MEMS Oscillator Market by Packaging Type (Surface-Mount Device Package and Chip-Scale Package), Band (MHz and kHz), General Circuitry (SPMO, TCMO, VCMO, FSMO, DCMO, and SSMO), Application, and Geography - Global Forecast to 2022

The overall MEMS oscillator market was valued at USD 79.2 Million in 2016 and is expected to reach USD 802.8 Million by 2022, at a CAGR of 46.08% between 2017 and 2022. This report provides the size and future growth potential of the market across different segments such as packaging type, band, general circuitry, application, and geography. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and industry-specific challenges; and detailed value chain and Porter’s five forces analysis. It also profiles the key players operating in the market. The rapid growth of mobile infrastructure, electronic wearables, and Internet of Things is expected to propel the growth of the overall market. The base year considered for the study is 2016, and the forecast period is between 2017 and 2022.

According to the forecast provided by MarketsandMarkets, the overall MEMS oscillator market was valued at USD 79.2 Million in 2016 and is expected to reach USD 802.8 Million by 2022, at a CAGR of 46.08% between 2017 and 2022. The growth of this market is driven by the rapid growth of electronic wearables, Internet of Things, and mobile infrastructure. Along with this, the rising need for electronic device miniaturization, improved performance, and increased functionality entails a growing demand for MEMS oscillators owing to their inherent advantages such as small size, high reliability, and low power consumption.

This report segments the MEMS oscillator market on the basis of packaging type, band, general circuitry, application, and geography. In 2016, SPMOs held a major share of the market owing to their innumerable applications. However, the market for TCMOs is expected to grow at the highest rate between 2017 and 2022. This growth is attributed to their ability to solve deep-rooted timing problems in telecom and networking with their excellent dynamic performance under stressful environmental conditions; and their increasing penetration in applications that require higher accuracy and longer battery life, such as wearables and Internet of Things and mobile devices. Considering the market segmented on the basis of packaging type, surface-mount device package held the largest share of the market in 2016, while the market for chip-scale package is likely to grow at the highest rate during the forecast period.

The wearables and Internet of Things application is expected to hold the largest size of the MEMS oscillator market during the forecast period. Explosive growth in interconnected devices and increasing adoption of wearable technology where MEMS oscillator is a preferred timing component, owing to its inherent advantages such as small size, low power consumption, and high reliability, are expected to drive the market. However, the market for networking, server, storage, and telecommunications; and automotive applications is expected to grow at high rates during the forecast period.

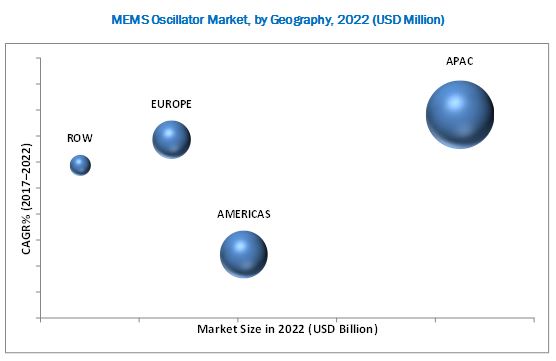

In terms of different geographic regions, APAC is expected to hold the largest share of the market between 2017 and 2022. The Americas is expected to capture the second-largest share of the market during the forecast period. The wearables and Internet of Things; mobile devices; and networking, server, storage, and telecommunications applications are expected to be the leading segments of the MEMS oscillator market in the Americas.

Actively managing performance and cost trade-offs without compromising on quality and reliability remains the biggest challenge for the companies in the market. The major vendors in the market are SiTime Corporation (U.S.), Microchip Technology Inc. (U.S.), Vectron International, Inc. (U.S.), Abracon Holdings, LLC (U.S.), Daishinku Corp. (Japan), Ecliptek Corporation (U.S.), Jauch Quartz GmbH (Germany), IQD Frequency Products Limited (U.K.), ILSI America LLC (U.S.), and Raltron Electronics Corporation (U.S.). These players adopted various strategies such as new product launches; and partnerships, agreements, and collaborations to uphold their positions in the market and to efficiently cater to the growing demand for MEMS oscillators from the end users.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.2 Secondary Data

