Medium Voltage Cables & Accessories Market by Installation (Overhead, Underground, Submarine), Products (MI, XLPE Cables, Terminations, Joints), Voltage (1-5, 6-13, 23, 34, 45, 69kV), End-User (Industrial, Infrastructure, Renewables) - Forecast to 2022

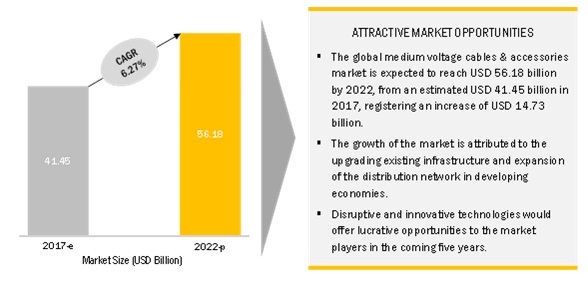

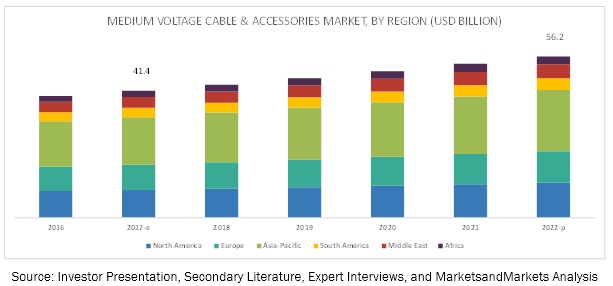

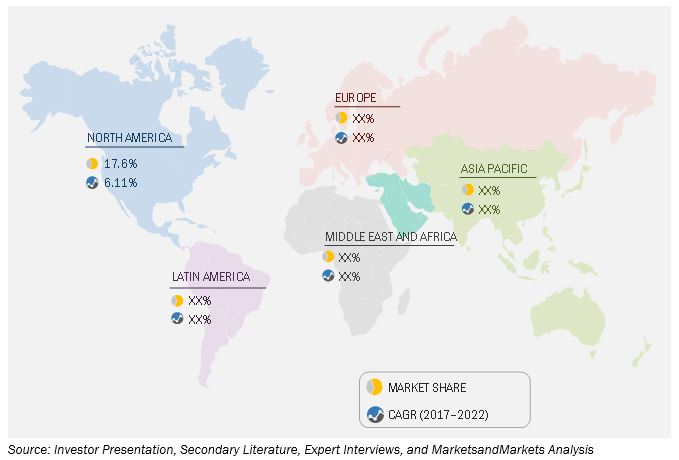

[222 Pages Report] The global medium voltage cables and accessories market was valued at USD 39.3 billion in 2016 and is projected to grow at a CAGR of 6.27%, from 2017 to 2022. Increase in renewable energy generation and rapid industrialization and urbanization are the major drivers for growth in the medium voltage cables and accessories market.

By installation type, the underground installation type segment is expected to grow at the highest CAGR during the forecast period

The underground cables segment is expected to hold the largest market share of the medium voltage cables and accessories market during the forecast period. Underground cables are mainly used to transmit power to populated areas. Low transmission losses, absorption of emergency power loads, low maintenance costs, and less susceptibility to weather are some of the benefits of using underground cables.

By voltage range, the 613 kV voltage range segment Medium Voltage Cable & Accessories segment held the largest market share during the forecast period

The 613 kV segment Medium Voltage Cable & Accessories segment held the largest market share in 2016 and is projected to dominate the market during the forecast period as they generally used in indoor and outdoor static installation and also in the renewable energy sector. It can be installed in any type of trench or duct, and in open air conditions.

Asia Pacific to account for the largest market size during the forecast period.

The market in Asia Pacific is currently the largest for medium voltage cables and accessories followed by the European market. Increase in renewable power generation is a major factor driving the medium voltage cables and accessories market in Asia Pacific.

Market Dynamics

Driver: increase in renewable energy generation

The concept of using renewable energy for power generation is increasing rapidly. It reduces the threat of climate change, and make air safer and healthy. A large number of countries across the world are increasing the expansion of renewable energy generation capacity by using different technologies, investments in electricity system, and making smart policy decisions. According to the Global Wind Energy Council (GWEC), more than 54 GW of clean renewable wind power has been installed in 2016 across the globe and would rise to 75 GW by 2021.

The use of wind power is continuously increasing in many European countries, such as Denmark, Germany, Uruguay, Portugal, Republic of Ireland, Spain and Cyprus. Another fastest growing renewable electricity source is solar which has been expected to grow on an average of 15.7% per year from 2012 to 2040. The growth of solar energy source is much higher than wind and geothermal energy sources. According to the International Energy Agency, 75 GW of solar power capacity was added in 2016 across the world, bringing the global installed capacity of solar photovoltaic generation to 303 GW. Thus, increasing use of wind and solar energy worldwide is expected to drive the growth of the medium voltage cables and accessories market as these cables would use to integrate the electricity generated through solar and wind to the grid. Increasing electricity generation would also require new transmission and distribution infrastructure.

Restraint: Project delays due to complex planning & authorization processes

Transmission and distribution network expansion projects are typically large-scale endeavors involving large budgetary allocations from government authorities. Such projects routinely get stuck in bureaucratic processes or face funding issues due to budgetary shortfalls. In India, there are nearly 100 power transmission delayed projects, which may cause additional burden to utilities and EPC companies. Delay in projects execution also leads to cost overrun. For example, In India power projects led by NTPC got delayed, resulting in USD 2 billion worth of cost overruns. Sometime the overrun cost is more than original estimated cost. Thus, project delays and cost overruns caused as a result of planning and authorization delays are a restraint for the market.

