Medical Equipment Cooling Market by Type (Liquid & Air-based Cooling), Compressor (Scroll, Screw, Centrifugal, Reciprocating), Configuration (Packaged, Modular, Split), Application (MRI, CT, PET, LINAC, Medical Lasers), End User (OEMS, Hospitals & Labs, Diagnostic Treatment Centers & Laboratories) - Global Forecast to 2024

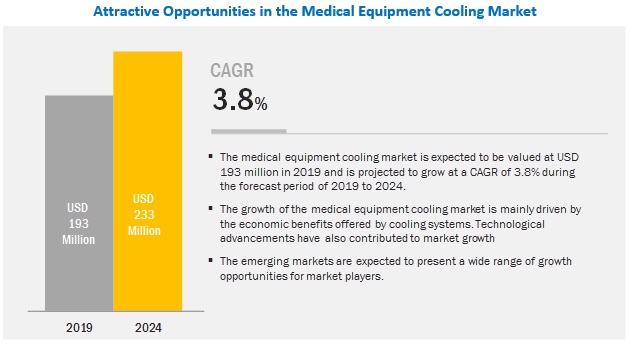

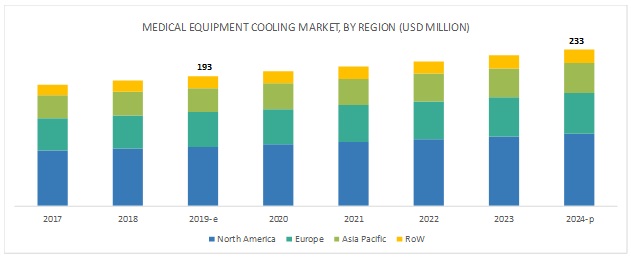

[138 Pages Report] The medical equipment cooling market is projected to grow from an estimated USD 233 million in 2024 to USD 193 million by 2019, at a CAGR of 3.8% during the forecast period. Growth of the market is mainly driven by the economic benefits offered by cooling systems, rising incidence of cancer and other diseases, and growing geriatric population.

By type, the liquid-based cooling segment was the largest contributor to the medical equipment cooling market in 2018.

Based on type, the market is further segmented into liquid-based cooling and air-based cooling. The liquid-based cooling segment accounted for the largest share of the medical equipment cooling market in 2018. The large share of this segment can be attributed to the advantages of liquid-based cooling systems, such as consistent & better energy efficiency and uniform cooling capabilities that prevent damage to sensitive equipment.

By compressor, the screw compressor segment is expected to grow at the highest CAGR in the medical equipment cooling market during the forecast period.

On the basis of the type of compressor, the medical equipment cooling market is further categorized into screw, scroll, centrifugal, and reciprocating compressors. The scroll compressors segment is expected to grow at the highest growth rate during the forecast period owing to factors such as decreased vibration levels and the lower risk of Refrigerant leakage associated with the use of screw compressors.

The packaged systems segment was the largest contributor to the medical equipment cooling market, by configuration in 2018

On the basis of configuration, the global medical equipment cooling market is further segmented into modular, packaged, and split systems. The packaged systems segment accounted for the largest share of the medical equipment cooling systems market in 2018. A major advantage associated with these systems is that the components are assembled at a factory, which eliminates the need to design and install these systems. This advantage is a major contributing factor to the large share of the packaged systems segment in the market.

Asia Pacific is expected to grow at the highest CAGR in the medical equipment cooling market during the forecast period.

The Asia Pacific region is one of the major revenue-generating regions in the medical equipment cooling industry. China, India, and Japan are the major countries responsible for the high growth of this regional market owing to factors such as the increasing awareness of optimal Thermal Management of medical equipment, increase in healthcare expenditure, and rising geriatric population.

Key Market Players

Glen Dimplex Group (Ireland), Legacy Chiller Systems Inc. (US), and Filtrine Manufacturing Company, Inc. (US). Other key players in this market include Laird Technologies, Inc. (US), Cold Shot Chillers (US), KKT Chillers (Germany), General Air Products, Inc. (US), Drake Refrigeration, Inc. (US), Lytron, Inc. (US), Motivair Corporation (US), American Chillers (US), Parker Hannifin Corp (US), Whaley Products Inc. (US), Johnson Thermal Systems (US), and Haskris (US), among others.

