Mexico Factory Automation and Machine Vision Market by Technology (ICS, MES, ERP, ITS), Field Devices, Products (PC-based, Smart Camera, Embedded), Components (Camera, FGOL), Application (Process, Discrete) - Global Forecast & Analysis to 2013 - 2020

Proximity to the U.S. and Government of Mexico’s impetus to increase manufacturing has pushed the factory Automation and machine vision market to the new heights. These systems are now being used in the industries to make the standardized and reliable production activities. The automation in the production activities are offering advantages in: cost-efficiency, waste reduction, speed production, ease in production monitoring and management, reduced feedback and action times, over the traditional manual processes. The various mechanical instruments and devices are coupled with the smart computing or IT systems for the better results in automation. The scope of the factory automation is not limited to the production floor, but it is extended to the overall business processes. The software systems like Enterprise Resource planning (ERP) are helping the mexico factory automation market to extend their service offerings. The maxico factory automation is indirectly offering customers better quality, standardized and reliable products within time and at affordable cost.

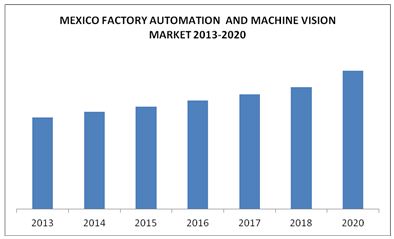

The factory automation market is projected to reach $6.99 Billion by 2020, from $4.61 Billion in the year 2013, with a CAGR of 6.18%. the major players in the market includes: as Siemens Ag (Germany), ABB LTD (Switzerland), Emerson Process Management LLC (U.S), Rockwell Automation Inc (U.S.), Schneider Electric SA (France) and Honeywell International Inc (U.S.).

The main drivers for the factory automation and machine vision market in Mexico includes, proximity to U.S. is attracting major manufacturers to shift manufacturing base from China, Increased foreign direct investment is aiding growth in the manufacturing segment. Increasing non vertical applications for machine vision equipment. In addition to this, technical factors such as increasing focus on energy saving and efficiency improvement, internet of things and services playing crucial role in integration of manufacturing and engineering.

The report covers the market by technology, field devices, products, components and applications of the factory automation and machine vision market. It provides the detailed analysis of the current market scenario and its estimation till the year 2020.

The report describes the value chain for mexico factory automation and machine vision market by considering all the major stakeholders in the market and their role in the analysis. The report also provides a detailed study of the Porter’s five force analysis of the market. All the five major factors in these markets have been quantified using the internal key parameters governing each of them.

The report covers the brief description of major players that are active in the factory automation and machine vision market. It also covers the competitive landscape of these players which includes the key growth strategies.

Scope of the report

The research report categorizes the “Mexico factory automation and machine vision market” on the basis of the different technologies, field devices, products, components, and application.

On the basis of Technology

The different technology for maxico factory automation systems includes Industrial Control Systems (ICS), Manufacturing Execution System (MES), Enterprise Resource Planning, Information Technology System (ITS).

On the basis Field devices

The different field devices in automation systems are robotics, sensors, relay & switch, motion & drives.

On the basis of Products

The different products in machine vision systems are PC-based, smart camera based and embedded based systems.

On the basis of Components

The different components in machine vision systems are camera, optics frame grabber and lighting, software & hardware and miscellaneous components.

On the basis Application

The different applications of the factory automation systems are in discrete industry and process industry.

The factory automation and machine vision market report covers the market data and information, with regards to the market drivers, trends and opportunities, key players, and competitive outlook. This report also makes ways for market tables to cover the sub-segments. In addition, it profiles 26 companies, which include overview, products & services, financials, strategy, SWOT analysis, recent developments and MnM View.

With the new surge of innovation in technology, the Mexico factory automation and machine vision systems are now being utilized by various industries for accurate and reliable process control. In the present scenario when the size of the hardware is reducing and the use of embedded systems has shown a reasonable growth; the upcoming trend of nanotechnology, nanotech sensors, machine-to-machine communication systems and Internet of things will generate growth for the factory automation and machine vision market.

