Metal Forming Market for Automotive by Technique (Roll, Stretch, Stamping, Deep Drawing, Hydroforming), Type (Hot, warm and Cold), Application (BIW, Chassis, Closure), Material (Steel, Aluminum, Magnesium), Vehicle (ICE & Electric) - Global Forecast to 2025

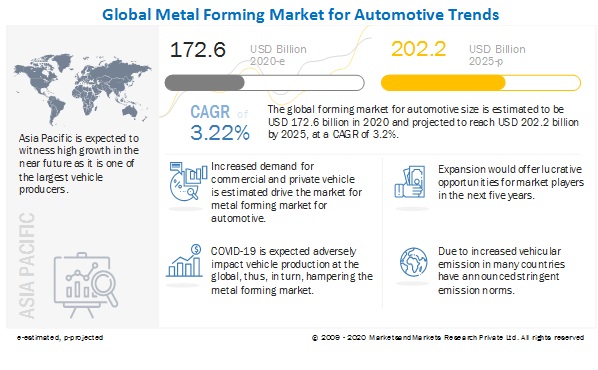

[215 Pages Report] The global metal forming market for automotive size was valued at USD 172.5 billion in 2020 and is expected to reach USD 202.2 billion by 2025 at a CAGR of 3.2 % during the forecast period 2020-2025. The driving factors for market include the growing vehicle production and the increasing trend of vehicle light weighting.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver : Stringent emission and fuel economy regulations for lightweight materials

Due to stringent fuel economy and emission regulations, OEMs have increased the use of lightweight materials such as aluminum and composites, which reduce fuel consumption as they consume low energy during acceleration. Multi-material designs, along with a combination of HSS, magnesium, composites, aluminum, and other materials, use a systematic approach to apply their best properties appropriately in a vehicle. Efficient design, material selection, manufacturing, and assembly result in effective light weighting.

The most widely adopted metal forming method for the given lightweight materials will compete in cost with powertrain efficiency measures and regulations. As aluminum is one of the most preferred lightweight materials in the automotive industry and is manufactured by forming techniques, the trend of weight reduction will drive the metal forming market.

Restraint: Increasing usage of composites in automotive applications

The automotive industry in the US is focusing on weight reduction by replacing some metal-formed components with composite material and plastics. As per the MarketsandMarkets repository, plastic use in vehicles is expected to grow by 70-75% in the next 5 years. OEMs are adopting new materials to reduce the overall weight of their vehicles to comply with government regulations and achieve better fuel efficiency. For instance, bumpers, side fenders, and trunk closures were manufactured using metals sheets and forming techniques. However, they are now manufactured using plastics and composites. This trend might affect the metal forming market for automotive. However, the impact will be limited.

Opportunity: Growing sales of electric and hybrid vehicles

The global battery electric vehicle (BEV) and hybrid electric vehicle (HEV) market is growing rapidly. Factors such as rising concerns about global warming and air pollution and government support to reduce air pollution are driving the BEV market. The growth of the HEV market is driven by factors such as better fuel efficiency, increased driving range, fast refueling, and lower greenhouse gas and air pollutant emissions. Because of such advantages over ICE vehicles, BEVs and HEVs are widely accepted across the globe. There is no such difference in manufacturing techniques of electric and hybrid vehicles. The manufacturing process of BIW and closure-related parts remains the same; hence, existing players in the metal forming market can leverage this opportunity.

Challenges: High capital investments for new entrants to set up metal forming process

High initial investment is required to set up a manufacturing unit with the required capabilities to provide quality and customized solutions to customers. Adequate training and operating conditions are required to carry out the metal forming process. With the help of automation, forming process efficiency can be improved; however, it may act as an additional cost liability for manufacturers. The manufacturers may also be required to change their production set up as per the requirements of automakers. Metal forming requires a substantial initial investment and has higher operating expenses such as labor and process automation. High initial and operating expenses may act as a major challenge for new entrants in the metal forming market for automotive.

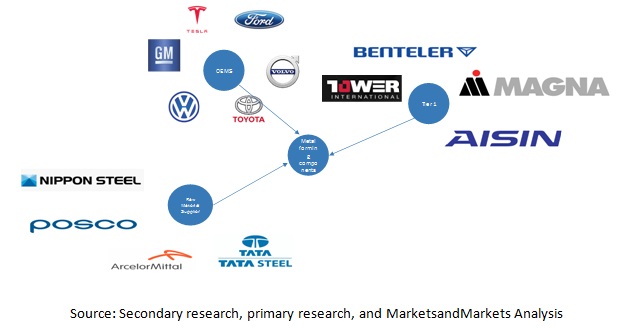

Ecosystem Analysis:

Aluminum is expected to show the fastest growth over the forecast period, by material type.

Aluminum is rapidly replacing steel in many automotive applications like body in white and chassis. The usage rate (%) of aluminum for forming applications is higher in Europe and North America when compared with that in Asia Oceania. The consumer spending power and vehicle costs are higher in countries such as the US and Germany, as compared to the developing economies. Thus, automakers are increasing the use of expensive lightweight materials such as aluminum, which helps to reduce the overall vehicle weight, thus improving the performance and fuel efficiency. However, it is 35-40% costlier than steel, because of which it has a low penetration in Asia Oceania.

By techniques type, stamping is expected to be the largest market over the forecast period

Stamping is one of the most common forming techniques used in the automotive industry. In the automotive industry, many structural components are manufactured through the stamping process. These include closures (doors, hood, and truck) and components of BIW such as A pillar, B pillar, cross beam, and roof liner. Because of such wide application and being the most cost-effective forming technique, stamping is expected to hold the largest market.

Cold forming market is estimated to be the largest market in forming type segment

Cold forming expected to maintain its position in the metal forming market for automotive. As cold forming is one of the most conventional manufacturing processes in which components are formed using different types of forming techniques at room temperature and do not require any additional handling and carrying. Because of this, the overall cost of the cold forming process is low as compared to the hot forming process. Owing to such cost advantages, cold forming is still the major preference of OEMs across the globe.

