Micro-Mobility Market by Type (Bicycle, E-bike, E-kick Scooter), Propulsion (Pedal Assist & Electric), Ownership (B2B, B2C), Sharing (Docked, Dock-less), Data (Navigation, Payment), Travel Range, Speed and Region - Global Forecast to 2027

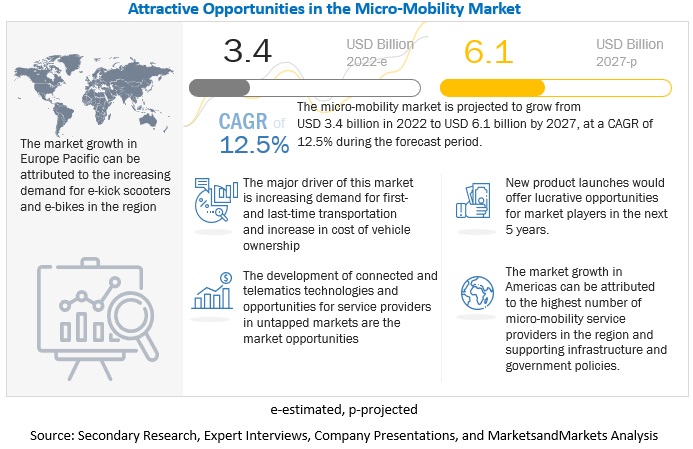

[231 Pages Report] The micro-mobility market is estimated to grow from USD 3.4 billion in 2022 to USD 6.1 billion by 2027 at a CAGR of 12.5% over the forecast period. The market growth is primarily driven by rapid urbanization, increasing costs of vehicle ownership, rising demand for emission-free vehicles, growing traffic congestion, strict emission norms, and increasing demand for an economical mode of transportation.

There has been a significant increase in population across the globe over the years. As the population increases, there is a need for public transportation across the cities for commuting. Usually, the public transit stations are far from home as well as from the work location. Hence, people avoid using personal vehicles to travel such long distances due to traffic congestion, the cost of vehicle ownership, rising gas and oil prices, rising insurance costs, and a lack of convenient parking.

The passenger faces various problems regarding first-mile and last-mile transportation. In various countries such as the US, Canada, Australia, and New Zealand, most people are not comfortable walking more than 1 km. Micro-mobility is the best solution to fill the gap between first-mile and last-mile transportation needs. Below factors mentioned are responsible for the growth of the micro-mobility market across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

DRIVER: Increasing demand for the on-demand public transportation system in smart cities

The rising urban population and development of smart cities further increase the demand for on-demand public transport. Micro-mobility implementation is further driven by regulations and an emerging focus on smart city initiatives. According to the European Commission, the smart cities project market is expected to exceed USD 2 trillion by 2025, with Europe speculated to have the highest investment globally. With 12 cities in the region ranking among the top 25 in the world, Europe continues to be the best-positioned geographical area for smart cities. Copenhagen, Amsterdam, London, Vienna, Paris, Barcelona, Stockholm, Berlin, and Helsinki have already initiated the development of smart city platforms. The complete transformation of these cities to smart cities will likely occur gradually with projects in the next decade.

Additionally, increasing urbanization will accentuate the need for better mobility services. Cities will continue with transformative changes to improve the quality of life by investing in urban mobility solutions. This would result in better transportation systems, continuously bringing changes in transport policies.

The rising number of smart cities and government initiatives for necessary bike and e-kick scooter lanes further increase the demand for micro-mobility services. The municipalities are setting policies and objectives and encouraging OEMs to participate in the micro-mobility services actively.

The smart cities include pop-up bike lanes, creating more open space, streets with only electric or low-speed vehicles, and dedicated lanes for micro-mobility devices. These contribute to the micro-mobility market's growth during the forecast period. A micro-mobility services network is highly efficient compared to other public transportation solutions. Once a network is implemented, a city can reduce the burden on other types of public transportation systems.

Increasing demand and affordability are expected to drive micro-mobility usage in the coming years. For instance, approximately 50%–60% of all car trips in the US are less than 5 miles long, which suggests that micro-mobility can potentially replace a huge portion of the vehicle miles traveled on the roads each year.

According to the World Government Summit, New York City has shown record levels of cyclists. The city’s Department of Transport reported a 50% increase in cycling over the same period last year and a 67% increase (May 2021) in the usage of New York’s Citi Bike sharing system. There is also a surge in demand for many bike-sharing systems in cities such as Minneapolis, Chicago, Oakland, San Diego, Portland, and San Francisco, creating “slow street” networks.

According to Lime’s 2019 Global Rider Survey in Washington DC, 44% of their riders used the shared e-scooter to go to their current job. The survey also revealed that 57% use shared e-scooters to go to work and school and 72% of e-scooter riders use shared e-scooters to visit local shops and attractions. Meanwhile, 29.3% of tourists use shared e-scooters to access shops within a city. According to Emory University’s Goizueta Business School, shared e-scooter schemes help to increase sales for food and beverage shops, contributing an extra USD 13.8 million in sales.

Micro-mobility vehicles such as bicycles, e-bike, e-kick scooters, and e-mopeds are usually parked outside the streets or campuses, allowing users to pick up and ride as and when required without waiting as in normal public transportation. Furthermore, the micro-mobility services offer fare comparison, flexibility, availability of vehicles, and other features such as subscription-based services, real-time feedback, online payment, mobile application, and navigation. These factors would increase the demand for micro-mobility services during the forecast period.

RESTRAINT: Low rate of internet penetration in developing regions or remote areas

Technology advancements and operational efficiency are the key factors required for the successful functioning of micro-mobility platforms. Efficient telecom infrastructure is necessary for various operations such as navigation, barcode scanning, payment services, and parking system. It would become difficult for service providers to offer micro-mobility services without better connectivity. Developing countries in Asia Oceania, the Middle East & Africa, and Latin America lack basic technologies such as telecom and networking infrastructure and cannot implement smart projects due to low budgets and low literacy rates.

4G technology has not yet matured in several developing countries, whereas South Korea, Germany, and the US are already using 5G technology. Although the governments of many developing countries are aware of the benefits of micro-mobility and its high RoI, initial budget constraints can lower micro-mobility development in these countries. This lack of telecom and networking infrastructure in developing economies can hinder the growth of the micro-mobility market.

OPPORTUNITY: Development in connected and telematics technologies

Micro-mobility service providers face challenges related to connectivity infrastructure, cloud platforms, advanced driver assistance systems (ADAS), bike theft and vandalism, and artificial intelligence capabilities. Data monetization, artificial intelligence, and connected ecosystem open opportunities for service providers. Service providers are looking for connectivity options, country-to-country fleet management, tracking and tracing the vehicle, telematics solutions, and the infrastructure to go live quickly.

