Automotive Blockchain Market by Application (Financing, Mobility Solutions, Smart Contract, Supply Chain), Provider (Application & Solution, Middleware, Infrastructure & Protocol), Mobility (Personal, Shared, Commercial) and Region - Global Forecast to 2030

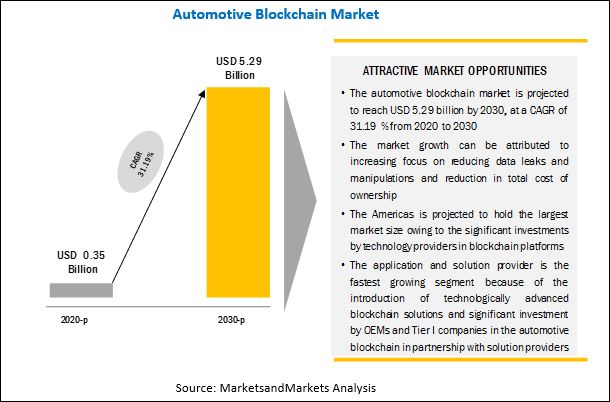

The global automotive blockchain market size was valued at USD 0.35 billion in 2020 and is expected to reach USD 5.29 billion by 2030, at a CAGR of 31.19%, during the forecast period. Increasing focus on reducing manipulation of data, better quality control, and the need for faster business transactions have triggered the growth of automotive blockchain market.

Years considered for this report:

- 2020 - Estimated Year

- 2030 - Forecasted year

- 2020–2030 - Forecast Period

Increasing focus on data integrity and transparency coupled with faster transaction time to drive the global automotive blockchain demand to $5.29 billion by 2030

BaaS, crypto-currency, and ICO will propel the growth of the automotive blockchain market, thereby simplifying business processes and creating transparency and immutability in the distributed ledger technology with benefits such as faster transactions and reduced total cost of ownership. The market will see the emergence of a new breed of programmable blockchain technology platforms. As venture capital funding in this market continues to increase, new technology providers are expected to enter the market, offering new service models. The high-growth potential in the emerging markets such as Asia Oceania and MEA makes the market more competitive. However, the market is still far from reaching its potential due to the lack of consumer awareness, fickle system reliability, and concerns over data privacy.

Furthermore, ongoing new product developments and partnerships by leading companies are likely to propel the growth of the automotive blockchain in the untapped markets for the long forecast.

Market Dynamics

Drivers

- Increasing focus on reducing data leaks and manipulations

- Faster transactions

- Reduced total cost of ownership

Restraints

- Uncertainty over regulations

Opportunities

- Higher adoption of automotive blockchain for payments, logistics and transportation, and usage-based insurance

- Increasing crypto currency market capital

Challenges

- Concerns over security, privacy, and control

- Gaining user acceptance and lack of technical expertise

- Limited scalability

Objectives of the study

- To analyze and forecast (2020–2030) the automotive blockchain market, in terms of value (Million/Billion)

- To define, describe, and project the global market based on application, provider, mobility type, and region

- To analyze and forecast the market across 4 key regions, namely, Asia Oceania, Europe, the Americas, and the Middle East and Africa (MEA)

- To analyze the regional markets for growth trends, prospects, and their contribution to the total market

- To analyze the opportunities offered by various segments of the market to the stakeholders

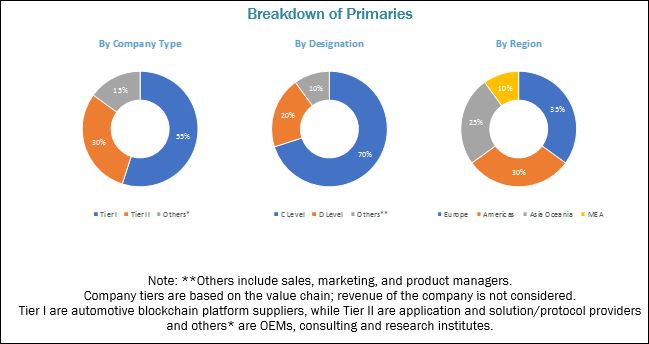

The research methodology used in the report involves various secondary sources, including automotive blockchain associations such as the Mobility Open Blockchain Initiative (MOBI), world blockchain association, and others; corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and automotive associations. Experts from related industries have been interviewed to understand the future trends of the automotive blockchain market for automotive.