Glen Dimplex is a leading player in the medical equipment cooling systems market. The company manufactures and delivers a wide range of chillers and cooling solutions across the medical, food packaging, plastics, and semiconductor industries in the US and internationally. Glen Dimplex offers active and passive cooling solutions either in integrated or stand-alone modes, for a wide range of medical equipment such as CT, MRI, linear accelerators, and medical laser technology. Along with high-quality products the company also offers a comprehensive range of tailored services to meet customer needs. The company has a global presence and a prominent after-sales service network, with locations across the US, China, Germany, and Ireland.

The scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2024 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2024 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Type, Compressor, Configuration, Application, End User, and Region |

|

Geographies Covered |

North America (US & Canada), Europe (Germany, France, UK, and RoE), APAC (Japan, China, India, and RoAPAC), and the RoW |

|

Companies Covered |

Glen Dimplex Group (Ireland), Legacy Chiller Systems Inc. (US), and Filtrine Manufacturing Company, Inc. (US). Other key players in this market include Laird Technologies, Inc. (US), Cold Shot Chillers (US), KKT Chillers (Germany), General Air Products, Inc. (US), Drake Refrigeration, Inc. (US), Lytron, Inc. (US), Motivair Corporation (US), American Chillers (US), Parker Hannifin Corp (US), Whaley Products Inc. (US), Johnson Thermal Systems (US), and Haskris (US). 15 major players were covered. |

This research report categorizes the medical equipment cooling market based on Type, Compressor, Configuration, Application, End User, and Region.

Medical Equipment Cooling Market, by Type

- Liquid-based Cooling

- Air-based Cooling

Medical Equipment Cooling Market, by Compressor

- Scroll Compressors

- Screw Compressors

- Centrifugal Compressors

- Reciprocating Compressors

Medical Equipment Cooling Market, by Configuration

- Packaged Systems

- Modular Systems

- Split Systems

Medical Equipment Cooling Market, by Application

-

Medical Devices

-

Medical Imaging Systems

- Magnetic Resonance Imaging Systems (MRI)

- Computed tomography scanners (CT)

- Positron Emission tomography systems (PET)

- Medical Lasers

- Linear Accelerators

-

Medical Imaging Systems

- Analytical & Laboratory Equipment

- Original Equipment Manufacturers (OEMs)

- Hospitals, Laboratories, & Outpatient Clinics

- Independent Diagnostic & Treatment Centers and Laboratories

- Other End Users

Medical Equipment Cooling Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World

Recent Developments:

- In 2018, Laird Technologies (US) enhanced its Tunnel Series TEA which offers an expanded line of cooling capacities ranging up to 100 watts.

- In 2016, KKT Chillers (Germany) established a new service center in Shanghai, China, to meet the increasing demand for chillers in the region.

Key Questions Addressed by the Report:

- What are the growth opportunities related to the adoption of medical equipment cooling across major regions in the future?

- Emerging countries have immense opportunities for the growth and adoption of medical equipment cooling modalities. Will this scenario continue in the next five years?

- Where will all the advancements in products offered by various companies take the industry in the mid- to long-term?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Estimation Methodology

2.2.1 Product-Based Market Estimation

2.2.2 Volume-Based Market Estimation

2.2.3 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Research Limitations and Assumptions

2.4.1 Limitations

2.4.2 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Medical Equipment Cooling Market Overview

4.2 Regional Analysis: Medical Equipment Cooling Market, By Configuration

4.3 Medical Equipment Cooling Market, By Type

4.4 Medical Equipment Cooling Market, By Compressor (USD Million)

4.5 Medical Equipment Cooling Market, By Application

4.6 Asia Pacific: Medical Equipment Cooling Market, By End User

4.7 Medical Equipment Cooling Market, By Region

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Economic Benefits Offered By Medical Equipment Cooling