Opportunity: Favorable renewable energy policies in key countries

The increasing problems related to global warming, carbon emissions, and increasing pollution has motivated countries across the globe to move towards clean energy sources. Governments across the globe are implementing strategies to tackle these environmental issues. Different initiatives are taken by the government across the globe to motivate renewable power generation projects that generate energy without producing and emitting CO2 to the atmosphere. Some of the incentives, such as feed-in tariffs and tax credits, along with the maturity of the technology at commercial scale have made investors and project developers to shift toward renewable power generation.

As per the European Photovoltaic Industry Association, the total installed capacity of solar energy was 138 GW in 2013. Almost 65 GW of capacity is expected to be installed in the next five years. On 11 January 2010, India launched the National Solar Mission. The scope behind the launch was to deploy 20,000 MW of solar power capacity by 2022. The scope has now been revised and the target at present is to install 100,000 MW of solar power capacity by 2022. India has a target to install 175 GW of renewable energy by 2021 to 2022. The global wind power capacity is expected to reach a cumulative installed capacity of over 800 GW by the end of 2021 as per the data from the Global Wind Energy Council. Thus, favorable renewable energy policies and the consequent increase in power capacity is an opportunity for the medium voltage cables and accessories market

Challenge: Availability of low-quality and inexpensive products

The availability of cheap substitutes and duplicates of original brand products is a big challenge for the medium voltage cables and accessories market. These products are generally available at a cheaper rate as compared to the original products and have a comparatively inferior quality. The medium voltage cables and accessories market includes both organized and unorganized sectors, where the organized sector provides high quality of product to the industries and the unorganized sector provides cheaper or lower quality products to the industry to maintain their presence in the market. Because of this, the leading players are facing challenges from the unorganized sector that provide cheaper quality products, particularly in the emerging economies of China and India. In such competitive environment, it is very difficult for leading market players to squeeze their profit margin and compete with small unorganized players which leads to negative impact on balance sheet of leading players.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20162022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Installation Type (underground, overhead, submarine), Voltage Range, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, South America, Middle East, and Africa |

|

Companies covered |

General Cable Corporation (US), Nexans S.A. (France), NKT Group A/S (Denmark), Prysmian S.p.A. (Italy), Sumitomo Electric Industries, Ltd. (Japan), Southwire Company, LLC (US), Kabelwerke Brugg AG Holding (Switzerland), EL Sewedy Electric Company (Egypt), Leoni AG (Germany), ABB Ltd. (Switzerland), The Okonite Company (US), Dubai Cable Company (Private) Ltd. (UAE), TPC Wire & Cable Corp. (US), Bahra Advanced Cable Manufacture Co. Ltd. (Saudi Arabia), Hendrix Wire and Cable (US), KABELWERK EUPEN AG (Belgium), Tratos (UK), Cablel Hellenic Cables Group (Greece), Caledonian Cables Ltd (UK), KEI Industries Limited (India), LS Cable & System Ltd. (South Korea), Riyadh Cables Group Company (Saudi Arabia), Top Cable (Spain), Hebei New Baofeng Wire & Cable Co., Ltd. (China), and Tele-Fonika Cable Americas Corporation (US). |

The research report categorizes the medium voltage cable & accessories market to forecast the revenues and analyze the trends in each of the following sub-segments:

Medium Voltage Cable & Accessories Market By installation Type

- Underground

- Overhead

- Submarine

Medium Voltage Cable & Accessories Market By Voltage Range

- 15 kV: 17.3

- 613 kV: 25.6

- 23 kV: 17.4

- 34 kV: 23.6

- 45 kV: 5.4

- 69 kV: 10.6

Medium Voltage Cable & Accessories Market By Region

- Asia Pacific

- Europe

- North America

- Middle East

- Africa

- South America

Key Market Players

General Cable Corporation (US), Nexans S.A. (France), NKT Group A/S (Denmark), Prysmian S.p.A. (Italy), Sumitomo Electric Industries, Ltd. (Japan), Southwire Company, LLC (US), Kabelwerke Brugg AG Holding (Switzerland), EL Sewedy Electric Company (Egypt), Leoni AG (Germany), ABB Ltd. (Switzerland), The Okonite Company (US), Dubai Cable Company (Private) Ltd. (UAE), TPC Wire & Cable Corp. (US), Bahra Advanced Cable Manufacture Co. Ltd. (Saudi Arabia), Hendrix Wire and Cable (US), KABELWERK EUPEN AG (Belgium), Tratos (UK), Cablel Hellenic Cables Group (Greece), Caledonian Cables Ltd (UK), KEI Industries Limited (India), LS Cable & System Ltd. (South Korea), Riyadh Cables Group Company (Saudi Arabia), Top Cable (Spain), Hebei New Baofeng Wire & Cable Co., Ltd. (China), and Tele-Fonika Cable Americas Corporation (US).

Nexans S.A. (France) is a global provider of cable products and services. The company mainly focuses on four segments, namely, electricity transmission and distribution (submarine networks and land-based networks), energy resources (oil & gas and mining and renewables), transport (rail, road, air, and sea), building (community facilities, housing, and datacenters). It operates sales offices in 40 countries including Australia, Belgium, Brazil, India, Russia, the Netherlands, and the UK. In October 2016, the company launched EDRMAX to enable grid connection and installation of renewable energy resources such as solar panels and wind turbines which would drive the medium voltage cables and accessories market.

Recent Developments

- In January 2017, Norddeutsche Seekabelwerke GmbH (NSW), a subsidiary of General Cable Corporation (US) was awarded a contract from USA, and SOC, a subsidiary of Siem Offshore Inc, Norway. The scope of the contract was to plan and manufacture 60 km of medium voltage submarine power cables. This will connect the 32 wind turbine foundations of Trianel Windpark Borkum phase 1.