The top-down approach has been used to estimate and validate the size of the global market. The global market size of the automotive blockchain has been derived by considering the revenue generated by all the technology players (application and solution providers, middleware providers, and infrastructure and protocol providers). Additionally, the year-on-year (Y-O-Y) growth of the blockchain industry has been considered while deriving the global blockchain market size. The market is also corrected, validated, and confirmed through primary expert insights. The market size of the automotive blockchain has been derived by multiplying the global blockchain market with the penetration (market share) of the automotive industry applications-based use cases, company developments, and primary insights. The global market for automotive blockchain is further divided into regions by considering factors such as regional developments, the market size of the automotive industry, and primary insights.

The regional automotive blockchain market, by country, has been derived by determining the penetration of different automotive blockchain applications considering factors such as government regulations, automotive blockchain applications, company developments, use cases, potential use cases, internet connectivity, and primary insights. Similarly, this market is segmented into provider and mobility type.

The figure given below shows the breakup of the profile of industry experts that participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The automotive blockchain market consists of companies such as IBM (US), Microsoft (US), Accenture (Ireland), carVertical (Estonia), Helbiz (US), Tech Mahindra (India), SHIFTMobility (US), and BigchainDB (Germany).

Target Audience

- Automotive OEMs

- Automotive blockchain platform providers

- Application and service providers

- Cloud service providers

- Crypto-currency companies

- Investors and venture capitalists

- Infrastructure and protocols providers

- Technology providers

- The automobile industry as an end-user industry and regional automobile associations

- Traders, distributors, and suppliers in the automotive blockchain industry

- Automotive blockchain system suppliers

- Research institutes and government organizations

Scope of the Report

By Application

- Smart Contracts

- Supply Chain

- Financing

- Mobility Solutions

- Others

By Provider

- Middleware Provider

- Infrastructure and Protocols Provider

- Application and Solution Provider

By Mobility Type

- Personal Mobility

- Shared Mobility

- Commercial Mobility

By Region

- Americas

- Asia Oceania

- Europe

- Middle East and Africa (MEA)

Critical Questions:

- When is Asia Oceania going to be a mass adoption market for the automotive blockchain?

- Which automotive application is going to dominate in the future?

- How are the industry players addressing the challenge of data privacy and limited scalability?

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to company-specific needs.

Automotive Blockchain Market, by Other Application

- Fleet Management

- Insurance

- Safety and Security

- IoT

Note: The chapter is further segmented by region (Asia Oceania, Europe, Americas, and MEA)

Automotive Blockchain Market, by Mobility Type & Country

- Personal Mobility

- Shared Mobility

- Commercial Mobility

Note: The chapter is further segmented by selected country [Asia Oceania (India, Japan, China), Europe (Germany, UK, France), Americas (US, Canada)]

The automotive blockchain market is projected to grow at a CAGR of 31.19% from 2020 to 2030, and the market size is projected to grow from USD 0.35 billion in 2020 to USD 5.29 billion by 2030. The increasing need for transparency and immutability in the complex automotive ecosystem and significant testing of blockchain use cases in automotive applications are expected to play a significant role in the growth of market.

The smart contracts segment is projected to be the fastest growing segment in the global market, by application. Smart contracts have a significant number of applications in the automotive industry, such as title transfer, dealership management, and B2B contractual agreements. For example, in May 2017, smart contracts enabled Innogy SE to launch hundreds of blockchain-powered charging stations for electric cars across Germany through its e-mobility startup venture Share&Charge. The significant concept testing and implementations of blockchain-based smart contract in the automotive industry is expected to play a major role in the growth of this market for smart contracts.

