Medical Processing Seals Market by Material ( Silicone, EPDM, Metals, PTFE, Nitrile Rubber), Type (O-Rings, Gaskets, Lip Seals), Application (Medical Equipment and Medical Devices), and Region - Global Forecast to 2023

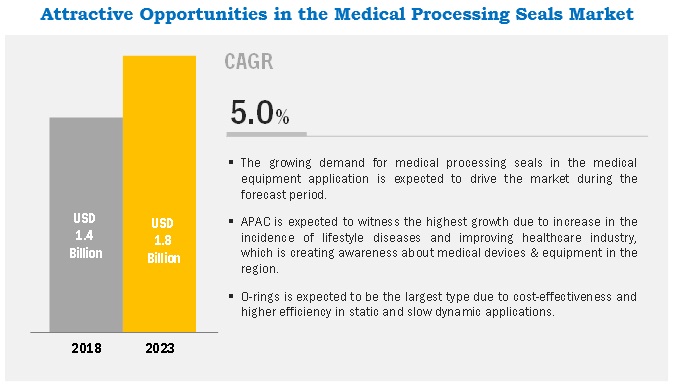

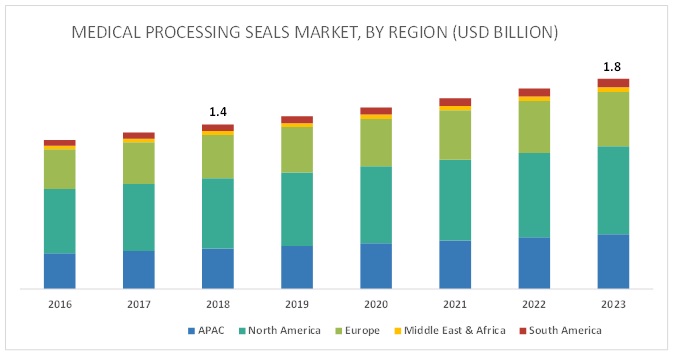

[133 Pages Report] The medical processing seals market size is estimated at USD 1.4 billion in 2018 and is projected to reach USD 1.8 billion by 2023, at a CAGR of 5.0%. The global medical processing seals industry is witnessing growth because of increasing demand from applications such as medical equipment & devices, technological advancements, and increasing demand in APAC, mainly from India, China, Korea, and the Southeast Asian countries. Also, the growing healthcare sector in the region is expected to increase the demand for medical equipment & devices, thereby benefiting the growth of the medical processing seals market.

Silicone dominates the medical processing seals market and is projected to be the fastest-growing material segment

In terms of material, silicone accounted for the largest share of the market, globally. Silicone is highly preferred material for the medical sealing application, as it is highly compatible with human tissue and body fluids as compared to other elastomers. Also, silicone does not support bacteria growth which makes it highly suitable for devices that have close contact with the human body. Another important material used in medical devices is liquid silicone rubber (LSR). LSR is used in different critical medical applications such as cardiology, oncology, and orthopedics, and others.

O-rings dominate the medical processing seals market by type

O-rings are universally used in medical equipment & devices owing to their low cost. O-rings are used in different types of dynamic and static applications in the medical industry. Static applications such as fluid or gas sealing applications majorly consume O-rings. The increasing demand for devices and equipment such as drug delivery devices, valves, pumps, cylinders, connectors, fluid transfer devices, respiratory equipment, and dialysis equipment in the developing countries APAC, South America, and the Middle East & Africa is expected to drive the demand for medical processing seals.

Medical equipment is the largest application segment of the medical processing seals market.

The medical equipment application dominated the total market in 2017. The increasing global demand for medical equipment due to growth of the healthcare industry and healthcare infrastructure is expected to drive the market. Medical equipment is used in the medical industry for a life support system and to release the patient from chronic pain. Reasons for the growing healthcare industry and the subsequent growth of medical equipment market are growing global population, rising incidences of chronic diseases, and increasing healthcare expenditure. The growing demand for seals in the medical equipment application is expected to drive the medical processing seals market.