The Mexico Factory Automation and Machine Vision Market is driven by the increasing prominence on energy saving and improving efficiency. The ‘Internet of things’ and the promising trend of cloud based technologies and services are increasing the scope of the factory automation system. The number of internet users have increased drastically in the last decade and almost doubled in the last eight years. With the advancement in wireless technology protocols there has been development in products like introduction of wireless PLC’s, and wireless Remote Terminal Units (RTU), and so on in order to make the automation control systems compatible with the wireless protocols. The countries and governments are promoting the automated and smart manufacturing activities. The market is finding good prospects in the emerging Mexican manufacturing sector. The proximity to the U.S. and Government of Mexico’s impetus to increase manufacturing has pushed the factory automation and machine vision market to the new heights.

The figure below shows the estimated continuous growth of the factory automation and machine vision system 2013 to 2020.

The Factory automation market in Mexico is expected to grow at a CAGR of 6.18% in the next six years (2014-2020). In the report the drivers, restraints, and opportunities for the Factory Automation and Machine Vision Market are also covered.

Some of the major companies present in the market are: Siemens Ag (Germany), ABB LTD (Switzerland), Emerson Electric Company (U.S), Rockwell Automation Inc (U.S.), Schneider Electric SA (France), Honeywell International Inc (U.S.), Johnson Controls Inc (U.S), General Electric Company (U.S.), Texas Instruments Inc (U.S), Teledyne Dalsa Inc (Canada), Eastman Kodak (U.S.) and Yokogawa Electric Corporation (Japan).

Table Of Contents

1 Introduction (Page No. - 23)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size Estimation

1.5.2 Key Data Points From Secondary Sources

1.5.3 Key Data Points From Primary Sources

1.5.4 Market Definition, Scope, And Assumptions

1.5.5 List Of Companies Covered During The Study

2 Executive Summary (Page No. - 40)

3 Market Overview (Page No. - 43)

3.1 Introduction

3.2 Market Definition

3.3 History & Evolution Of Factory Automation And Machine Vision Systems

3.4 Market Dynamics

3.4.1 Market Drivers

3.4.1.1 Proximity To The U.S.

3.4.1.2 Increase In Fdi: A Boost For The Manufacturing Undertakings In Mexican Region

3.4.1.3 Optimization Of Resources And Reduction In Waste

3.4.1.4 Machine Vision-An Eye For The Robot

3.4.1.5 Increasing Applications In Non-Verticals

3.4.2 Market Restraints

3.4.2.1 Utilization Of Existing Business Network

3.4.2.2 Absence Of Skilled Workforce

3.4.2.3 Adoption Of Advanced Manufacturing Technology Involves Huge Capital Expenditure

3.4.3 Market Opportunities

3.4.3.1 Mexico: Favorable Trade And Investment Climate, Proximity To Major Us Firms, And Developing Manufacturing Base

3.4.3.2 Factory Automation To Have Ripple Effect On Growth Of Robotics And Other Electronic Devices Used In Micro Scale Industries