5.2.1.2 Technological Advancements in Diagnostic Imaging Modalities

5.2.1.3 Growing Global Prevalence of Cancer

5.2.1.4 Increasing Geriatric Population and Disease Incidence

5.2.1.5 Growing Number of Diagnostic Centers and Hospitals

5.2.2 Opportunities

5.2.2.1 Emerging Markets

5.2.3 Challenges

5.2.3.1 Risk of Corrosion in Cooling Systems

6 Medical Equipment Cooling Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Liquid-Based Cooling

6.2.1 Long Lifespans and Reduced Noise of Liquid Cooling Systems are Key Drivers of Market Growth

6.2.2 Liquid-Liquid Configuration

6.2.3 Liquid-Air Heat Transfer Configuration

6.2.4 Compressor-Based Recirculating Configuration

6.3 Air-Based Cooling

6.3.1 The Reduced Cost of Air Cooling is A Key Factor Driving Product Demand

6.3.2 Direct-To-Air Configuration

6.3.3 Air-To-Air Configuration

7 Medical Equipment Cooling Market, By Compressor (Page No. - 50)

7.1 Introduction

7.2 Scroll Compressors

7.2.1 Reduced Prices of Scroll Compressors are Driving Their Demand Among End Users

7.3 Screw Compressors

7.3.1 Screw Compressors Offer the Advantage of Reduced Risk of Refrigerant Leakage

7.4 Centrifugal Compressors

7.4.1 High Energy Efficiency of Centrifugal Compressors – A Major Factor Driving Their Demand Among End Users

7.5 Reciprocating Compressors

7.5.1 The Complex Nature of Installation of Reciprocating Compressors is Limiting Their Adoption

8 Medical Equipment Cooling Market, By Configuration (Page No. - 56)

8.1 Introduction

8.2 Packaged Systems

8.2.1 Components Assembled at A Factory Eliminate the Need to Design and Install These Systems—A Key Factor Driving Market Growth

8.3 Modular Systems

8.3.1 Modular Cooling Systems are Self-Contained, Which Eliminates the Need to Assemble Components—A Key Factor Driving the Adoption of These Systems

8.4 Split Systems

8.4.1 The Added Cost of Assembling and Engineering Split Units is A Key Market Restraint

9 Medical Equipment Cooling Market, By Application (Page No. - 61)

9.1 Introduction

9.2 Medical Devices

9.2.1 Medical Imaging Systems

9.2.1.1 Magnetic Resonance Imaging Systems

9.2.1.1.1 Growing Use of Mri Systems in Diagnostic Imaging is Driving Market Growth

9.2.1.2 Computed Tomography Scanners

9.2.1.2.1 Technological Advancements in the Field of CT are Driving the Demand for Optimal Cooling

9.2.1.3 Positron Emission Tomography Scanners

9.2.1.3.1 Increasing Use of Pet Scanners has Boosted the Demand for Cooling Systems

9.2.2 Medical Lasers

9.2.2.1 Optimal Cooling is Required to Improve the Shelf-Life of Lasers

9.2.3 Linear Accelerators

9.2.3.1 Increasing Prevalence of Cancer is Driving the Demand for Linac Cooling

9.3 Analytical & Laboratory Equipment

9.3.1 Need for High Heat Dissipation in Analytical and Laboratory Equipment Driving the Growth

10 Medical Equipment Cooling Market, By End User (Page No. - 70)

10.1 Introduction

10.2 Original Equipment Manufacturers

10.2.1 OEMs Depend on Efficient Cooling Systems to Remove High-Watt Density Heat Loads From Medical Imaging Equipment

10.3 Hospitals, Laboratories, and Outpatient Clinics

10.3.1 Growth of This Segment Can Be Attributed to the Rising Number of Diagnostic Imaging Procedures Performed in Hospital Settings

10.4 Independent Diagnostic & Treatment Centers and Laboratories

10.4.1 Increasing Number of Private and Public Imaging Centers to Support Market Growth

10.5 Other End Users

11 Medical Equipment Cooling Market, By Region (Page No. - 76)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 US Dominates the Global Medical Equipment Cooling Market, Due to the Presence of A Well-Established Healthcare System & Greater Adoption of Advanced Technologies in the Region

11.2.2 Canada

11.2.2.1 Lower Adoption of Advanced Medical Devices is Restraining the Growth of the Medical Equipment Cooling Market in Canada

11.3 Europe

11.3.1 Germany

11.3.1.1 Germany to Register the Highest Growth in the European Medical Equipment Cooling Market During the Forecast Period