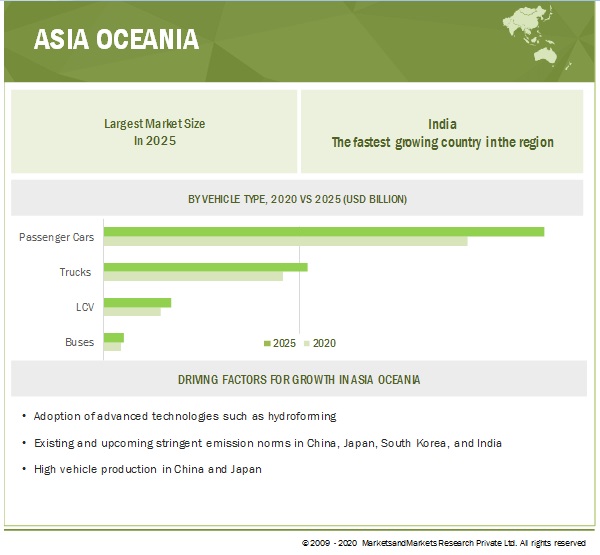

Asia Oceania is estimated to account for the largest market share in metal forming market for automotive.

Because of large vehicle production in the Asia Oceania region, it is estimated to be the largest metal forming market for automotive over the forecast period. China, India, Japan, South Korea, and others are considered under the Asia Oceania region for this study. China is the largest contributor in terms of vehicle production for the Asia Oceania region. Out of the total vehicle production, China contributed approximately 24.9% in 2019. Japan is the second largest vehicle producing country and contributes approximately 8.4% to the global vehicle production. In addition to vehicle production, the trend of vehicle light weighting is also expected to drive this market.

The recent COVID-19 pandemic is expected to impact the global automotive industry. The entire supply chain is disrupted due to limited supply of parts. For instance, UK, France and Spain, which accounts for significant vehicle sales in Europe, is severely impacted by pandemic. Tier 1 suppliers around the globe have placed production lines on halt or shut them down completely. Also, legal and trade restrictions, such as sealed borders, increase the shortage of required parts. Such disruptions in supply chain is expected to affect the assembly of OEMs in Europe and North America.

To know about the assumptions considered for the study, Download the PDF Brochure

Key Market Players

Metal forming market for automotive is dominated by manufacturers such as Magna (Canada), Benteler (Germany), Tower International (UK), Toyota Boshoku (Japan), Aisin Seiki (Japan). Most of the manufacturers are undertaking inorganic developments such as expansion, joint venture, and supply contract. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

USD 172.5 billion |

|

Estimated Value by 2025 |

USD 202.2 billion |

|

Growth Rate |

Poised to grow at a CAGR of 3.2% |

|

Market Segmentation |

By Application, by forming, by technique, By Vehicle, By EV, By Component & by Region |

|

Market Driver |

Stringent emission and fuel economy regulations for lightweight materials |

|

Market Opportunity |

Growing sales of electric and hybrid vehicles |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World |

Global Metal Forming Market, By Technique Type

- Roll Forming

- Stretch Forming

- Stamping

- Deep Drawing

- Hydroforming

- Others

Global Metal Forming Market, By Application Type

- BIW

- Chassis

- Closures

- Others

Global Metal Forming Market, By Electric & Hybrid Vehicle Type

- Fuel Cell Electric Vehicle (FCEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Battery Electric Vehicle (BEV)

Global Metal Forming Market, By ICE Vehicle Type

- Passenger Car

- LCV

- Truck

- Bus

Global Metal Forming Market, By Forming Type

- Cold Forming

- Hot Forming

- Warm Forming

Global Metal Forming Market, By Material Type

- Steel

- Aluminum

- Magnesium

- Others

Global Metal Forming Market, By Region

- North America

- Asia Oceania

- Europe

- South America

- Middle East and Africa

Frequently Asked Questions (FAQ):

How big is the metal forming market for automotive?

The global metal forming market for automotive was valued at USD 172.5 billion in 2020 and is expected to reach USD 202.2 billion by 2025 at a CAGR of 3.2 % during the forecast period 2020-2025.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- France

- Spain

- Turkey

- Russia

- UK

- Rest of Europe

Who are the winners in the global metal forming market for automotive?

Companies such as Magna, Aisin Seiki, Tower international and Benteler fall under the winners category. These companies cater to the requirements of their customers by providing customized products. Moreover, these companies have multiple supply contracts with global OEMs and have effective supply chain strategies. Such advantages give these companies an edge over other companies that are metal forming product suppliers.

What is the COVID-19 impact on automotive metal forming component manufacturers?

Industry experts believe that COVID-19 could affect vehicle production by 15–20% globally in 2020. This also translates into a snowballing effect on the metal forming market. For instance, in March 2020, Magna announced the temporary closure of its six plants in India because of the COVID-19 lockdown. The lockdown could highly impact the metal forming market of Magna. New vehicle models, along with the BS-VI stages, were around the corner for April 2020. It could have created revenue generating opportunities for Magna in India.

What are some of the technological advancements in the market?