3.5 Burning Issue

3.5.1 Exports: Major Dependancy On The U.S.

3.6 Winning Imperative

3.6.1 Transportation And Logistics: Changes Due To Infrastructure Development

3.7 Porter’s Five Forces Analysis

3.7.1 Degree Of Competition

3.7.2 Bargaining Power Of Buyers

3.7.3 Bargaining Power Of Suppliers

3.7.4 Threat From Substitutes

3.7.5 Threat From New Entrants

3.8 Value Chain Analysis

4 Mexico Factory Automation Market (Page No. - 66)

4.1 Introduction

4.2 Industrial Control Systems

4.2.1 Distributed Control Systems (DCS)

4.2.2 Supervisory Control And Data Acquistion (Scada)

4.2.3 Programmable Logic Control (PLC)

4.3 Manufacturing Execution System

4.3.1 Process Industry Mes

4.3.2 Discrete Industry Mes

4.4 Field Devices

4.4.1 Robotics

4.4.1.1 Robot With Revolute Configuration Or Jointed-Arm

4.4.1.2 Cartesian Robot

4.4.1.3 Selective Compliance Assembly Robot Arm

4.4.1.4 Cylindrical Robot

4.4.1.5 Other Robots

4.4.2 Sensors

4.4.2.1 Pressure Sensor

4.4.2.2 Temperature Sensors

4.4.2.3 Position Sensor

4.4.2.4 Image Sensors

4.4.2.5 Other Sensors

4.4.3 Relays & Switches

4.4.4 Motion & Drives

4.4.5 Others

4.4.5.1 Actuators

4.4.5.2 Power Supply And Backup

4.4.5.3 Wireless Communications

4.4.5.3.1 Sensors

4.4.5.3.2 Microprocessor System

4.4.6 RFID System

4.4.6.1.1 Chip-Based Rfid

4.4.6.1.2 Tags

4.4.6.1.3 Middleware

4.4.6.1.4 Reader

4.5 Enterprise Resource Planning (ERP)

4.5.1 Finance Resource Management

4.5.2 Manufacturing Resource Management

4.5.3 Supply Chain Management

4.5.4 Customer Relationship Management

4.5.5 Human Resource Management

4.6 Information Technology Systems

4.6.1 Product Lifecycle Management (PLM)

5 Mexico Machine Vision Systems Market (Page No. - 103)

5.1 Introduction

5.2 Machine Vision System Market, By Product

5.2.1 Pc Based Systems

5.2.1.1 Pc-Based Systems Segmentation By Industry Vertical

5.2.1.2 Pc Based Systems Segmentation By Non-Industry Vertical

5.2.2 Smart Camera Based Systems

5.2.2.1 Smart Camera Based Systems Segmentation By Industry Vertical

5.2.2.2 Smart Camera Based Systems Segmentation By Non-Industry Vertical

5.2.3 Embedded Systems

5.2.3.1 Embedded Systems Segmentation By Industry Vertical

5.2.3.2 Embedded Systems Segmentation By Non-Industry Vertical

5.3 Machine Vision Systems Market Size, By Component

5.3.1 Machine Vision System Market By Camera

5.3.1.1 Machine Vision Camera Market By Technology

5.3.1.2 Analog Cameras

5.3.1.3 Digital Cameras

5.3.1.4 Smart Camera

5.3.2 Frame Grabber, Optics, & Lightings

5.3.2.1 Frame Grabber

5.3.2.2 Optics

5.3.2.3 Lighting

5.3.3 Software And Hardware

5.3.4 Miscellaneous Components

5.4 Machine Vision Systems Market, By Application

5.4.1 Location

5.4.1.1 Market For Locating Application By Industry Vertical

5.4.1.2 Market For Locating Application By Non-Industry Vertical

5.4.2 Measurement

5.4.2.1 Market For Measurement Application By Industry Vertical

5.4.2.2 Market For Measurement Application By Non-Industry Vertical

5.4.3 Inspection

5.4.3.1 Market For Inspection Application By Industry Vertical

5.4.3.2 Machine Vision Systems Market For Inspection Application By Non-Industry Vertical

5.4.4 Identification

5.4.4.1 Machine Vision Systems Market For Identification Application By Industry Vertical

5.4.4.2 Market For Identification Application By Non-Industry Vertical

6 Mexican Factory Automaton Market By Vertical (Page No. - 138)

6.1 Introduction

6.2 Power

6.3 Textile

6.4 Automotive

6.5 Chemicals

6.6 Printing And Packaging

6.7 Plastics

