Document Management Systems Market by Offering (Solutions, Services), Deployment Mode (On-Premise, Cloud-Based, and Hybrid), Organization (Small & Medium-Sized Enterprise, Large Enterprise), Application, and Geography - Global Forecast to 2023

The document management systems market is expected to reach USD 6.78 Billion by 2023 from USD 3.09 Billion in 2016, at a CAGR of 11.17% during the forecast period. The base year considered for the study is 2016 and the forecast period is between 2017 and 2023.

Objectives of the Document Management Systems Market

- To define, describe, and forecast the overall market segmented on the basis of offerings, deployment mode, organization, applications, and geography

- To forecast the size in terms of value of the market segments with respect to four major regions North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

- To analyze various strategic developments such as joint ventures, mergers and acquisitions, product launches, and research and development (R&D) activities in the market

Get more insight on other verticals of Semiconductor and Electronics Market Research Reports & Consulting

The document management systems market is expected to reach USD 6.78 Billion by 2023 from USD 3.59 Billion in 2017, at a CAGR of 11.17% during the forecast period. Growth in this market is mainly driven by factors such as the increasing need to streamline business operations, benefits of digitalizing content across enterprises, and the increasing need to adhere to compliance requirements.

Document management systems are mainly used for the storage and retrieval of self-contained electronic data sources in the document form. These systems are designed to help organizations manage the creation and flow of documents through a centralized repository. Document management systems play a pivotal role in sourcing, monitoring, and managing content and extracting intelligible strategic business insights from the voluminous content generated by enterprises. Owing to this, there is an increased demand for document management systems mostly among enterprises as data is regarded as a corporate asset in enterprises.

In this report, the size of the document management systems market has been arrived at based on segments such as offerings, deployment mode, organization, applications, and regions. Depending on the organization, document management systems can be installed in both small and medium-sized enterprises (SMEs) as well as large enterprises. Based on deployment mode, the market is further segmented into on-premise, cloud-based, and hybrid models. On the basis of applications, the market is further classified into banking, financial services, and insurance (BFSI); government; healthcare; education; corporate; industrial manufacturing; retail; and other applications.

The document management systems market, by offering, is segmented into solutions and services. The solutions segment is growing at a significant rate due to the increasing demand for document management, digital asset management, and eDiscovery by enterprises to achieve a strategic advantage and streamline their document management operations to minimize risks.

The market has been segmented on the basis of deployment mode into on-premise, cloud-based, and hybrid deployment modes. The hybrid segment is estimated to be the fastest-growing segment of all the deployment models due to benefits such as better flexibility, technical control, enhanced security, and improved adherence to compliance requirements.

The document management systems market has been segmented on the basis of organization into small and medium-sized enterprises (SMEs) and large enterprises. The market for SMEs is expected to grow at a higher rate. Growth in this segment is projected to be steady during the next 5 years, mainly because of the deployment of innovative technologies such as Social, Mobility, Analytics, and Cloud (SMAC) by new entrants in the market, which is compelling existing players to modernize their traditional IT infrastructures to meet changing customer requirements.

Moreover, the market is segmented on the basis of application into BFSI, government, education, healthcare, corporate, industrial manufacturing, retail, and other applications. The BFSI segment is expected to hold the largest share of the market during the forecast period. Document management systems play a pivotal role in the BFSI sector in terms of gathering and managing all the financial data. These systems also provide enhanced data security and access controls in the event of cyber-attacks, bank robberies, and natural disasters. The deployment of document management systems in the BFSI sector ensures better accountability, risk management, operational management and end-to-end content governance, and better management among different functional departments.