Connected e-bikes are coming into the market, wherein the SIM module enables the e-bike to send and receive data to and from the cloud without a connected smartphone. Some important features offered by the connected e-bike include automatic emergency calls, integrated navigation, social media connection, an anti-theft system, and remote diagnostics. Bosch developed a SmartphoneHub, which can connect e-bikes to a smartphone and support the riders before and after their journey. The lock premium function by Bosch also transforms the Kiox-connected onboard computer into the key for greater security. On platforms such as komoot, which is integrated into the COBI.Bike app, millions of users can exchange information with each other and discover new routes with recommendations and tips from the community.

Similarly, other companies are also coming forward to develop connected solutions. For instance, Ituran (Israel) developed a tick track solution for micro-mobility, which gives 24/7 tracking of the location and usage of individual micro-mobility units. It can monitor its micro-mobility vehicle in real-time, receive real-time alerts in cases of suspicious movement/use of the vehicle, and act immediately when needed. Spin (US) and Helbiz Inc. (US) are developing camera-based solutions which can detect the rider's activity and stop the ride in collision and emergency braking when the rider is about to hit a pedestrian. Streetlogic (US) is launching a safety-focused ADAS system for e-bikes. Specialized Bicycle Components Inc (US) has developed mission control and ride features in its e-bikes. The companies are developing anti-theft alarm systems and GPS tracking to reduce bike vandalism and theft. Onomondo ApS (Denmark) developed the Internet of Things (IoT) for micro-mobility companies, which offers driving assistance, emergency alert, route navigation systems, IoT sensors for theft prevention, and battery power tracking. See.Sense. (Limeforge Ltd) (UK) developed Sensor Unlocked Micro-Mobility Insight Technology (SUMMIT) which helps GPS tracking, accurate positioning, and low battery drain in e-bikes and e-kick scooters. The technology tracks and collects data on movement patterns, swerving, braking, speed, distance, and road surface.

According to a United Nations report, ~70% of the world’s population would live in cities, resulting in more road traffic congestion by 2050. Therefore, the trend for connected and telematics technologies would create an opportunity for the micro-mobility market to develop and grow during the forecasted period.

CHALLENGE: Rise in bike vandalism

Bike vandalism and theft are the major problems in many cities where micro-mobility services have been launched. Some players are facing issues like battery theft, missing helmets, bicycle theft, and other components such as motor, mirror, and tires stolen.

Some micro-mobility service providers have ended their business as a greater number of vandalism and theft occurred in the country. For instance, Salem’s bike share program launched in 2019, working in Portland, Seattle, and San Francisco with the municipal transportation departments. It ended after three years as vandalism and theft became the major problem and affected its revenue. Voi also stopped their micro-mobility services in Peterborough due to “unprecedented” acts of vandalism in the city. In 2021, the Voi’s e-bikes rode ~10,000 times, racking up more than 21,000 miles in Peterborough. The significant number of bike vandalism and theft losses the company's major revenue. In 2019, Mobike reported losing more than 200,000 bikes to theft or vandalism. In November 2021, Cardiff’s bike-sharing scheme also stopped in the Vale of Glamorgan due to the theft of more than 300 bikes and a further 260 cases of vandalism, such as bikes being set on fire, snapped in half, and dumped in rivers.

Another concern is the throwing up e-bikes and e-kick scooters in canals and bins. The careless users leave their e-bikes or e-kick scooters on sidewalks and remote locations, obstructing pedestrians and disabled persons and creating safety hazards. In December 2021, Divers pulled nearly 60 e-kick scooters and rentable bicycles from the Willamette River in Oregon.

The weather conditions are a major concern in some of the countries in Europe. The rain, snow, and harsher climate make it difficult and dangerous for the users and shared scooter and bike companies might force the fleets off the road and potentially lose profits. Hence, the rise in bike vandalism and theft has become a challenge for micro-mobility service providers.

The docked segment is projected to dominate the micro-mobility market in 2027

The docked sharing type segment is currently leading the market in terms of value generation globally. This is mainly because of the number of docked service providers, users' preference to scan and unlock the system, and the preference for service providers to offer docked systems, as it reduces the chances of theft and vandalism. The docked segment is predicted to have the largest micro-mobility market. Americas is leading the station-based (docked) segment. According to NABSA, amongst the 128 million trips conducted by micro-mobility vehicles, 57.7 million trips were carried out by docked bikes in North America in 2021. In 2021, in North America, the total number of micro-mobility vehicles deployed were around 232 thousand, amongst which 78 thousand were station-based bikes, which shows that there is high demand for station-based bikes compared to dock-less in North America. For docked stations, companies such as Swiftmile, Charge, and Others are involved in the US. Charge is an American company which is working mainly to install its stations on private land and carparks and recently signed a deal with LAZ for 250 stations in Atlanta. Such developments are responsible for the growth of docked micro-mobility vehicles.

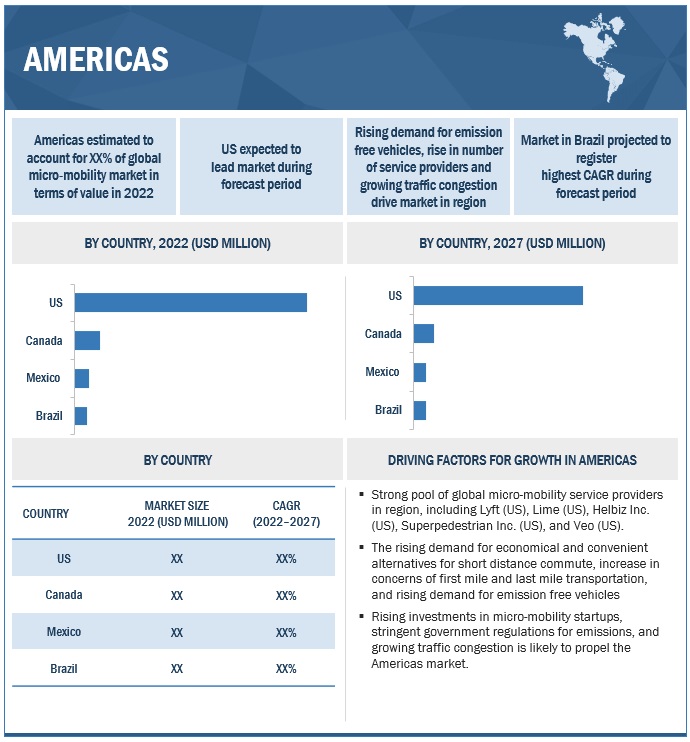

Americas is estimated to have the largest market in 2027

The leading countries such as the US, Canada, Mexico, and Brazil are considered under the Americas region. The micro-mobility demand in the Americas is rapidly increasing because of rising concerns over issues such as traffic congestion, air pollution, and greenhouse gas emissions, which have risen due to the rise in urban population, growing investments by several major players in these key countries. In addition, rising number of micro-mobility service providers, surging internet penetration, increasing preference for short mile commute would fuel the growth of market. Recent investments from various investors in micro-mobility start-ups has promised the growth of micro-mobility market in this region. Some of the leading companies that are present in this region are Bird Global, Inc. (US), Lyft, Inc. (US), Lime (US), Helbiz Inc. (US), Veo (US) and others.