North America is projected to be the largest medical processing seals market.

North America (comprising the US, Canada, and Mexico) is estimated to account for the largest share of the global medical processing seals market in 2018. Huge consumption and demand for new and innovative medical devices & equipment in the region due to the presence of a strong healthcare sector is driving the demand for medical processing seals in the region.

IDEX Corporation (US), Saint-Gobain S.A. (France), Freudenberg Group (Germany), Trelleborg AB (Sweden), Parker Hannifin Corp (US), Minnesota Rubber and Plastics (US), Marco Rubber & Plastic Products, LLC (US), Morgan Advanced Materials Plc (UK), Bal Seal Engineering, Inc. (US), and Techno AD Ltd (Israel) are the key players operating in the market.

These companies have adopted various organic as well as inorganic growth strategies between 2014 and 2018 to strengthen their position in the market. New product launch and merger & acquisition were among the key growth strategies adopted by these leading players to enhance their product offering and regional presence as well as meet the growing demand for medical processing seals from emerging economies.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

|

|

Base year |

2017 |

|

Forecast period |

20182023 |

|

Unit considered |

Value (USD Million) |

|

Segments |

Type, Material, Application, and Region |

|

Regions |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

IDEX Corporation (US), Saint-Gobain S.A. (France), Freudenberg Group (Germany), Trelleborg AB (Sweden), Parker Hannifin Corp (US), Minnesota Rubber and Plastics (US), Marco Rubber & Plastic Products, LLC (US), Morgan Advanced Materials Plc (UK), Bal Seal Engineering, Inc. (US), and Techno AD Ltd (Israel). |

This research report categorizes the medical processing seals market based on type, material, application, and region.

The medical processing seals market by type:

- O-rings

- Gaskets

- Lip Seals

- Others (Diaphragm Seals, C-rings, X-rings)

The medical processing seals market by material:

- Silicone

- Metal

- PTFE

- Nitrile Rubber

- EPDM

- Others (UHMW, PEEK)

The medical processing seals market, by application:

- Medical Equipment

- Medical Devices

The medical processing seals market, by region:

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The medical processing seals market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In January 2019, Trelleborg Sealing Solutions, a division of Trelleborg AB, acquired Sil-Pro, LLC (US), a manufacturer of silicone and thermoplastic components for the medical industry. The acquisition is a part of the companys strategy to strengthen its silicone product offering and expand the manufacturing footprint.

- In August 2018, the company expanded its R&D base in Kontich, Belgium by expanding the previous 150 square meter laboratory to 390 square meter facility. The newly expanded space is especially dedicated for in-house testing and approval of seals.

- In June 2017, Minnesota Rubber and Plastics developed a new material, Quniton. This product is designed to have a low Coefficient of Friction (CoF) and resists bonding or sticking to a wide range of materials. Some applications of Quniton are water heater valves, flow meters, syringe plugs, plunger seals, standard O-rings, and Quad rings.

- In August 2016, IDEX Corporation (US), the parent company of Precision Polymer Engineering, acquired SFC KOENIG AG (Switzerland), a major player of the sealing market. This acquisition is a part of the companys strategic initiative to strengthen its position in the sealing market.

- In September 2016, Trelleborg Sealing Solutions, a division of Trelleborg AB, acquired Anderson Seal LLC, a privately-owned seal distributor in the US. This acquisition is a part of the companys growth strategy for seals, gaskets, and custom-molded products for original equipment manufacturers (OEMs) in industries such as automotive, hydraulic, and medical/life sciences.

Critical questions the report answers:

- Are there any upcoming hot bets for the medical processing seals market?

- How are the market dynamics for different types of medical processing seals?

- How are the market dynamics for different applications of medical processing seals?

- Who are the major manufacturers of medical processing seals?