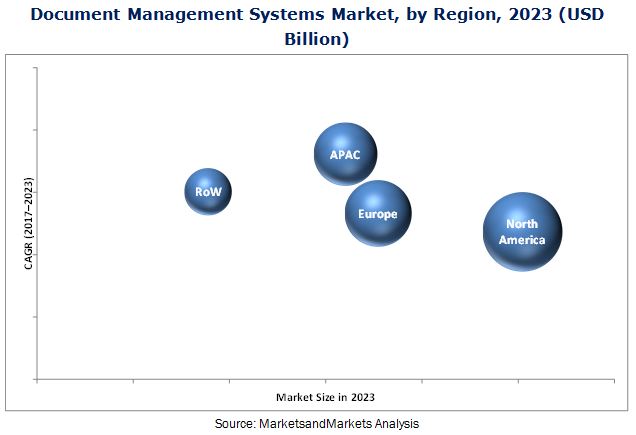

On the basis of geography, the document management systems market has been segmented into North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). The market in APAC is expected to grow at the highest CAGR during the forecast period. Market growth can be attributed to several initiatives by the governments as well as private and public sectors in APAC. Moreover, the presence of major players in the document management systems ecosystem results in the increasing adoption of these systems in APAC. However, the high cost of implementation is a major restraint for the market.

Key players in this market focus on inorganic strategies such as mergers and acquisitions to expand their business and related offerings. In January 2017, OpenText Corporation (Canada) acquired the enterprise content division of Dell EMC.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographical Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Market: Overview

4.2 North America: Market By Deployment Mode

4.3 APAC: Market, By Application

4.4 APAC: Market, By Organization

4.5 Market, By Country/Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Need to Streamline Business Operations

5.2.1.2 Benefits of Digitalizing Content Across Enterprises

5.2.1.3 Increasing Need to Adhere to Compliance Requirements

5.2.1.4 Increasing Adoption of Cloud-Based Services and Cloud Computing

5.2.2 Restraints

5.2.2.1 High Implementation Costs

5.2.3 Opportunities

5.2.3.1 Integration With Client and Employee Portals

5.2.3.2 Initiatives From Organizations to Reduce Paper Wastage

5.2.4 Challenges

5.2.4.1 Data Migration From Legacy Systems to Cloud-Based Content Management

5.3 Value Chain Analysis

6 Document Management Systems Market, By Offering (Page No. - 42)

6.1 Introduction

6.2 Solutions

6.3 Services

6.3.1 Implementation Services

6.3.2 Training and Education

6.3.3 Support and Maintenance

7 Market, By Deployment Mode (Page No. - 45)

7.1 Introduction

7.2 On-Premise

7.3 Cloud-Based

7.4 Hybrid

8 Market, By Organization (Page No. - 51)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Market, By Application (Page No. - 55)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance (BFSI)

9.3 Government

9.4 Education

9.5 Healthcare

9.6 Corporate

9.7 Industrial Manufacturing

9.8 Retail

9.9 Other Applications

10 Geographic Analysis (Page No. - 81)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 South Korea

10.4.4 Australia

10.4.5 Rest of APAC

10.5 RoW

10.5.1 Middle East and Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 100)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 New Product Launches

11.3.2 Partnerships/Agreements/Collaborations

11.3.3 Acquisitions

11.3.4 Expansions

12 Company Profiles (Page No. - 104)

(Business Overview, Products & Software Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, and Key Relationships)*

12.1 Opentext

12.2 Xerox

12.3 IBM

12.4 Canon

12.5 Hyland

12.6 Oracle

12.7 Ricoh Company

12.8 M-Files

12.9 Efilecabinet

12.10 Newgen Software

12.11 Alfresco

12.12 Springcm

12.13 Key Innovators and Start-Ups

12.13.1 Maxxvault

12.13.2 Box

12.13.3 Docuware

12.13.4 Docstar

12.13.5 Sapphire Systems

12.14 Other Important Players

12.14.1 Everteam

12.14.2 Laserfiche

12.14.3 Fabricated Software

12.14.4 Office Gemini

12.14.5 Open Document Management System

12.14.6 Mastercontrol

12.14.7 Lucion Technologies

12.14.8 Ideagen

12.14.9 LSSP

12.14.10 Docpoint Solutions

12.14.11 Blue Project Software

12.14.12 Ademero

12.14.13 Zoho

*Details on Business Overview, Products & Software Offered, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments, and Key Relationships Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 150)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (82 Tables)