In the automotive blockchain market, by provider, the application and solution provider segment is projected to hold the largest market share because of the introduction of technologically advanced blockchain solutions and the significant investments by OEMs and Tier I companies in the automotive blockchain in partnership with solution providers. Additionally, applications and solutions require higher costs to develop and maintain than middleware and platforms. Hence, the revenue generated by the application and solution providers is higher.

Personal mobility is projected to be the largest segment of the blockchain market for automotive, by mobility type. Strong economic growth, increasing population, rapid urbanization, and growing purchasing power have triggered the demand for personal mobility across the globe. As passenger car production and sales constitute the largest share of the revenue generated by all industry participants, the applications of blockchain are also projected to generate maximum revenues from the production, sales, and services related to passenger cars or personal mobility. Additionally, leading OEMs and Tier I companies have started implementing blockchain to streamline their operations. For instance, in July 2017, automaker Renault unveiled a new digitized car maintenance log prototype built using blockchain.

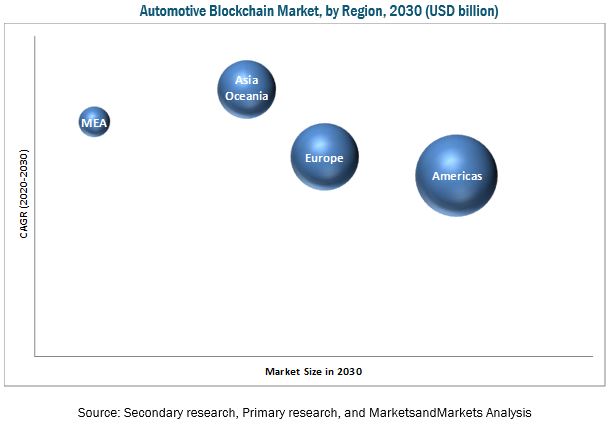

The Americas region will be one of the early adopters of the blockchain technology for automotive applications and is estimated to be the major contributor to this market over the forecast period. The growth will likely be driven by two key factors increasing demand for transparency and immutability in business operations and the significant investments by technology providers in the blockchain platform. In May 2018, SHIFTMobility revealed the world’s first blockchain-powered platform for the automotive industry. The platform will help connect, understand, and harness the demand from the myriad of vehicles and supply chain apps, commerce channels, enhanced diagnostics, and transportation logistics for now and in the autonomous future. The major companies such as IBM, AWS, and Microsoft, which have their operating base in the Americas, have a major impact on the regional and global market. Also, the strong financial position of this region allows these countries to invest heavily in leading technologies such as automotive blockchain.

Asia Oceania is projected to be the fastest growing market for automotive blockchain. In the recent years, the region has emerged as a hub for automobile production. Strong economic growth, increasing population, rapid urbanization, and growing purchasing power has triggered the demand for automobiles in the region. The growing automotive industry in Asia Oceania is set to adopt the blockchain technology to increase transparency and combat frauds in the automotive sector. For instance, in 2015, Chinese conglomerate Wanxiang Group, one of the largest auto parts manufacturers, decided to invest USD 50.0 million in blockchain technology. Hence, these developments are expected to drive the growth of automotive blockchain in the region in the near future. Additionally, China and India, being the leading markets for mobility solutions, have the potential to integrate blockchain technology in ridesharing applications.

The key factors restraining the growth of the automotive blockchain market is the uncertainty over government regulations. The blockchain technology in automotive is still is in a nascent stage in the automotive industry, and the regulatory entities have always found it difficult to cope with these advancements in technology. As blockchain is decentralized, no single company or government can control the blockchain, thereby subjecting it to regulations. For example, the EU implemented the General Data Protection Regulation (GDPR) in May 2018. This regulation allows data privacy and EU citizens have the “right to be forgotten.” This contradicts with the immutability and decentralized nature of blockchain. Hence, there is a lot of ambiguity over regulations on the blockchain.