- What are the factors governing the medical processing seals market in each region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

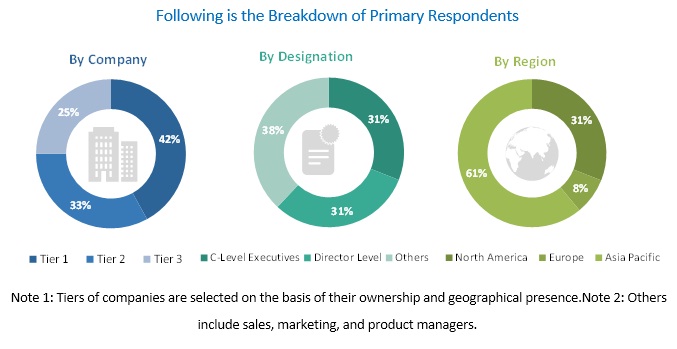

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Medical Processing Seals Market

4.2 Medical Processing Seals Market in North America, By Type and Country

4.3 Medical Processing Seals Market: Major Countries

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in the Demand for Medical Devices & Equipment

5.2.1.2 Improved Medical Services in Urban Areas of Developing Countries

5.2.1.3 Adoption of Managed Equipment Services

5.2.2 Restraints

5.2.2.1 Increase in the Purchase of Refurbished Medical Systems

5.2.3 Opportunities

5.2.3.1 Miniaturization of Medical Devices

5.2.3.2 Non-Availability of Substitutes for Medical Seals

5.2.4 Challenges

5.2.4.1 Increase in the Overall Cost and Time Owing to Dynamic Regulatory Measures

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 Contribution of the Healthcare Sector to GDP

6 Medical Processing Seals Market, By Material (Page No. - 39)

6.1 Introduction

6.2 Silicone

6.2.1 Increasing Demand for O-Rings in APAC is Driving the Growth of the Silicone Segment in the Medical Processing Seals Market

6.3 Metal

6.3.1 Increasing Demand for Gaskets is Driving the Metal-Based Medical Processing Seals Market

6.4 Ptfe

6.4.1 Increasing Demand for Medical Devices and Equipment Globally is Driving the Demand for Ptfe-Based Medical Processing Seals

6.5 Nitrile Rubber

6.5.1 The Increasing Demand for O-Rings and Lip Seals in the Region is Driving the Nitrile Rubber Market in North America

6.6 Epdm

6.6.1 Increasing Demand for O-Rings and Gaskets Used in Medical Devices and Equipment is Driving the Epdm Market Globally

6.7 Others

7 Medical Processing Seals Market, By Type (Page No. - 47)

7.1 Introduction

7.2 O-Rings

7.2.1 The Growing Medical Devices & Equipment Market Due to the Increasing Incidence of Chronic Diseases has Boosted the Demand for O-Rings in 49

7.3 Gaskets

7.3.1 Growing Medical Equipment Market has Boosted the Demand for Gaskets in APAC

7.4 Lip Seals

7.4.1 Increasing Demand for Effective Medical Devices and Equipment Due to the Growth in Medical Conditions has Boosted the Lip Seals Market

7.5 Others

8 Medical Processing Seals Market, By Application (Page No. - 53)

8.1 Introduction

8.2 Medical Devices

8.2.1 Increasing Demand for Medical Devices for Diabetes in APAC is Expected to Drive the Demand for Medical Processing Seals

8.3 Medical Equipment

8.3.1 Increasing Demand for Diagnostic and therapeutic Equipment is Driving the Medical Processing Seals Market

9 Medical Processing Seals Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increase in the Demand for Innovative Medical Equipment and R&D Expenditure has Boosted the Medical Processing Seals Market in the Country

9.2.2 Canada

9.2.2.1 Increase in Demand for Medical Equipment Due to the Rise in Health Awareness and Its Demand in Public Hospitals has Boosted the MediSeaCountry

9.2.3 Mexico

9.2.3.1 Increase in the Demand for Medical Equipment From the PublAnd Private Hospitals is Driving the Medical Processing SealMarket in the Country

9.3 Europe

9.3.1 Germany

9.3.1.1 Increasing Demand for Medical Equipment Due to Growing Incidences of Chronic Diseases is Driving the Market for Medical Processing Seals