Various research activities have been conducted by OEMs across the globe to reduce the overall weight of the vehicle. And usage of lightweight material such as Aluminum and Magnesium will increase. Many companies are doing multiple R&D on higher usage of aluminum in vehicle body structures. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: METAL FORMING MARKET FOR AUTOMOTIVE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 METAL FORMING MARKET FOR AUTOMOTIVE: RESEARCH DESIGN

FIGURE 3 RESEARCH DESIGN MODEL

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES FOR VEHICLE PRODUCTION

2.2.2 KEY SECONDARY SOURCES FOR MARKET SIZING

2.2.3 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

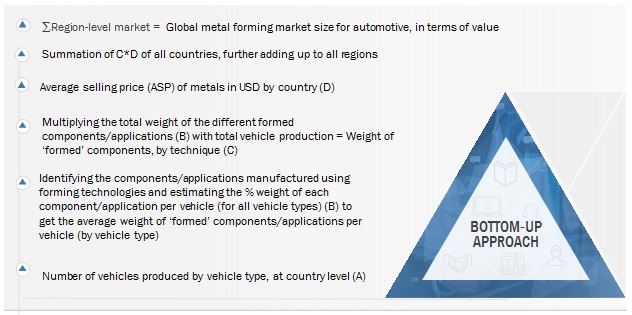

2.4.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET: BOTTOM-UP APPROACH

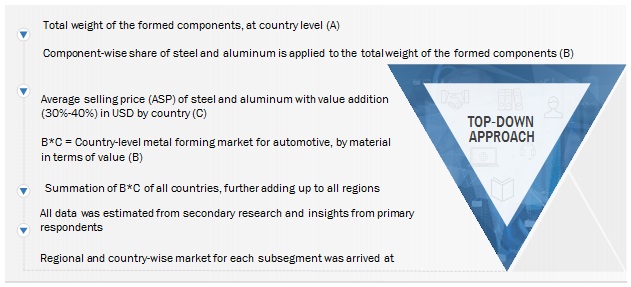

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET, BY METAL: TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 METAL FORMING MARKET FOR AUTOMOTIVE: MARKET OUTLOOK

FIGURE 9 COVID-19 IMPACT ON MARKET

FIGURE 10 MARKET, BY REGION, 2020 VS. 2025 (USD BILLION)

FIGURE 11 CORE COMPETENCY, BY COMPANY

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 12 TREND OF VEHICLE LIGHT WEIGHTING TO DRIVE MARKET

4.2 MARKET, BY FORMING TYPE

FIGURE 13 COLD FORMING SEGMENT TO DOMINATE OVER THE FORECAST PERIOD (USD BILLION)

4.3 MARKET, BY TECHNIQUE

FIGURE 14 STAMPING TO BE DOMINANT METAL FORMING TECHNIQUE OVER THE FORECAST PERIOD (USD BILLION)

4.4 MARKET, BY MATERIAL

FIGURE 15 STEEL TO BE LARGEST MATERIAL MARKET OVER THE FORECAST PERIOD (USD BILLION)

4.5 MARKET, BY APPLICATION

FIGURE 16 BIW TO DOMINATE AS METAL FORMING APPLICATION OVER THE FORECAST PERIOD (USD BILLION)

4.6 MARKET, BY VEHICLE TYPE

FIGURE 17 PASSENGER CARS TO HOLD LARGEST MARKET SHARE OVER THE FORECAST PERIOD (USD BILLION)

4.7 MARKET, BY ELECTRIC & HYBRID VEHICLE

FIGURE 18 BEV ESTIMATED TO LEAD THE MARKET OVER THE FORECAST PERIOD (USD BILLION)

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 METAL FORMING MARKET FOR AUTOMOTIVE: MARKET DYNAMICS

TABLE 1 IMPACT ANALYSIS: METAL FORMING FOR AUTOMOTIVE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising global vehicle production and growing commercial vehicle demand

FIGURE 20 GLOBAL VEHICLE PRODUCTION, BY VEHICLE TYPE, 2020-2025 (MILLION UNITS)

5.2.1.2 Stringent emission and fuel economy regulations for lightweight materials

FIGURE 21 GLOBAL EMISSION REGULATIONS, BY COUNTRY, 2014-2025

5.2.2 RESTRAINTS

5.2.2.1 Increasing usage of composites in automotive applications

TABLE 2 US: FUTURE WEIGHT REDUCTION TARGETS, BY COMPONENT, 2025 VS. 2050

TABLE 3 PLASTIC USE IN VEHICLES

5.2.3 OPPORTUNITY

5.2.3.1 Growing sales of electric and hybrid vehicles

FIGURE 22 BEV & HEV SALES: 2018 VS. 2020 VS. 2025

5.2.3.2 Increasing adoption of hydroforming techniques

5.2.4 CHALLENGES

5.2.4.1 High capital investments for new entrants to set up metal forming process

5.3 ECOSYSTEM ANALYSIS

FIGURE 23 MARKET: ECOSYSTEM

5.4 COVID-19 IMPACT ON METAL FORMING MARKET

FIGURE 24 MARKET: PRE-COVID-19 VS. POST COVID -19

6 TECHNOLOGICAL OVERVIEW (Page No. - 63)

6.1 INTRODUCTION

6.2 ADVANTAGES OF METAL FORMING TECHNIQUES OVER OTHER TECHNIQUES

6.3 TYPES OF FORMING TECHNIQUES

6.3.1 ROLL FORMING

FIGURE 25 ROLL FORMING PROCESS

6.3.2 STRETCH FORMING

FIGURE 26 STRETCH FORMING PROCESS

6.3.3 DEEP DRAWING

FIGURE 27 DEEP DRAWING PROCESS

6.3.4 STAMPING

FIGURE 28 STAMPING PROCESS

6.3.5 HOT FORMING

FIGURE 29 HOT FORMING PROCESS

6.3.6 HYDROFORMING

FIGURE 30 HYDROFORMING PROCESS

6.4 HYDROFORMING: THE FUTURE OF AUTOMOTIVE FORMING

6.4.1 ADVANTAGES OF HYDROFORMING

6.5 ADDITIVE MANUFACTURING

6.5.1 ADVANTAGES OF ADDITIVE MANUFACTURING

6.5.2 DISADVANTAGES OF ADDITIVE MANUFACTURING

7 METAL FORMING MARKET FOR AUTOMOTIVE, BY TECHNIQUE (Page No. - 70)

7.1 INTRODUCTION

FIGURE 31 MARKET, BY TECHNIQUE, 2020 VS. 2025 (USD BILLION)

TABLE 4 MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 5 MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

TABLE 6 ASSUMPTIONS: BY TECHNIQUE

7.1.3 KEY PRIMARY INSIGHTS

FIGURE 32 KEY PRIMARY INSIGHTS

7.2 ROLL FORMING

7.2.1 HIGHEST VEHICLE PRODUCTION WILL DRIVE ASIA OCEANIA’S THE MARKET FOR ROLL FORMING

TABLE 7 ROLL FORMING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 8 ROLL FORMING: MARKET, BY REGION, 2017–2025 (USD BILLION)