11.3.2 UK

11.3.2.1 Increasing Adoption of High-End Cancer Diagnostic Equipment to Drive Market Growth

11.3.3 France

11.3.3.1 Rising Healthcare Expenditure in France has Boosted the Adoption of Medical Equipment Cooling Systems

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Favorable Government Investments and Growing Population Have Driven Healthcare Infrastructural Development

11.4.2 Japan

11.4.2.1 Rising Geriatric Population is Boosting the Adoption of Medical Equipment Cooling in Japan

11.4.3 India

11.4.3.1 India’s First Domestic, Low-Cost Mri Machine Was Introduced in 2018

11.4.4 Rest of Asia Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 111)

12.1 Introduction

12.2 Ranking of Players, 2017

12.3 Competitive Scenario

12.3.1 Product Enhancement

12.3.1 Expansions

12.4 Vendor Dive Overview

12.5 Vendor Inclusion Criteria

12.6 Vendor Dive

12.6.1 Vanguards

12.6.2 Innovators

12.6.3 Dynamic Players

12.6.4 Emerging Companies

13 Company Profiles (Page No. - 115)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 American Chillers

13.2 Cold Shot Chillers

13.3 Drake Refrigeration, Inc.

13.4 Filtrine Manufacturing Company

13.5 General Air Products, Inc.

13.6 Glen Dimplex Group

13.7 Haskris

13.8 Johnson Thermal Systems

13.9 KKT Chillers

13.10 Laird Technologies, Inc.

13.11 Legacy Chiller Systems

13.12 Lytron Inc

13.13 Motivair Corporation

13.14 Parker Hannifin Corp

13.15 Whaley Products, Inc.

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 131)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (92 Tables)

Table 1 Medical Equipment Cooling Market, By Type, 2017–2024 (USD Million)

Table 2 Liquid-Based Cooling Market, By Type, 2017–2024 (USD Million)

Table 3 Liquid-Based Cooling Market, By Region, 2017–2024 (USD Million)

Table 4 Air-Based Cooling Market, By Type, 2017–2024 (USD Million)

Table 5 Air-Based Cooling Market, By Region, 2017–2024 (USD Million)

Table 6 Market, By Compressor, 2017–2024 (USD Million)

Table 7 Market for Scroll Compressors, By Region, 2017–2024 (USD Million)

Table 8 Market for Screw Compressors, By Region, 2017–2024 (USD Million)

Table 9 Market for Centrifugal Compressors, By Region, 2017–2024 (USD Million)

Table 10 Market for Reciprocating Compressors, By Region, 2017–2024 (USD Million)

Table 11 Market, By Configuration, 2017–2024 (USD Million)

Table 12 Packaged Medical Equipment Cooling Systems Market, By Region, 2017–2024 (USD Million)

Table 13 Modular Medical Equipment Cooling Systems Market, By Region, 2017–2024 (USD Million)

Table 14 Split Medical Equipment Cooling Systems Market, By Region, 2017–2024 (USD Million)

Table 15 Market, By Application, 2017–2024 (USD Million)

Table 16 Medical Device Cooling Market, By Region, 2017–2024 (USD Million)

Table 17 Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 18 Medical Imaging System Cooling Market, By Application, 2017–2024 (USD Million)

Table 19 Medical Imaging System Cooling Market, By Region, 2017–2024 (USD Million)

Table 20 Mri System Cooling Market, By Region, 2017–2024 (USD Million)

Table 21 CT Scanner Cooling Market, By Region, 2017–2024 (USD Million)

Table 22 Pet Scanner Cooling Market, By Region, 2017–2024 (USD Million)

Table 23 Medical Laser Cooling Market, By Region, 2017–2024 (USD Million)

Table 24 Linac Cooling Market, By Region, 2017–2024 (USD Million)

Table 25 Analytical & Laboratory Equipment Cooling Market, By Region, 2017–2024 (USD Million)

Table 26 Market, By End User, 2017–2024 (USD Million)

Table 27 Market for Original Equipment Manufacturers, By Region, 2017–2024 (USD Million)

Table 28 Market for Hospitals, Laboratories, and Outpatient Clinics, By Region, 2017–2024 (USD Million)