9.3.2 France

9.3.2.1 Increasing Demand for Diagnostic and Intense Care Equipment is Driving the Demand for Medical Processing Seals in the Country

9.3.3 UK

9.3.3.1 Increase in the Healthcare Expenditure and Demand for Innovative Products in the Country is Driving the Medical Equipment & Devices Segment

9.3.4 Italy

9.3.4.1 Rise in Demand for Home Care System and Increase in Per Capita Income to Drive the Medical Equipment & Devices Segment

9.3.5 Switzerland

9.3.5.1 Increasing Market for Medical Equipment Due to Favorable Trade Policies is Driving the Medical Processing Seals Market in the Country

9.3.6 Rest of Europe

9.4 APAC

9.4.1 China

9.4.1.1 Increasing Elderly Population and Growing Incidence of Chronic Diseases Have Boosted the Demand for Medical Processing Seals

9.4.2 Japan

9.4.2.1 Increasing Healthcare Industry Due to the Rapidly Growing Elderly Population in the Country has Boosted the Demand for Medical Processing Seals

9.4.3 Singapore

9.4.3.1 Favorable Rules and Regulations for the Healthcare Industry in the Country to Boost the Demand for Medical Processing Seals

9.4.4 South Korea

9.4.4.1 Increase in the Elderly Population and the Incidence of Chronic Diseases has Boosted the Demand for Medical Processing Seals in the Country

9.4.5 India

9.4.5.1 Growing Healthcare Industry has Boosted the Demand FoMedical Processing Seals in the Country

9.4.6 Taiwan

9.4.6.1 Increase in the Healthcare Expenditure and the Elderly Population has Boosted the Demand for Medical Processing Seals in the Country

9.4.7 Australia

9.4.7.1 Increasing Medical Equipment and Devices Market Due to the Growing Healthcare Industry has Boosted the DemandMedical Processing Seals in the 86

9.4.8 Rest of APAC

9.5 South America

9.5.1 Brazil

9.5.1.1 Changing Regulatory Norms for Medical Equipment and High Demand for New Technologies and Innovation are Driving the Market ForCountry

9.5.2 Argentina

9.5.2.1 Increasing Domestic Production of Lower and Middle Range Medical Equipment is Driving the Equipment Market in the Country

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.1.1 The Market for Medical Processing Seals in the Country is Driven By New Government Initiatives for the Development of Medical Equipment and Devices

9.6.2 UAE

9.6.2.1 Development of the Healthcare Sector is Driving the Demand for Medical Processing Seals in the Country

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 98)

10.1 Introduction

10.2 Market Ranking

10.3 Competitive Situations & Trends

10.3.1 New Product Developments

10.3.2 Mergers & Acquisitions

10.3.3 Expansions

11 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Idex Corporation

11.2 Saint-Gobain S.A.

11.3 Freudenberg Group

11.4 Trelleborg Ab

11.5 Parker Hannifin Corp

11.6 Minnesota Rubber and Plastics

11.7 Marco Rubber & Plastics, Llc

11.8 Morgan Advanced Materials Plc

11.9 Bal Seal Engineering, Inc.

11.10 Techno Ad Ltd

11.11 Additional Company Profiles

11.11.1 Maclellan Rubber Ltd

11.11.2 Precision Associates, Inc.

11.11.3 Fabri-Tech Components, Inc.

11.11.4 Performance Sealing Inc.

11.11.5 American High Performance Seals

11.11.6 Sur-Seal

11.11.7 Apple Rubber Products, Inc.

11.11.8 Darcoid of California

11.11.9 Technetics Group

11.11.10 Seal & Design Inc.

11.11.11 Le Joint Technique

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 127)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (67 Tables)

Table 1 Contribution of Healthcare to GDP, 2015 and 2016 (Percentage)

Table 2 Medical Processing Seals Market Size, By Material, 20162023 (USD Million)

Table 3 Silicone-Based Medical Processing Seal Market Size, By Region, 20162023 (USD Million)

Table 4 Metal-Based Medical Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 5 Ptfe-Based Medical Processing Seal Market Size, By Region, 20162023 (USD Million)