2.2.1 Major Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Primary Interviews With Experts

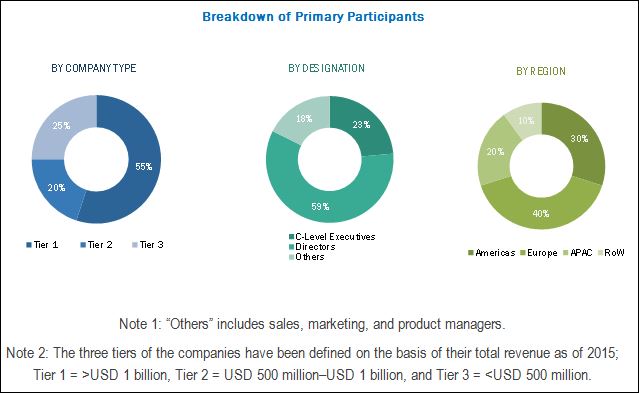

2.3.2 Breakdown of Primaries

2.4 Key Data From Primary Sources

2.4.1 Secondary and Primary Research

2.4.2 Key Industry Insights

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Top-Down Approach

2.6 Market Breakdown and Data Triangulation

2.7 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Market

4.2 Market, By General Circuitry (2017–2022)

4.3 Market, By Application (2017–2022)

4.4 Market, By Packaging Type and Band

4.5 Market, By Geography

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Packaging Type

5.2.2 By General Circuitry

5.2.3 By Band

5.2.4 By Application

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Rapid Growth of Mobile Infrastructure, Electronic Wearables, and Internet of Things

5.3.1.2 Standardized Supply Chain With High Ramp Rates and Short Lead Times

5.3.1.3 Rising Need for Electronic Device Miniaturization, Improved Performance, and Increased Functionality

5.3.2 Restraints

5.3.2.1 Use of Long-Established Quartz Technology

5.3.2.2 High R&D Costs and Low Profit Margins

5.3.3 Opportunities

5.3.3.1 Growing Need for High-Precision Timing Components Owing to Network Densification

5.3.3.2 Increasing Adoption of Advanced Automotive Electronics

5.3.4 Challenges

5.3.4.1 Actively Managing Performance and Cost Trade-Offs Without Compromising on Quality and Reliability

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 MEMS Oscillator Market, By Packaging Type (Page No. - 54)

7.1 Introduction

7.2 Surface-Mount Device Package

7.3 Chip-Scale Package

8 MEMS Oscillator Market, By Band (Page No. - 59)

8.1 Introduction

8.2 MHZ Band

8.3 KHZ Band

9 MEMS Oscillator Market, By General Circuitry (Page No. - 65)

9.1 Introduction

9.2 Simple Packaged MEMS Oscillator (SPMO)

9.3 Temperature-Compensated MEMS Oscillator (TCMO)

9.4 Voltage-Controlled MEMS Oscillator (VCMO)

9.5 Frequency Select MEMS Oscillator (FSMO)

9.6 Digitally Controlled MEMS Oscillator (DCMO)

9.7 Spread-Spectrum MEMS Oscillator (SSMO)

10 MEMS Oscillator Market, By Application (Page No. - 74)

10.1 Introduction

10.2 Networking, Server, Storage, and Telecommunications

10.3 Consumer Electronics

10.4 Industrial

10.5 Automotive

10.6 Wearables and Internet of Things

10.7 Mobile Devices

10.8 Military and Aerospace

10.9 Others

11 MEMS Oscillator Market, By Geography (Page No. - 90)

11.1 Introduction

11.2 Americas

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.2.4 Rest of Americas

11.3 APAC

11.3.1 China

11.3.2 Japan

11.3.3 South Korea

11.3.4 Taiwan

11.3.5 Rest of APAC

11.4 Europe

11.4.1 Germany

11.4.2 U.K.

11.4.3 France

11.4.4 Rest of Europe

11.5 RoW

11.5.1 Middle East

11.5.2 Africa

12 Competitive Landscape (Page No. - 113)

12.1 Overview

12.2 Market Ranking Analysis of the Market

12.3 Competitive Situations and Trends

12.3.1 New Product Launches

12.3.2 Partnerships and Agreements

12.3.3 Acquisitions

13 Company Profiles (Page No. - 120)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Sitime Corporation

13.3 Microchip Technology Inc.

13.4 Vectron International, Inc.

13.5 Daishinku Corp.

13.6 Abracon Holdings, LLC

13.7 ILSI America LLC

13.8 Ecliptek Corporation

13.9 Jauch Quartz GmbH

13.10 IQD Frequency Products Limited

13.11 Raltron Electronics Corporation

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 142)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (67 Tables)

