Microcontrollers, DSP, & IP Core Chip Market by Type, Applications (Automotive & Transportation, Consumer Electronics, Industrial, Communications, Security, and Medical & Healthcare) and Geography (Americas, Europe, APAC & ROW) - Analysis & Forecast to 2014 – 2020

Ever since the inception of chip designing, there have been dramatic improvements in the performance of the products and proportionate decrease in prices. This has led the consumer market in a direction where high-end technology goods became increasingly productive and affordable for the consumers. This makes the semiconductor industry unique, which controls all modern electronic segments.

Microcontrollers, which are one of the most widely used component in industries such as automobile and consumer electronics, have seen tremendous improvements in recent years in terms of increased number of applications as well as developments in technology. With the increased rate of consumer devices involving image, audio, and video processing, demand of digital signal processors have been positive. Also, the need for improved performance, fast time-to-market, increased customization, and lower risk of fatigue is profiting the Intellectual Property (IP) core chip companies tremendously. A semiconductor Intellectual Property Core, also known as IP Core or IP Block, is a unit of architectural layout of a specific or whole part of a semiconductor chip. IP cores, after the development by third parties, in general are licensed to semiconductor chip manufacturers. Or they can be developed in-house, owned and used by a single semiconductor chip manufacturer alone. IP cores can be used as building blocks within semiconductor chips to add advanced features and characteristics by developing them as per the prescribed architectural design.

The report on the Microcontrollers, Digital signal processor, and IP core chips market analyzes the Microcontroller, DPS, and IP core chip’s individual value chain, giving a bird’s eye-view of all the major and allied segments to the industry. The Microcontrollers, Digital signal processor, and IP core chips market is classified by various types of market segmentations and discussed in detail with the market estimates for each of the sub-segments. The report also discusses and analyzes the market dynamics of the individual markets, namely its market drivers, restraints, and opportunities along with the industry’s burning issues and winning imperatives.

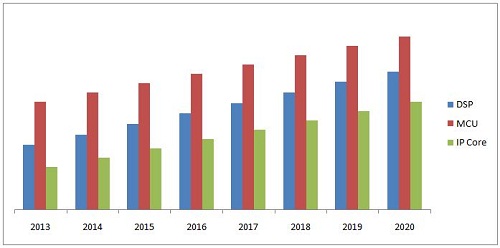

This study showcases a comprehensive overview of the global market by enveloping all major market segmentations combined with detailed qualitative and quantitative analysis of each market segment. The market numbers are forecasted from 2013 till 2020, to present a glance of the huge market potential offered within the forecast period.

Microcontrollers, Digital signal processor, & IP-core chips market is expected to reach $41.69 Billion by 2020, growing at a CAGR of 6.96% from 2014 to 2020.

The report also includes the company profiles of leading players of this industry with their recent developments and other strategic industry activities. The competitive landscape section comprises key growth strategies and detailed market share ranking analysis of the key Microcontrollers, DSPs, and IP core chips vendors. Some of the key players profiled in this report are Analog Devices, Inc. (U.S.), Freescale Semiconductor, Inc. (U.S.), Panasonic Corporation (Japan), Infineon Technologies AG (Germany), Renesas Electronics Corporation (Japan), Xilinx, Inc. (U.S.), ARM Holdings PLC (U.K.), and CEVA Inc. (U.S.), among others.

Scope of the report

This research report categorizes the global market for Microcontrollers, Digital signal processor, and IP core chips on the basis of Microcontroller type, DSP type, IP core chip type, Applications, and Geography, forecasting revenue during the forecast period from 2014 to 2020.

Microcontroller market: The Microcontrollers, DSPs, and IP core chips market report is individually segmented in the types of microcontrollers. The report further segments the microcontrollers in three types, namely 8-bit microcontrollers, 16-bit microcontrollers, and 32-bit microcontrollers.

Digital signal processor market: The Digital signal processor market is classified in terms of core type and product type.

- DSP by core type: DSP market classification in terms of core type includes two sub-segments, namely single-core DSP and multi-core DSP

- DSP by product type: Further segmentation of DSPs is done by product type as General purpose DSP, Application specific DSP, and Programmable (FPGA & PLD) DSP

IP core chips market: The IP core chips market is segmented in three ways, namely by IP customization, by IP core nature, and by processor design.

