan: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 60 Rest of Asia Pacific: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 61 RoW: Microencapsulated Pesticides Market Size, By Region, 20152022 (USD Million)

Table 62 RoW: Market Size, By Region, 20152022 (Tons)

Table 63 RoW: Market Size, By Type, 20152022 (USD Million)

Table 64 RoW: Market Size, By Type, 20152022 (Tons)

Table 65 RoW: Market Size, By Technology, 20152022 (USD Million)

Table 66 South America: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 67 The Middle East & Africa: Microencapsulated Pesticides Market Size, By Technology, 20152022 (USD Million)

Table 68 Company Ranking, Microencapsulated Pesticides, 2016

Table 69 New Product Launches, 2013-2017

Table 70 Agreements, Partnerships, and Collaborations, 20122017

Table 71 Investments and Expansions 20122017

List of Figures (43 Figures)

Figure 1 Microencapsulated Pesticides: Market Segmentation

Figure 2 Microencapsulated Pesticides: Regional Segmentation

Figure 3 Research Design

Figure 4 Breakdown of Primaries: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation

Figure 8 Microencapsulated Pesticides Market, By Type, 2017 vs 2022

Figure 9 Market, By Technology, 2017 vs 2022

Figure 10 Market, By Application Sector, 2017 vs 2022

Figure 11 Regional Snapshot

Figure 12 Increase in Demand for Pesticides of Low Toxicity to Drive The Market

Figure 13 Europe Recorded Largest Share in 2016

Figure 14 European Microencapsulated Pesticides Market Share, By Type & Country, 2016

Figure 15 Agricultural Sector Recorded Largest Share in Microencapsulated Pesticides Market in 2016

Figure 16 US and France: Important Markets for Microencapsulated Pesticides, 2016

Figure 17 Insecticide Consumption, By Key Region, 20102014

Figure 18 Estimated Urban Population of Key Countries, 2015

Figure 19 Urban Population Growth Trend of Important Countries, 2015

Figure 20 Insecticide Exports, By Key Markets, 20112015

Figure 21 Insecticide Imports, By Key Markets, 20112015

Figure 22 Microencapsulated Pesticides Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 European Imports of Fruits & Vegetables From India & China, 20122016

Figure 24 Number of Patents Approved for Microencapsulated Pesticides, By Key Companies, 20112017

Figure 25 Regional Analysis: Patent Approval for Microencapsulated Pesticides, By Key Country, 20122017

Figure 26 Microencapsulated Pesticides Market Size, By Type, 2017-2022 (USD Million)

Figure 27 Market Size, By Application Sector, 2017 vs 2022 (USD Million)

Figure 28 Microencapsulated Pesticides Market Size, By Technology, 20172022 (USD Million)

Figure 29 Spain Recorded Highest Growth in The Global Microencapsulated Pesticides Market

Figure 30 North America: Market Snapshot

Figure 31 Europe: Market Snapshot

Figure 32 Key Developments By Leading Players in The Microencapsulated Pesticides Market, 20142017

Figure 33 BASF: Company Snapshot

Figure 34 BASF: SWOT Analysis

Figure 35 Bayer: Company Snapshot

Figure 36 Bayer: SWOT Analysis

Figure 37 Monsanto: Company Snapshot

Figure 38 Monsanto: SWOT Analysis

Figure 39 Syngenta: Company Snapshot

Figure 40 Syngenta: SWOT Analysis

Figure 41 Adama: Company Snapshot

Figure 42 Adama: SWOT Analysis

Figure 43 FMC Corporation: Company Snapshot

Growth opportunities and latent adjacency in Microencapsulated Pesticides Market