The major organizations in the region such as the US Department of Transportation Research and Innovative Technology Administration (RITA) are focusing on R&D in the field of smart public transportation. With the increasing population, the dependence on public transit is very high in Americas; this has resulted in a huge requirement for an effective micro-mobility management system.

According to a primary respondent, there has been an increase in the demand for bicycles in the US during the ongoing COVID-19 crisis. Consumers are inclined to use more micro-mobility services compared to other mobility offerings. e-kick scooters are being widely used as a substitute for bicycles. The respondent also stressed that the market share of micro-mobility services is likely to increase, and the service will dominate the market in the next 2-3 years.

The US is projected to dominate the Americas micro-mobility market with a value of USD 2,064.9 million by 2027. This is mainly because of most disruptive mobility start-ups in the industry are headquartered in the US, and hence, it has the largest share in Americas. According to Federal Highway Administration, in mid of 2020, more than 260 shared micro-mobility systems, including docked and dock less bikeshare and e-scooter systems, in the United States. The Federal Highway Administration and US Department of Transportation are helping State Department of Transportation and cities manage micro-mobility deployment and are monitoring trends and evaluating facilities and design needs to rise the bikeshare and shared e-kick scooter systems in the US. Furthermore, The Federal Highway Administration is working on research and development on the micro-mobility and looking into five areas such as curbside management, safety, equity, resiliency, and user behavior. The presence of major micro-mobility manufacturers in US and their increasing organic and inorganic investments in micro-mobility, subsystems, charging infrastructure management, and battery developments are some other key reasons for the growth of market in US.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The micro-mobility market is dominated by a few globally established companies such as Bird Global, Inc. (US), Lyft, Inc. (US), Lime (US), TIER (Germany), Dott (Netherlands).

These companies adopted new product launches, partnerships, and joint ventures to gain traction in the micro-mobility market

Scope of the Report

|

Report Attributes |

Details |

|

Market size value in 2022: |

USD 3.4 Billion |

|

Projected to reach 2027: |

USD 6.1 Billion |

|

CAGR: |

12.5% |

|

Base Year Considered: |

2021 |

|

Forecast Period: |

2022-2027 |

|

Largest Market: |

Americas |

|

Region Covered: |

Asia Pacific, North America, and Europe |

|

Segments Covered: |

Type, Speed, Propulsion, Sharing Type, Ownership and Region |

|

Companies Covered: |

Lime (US), Bird Global, Inc. (US), Lyft, Inc. (US), TIER (Germany), Dott (Netherlands)ompagnie de Saint-Gobain S.A.(France), AGC Inc. (Japan), Fuyao Glass Industry Group Co., Ltd. (China), Motherson Sumi Systems Limited (Japan), Central Glass Co., Ltd. (Japan) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the micro-mobility market:

By Type

- Bicycles

- E-bikes

- E-kick scooters

- Others

By Speed

- Up To 25 kmph

- 25-45 kmph

By Propulsion

- Human Powered

- Electrically Powered

By Sharing Type

- Docked

- Dock-less

By Ownership

- Business-to-Business

- Business-to-Consumer

By Data Service

- Navigation

- Payment

- Other Data Services

By Travel Range

- Up to 3 Miles

- 3-6 Miles

By Region

- Asia Pacific

- Americas

- Europe

Recent Developments

- In August 2022, Bird Global, Inc. expanding into new US cities. Bird Global, Inc. announced that cities including San Diego, California, Memphis, Tennessee, and Newark, New Jersey, as well as Durham, North Carolina and Louisville, Kentucky, will extend their shared e-mobility programs with Bird. The company is further expanding to Bradenton, Florida, Knoxville, Tennessee, the University of Oregon and Eugene, Oregon, and UNC Wilmington, North Carolina to enhance its presence in the US.

- In August 2022, Lyft, Inc. signed partnership agreement with Mexico City’s Mobility Department. The partnership focuses on providing the bikes, stations, rider app, rider website, and back-end operator software to Mexico City’s Mobility Department bike share system. The bike share system is operating in the US including Citi Bike in New York, Capital Bikeshare in Washington DC, Divvy in Chicago, and Bay Wheels in the San Francisco Bay Area. Its helps Lyft, Inc. to enhance its presence and increase its brand name.

- In April 2022, Bird Global, Inc. signed joint venture agreement with Madrid Municipal Transport Company (EMT) for bike sharing integration program.

- In May 2022, Bird Global, Inc. developed new parking technology, Bird Visual Parking System (VPS), which is available for free to city partners and requires zero infrastructure or tech investments on behalf of the community. The new parking technology is powered by Google’s ARCore Geospatial API. The new ARCore Geospatial API from Google helps to offer the Visual Parking System that’s unmatched in terms of accuracy and scalability.

- In April 2022, Lyft, Inc. acquired PBSC Urban Solutions, a global supply leader for bikeshare equipment and technology. The PBSC has deployed 7,500 stations and 95,000 bikes to 45 markets and 15 countries. The acquisition helps the Lyft, Inc. to expand its mobility services and deliver world-class products and experiences to riders in the largest cities.

- In March 2022, Lime joined a partner with Aspiration. The partnership focuses on sustainability as a service” platform, to offer riders a simple, automated way to act against climate change. The partnership helps the company to further contribute to decarbonization by funding the planting of a tree for each ride through Aspiration’s reforestation initiative.

- In January 2022, Helbiz Inc. signed a partnership agreement with Segway, a leader in personal transportation services. The partnership expansion of wide range of vehicles, from electric scooters to electric bikes.

- In May 2021, Lyft, Inc. launched new bike and scooter program in partnership with the City of Denver. The Lyft’s bikes, scooters, in-app transit ticketing, rideshare, and rentals, all available through the app.