7.3 STRETCH FORMING

7.3.1 LOW COST OF STRETCH FORMING PROCESS DRIVES PRICE-SENSITIVE ASIA OCEANIA MARKET

TABLE 9 STRETCH FORMING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 10 STRETCH FORMING: MARKET, BY REGION, 2017–2025 (USD BILLION)

7.4 DEEP DRAWING

7.4.1 USE OF PLASTICS & COMPOSITES IN COMPONENTS HAMPERS DEEP DRAWING SEGMENT IN EUROPE AND NORTH AMERICA

TABLE 11 DEEP DRAWING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 12 DEEP DRAWING: MARKET, BY REGION, 2017–2025 (USD BILLION)

7.5 STAMPING

7.5.1 WIDE USE OF STAMPING DRIVES ITS DOMINANCE IN MARKET

TABLE 13 STAMPING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 14 STAMPING: MARKET, BY REGION, 2017–2025 (USD BILLION)

7.6 HYDROFORMING

7.6.1 DEMAND FOR BETTER SURFACE QUALITY DRIVES THE MARKET FOR HYDROFORMING TECHNIQUE

TABLE 15 HYDROFORMING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 16 HYDROFORMING: MARKET, BY REGION, 2017–2025 (USD BILLION)

7.7 OTHERS

TABLE 17 OTHER TECHNIQUES: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 18 OTHER TECHNIQUES: MARKET, BY REGION, 2017–2025 (USD BILLION)

8 METAL FORMING MARKET FOR AUTOMOTIVE, BY FORMING TYPE (Page No. - 80)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY FORMING TYPE, 2020 VS. 2025 (USD BILLION)

TABLE 19 MARKET, BY FORMING TYPE, 2017–2025 (MILLION TON)

TABLE 20 MARKET, BY FORMING TYPE, 2017–2025 (USD BILLION)

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

TABLE 21 ASSUMPTIONS: BY FORMING TYPE

8.1.3 KEY PRIMARY INSIGHTS

FIGURE 34 KEY PRIMARY INSIGHTS

8.2 COLD FORMING

8.2.1 COLD FORMING TO REMAIN MOST PROMINENT AND ECONOMICAL METHOD OF FORMING FOR AUTOMOTIVE PARTS

TABLE 22 COLD FORMING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 23 COLD FORMING: MARKET, BY REGION, 2017–2025 (USD BILLION)

8.3 HOT FORMING

8.3.1 INCREASING DEMAND FOR BETTER-QUALITY AUTOMOTIVE COMPONENTS TO DRIVE HOT FORMING SEGMENT

TABLE 24 HOT FORMING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 25 HOT FORMING: MARKET, BY REGION, 2017–2025 (USD BILLION)

8.4 WARM FORMING

8.4.1 ADVANTAGES OVER HOT AND COLD FORMING PROPEL DEMAND FOR WARM FORMING METHOD

TABLE 26 WARM FORMING: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 27 WARM FORMING: MARKET, BY REGION, 2017–2025 (USD BILLION)

9 METAL FORMING MARKET FOR AUTOMOTIVE, BY APPLICATION (Page No. - 87)

9.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION, 2020 VS. 2025 (USD BILLION)

TABLE 28 MARKET, BY APPLICATION, 2017–2025 (MILLION TON)

TABLE 29 MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

TABLE 30 ASSUMPTIONS: BY APPLICATION

9.1.3 KEY PRIMARY INSIGHTS

FIGURE 36 KEY PRIMARY INSIGHTS

9.2 BIW

TABLE 31 EC AND EUCAR - SUPER LIGHT-CAR (SLC) PROJECT

9.2.1 BIW SEGMENT TO BE DRIVEN BY HIGH VEHICLE PRODUCTION IN ASIA OCEANIA

TABLE 32 BIW: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 33 BIW: MARKET, BY REGION, 2017–2025 (USD BILLION)

9.3 CHASSIS

9.3.1 DEMAND FOR LIGHTWEIGHTING OF LCVS AND COMMERCIAL VEHICLES INFLUENCES DEMAND FOR CHASSIS IN NORTH AMERICA

TABLE 34 CHASSIS: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 35 CHASSIS: MARKET, BY REGION, 2017–2025 (USD BILLION)

9.4 CLOSURES

9.4.1 NORTH AMERICA TO WITNESS HIGHEST GROWTH RATE FOR CLOSURES

TABLE 36 CLOSURES: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 37 CLOSURES: MARKET, BY REGION, 2017–2025 (USD BILLION)

9.5 OTHERS

9.5.1 DEMAND FOR ASTATIC FEATURES TO DRIVE DEMAND FOR OTHER APPLICATIONS IN NORTH AMERICA

TABLE 38 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 39 OTHER APPLICATIONS: MARKET, BY REGION, 2017–2025 (USD BILLION)

10 METAL FORMING MARKET FOR AUTOMOTIVE, BY MATERIAL (Page No. - 96)

10.1 INTRODUCTION

TABLE 40 AVERAGE MASS REDUCTION WITH THE USE OF LIGHTWEIGHT MATERIALS (%)

FIGURE 37 MARKET, BY MATERIAL, 2020 VS. 2025

TABLE 41 MARKET, BY MATERIAL, 2017–2025 (MILLION TON)

TABLE 42 MARKET, BY MATERIAL, 2017–2025 (USD BILLION)

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

TABLE 43 ASSUMPTIONS: BY MATERIAL

10.1.3 KEY PRIMARY INSIGHTS

FIGURE 38 KEY PRIMARY INSIGHTS

10.2 STEEL

10.2.1 MARGINAL DECLINE IN ADOPTION OF STEEL LIKELY, OWING TO TREND OF MULTI-MATERIAL BODY

TABLE 44 STEEL: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 45 STEEL: MARKET, BY REGION, 2017–2025 (USD BILLION)