- In May 2016, Standard Motor Products, Inc. (US) acquired automotive ignition wire business of General Cable Corporation (US) for USD 71 million. This includes automotive ignition wire business in North America and a subsidiary in Mexico.

- In December 2017, Nexans S.A. (France) was awarded a contract from DONG Energy Wind Power A/S (Denmark), to supply 34 kV subsea cables for the offshore array cabling in its first construction phase of the 1.2 gigawatt wind farm.

- In December 2016, Nexans S.A. (France) signed a contract with Qatar General Electricity and Water Corporation (Kahramaa) (Qatar), to supply low and medium voltage cables for civil infrastructure projects in Qatar.

- In March 2017, NKT Cables Group A/S (Germany) acquired the HV cables business of ABB (Switzerland). The scope of the acquisition was to develop the interconnector grid and to hold the growth of the global offshore wind industry.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Medium Voltage Cable & Accessories market?

- Which segment provides the most opportunity for growth?

- Who are the leading manufacturers operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 24)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 28)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 41)

4.1 Medium Voltage Cables & Accessories Market, By Installation

4.2 Medium Voltage Cables & Accessories Market, By Voltage Range

4.3 Asia Pacific Market: Installation Type vs. End-User

4.4 Medium Voltage Cables and Accessories Market, By Region, 2022

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Renewable Energy Generation

5.2.1.2 Rapid Pace of Industrialization & Urbanization

5.2.2 Restraints

5.2.2.1 Project Delays Due to Complex Planning & Authorization Processes

5.2.2.2 Funding Constraints for Large Investments

5.2.3 Opportunities

5.2.3.1 Favorable Renewable Energy Policies in Key Countries

5.2.3.2 Increase in Power Demand

5.2.3.3 Implementation of Smart Grid Technology

5.2.4 Challenges

5.2.4.1 Availability of Low-Quality and Inexpensive Products

6 Medium Voltage Cables & Accessories Market, By Voltage Range (Page No. - 50)

6.1 Introduction

6.1.1 Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

6.2 15 Kv

6.2.1 15 Kv:Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

6.3 613 Kv

6.3.1 613 Kv:Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

6.4 23 Kv

6.4.1 23 Kv:Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

6.5 34 Kv

6.5.1 34 Kv:Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

6.6 45 Kv

6.6.1 45 Kv:Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

6.7 69 Kv

6.7.1 69 Kv:Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7 Medium Voltage Cables & Accessories Market, By Installation Type (Page No. - 57)

7.1 Introduction

7.1.1 Medium Voltage Cable & Accessories Market Size, By Installation Type, 20152022 (USD Million)

7.2 Underground Cables & Accessories

7.2.1 Underground Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.2.2 Underground Medium Voltage Cables & Accessories Market, By Product

7.2.2.1 XLPE Cables

7.2.2.1.1 XLPE Cables: Underground Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.2.2.2 Mi Cables

7.2.2.2.1 Mi Cables: Underground Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.2.2.3 Cable Joints

7.2.2.3.1 Cables Jonits: Underground Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.2.2.4 Cable Terminations

7.2.2.4.1 Cables Terminations: Underground Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.2.2.5 Others

7.2.2.5.1 Others: Underground Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.3 Overhead Cables & Accessories

7.3.1 Overhead Cable & Accessories Market Size, By Region, 20152022 (USD Million)

7.3.2 Overhead Medium Voltage Cables and Accessories Market, By Product

7.3.2.1 Overhead Cable & Accessories: Medium Voltage Cables & Accessories Market Size, By Product, 20152022 (USD Million)

7.3.3 Conductors

7.3.3.1 Conductors :Overhead Market Size, By Product, 20152022 (USD Million)

7.3.4 Fittings & Fixtures

7.3.4.1 Fittings & Fixtures :Overhead Market Size, By Product, 20152022 (USD Million)

7.3.5 Others

7.3.5.1 Others : Overhead Market Size, By Product, 20152022 (USD Million)

7.3.6 Submarine Cables & Accessories

7.3.6.1 Submarine Cables & Accessories: Medium Voltage Cables & Accessories Market Size, By Product, 20152022 (USD Million)