- In December 2021, TIER acquired Vento Mobility SRL the Italian subsidiary of Wind Mobility. TIER e-scooters are now available in Bari and Palermo and company also planning to launch in other cities in Italy.

Frequently Asked Questions (FAQ):

What is the projected market size & growth rate of the micro-mobility market?

USD 6.1 billion is projected for the forecast year 2027, at a CAGR of 12.5% for micro-mobility market.

What is the current size of the global micro-mobility market?

The micro-mobility market is estimated to grow from USD 3.4 billion in 2022 .

Many companies are operating in the global market space across the globe. Do you know who are the front leaders, and what strategies have been adopted by them?

The market is dominated by a few globally established companies such as Bird Global, Inc. (US), Lyft, Inc. (US), Lime (US), TIER (Germany), Dott (Netherlands). These companies adopted new product launches, partnership, and joint venture to gain traction in the market

How is the demand for global market varies by region?

With the high electrification trend in developed countries and high demand for micro-mobility sharing services, Americas region is predicted to lead the market with a CAGR of 9.2%. The stringent emission norms from this region, rising number of serice providers, increase in preference for first mile and last mile transportation are some of the key reasons for this region also to have the largest market for micro-mobility.

What are the growth opportunities for the global market supplier?

Developing connected and telematics technologies and electric two-wheeler and component manufacturers entering the micro-mobility business would create growth opportunities for the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 MICRO-MOBILITY DEVICES AND THEIR KEY CHARACTERISTICS

1.3 STUDY SCOPE

FIGURE 1 MICRO-MOBILITY MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH APPROACH

FIGURE 2 MICRO-MOBILITY MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.1 Sampling techniques and data collection methods

2.1.2.2 Primary participants

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: HYPOTHESIS BUILDING

2.2.1 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH: MICRO-MOBILITY MARKET, BY TYPE

2.3 FACTOR ANALYSIS

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 8 MICRO-MOBILITY MARKET OUTLOOK

FIGURE 9 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 MICRO-MOBILITY MARKET OVERVIEW

FIGURE 10 INCREASING DEMAND FOR FIRST- AND LAST-MILE TRANSPORTATION DRIVES MARKET

4.2 MARKET, BY TYPE

FIGURE 11 SUPPORTING INFRASTRUCTURE AND GOVERNMENT POLICIES TO BOOST DEMAND FOR E-KICK SCOOTERS

4.3 MARKET, BY SHARING TYPE

FIGURE 12 STATION BASED SEGMENT HOLDS MAXIMUM MARKET SHARE DUE TO INCREASING VEHICLE SAFETY CONCERNS

4.4 MARKET, BY PROPULSION

FIGURE 13 HUMAN-POWERED PROPULSION HAS LARGEST MARKET SHARE DUE TO CHALLENGES OF BATTERY CHARGING AND ITS CAPACITY

4.5 MARKET, BY OWNERSHIP

FIGURE 14 BUSINESS-TO-CONSUMER TO BE LARGEST SEGMENT IN MARKET

4.6 MARKET, BY DATA SERVICE

FIGURE 15 NAVIGATION SEGMENT LEADS OWING TO ROUTE PLANNING AND VEHICLE TRACKING FEATURES OFFERED FOR BETTER USER EXPERIENCE

4.7 MARKET, BY SPEED

FIGURE 16 UP TO 25 KMPH SEGMENT LEADS MARKET

4.8 MARKET, BY TRAVEL RANGE

FIGURE 17 UP TO 3 MILES SEGMENT IS EXPECTED TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.9 MARKET, BY REGION

FIGURE 18 AMERICAS TO LEAD OWING TO RISING VENTURE CAPITAL AND STRATEGIC INVESTMENT BY KEY SERVICE PROVIDERS

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MICRO-MOBILITY MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing concerns regarding first- and last-mile transportation to drive micro-mobility demand

5.2.1.1.1 Rapid urbanization

5.2.1.1.2 Rising trend of on-demand public transportation systems in smart cities

FIGURE 20 THE FREQUENCY OF MICRO-MOBILITY VEHICLE USE, BY COUNTRY, 2021

TABLE 2 MODE OF TRANSPORTATION VARIES BY DISTANCE

FIGURE 21 COST-EFFECTIVENESS OF MICRO-MOBILITY SERVICES

5.2.1.1.3 Increase in cost of vehicle ownership

FIGURE 22 AVERAGE COST PER CAR, 2020 VS 2022 (CENTS PER MILE)

5.2.1.1.4 Demand for environment-friendly services

5.2.1.2 Rise in venture capital and strategic investments

5.2.1.3 Increase in usage of smartphones

FIGURE 23 GLOBAL INTERNET USAGE, 2005–2021 (BILLION PEOPLE)

FIGURE 24 SMARTPHONE PENETRATION IN MAJOR COUNTRIES, 2021

5.2.2 RESTRAINTS

5.2.2.1 Low rate of internet penetration in developing regions or remote areas

5.2.3 OPPORTUNITIES

5.2.3.1 Development in connected and telematics technologies

5.2.3.2 Opportunities for service providers in untapped markets

5.2.3.3 Electric two-wheeler and component manufacturers entering micro-mobility business

FIGURE 25 MICRO-MOBILITY BUSINESS OPPORTUNITY HEAT MAP

5.2.4 CHALLENGES

5.2.4.1 Rise in bike vandalism and theft

5.2.4.2 Regulations in developed countries

TABLE 3 REGULATIONS AND POLICIES IN VARIOUS COUNTRIES

5.2.4.3 Identification and allocation of received investments

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 IMPACT OF PORTER’S FIVE FORCES ANALYSIS ON MICRO-MOBILITY MARKET

FIGURE 26 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TRADE ANALYSIS

5.4.1 EXPORT TRADE DATA

FIGURE 27 EXPORT TRADE DATA, BY KEY COUNTRIES, 2017–2021 (USD)

5.4.2 IMPORT TRADE DATA

FIGURE 28 IMPORT TRADE DATA, BY KEY COUNTRIES, 2017–2021 (USD)