Table 1 MEMS Oscillator Market, By Packaging Type

Table 2 Market, By General Circuitry

Table 3 Porter’s Five Forces Analysis: Bargaining Power of Buyers and Threat of Substitutes Had A High Impact on the Market

Table 4 Market, By Packaging Type, 2015–2022 (USD Million)

Table 5 Market for Surface-Mount Device Package, By Region, 2015–2022 (USD Million)

Table 6 Market for Chip-Scale Package, By Region, 2015–2022 (USD Million)

Table 7 Market, By Band, 2015–2022 (USD Million)

Table 8 Market for MHZ Band, By Region, 2015–2022 (USD Million)

Table 9 Market for MHZ Band, By Application, 2015–2022 (USD Million)

Table 10 MEMS Oscillator Market for KHZ Band, By Region, 2015–2022 (USD Million)

Table 11 MEMS Oscillator Market for KHZ Band, By Application, 2015–2022 (USD Million)

Table 12 Market, By General Circuitry, 2015–2022 (USD Million)

Table 13 Market for SPMO, By Application, 2015–2022 (USD Million)

Table 14 MEMS Oscillator Market for TCMO, By Application, 2015–2022 (USD Million)

Table 15 MEMS Oscillator Market for VCMO, By Application, 2015–2022 (USD Million)

Table 16 MEMS Oscillator Market for FCMO, By Application, 2015–2022 (USD Million)

Table 17 MEMS Oscillator Market for DCMO, By Application, 2015–2022 (USD Million)

Table 18 MEMS Oscillator Market for SSMO, By Application, 2015–2022 (USD Million)

Table 19 Market, By Application, 2015–2022 (USD Million)

Table 20 MEMS Oscillator Market for Networking, Server, Storage, and Telecommunications, By General Circuitry, 2015–2022 (USD Million)

Table 21 Market for Networking, Server, Storage, and Telecommunications, By Region, 2015–2022 (USD Million)

Table 22 Market for Networking, Server, Storage, and Telecommunications, By Band, 2015–2022 (USD Million)

Table 23 Market for Consumer Electronics, By General Circuitry, 2015–2022 (USD Million)

Table 24 MEMS Oscillator Market for Consumer Electronics, By Region, 2015–2022 (USD Million)

Table 25 MEMS Oscillator Market for Consumer Electronics, By Band, 2015–2022 (USD Million)

Table 26 Market for Industrial Application, By General Circuitry, 2015–2022 (USD Million)

Table 27 Market for Industrial Application, By Region, 2015–2022 (USD Million)

Table 28 Market for Industrial Application, By Band, 2015–2022 (USD Million)

Table 29 Market for Automotive Application, By General Circuitry, 2015–2022 (USD Million)

Table 30 Market for Automotive Application, By Region, 2015–2022 (USD Million)

Table 31 Market for Automotive Application, By Band, 2015–2022 (USD Million)

Table 32 Market for Wearables and Internet of Things, By General Circuitry, 2015–2022 (USD Million)

Table 33 Market for Wearables and Internet of Things, By Region, 2015–2022 (USD Million)

Table 34 Market for Wearables and Internet of Things, By Band, 2015–2022 (USD Million)

Table 35 Market for Mobile Devices, By General Circuitry, 2015–2022 (USD Million)

Table 36 Market for Mobile Devices, By Region, 2015–2022 (USD Million)

Table 37 Market for Mobile Devices, By Band, 2015–2022 (USD Million)

Table 38 Market for Military and Aerospace, By General Circuitry, 2015–2022 (USD Million)

Table 39 Market for Military and Aerospace, By Region, 2015–2022 (USD Million)

Table 40 Market for Military and Aerospace, By Band, 2015–2022 (USD Million)

Table 41 Market for Other Applications, By General Circuitry, 2015–2022 (USD Million)

Table 42 Market for Other Applications, By Region, 2015–2022 (USD Million)

Table 43 Market for Other Applications, By Band, 2015–2022 (USD Million)

Table 44 Market, By Region, 2015–2022 (USD Million)

Table 45 Market in Americas, By Country, 2015–2022 (USD Million)

Table 46 Market in U.S., By Application, 2015–2022 (USD Million)

Table 47 Market in Americas, By Packaging Type, 2015–2022 (USD Million)

Table 48 Market in Americas, By Band, 2015–2022 (USD Million)

Table 49 Market in Americas, By Applicaion, 2015–2022 (USD Million)