The automotive blockchain market is dominated by leading technology players such as IBM (US), Microsoft (US), BigchainDB (Germany), Tech Mahindra (India), and carVertical (Estonia).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives

1.2 Product and Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Automotive Blockchain Market – Global Trends

4.2 Market, By Application

4.3 Market, By Provider

4.4 Market, By Mobility Type

4.5 Market, By Country

4.6 Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.1.1 Types of Blockchain

5.1.1.1 Private Blockchain

5.1.1.2 Public Blockchain

5.1.1.3 Hybrid Blockchain

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Focus on Reducing Data Leaks and Manipulations

5.2.1.2 Faster Transactions

5.2.1.3 Reduced Operational Costs

5.2.2 Restraints

5.2.2.1 Uncertainty Over Regulations

5.2.3 Opportunities

5.2.3.1 Higher Adoption of Automotive Blockchain for Payments, Logistics and Transportation, and Usage-Based Insurance

5.2.3.1.1 Payments and Mobility Services

5.2.3.1.2 Logistics and Transportation

5.2.3.1.3 Usage-Based Insurance

5.2.3.2 Increasing Crypto currency Market Capital

5.2.4 Challenges

5.2.4.1 Concerns Over Security, Privacy, and Control

5.2.4.2 Gaining User Acceptance and Lack of Technical Expertise

5.2.4.3 Limited Scalability

6 Automotive Blockchain Market, By Application (Page No. - 45)

Note: the Chapter is Further Segmented By Region (Asia Oceania, Europe, Americas, and MEA)

6.1 Introduction

6.2 Smart Contracts

6.3 Supply Chain

6.4 Financing

6.5 Mobility Solutions

6.6 Others

7 Automotive Blockchain Market, By Provider (Page No. - 54)

Note: the Chapter is Further Segmented By Region (Asia Oceania, Europe, Americas, and MEA

7.1 Introduction

7.2 Middleware Provider

7.3 Infrastructure and Protocols Provider

7.4 Application and Solution Provider

8 Automotive Blockchain Market, By Mobility Type (Page No. - 60)

Note: the Chapter is Further Segmented By Region (Asia Oceania, Europe, Americas, and MEA)

8.1 Introduction

8.2 Personal Mobility

8.3 Shared Mobility

8.4 Commercial Mobility

9 Automotive Blockchain Market, By Region (Page No. - 66)

Note: the Chapter is Further Segmented By Application(Financing, Mobility Solutions, Smart Contract, Supply Chain, and Others) and By Provider (Application and Solution Provider, Middleware Provider, Infrastructure and Protocols Provider)

9.1 Introduction

9.2 Asia Oceania

9.2.1 Australia

9.2.2 China

9.2.3 India

9.2.4 Japan

9.2.5 Rest of Asia Oceania

9.3 Europe

9.3.1 France

9.3.2 Germany

9.3.3 UK

9.3.4 Spain

9.3.5 The Netherlands

9.3.6 Rest of Europe

9.4 Americas

9.4.1 Brazil

9.4.2 Canada

9.4.3 Mexico

9.4.4 US

9.4.5 Rest of Americas

9.5 Middle East and Africa (MEA)

9.5.1 Middle East

9.5.2 Africa

10 Competitive Landscape (Page No. - 96)

10.1 Introduction

10.2 Automotive Blockchain: Top Players

10.3 Competitive Situation & Trends

10.3.1 Competitive Situation & Trends: New Product Developments Was the Most Widely Adopted Strategy

10.3.2 Supply Contracts/Collaborations/Partnerships/Joint Ventures

10.3.3 New Product Developments

10.3.4 Expansions/ Mergers & Acquisitions

11 Company Profiles (Page No. - 101)

(Overview, Products Offered, Recent Developments & SWOT Analysis)*

11.1 IBM

11.2 Accenture

11.3 Microsoft

11.4 Carvertical

11.5 Helbiz

11.6 Tech Mahindra

11.7 HCL Technologies

11.8 Xain

11.9 NXM Labs

11.10 Carblock

11.11 Cube

11.12 Context Labs

11.13 Shiftmobility

11.14 Bigchaindb

11.15 Dashride

11.16 Consensys

11.17 Foam

11.18 RSK Labs

11.19 GEM

*Details on Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 140)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.4.1 Automotive Blockchain Market, By Other Application