7.3.7 Submarine Market, By Product

7.3.7.1 Submarine Market Size, By Product, 20152022 (USD Million)

7.3.7.2 XLPE Cables

7.3.7.2.1 XLPE Cables: Submarine Market Size, By Product, 20152022 (USD Million)

7.3.7.3 Mi Cables

7.3.7.3.1 Mi Cables: Submarine Market Size, By Product, 20152022 (USD Million)

7.3.7.4 Cable Joints

7.3.7.4.1 Cable Joints: Submarine Market Size, By Product, 20152022 (USD Million)

7.3.7.5 Cable Terminations

7.3.7.5.1 Cable Terminations: Submarine Market Size, By Product, 20152022 (USD Million)

7.3.7.6 Others

7.3.7.6.1 Others: Submarine Market Size, By Product, 20152022 (USD Million)

8 Medium Voltage Cables & Accessories Market, By End-User (Page No. - 72)

8.1 Introduction

8.1.1 Medium Voltage Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

8.2 Industrial

8.2.1 Industrial: Market Size, By Region, 20152022 (USD Million)

8.2.2 Industrial: Market Size, By End-User, 20152022 (USD Million)

8.2.3 Utilities

8.2.3.1 Utilities: Market Size, By Region, 20152022 (USD Million)

8.2.3.2 Utilities: Market Size, By End-User, 20152022 (USD Million

8.2.4 Oil & Gas

8.2.4.1 Oil & Gas: Market Size, By Region, 20152022 (USD Million)

8.2.4.2 Oil & Gas: Market Size, By End-User, 20152022 (USD Million

8.2.5 Mining & Metals

8.2.5.1 Mining & Metals: Market Size, By Region, 20152022 (USD Million)

8.2.5.2 Mining & Metals: Market Size, By End-User, 20152022 (USD Million

8.2.6 Chemicals & Petrochemicals

8.2.6.1 Chemicals and Petrochemicals: Market Size, By Region, 20152022 (USD Million)

8.2.6.2 Chemicals and Petrochemicals: Market Size, By End-User, 20152022 (USD Million

8.2.7 Cement & Manufacturing

8.2.7.1 Cement & Manufacturing: Market Size, By Region, 20152022 (USD Million)

8.2.7.2 Cement & Manufacturing: Market Size, By End-User, 20152022 (USD Million

8.2.8 Others

8.2.8.1 Others: Market Size, By Region, 20152022 (USD Million)

8.2.8.2 Others: Market Size, By End-User, 20152022 (USD Million

8.3 Renewables

8.3.1 Renewables: Market Size, By End-User, 20152022 (USD Million)

8.3.2 Wind

8.3.2.1 Wind: Market Size, By Region, 20152022 (USD Million)

8.3.3 Solar

8.3.3.1 Solar: Market Size, By Region, 20152022 (USD Million)

8.4 Infrastructure

8.4.1 Infrastructure-: Market Size, By Region, 20152022 (USD Million)

8.4.2 Transportation

8.4.2.1 Transportation: Market Size, By Region, 20152022 (USD Million)

8.4.3 Commercial & Residential

8.4.3.1 Commercial & Residential: Market Size, By Region, 20152022 (USD Million)

9 Medium Voltage Cables & Accessories Market, By Region (Page No. - 85)

9.1 Introduction

9.1.1 Medium Voltage Cables & Accessories Market Size, By Region, 20152022 (USD Million)

9.2 Asia Pacific

9.2.1 Asia Pacific:Market Size, By Country, 20152022 (USD Million)

9.2.2 Asia Pacific:Market Size, By Installation Type, 20152022 (USD Million)

9.2.3 Asia Pacific:Overhead Market Size, By Product, 20152022 (USD Million)

9.2.4 Asia Pacific: Underground Market Size, By Product, 20152022 (USD Million)

9.2.5 Asia Pacific: Submarine Market Size, By Product, 20152022 (USD Million)

9.2.6 Asia Pacific:Market Size, By Voltage Range, 20152022 (USD Million)

9.2.7 Asia Pacific: Market Size, By End-User, 20152022 (USD Million)

9.2.8 Asia Pacific:Industry Market Size, By End-User, 20152022 (USD Million)

9.2.9 Asia Pacific:Renewable Market Size, By End-User, 20152022 (USD Million)

9.2.10 Asia Pacific:Infrastructure Market Size, By End-User, 20152022 (USD Million)

9.2.11 Greater China

9.2.11.1 Greater China: Market Size, By Installation Type, 20152022 (USD Million)

9.2.11.2 Greater China: Market Size, By Country, 20152022 (USD Million)

9.2.12 India

9.2.12.1 India: Market Size, By Installation Type, 20152022 (USD Million)

9.2.13 Japan

9.2.13.1 Japan: Market Size, By Installation Type, 20152022 (USD Million)

9.2.14 Australia

9.2.14.1 Australia: Market Size, By Installation Type, 20152022 (USD Million)

9.2.15 Indonesia

9.2.15.1 Indonesia: Market Size, By Installation Type, 20152022 (USD Million)

9.2.16 Malaysia

9.2.16.1 Malaysia: Market Size, By Installation Type, 20152022 (USD Million)

9.2.17 Rest of Asia Pacific

9.2.17.1 Rest of Asia Pacific: Market Size, By Installation Type, 20152022 (USD Million)

9.3 Europe

9.3.1 Europe:Medium Voltage Cables & Accessories Market Size, By Country, 20152022 (USD Million)

9.3.2 Europe:Market Size, By Installation Type, 20152022 (USD Million)

9.3.3 Europe:Overhead Market Size, By Product, 20152022 (USD Million)

9.3.4 Europe: Underground Market Size, By Product, 20152022 (USD Million)

9.3.5 Europe: Submarine Market Size, By Product, 20152022 (USD Million)

9.3.6 Europe:Medium Voltage Cables & Accessories Market Size, By Voltage Range, 20152022 (USD Million)

9.3.7 Europe: Market Size, By End-User, 20152022 (USD Million)

9.3.8 Europe:Industry Market Size, By End-User, 20152022 (USD Million)

9.3.9 Europe:Renewable Market Size, By End-User, 20152022 (USD Million)

9.3.10 Europe:Infrastructure Market Size, By End-User, 20152022 (USD Million)

9.3.11 Germany

9.3.11.1 Germany: Market Size, By Installation Type, 20152022 (USD Million)

9.3.12 UK

9.3.12.1 UK: Market Size, By Installation Type, 20152022 (USD Million)

9.3.13 Spain

9.3.13.1 Spain: Market Size, By Installation Type, 20152022 (USD Million)

9.3.14 Italy

9.3.14.1 Italy: Market Size, By Installation Type, 20152022 (USD Million)

9.3.15 France

9.3.15.1 France: Market Size, By Installation Type, 20152022 (USD Million)

9.3.16 Belgium

9.3.16.1 Belgium: Market Size, By Installation Type, 20152022 (USD Million)

9.3.17 Denmark

9.3.17.1 Denmark: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

9.3.18 Republic of Ireland