6.8 Oil And Gas

6.9 Food Processing

6.10 Medical Equipment

6.11 Oem

6.12 Others

7 Mexico Machine Vision Systems Market, By Vertical (Page No. - 155)

7.1 Introduction

7.2 Industrial Machine Vision Market

7.2.1 Automotive

7.2.1.1 Dimensional Gauging

7.2.1.2 Assembly Verification

7.2.1.3 Flaw Detection

7.2.1.4 Print Verification

7.2.1.5 Code Reading

7.2.1.6 Electric Controls

7.2.1.7 Brakes

7.2.2 Semiconductor

7.2.3 Electronics

7.2.4 Glass

7.2.4.1 Cut Plate Inspection

7.2.4.2 Mirrored Glass Inspection

7.2.4.3 Interleaving Powder Coverage Measurement

7.2.4.4 Portable Interleaving Powder Coverage Measurement

7.2.5 Metals

7.2.6 Wood & Paper

7.2.7 Pharmaceutical & Cosmetic

7.2.7.1 Label Inspection

7.2.7.2 Blister Pack Inspection

7.2.7.3 Cosmetics

7.2.8 Rubber & Plastics

7.2.9 Containers & Packaging

7.2.9.1 Glass Containers

7.2.9.2 Plastic Bottles

7.2.9.3 Metal Containers

7.2.10 Medical Devices

7.2.11 Printing

7.2.12 Food

7.2.12.1 Grading

7.2.12.2 Sorting

7.2.12.3 Portioning

7.2.12.4 Quality Check During Processing

7.2.12.5 Packaging

7.2.13 Other Industrial

7.3 Non-Industrial Machine Vision Market

7.3.1 Healthcare Application

7.3.2 Transportation, Traffic Management, & Road Safety

7.3.3 Security & Surveillance

7.3.4 Postal & Logistics

7.3.5 Document Processing

7.3.6 Military & Defense

8 Competitive Landscape For The Mexico Factory Automation And Machine Vision Market (Page No. - 206)

8.1 Introduction

8.2 Key Growth Strategies

8.3 Market Share Analysis Of The Factory Automation Providers In Mexico

8.4 Product Launches

8.5 Acquisitions & Collaborations

8.6 Partnerships/Agreements/Contracts/ Expansion

8.7 Awards/New Facility Center/New Development Center/Patent

8.8 Competitive Landscape

8.9 Introduction

8.10 Key Growth Strategies

8.11 Market Share Analysis Of The Machine Vision Providers In Mexico

8.12 Product Launches

8.13 Acquisitions And Collaboration

8.14 Partnerships/Agreements/Contracts/ Expansion/Investment In R&D

9 Company Profiles (Page No. -249)

9.1 Abb Ltd.

9.2 Adept Technology, Inc.

9.3 Allied Vision Technologies, Gmbh

9.4 Applied Vision Corporation

9.5 Avalon Vision Solutions Llc

9.6 B&R Automation

9.7 Bosch Rexroth Ag

9.8 Cognex Corporation

9.9 Danfoss A/S

9.10 Dassault Systemes Sa

9.11 Eastman Kodak

9.12 Emerson Electric Co.

9.13 General Electric

9.14 Invensys Plc.

9.15 Mitsubishi Electric Corporation

9.16 Omron Corporation

9.17 Oerlikon Balzers Coating Ag

9.18 Pollux Automation

9.19 Pepperl+Fuchs Gmbh

9.20 Rockwell Automation

List Of Tables (70 Tables)

Table 1 Market Definition And Scope

Table 2 General Assumptions

Table 3 Mexico Factory Automation And Machine Vision: List Of Companies Covered

Table 4 Mexico Machine Vision: List Of Companies Covered

Table 5 Factory Automation And Machine Vision Drivers Impact Analysis

Table 6 Market Restraints Impact Analysis

Table 7 Market Opportunities Impact Analysis

Table 8 Mexico Factory Automation Market Value, By Technology, 2013 – 2020 ($Billion)

Table 9 Industrial Control System Market Value, By Type, 2013 – 2020 ($Billion)

Table 10 Industrial Control System Market Value, By Application, 2013 – 2020 ($Billion)

Table 11 Dcs Market Value, By Application, 2013 – 2020($Billion)

Table 12 Scada Market Value, By Application, 2013 – 2020 ($Billion)

Table 13 Plc Market Value, By Application, 2013 – 2020 ($Million)

Table 14 Mes Market Value, By Application, 2013 – 2020 ($Billion)

Table 15 Field Devices Market Value, By Type, 2013 – 2020 ($Billion)