Table 6 Nitrile Rubber-Based Medical Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 7 Epdm-Based Medical Processing Seal Market Size, By Region, 20162023 (USD Million)

Table 8 Other Materials-Based Medical Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 9 Medical Processing Seal Market Size, By Type, 20162023 (USD Million)

Table 10 O-Rings: Medical Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 11 Gaskets: By Market Size, By Region, 20162023 (USD Million)

Table 12 Lip Seals: Medical Processing Seal Market Size, By Region, 20162023 (USD Million)

Table 13 Other Medical Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 14 Usp Classification of Medical Devices

Table 15 Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 16 Medical Processing Seal Market Size in Medical Devices Application, By Region, 20162023 (USD Million)

Table 17 By Market Size in Medical Equipment Application, By Region, 20162023 (USD Million)

Table 18 Medical Processing Seals Market Size, By Region, 20162023 (USD Million)

Table 19 By Market Size, By Type, 20162023 (USD Million)

Table 20 Medical Processing Seals Market Size, By Material, 20162023 (USD Million)

Table 21 By Market Size, By Application, 20162023 (USD Million)

Table 22 North America: Medical Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 23 North America: By Market Size, By Type, 20162023 (USD Million)

Table 24 North America: By Market Size, By Material, 20162023 (USD Million)

Table 25 North America: By Market Size, By Application, 20162023 (USD Million)

Table 26 US: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 27 Canada: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 28 Mexico: By Market Size, By Application, 20162023 (USD Million)

Table 29 Europe: Medical Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 30 Europe: By Market Size, By Type, 20162023 (USD Million)

Table 31 Europe: By Market Size, By Material, 20162023 (USD Million)

Table 32 Europe: By Market Size, By Application, 20162023 (USD Million)

Table 33 Germany: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 34 France: By Market Size, By Application, 20162023 (USD Million)

Table 35 UK: Medical Processing Seal Market Size, By Application, 20162023 (USD Million)

Table 36 Italy: By Market Size, By Application, 20162023 (USD Million)

Table 37 Switzerland: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 38 Rest of Europe: By Market Size, By Application, 20162023 (USD Million)

Table 39 APAC: Medical Processing Seal Market Size, By Country, 20162023 (USD Million)

Table 40 APAC: By Market Size, By Type, 20162023 (USD Million)

Table 41 Medical Processing Seals Market Size, By Material, 20162023 (USD Million)

Table 42 By Market Size, By Application, 20162023 (USD Million)

Table 43 China: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 44 Japan: By Market Size, By Application, 20162023 (USD Million)

Table 45 Singapore: Medical Processing Seal Market Size, By Application, 20162023 (USD Million)

Table 46 South Korea: By Market Size, By Application, 20162023 (USD Million)

Table 47 India: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 48 Taiwan: By Market Size, By Application, 20162023 (USD Million)

Table 49 Australia: Medical Processing Seal Market Size, By Application, 20162023 (USD Million)

Table 50 Rest of APAC: By Market Size, By Application, 20162023 (USD Million)

Table 51 South America : Medical Processing Seals Market Size, By Country, 20162023 (USD Million)

Table 52 South America : By Market Size, By Type, 20162023 (USD Million)

Table 53 South America : By Market Size, By Material, 20162023 (USD Million)

Table 54 South America : By Market Size, By Application, 20162023 (USD Million)

Table 55 Brazil: Medical Processing Seal Market Size, By Application, 20162023 (USD Million)

Table 56 Argentina: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 57 Rest of South America: By Market Size, By Application, 20162023 (USD Million)

Table 58 Middle East & Africa: Medical Processing Seal Market Size, By Country, 20162023 (USD Million)

Table 59 Middle East & Africa: By Market Size, By Type, 20162023 (USD Million)

Table 60 Middle East & Africa: By Market Size, By Material, 20162023 (USD Million)

Table 61 Middle East & Africa: By Market Size, By Application, 20162023 (USD Million)

Table 62 Saudi Arabia: Medical Processing Seal Market Size, By Application, 20162023 (USD Million)