9.3.18.1 Republic of Ireland: Market Size, By Installation Type, 20152022 (USD Million)

9.3.19 Netherlands

9.3.19.1 Netherlands: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

9.3.20 Switzerland

9.3.20.1 Switzerland: Market Size, By Installation Type, 20152022 (USD Million)

9.3.21 Russia

9.3.21.1 Russia: Market Size, By Installation Type, 20152022 (USD Million)

9.3.22 Romania

9.3.22.1 Romania: Market Size, By Installation Type, 20152022 (USD Million)

9.3.23 Poland

9.3.23.1 Poland: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

9.3.24 Czech Republic

9.3.24.1 Czech Republic: Market Size, By Installation Type, 20152022 (USD Million)

9.4 North America

9.4.1 North America:Market Size, By Country, 20152022 (USD Million)

9.4.2 North America:Market Size, By Installation Type, 20152022 (USD Million)

9.4.3 North America:Overhead Market Size, By Product, 20152022 (USD Million)

9.4.4 North America: Underground Market Size, By Product, 20152022 (USD Million)

9.4.5 North America: Submarine Market Size, By Product, 20152022 (USD Million)

9.4.6 North America:Market Size, By Voltage Range, 20152022 (USD Million)

9.4.7 North America: Market Size, By End-User, 20152022 (USD Million)

9.4.8 North America: Industry Market Size, By End-User, 20152022 (USD Million)

9.4.9 North America: Renewable Market Size, By End-User, 20152022 (USD Million)

9.4.10 North America: Infrastructure Market Size, By End-User, 20152022 (USD Million)

9.4.11 US

9.4.11.1 US: Market Size, By Installation Type, 20152022 (USD Million)

9.4.12 Canada

9.4.12.1 Canada: Market Size, By Installation Type, 20152022 (USD Million)

9.5 Latin America

9.5.1 Latin America: Market Size, By Country, 20152022 (USD Million)

9.5.2 Latin America: Market Size, By Installation Type, 20152022 (USD Million)

9.5.3 Latin America:Overhead Market Size, By Product, 20152022 (USD Million)

9.5.4 Latin America: Underground Medium Voltage Cables & Accessories Market Size, By Product, 20152022 (USD Million)

9.5.5 Latin America: Submarine Market Size, By Product, 20152022 (USD Million)

9.5.6 Latin America:Market Size, By Voltage Range, 20152022 (USD Million)

9.5.7 Latin America: Market Size, By End-User, 20152022 (USD Million)

9.5.8 Latin America:Industry Market Size, By End-User, 20152022 (USD Million)

9.5.9 Latin America:Renewable Market Size, By End-User, 20152022 (USD Million)

9.5.10 Latin America:Infrastructure Medium Voltage Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

9.5.11 Brazil

9.5.11.1 Brazil: Market Size, By Installation Type, 20152022 (USD Million)

9.5.12 Mexico

9.5.12.1 Mexico: Market Size, By Installation Type, 20152022 (USD Million)

9.5.13 Argentina

9.5.13.1 Argentina: Market Size, By Installation Type, 20152022 (USD Million)

9.5.14 Colombia

9.5.14.1 Colombia: Market Size, By Installation Type, 20152022 (USD Million)

9.5.15 Rest of Latin America

9.5.15.1 Rest of Latin America: Market Size, By Installation Type, 20152022 (USD Million)

9.6 Middle East & Africa

9.6.1 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

9.6.2 Middle East & Africa: Market Size, By Installation Type, 20152022 (USD Million)

9.6.3 Middle East & Africa: Overhead Market Size, By Product, 20152022 (USD Million)

9.6.4 Middle East & Africa: Underground Market Size, By Product, 20152022 (USD Million)

9.6.5 Middle East & Africa: Submarine Medium Voltage Cables & Accessories Market Size, By Product, 20152022 (USD Million)

9.6.6 Middle East & Africa: Market Size, By Voltage Range, 20152022 (USD Million)

9.6.7 Middle East & Africa: Market Size, By End-User, 20152022 (USD Million)

9.6.8 Middle East & Africa: Industry Market Size, By End-User, 20152022 (USD Million)

9.6.9 Middle East & Africa: Renewable Market Size, By End-User, 20152022 (USD Million)

9.6.10 Middle East & Africa: Infrastructure Market Size, By End-User, 20152022 (USD Million)

9.6.11 Saudi Arabia

9.6.11.1 Saudi Arabia: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

9.6.12 UAE

9.6.12.1 UAE: Market Size, By Installation Type, 20152022 (USD Million)

9.6.13 Kuwait

9.6.13.1 Kuwait: Market Size, By Installation Type, 20152022 (USD Million)

9.6.14 South Africa

9.6.14.1 South Africa: Market Size, By Installation Type, 20152022 (USD Million)

9.6.15 Rest of Middle East & Africa

9.6.15.1 Rest of Middle East & Africa: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

10 Competitive Landscape (Page No. - 143)

10.1 Overview

10.2 Market Ranking, Medium Voltage Cables & Accessories, 2016

10.3 Competitive Situations & Trends

11 Company Profiles (Page No. - 146)

11.1 General Cable Corporation

11.1.1 Business Overview

11.1.2 Product Offering

11.1.3 Strength of Product Portfolio

11.1.4 Business Strategy Excellence

11.1.5 Recent Developments

11.1.5.1 New Product Launches

11.1.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.2 Nexans S.A.

11.2.1 Business Overview

11.2.2 Product Offering

11.2.3 Strength of Product Portfolio

11.2.4 Business Strategy Excellence

11.2.5 Recent Developments

11.2.5.1 New Product Launches

11.2.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.3 NKT Group

11.3.1 Business Overview

11.3.2 Product Offering

11.3.3 Strength of Product Portfolio

11.3.4 Business Strategy Excellence

11.3.5 Recent Developments

11.3.5.1 New Product Launches

11.3.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.4 Prysmian S.P.A.

11.4.1 Business Overview

11.4.2 Product Offering

11.4.3 Strength of Product Portfolio

11.4.4 Business Strategy Excellence

11.4.5 Recent Developments

11.4.5.1 New Product Launches

11.4.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.5 Sumitomo Electric Industries, Ltd.