10.3 ALUMINUM

10.3.1 ALUMINUM TO GAIN PROMINENCE AS MATERIAL OF CHOICE FOR BIW DURING FORECAST PERIOD

TABLE 46 ALUMINUM: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 47 ALUMINUM: MARKET, BY REGION, 2017–2025 (USD BILLION)

10.4 MAGNESIUM

10.4.1 DRIVEN BY COLLABORATIONS BETWEEN OEMS AND TIER 1 R&D, ADOPTION OF MAGNESIUM TO INCREASE

TABLE 48 MAGNESIUM: MARKET, BY REGION, 2017–2025 (‘000 TON)

TABLE 49 MAGNESIUM: MARKET, BY REGION, 2017–2025 (USD BILLION)

10.5 OTHERS

10.5.1 ASIA OCEANIA TO GROW AT HIGHEST CAGR FOR OTHER MATERIALS

TABLE 50 OTHER MATERIALS: MARKET, BY REGION, 2017–2025 (‘000 TON)

TABLE 51 OTHER MATERIALS: MARKET, BY REGION, 2017–2025 (USD BILLION)

11 METAL FORMING MARKET FOR AUTOMOTIVE, BY VEHICLE TYPE (Page No. - 105)

11.1 INTRODUCTION

FIGURE 39 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD BILLION)

TABLE 52 MARKET, BY VEHICLE TYPE, 2017–2025 (MILLION TON)

TABLE 53 MARKET, BY VEHICLE TYPE, 2017–2025 (USD BILLION)

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

TABLE 54 ASSUMPTIONS: BY VEHICLE TYPE

11.1.3 KEY PRIMARY INSIGHTS

FIGURE 40 KEY PRIMARY INSIGHTS

11.2 PASSENGER CARS

11.2.1 HIGH VEHICLE PRODUCTION IN ASIA PACIFIC A RESULT OF INCREASED MOBILITY NEEDS IN CHINA AND INDIA

TABLE 55 PASSENGER CARS: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 56 PASSENGER CARS: MARKET, BY REGION, 2017–2025 (USD BILLION)

11.3 LIGHT COMMERCIAL VEHICLES (LCV)

11.3.1 INCREASING DEMAND FOR LAST-MILE DELIVERY TO INCREASE DEMAND FOR LCVS IN NORTH AMERICA

TABLE 57 LCV: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 58 LCV: MARKET, BY REGION, 2017–2025 (USD BILLION)

11.4 TRUCKS

11.4.1 STRINGENT EMISSION NORMS TO RESULT IN SHIFT TO LIGHTWEIGHT SOLUTIONS FOR METAL FORMING IN TRUCKS

TABLE 59 TRUCKS: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 60 TRUCKS: MARKET, BY REGION, 2017–2025 (USD BILLION)

11.5 BUSES

11.5.1 INCREASING TREND OF INTER AND INTRA CITY TRAVEL SPURS DEMAND FOR BUSES

TABLE 61 BUSES: MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 62 BUSES: MARKET, BY REGION, 2017–2025 (USD BILLION)

12 METAL FORMING MARKET FOR ELECTRIC AND HYBRID VEHICLES, BY VEHICLE TYPE (Page No. - 115)

12.1 INTRODUCTION

FIGURE 41 MARKET, BY VEHICLE TYPE, 2020 VS. 2025 (USD BILLION)

TABLE 63 MARKET, BY VEHICLE TYPE, 2017–2025 (000’ TON)

TABLE 64 MARKET, BY VEHICLE TYPE, 2017–2025 (USD BILLION)

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

TABLE 65 ASSUMPTIONS: BY ELECTRIC AND HYBRID VEHICLE TYPE

12.1.3 KEY PRIMARY INSIGHTS

FIGURE 42 KEY PRIMARY INSIGHTS

12.2 BEV

TABLE 66 TOP SELLING MODELS OF BEV

12.2.1 INCREASING DEMAND FOR EMISSION-FREE VEHICLES STIMULATES MARKET FOR BEV METAL FORMING

TABLE 67 BEV: MARKET, BY REGION, 2017–2025 (000’ TON)

TABLE 68 BEV: MARKET, BY REGION, 2017–2025 (USD BILLION)

12.3 PHEV

12.3.1 INCREASING ADOPTION OF LOW-EMISSION VEHICLES PROPELS PHEV MARKET

TABLE 69 PHEV: MARKET, BY REGION, 2017 -2025 (000’ TON)

TABLE 70 PHEV: MARKET, BY REGION, 2017–2025 (USD BILLION)

12.4 FCEV

12.4.1 ASIA PACIFIC TO DOMINATE MARKET FOR FCEV

TABLE 71 FCEV: MARKET, BY REGION, 2017–2025 (000’ TON)

TABLE 72 FCEV: MARKET, BY REGION, 2017–2025 (USD MILLION)

13 METAL FORMING MARKET FOR AUTOMOTIVE, BY REGION (Page No. - 122)

13.1 INTRODUCTION

FIGURE 43 MARKET, BY REGION, 2020 VS. 2025 (USD BILLION)

TABLE 73 MARKET, BY REGION, 2017–2025 (MILLION TON)

TABLE 74 MARKET, BY REGION, 2017–2025 (USD BILLION)

13.2 ASIA OCEANIA

13.2.1 IMPACT OF COVID-19 ON ASIA OCEANIA MARKET

FIGURE 44 ASIA OCEANIA MARKET: PRE-COVID-19 VS. POST-COVID-19 SCENARIO

TABLE 75 ASIA PACIFIC: MARKET, PRE-COVID-19 VS. POST-COVID-19 SCENARIO (USD BILLION)

FIGURE 45 ASIA OCEANIA: MARKET SNAPSHOT

FIGURE 46 ASIA OCEANIA: MARKET, BY COUNTRY, 2020 VS. 2025 (USD BILLION)