12.4.1.1 Fleet Management

12.4.1.2 Insurance

12.4.1.3 Safety and Security

12.4.1.4 IoT

12.4.2 Automotive Blockchain Market, By Mobility Type & Country

12.4.2.1 Personal Mobility

12.4.2.2 Shared Mobility

12.4.2.3 Commercial Mobility

12.5 Related Reports

12.6 Author Details

List of Tables (61 Tables)

Table 1 Currency Exchange Rates (Wrt USD)

Table 2 Automotive Blockchain Market, By Application, 2020–2030 (USD Million)

Table 3 Smart Contracts: Market, By Region, 2020–2030 (USD Million)

Table 4 Supply Chain: Market, By Region, 2020–2030 (USD Million)

Table 5 Financing: Market, By Region, 2020–2030 (USD Million)

Table 6 Mobility Solutions: Market, By Region, 2020–2030 (USD Million)

Table 7 Others: Market, By Region, 2020–2030 (USD Million)

Table 8 Market, By Provider, 2020–2030 (USD Million)

Table 9 Middleware Provider: Market, By Region, 2020–2030 (USD Million)

Table 10 Infrastructure and Protocols Provider: Market, By Region, 2020–2030 (USD Million)

Table 11 Application and Solution Provider: Market, By Region, 2020–2030 (USD Million)

Table 12 Market, By Mobility Type, 2020–2030 (USD Million)

Table 13 Personal Mobility: Market, By Region, 2020–2030 (USD Million)

Table 14 Shared Mobility: Market, By Region, 2020–2030 (USD Million)

Table 15 Commercial Mobility: Market, By Region, 2020–2030 (USD Million)

Table 16 Global Market, By Region, 2020–2030 (USD Million)

Table 17 Global Market, By Application, 2020–2030 (USD Million)

Table 18 Global Market, By Provider, 2020–2030 (USD Million)

Table 19 Asia Oceania: Automotive Blockchain Market, By Country, 2020–2030 (USD Million)

Table 20 Australia: Market, By Application, 2020–2030 (USD Million)

Table 21 Australia: Market, By Provider, 2020–2030 (USD Million)

Table 22 China: Market, By Application, 2020–2030 (USD Million)

Table 23 China: Market, By Provider, 2020–2030 (USD Million)

Table 24 India: Market, By Application, 2020–2030 (USD Million)

Table 25 India: Market, By Provider, 2020–2030 (USD Million)

Table 26 Japan: Market, By Application, 2020–2030 (USD Million)

Table 27 Japan: Market, By Provider, 2020–2030 (USD Million)

Table 28 Rest of Asia Oceania: Market, By Application, 2020–2030 (USD Million)

Table 29 Rest of Asia Oceania: Market, By Provider, 2020–2030 (USD Million)

Table 30 Europe: Market, By Country, 2020–2030 (USD Million)

Table 31 France: Market, By Application, 2020–2030 (USD Million)

Table 32 France: Market, By Provider, 2020–2030 (USD Million)

Table 33 Germany: Market, By Application, 2020–2030 (USD Million)

Table 34 Germany: Market, By Provider, 2020–2030 (USD Million)

Table 35 UK: Market, By Application, 2020–2030 (USD Million)

Table 36 UK: Market, By Provider, 2020–2030 (USD Million)

Table 37 Spain: Market, By Application, 2020–2030 (USD Million)

Table 38 Spain: Market, By Provider, 2020–2030 (USD Million)

Table 39 The Netherlands: Market, By Application, 2020–2030 (USD Million)

Table 40 The Netherlands: Market, By Provider, 2020–2030 (USD Million)

Table 41 Rest of Europe: Market, By Application, 2020–2030 (USD Million)

Table 42 Rest of Europe: Market, By Provider, 2020–2030 (USD Million)

Table 43 Americas: Automotive Blockchain Market, By Country, 2020–2030 (USD Million)

Table 44 Brazil: Market, By Application, 2020–2030 (USD Million)

Table 45 Brazil: Market, By Provider, 2020–2030 (USD Million)

Table 46 Canada: Market, By Application, 2020–2030 (USD Million)

Table 47 Canada: Market, By Provider, 2020–2030 (USD Million)

