CT Scanner Market by Type (Stationary, Portable), Architecture (C-arm, O-arm), Technology (High, Mid, Low Slice, CBCT), Application (Human, Veterinary, Research), End User (Hospital, Diagnostic Center, Research, Veterinary Clinic) - Global Forecast to 2022

The global CT scanner market is expected to grow at a CAGR of 5.4%. Major factors driving the growth of this market include growing need for effective and early diagnosis, rising global prevalence of targeted diseases coupled with an aging population, increasing preference for minimally invasive diagnostic procedures, increasing benefits of CT scans over other imaging modalities, and technological advancements. However, ssignificant installation and maintenance costs, uncertain reimbursement scenario across developing nations, dearth of well-trained and skilled healthcare professionals may hinder the growth of the CT scanner market during the forecast period.

Market Dynamics

Drivers

- Technological advancements

- Growing patient emphasis on effective and early disease diagnosis

- Rising prevalence of targeted diseases

- Increasing preference for minimally invasive diagnostic procedures

- Procedural benefits offered by computed tomography

Restraints

- Significant installation and maintenance costs

- Uncertain reimbursement scenario across developing nations

- Dearth of well-trained and skilled healthcare professionals

Opportunities

- Emerging markets

- Growing market preference for multimodal Diagnostic Imaging systems

- Ongoing market shift towards image-guided interventions

Challenges

- Growing adoption of refurbished CT Scanner

Technological innovation coupled with rising preference for minimally invasive surgeries are the major drivers for the market.

Over the last decade, the diagnostic imaging industry has witnessed significant technological advancements in the field of computed tomography, including the emergence of low-dose and automated CT scanners. These devices offer high image quality with improved spatial resolution and low radiation exposure to the patient as well as surgeons. These advanced CT devices have a simplified console, offer ease of operability, and provide affordable installation with minimal space requirements. These factors are driving the adoption of such products among healthcare professionals and researchers across major healthcare markets worldwide. Moreover, ongoing advancements in the field of semiconductor materials have enabled device miniaturization as well as the development of multi-slice CT scanners that offer 128-, 256-, 320-, or 500- slice CT images. These developments along with expansion in the application horizon of CT technology have resulted in their growing adoption among various end users worldwide. For instance, in 2015, Siemens Healthineers (Germany) received U.S. FDA’s 510(k) clearance for its SOMATOM Force, SOMATOM Definition Flash, SOMATOM Definition Edge, SOMATOM Definition AS/AS+, SOMATOM Perspective, SOMATOM Scope, and the SOMATOM Emotion 16 CT systems; these systems offer low radiation exposure during lung cancer screening. Also, in 2016, Koninklijke Philips N.V. (Netherlands) launched the IQon Spectral CT system in Canada; this system offers exclusive spectral imaging capabilities with low radiation exposure.

The following are the major objectives of the study

To define, describe, and forecast the CT scanner market on the basis of product type, device architecture, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the market

- To analyze opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to four major regions, namely, North America, Europe, Asia-Pacific, and RoW2

- To profile the key players in the market and comprehensively analyze their market shares and core competencies3

- To track and analyze competitive developments such as product launches; agreements, partnerships, & collaborations; mergers & acquisitions; and research & development activities in the global CT scanner market

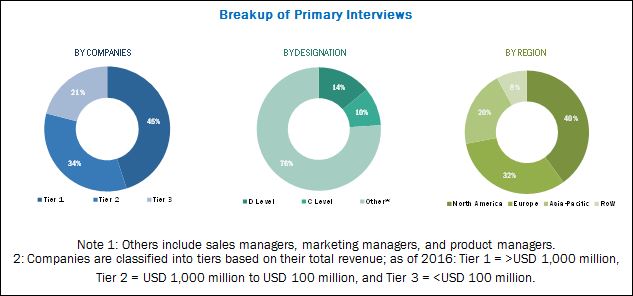

During this research study, major players operating in the CT scanner market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Major players in the CT scanner market include General Healthcare (US), Siemens (Germany), Philips (Netherlands), Toshiba Corporation (Japan), Hitachi (Japan), Shimadzu (Japan), Samsung (South Korea), Neusoft Medical Systems. (China), Medtronic (Ireland), Shenzhen (Hong Kong), and Accuray (US), among others. Product approvals, launches, and enhancements were the key strategies adopted by players to grow and expand their presence in the CT scanner market.

Major Market Developments:

- In 2017, GE Healthcare introduced a dedicated cardiovascular CT system, namely, CardioGraphe which creates 3D images of coronaries, valves, chambers and myocardium in one heartbeat.

- In 2017, Toshiba, signed a three-year pricing agreement with Varex Imaging Corporation in order to supply CT tubes for integration into Toshiba’s CT systems

- In 2017, Siemens signed an agreement with HeartFlow for the integration of Siemens’s CT scanner systems with HeartFlow’s FFRct Analysis.