5.5 MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 29 REVENUE SHIFT FOR MICRO-MOBILITY MARKET

5.6 CASE STUDIES

5.6.1 VOI AND OSLO DISTRICT COLLABORATE ON PARKING INFRASTRUCTURE TO ALLOCATE SPACE FOR ZERO-EMISSION TRANSPORT

5.6.2 INNOVATIVE MOBILE APP TO CONTROL ELECTRIC SCOOTER NAVIGATION AND BATTERY STATUS

5.6.3 IMPROVING IN-RIDE EXPERIENCE OF POPULAR E-SCOOTER-SHARING APP

5.6.4 EBIKELABS SMART E-BIKES FOR HEALTH ENTITIES

5.7 PATENT ANALYSIS

FIGURE 30 MICRO-MOBILITY PATENTS FILINGS WORLDWIDE, 2012–2020

TABLE 5 PATENT ANALYSIS

5.8 VALUE CHAIN ANALYSIS

FIGURE 31 MARKET: VALUE CHAIN ANALYSIS

5.9 MICRO-MOBILITY MARKET ECOSYSTEM

FIGURE 32 MARKET ECOSYSTEM

TABLE 6 ROLE OF COMPANIES IN THE MARKET ECOSYSTEM

5.10 REGULATORY ANALYSIS

5.10.1 CLASSIFICATION OF MICRO-MOBILITY VEHICLES AT REGIONAL LEVEL

5.10.1.1 Europe

TABLE 7 EUROPE: LIST OF REGULATORY BODIES, VEHICLE TYPES, AND THEIR FEATURES

5.10.1.2 US

TABLE 8 US: LIST OF REGULATORY BODIES, VEHICLE TYPES, AND THEIR FEATURES

5.10.1.3 Asia

5.10.1.4 Latin America

5.11 PRICING ANALYSIS

5.11.1 AVERAGE COST PER TRIP, 2021 (USD)

TABLE 9 AVERAGE COST PER TRIP FOR E-KICK SCOOTERS, 2021 (USD)

5.12 TECHNOLOGY ANALYSIS

5.12.1 SMART PARKING TECHNOLOGY

5.12.2 IN-APP SOFTWARE EDUCATES AND INCREASES SAFE VEHICLE USE

5.12.3 CONNECTIVE TECHNOLOGY ALLOWS MULTIMODALITY

5.12.4 BATTERY SWAPPING

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 10 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR MICRO-MOBILITY SERVICES (%)

5.14.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR THE MICRO-MOBILITY MARKET

TABLE 11 KEY BUYING CRITERIA FOR MICRO-MOBILITY TYPES

6 MICRO-MOBILITY MARKET, BY BATTERY TYPE (Page No. - 90)

6.1 INTRODUCTION

6.2 LITHIUM-ION

6.2.1 E-BIKES HAVE MAXIMUM PENETRATION OF LITHIUM-ION BATTERIES OWING TO HIGH POWER RANGE AND COMPACT SIZE

6.3 LITHIUM-ION POLYMER

6.3.1 LOW WEIGHT AND BETTER RANGE OF LITHIUM-ION POLYMER BATTERIES DRIVE DEMAND

6.4 LEAD ACID

6.4.1 LOW COST AND LIGHTWEIGHT FEATURES OF LEAD-ACID BATTERY DRIVE DEMAND

6.5 OTHERS

6.5.1 LITHIUM-TITANATE BATTERY DEMAND EXPECTED TO INCREASE IN FUTURE

7 MICRO-MOBILITY MARKET, BY VOLTAGE (Page No. - 93)

7.1 INTRODUCTION

7.2 BELOW 24V

7.2.1 E-SKATEBOARDS, SCOOTERS, AND E-BIKES USUALLY USE LESS THAN 24V BATTERIES

7.3 36V

7.3.1 36V BATTERIES INCREASE DISTANCE RANGE AND IMPROVE VEHICLE PERFORMANCE

7.4 48V

7.4.1 MANUFACTURERS OF E-KICK SCOOTERS AND E-MOPEDS PREFER 48V BATTERIES FOR A FEW MODELS

7.5 > 48V

7.5.1 DEMAND FOR 60V BATTERIES EXPECTED TO GROW IN A FEW MICRO-MOBILITY APPLICATIONS

8 MICRO-MOBILITY MARKET, BY TYPE (Page No. - 95)

8.1 INTRODUCTION

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

8.1.3 INDUSTRY INSIGHTS

FIGURE 34 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 12 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 13 MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.2 BICYCLES

8.2.1 DEMAND FOR ENVIRONMENT-FRIENDLY FIRST- AND LAST-MILE TRANSPORT SOLUTIONS DRIVING DEMAND

TABLE 14 BICYCLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 15 BICYCLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 E-BIKES

8.3.1 SUPPORTING GOVERNMENT POLICIES AND FUNDING FROM KEY SERVICE PROVIDERS DRIVING MARKET

TABLE 16 E-BIKES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 E-BIKES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 E-KICK SCOOTERS

8.4.1 CUSTOMER PREFERENCE FOR BETTER AESTHETICS AND HIGHER COMFORT TO DRIVE DEMAND

TABLE 18 E-KICK SCOOTERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 E-KICK SCOOTERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 OTHERS

8.5.1 DEMAND FOR SKATEBOARDS AND SEGWAYS TO INCREASE OWING TO SUPPORTING INFRASTRUCTURE

TABLE 20 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MICRO-MOBILITY MARKET, BY PROPULSION (Page No. - 103)

9.1 INTRODUCTION

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

9.1.3 INDUSTRY INSIGHTS

FIGURE 35 MARKET, BY PROPULSION, 2022 VS. 2027 (USD MILLION)

TABLE 22 MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY PROPULSION, 2022–2027 (USD MILLION)

9.2 HUMAN POWERED (PEDAL-ASSIST)

9.2.1 EASY ACCESSIBILITY AND COST-EFFECTIVENESS INCREASING DEMAND FOR HUMAN-POWERED BICYCLES

TABLE 24 HUMAN POWERED (PEDAL ASSIST): MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 HUMAN POWERED (PEDAL ASSIST): MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ELECTRICALLY POWERED

9.3.1 GROWING CHARGING INFRASTRUCTURE AND IMPROVED BATTERY PERFORMANCE TO DRIVE MARKET

TABLE 26 ELECTRICALLY POWERED: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 ELECTRICALLY POWERED: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MICRO-MOBILITY MARKET, BY SHARING TYPE (Page No. - 108)

10.1 INTRODUCTION

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

FIGURE 36 MARKET, BY SHARING TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 28 MARKET, BY SHARING TYPE, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY SHARING TYPE, 2022–2027 (USD MILLION)

10.2 STATION BASED (DOCKED)

10.2.1 DOCKED SHARING TYPE PROVIDES MORE SECURE SOLUTION FOR FLEETS

TABLE 30 STATION BASED (DOCKED): MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 STATION BASED (DOCKED): MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 DOCK-LESS

10.3.1 DOCK-LESS STATIONS OFFER MAXIMUM FREEDOM TO CUSTOMERS

TABLE 32 DOCKLESS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 DOCKLESS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 MICRO-MOBILITY MARKET, BY OWNERSHIP (Page No. - 114)

