Low Voltage Cable Market by Overhead (Conductors, Fittings & Fixtures, Others), by Underground (PVC Cables, XLPE Cables, Cable Terminations, Cable Joints, Others), by End-User (Infrastructure, Industrial, Renewables) and by Region - Global Trends & Forecast to 2020

[188 Pages Report] Power cables & accessories are the basic requirement for transmission and distribution of electricity from the point of generation to the point of consumption. Depending on the application, power cables are classified into four voltage categories: low voltage, medium voltage, high voltage, and extra-high voltage. Low voltage cable is an essential component for the secondary distribution of electricity at voltage range below 1 kV. Low voltage accessories are used to support cables in the distribution network. Different types of accessories are used for different types of cable installations, namely, overhead and underground installations. Such accessories include fittings and fixtures, cable terminations, cable joints, cable connectors, spacers, insulators, and guy wires, among others.

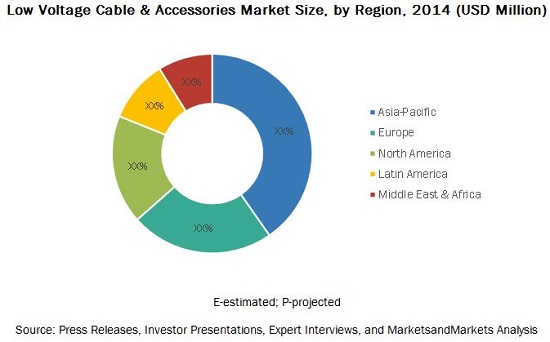

Global low voltage cable & accessories market was valued at USD 99.2 Billion in 2014. It is projected to grow 147.3 Billion at a CAGR of 7.0% from 2015 to 2020. The market has been studied and analyzed based on Installation, Product type, end-user, and region.

Various factors such as the increasing industrialization and urbanization, increased renewable energy production, growth in transmission and distribution network, and governmental initiatives to expand or upgrade the system are driving the global low voltage cable market. However, funding constraints and complex planning & authorization are restraining the market. Low voltage cable market is expected to grow fast in the developing regions such as Asia-Pacific, South America, and the Middle East & Africa due to the increasing industrialization and expansion in transmission and distribution network.

The report profiles leading players in the global low voltage cable market, along with their recent developments and other strategic industry activities. These players include Prysmian S.P.A (Italy), Nexans S.A. (France), General Cable Corporation (U.S.), Sumitomo Electric Industries (Japan), NKT Cables Group GmbH (Germany), ABB Ltd. (Switzerland), Encore Wire Corporation (U.S.), Finolex Cables Limited (India), and Polycab Wires Pvt. Ltd. (India).

Asia-Pacific is expected to be a lucrative market, and is estimated at USD 42.6 Billion in 2015. It is projected to grow at a CAGR of 7.6% from 2015 to 2020.

The report includes Porter's Five Forces model and Value chain analysis. It also describes the competitive landscape of major market players, based on strategies, such as new product developments, mergers & acquisitions, facility expansion, agreements & collaborations, and contracts. Key developments have been identified for the major market players to determine the growth strategies implemented by them. Additionally, the study provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges in the low voltage cable market.

Scope of the Report:

Global low voltage cable market size, in terms of value (USD million), has been analyzed as follows:

By Installation

- Overhead

- Underground

By Overhead Product

- Conductors

- Fittings & Fixtures

- Others include spacers, insulators, connectors, overhead ground wires, and guy wires

By Underground Product

- PVC Cables

- XLPE Cables

- Cable Terminations

- Cable Joints

- Others include EPR cable, cable connectors, cable glands, cleats & cable fixings, and cabinets

By End-User

- Infrastructure

- Commercial & Residential

- Transportation & Others

- Industrial

- Utilities

- Oil & Gas

- Mining

- Chemicals & Petrochemicals

- Others include fertilizers plant and cement

- Renewables

- Wind

- Solar

By Region

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

This report contains market analysis and forecasts for important decision-makers among low voltage cable manufacturers, distributors, raw material suppliers, component suppliers, and independent market analysts. The scope accordingly assists market participants to identify high growth markets and managing key investment decisions.