11.5.1 Business Overview

11.5.2 Product Offering

11.5.3 Strength of Product Portfolio

11.5.4 Business Strategy Excellence

11.5.5 Recent Developments

11.5.5.1 New Product Launches

11.5.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.6 Southwire Company, LLC

11.6.1 Business Overview

11.6.2 Products Offering

11.6.3 Strength of Product Portfolio

11.6.4 Business Strategy Excellence

11.6.5 Recent Developments

11.6.5.1 New Product Launches

11.6.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.7 Kabelwerke Brugg AG

11.7.1 Business Overview

11.7.2 Product Offering

11.7.3 Strength of Product Portfolio

11.7.4 Business Strategy Excellence

11.7.5 Recent Developments

11.7.5.1 New Product Launches

11.7.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.8 Hebei New Baofeng Wire & Cable Co., Ltd.

11.8.1 Business Overview

11.8.2 Product Offering

11.8.3 Strength of Product Portfolio

11.8.4 Business Strategy Excellence

11.8.5 Recent Developments

11.8.5.1 New Product Launches

11.8.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.9 LS Cable & System Ltd.

11.9.1 Business Overview

11.9.2 Products Offering

11.9.3 Strength of Product Portfolio

11.9.4 Business Strategy Excellence

11.9.5 Recent Developments

11.9.5.1 New Product Launches

11.9.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.10 EL Sewedy Electric Company

11.10.1 Business Overview

11.10.2 Product Offering

11.10.3 Strength of Product Portfolio

11.10.4 Business Strategy Excellence

11.10.5 Recent Developments

11.10.5.1 New Product Launches

11.10.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.11 Leoni AG

11.11.1 Business Overview

11.11.2 Product Offering

11.11.3 Strength of Product Portfolio

11.11.4 Business Strategy Excellence

11.11.5 Recent Developments

11.11.5.1 New Product Launches

11.11.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.12 Tele-Fonika Kable Sa

11.12.1 Business Overview

11.12.2 Product Offering

11.12.3 Strength of Product Portfolio

11.12.4 Business Strategy Excellence

11.12.5 Recent Developments

11.12.5.1 New Product Launches

11.12.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.13 ABB Ltd.

11.13.1 Business Overview

11.13.2 Product Offering

11.13.3 Strength of Product Portfolio

11.13.4 Business Strategy Excellence

11.13.5 Recent Developments

11.13.5.1 New Product Launches

11.13.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.14 Dubai Cable Company (Private) Ltd.

11.14.1 Business Overview

11.14.2 Product Offering

11.14.3 Strength of Product Portfolio

11.14.4 Business Strategy Excellence

11.14.5 Recent Developments

11.14.5.1 New Product Launches

11.14.5.2 Contracts & Agreements/Mergers & Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

11.15 Tpc Wire & Cable Corp.

11.15.1 Business Overview

11.15.2 Product Offering

11.15.3 Strength of Product Portfolio

11.15.4 Business Strategy Excellence

11.15.5 Recent Developments

11.15.5.1 New Product Launches

11.15.5.2 Contracts & Agreements/Mergers Acquisitions/Partnerships/Collaborations/Joint Ventures/Expansions

12 Appendix (Page No. - 213)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (132 Tables)

Table 1 Global Medium Voltage Cables & Accessories Market Snapshot

Table 2 Asia Pacific Urbanization Prospects

Table 3 Medium Voltage Cable & Accessories Market Size, By Voltage, 20152022 (USD Million)

Table 4 15 Kv: Medium Voltage Cables & Accessories Market Size, By Region, 20152022 (USD Million)

Table 5 613 Kv: Market Size, By Region, 20152022 (USD Million)

Table 6 23 Kv: Medium Voltage Cable & Accessories Market Size, By Region, 20152022 (USD Million)

Table 7 34 Kv: Market Size, By Region, 20152022 (USD Million)

Table 8 45 Kv: Market Size, By Region, 20152022 (USD Million)

Table 9 69 Kv: Medium Voltage Cables and Accessories Market Size, By Region, 20152022 (USD Million)

Table 10 Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022, (USD Million)

Table 11 Underground Cables & Accessories: Medium Voltage Cables and Accessories Market Size, By Region, 20152022 (USD Million)

Table 12 Underground Cables & Accessories: Medium Voltage Cables & Accessories Market Size, By Product, 20152022 (USD Million)

Table 13 XLPE Cables: Underground Market Size, By Region, 20152022 (USD Million)

Table 14 Mi Cables: Underground Market Size, By Region, 20152022 (USD Million)

Table 15 Cable Joints: Underground Market Size, By Region, 20152022 (USD Million)

Table 16 Cable Terminations: Underground Market Size, By Region, 20152022 (USD Million)

Table 17 Others: Underground Medium Voltage Cables & Accessories Market Size, By Region, 20152022 (USD Million)

Table 18 Overhead Cables & Accessories Market Size, By Region, 20152025 (USD Million)

Table 19 Overhead Cables & Accessories: Market Size, By Product, 20152022 (USD Million)

Table 20 Conductors: Overhead Market Size, By Region, 20152022 (USD Million)

Table 21 Fittings & Fixtures: Overhead Market Size, By Region, 20152022 (USD Million)

Table 22 Others: Overhead Medium Voltage Cables & Accessories Market Size, By Region, 20152022 (USD Million)

Table 23 Submarine Cables & Accessories: Market Size, By Region, 20152022 (USD Million)

Table 24 Submarine Medium Voltage Cables & Accessories Market Size, By Product, 20152022 (USD Million)

Table 25 XLPE Cables: Submarine Market Size, By Region, 20152022 (USD Million)

Table 26 Mi Cables: Submarine Market Size, By Region, 20152022 (USD Million)