Table 16 Field Devices Market Value, By Application, 2013 – 2020 ($Billion)

Table 17 Sensors Field Devices Market Value, By Type, 2013 – 2020 ($Million)

Table 18 Other Field Devices Market Value, By Type, 2013 – 2020 ($Million)

Table 19 Enterprise Resource Planning Market Value, By Type, 2013 – 2020 ($Billion)

Table 20 Erp Market Value, By Application, 2013 – 2020 ($Billion)

Table 21 Information Technology Systems Market Value, By Type, 2013 - 2020, ($Million)

Table 22 Its Market Value, By Application, 2013 - 2020, ($Billion)

Table 23 Plm Market Value, By Solution Type, 2013-2020, ($Billion)

Table 24 Machine Vision Systems Market Size, By Product, 2013 – 2020 ($Million)

Table 25 Pc Based Systems Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 26 Pc Based Systems Market Size, By Non-Industry Vertical, 2013-2020 ($Million)

Table 27 Smart Camera Based Machine Vision Systems Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 28 Smart Camera Based Systems Market Size, By Non-Industry Vertical, 2013-2020 ($Million)

Table 29 Embedded Machine Vision Systems Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 30 Market Size, By Non-Industry Vertical, 2013-2020 ($Million)

Table 31 Systems Market Size, By Component, 2013-2020 ($Million)

Table 32 Comparison Of Analog Camera And Digital Camera Types

Table 33 Machine Vision Camera Market Size, By Type, 2013-2020 ($Million)

Table 34 Systems Market, By Component, 2013-2020 ($Million)

Table 35 Software And Hardware Machine Vision Systems Market, By Component, 2013-2020 ($Million)

Table 36 Systems Market, By Application, 2013-2020 ($Million)

Table 37 Machine Vision Market For Locating Application By Industry Vertical, 2013-2020 ($Million)

Table 38 Market For Locating Application By Non-Industry Vertical, 2013-2020 ($Million)

Table 39 Market For Measurement Application By Industry Vertical, 2013-2020 ($Million)

Table 40 Market For Measurement Application By Non-Industry Vertical, 2013-2020 ($Million)

Table 41 Market For Inspection Application By Industry Vertical, 2013-2020 ($Million)

Table 42 Market For Inspection Application By Non-Industry Vertical, 2013-2020 ($Million)

Table 43 Market For Identification Application By Industry Vertical, 2013-2020 ($Million)

Table 44 Market For Identification Application By Non-Industry Vertical, 2013-2020 ($Million)

Table 45 Factory Automation Market Size, By Vertical, 2013-2020 ($Million)

Table 46 Machine Vision Applications Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 47 Machine Vision Products Market Size, By Industry Vertical, 2013-2020 ($Million)

Table 48 Machine Vision Applications Market Size, By Non-Industry Vertical, 2013-2020 ($Million)

Table 49 Machine Vision Products Market Size, By Non-Industry Vertical, 2013-2020 ($Million)

Table 50 Product Launches In The Factory Automation Market

Table 51 Acquisitions & Collaborations In The Factory Automation Market

Table 52 Partnerships/Agreements/Contracts/ Expansion In The Factory Automation Market

Table 53 Awards/New Facility Centers/New Development Centers/Patents In The Factory Automation Market

Table 54 Product Launches In The Machine Vision Market

Table 55 Acquisitions And Collaborations In The Machine Vision Market

Table 56 Partnerships/Agreements/Contracts/Expansion/ Investment In R&D In Market

Table 57 Adept Technology Inc. Product Portfolio

Table 58 Allied Vision Technologies, Gmbh: Company Snapshot

Table 59 Allied Vision Technologies Product Portfolio

Table 60 Applied Vision Corporation: Company Snapshot

Table 61 Avalon Vision Solutions Llc: Company Snapshot

Table 62 B&R Automation: Company Snapshot

Table 63 Bosch Rexroth Ag: Company Snapshot

Table 64 Cognex’s Product Portfolio

Table 65 Danfoss A/S: Company Snapshot

Table 66 Eastman Kodak’s Product Portfolio

Table 67 Omron’s Product Portfolio

Table 68 Oerlikon Balzers Coating Ag: Company Snapshot

Table 69 Pollux Automation: Company Snapshot

Table 70 Pepperl+Fuchs : Company Snapshot

List Of Figures (96 Figures)