TABLE 76 ASIA OCEANIA: MARKET, BY COUNTRY, 2017–2025 (MILLION TON)

TABLE 77 ASIA OCEANIA: MARKET, BY COUNTRY, 2017–2025 (USD BILLION)

13.2.2 CHINA

13.2.2.1 Roll forming to account for largest market share in China

TABLE 78 CHINA: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 79 CHINA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.2.3 INDIA

13.2.3.1 Increasing production of mid-level cars to drive demand for hydroforming in India

TABLE 80 INDIA: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 81 INDIA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.2.4 JAPAN

13.2.4.1 Mature automotive market in Japan to witness slow growth in forecast period

TABLE 82 JAPAN: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 83 JAPAN: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.2.5 SOUTH KOREA

13.2.5.1 Stamping to dominate the market in South Korea

TABLE 84 SOUTH KOREA: ARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 85 SOUTH KOREA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.2.6 THAILAND

13.2.6.1 Market in Thailand to witness slow growth in forecast period

TABLE 86 THAILAND: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 87 THAILAND: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.2.7 REST OF ASIA OCEANIA

13.2.7.1 Countries such as Indonesia boost demand for hydroforming in the Rest of Asia Oceania

TABLE 88 REST OF ASIA OCEANIA: MARKET , BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 89 REST OF ASIA OCEANIA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3 EUROPE

13.3.1 IMPACT OF COVID-19 ON THE EUROPEAN MARKET

FIGURE 47 EUROPEAN MARKET: PRE-COVID-19 VS. POST-COVID-19 SCENARIO

TABLE 90 EUROPE: MARKET, PRE-COVID-19 VS. POST-COVID-19 SCENARIO (USD BILLION)

FIGURE 48 EUROPE: MARKET SNAPSHOT

FIGURE 49 EUROPE: MARKET, BY COUNTRY, 2020 VS. 2025 (USD BILLION)

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2017–2025 (MILLION TON)

TABLE 92 EUROPE: MARKET, BY COUNTRY, 2017–2025 (USD BILLION)

13.3.2 FRANCE

13.3.2.1 Trend of lightweighting hampers growth of deep drawing segment in France

TABLE 93 FRANCE: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 94 FRANCE: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3.3 GERMANY

13.3.3.1 Germany – Europe’s vehicle manufacturing hub to account for largest share in metal forming market

TABLE 95 GERMANY: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 96 GERMANY: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3.4 RUSSIA

13.3.4.1 Stamping to hold largest share of metal forming market in Russia

TABLE 97 RUSSIA: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 98 RUSSIA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3.5 SPAIN

13.3.5.1 Lightweighting trend to boost demand for hydroforming in Spain

TABLE 99 SPAIN: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 100 SPAIN: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3.6 TURKEY

13.3.6.1 Turkey projected to be fastest-growing market in Europe

TABLE 101 TURKEY: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 102 TURKEY: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3.7 UK

13.3.7.1 Stamping estimated to account for largest share, followed by roll forming in the UK

TABLE 103 UK: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 104 UK: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.3.8 REST OF EUROPE

13.3.8.1 Demand from high-income Nordic countries to drive demand for hydroforming in forecast period

TABLE 105 REST OF EUROPE: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 106 REST OF EUROPE: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.4 NORTH AMERICA

13.4.1 IMPACT OF COVID-19 ON NORTH AMERICAN MARKET

FIGURE 50 NORTH AMERICAN MARKET: PRE-COVID-19 VS. POST-COVID-19 SCENARIO

TABLE 107 NORTH AMERICA: MARKET, PRE-COVID-19 VS. POST-COVID-19 SCENARIO (USD BILLION)

FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 52 NORTH AMERICA: MARKET, BY COUNTRY, 2020 VS. 2025 (USD BILLION)

TABLE 108 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (MILLION TON)

TABLE 109 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (USD BILLION)

13.4.2 CANADA

13.4.2.1 Stringent emission standards to drive demand for hydroforming in Canada

TABLE 110 CANADA: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 111 CANADA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.4.3 MEXICO

13.4.3.1 Increasing demand for mobility to drive Mexican market for vehicles, and subsequently metal forming

TABLE 112 MEXICO: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 113 MEXICO: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.4.4 US

13.4.4.1 US estimated to account for largest market share in North America

TABLE 114 US: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 115 US: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.5 SOUTH AMERICA

FIGURE 53 SOUTH AMERICA: MARKET, BY COUNTRY, 2020 VS. 2025 (USD BILLION)

13.5.1 IMPACT OF COVID-19 ON SOUTH AMERICAN MARKET

FIGURE 54 SOUTH AMERICAN MARKET: PRE-COVID-19 VS. POST-COVID-19 SCENARIO

TABLE 116 SOUTH AMERICA: MARKET, PRE-COVID-19 VS. POST-COVID-19 SCENARIO (USD BILLION)

TABLE 117 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (MILLION TON)

TABLE 118 SOUTH AMERICA: MARKET, BY COUNTRY, 2017–2025 (USD BILLION)

13.5.2 BRAZIL

13.5.2.1 Brazil estimated to record fastest growth and account for largest share in the region

TABLE 119 BRAZIL: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 120 BRAZIL: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.5.3 ARGENTINA

13.5.3.1 Emission regulations in Argentina to drive market for hydroforming

TABLE 121 ARGENTINA: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 122 ARGENTINA: MARKET, BY TECHNIQUE, 2017–2025 (USD BILLION)

13.6 MIDDLE EAST & AFRICA

FIGURE 55 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020 VS. 2025 (USD BILLION)

13.6.1 IMPACT OF COVID-19 ON MIDDLE EAST & AFRICA MARKET

FIGURE 56 MIDDLE EAST & AFRICA MARKET: PRE-COVID-19 VS. POST-COVID-19 SCENARIO

TABLE 123 MIDDLE EAST & AFRICA: MARKET, PRE-COVID-19 VS. POST-COVID-19 SCENARIO (USD BILLION)

TABLE 124 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2025 (MILLION TON)

TABLE 125 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2025 (USD BILLION)