Table 29 Market for Independent Diagnostic & Treatment Centers and Laboratories, By Region, 2017–2024 (USD Million)

Table 30 Market for Other End Users, By Region, 2017–2024 (USD Million)

Table 31 Market, By Region, 2017–2024 (USD Million)

Table 32 North America: Market, By Country, 2017–2024 (USD Million)

Table 33 North America: Market, By Type, 2017–2024 (USD Million)

Table 34 North America: Market, By Compressor, 2017–2024 (USD Million)

Table 35 North America: Market, By Configuration, 2017–2024 (USD Million)

Table 36 North America: Market, By Application, 2017–2024 (USD Million)

Table 37 North America: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 38 North America: Medical Imaging System Cooling Market, By Application, 2017–2024 (USD Million)

Table 39 North America: Market, By End User, 2017–2024 (USD Million)

Table 40 US: Market, By Type, 2017–2024 (USD Million)

Table 41 US: Market, By Application, 2017–2024 (USD Million)

Table 42 US: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 43 Canada: Market, By Type, 2017–2024 (USD Million)

Table 44 Canada: Market, By Application, 2017–2024 (USD Million)

Table 45 Canada: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 46 Europe: Market, By Country, 2017–2024 (USD Million)

Table 47 Europe: Market, By Type, 2017–2024 (USD Million)

Table 48 Europe: Market, By Compressor, 2017–2024 (USD Million)

Table 49 Europe: Market, By Configuration, 2017–2024 (USD Million)

Table 50 Europe: Market, By Application, 2017–2024 (USD Million)

Table 51 Europe: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 52 Europe: Medical Imaging System Cooling Market, By Application, 2017–2024 (USD Million)

Table 53 Europe: Market, By End User, 2017–2024 (USD Million)

Table 54 Germany: Market, By Type, 2017–2024 (USD Million)

Table 55 Germany: Market, By Application, 2017–2024 (USD Million)

Table 56 Germany: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 57 UK: Market, By Type, 2017–2024 (USD Million)

Table 58 UK: Market, By Application, 2017–2024 (USD Million)

Table 59 UK: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 60 France: Market, By Type, 2017–2024 (USD Million)

Table 61 France: Market, By Application, 2017–2024 (USD Million)

Table 62 France: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 63 RoE: Market, By Type, 2017–2024 (USD Million)

Table 64 RoE: Market, By Application, 2017–2024 (USD Million)

Table 65 RoE: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 66 Asia Pacific: Market, By Country, 2017–2024 (USD Million)

Table 67 Asia Pacific: Market, By Type, 2017–2024 (USD Million)

Table 68 Asia Pacific: Market, By Compressor, 2017–2024 (USD Million)

Table 69 Asia Pacific: Market, By Configuration, 2017–2024 (USD Million)

Table 70 Asia Pacific: Market, By Application, 2017–2024 (USD Million)

Table 71 Asia Pacific: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 72 Asia Pacific: Medical Imaging System Cooling Market, By Application, 2017–2024 (USD Million)

Table 73 Asia Pacific: Market, By End User, 2017–2024 (USD Million)

Table 74 China: Market, By Type, 2017–2024 (USD Million)

Table 75 China: Market, By Application, 2017–2024 (USD Million)

Table 76 China: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 77 Japan: Market, By Type, 2017–2024 (USD Million)

Table 78 Japan: Market, By Application, 2017–2024 (USD Million)

Table 79 Japan: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 80 India: Market, By Type, 2017–2024 (USD Million)

Table 81 India: Market, By Application, 2017–2024 (USD Million)

Table 82 Japan: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 83 RoAPAC: Market, By Type, 2017–2024 (USD Million)

Table 84 RoAPAC: Market, By Application, 2017–2024 (USD Million)

Table 85 RoAPAC: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 86 RoW: Market, By Type, 2017–2024 (USD Million)

Table 87 RoW: Market, By Compressor, 2017–2024 (USD Million)

Table 88 RoW: Market, By Configuration, 2017–2024 (USD Million)

Table 89 RoW: Market, By Application, 2017–2024 (USD Million)

Table 90 RoW: Medical Device Cooling Market, By Application, 2017–2024 (USD Million)