Global low voltage cable & accessories market was valued at USD 99.2 Billion in 2014. It is projected to grow at a CAGR of 7.0% from 2015 to 2020. The increasing spending on transmission and distribution network, growing industrialization and urbanization, and shift in focus towards renewable energy production are some of the key drivers of this market.

Transmission & distribution (T&D) network is expanding globally on account of increase in power generation to satisfy the growing demand for electricity. Power cables & accessories are vital components for T&D network and will also grow in sync with the growth in T&D network. Low voltage cables & accessories market is expected to grow faster in developing countries where the T&D industry is in the growth stage. Moreover in the developed countries of Europe and North America the market will grow due to upgrade of their existing T&D network.

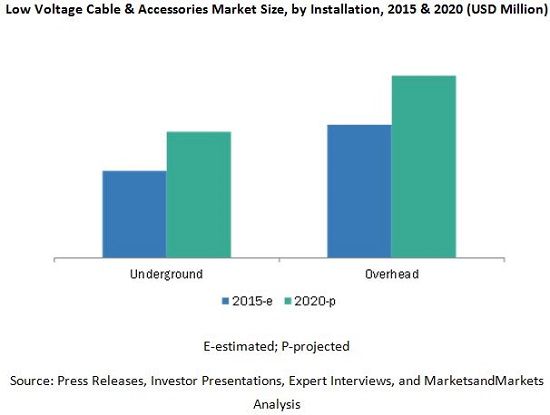

The global low voltage cable market has been segmented based on installation into overhead and underground. The market has been further segmented; overhead products into conductors, fittings & fixtures, and others, where others include spacers, insulators, connectors, overhead ground wires, and guy wires; and underground products into PVC cables, XLPE cables, cable terminations, cable joints, and others, where others include EPR cable, cable connectors, cable glands, cleats & cable fixings, and cabinets.

Major end-users covered into this report are infrastructure, industrial and renewables. The regions considered in this report are Asia-Pacific, North America, Europe, Latin America, and Middle East & Africa. Information regarding the key countries in each region, such as the U.S., Canada, Mexico, Brazil, Argentina, China, India, Japan, Australia, Germany, the U.K., Russia, Denmark, South Africa, Saudi Arabia, Kuwait, and the UAE, among others has also been included in this report.

The method of installation for low voltage cable & accessories are broadly classified into overhead and underground. There is a varied trend in the preference of installation type across the globe. In developed regions, such as Europe and North America, underground cables are more preferred than overhead lines while in the developing region, such as Asia-Pacific, Latin America, and the Middle East & Africa overhead lines are more preferred.

This report offers a detailed analysis of key companies and a competitive analysis of developments recorded in the industry in the past four years. Market drivers, restraints, opportunities, and challenges have been discussed in detail. Leading players in the market, such as Prysmian S.P.A (Italy), Nexans S.A. (France), General Cable Corporation (U.S.), Sumitomo Electric Industries (Japan), NKT Cables Group GmbH (Germany), ABB Ltd. (Switzerland), Encore Wire Corporation (U.S.), Finolex Cables Limited (India), and Polycab Wires Pvt. Ltd. (India) have been profiled in this report.

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries: By Company Type, By Designation and By Reigon

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Growth Opportunities in the Low Voltage Cable & Accessories Market

