Medical Packaging Market by Material (Polymer, Non-woven Fabric, Paper & Paperboard), Packaging Type (Bags & Pouches, Trays, Boxes), Application (Medical Equipment & Tools, Medical Devices, Implants, IVDs), Packing Type, and Region - Forecast to 2022

The medical packaging market is projected to reach USD 50.55 billion by 2022, at a CAGR of 6.29%. Medical packaging has been widely used for the packaging of medical devices, equipment, implants, and medicines. Rise in income levels, growth in healthcare awareness, and increase in incidences of chronic conditions will drive the market for medical packaging. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Medical Packaging Market Dynamics

Drivers

- Increase in incidences of chronic conditions and expenditure of healthcare facilities

- High growth in the implantable device market

- Rise in IoT in the healthcare and medical industries

- Increase in demand for counterfeit prevention mechanisms

Restraints

- Fluctuations in the raw material prices

Opportunities

- Growing demand for sustainable packaging solutions

- Emerging markets represent business expansion opportunities

Challenges

- Stringent rules & regulations

Rise in IoT in the healthcare and medical industries

The presence of IoT in healthcare systems can track every package of medicine, record the medication activity of every tablet of the capsule, and present all prescription information related to patients. Rise of Intelligent and Interactive Packaging (I2Pack) is a suitable format for smart devices for this purpose. The I2Pack is the next generation of medical packaging which can interact with customers by integrating RFID, sensing, energy harvesting, communicating, and other functions over traditional packaging mediums. The information fetched and carried by the packaging will transform from static to dynamic, the flow of information will transform from single-directional (product-to-consumer only) to dual-directional (both product-to-consumer and consumer-to-producer; therefore, the I2Pack can be assigned more responsibilities in addition to the containing and protecting of goods.

Packaging plays a key role of communication between suppliers and consumers. Adding to this, it also plays a role of a seller on-site, an information presenter, an information collector, and even an executor of particular operations

The Following are the Major Objectives of the Medical Packaging Market Study.

- To describe and forecast the global medical packaging market on the basis of packaging type, application, material, packing type and region

- To describe and forecast the medical packaging market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the medical packaging ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the medical packaging market

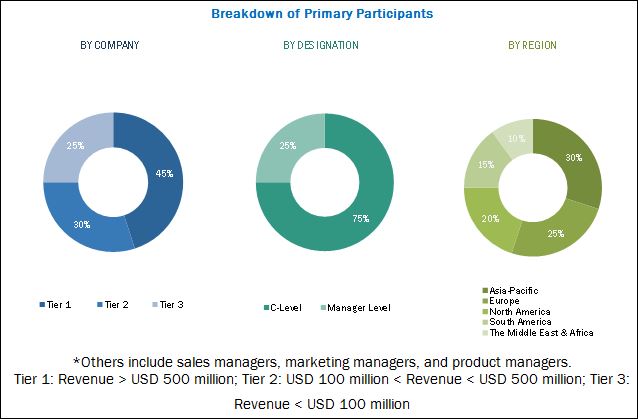

During this research study, major players operating in the medical packaging market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The medical packaging market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the medical packaging market are as Avery Dennison Corporation (U.S.), 3M Company (U.S.), E.I. du Pont de Nemours and Company (U.S.), CCL Industries Inc. (Canada), Amcor Limited (Australia), Constantia Flexibles Group GmbH (Austria), Bemis Company, Inc (U.S.), Sonoco Company (U.S.), WestRock Company (U.S.).

Major Medical Packaging Market Developments

- In January 2017, WestRock acquired Multi Packaging Solutions (U.S.). This acquisition enhanced WestRock’s position as a leading provider of differentiated paper and packaging solutions.

- In January 2017, Berry Plastics Group, Inc. acquired AEP Industries, Inc. (U.S.) to expand its breadth of product offerings and increase its production capacity in the market.

- In June 2015, Amcor acquired Zhongshan Tiancai Packaging (China) to expand its presence in China. This acquisition helped the company to expand its business in the growing Chinese market.