Figure 1 Factory Automation Market Segmentation

Figure 2 Machine Vision Market Segmentation

Figure 3 Market Research Methodology

Figure 4 Market Size Estimation

Figure 5 Mexican Factory Automation Market Size, By Technology And Field Device, 2013-2020 ($Billion) Figure 6 Mexico Industry Control And Factory Automation Market: Companies And Their Market Share

Figure 7 Emergence Of Factory Automation

Figure 8 Evolution Of Machine Vision Technology

Figure 9 Factory Automation And Machine Vision Market

Figure 10 Market: Degree Of Competition

Figure 11 Market: Bargaining Power Of Buyers

Figure 12 Market: Bargaining Power Of The Suppliers

Figure 13 Market: Threat From Substitutes

Figure 14 Market: Threat From New Entrants

Figure 15 Market Value Chain

Figure 16 Benefits Of MES

Figure 17 Field Devices Market

Figure 18 Sensors Classification, By Type

Figure 19 Mexico Factory Automation Market Size For Power Sector 2013-2020 ($Million)

Figure 20 Mexico Factory Automation Market Size For Textile Sector 2013-2020 ($Million)

Figure 21 Mexico Factory Automation Market Size For Automobile Sector 2013-2020 ($Million)

Figure 22 Mexico Factory Automation Market Size For Chemicals Sector 2013-2020 ($Million)

Figure 23 Mexico Factory Automation Market Size For Printing And Packaging Sector 2013-2020 ($Million)

Figure 24 Mexico Factory Automation Market Size For Plastic Sector 2013-2020 ($Million)

Figure 25 Mexico Factory Automation Market Size For Oil And Gas Sector 2013-2020 ($Million)

Figure 26 Mexico Factory Automation Market Sizef For Food Processing Sector 2013-2020 ($Million)

Figure 27 Mexico Factory Automation Market Size For Medical Equipment Sector 2013-2020 ($Million)

Figure 28 Mexico Factory Automation Market Size For Oem Sector 2013-2020 ($Million)

Figure 29 Mexico Factory Automation Market Size For Others Sector 2013-2020 ($Million)

Figure 30 Machine Vision Applications Market Size, For Automotive Sector, 2013-2020 ($Million)

Figure 31 Machine Vision Products Market Size, For Automotive Sector, 2013-2020 ($Million)

Figure 32 Machine Vision Applications Market Size, For Semicontuctors Sector, 2013-2020 ($Million)

Figure 33 Products Market Size, For Semiconductors Sector, 2013-2020 ($Million)

Figure 34 Applications Market Size, For Electronics Sector, 2013-2020 ($Million)

Figure 35 Products Market Size, For Electronics Sector, 2013-2020 ($Million)

Figure 36 Applications Market Size, For Glass Sector, 2013-2020 ($Million)

Figure 37 Products Market Size, For Glass Sector, 2013-2020 ($Million)

Figure 38 Applications Market Size, For Metal Sector, 2013-2020 ($Million)

Figure 39 Products Market Size, For Metal Sector, 2013-2020 ($Million)

Figure 40 Applications Market Size, For Wood And Paper Sector, 2013-2020 ($Million)

Figure 41 Products Market Size, For Wood And Paper Sector, 2013-2020 ($Million)

Figure 42 Applications Market Size, For Pharmaceutical & Cosmetic Sector, 2013-2020 ($Million)

Figure 43 Machine Vision Products Market Size, For Pharmaceuticals & Cosmetics Sector, 2013-2020 ($Million)

Figure 44 Applications Market Size, For Rubber And Plastic Sector, 2013-2020 ($Million)

Figure 45 Products Market Size, For Rubber And Plastic Sector, 2013-2020 ($Million)