4.2 Low Voltage Cable & Accessories Market, By Installation

4.3 Low Voltage Cable & Accessories Market in the Asia-Pacific Region, 2014

4.4 China Dominated the Low Voltage Cable & Accessories Market During the Forecast Period

4.5 Conductors Expected to Be the Fastest-Growing Overhead Product During the Forecast Period

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Installation

5.2.2 By Product

5.2.2.1 Overhead Product

5.2.2.2 Underground Product

5.2.3 By End-User

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Renewable Energy Production

5.3.1.2 Growth in Industrialization & Urbanization

5.3.1.3 Government Initiative to Expand Or Upgrade the System

5.3.2 Restraint

5.3.2.1 Funding Constraint Makes the Market Volatile

5.3.2.2 Complex Planning & Authorization Delays the Project

5.3.3 Opportunities

5.3.3.1 Increasing Demand of Power

5.3.3.2 Wind Policies in Key Countries

5.3.4 Challenges

5.3.4.1 Raw Material Price Volatility

5.3.4.2 Budding Grey Market Providing Low Quality and Cheap Products

5.4 Impact Analysis of Market Dynamics

5.5 Value Chain Analysis

5.6 Porters Five Forces Analysis: Low Voltage Cables & Accessories Market

5.6.1 Threat of New Entrants

5.6.2 Threat of Substitutes

5.6.3 Bargaining Power of Suppliers

5.6.4 Bargaining Power of Buyers

5.6.5 Intensity of Competetive Rivalry

6 Low Voltage Cable & Accessories Market, By Installation (Page No. - 53)

6.1 Introduction

6.2 Overhead

6.3 Underground

7 Low Voltage Cable & Accessories Market, By Product (Page No. - 58)

7.1 Overhead Products

7.1.1 Conductors

7.1.2 Fittings & Fixtures

7.1.3 Other Low Voltage Accessories

7.2 Underground Products

7.2.1 PVC Cables

7.2.2 XLPE Cables

7.2.3 Cable Terminations

7.2.4 Cable Joints

7.2.5 Other Low Voltage Cables & Accessories

8 Low Voltage Cable & Accessories Market, By End-User (Page No. - 67)

8.1 Introduction

8.2 Infrastructure

8.2.1 Commercial & Residential

8.2.2 Transportation & Others

8.3 Industrial Low Voltage Cable & Accessories Market

8.3.1 Utilities Low Voltage Cable & Accessories

8.3.2 Oil & Gas Low Voltage Cable & Accessories

8.3.3 Mining Low Voltage Cable & Accessories

8.3.4 Chemicals & Petrochemicals Low Voltage Cables & Accessories

8.3.5 Other Industrial Low Voltage Cable & Accessories

8.4 Renewables Low Voltage Cable & Accessories

8.4.1 Wind Power Low Voltage Cable & Accessories

8.4.2 Solar Power Low Voltage Cable & Accessories

9 Low Voltage Cable & Accessories Market, By Region (Page No. - 81)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 Australia

9.2.5 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 U.K.

9.3.3 Russia

9.3.4 Denmark

9.3.5 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.5 Latin America

9.5.1 Brazil

9.5.2 Mexico

9.5.3 Argentina

9.5.4 Rest of Latin America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.2 South Africa

9.6.3 UAE

9.6.4 Kuwait

9.6.5 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 116)

10.1 Overview

10.2 Competitive Situation & Trends

10.3 Contracts & Agreements

10.4 Expansions

10.5 Mergers & Acquisitions

10.6 New Product Launches

11 Company Profiles (Page No. - 126)

11.1 Introduction

11.2 Prysmian S.P.A

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments, 20112015

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Nexans S.A.