11.1 INTRODUCTION

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

FIGURE 37 MARKET, BY OWNERSHIP, 2022 VS. 2027 (USD MILLION)

TABLE 34 MARKET, BY OWNERSHIP, 2018–2021 (USD MILLION)

TABLE 35 MARKET, BY OWNERSHIP, 2022–2027 (USD MILLION)

11.2 BUSINESS-TO-BUSINESS

11.2.1 RISING DEMAND FOR EMISSION-FREE VEHICLES IN UNIVERSITIES AND CAMPUSES DRIVES MARKET

TABLE 36 BUSINESS-TO-BUSINESS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 BUSINESS-TO-BUSINESS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 BUSINESS-TO-CONSUMER

11.3.1 RISE IN SMART CITY PROJECTS AND INCREASE IN DEMAND FOR SHORT-DISTANCE TRAVEL BOOST MARKET GROWTH

TABLE 38 BUSINESS-TO-CONSUMER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 39 BUSINESS-TO-CONSUMER: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 MICRO-MOBILITY MARKET, BY DATA SERVICE (Page No. - 119)

12.1 INTRODUCTION

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

FIGURE 38 MARKET, BY DATA SERVICE, 2022 VS. 2027 (USD MILLION)

TABLE 40 MARKET, BY DATA SERVICE, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY DATA SERVICE, 2022–2027 (USD MILLION)

12.2 NAVIGATION

12.2.1 REAL-TIME DATA AND ROUTE PLANNING FEATURES BOOST NAVIGATION SEGMENT

TABLE 42 NAVIGATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 NAVIGATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 PAYMENT

12.3.1 INCREASE IN POPULARITY OF DIGITAL PAYMENTS AND THEIR CONVENIENCE IS DRIVING DEMAND

TABLE 44 PAYMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 PAYMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 OTHERS

12.4.1 DOCK-LESS STATIONS OFFERING MAXIMUM FREEDOM TO CUSTOMERS DRIVING GROWTH

TABLE 46 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 OTHER: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 MICRO-MOBILITY MARKET, BY TRAVEL RANGE (Page No. - 125)

13.1 INTRODUCTION

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

FIGURE 39 MARKET, BY TRAVEL RANGE, 2022 VS. 2027 (USD MILLION)

TABLE 48 MARKET, BY TRAVEL RANGE, 2018–2021 (USD MILLION)

TABLE 49 MARKET, BY TRAVEL RANGE, 2022–2027 (USD MILLION)

13.2 UP TO 3 MILES

13.2.1 E-KICK SCOOTERS AND BICYCLES USED TO COMMUTE UP TO 3 MILES

TABLE 50 UP TO 3 MILES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 UP TO 3 MILES: MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 3–6 MILES

13.3.1 MAJORITY OF E-MOPEDS USED TO COMMUTE 3–6 MILES DISTANCE

TABLE 52 3–6 MILES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 3–6 MILES: MARKET, BY REGION, 2022–2027 (USD MILLION)

14 MICRO-MOBILITY MARKET, BY SPEED (Page No. - 130)

14.1 INTRODUCTION

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS

14.1.3 INDUSTRY INSIGHTS

FIGURE 40 MARKET, BY SPEED, 2022 VS. 2027 (USD MILLION)

TABLE 54 MARKET, BY SPEED, 2018–2021 (USD MILLION)

TABLE 55 MARKET, BY SPEED, 2022–2027 (USD MILLION)

14.2 UP TO 25 KMPH

14.2.1 INCREASE IN DEMAND FOR E-BIKES AND E-KICK SCOOTERS WOULD DRIVE MARKET

TABLE 56 CITY SPEED LIMITS, 2022

TABLE 57 UP TO 25 KMPH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 UP TO 25 KMPH: MARKET, BY REGION, 2022–2027 (USD MILLION)

14.3 25–45 KMPH

14.3.1 LONG-DISTANCE COVERAGE AND EMERGENCE OF TOURISM TO BOOST MARKET GROWTH

TABLE 59 25–45 KMPH: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 25–45 KMPH: MARKET, BY REGION, 2022–2027 (USD MILLION)

15 MICRO-MOBILITY MARKET, BY REGION (Page No. - 136)

15.1 INTRODUCTION

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS

15.1.3 INDUSTRY INSIGHTS

FIGURE 41 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 61 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MARKET, BY REGION, 2022–2027 (USD MILLION)

15.2 AMERICAS

TABLE 63 NUMBER OF TRIPS IN NORTH AMERICA

FIGURE 42 AMERICAS: MARKET SNAPSHOT

TABLE 64 AMERICAS: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 65 AMERICAS: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.2.1 US

15.2.1.1 US holds largest market share owing to presence of Lime and Lyft

TABLE 66 US: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 67 US: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.2.2 CANADA

15.2.2.1 E-kick scooter estimated to show fastest growth in Canada micro-mobility market

TABLE 68 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 69 CANADA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.2.3 MEXICO

15.2.3.1 Rising demand for e-kick scooters driving market

TABLE 70 MEXICO: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 MEXICO: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.2.4 BRAZIL

15.2.4.1 Brazil projected to be fastest-growing market in Americas

TABLE 72 BRAZIL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 BRAZIL: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3 EUROPE

FIGURE 43 EUROPE: MARKET SNAPSHOT

TABLE 74 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

15.3.1 GERMANY

15.3.1.1 Structural lanes and developed infrastructure supporting micro-mobility will drive market in Germany

TABLE 76 GERMANY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 77 GERMANY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.2 FRANCE

15.3.2.1 High demand for bicycles and e-kick scooters will drive market in France

TABLE 78 FRANCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 79 FRANCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.3 ITALY

15.3.3.1 Increasing use of micro-mobility in Rome and Milan will boost Italian market

TABLE 80 ITALY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 81 ITALY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.4 RUSSIA

15.3.4.1 Increasing government initiatives to fuel market in Russia

TABLE 82 RUSSIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 RUSSIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.5 SPAIN

15.3.5.1 E-kick scooters estimated to show fastest growth in Spain

TABLE 84 SPAIN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 85 SPAIN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.6 UK

15.3.6.1 Increasing focus on low-speed sharing vehicles to drive demand

TABLE 86 UK: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 87 UK: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.3.7 NETHERLANDS

15.3.7.1 Rising focus on bicycles as a sharing service to boost market growth

TABLE 88 NETHERLANDS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 89 NETHERLANDS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4 ASIA PACIFIC

TABLE 90 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 91 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

FIGURE 44 ASIA PACIFIC:MARKET, 2022 VS 2027 (USD MILLION)