Table 50 Market in APAC, By Country, 2015–2022 (USD Million)

Table 51 Market in China, By Application, 2015–2022 (USD Million)

Table 52 Market in Japan, By Application, 2015–2022 (USD Million)

Table 53 Market in APAC, By Packaging Type, 2015–2022 (USD Million)

Table 54 Market in APAC, By Band, 2015–2022 (USD Million)

Table 55 Market in APAC, By Applicaion, 2015–2022 (USD Million)

Table 56 Market in Europe, By Country, 2015–2022 (USD Million)

Table 57 Market in Europe, By Packaging Type, 2015–2022 (USD Million)

Table 58 Market in Europe, By Band, 2015–2022 (USD Million)

Table 59 Market in Europe, By Applicaion, 2015–2022 (USD Million)

Table 60 Market in RoW, By Region, 2015–2022 (USD Million)

Table 61 Market in RoW, By Packaging Type, 2015–2022 (USD Million)

Table 62 Market in RoW, By Band, 2015–2022 (USD Million)

Table 63 Market in RoW, By Applicaion, 2015–2022 (USD Million)

Table 64 Top Players in the Market, 2016

Table 65 New Product Launches, 2015–2016

Table 66 Partnerships and Agreements, 2015–2016

Table 67 Acquisitions, 2014–2015

List of Figures (61 Figures)

Figure 1 MEMS Oscillator Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Snapshot of the Market (2015–2022)

Figure 7 Chip-Scale Package Expected to Be the Fastest-Growing Segment of the Market Based on Packaging Type During the Forecast Period

Figure 8 KHZ Band Expected to Be the Fastest-Growing Segment of the Market Based on Band Type During the Forecast Period

Figure 9 TCMO Expected to Be the Fastest-Growing Segment of the Market Based on General Circuitry During the Forecast Period

Figure 10 Wearables & Internet of Things Expected to Be the Fastest-Growing Application of the Market During the Forecast Period

Figure 11 APAC Led the Market in 2016

Figure 12 APAC Expected to Dominate the Market Between 2017 and 2022

Figure 13 TCMO Expected to Lead the Market By 2022

Figure 14 Wearables & Internet of Things Expected to Be the Fastest-Growing Application for MEMS Oscillators Between 2017 and 2022

Figure 15 SMD Package Expected to Hold A Major Share of the Market During the Forecast Period

Figure 16 China and U.S. Expected to Lead the Market During the Forecast Period

Figure 17 Market in Americas Expected to Enter Into the Maturity Stage Between 2017 and 2022

Figure 18 Market, By Band

Figure 19 Market, By Application

Figure 20 Market, By Geography

Figure 21 Rapid Growth of Mobile Infrastructure, Electronic Wearables, and Internet of Things Expected to Drive the Market

Figure 22 Growth of Mobile Data Traffic From 2015 to 2020

Figure 23 Growth of Connected Wearable Devices From 2015 to 2020

Figure 24 Market: Value Chain Analysis

Figure 25 Market: Porter’s Five Forces Analysis, 2015

Figure 26 Porter’s Five Forces: Impact Analysis

Figure 27 Intensity of Competitive Rivalry in the Market

Figure 28 Threat of Substitutes in the Market

Figure 29 Bargaining Power of Buyers in the Market

Figure 30 Bargaining Power of Suppliers in the Market

Figure 31 Threat of New Entrants in the Market

Figure 32 Chip-Scale Package Expected to Be the Fastest-Growing Packaging Type of the Market During the Forecast Period

Figure 33 KHZ Band Expected to Be the Fastest-Growing Band of the Market During the Forecast Period

Figure 34 Networking, Server, Storage, and Telecommunications Application Expected to Dominate the Market for MHZ Band During the Forecast Period

Figure 35 Wearables and Internet of Things Application Expected to Dominate the Market for KHZ Band During the Forecast Period

Figure 36 TCMO Expected to Be the Fastest-Growing General Circuitry of the Market During the Forecast Period

Figure 37 Wearables and Internet of Things Application Expected to Dominate the Market for TCMO During the Forecast Period

Figure 38 Wearables and Internet of Things Expected to Be the Fastest-Growing Application of the Market During the Forecast Period

Figure 39 Geographic Snapshot of the Market (2017-2022)

Figure 40 APAC Expected to Be the Largest and Fastest-Growing Market for MEMS Oscillators Between 2017 and 2022