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments, 20112015

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 General Cable Corporation

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments, 20112015

11.4.4 SWOT Analysis

11.4.5 MnM View

11.5 Sumitomo Electric Industries, Ltd.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments, 20112015

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 NKT Cables Group GmbH

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments, 20112015

11.6.4 SWOT Analysis

11.6.5 MnM View

11.7 ABB Ltd.

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Developments, 2012

11.8 Encore Wire Corporation

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Developments, 2011-2014

11.9 Finolex Cables Limited

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Developments

11.10 TE Connectivity Ltd.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Developments, 2012

11.11 Bahra Advanced Cable Manufacture Co. Ltd.

11.11.1 Business Overview

11.11.2 Products Offered

11.11.3 Developments, 2010-2014

11.12 Brugg Group

11.12.1 Business Overview

11.12.2 Products Offered

11.12.3 Developments, 2011

11.13 Caledonian Cables Ltd.

11.13.1 Business Overview

11.13.2 Products Offered

11.13.3 Recent Developments, 2011-2015

11.14 Dubai Cable Company (Private) Ltd.

11.14.1 Business Overview

11.14.2 Products Offered

11.14.3 Recent Developments, 2010-2015

11.15 Hebei New Baofeng Wire & Cable Co., Ltd.

11.15.1 Business Overview

11.15.2 Products Offered

11.15.3 Recent Developments

11.16 Kabelwerk Eupen AG

11.16.1 Business Overview

11.16.2 Products Offered

11.16.3 Recent Developments

11.17 LS Cable & System Ltd.

11.17.1 Business Overview

11.17.2 Products Offered

11.17.3 Recent Developments, 2011-2012

11.18 Polycab Wires Pvt. Ltd.

11.18.1 Business Overview

11.18.2 Products Offered

11.18.3 Recent Developments, 2011-2015

11.19 Riyadh Cables Group of Companies

11.19.1 Business Overview

11.19.2 Products Offered

11.19.3 Recent Developments

11.20 Southwire Company, LLC

11.20.1 Business Overview

11.20.2 Products Offered

11.20.3 Recent Developments, 2010-2014

11.21 Top Cable, S.A.

11.21.1 Business Overview

11.21.2 Products Offered

11.21.3 Recent Developments

12 Appendix (Page No. - 182)

12.1 Insights From Industry Experts

12.2 Other Developments, 2011-2015

12.3 Discussion Guide

12.4 Available Customizations

12.5 Introducing RT: Real Time Market Intelligence

12.6 Related Reports

List of Tables (82 Tables)

Table 1 Impact Analysis of Market Dynamics

Table 2 Low Voltage Cable S& Accessories Market Size, By Installation, 2013-2020 (USD Million)

Table 3 Overhead Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 4 Underground Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 5 Overhead Low Voltage Cable & Accessories Market Size, By Product, 20132020 (USD Million)

Table 6 Overhead Low Voltage Conductors Market Size, By Region, 20132020 (USD Million)

Table 7 Overhead Low Voltage Fittings & Fixtures Market Size, By Region, 20132020 (USD Million)

Table 8 Overhead Other Low Voltage Accessories Market Size, By Region, 20132020 (USD Million)

Table 9 Underground Low Voltage Cable & Accessories Market Size, By Product, 20132020 (USD Million)

Table 10 Underground Low Voltage PVC Cable Market Size, By Region, 20132020 (USD Million)

Table 11 Underground Low Voltage XLPE Cable Market Size, By Region, 20132020 (USD Million)

Table 12 Underground Low Voltage Cable Terminations Market Size, By Region, 20132020 (USD Million)

Table 13 Underground Low Voltage Cable Joints Market Size, By Region, 20132020 (USD Million)

Table 14 Underground Other Low Voltage Cable & Accessories Market Size, By Region, 20132020 (USD Million)

Table 15 Low Voltage Cable & Accessories Market Size, By End-User, 2013-2020 (USD Million)

Table 16 Infrastructure Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 17 Infrastructure Low Voltage Cable & Accessories Market Size, By End-User, 2013-2020 (USD Million)

Table 18 Commercial & Residential Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 19 Transportation & Others Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 20 Industrial Low Voltage Cable & Accessories Market Size, By Region, 20132020 (USD Million)

Table 21 Industrial Low Voltage Cable & Accessories Market Size, By End-User, 20132020 (USD Million)

Table 22 Utilities Low Voltage Cable & Accessories Market Size, By End-User, 20132020 (USD Million)

Table 23 Oil & Gas Low Voltage Cable & Accessories Market Size, By End-User, 20132020 (USD Million)

Table 24 Mining Low Voltage Cable & Accessories Market Size, By End-User, 20132020 (USD Million)

Table 25 Investment: Global Mining Project, By Metal, 2013

Table 26 Chemicals & Petrochemicals Low Voltage Cable & Accessories Market Size, By End-User, 20132020 (USD Million)

Table 27 Other Industrial Low Voltage Cable & Accessories Market Size, By End-User, 20132020 (USD Million)