Figure 46 Applications Market Size, For Containers And Packaging Sector, 2013-2020 ($Million)

Figure 47 Machine Vision Products Market Size, For Containers And Packaging Sector, 2013-2020 ($Million)

Figure 48 Machine Vision Applications Market Size, For Medical Devices Sector, 2013-2020 ($Million)

Figure 49 Machine Vision Products Market Size, For Medical Devices Sector, 2013-2020 ($Million)

Figure 50 Machine Vision Applications Market Size, For Printing Sector, 2013-2020 ($Million)

Figure 51 Market Size, For Printing Sector, 2013-2020 ($Million)

Figure 52 Market Size, For Food Sector, 2013-2020 ($Million)

Figure 53 Market Size, For Food Sector, 2013-2020 ($Million)

Figure 54 Market Size, For Other Sector, 2013-2020 ($Million)

Figure 55 Market Size, For Other Sector, 2013-2020 ($Million)

Figure 56 Market Size, For Healthcare Sector, 2013-2020 ($Million)

Figure 57 Market Size, For Healthcare Sector, 2013-2020 ($Million)

Figure 58 Market Size, For Traffic Management Sector, 2013-2020 ($Million)

Figure 59 Market Size, For Traffic Management Sector, 2013-2020 ($Million)

Figure 60 Market Size, For Security And Surveillance Sector, 2013-2020 ($Million)

Figure 61 Machine Vision Products Market Size, For Security And Surveillance Sector, 2013-2020 ($Million)

Figure 62 Machine Vision Applications Market Size, For Postal And Logistics Sector, 2013-2020 ($Million)

Figure 63 Machine Vision Products Market Size, For Postal And Logistics Sector, 2013-2020 ($Million)

Figure 64 Machine Vision Applications Market Size, For Document Processing Sector, 2013-2020 ($Million)

Figure 65 Market Size, For Document Processing Sector, 2013-2020 ($Million)

Figure 66 Market Size, For Military And Defense Sector, 2013-2020 ($Million)

Figure 67 Market Size, For Military And Defense Sector, 2013-2020 ($Million)

Figure 68 Key Growth Strategies Of The Mexico Factory Automation Market, 2011-2014

Figure 69 Mexican Factory Automation Market: Companies And Their Market Share For 2013

Figure 70 Key Growth Strategies Of Mexico Machine Vision Market, 2011-2014

Figure 71 Mexico Machine Vision Market: Companies And Their Market Share For 2013

Figure 72 Abb Ltd.: Company Snapshot

Figure 73 Swot Analysis Of Abb Ltd.

Figure 74 Adept Technology Inc.: Company Snapshot

Figure 75 Applied Vision Corporation: Product Offerings

Figure 76 Avalon Vision Solutions Llc: Product Offerings

Figure 77 B&R: Product Offering

Figure 78 Bosch Rexroth Ag: Product Offerings

Figure 79 Cognex Corporation: Company Snapshot

Figure 80 Dassault Systemes Sa: Company Snapshot

Figure 81 Dassault Systemes Sa: Product Portfolio

Figure 82 Eastman Kodak: Company Snapshot

Figure 83 Emerson Electric Co: Company Snapshot

Figure 84 Swot Analysis Of Emerson Electric Co.

Figure 85 General Electric: Company Snapshot

Figure 86 Products And Services Portfolio Catering To Different Industries Of General Electic

Figure 87 Swot Analysis Of General Electric

Figure 88 Invensys Plc: Company Snapshot

Figure 89 Invensys Plc: Products & Services

Figure 90 Mitsubishi Electric Corporation : Company Snapshot

Figure 91 Omron Corporation: Company Snapshot

Figure 92 Oerlikon Balzers Coating Ag: Product Offerings

Figure 93 Pollux Automation: Service Offrings

Figure 94 Rockwell Automation: Company Snapshot

Figure 95 Rockwell Automation: Products And Solutions Portfolio

Figure 96 Swot Analysis Of Rockwell Automation Inc.

Growth opportunities and latent adjacency in Mexico Factory Automation and Machine Vision Market