- By IP customization: This segment includes Standard IP cores and Customizable IP core chips

- By IP core nature: It includes Soft core IPs and Hard core IPs

- By processor design: There are three types of IP core chips included in this segment, namely General processor IP and Embedded processor IP

Market on the basis of application: Application areas include automotive and transportation, consumer electronics, industrial, security, communications, and medical and healthcare.

Market on the basis of geography: Global market perspective including broad segments of Americas, Europe, Asia-Pacific, and Rest of the World (ROW)

Microcontrollers, Digital signal processor, and IP core chips are the backbone of all the systems and products that modern day consumers use to communicate, travel, entertain, work, produce energy, and increase comfort. Over the last few decades, Moore’s Law which connects the increasing power and decreasing price of semiconductors, led to a tremendous growth of the electronics industry. This, in turn, has led to the continuous production of devices and solutions which are cheaper, more powerful, and smaller in size. Also, the government interests in building semiconductor industries in the developing countries, such as China and India, is a push for the Microcontrollers, DSPs, and IP core chips market and all the related semiconductor markets.

The Microcontrollers, DSPs, and IP core chips markets are expected to show a huge potential in terms of applications such as automotive and transportation, consumer electronics, industrial, security, communications, and medical and healthcare. The emergence of a number of connected devices, increased demand of faster image, video, and audio processing capabilities, and immense competition are pushing increased investments in the R&D activities. This is bound to result in a significant number of changes in the Microcontrollers, DSPs, and IP core chips market.

In the report, the drivers, restraints, and opportunities for the Microcontrollers, DSPs, and IP core chips markets are covered. The major driving factors for the Microcontrollers, DSPs, and IP core chips include: growth in the automobile sector, booming number of wireless devices and developments in the wireless infrastructure, upsurge in the global mobile data traffic, and others. The major restraints for the Microcontrollers, DSPs, and IP core chips markets include: large number of players, price war affecting performance parameters, and others. Emergence of smart grid applications, increased mobile data traffic, and Internet of Things (IoT) are some of the major opportunity areas for Microcontrollers, DSPs, and IP core chips markets.

The figure below shows the estimated continuous growth of the Microcontrollers, Digital signal processor, and IP core chips market in the coming six years from 2014 to 2020.

Source: MarketsandMarkets Analysis

Some of the major companies include Analog Devices, Inc. (U.S.), Freescale Semiconductor, Inc. (U.S.), Panasonic Corporation (Japan), Infineon Technologies AG (Germany), Renesas Electronics Corporation (Japan), Xilinx, Inc. (U.S.), ARM Holdings PLC (U.K.), and CEVA Inc. (U.S.), among others.

Geographically, the Microcontrollers, Digital signal processor, and IP core chips markets are majorly covered by the North America, South America, APAC, Europe, and Rest of the World (RoW).