Table 63 UAE: By Market Size, By Application, 20162023 (USD Million)

Table 64 Rest of Middle East & Africa: Medical Processing Seals Market Size, By Application, 20162023 (USD Million)

Table 65 New Product Developments, 20142018

Table 66 Mergers & Acquisitions, 20142018

Table 67 Expansions, 20142018

List of Figures (41 Figures)

Figure 1 Medical Processing Seals Market: Research Design

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Medical Processing Seals Market: Data Triangulation

Figure 5 O-Rings Was the Largest Type of Medical Processing Seals in 2017

Figure 6 Silicone to Be the Largest Material for Medical Processing Seals During the Forecast Period

Figure 7 Medical Equipment Was the Larger Application of Medical Processing Seals in 2017

Figure 8 North America Accounted for the Largest Share of the Medical Processing Seal Market in 2017

Figure 9 Growing Medical Equipment Application to Drive the Market During the Forecast Period

Figure 10 O-Rings and the US Accounted for the Largest Share in the North American Market for Medical Processing Seals in 2017

Figure 11 China to Grow at the Highest Rate During the Forecast Period

Figure 12 Drivers, Restraints, Opportunities, and Challenges: Medical Processing Seals Market

Figure 13 Medical Processing Seals Market: Porters Five Forces Analysis

Figure 14 Contribution of Healthcare to GDP, 2015 and 2016

Figure 15 Silicone to Lead the Medical Processing Seal Market

Figure 16 North America to Be the Largest Silicone-Based Medical Processing Seals Market

Figure 17 O-Rings to Be the Largest Type of Medical Processing Seals

Figure 18 APAC to Register the Highest Cagr in O-Rings Medical Processing Seal Market

Figure 19 FDA Classification of Medical Devices

Figure 20 Medical Equipment Application to Dominate the Market

Figure 21 North America to Be the Largest Market in the Medical Devices Application

Figure 22 APAC to Be the Fastest-Growing Market in the Medical Equipment Application

Figure 23 China to Witness the Fastest Growth During the Forecast Period

Figure 24 North America: Market Snapshot

Figure 25 Europe: By Market Snapshot

Figure 26 APAC: Market Snapshot

Figure 27 South America: By Market Snapshot

Figure 28 Middle East & Africa: Market Snapshot

Figure 29 Companies Adopted Expansions and Mergers & Acquisitions as the Major Growth Strategies (20142018)

Figure 30 Market Ranking of Key Players in 2017

Figure 31 Idex Corporation: Company Snapshot

Figure 32 Idex Corporation: SWOT Analysis

Figure 33 Saint-Gobain S.A.: Company Snapshot

Figure 34 Saint-Gobain S.A.: SWOT Analysis

Figure 35 Freudenberg Group: Company Snapshot

Figure 36 Freudenberg Group: SWOT Analysis

Figure 37 Trelleborg Ab: Company Snapshot

Figure 38 Trelleborg Ab: SWOT Analysis

Figure 39 Parker Hannifin Corp: Company Snapshot

Figure 40 Parker Hannifin Corp: SWOT Analysis

Figure 41 Morgan Advanced Materials Plc: Company Snapshot

The study involves four major activities in estimating the current market size for medical processing seals. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to, for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The medical processing seals market comprises several stakeholders such as raw material suppliers, distributors of medical processing seals, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of manufacturers and suppliers of medical devices & equipment. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the medical processing seals market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the medical processing seals market.

Objectives of the Study:

- To define, describe, and forecast the medical processing seals market size, in terms of value

- To identify and analyze the key drivers, restraints, challenges, and opportunities influencing the market

- To forecast the market by type, by material, and by application

- To forecast the size of the market, on the basis of regionNorth America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the market opportunities and provide a competitive landscape of the stakeholders and market leaders

- To analyze the recent developments and competitive strategies, such as new product developments, mergers & acquisitions, and expansions, in the market

- To strategically identify and profile the key market players and analyze their core competencies1 in the market

Notes: Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- A country-level analysis of the medical processing seals market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Medical Processing Seals Market