Target Audience in Medical Packaging Market

- Medical Packaging manufacturers

- OEMs

- Manufacturing organizations

- Automotive manufacturers

- Construction organizations

Medical Packaging Market Report Scope

By Material:

- Polymer

- Paper and paperboard

- Nonwoven material

- Others

By Applications:

- Equipment & tools

- Devices

- IVD

- Implants

By Packaging type:

- bags and pouches

- trays

- Boxes

- Others

By Packing type:

- Primary

- Secondary

- Tertiary

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Critical questions which the report answers

- What are new application areas which the medical packaging are exploring?

- Which are the key players in the market and how intense is the competition?

Medical Packaging Market Report Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

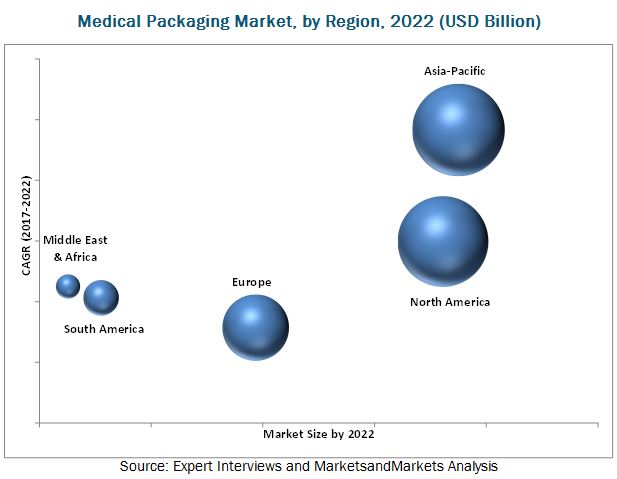

The overall medical market is expected to grow from USD 37.27 billion in 2017 to USD 50.55 billion by 2022 at a CAGR of 6.29%. The growth of the market is propelled by the rise in population, income level, and awareness of the world. The market is further fostered by factors such as the growth of the implantable device market and single use disposable products market, and more importantly, rise in awareness regarding hospital-acquired infections. The high growth potential of the healthcare sector in the emerging markets, and advancement in medical device and equipment designing & packaging, provide new growth opportunities to the players in the medical packaging market.

The medical packaging market has been segmented, on the basis of application, into medical tools & equipment, medical devices, implants and IVDs. In terms of application, the medical tools & equipment segment accounted for the largest share. The medical equipment is highly used in hospitals globally for in a various applications such as dental, cardiovascular, orthodontics, wound care, and many more; it thus accounts for the largest market share. The devices segment accounted for the second largest market. The high number of devices used in the medical industry can be contributed to their high market share in the packaging market.

The medical packaging market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Asia-Pacific is projected to grow faster than any other region-level market, as it is the most widely populated region in the world, Countries such as India and China are expected to witness high growth in the medical packaging market due to the growing developmental activities and rapid economic expansion. In addition to this, the growing population in these countries presents a large customer base for the ageing population, which in turn is expected to lead to the growth of the medical packaging market.

Increase in incidences of chronic conditions and expenditure of healthcare facilities is driving the growth of the medical packaging market

Primary Medical Packaging Market

Primary packaging is that material which is in direct contact with the products. Primary packaging is most important in medical packaging as it should keep medicines conditions intact and safe for use. For primary packaging, it is necessary to know the possible interactions between the container and the contents. Normally, product/ component stability and compatibility are confirmed during the primary research and development stage. The packaging needs to be such that there is no interaction with the drug and will provide proper containment of pharmaceuticals. Such as blister packages, Strip packages, etc. For primary packaging, they may include glass, plastic or metal containers, bottles, vials, ampules, caps, lids, stoppers, seals, desiccants, fillers, and others.

Secondary Medical Packaging Market

Secondary packaging is outside the primary packaging mostly used to group primary packages together. They are also known as non-critical packaging. The secondary packaging material should be strong enough to maintain strength of tools, medicines or equipment strong enough. Highly used materials for secondary packaging paper and boards carton, corrugated, fibres boxes. These materials are highly used to pack tablets strips, bottles, medical equipment’s and even the tools.