Table 28 Renewables Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 29 Renewables: Low Voltage Cable & Accessories Market Size, By End-User, 2013-2020 (USD Million)

Table 30 Wind Power: Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 31 Solar Power Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 32 Low Voltage Cable & Accessories Market Size, By Region, 2013-2020 (USD Million)

Table 33 Asia-Pacific: Low Voltage Cable & Accessories Market Size, By Installation, 2013-2020 (USD Million)

Table 34 Asia-Pacific: Overhead Low Voltage Cable & Accessories Market Size, By Product, 2013-2020 (USD Million)

Table 35 Asia-Pacific: Underground Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 36 Asia-Pacific: Low Voltage Cable Market Size, By End-User, 2013-2020 (USD Million)

Table 37 Asia-Pacific: Low Voltage Cable Market Size, By Country, 2013-2020 (USD Million)

Table 38 China: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 39 India: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 40 Japan: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 41 Australia: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 42 Rest of Asia-Pacific: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 43 Europe: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 44 Europe: Overhead Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 45 Europe: Underground Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 46 Europe: Low Voltage Cable Market Size, By End-User, 2013-2020 (USD Million)

Table 47 Europe: Low Voltage Cable Market Size, By Country, 2013-2020 (USD Million)

Table 48 Germany: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 49 U.K.: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 50 Russia: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 51 Denmark: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 52 Rest of Europe: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 53 North America: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 54 North America: Overhead Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 55 North America: Underground Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 56 North America: Low Voltage Cable Market Size, By End-User, 2013-2020 (USD Million)

Table 57 North America: Low Voltage Cable Market Size, By Country, 2013-2020 (USD Million)

Table 58 U.S.: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 59 Canada: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 60 Latin America: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 61 Latin America: Overhead Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 62 Latin America: Underground Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 63 Latin America: Low Voltage Cable Market Size, By End-User, 2013-2020 (USD Million)

Table 64 Latin America: Low Voltage Cable Market Size, By Country, 2013-2020 (USD Million)

Table 65 Brazil: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 66 Mexico: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 67 Argentina: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 68 Rest of Latin America: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 69 Middle East & Africa: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 70 Middle East & Africa: Overhead Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 71 Middle East & Africa: Underground Low Voltage Cable Market Size, By Product, 2013-2020 (USD Million)

Table 72 Middle East & Africa: Low Voltage Cable Market Size, By End-User, 2013-2020 (USD Million)

Table 73 Middle East & Africa: Low Voltage Cable Market Size, By Country, 2013-2020 (USD Million)

Table 74 Saudi Arabia: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 75 South Africa: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 76 UAE: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 77 Kuwait: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 78 Rest of Middle East & Africa: Low Voltage Cable Market Size, By Installation, 2013-2020 (USD Million)

Table 79 Contracts & Agreements, 2011-2015

Table 80 Expansions, 2012-2014

Table 81 Mergers & Acquisitions, 2012-2014

Table 82 New Product Launches, 2011-2013

List of Figures (63 Figures)

Figure 1 Markets Covered: Low Voltage Cable & Accessories Market

Figure 2 Low Voltage Cable Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Low Voltage Cable Market Snapshot (2015 vs 2020): Overhead to Lead the Market During the Forecast Period

Figure 7 Overhead Low Voltage Cable & Market By Product, 20152020

Figure 8 Underground Low Voltage Cable & Market By Product, 2015 vs 2020

Figure 9 Asia-Pacific Led the Low Voltage Cable Market in 2014

Figure 10 Low Voltage Cable & Accessories Market is Expected to Rise With an Impressive CAGR From 2015 to 2020

Figure 11 Overhead Installation to Dominate the Overall Low Voltage Cables & Accessories Market During the Forecast Period

Figure 12 China Held the Highest Market Share in Asia-Pacific in 2014 (USD Million)

Figure 13 China is Expected to Be Fastest Growing Market During the Forecast Period

Figure 14 Market for Conducting Wires is Growing Faster Than Other Overhead Products

Figure 15 Asia-Pacific Market is Expected to Grow at the Highest Rate During the Forecast Period