Figure 41 Americas: Market Snapshot

Figure 42 U.S. Expected to Hold the Largest Share of the Market in Americas Between 2017 and 2022

Figure 43 APAC: Market Snapshot

Figure 44 Japan Expected to Be the Fastest-Growing Market for MEMS Oscillators in APAC During the Forecast Period

Figure 45 Europe: Market Snapshot

Figure 46 Rest of Europe Expected to Be the Fastest-Growing Market for MEMS Oscillators in Europe Between 2017 and 2022

Figure 47 RoW: Market Snapshot

Figure 48 Africa Expected to Be the Fastest-Growing Market for MEMS Oscillators in RoW Between 2017 and 2022

Figure 49 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2016

Figure 50 Market Evolution Framework: New Product Launches Was the Major Strategy Adopted By Key Players (2014–2016)

Figure 51 Battle for Market Share: New Product Launches as the Key Growth Strategy

Figure 52 Geographic Revenue Mix of Major Market Players (2015)

Figure 53 Sitime Corporation: Company Snapshot

Figure 54 Sitime Corporation: SWOT Analysis

Figure 55 Microchip Technology Inc.: Company Snapshot

Figure 56 Microchip Technology Inc.: SWOT Analysis

Figure 57 Vectron International, Inc.: Company Snapshot

Figure 58 Vectron International, Inc.: SWOT Analysis

Figure 59 Daishinku Corp.: Company Snapshot

Figure 60 Daishinku Corp.: SWOT Analysis

Figure 61 Abracon Holdings, LLC: SWOT Analysis

The research methodology used to estimate and forecast the MEMS oscillator market begins with capturing data on key vendor revenues through secondary research. The secondary sources include annual reports; press releases; investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the size of the overall market from the revenue of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with key industry experts such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary respondents is depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The MEMS oscillator ecosystem includes the R&D phase, followed by raw material suppliers and original equipment manufacturers, such as SiTime Corporation (U.S.), Microchip Technology Inc. (U.S.), Vectron International, Inc. (U.S.), Abracon Holdings, LLC (U.S.), Daishinku Corp. (Japan), Ecliptek Corporation (U.S.), Jauch Quartz GmbH (Germany), IQD Frequency Products Limited (U.K.), ILSI America LLC (U.S.), and Raltron Electronics Corporation (U.S.).

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2022 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

SiTime Corporation (U.S.), Microchip Technology Inc. (U.S.), Vectron International, Inc. (U.S.), Abracon Holdings, LLC (U.S.), Daishinku Corp. (Japan), Ecliptek Corporation (U.S.), Jauch Quartz GmbH (Germany), IQD Frequency Products Limited (U.K.), ILSI America LLC (U.S.), and Raltron Electronics Corporation (U.S.) |

Key Target Audience

- Raw material and manufacturing equipment suppliers

- Electronic design automation and design tool vendors

- Component manufacturers

- Original equipment manufacturers (OEMs)

- Integrated device manufacturers (IDMs)

- Original design manufacturers (ODMs)

- ODM and OEM technology solution providers

- Assembly, testing, and packaging vendors

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Technology investors

- Research institutes and organizations

- Market research and consulting firms

Scope of the Report

The MEMS oscillator market has been covered in detail in this report. To provide a holistic picture, the current market demand and forecasts have also been included in the report.

The MEMS oscillator market has been segmented as follows:

MEMS oscillator market By Packaging Type

- Surface-Mount Device Package

- Chip-Scale Package

By Band

- MHz Band

- kHz Band

MEMS oscillator market By General Circuitry

- Simple Packaged MEMS Oscillator (SPMO)

- Temperature-Compensated MEMS Oscillator (TCMO)

- Voltage-Controlled MEMS Oscillator (VCMO)

- Frequency Select MEMS Oscillator (FSMO)

- Digital-Controlled MEMS Oscillator (DCMO)

- Spread-Spectrum MEMS Oscillator (SSMO)

MEMS oscillator market By Application

- Automotive

- Consumer Electronics

- Industrial

- Mobile Devices

- Military & Aerospace

- Networking, Server, Storage, and Telecommunications

- Wearables & Internet of Things

- Others (research, measurement, and medical equipment applications)

By Geography

- Americas

- Asia-Pacific (APAC)

- Europe

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Company Information: Detailed analysis and profiling of additional market players (up to five).

Growth opportunities and latent adjacency in MEMS Oscillator Market