15.4.1 CHINA

15.4.1.1 Increasing adoption of e-bikes and e-kick scooters and government incentives to lead to reduced emissions

TABLE 92 CHINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 93 CHINA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.2 INDIA

15.4.2.1 India estimated to be fastest-growing market in Asia Pacific

TABLE 94 INDIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 95 INDIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.3 JAPAN

15.4.3.1 E-kick scooter shows fastest growth in Japan’s micro-mobility market

TABLE 96 JAPAN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 97 JAPAN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.4 SINGAPORE

15.4.4.1 Presence of leading players makes Singapore third-largest market in Asia Pacific

TABLE 98 SINGAPORE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 99 SINGAPORE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.5 INDONESIA

15.4.5.1 Indonesia second-largest market for micro-mobility in Asia Pacific

TABLE 100 INDONESIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 101 INDONESIA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

15.4.6 SOUTH KOREA

15.4.6.1 E-kick scooters estimated to show fastest growth

TABLE 102 SOUTH KOREA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 103 SOUTH KOREA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 166)

16.1 OVERVIEW

16.2 MICRO-MOBILITY MARKET SHARE ANALYSIS, 2021

TABLE 104 MARKET SHARE ANALYSIS, 2021

FIGURE 45 MARKET SHARE, 2021

16.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

FIGURE 46 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2019–2021

16.4 COMPANY EVALUATION QUADRANT: MICRO-MOBILITY SERVICE PROVIDER

16.4.1 STARS

16.4.2 EMERGING LEADERS

16.4.3 PERVASIVE PLAYERS

16.4.4 PARTICIPANTS

TABLE 105 MICRO-MOBILITY MARKET: COMPANY SERVICES FOOTPRINT, 2021

TABLE 106 MARKET: COMPANY MICRO-MOBILITY SERVICES FOOTPRINT, 2021

TABLE 107 MARKET: COMPANY REGION FOOTPRINT, 2021

FIGURE 47 COMPETITIVE EVALUATION MATRIX: MICRO-MOBILITY SERVICE PROVIDERS, 2021

FIGURE 48 DETAILS ON KEY DEVELOPMENTS BY LEADING PLAYERS

16.5 COMPETITIVE SCENARIO

16.5.1 NEW PRODUCT DEVELOPMENTS

TABLE 108 NEW PRODUCT DEVELOPMENTS, 2022

16.5.2 DEALS

TABLE 109 DEALS, 2022

16.5.3 EXPANSIONS, 2019–2022

TABLE 110 EXPANSIONS, 2022

16.6 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019–2022

TABLE 111 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND PARTNERSHIPS AS KEY GROWTH STRATEGIES FROM 2019 TO 2022

16.7 COMPETITIVE BENCHMARKING

TABLE 112 MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 113 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