Tertiary Medical Packaging Market

Tertiary packaging is used for bulk handling, warehouse storage and transport shipping. Barrels and containers are highly used for tertiary packaging. There are two types of container glass containers and plastic containers. Glass containers need to be chemically inert, impermeable, strong and rigid proving FDA clearance.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for medical packaging?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Medical Packaging: Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Market Share Estimation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Developing Economies to Witness Higher Demand for Medical Packaging

4.2 Market, By Application

4.3 Market, By Packaging Type

4.4 Market, By Material

4.5 North America: Medical Packaging Market

4.6 Medical Packaging Market: Regional Snapshot

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Evolution of the Medical Packaging Market

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Incidences of Chronic Conditions and Expenditure of Healthcare Facilities

5.3.1.2 High Growth of the Implantable Device Market

5.3.1.3 Rise in IoT in the Healthcare and Medical Industries

5.3.1.4 Increase in Demand for Counterfeit Prevention Mechanisms

5.3.2 Restraints

5.3.2.1 Fluctuations in the Prices of Raw Materials

5.3.3 Opportunities

5.3.3.1 Growth in Demand for Sustainable Packaging Solutions

5.3.3.2 Emerging Markets Represent Business Expansion Opportunities

5.3.4 Challenges

5.3.4.1 Stringent Rules & Regulations

5.4 Rules & Regulations

5.5 Macroeconomic Overview

5.5.1 Trends and Forecast of GDP

5.5.2 Current Expenditure on Healthcare Industry

5.5.3 Trends of the Medical Devices

6 Medical Packaging Market, By Material (Page No. - 46)

6.1 Introduction

6.1.1 Medical Packaging Market, By Material

6.2 Polymer

6.2.1 Pvc

6.2.2 Polyethylene Terephthalate (PET)

6.2.3 Pe

6.3 Paper & Paperboard

6.4 Non-Woven Fabric

6.5 Others

7 Medical Packaging Market, By Application (Page No. - 49)

7.1 Introduction

7.1.1 Medical Packaging Market, By Application

7.2 Medical Tools & Equipment

7.3 Medical Devices

7.4 In-Vitro Diagnostic Products

7.5 Implants

8 Medical Packaging Market, By Packaging Type (Page No. - 52)

8.1 Introduction

8.1.1 Medical Packaging Market, By Packaging Type

8.2 Bags & Pouches

8.3 Trays

8.4 Boxes

8.5 Others

9 Medical Packaging Market, By Packing Type (Page No. - 55)

9.1 Primary Packaging

9.2 Secondary Packaging

9.3 Tertiary Packaging

10 Medical Packaging Market, By Region (Page No. - 56)

10.1 Introduction

10.2 North America

10.2.1 North America: Medical Packaging Market, By Country

10.2.2 North America: Market, By Material

10.2.3 North America: Market, By Application

10.2.4 North America: Market, By Packaging Type

10.2.5 U.S.

10.2.5.1 U.S.: Medical Packaging Market, By Material

10.2.5.2 U.S.: Market, By Application

10.2.5.3 U.S.: Market, By Packaging Type

10.2.6 Canada

10.2.6.1 Canada: Medical Packaging Market, By Material

10.2.6.2 Canada: Market, By Application

10.2.6.3 Canada: Market, By Packaging Type

10.2.7 Mexico

10.2.7.1 Mexico: Medical Packaging Market, By Material

10.2.7.2 Mexico: Market, By Application

10.2.7.3 Mexico: Market, By Packaging Type

10.3 Europe

10.3.1 Europe: Medical Packaging Market, By Country

10.3.2 Europe: Market, By Material

10.3.3 Europe: Market, By Application

10.3.4 Europe: Market, By Packaging Type

10.3.5 Germany

10.3.5.1 Germany: Medical Packaging Market, By Material

10.3.5.2 Germany: Market, By Application

10.3.5.3 Germany: Market, By Packaging Type

10.3.6 U.K.

10.3.6.1 U.K.: Medical Packaging Market, By Material

10.3.6.2 U.K.: Market, By Application

10.3.6.3 U.K.: Market, By Packaging Type

10.3.7 France

10.3.7.1 France: Medical Packaging Market, By Material