Table of Contents

1. Introduction

1.1. Key Take-Aways

1.2. Report Description

1.3. Markets Covered

1.4. Stakeholders

1.5. Research Methodology

1.5.1. Market Size Estimation

1.5.2. Market Crackdown and Data Triangulation

1.5.3. Key Data Points Taken From Secondary Sources

1.5.4. Key Data Points Taken From Primary Sources

1.5.5. Assumptions Made for This Report

1.5.6. List of Companies Covered During Study

2. Executive Summary

3. Cover Story

4. Market Overview

4.1. Introduction

4.2. Market Definition

4.3. History and Evolution of Integrated Circuits

4.4. Trends in the Microcontrollers, Digital signal processor & IP Core Chips

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunities

4.6. Burning Issues

4.7. Winning Imperatives

4.8. Value Chain Analysis

4.9. Industry Trend Analysis

4.10. Porter’s Five forces Model

4.10.1. Threat From New Entrants

4.10.2. Threat From Substitutes

4.10.3. Bargaining Power of Suppliers

4.10.4. Bargaining Power of Customers

4.10.5. Degree of Competition

5. Microcontrollers Market

5.1. Introduction

5.2. Microprocessor VS. Microcontroller

5.3. General Architecture of Microcontroller

5.3.1. Central Processing Unit (CPU)

5.4. Program Counter (PC)

5.5. Instruction Register (IR)

5.6. Arithmetic Logic Unit (ALU)

5.7. Registers

5.8. I/O Ports

5.9. Classification of Microcontrollers

5.9.1. 8-Bit Microcontroller

5.9.2. 16-Bit Microcontroller

5.9.3. 32-Bit Microcontroller

5.10. Market Dynamics – Microcontrollers

5.10.1. Drivers

5.10.1.1. Growth in the Automobile Sector Will Drive the Microcontroller Market

5.10.1.2. Declining Price of Microcontrollers Is Expected to Fuel the Growth

5.10.1.3. Increased Adoption of ARM Cores

5.10.1.4. Migration to Small Technology Nodes (Process Nodes) Further Drives the 32-Bit Microcontrollers Market

5.10.1.5. Smartphones Boost the Microcontrollers Market

5.10.2. Market Restraint

5.10.2.1. Large Number of Companies in the Market

5.10.3. Market Opportunities

5.10.3.1. Smart-Grid Projects Act As Attractive Prospects for the Microcontroller Market

6. Digital Signal Processor (DSP) Market

6.1. Introduction

6.2. Classification By Product Segments

6.2.1. General Purpose Digital signal processor

6.2.2. Application Specific DSP

6.2.3. Programmable (FPGA & PLD) DSP

6.3. Classification By Core Type

6.3.1. Single-Core DSP Processor Market

6.3.2. Multi-Core DSP Processor Market

6.4. Market Dynamics –DSP

6.4.1. Drivers

6.4.1.1. Booming Number of Wireless Devices and Developments in the Wireless Infrastructure

6.4.1.2. Upsurge in the Global Mobile Data Traffic

6.4.1.3. Emergence of New Devices and Modish Applications

6.4.1.4. Internet Protocol (IP) Video Surveillance

6.4.2. Restraint

6.4.2.1. Price War Affecting Performance Parameters

6.4.3. Opportunities

6.4.3.1. Increasing Demand for Voip and IP Video

6.4.3.2. Emerging Economies

7. IP-Core Chips Market

7.1. Introduction

7.2. Classification By Customization

7.2.1. Standard IP Core

7.2.2. Customizable IP Core

7.3. Classification By IP Nature

7.3.1. Soft Core

7.3.2. Hard Core

7.4. Classification By IP Architecture

7.4.1. General Processor IP

7.4.2. Embedded Processor IP

7.5. Market Dynamics

7.5.1. Market Drivers

7.5.1.1. Continuously Rising Chip Design Cost and Expenditure, Acts As A Major Driver for the IP Core Chip Market

7.5.1.2. Adopting Third Party IP Core Chips Due to Rapidly Changing Technology Nodes

7.5.1.3. Fierce Competition Requiring Lesser Time-to-Market in Consumer Electronics

7.6. Market Restraints

7.6.1. Volatility in the Process Nodes of Chip Manufacturing

7.6.2. Effects of Changing Process Nodes On the Global Semiconductor IP Market

7.6.3. Effect On Volume/Production of Semiconductor Chips Which Further Affect the Semiconductor IP Revenues

7.6.4. Increased IP Design Complexity

7.7. Market Opportunities

7.7.1. Avionics, Aerospace and Defense

7.7.2. Embedded and Programmable Digital signal processor IP Market Segments 23

8. Market By Application

8.1. Introduction

8.2. Automotive & Transportation

8.2.1. Automotive Body Electronics

8.2.2. Automotive Infotainment Applications

8.2.3. Automotive Control Systems

8.2.4. Automotive Sensors

8.2.5. In-Vehicle Networking

8.3. Consumer Electronics

8.3.1. Smartphones & Tablets

8.3.2. Cameras & Projectors

8.3.3. STB & Digital TVS

8.3.4. DVD, Blu-Ray Players & Home Audio Systems