13.6.2 IRAN

13.6.2.1 Debt-ridden automotive industry in Iran to witness flat growth in forecast period

TABLE 126 IRAN: MARKET, BY TECHNIQUE, 2017–2025 (000’ TON)

TABLE 127 IRAN: MARKET, BY TECHNIQUE, 2017–2025 (USD MILLION)

13.6.3 SOUTH AFRICA

13.6.3.1 Increasing population in South Africa to drive demand for mobility

TABLE 128 SOUTH AFRICA: MARKET, BY TECHNIQUE, 2017–2025 (MILLION TON)

TABLE 129 SOUTH AFRICA: MARKET, BY TECHNIQUE, 2017–2025 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 162)

14.1 OVERVIEW

FIGURE 57 COMPANIES ADOPTED EXPANSIONS AS THE KEY GROWTH STRATEGY, 2017–2020

14.2 METAL FORMING MARKET FOR AUTOMOTIVE: MARKET RANKING ANALYSIS

FIGURE 58 MARKET: RANKING ANALYSIS, 2019

14.3 COMPETITIVE LEADERSHIP MAPPING

14.3.1 STARS

14.3.2 EMERGING LEADERS

14.3.3 PERVASIVE COMPANIES

14.3.4 EMERGING COMPANIES

FIGURE 59 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

14.4 COMPETITIVE SCENARIO

14.4.1 EXPANSIONS

TABLE 130 EXPANSIONS, 2017-2020

14.4.2 SUPPLY CONTRACTS

TABLE 131 SUPPLY CONTRACTS, 2017-2020

14.4.3 NEW PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 132 NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2017–2020

14.4.4 PARTNERSHIPS/JOINT VENTURES

TABLE 133 PARTNERSHIP/JOINT VENTURES, 2017-2020

15 COMPANY PROFILES (Page No. - 169)

15.1 INTRODUCTION

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

15.2 BENTELER

FIGURE 60 BENTELER: COMPANY SNAPSHOT

FIGURE 61 BENTELER: SWOT ANALYSIS

15.3 TOWER INTERNATIONAL

FIGURE 62 TOWER INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 63 TOWER INTERNATIONAL: SWOT ANALYSIS

15.4 MAGNA INTERNATIONAL

FIGURE 64 MAGNA: COMPANY SNAPSHOT

FIGURE 65 MAGNA: SWOT ANALYSIS

15.5 TOYOTA BOSHOKU CORPORATION

FIGURE 66 TOYOTA BOSHOKU: COMPANY SNAPSHOT

FIGURE 67 TOYOTA BOSHOKU: SWOT ANALYSIS

15.6 AISIN SEIKI

FIGURE 68 AISIN SEIKI: COMPANY SNAPSHOT

FIGURE 69 AISIN SEIKI: SWOT ANALYSIS

15.7 KIRCHHOFF

FIGURE 70 KIRCHHOFF: COMPANY SNAPSHOT

15.8 CIE AUTOMOTIVE

FIGURE 71 CIE AUTOMOTIVE: COMPANY SNAPSHOT

15.9 MILLS PRODUCTS

15.10 VNT AUTOMOTIVE

15.11 SUPERFORM ALUMINIUM

15.12 HIROTEC

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

15.13 CLIENT REQUIREMENT

15.13.1 PWO

TABLE 134 PWO: PRODUCT OFFERINGS

TABLE 135 PWO: KEY CUSTOMERS

15.13.2 ERNST UMFORMTECHNIK

TABLE 136 ERNST UMFORMTECHNIK: PRODUCT OFFERINGS

TABLE 137 ERNST UMFORMTECHNIK: KEY CUSTOMERS

15.13.3 HÖRNLEIN

TABLE 138 HORNLEIN: PRODUCT OFFERINGS

15.13.4 HUBERT STÜKEN GMBH & CO. KG (STÜKEN)

TABLE 139 STÜKEN: PRODUCT OFFERINGS

15.13.5 STEWART EFI

TABLE 140 STEWART EFI: PRODUCT OFFERINGS

15.13.6 TRUELOVE & MACLEAN (ACQUIRED BY SFS GROUP AG)

TABLE 141 TRUELOVE & MACLEAN: INDUSTRIES SERVED

15.13.7 METAL FLOW

TABLE 142 METAL FLOW: PRODUCT OFFERINGS

TABLE 143 METAL FLOW: KEY CUSTOMERS

15.13.8 TRANSFER TOOL

TABLE 144 TRANSFER TOOL: INDUSTRIES SERVED

15.14 ADDITIONAL COMPANIES

15.14.1 NORTH AMERICA

15.14.1.1 Vari-Form

15.14.1.2 LTC Roll

15.14.1.3 Martinrea International Inc

15.14.1.4 Multimatic

15.14.2 ASIA OCEANIA

15.14.2.1 Kaizen Metal Forming

15.14.2.2 AES Automotive

15.14.2.3 JBM Auto

15.14.2.4 MIM

15.14.3 EUROPE

15.14.3.1 Craemer

15.14.3.2 Voestalpine

15.14.3.3 Gestamp Automoción

15.14.3.4 Quintus Technologies

16 APPENDIX (Page No. - 205)

16.1 CURRENCY

TABLE 145 CURRENCY EXCHANGE RATES (USD)

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.4.1 METAL FORMING MARKET FOR AUTOMOTIVE, BY APPLICATION & TECHNIQUES