10.3.7.2 France: Market, By Application

10.3.7.3 France: Market, By Packaging Type

10.3.8 Italy

10.3.8.1 Italy: Medical Packaging Market, By Material

10.3.8.2 Italy: Market, By Application

10.3.8.3 Italy: Market, By Packaging Type

10.3.9 Rest of Europe

10.3.9.1 Rest of Europe: Medical Packaging Market, By Material

10.3.9.2 Rest of Europe: Market, By Application

10.3.9.3 Rest of Europe: Market, By Packaging Type

10.4 Asia-Pacific

10.4.1 Asia-Pacific: Medical Packaging Market, By Country

10.4.2 Asia-Pacific: Market, By Material

10.4.3 Asia-Pacific: Market, By Application

10.4.4 Asia-Pacific: Market, By Packaging Type

10.4.5 China

10.4.5.1 China: Medical Packaging Market, By Material

10.4.5.2 China: Market, By Application

10.4.5.3 China: Market, By Packaging Type

10.4.6 Japan

10.4.6.1 Japan: Medical Packaging Market, By Material

10.4.6.2 Japan: Market, By Application

10.4.6.3 Japan: Market, By Packaging Type

10.4.7 India

10.4.7.1 India: Medical Packaging Market, By Material

10.4.7.2 India: Market, By Application

10.4.7.3 India: Market, By Packaging Type

10.4.8 South Korea

10.4.8.1 South Korea: Medical Packaging Market, By Material

10.4.8.2 South Korea: Market, By Application

10.4.8.3 South Korea: Market, By Packaging Type

10.4.9 Rest of Asia-Pacific

10.4.9.1 Rest of Asia-Pacific: Medical Packaging Market, By Material

10.4.9.2 Rest of Asia-Pacific: Market, By Application

10.4.9.3 Rest of Asia-Pacific: Market, By Packaging Type

10.5 Middle East & Africa

10.5.1 Middle East & Africa: Medical Packaging Market, By Country

10.5.2 Middle East & Africa: Market, By Material

10.5.3 Middle East & Africa: Market, By Application

10.5.4 Middle East & Africa: Market, By Packaging Type

10.5.5 Saudi Arabia

10.5.5.1 Saudi Arabia: Medical Packaging Market, By Material

10.5.5.2 Saudi Arabia: Market, By Application

10.5.5.3 Saudi Arabia: Market, By Packaging Type

10.5.6 UAE

10.5.6.1 UAE: Medical Packaging Market, By Material

10.5.6.2 UAE: Market, By Application

10.5.6.3 UAE: Market, By Packaging Type

10.5.7 South Africa

10.5.7.1 South Africa: Medical Packaging Market, By Material

10.5.7.2 South Africa: Market, By Application

10.5.7.3 South Africa: Market, By Packaging Type

10.5.8 Rest of the Middle East & Africa

10.5.8.1 Rest of the Middle East & Africa: Medical Packaging Market, By Material

10.5.8.2 Rest of the Middle East & Africa: Market, By Application

10.5.8.3 Rest of the Middle East & Africa: Market, By Packaging Type

10.6 South America

10.6.1 South America: Medical Packaging Market, By Country

10.6.2 South America: Market, By Material

10.6.3 South America: Market, By Application

10.6.4 South America: Market, By Packaging Type

10.6.5 Brazil

10.6.5.1 Brazil: Medical Packaging Market, By Material

10.6.5.2 Brazil: Market, By Application

10.6.5.3 Brazil: Market, By Packaging Type

10.6.6 Argentina

10.6.6.1 Argentina: Medical Packaging Market, By Material

10.6.6.2 Argentina: Market, By Application

10.6.6.3 Argentina: Market, By Packaging Type

10.6.7 Rest of South America

10.6.7.1 Rest of South America: Medical Packaging Market, By Material

10.6.7.2 Rest of South America: Market, By Application

10.6.7.3 Rest of South America: Market, By Packaging Type

11 Competitive Landscape (Page No. - 100)

11.1 Introduction

11.1.1 Dynamic Differentiators

11.1.2 Innovators

11.1.3 Visionary Leaders

11.1.4 Emerging Companies

11.2 Competitive Leadership Mapping - 2016

11.2.1 Strength of Product Offerings

11.2.2 Business Strategy Exellence

11.3 Market Share Analysis, 2016

11.3.1 3M Company

11.3.2 Dupont

11.3.3 Westrock Company

11.3.4 Amcor Limited

11.3.5 Berry Plastics Corporation

12 Company Profiles (Page No. - 106)

(Business Overview, Products Offered, Scorecard of Product Offering, Scorecard of Business Strategy, and New Product Launch)