Table 91 RoW: Medical Imaging System Cooling Market, By Application, 2017–2024 (USD Million)

Table 92 RoW: Market, By End User, 2017–2024 (USD Million)

List of Figures (31 Figures)

Figure 1 Medical Equipment Cooling Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Bottom-Up Approach Market Size Estimation: Medical Equipment Cooling Market

Figure 4 Top-Down Approach Market Size Estimation: Medical Equipment Cooling Product Market

Figure 5 Data Triangulation Methodology

Figure 6 Market, By Type, 2019 (USD Million)

Figure 7 Market, By Compressor, 2019 vs 2024 (USD Million)

Figure 8 Market Share, By Configuration, 2019 vs 2024

Figure 9 Market Share, By Application, 2019 vs 2024

Figure 10 Market, By End User, 2019 vs 2024 (USD Million)

Figure 11 Market: Geographical Snapshot

Figure 12 Technological Advancements in Diagnostic Imaging are Driving the Growth of the Medical Equipment Cooling Market

Figure 13 North America to Dominate the Medical Equipment Cooling Configuration Market in 2019

Figure 14 Air-Based Cooling to Register the Highest CAGR in the Market During the Forecast Period

Figure 15 Scroll Compressors to Dominate the Market During the Forecast Period

Figure 16 Medical Imaging Systems to Hold the Largest Share of the Medical Device Cooling Market During the Forecast Period

Figure 17 Original Equipment Manufacturers to Dominate the Market in Asia Pacific in 2019

Figure 18 China to Witness the Highest CAGR During the Forecast Period (2019–2024)

Figure 19 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Liquid-Based Cooling Segment Dominated the Market During the Forecast Period

Figure 21 Scroll Compressors Segment to Account for the Largest Share of the Market During the Forecast Period

Figure 22 Packaged Systems to Hold the Largest Share of the Market During the Forecast Period

Figure 23 Medical Devices to Hold the Largest Share of the Market During the Forecast Period

Figure 24 OEMs are Expected to Hold the Largest Share of the Market During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Europe: Market Snapshot

Figure 27 Asia Pacific: Market Snapshot

Figure 28 RoW: Market Snapshot

Figure 29 Glen Dimplex Group Held the Leading Position in the Market in 2017

Figure 30 Competitive Leadership Mapping (Overall Market)

Figure 31 Parker Hannifin Corp: Company Snapshot (2018)

This study involved four major activities in estimating the current size of the medical equipment cooling market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Businessweek, and Factiva) were referred to in order to identify and collect information for this study.

Primary Research

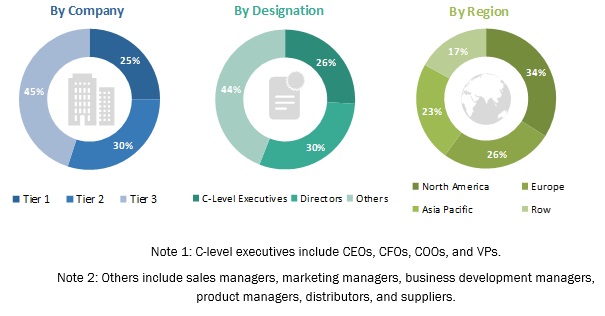

The medical equipment cooling market comprises several stakeholders such as medical equipment cooling system manufacturers, suppliers and distributors, healthcare service providers, and diagnostic centers. The demand side of this market is characterized by the increasing technological advancements in diagnostic imaging modalities and the global rise in the prevalence of cancer. The supply side is characterized by advancements in technology and product enhancements. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical equipment cooling market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the medical equipment cooling industry.

Report Objectives

- To define, describe, and forecast the global medical equipment cooling market on the basis of type, compressor, configuration, application, end user, and region

- To provide detailed information regarding major factors influencing the growth of the market (such as drivers, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to four main regions, namely, North America (the US and Canada), Europe (Germany, France, the UK, and RoE), Asia Pacific (China, Japan, India, and RoAPAC), and the Rest of the World

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as new product launches; agreements, partnerships, and joint ventures; mergers & acquisitions; and research & development activities in the medical equipment cooling market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global medical equipment cooling market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market companies (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Equipment Cooling Market