Table 1 Market, By Offering, 2014–2023 (USD Billion)

Table 2 Market, By Deployment Mode, 2014–2023 (USD Billion)

Table 3 On-Premise Document Management Systems Market, By Application, 2014–2023 (USD Million)

Table 4 On-Premise Market, By Region, 2014–2023 (USD Million)

Table 5 Cloud-Based Document Management Systems Market, By Application, 2014–2023 (USD Million)

Table 6 Cloud-Based Market, By Region, 2014–2023 (USD Million)

Table 7 Hybrid Document Management Systems Market, By Application, 2014–2023 (USD Million)

Table 8 Hybrid Market, By Region, 2014–2023 (USD Million)

Table 9 Market, By Organization, 2014–2023 (USD Billion)

Table 10 Market for Small and Medium-Sized Enterprises, By Region, 2015–2023 (USD Million)

Table 11 Market for Large Enterprises, By Region, 2014–2023 (USD Million)

Table 12 Market, By Application, 2014–2023 (USD Billion)

Table 13 Market for Banking, Financial Services, and Insurance, By Deployment Mode, 2014–2023 (USD Million)

Table 14 Market for Banking, Financial Services, and Insurance, By Region, 2014–2023 (USD Million)

Table 15 North America: Market for Banking, Financial Services, and Insurance, By Country, 2014–2023 (USD Million)

Table 16 Europe: Market for Banking, Financial Services, and Insurance, By Country, 2014–2023 (USD Million)

Table 17 APAC: Market for Banking, Financial Services, and Insurance, By Country, 2014–2023 (USD Million)

Table 18 RoW: Market for Banking, Financial Services, and Insurance, By Region, 2014–2023 (USD Million)

Table 19 Market for Government Applications, By Deployment Mode, 2014–2023 (USD Million)

Table 20 Market for Government Applications, By Region, 2014–2023 (USD Million)

Table 21 North America: Market for Government Applications, By Country, 2014–2023 (USD Million)

Table 22 Europe: Market for Government Applications, By Country, 2014–2023 (USD Million)

Table 23 APAC: Market for Government Applications, By Country, 2014–2023 (USD Million)

Table 24 RoW: Market for Government Applications, By Region, 2014–2023 (USD Million)

Table 25 Market for Education, By Deployment Mode, 2014–2023 (USD Million)

Table 26 Market for Education, By Region, 2014–2023 (USD Million)

Table 27 North America: Market for Education, By Country, 2014–2023 (USD Million)

Table 28 Europe: Market for Education, By Country, 2014–2023 (USD Million)

Table 29 APAC: Market for Education, By Country, 2014–2023 (USD Million)

Table 30 RoW: Market for Education, By Region, 2014–2023 (USD Million)

Table 31 Market for Healthcare, By Deployment Mode, 2014–2023 (USD Million)

Table 32 Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 33 North America: Market for Healthcare, By Country, 2014–2023 (USD Million)

Table 34 Europe: Market for Healthcare, By Country, 2014–2023 (USD Million)

Table 35 APAC: Market for Healthcare, By Country, 2014–2023 (USD Million)

Table 36 RoW: Market for Healthcare, By Region, 2014–2023 (USD Million)

Table 37 Market for Corporate Applications, By Deployment Mode, 2014–2023 (USD Million)

Table 38 Market for Corporate Applications, By Region, 2014–2023 (USD Million)

Table 39 North America: Market for Corporate Applications, By Country, 2014–2023 (USD Million)

Table 40 Europe: Market for Corporate Applications, By Country, 2014–2023 (USD Million)

Table 41 APAC: Market for Corporate Applications, By Country, 2014–2023 (USD Million)

Table 42 RoW: Market for Corporate Applications, By Region, 2014–2023 (USD Million)

Table 43 Market for Industrial Manufacturing, By Deployment Mode, 2014–2023 (USD Million)

Table 44 Market for Industrial Manufacturing, By Region, 2014–2023 (USD Million)

Table 45 North America: Market for Industrial Manufacturing, By Country, 2014–2023 (USD Million)