Table 48 Mexico: Market, By Application, 2020–2030 (USD Million)

Table 49 Mexico: Market, By Provider, 2020–2030 (USD Million)

Table 50 US: Market, By Application, 2020–2030 (USD Million)

Table 51 US: Market, By Provider, 2020–2030 (USD Million)

Table 52 Rest of Americas: Market, By Application, 2020–2030 (USD Million)

Table 53 Rest of Americas: Market, By Provider, 2020–2030 (USD Million)

Table 54 Middle East & Africa: Automotive Blockchain Market, By Country, 2020–2030 (USD Million)

Table 55 Middle East: Market, By Application, 2020–2030 (USD Million)

Table 56 Middle East: Market, By Provider, 2020–2030 (USD Million)

Table 57 Africa: Market, By Application, 2020–2030 (USD Million)

Table 58 Africa: Market, By Provider, 2020–2030 (USD Million)

Table 59 Supply Contracts/Collaboration/Partnerships/Joint Ventures

Table 60 New Product Developments, 2017–2018

Table 61 Expansions/ Mergers & Acquisitions, 2017–2018

List of Figures (38 Figures)

Figure 1 Segments of Automotive Blockchain Market

Figure 2 Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Automotive Blockchain: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Automotive Blockchain: Market Outlook

Figure 8 Market, By Region, 2020 vs 2025 vs 2030 (USD Million)

Figure 9 Increasing Focus on Reducing Data Leaks and Manipulations to Drive this Market During the Forecast Period

Figure 10 Increasing Vehicle Production and Sales Would Result in Supply Chain Being the Leading Application From 2020–2030 (USD Million)

Figure 11 Higher Cost of Development and Maintenance Would Drive the Application and Solution Provider Segment to Be the Largest Market, 2020 vs 2030 (USD Million)

Figure 12 Personal Mobility is Projected to Dominate the Automotive Blockchain, 2030 (USD Million)

Figure 13 Higher Presence of Blockchain Providers and A Robust Automotive Industry Would Result in the US Being the Largest Market in 2030 (USD Million)

Figure 14 Americas is Projected to Be the Largest Market, 2020 vs 2030 (USD Million)

Figure 15 Automotive Blockchain : Market Dynamics

Figure 16 Automotive Connected Ecosystem

Figure 17 Integration of Blockchain in Automotive Applications

Figure 18 Market for Automotive Blockchain, By Application, 2020 vs 2025 vs 2030 (USD Million)

Figure 19 Market for Automotive Blockchain: Connected Ecosystem

Figure 20 Market for Automotive Blockchain, By Provider, 2020 vs 2025 vs 2030 (USD Million)

Figure 21 Market for Automotive Blockchain, By Mobility Type, 2020 vs 2025 vs 2030 (USD Million)

Figure 22 Global Market, By Region: Americas Account for the Largest Market Share, By Value, 2020 vs 2025 vs 2030 (USD Million)

Figure 23 Asia Oceania: Market Snapshot

Figure 24 Europe: Germany is Projected to Be the Largest Market, 2020 vs 2025 vs 2030 (USD Million)

Figure 25 Americas: Market Snapshot

Figure 26 Middle East & Africa: Middle East is Projected to Be the Largest Market, 2020 vs 2025 vs 2030 (USD Million)

Figure 27 Key Development By Leading Players in Automotive Blockchain Market

Figure 28 Automotive Blockchain: Top Players Analysis of Platform Providers (2017–2018)

Figure 29 IBM: Company Snapshot

Figure 30 IBM: SWOT Analysis

Figure 31 Accenture: Company Snapshot

Figure 32 Accenture: SWOT Analysis

Figure 33 Microsoft: Company Snapshot

Figure 34 Microsoft: SWOT Analysis

Figure 35 Carvertical: SWOT Analysis

Figure 36 Helbiz: SWOT Analysis

Figure 37 Tech Mahindra: Company Snapshot

Figure 38 HCL Technologies: Company Snapshot

Growth opportunities and latent adjacency in Automotive Blockchain Market

Great post!