17 COMPANY PROFILES (Page No. - 182)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

17.1 INTRODUCTION

17.2 KEY PLAYERS

17.2.1 BIRD GLOBAL, INC.

TABLE 114 BIRD GLOBAL, INC.: BUSINESS OVERVIEW

FIGURE 49 BIRD GLOBAL, INC.: COMPANY SNAPSHOT

TABLE 115 BIRD GLOBAL, INC.: PRODUCTS OFFERED

TABLE 116 BIRD GLOBAL, INC.: DEALS

TABLE 117 BIRD GLOBAL, INC.: NEW PRODUCT DEVELOPMENTS

TABLE 118 BIRD GLOBAL, INC.: EXPANSION

17.2.2 LYFT, INC.

TABLE 119 LYFT, INC.: BUSINESS OVERVIEW

FIGURE 50 LYFT, INC.: COMPANY SNAPSHOT

TABLE 120 LYFT, INC.: PRODUCTS OFFERED

TABLE 121 LYFT, INC.: NEW PRODUCT DEVELOPMENTS

TABLE 122 LYFT, INC.: DEALS

17.2.3 LIME

TABLE 123 LIME: BUSINESS OVERVIEW

TABLE 124 LIME: PRODUCTS OFFERED

TABLE 125 LIME: NEW PRODUCT DEVELOPMENTS

TABLE 126 LIME: DEALS

17.2.4 DOTT

TABLE 127 DOTT: BUSINESS OVERVIEW

TABLE 128 DOTT: PRODUCTS OFFERED

TABLE 129 DOTT: NEW PRODUCT DEVELOPMENTS

TABLE 130 DOTT: DEALS

17.2.5 HELBIZ INC.

TABLE 131 HELBIZ INC.: BUSINESS OVERVIEW

FIGURE 51 HELBIZ INC.: COMPANY SNAPSHOT

TABLE 132 HELBIZ INC.: PRODUCTS OFFERED

TABLE 133 HELBIZ INC.: NEW PRODUCT DEVELOPMENTS

TABLE 134 HELBIZ INC.: DEALS

17.2.6 TIER

TABLE 135 TIER: BUSINESS OVERVIEW

TABLE 136 TIER: PRODUCTS OFFERED

TABLE 137 TIER: NEW PRODUCT DEVELOPMENTS

TABLE 138 TIER: DEALS

17.2.7 BOLT TECHNOLOGY OÜ

TABLE 139 BOLT TECHNOLOGY OÜ: BUSINESS OVERVIEW

TABLE 140 BOLT TECHNOLOGY OÜ: PRODUCTS OFFERED

TABLE 141 BOLT TECHNOLOGY OÜ: NEW PRODUCT DEVELOPMENTS

TABLE 142 BOLT TECHNOLOGY OÜ: DEALS

17.2.8 VOI

TABLE 143 VOI: BUSINESS OVERVIEW

TABLE 144 VOI: PRODUCTS OFFERED

TABLE 145 VOI: NEW PRODUCT DEVELOPMENTS

TABLE 146 VOI: DEALS

17.2.9 SUPERPEDESTRIAN INC.

TABLE 147 SUPERPEDESTRIAN INC.: BUSINESS OVERVIEW

TABLE 148 SUPERPEDESTRIAN INC.: PRODUCTS OFFERED

TABLE 149 SUPERPEDESTRIAN INC.: DEALS

17.2.10 SPIN

TABLE 150 SPIN: BUSINESS OVERVIEW

TABLE 151 SPIN: PRODUCTS OFFERED

TABLE 152 SPIN: NEW PRODUCT DEVELOPMENTS

TABLE 153 SPIN: DEALS

17.3 OTHER PLAYERS

17.3.1 NIU INTERNATIONAL

TABLE 154 NIU INTERNATIONAL: COMPANY OVERVIEW

17.3.2 VEO

TABLE 155 VEO: COMPANY OVERVIEW

17.3.3 FELYX SHARING B.V.

TABLE 156 FELYX SHARING B.V.: COMPANY OVERVIEW

17.3.4 YULU

TABLE 157 YULU: COMPANY OVERVIEW

17.3.5 MOOVIT INC.

TABLE 158 MOOVIT INC.: COMPANY OVERVIEW

17.3.6 WIND TEL-AVIV (BY-BYKE) LTD.

TABLE 159 WIND TEL-AVIV (BY-BYKE) LTD.: COMPANY OVERVIEW

17.3.7 BEAM MOBILITY HOLDINGS PTE. LTD.

TABLE 160 BEAM MOBILITY HOLDINGS PTE. LTD.: COMPANY OVERVIEW

17.3.8 E-STRALIAN PTY LTD

TABLE 161 E-STRALIAN PTY LTD: COMPANY OVERVIEW

17.3.9 HELLO-BIKE

TABLE 162 HELLO-BIKE: COMPANY OVERVIEW

17.3.10 SPLYT TECHNOLOGIES LTD.

TABLE 163 SPLYT TECHNOLOGIES LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

18 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 221)

18.1 NORTH AMERICA LEADING MICRO-MOBILITY MARKET GLOBALLY

18.2 E-KICK SCOOTERS DEMAND INCREASING IN EUROPE OWING TO SUPPORTING GOVERNMENT REGULATIONS

18.3 CONCLUSION

19 APPENDIX (Page No. - 223)

19.1 KEY INSIGHTS OF INDUSTRY EXPERTS

19.2 DISCUSSION GUIDE

19.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.4 AVAILABLE CUSTOMIZATIONS

19.4.1 MICRO-MOBILITY MARKET, BY AGE GROUP

19.4.1.1 15–34

19.4.1.2 34–54

19.4.1.3 55 & Above

19.4.2 MARKET, BY LOCATION

19.4.2.1 Roads

19.4.2.2 Tracks

19.4.2.3 Footpaths

19.4.3 SKATEBOARDS MARKET, BY REGION

19.4.3.1 Americas

19.4.3.2 Europe

19.4.3.3 Asia Pacific

19.4.4 SEGWAYS MARKET, BY REGION

19.4.4.1 Americas

19.4.4.2 Europe

19.4.4.3 Asia Pacific

19.5 RELATED REPORTS

19.6 AUTHOR DETAILS

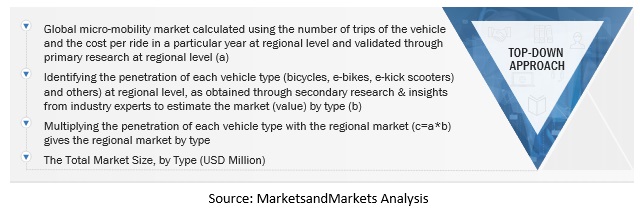

The study involves four main activities to estimate the current size of the micro-mobility market.

- Exhaustive secondary research was done to collect information on the market, such as micro-mobility market by type, speed, propulsion, sharing type, ownership, data service, travel range and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

- Top-down approach were employed to estimate the complete market size for different segments considered under this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources.

Secondary research was used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

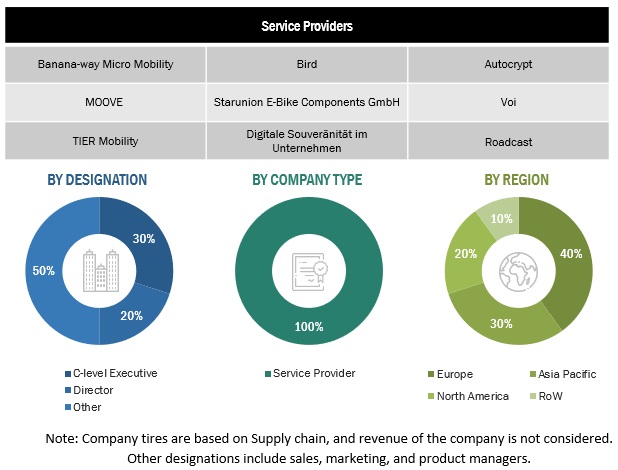

Extensive primary research was conducted after acquiring an understanding of the micro-mobility market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand - (micro-mobility vehicle users) and supply-side (micro-mobility service providers, battery suppliers, data service providers and others) players across three major regions, namely, Americas, Europe, and Asia Pacific. Approximately 90-100% of the primary interviews were conducted from the supply side. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration were strived, to provide a holistic viewpoint in reports while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, has led to the findings delineated in the rest of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the micro-mobility market and other dependent submarkets, as mentioned below:

- The regional data has been collected using the number of trips travelled by the micro-mobility vehicles in a year and the per ride cost. Further, top-down approach has been used to estimate the country level market by type of vehicle. The country level penetration of each vehicle type is applied on the country level market and hence country level market for each vehicle type has been derived.

Micro-Mobility Market Size: Top-Down Approach (Type)

To know about the assumptions considered for the study, Request for Free Sample Report

Micro-Mobility Market Size: Top-Down Approach (Region)

Report Objectives

- To define, describe, and forecast the size of the micro-mobility market in terms value

- By Type (Bicycles, E-bikes, E-kick scooters, and Others)

- By Speed (Up To 25 kmph and 25-45 kmph)

- By Propulsion (Human Powered and Electrically Powered)

- By Sharing Type (Docked) and Dock-less)

- By Ownership (Business-to-Business and Business-to-Consumer)

- By Data Service (Navigation, Payment, and Other Data Services)

- By Travel Range (Up to 3 Miles and 3-6 Miles)

- By Region (Asia-Pacific, Europe, Americas)

- To qualitatively analyze and assess the market, by voltage and by battery type

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the share of leading players in the micro-mobility market and evaluate competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue analysis

- To strategically analyze the market with Porter’s Five Forces analysis, supply chain analysis, market ecosystem, trade analysis, case studies, ASP analysis, patent analysis, trends/disruptions impacting buyers, technology trend and regulatory analysis.

- To analyze recent developments, including new product launches, expansions, and other activities, undertaken by key industry participants in the market.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

Micro-Mobility Market, By AGE Group

- 15-34

- 34-54

- 55 & Above

Micro-Mobility Market, By Location

- Roads

- Tracks

- Footpaths

Skateboards Micro-Mobility Market, By Region

- Americas

- Europe

- Asia Pacific

Segways Micro-Mobility Market, By Region

- Americas

- Europe

- Asia Pacific

Detailed Analysis and Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro-Mobility Market