Table 46 Europe: Market for Industrial Manufacturing, By Country, 2014–2023 (USD Million)

Table 47 APAC: Market for Industrial Manufacturing, By Country, 2014–2023 (USD Million)

Table 48 RoW: Market for Industrial Manufacturing, By Region, 2014–2023 (USD Million)

Table 49 Market for Retail, By Deployment Mode, 2014–2023 (USD Million)

Table 50 Market for Retail, By Region, 2014–2023 (USD Million)

Table 51 North America: Market for Retail, By Country, 2014–2023 (USD Million)

Table 52 Europe: Market for Retail, By Country, 2014–2023 (USD Million)

Table 53 APAC: Market for Retail, By Country, 2014–2023 (USD Million)

Table 54 RoW: Market for Retail, By Region, 2014–2023 (USD Million)

Table 55 Market for Other Applications, By Deployment Mode, 2014–2023 (USD Million)

Table 56 Market for Other Applications, By Region, 2014–2023 (USD Million)

Table 57 North America: Market for Other Applications, By Country, 2014–2023 (USD Million)

Table 58 Europe: Market for Other Applications, By Country, 2014–2023 (USD Million)

Table 59 APAC: Market for Other Applications, By Country, 2014–2023 (USD Million)

Table 60 RoW: Market for Other Applications, By Region, 2014–2023 (USD Million)

Table 61 Market, By Region, 2014–2023 (USD Billion)

Table 62 North America: Market, By Application, 2014–2023 (USD Million)

Table 63 North America: Market, By Organization, 2014–2023 (USD Billion)

Table 64 North America: Market, By Deployment Mode, 2014–2023 (USD Billion)

Table 65 North America: Market, By Country, 2014–2023 (USD Million)

Table 66 Europe: Market for Europe, By Application, 2014–2023 (USD Million)

Table 67 Europe: Market for Europe, By Organization, 2014–2023 (USD Million)

Table 68 Europe: Market for Europe, By Deployment Mode, 2014–2023 (USD Million)

Table 69 Europe: Market, By Country, 2014–2023 (USD Million)

Table 70 APAC: Market, By Application, 2014–2023 (USD Million)

Table 71 APAC: Market, By Organization, 2014–2023 (USD Million)

Table 72 APAC: Market, By Deployment Mode, 2014–2023 (USD Million)

Table 73 APAC: Market, By Country, 2014–2023 (USD Million)

Table 74 RoW: Market, By Application, 2014–2023 (USD Million)

Table 75 RoW: Market, By Organization, 2014–2023 (USD Billion)

Table 76 RoW: Market, By Deployment Mode, 2014–2023 (USD Billion)

Table 77 RoW: Market, By Region, 2015–2023 (USD Billion)

Table 78 Market Ranking of the Top 5 Players in the Market, 2016

Table 79 New Product Launches, By Company (2014–2017)

Table 80 Partnerships/Agreements/Collaborations/Contracts, By Company (2014–2017)

Table 81 Acquisitions, By Company (2014–2017)

Table 82 Expansions, By Company (2014–2017)

List of Figures (31 Figures)

Figure 1 Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Solutions to Dominate the Market During the Forecast Period

Figure 6 Government Applications to Register Highest Growth in the Market Between 2017 and 2023

Figure 7 Small and Medium-Sized Enterprises to Grow at the Highest Rate Between 2017 and 2023

Figure 8 Cloud-Based Deployment Mode to Dominate the Market During the Forecast Period

Figure 9 Efforts to Streamline Business Processes and Growing Initiatives to Digitalize Content Across Enterprises to Drive the Market During the Forecast Period

Figure 10 Hybrid Mode of Deployment Segment to Grow at the Highest CAGR in the North American Market During the Forecast Period

Figure 11 BFSI Applications to Dominate the Market in APAC in 2017

Figure 12 Small and Medium-Sized Enterprises Estimated to Grow at the Highest CAGR Between 2017 and 2023

Figure 13 Australia to Register the Highest Growth Rate During the Forecast Period