8.3.5. Printers & Photocopy Machines

8.3.6. White Goods (Home Appliances)

8.4. Medical & Healthcare

8.4.1. Medical Telemetry Devices

8.4.2. High Voltage Medical Devices

8.4.3. Implantable Medical Devices

8.4.4. Monitoring Applications

8.5. Communication

8.5.1. Wireless Communication Applications

8.5.2. Wireless Lan

8.5.3. RFid Applications

8.6. Industrial

8.6.1. Industrial Automation Applications

8.6.2. Industrial Control Systems

8.6.3. Industrial Sensors

8.6.4. Others

8.7. Others

9. Market By Geography

9.1. Introduction

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. South America

9.3.1. Brazil

9.3.2. Argentina

9.3.3. Others

9.4. Europe

9.4.1. Germany

9.4.2. U.K.

9.4.3. Others

9.5. APAC

9.5.1. Japan

9.5.2. China

9.5.3. Taiwan

9.5.4. Others

9.6. ROW

10. Competitive Landscape

10.1. Overview

10.2. Key Players

10.3. Competitive Analysis

10.3.1. Market Share Analysis

10.4. Competitive Situation & Trends

10.4.1. New Product Developments& Announcements

10.4.2. AGreements, Partnerships, Joint Ventures & Collaborations

10.4.3. Mergers & Acquisitions

11. Company Profiles

11.1. Altera Corporation (U.S.)

11.2. Analog Devices, Inc. (U.S.)

11.3. ARM Holdings PLC (U.S.)

11.4. Cadence Design Systems (U.S.)

11.5. CEVA Inc. (U.S.)

11.6. Freescale Semiconductor, Inc. (U.S.)

11.7. Infineon Technologies AG (Germany)

11.8. Maxim Integrated Products, Inc. (U.S.)

11.9. Panasonic Corporation (Japan)

11.10. Renesas Electronics Corporation (Japan)

11.11. Stmicroelectronics N.V. (Switzerland)

11.12. Texas Instruments Inc. (U.S.)

11.13. Xilinx, Inc. (U.S.)

List of Tables (78 Tables)

Table 1 General Assumptions, Terminology and Application Key Notes forthe Microcontrollers, DSPs, and IP Core Chips Markets

Table 2 Assumptions Made for Company Profiles and SWOT Analysis

Table 3 IP Core Chip Business Models Comparison

Table 4 Microcontrollers VS. Microprocessors

Table 5 Microcontroller, Digital signal processor and IP Core Chip Market Size (Value), 2013 - 2020 ($Billion)

Table 6 Microcontroller Market Size (Value & Volume), & ASP, 2013 - 2020 ($Million), (Million Units), & ($)

Table 7 Microcontroller Market Size (Value), By Type, 2013-2020, ($Million)

Table 8 Microcontroller Market Size (Volume), By Type, 2013-2020, (Million Units)

Table 9 Microcontroller Market Size (Value), By Application, 2013-2020, ($Million)

Table 10 Microcontroller Market Size (Volume), By Application, 2013-2020, (Million Units)

Table 11 Microcontroller Market Size (Value), By Automotive & Transportation, 2013-2020, ($Million)

Table 12 Microcontroller Market Size (Volume), By Automotive & Transportation, 2013-2020, (Million Units)

Table 13 Microcontroller Market Size (Value), By Consumer Electronics, 2013-2020, ($Million)

Table 14 Microcontroller Market Size (Volume), By Consumer Electronics, 2013-2020, (Million Units)

Table 15 Microcontroller Market Size (Value), Industrial, Building & Home, 2013-2020, ($Million)

Table 16 Microcontroller Market Size (Volume), By Industrial, Building & Home, 2013-2020, (Million Units)

Table 17 Microcontroller Market Size (Value), Security, 2013-2020, ($Million)

Table 18 Microcontroller Market Size (Volume), By Security, 2013-2020, (Million Units)

Table 19 Microcontroller Market Size (Value), By Communications, 2013-2020, ($Million)

Table 20 Microcontroller Market Size (Volume), By Communications, 2013-2020, (Million Units)

Table 21 Microcontroller Market Size (Value), By Medical & Healthcare, 2013-2020, ($Million)

Table 22 Microcontroller Market Size (Volume), By Medical & Healthcare, 2013-2020, (Million Units)

Table 23 Microcontroller Market Size (Value), By Geography, 2013-2020, ($Million)

Table 24 Microcontroller Market Size (Value), By North America, 2013-2020, ($Million)

Table 25 Microcontroller Market Size (Value), By South America, 2013-2020, ($Million)

Table 26 Microcontroller Market Size (Value), By Europe, 2013-2020, ($Million)

Table 27 Microcontroller Market Size (Value), By APAC, 2013-2020, ($Million)

Table 28 Microcontroller Market Size (Value), By ROW, 2013-2020, ($Million)

Table 29 Digital signal processor Market Size (Value & Volume), & ASP, 2013 - 2020 ($Million), (Million Units), & ($)

Table 30 DSP Market Size (Value), By Product Segment, 2013-2020 ($Million)

Table 31 DSP Market Size (Volume), By Product Segment, 2013-2020 (Million Units)