12.1 Introduction

12.2 3M Company

12.3 E.I. Du Pont De Nemours and Company

12.4 Westrock Company

12.5 Amcor Limited

12.6 Berry Plastics Corporation

12.7 Avery Dennison Corporation

12.8 CCL Industries Inc.

12.9 Constantia Flexibles Group GmbH

12.10 Bemis Company

12.11 Sonoco Products Company

12.12 West Pharmaceutical Services, Inc.

12.13 Technipaq Inc.

12.14 Steripack Contract Manufacturing

12.15 Toppan Printing Co., Ltd.

12.16 Thomas Packaging LLC.

12.17 Tekni-Plex, Inc.

12.18 Campak Inc

12.19 Wipak Group

12.20 Oliver Healthcare Packaging

12.21 Rollprint Packaging Products, Inc.

12.22 Uhlmann Pac-Systeme GmbH & Co. Kg

12.23 Hamer Packaging Technology

12.24 Klöckner Pentaplast Group

12.25 Beacon Plastics

12.26 Placon Corporation

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 142)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (86 Tables)

Table 1 GDP, By Country, 2014–2021 (USD Billion)

Table 2 Current Expenditure on Healthcare and % of Gross Domestic Product

Table 3 Medical Packaging Market, By Material, 2015–2022 (USD Billion)

Table 4 Market Size, By Application, 2015–2022 (USD Billion)

Table 5 Market, By Packaging Type, 2015–2022 (USD Billion)

Table 6 Market Size, By Region, 2015–2022 (USD Million)

Table 7 North America: Medical Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 8 North America: By Market Size, By Material, 2015–2022 (USD Million)

Table 9 North America: By Market Size, By Application, 2015–2022 (USD Million)

Table 10 North America: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 11 U.S.: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 12 U.S.: By Market Size, By Application, 2015–2025 (USD Million)

Table 13 U.S.: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 14 Canada: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 15 Canada: By Market Size, By Application, 2015–2022 (USD Million)

Table 16 Canada: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 17 Mexico: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 18 Mexico: By Market Size, By Application, 2015–2022 (USD Million)

Table 19 Mexico: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 20 Europe: Medical Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 21 Europe: By Market Size, By Material, 2015–2022 (USD Million)

Table 22 Europe: By Market Size, By Application, 2015–2022 (USD Million)

Table 23 Europe: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 24 Germany: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 25 Germany: By Market Size, By Application, 2015–2022 (USD Million)

Table 26 Germany: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 27 U.K.: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 28 U.K.: By Market Size, By Application, 2015–2022 (USD Million)

Table 29 U.K.: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 30 France: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 31 France: By Market Size, By Application, 2015–2022 (USD Million)

Table 32 France: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 33 Italy: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 34 Italy: By Market Size, By Application, 2015–2022 (USD Million)

Table 35 Italy: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 36 Rest of Europe: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 37 Rest of Europe: By Market Size, By Application, 2015–2022 (USD Million)

Table 38 Rest of Europe: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 39 Asia-Pacific: Medical Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 40 Asia-Pacific: By Market Size, By Material, 2015–2022 (USD Million)

Table 41 Asia-Pacific: By Market Size, By Application, 2015–2022 (USD Million)

Table 42 Asia-Pacific: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 43 China: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 44 China: By Market Size, By Application, 2015–2022 (USD Million)

Table 45 China: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 46 Japan: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 47 Japan: By Market Size, By Application, 2015–2022 (USD Million)

Table 48 Japan: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 49 India: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 50 India: By Market Size, By Application, 2015–2022 (USD Million)

Table 51 India: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 52 South Korea: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 53 South Korea: By Market Size, By Application, 2015–2022 (USD Million)