Figure 16 Low Voltage Cable Market Segmentation: By Installation

Figure 17 Overhead Low Voltage Cable Market Segmentation: By Product

Figure 18 Underground Low Voltage Cable Market Segmentation: By Product

Figure 19 Low Voltage Cable Market Segmentation: By End-User

Figure 20 Low Voltage Cable Market Segmentation: By Region

Figure 21 Growing Industrialization & Urbanization Along With Increasing Renewable Production to Propel Market Growth

Figure 22 Global Renewable Electricity Production, 20082020 (TWH)

Figure 23 Global Power Consumption, 2010-2040 (Quadrillion BTU)

Figure 24 Low Voltage Cable & Accessories Market: Value Chain Analysis

Figure 25 Porters Five Forces Analysis: the Bargaining Power of Buyers is Moderate to High in the Low Voltage Cables & Accessories Market

Figure 26 Overhead Low Voltage Cable & Accessories is Expected to Dominate the Market During the Forecast Period

Figure 27 Overhead Low Voltage Cable & Accessories Market is Expected to Grow at the Highest Rate in Asia-Pacific By 2020

Figure 28 Conductors Segment is Expected to Dominate the Overhead Low Voltage Cables & Accessories Market During the Forecast Period

Figure 29 PVC Cables Dominated the Underground Low Voltage Cables & Accessories Market in 2014

Figure 30 Infrastructure Segment is Expected to Dominate the Market During the Forecast Period

Figure 31 Asia-Pacific is Expected to Dominate the Infrastructure Low Voltage Cables & Accessories Market During the Forecast Period

Figure 32 Regional Snapshot: Rapidly Growing Markets are Emerging as New Hot Spots

Figure 33 China an Attractive Destination for All Product Categories

Figure 34 Companies Adopted Various Growth Strategies in the Past Five Years

Figure 35 Battle for Market Share: Contracts & Agreements is the Key Strategy Adopted By the Players, 2011-2015

Figure 36 Market Share Analysis: Prysmian Held the Major Market Share (Value) in 2014

Figure 37 Market Leaders Based on Developments, 2011-2015

Figure 38 Market Evolution Framework: Contracts & Agreements Led to Market Growth Between 2011 & 2015

Figure 39 Prysmian S.P.A: Company Snapshot

Figure 40 Prysmian S.P.A: SWOT Analysis

Figure 41 Nexans S.A.: Company Snapshot

Figure 42 Nexans S.A.: SWOT Analysis

Figure 43 General Cable Corporation: Company Snapshot

Figure 44 General Cable Corporation: SWOT Analysis

Figure 45 Sumitomo Electric Industries, Ltd.: Company Snapshot

Figure 46 Sumitomo Electric Industries, Ltd.: SWOT Analysis

Figure 47 NKT Cables Group GmbH: Company Snapshot

Figure 48 NKT Cables Group GmbH: SWOT Analysis

Figure 49 ABB Ltd.: Company Snapshot

Figure 50 Encore Wire Corporation: Company Snapshot

Figure 51 Finolex Cables Limited: Company Snapshot

Figure 52 TE Connectivity Ltd.: Company Snapshot

Figure 53 Bahra Advanced Cable Manufacture Co. Ltd.: Company Snapshot

Figure 54 Brugg Group: Company Snapshot

Figure 55 Caledonian Cables Ltd.: Company Snapshot

Figure 56 Dubai Cable Company (Private) Ltd.: Company Snapshot

Figure 57 Hebei New Baofeng Wire & Cable Co., Ltd.: Company Snapshot

Figure 58 Kabelwerk Eupen AG: Company Snapshot

Figure 59 LS Cable & System Ltd.: Company Snapshot

Figure 60 Polycab Wires Pvt. Ltd.: Company Snapshot

Figure 61 Riyadh Cables Group of Companies: Company Snapshot

Figure 62 Southwire Company, LLC: Company Snapshot

Figure 63 Top Cable, S.A.: Company Snapshot

Growth opportunities and latent adjacency in Low Voltage Cable Market