Table 32 DSP Market Size (Value), By Core Type, 2013-2020, ($Million)

Table 33 DSP Market Size (Volume), By Core Type, 2013-2020, (Million Units)

Table 34 DSP Market Size (Value), By Application, 2013-2020, ($Million)

Table 35 DSP Market Size (Volume), By Application, 2013-2020, (Million Units)

Table 36 DSP Market Size (Value), By Computer Sector, 2013-2020 ($Million)

Table 37 DSP Market Size (Volume), By Computer Sector, 2013-2020 (Million Units)

Table 38 DSP Market Size (Value), By Communications Sector, 2013-2020 ($Million)

Table 39 DSP Market Size (Volume), By Communications Sector, 2013-2020 (Million Units)

Table 40 DSP Market Size (Value), By Consumer Electronics Sector, 2013-2020 ($Million)

Table 41 DSP Market Size (Volume), By Consumer Electronics Sector, 2013-2020 (Million Units)

Table 42 DSP Market Size (Value), By Automotive & Transportation Sector, 2013-2020 ($Million)

Table 43 DSP Market Size (Volume), By Automotive & Transportation Sector, 2013-2020 (Million Units)

Table 44 DSP Market Size (Value), By Industrial Sector, 2013-2020 ($Million)

Table 45 DSP Market Size (Volume), By Industrial Sector, 2013-2020 (Million Units)

Table 46 DSP Market Size (Value), By Military, Defense, & Aerospace Sector, 2013-2020 ($Million)

Table 47 DSP Market Size (Volume), By Military, Defense, & Aerospace Sector, 2013-2020 (Million Units)

Table 48 DSP Market Size (Value), By Medical Sector, 2013-2020 ($Million)

Table 49 DSP Market Size (Volume), By Medical Sector, 2013-2020 (Million Units)

Table 50 DSP Market Size (Value), By RF & Others Sector, 2013-2020 ($Million)

Table 51 DSP Market Size (Volume), By RF & Others Sector, 2013-2020 (Million Units)

Table 52 DSP Market Size (Value), By Geography, 2013-2020 ($Million)

Table 53 DSP Market Size (Value), By North America, 2013-2020 ($Million)

Table 54 DSP Market Size (Value), By Europe, 2013-2020 ($Million)

Table 55 DSP Market Size (Value), By APAC, 2013-2020 ($Million)

Table 56 DSP Market Size (Value), By ROW, 2013-2020 ($Million)

Table 57 IP Core Chip Market Size (Value), By IP Nature, 2013-2020, ($Million)

Table 58 IP Core Chip Market Size (Value), By Customization, 2013-2020, ($Million)

Table 59 IP Core Chip Market Size (Value), By Application, 2013 - 2020, ($Million)

Table 60 IP Core Chip Market Size (Value), By Computer Sector, 2013 - 2020, ($Million)

Table 61 Computer Sector IP Core Chip Market Size (Value), By Geography, 2013-2020, ($Million)

Table 62 IP Core Chip Market Size (Value), By Communications Sector, 2013 - 2020, ($Million)

Table 63 Communications Sector IP Core Chip Market Size (Value), By Geography, 2013-2020, ($Million)

Table 64 IP Core Chip Market Size (Value), By Consumer Electronics Sector, 2013 - 2020, ($Million)

Table 65 Consumer Electronics Sector IP Core Chip Market Size (Value), By Geography, 2013-2020, ($Million)

Table 66 IP Core Chip Market Size (Value), By Automotive & Transportation Sector, 2013 - 2020, ($Million)

Table 67 Automotive & Transportation Sector IP Core Chip Market Size (Value), By Geography, 2013-2020, ($Million)

Table 68 IP Core Chip Market Size (Value), By Other Application Sector, 2013 - 2020, ($Million)

Table 69 Other Application Sector IP Core Chip Market Size (Value), By Geography, 2013-2020, ($Million)

Table 70 IP Core Chip Market Size (Value), By Geography, 2013-2020, ($Million)

Table 71 North America: IP Core Chip Market Size (Value), By Country, 2013 - 2020, ($Million)

Table 72 North America: IP Core Chip Market Size (Value), By Application, 2013 - 2020, ($Million)

Table 73 Europe: IP Core Chip Market Size (Value), By Country, 2013 - 2020, ($Million)