Table 27 Cable Joints: Submarine Market Size, By Region, 20152022 (USD Million)

Table 28 Cable Terminations: Submarine Market Size, By Region, 20152022 (USD Million)

Table 29 Others: Submarine Market Size, By Region, 20152022 (USD Million)

Table 30 Medium Voltage Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 31 Industrial: Market Size, By Region, 20152022 (USD Million)

Table 32 Industrial: Market Size, By End-User, 20152022 (USD Million)

Table 33 Utility: Market Size, By Region, 20152022 (USD Million)

Table 34 Oil & Gas: Market Size, By Region, 20152022 (USD Million)

Table 35 Mining & Metals: Market Size, By Region, 20152022 (USD Million)

Table 36 Chemicals & Petrochemicals: Market Size, By Region, 20152022 (USD Million)

Table 37 Cement & Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 38 Others: Market Size, By Region, 20152022 (USD Million)

Table 39 Renewables: Market Size, By End-User, 20152022 (USD Million)

Table 40 Wind: Market Size, By Region, 20152022 (USD Million)

Table 41 Solar: Market Size, By Region, 20152022 (USD Million)

Table 42 Infrastructure: Market Size, By End-User, 20152022 (USD Million)

Table 43 Transportation: Medium Voltage Cables & Accessories Market Size, By Region, 20152022 (USD Million)

Table 44 Commercial & Residential: Market Size, By Region, 20152022 (USD Million)

Table 45 Medium Voltage Cables & Accessories Market Size, By Region, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Installation Type, 20152022 (USD Million)

Table 48 Asia Pacific: Overhead MV Cables & Accessories Market Size, By Product, 20152022 (USD Million)

Table 49 Asia Pacific: Underground MV Cables & Accessories Market Size, By Product, 20152022 (USD Million)

Table 50 Asia Pacific: Submarine MV Cables & Accessories Market Size, By Product, 20152022 (USD Million)

Table 51 Asia Pacific: MV Cables & Accessories Market Size, By Voltage Range, 20152022 (USD Million)

Table 52 Asia Pacific: MV Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 53 Asia Pacific: Industrial MV Cables & Accessories Market, By End-User, 20152022 (USD Million)

Table 54 Asia Pacific: Renewables MV Cables & Accessories Market, By End-User, 20152022 (USD Million)

Table 55 Asia Pacific: Infrastructure MV Cables & Accessories Market, By End-User, 20152022 (USD Million)

Table 56 Greater China: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 57 Greater China: MV Cables & Accessories Market Size, By Country, 20152022 (USD Million)

Table 58 India: Medium Voltage Cables & Accessories Size, By Installation Type, 20152022 (USD Million)

Table 59 Japan: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 60 Australia: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 61 Indonesia: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 62 Malaysia: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 63 Rest of Asia Pacific: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 64 Europe: MV Cables & Accessories Market Size, By Region, 20152022 (USD Million)

Table 65 Europe: Medium Voltage Cables & Accessories Market Size, By the Western European Region, 20152022 (USD Million)

Table 66 Europe: Medium Voltage Cables & Accessories Market Size, By Central & Eastern Europe, 20152022 (USD Million)

Table 67 Europe: Market Size, By Installation Type, 20152022 (USD Million)

Table 68 Europe: Overhead Market Size, By Product, 20152022 (USD Million)

Table 69 Europe: Underground Market Size, By Product, 20152022 (USD Million)

Table 70 Europe: Submarine Market Size, By Product, 20152022 (USD Million)

Table 71 Europe: Medium Voltage Cables & Accessories Market Size, By Voltage Range, 20152022 (USD Million)

Table 72 Europe: MV Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 73 Europe: Industrial MV Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 74 Europe: Renewables MV Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 75 Europe: Infrastructure MV Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 76 Germany: Market Size, By Installation Type, 20152022 (USD Million)

Table 77 UK: Market Size, By Installation Type, 20152022 (USD Million)

Table 78 Spain: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 79 Italy: Market Size, By Installation Type, 20152022 (USD Million)

Table 80 France: Market Size, By Installation Type, 20152022 (USD Million)

Table 81 Belgium: Market Size, By Installation Type, 20152022 (USD Million)

Table 82 Denmark: Market Size, By Installation Type, 20152022 (USD Million)

Table 83 Republic of Ireland: Market Size, By Installation Type, 20152022 (USD Million)

Table 84 Netherlands: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 85 Switzerland: MV Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 86 Russia: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 87 Romania: Market Size, By Installation Type, 20152022 (USD Million)

Table 88 Poland: Market Size, By Installation Type, 20152022 (USD Million)

Table 89 Czech Republic: Market Size, By Installation Type, 20152022 (USD Million)

Table 90 North America: Market Size, By Country, 20152022 (USD Million)

Table 91 North America: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 92 North America: Overhead Market Size, By Product, 20152022 (USD Million)

Table 93 North America: Underground Market Size, By Product, 20152022 (USD Million)

Table 94 North America: Submarine Market Size, By Product, 20152022 (USD Million)

Table 95 North America: Market Size, By Voltage Range, 20152022 (USD Million)

Table 96 North America: Market Size, By End-User, 20152022 (USD Million)

Table 97 North America: Industrial Market Size, By End-User 20152022 (USD Million)

Table 98 North America: Renewables Market Size, By End-User, 20152022 (USD Million)

Table 99 North America: Infrastructure Market Size, By End-User, 20152022 (USD Million)

Table 100 US: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 101 Canada: Market Size, By Installation Type, 20152022 (USD Million)

Table 102 Latin America: Market Size, By Country, 20152022 (USD Million)

Table 103 Latin America: Market Size, By Installation Type, 20152022 (USD Million)

Table 104 Latin America: Overhead Market Size, By Product, 20152022 (USD Million)

Table 105 Latin America: Underground Market Size, By Product, 20152022 (USD Million)