Table 54 South Korea: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 55 Rest of Asia-Pacific: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 56 Rest of Asia-Pacific: By Market Size, By Application, 2015–2022 (USD Million)

Table 57 Rest of Asia-Pacific: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 58 Middle East & Africa: Medical Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 59 Middle East & Africa: By Market Size, By Material, 2015–2022 (USD Million)

Table 60 Middle East & Africa: By Market Size, By Application, 2015–2022 (USD Million)

Table 61 Middle East & Africa: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 62 Saudi Arabia: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 63 Saudi Arabia: By Market Size, By Application, 2015–2022 (USD Million)

Table 64 Saudi Arabia: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 65 UAE: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 66 UAE: By Market Size, By Application, 2015–2022 (USD Million)

Table 67 UAE: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 68 South Africa: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 69 South Africa: Medical Packaging Market Size, By Application, 2015–2022 (USD Million)

Table 70 South Africa: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 71 Rest of the Middle East & Africa: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 72 Rest of the Middle East & Africa: Medical Packaging Market Size, By Application, 2015–2022 (USD Million)

Table 73 Rest of the Middle East & Africa: By Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 74 South America: Medical Packaging Market Size, By Country, 2015–2022 (USD Million)

Table 75 South America: Market Size, By Material, 2015–2022 (USD Million)

Table 76 South America: Market Size, By Application, 2015–2022 (USD Million)

Table 77 South America: Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 78 Brazil: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 79 Brazil: Market Size, By Application, 2015–2022 (USD Million)

Table 80 Brazil: Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 81 Argentina: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 82 Argentina: Market Size, By Application, 2015–2022 (USD Million)

Table 83 Argentina: Market Size, By Packaging Type, 2015–2022 (USD Million)

Table 84 Rest of South America: Medical Packaging Market Size, By Material, 2015–2022 (USD Million)

Table 85 Rest of South America: Market Size, By Application, 2015–2022 (USD Million)

Table 86 Rest of South America: Market Size, By Packaging Type, 2015–2022 (USD Million)

List of Figures (31 Figures)

Figure 1 Medical Packaging Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Bags & Pouches Segment Estimated to Be the Largest in 2017

Figure 5 Equipment & Tools Segment to Continue to Be the Largest Through 2022

Figure 6 Polymer Sector to Dominate the Demand for the Medical Packaging Market Through 2022

Figure 7 North America is the Largest Market in 2016

Figure 8 Emerging Economies Offer Attractive Opportunities in the Medical Packaging Market

Figure 9 Equipment & Tools Segment to Lead the Market Through 2022

Figure 10 Bags & Pouches Segment Estimated to Be the Largest Market in 2017

Figure 11 Polymer Segment to Be the Largest By 2022

Figure 12 Equipment & Tools Segment Estimated to Have the Largest Share in the North American Market in 2017

Figure 13 Market in India is Projected to Grow at the Highest Rate From 2016 to 2022

Figure 14 Evolution of Medical Packaging

Figure 15 Factors Governing the Medical Packaging Market

Figure 16 Percentage Distribution of Population Aged 65 and Over By Region: 2015 and 2050

Figure 17 Fluctuations in Raw Material Prices

Figure 18 Geographic Snapshot: Market in India is Projected to Grow at the Highest Rate, in Terms of Value (2017–2022)

Figure 19 North American Medical Packaging Market Snapshot: U.S. is Projected to Be the Fastest-Growing Market Between 2017 and 2022

Figure 20 Asia-Pacific: Medical Packaging Market Snapshot

Figure 21 Competitive Benchmarking

Figure 22 3M Company: Company Snapshot

Figure 23 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 24 Westrock Company: Company Snapshot

Figure 25 Amcor Limited: Company Snapshot

Figure 26 Berry Plastics Corporation: Company Snapshot

Figure 27 Avery Dennison Corporation: Company Snapshot

Figure 28 CCL Industries Inc.: Company Snapshot

Figure 29 Constantia Flexibles Group GmbH: Company Snapshot

Figure 30 Bemis Company, Inc.: Company Snapshot

Figure 31 Sonoco Products Company: Company Snapshot

Growth opportunities and latent adjacency in Medical Packaging Market