Figure 14 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 15 Value Chain Analysis: Major Value Added During the Software Development and Integration Stages

Figure 16 Cloud-Based Market for Government Applications to Grow at the Highest CAGR During the Forecast Period

Figure 17 Australia is Expected to Grow at the Highest CAGR in the Market for Education

Figure 18 Cloud-Based Document Management Systems to Grow at the Highest Rate in the Market for Corporate Applications

Figure 19 Middle East and Africa to Grow at the Highest CAGR in the Market for Industrial Manufacturing

Figure 20 Geographic Snapshot: Market in APAC to Grow at the Highest CAGR During the Forecast Period

Figure 21 Market in Australia to Grow at the Highest CAGR Between 2017 and 2023

Figure 22 Snapshot: Market in North America

Figure 23 Snapshot: Market in Europe

Figure 24 APAC: Market Snapshot

Figure 25 Key Developments By Leading Players in the Market, 2014-2017

Figure 26 Opentext: Company Snapshot

Figure 27 Xerox: Company Snapshot

Figure 28 IBM: Company Snapshot

Figure 29 Canon: Company Snapshot

Figure 30 Oracle: Company Snapshot

Figure 31 Ricoh Company: Company Snapshot

Research Methodology:

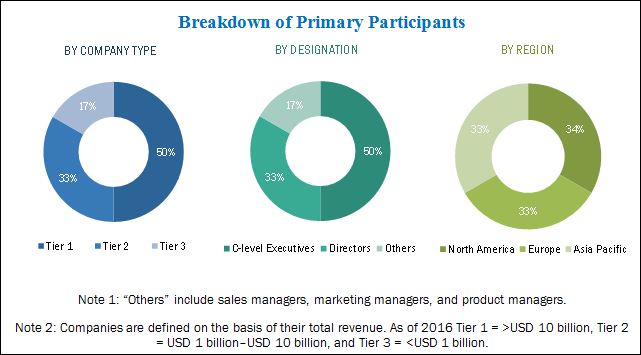

This research study incorporates the use of secondary sources, directories, and databases, such as D & B Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for the extensive technical, market-oriented, and commercial study of the document management systems market. Primary sources mainly comprise several experts from core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and standards and certification organizations related to various parts of this industry’s value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key companies, and consultants have been conducted to obtain and verify critical qualitative and quantitative information as well as assess prospects. The breakdown of the profiles of primaries has been depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights into the ecosystem of the document management systems market. The major players in this market include OpenText Corporation (Canada), Xerox Corporation (US), Canon Inc. (Japan), Ricoh Company Ltd. (Japan), IBM Corporation (US), eFileCabinet Inc. (US), SpringCM (US), Oracle Corporation (US), Alfresco Software Inc. (UK), and Hyland Software Inc. (US).

Please visit 360Quadrants to see the vendor listing of Landing Page Builders

Scope of the Report:

|

Report Metric |

Details |

|

Base year |

2016 |

|

Forecast period |

2017–2023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

OpenText Corporation (Canada), Xerox Corporation (US), Canon Inc. (Japan), Ricoh Company Ltd. (Japan), IBM Corporation (US), eFileCabinet Inc. (US), SpringCM (US), Oracle Corporation (US), Alfresco Software Inc. (UK), and Hyland Software Inc. (US). |

Key Target Audience:

- IT service providers

- Cloud service providers

- Printer suppliers

- Original equipment manufacturers (OEMs)

- System integrators and third-party vendors

- Software solution providers

- Government bodies

- Technology investors

- Enterprise data center professionals

- Research institutes and organizations

- Market research and consulting firms

Scope of the Report:

The research report segments the market into the following subsegments:

Market, by Offering

- Solutions

- Services

Market, by Deployment Mode

- On-premise

- Cloud-based

- Hybrid

Market, by Organization

- Small and Medium-sized enterprises (SMEs)

- Large Enterprises

Market, by Application

- BFSI

- Government

- Education

- Healthcare

- Corporate

- Industrial Manufacturing

- Retail

- Other Applications

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report.

-

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Document Management Systems Market