Table 106 Latin America: Submarine Market Size, By Product, 20152022 (USD Million)

Table 107 Latin America: Market Size, By Voltage Range, 20152022 (USD Million)

Table 108 Latin America: Market Size, By End-User, 20152022 (USD Million)

Table 109 Latin America: Infrastructure Market Size, By End-User, 20152022 (USD Million)

Table 110 Latin America: Industrial Market Size, By End-User, 20152022 (USD Million)

Table 111 Latin America: Renewables Market Size, By End-User, 20152022 (USD Million)

Table 112 Brazil: Market Size, By Installation Type, 20152022 (USD Million)

Table 113 Mexico: Medium Voltage Cables & Accessories Market Size, By Installation Type, 20152022 (USD Million)

Table 114 Argentina: Market Size, By Installation Type, 20152022 (USD Million)

Table 115 Colombia: Market Size, By Installation Type, 20152022 (USD Million)

Table 116 Rest of Latin America: Market Size, By Installation Type, 20152022 (USD Million)

Table 117 Middle East & Africa: Market Size, By Country, 20152022 (USD Million)

Table 118 Middle East & Africa: Market Size, By Installation Type, 20152022 (USD Million)

Table 119 Middle East & Africa: Overhead Market Size, By Product, 20152022 (USD Million)

Table 120 Middle East & Africa: Underground Market Size, By Product, 20152022 (USD Million)

Table 121 Middle East & Africa: Submarine Market Size, By Product, 20152022 (USD Million)

Table 122 Middle East & Africa: Market Size, By Voltage Range, 20152022 (USD Million)

Table 123 Middle East & Africa: Market Size, By End-User, 20152022 (USD Million)

Table 124 Middle East & Africa: Industrial Market Size, By End-User, 20152022 (USD Million)

Table 125 Middle East & Africa: Renewables Market Size, By End-User, 20152022 (USD Million)

Table 126 Middle East & Africa: Infrastructure Medium Voltage Cables & Accessories Market Size, By End-User, 20152022 (USD Million)

Table 127 Saudi Arabia: Market Size, By Installation Type, 20152022 (USD Million)

Table 128 UAE: Market Size, By Installation Type, 20152022 (USD Million)

Table 129 Kuwait: Market Size, By Installation Type, 20152022 (USD Million)

Table 130 South Africa: Market Size, By Installation Type, 20152022 (USD Million)

Table 131 Rest of the Middle East & Africa: Market Size, By Installation Type, 20152022 (USD Million)

Table 132 Market Ranking Based on Revenue, 2016

List of Figures (37 Figures)

Figure 1 Medium Voltage Cables & Accessories: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Assumptions of the Research Study

Figure 6 Medium Voltage Cables & Accessories Market: Region-Wise Market Share, 2017

Figure 7 Asia Pacific is Expected to Dominate the Medium Voltage Cables & Accessories Market During the Forecast Period, 20172022

Figure 8 Medium Voltage Cables & Accessories Market, By Installation Type, 20172022 (USD Billion)

Figure 9 Medium Voltage Cables & Accessories Market, By End User, 20172022 (USD Billion)

Figure 10 Attractive Market Opportunities in the Market

Figure 11 Underground Segment Dominated the Market Share, During Forecast Period, 20172022

Figure 12 6-13 Kv Segment is Expected to Dominate the Market, 2022

Figure 13 Underground Medium Voltage Cables & Accessories Segment Held the Largest Market Share in 2016

Figure 14 Asia Pacific: the Largest and Fastest Growing Market During the Forecast Period

Figure 15 Market Dynamics: Medium Voltage Cables & Accessories Market

Figure 16 Global Renewable Electricity Production (Twh), 2008-2020

Figure 17 Oecd and Non-Oecd Net Electricity Generation, 20122040 (Trillion Kilowatt Hours)

Figure 18 Medium Voltage Cable & Accessories, By Voltage Range, 2016

Figure 19 The Underground Segment Dominated the Medium Voltage Cables & Accessories Market in 2016

Figure 20 Industrial Segment is Expected to Be the Largest Segment for Medium Voltage Cables & Accessories Market From 2017 to 2022

Figure 21 Utilities Segment Was the Largest Segment for Industrial End-User in 2016

Figure 22 Regional Snapshot (2016): Asia Pacific is Expected to Be the Fastest Growing Market for Medium Voltage Cables & Accessories During the Forecast Period

Figure 23 Medium Voltage Cables & Accessories Market Size, By Region,

2017 vs 2022 (USD Million) 77

Figure 24 Asia Pacific: Medium Voltage Cables & Accessories Market Snapshot

Figure 25 Europe: Medium Voltage Cables & Accessories Market Snapshot

Figure 26 Companies Adopted Contracts & Agreements & Expansions & Investments as the Key Strategies to Capture the Market, 20142017

Figure 27 Market Evaluation Framework: Contracts & Agreements, Expansions & Investments, & New Product Launches Have Fueled the Growth of the Companies, 20152017

Figure 28 General Cable Corporation: Company Snapshot

Figure 29 Nexans S.A.: Company Snapshot

Figure 30 NKT Group: Company Snapshot (2016)

Figure 31 Prysmian Group: Company Snapshot (2016)

Figure 32 Sumitomo Electric Industries, Ltd.: Company Snapshot (2016)

Figure 33 Kabelwerke Brugg AG: Company Snapshot (2016)

Figure 34 LS Cable & System Ltd.: Company Snapshot (2016)

Figure 35 EL Sewedy Electric Company: Company Snapshot (2016)

Figure 36 Leoni AG: Company Snapshot (2016)

Figure 37 ABB Ltd.: Company Snapshot (2016)

Growth opportunities and latent adjacency in Medium Voltage Cables & Accessories Market