16.4.1.1 BIW: Market, by technique

16.4.1.1.1 Roll forming

16.4.1.1.2 Stretch forming

16.4.1.1.3 Stamping

16.4.1.1.4 Deep drawing

16.4.1.1.5 Hydroforming

16.4.1.1.6 Others

16.4.1.2 Chassis: Market, by technique

16.4.1.2.1 Roll forming

16.4.1.2.2 Stretch forming

16.4.1.2.3 Stamping

16.4.1.2.4 Deep drawing

16.4.1.2.5 Hydroforming

16.4.1.2.6 Others

16.4.1.3 Closures: Market, by technique

16.4.1.3.1 Roll forming

16.4.1.3.2 Stretch forming

16.4.1.3.3 Stamping

16.4.1.3.4 Deep drawing

16.4.1.3.5 Hydroforming

16.4.1.3.6 Others

16.4.1.4 Others: Market, by Technique

16.4.1.4.1 Roll forming

16.4.1.4.2 Stretch forming

16.4.1.4.3 Stamping

16.4.1.4.4 Deep drawing

16.4.1.4.5 Hydroforming

16.4.1.4.6 Others

16.4.2 METAL FORMING MARKET FOR AUTOMOTIVE, BY APPLICATION & MATERIAL

16.4.2.1 BIW: Market by material type

16.4.2.1.1 Steel

16.4.2.1.2 Aluminum

16.4.2.1.3 Other

16.4.2.2 Chassis: Market by material type

16.4.2.2.1 Steel

16.4.2.2.2 Aluminum

16.4.2.2.3 Other

16.4.2.3 Closures: Market by material type

16.4.2.3.1 Steel

16.4.2.3.2 Aluminum

16.4.2.3.3 Other

16.4.2.4 Others: Market by material type

16.4.2.4.1 Steel

16.4.2.4.2 Aluminum

16.4.2.4.3 Other

16.4.3 METAL FORMING MARKET FOR AUTOMOTIVE, BY APPLICATION

16.4.3.1 BIW: Market by vehicle type

16.4.3.1.1 Passenger car

16.4.3.1.2 LCV

16.4.3.1.3 Truck

16.4.3.1.4 Bus

16.4.3.2 Chassis: Market by vehicle type

16.4.3.2.1 Passenger car

16.4.3.2.2 LCV

16.4.3.2.3 Truck

16.4.3.2.4 Bus

16.4.3.3 Closures: Market by vehicle type

16.4.3.3.1 Passenger car

16.4.3.3.2 LCV

16.4.3.3.3 Truck

16.4.3.3.4 Bus

16.4.3.4 Others: Metal forming market for automotive by vehicle type

16.4.3.4.1 Passenger car

16.4.3.4.2 LCV

16.4.3.4.3 Truck

16.4.3.4.4 Bus

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The study involved four major activities in estimating the size for global metal forming market for. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used in the report involves various secondary sources, paid databases, and directories, such as Society of Indian Automobile Manufacturers (SIAM), European Automobile Manufacturers' Association (ACEA), and The International Council on Clean Transportation (ICCT), Factiva, Bloomberg, and Hoovers. Experts from related industries and suppliers have been interviewed to understand the future trends of the metal forming market for automotive.

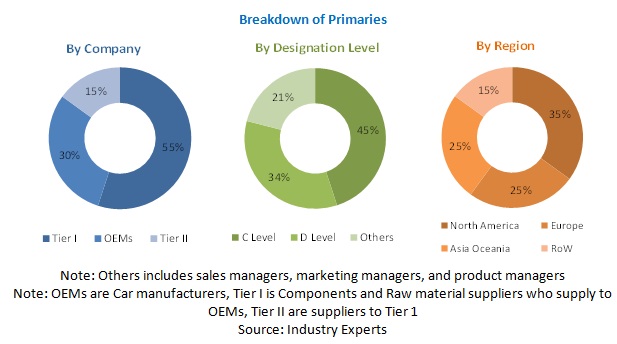

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the metal forming market for automotive scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (vehicle manufacturers) and supply-side (metal forming component manufacturers, tier-1 players and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, South America and Middle East and Africa. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

The below figure shows the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, Download the PDF Brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the metal forming market for automotive.

- In this approach, the vehicle production statistics for each vehicle type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of forming techniques used in the automotive industry.

- Several primary interviews have been conducted with key opinion leaders related to automotive metal forming development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global metal forming market for automotive (for volume) : Bottom Up Approach

Global metal forming market for automotive (Value): Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Objectives of the study:

- To analyze and forecast (2020–2025) the metal forming techniques market for automotive, in terms of value (USD billion) and volume (million tons)

- To define, describe, and project the metal forming technologies market for automotive based on forming techniques, application, material, ICE vehicle type, electric and hybrid vehicle, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the total market

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, new product launches, expansions, and other activities carried out by the key industry participants

- To analyze the opportunities offered by various segments of the metal forming technologies market for automotive to the stakeholders

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Metal forming market for automotive, by Application type & Techniques, 2017–2025

- BIW: Market, by technique*

- Chassis: Market, by technique*

- Closures: Market, by technique*

- Others: Market, by technique*

(Note: * By technique inclusive of Roll forming, Stretch forming, Stamping, Deep drawing, Hydroforming, and Others)

Metal forming market for automotive, by Application & material

- BIW: Market, by material type**

- Chassis: Market, by material type**

- Closures: Market, by material type**

- Others: Market, by material type**

(Note: ** By material type inclusive of Steel, Aluminum, and Others)

Metal forming market for automotive, by Application

- BIW: Market, by vehicle type***

- Chassis: Market,by vehicle type***

- Closures: Market, by vehicle type***

- Others: Market, by vehicle type***

(Note: ***By vehicle type inclusive of Passenger car, LCV, Truck, and Bus)

Growth opportunities and latent adjacency in Metal Forming Market

HI, We would like to know what type of forming technologies are analyzed in the chapter "7.7 others" Metal Forming Market for Automotive, By Techniques (Page No. - 52) Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW 7.1 Introduction 7.2 Roll Forming 7.3 Stretch Forming 7.4 Deep Drawing 7.5 Stamping 7.6 Hydroforming 7.7 Others Thank You

HI, We would like to know what type of forming technologies are analyzed in the chapter "7.7 others" Metal Forming Market for Automotive, By Techniques (Page No. - 52) Note - The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Oceania, Europe, North America, and RoW 7.1 Introduction 7.2 Roll Forming 7.3 Stretch Forming 7.4 Deep Drawing 7.5 Stamping 7.6 Hydroforming 7.7 Others Thank You