Table 74 Europe: IP Core Chip Market Size (Value), By Application, 2013 - 2020, ($Million)

Table 75 APAC: IP Core Chip Market Size (Value), By Country, 2013 - 2020, ($Million)

Table 76 APAC: IP Core Chip Market Size (Value), By Application, 2013 - 2020, ($Million)

Table 77 ROW: IP Core Chip Market Size (Value), By Region, 2013 - 2020, ($Million)

Table 78 ROW: IP Core Chip Market Size (Value), By Application, 2013 - 2020, ($Million)

List of Figures (58 Figures)

Figure 1 Microcontrollers, DSPs, and IP Core Chips Marketsegmentation

Figure 2 Research Methodology ofmicrocontrollers, DSPs, and IP Core Chips Market

Figure 3 Microcontrollers, DSPs, and IP Core Chipsmarket Size Estimation

Figure 4 Microcontrollers, DSPs, and IP Core Chipsmarket Crackdown and Data Triangulation

Figure 5 Industry Value Chain - IP Core Chip

Figure 6 IP Core Chip Customer Segments Chain

Figure 7 IP Core Chip Vendor- Foundry Vendor Relationship

Figure 8 Industry Value Chain- Microcontrollers & DSPs

Figure 9 General Architecture of A Microcontroller

Figure 10 Microcontroller Types

Figure 11 Impact Analysis of Drivers: Microcontroller

Figure 12 Impact Analysis of Restraint: Microcontroller

Figure 13 Impact Analysis of Opportunity: Microcontroller

Figure 14 Digital signal processor Architecture

Figure 15 DSP: Classification By Product Segment

Figure 16 DSP: Classification By Core Type

Figure 17 Impact Analysis of Drivers - DSP

Figure 18 Technology and Data Transfer Rate

Figure 19 Increasing Mobile Data Traffic (Exabytes/Month)

Figure 20 Impact Analysis of Restraint - DSP

Figure 21 Impact Analysis of Opportunities - DSP

Figure 22 Classification of IP-Core Chips

Figure 23 Impact Analysis of Market Drivers

Figure 24 Impact Analysis of Market Restraints

Figure 25 Impact Analysis of Market Opportunities

Figure 26 Analog Devices, Inc.: Company Snapshot

Figure 27 Analog Devices, Inc.: Products and Services

Figure 28 Analog Devices, Inc.: Processors and DSP

Figure 29 Freescale Semiconductor, Inc.: Company Snapshot

Figure 30 Freescale Semiconductor, Inc.: Products and Services

Figure 31 Freescale Semiconductor, Inc.: Microcontrollers Product Portfolio

Figure 32 Stmicroelectronics N.V.: Company Snapshot

Figure 33 Stmicroelectronics N.V.: Products and Services

Figure 34 Stmicroelectronics N.V.: Microcontrollers

Figure 35 Stmicroelectronics N.V.: SWOT Analysis

Figure 36 Panasonic Corporation: Company Snapshot

Figure 37 Panasonic Corporation: Products and Services

Figure 38 Infineon Technologies AG: Company Snapshot

Figure 39 Infineon Technologies AG: Products and Services

Figure 40 Renesas Electronics Corporation: Company Snapshot

Figure 41 Renesas Electronics Corporation: Products and Services

Figure 42 Maxim Integrated Products, Inc.: Company Snapshot

Figure 43 Maxim Integrated Products, Inc.: Products and Services

Figure 44 Texas Instruments Inc.: Company Snapshot

Figure 45 Texas Instruments Inc.: Products and Services

Figure 46 Texas Instruments Inc.: SWOT Analysis

Figure 47 Xilinx, Inc.: Company Snapshot

Figure 48 Xilinx Inc.: Products and Services

Figure 49 Xilinx Inc.: SWOT Analysis

Figure 50 Altera Corporation: Company Snapshot

Figure 51 Altera Corporation: Products and Services

Figure 52 ARM Holdings PLC: Company Snapshot

Figure 53 ARM Holdings PLC: Product Portfolio

Figure 54 ARM Holdings: SWOT Analysis

Figure 55 Cadence Design Systems: Company Snapshot

Figure 56 Cadence Design Systems: Products & Technology

Figure 57 CEVA Inc.: Company Snapshot

Figure 58 CEVA Inc.:Products and Services

Growth opportunities and latent adjacency in Microcontrollers, DSP, & IP Core Chip Market