- In 2017, Hiatchi, signed an agreement with Redlen Technologies for the development of a multi-energy photon-counting Computed tomography (PCCT) semiconductor detector module

Target Audience:

- CT scanning device manufacturers

- Medical device suppliers and distributors

- Research laboratories and academic institutes

- Research and development (R&D) companies

- Government and non-government organizations

- Venture capitalists and other private funding organizations

- Market research and consulting firms

- Healthcare service providers (including hospitals and diagnostic centers)

- Veterinary hospitals and clinics

- Pharmaceutical and biotechnology companies

Scope of the Report

This report categorizes the Coronary Stent market into the following segments and subsegments.

Global CT scanner market, by type

- Stationary CT scanners

- Portable CT scanners

Global CT scanner market, by device architecture

- C-arm CT Scanners

- O-arm CT Scanners

Global CT scanner market, by technology

- High-slice CT

- Mid-slice CT

- Low-slice CT

- Cone-beam CT (CBCT)

Global CT scanner market, by application

- Human Application

- Diagnostic Applications

- Cardiology Applications

- Oncology Applications

- Neurology Applications

- Other Diagnostic Applications

- Intraoperative Applications

- Veterinary Application

- Research Application

Global CT scanner market, by region

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

The global CT scanners market is expected to reach USD 6.20 billion by 2022 from USD 4.76 billion in 2017, at a CAGR of 5.4% during the forecast period. Technological advancements, growing patient emphasis on early disease diagnosis, rising incidence of targeted diseases, increasing priority for minimally invasive diagnostic procedures, and procedural benefits offered by CT scanners are key factors driving the growth of the market.

The CT scanner market is segmented into type, device architecture, technology, application, and end user. On the basis of type, the market is categorized into stationary and portable CT scanner, in which stationary CT scanners is expected to account for the largest share of the market. This is attributed to the significant adoption of stationary CT scanners for its growing application horizons.

Based on device architecture, the CT scanner market is segmented into C-arm and O-arm CT scanners. The O-arm CT segment is estimated to command the larger share of the global market due to the ongoing commercialization of mobile CT scanners and the procedural benefits offered by the O-arm devices.

On the basis of technology, the CT scanner market is segmented into high-slice, mid-slice, low-slice, and cone beam CT technology. In 2017, the high-slice segment is estimated to command the largest share, majorly due to the rising adoption of CT for diagnostic procedures and the expanded application horizons of CT technology.

Based on applications, the global CT scanners market is segmented into human, veterinary, and research applications. The human applications segment is further sub segmented into diagnostic applications (cardiology, oncology, neurology, and other diagnostic applications) and intraoperative applications. The human application segment is estimated to command the largest share of the global CT scanner market in 2017, due to increasing market demand in intraoperative surgical procedures, increasing demand for effective disease management, and the rising incidence of chronic diseases.

On the basis of the end user, the CT scanners market is segmented into hospitals and diagnostic centers, ambulatory care centers, research laboratories, veterinary clinics, and other end users. Among these veterinary clinics and hospitals segment is poised to grow the fastest during the forecast period mainly due to growing market demand for enhanced virility of poultry & livestock and rising prevalence of major veterinary diseases.

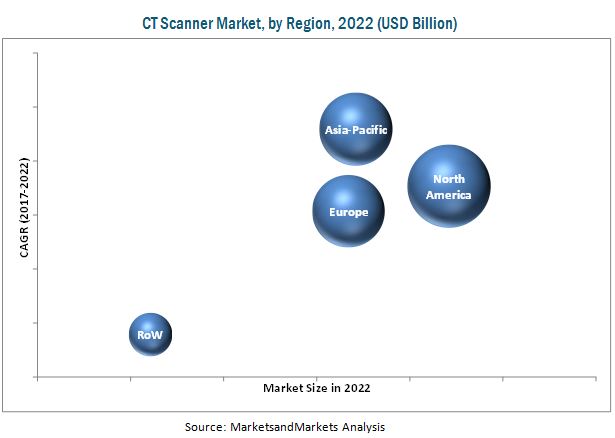

North America is expected to command the largest share of the market in 2017. However, Asia-Pacific is expected to register the highest growth rate during the forecast period, due increasing incidence of target diseases, rising patient awareness on the benefits of CT scanning in early disease diagnosis, ongoing expansion and modernization of healthcare infrastructure in Asian countries.

Cone Beam CT Technology form the fastest growing technology segment.

HIGH-SLICE CT

High-slice CT scanners offer advanced imaging capabilities, with as many as 128, 256, 320, or more slices in a single rotation. These devices offer advanced capabilities for cardiac and Vascular Imaging as well as cancer diagnosis and treatment. Market growth is mainly driven by the ongoing commercialization of advanced products across major markets, increasing public-private investments in the field of high-slice CT, and growing emphasis on effective & early disease diagnosis & treatment. Moreover, advanced CT imaging capabilities offered by high-slice CT devices and their growing adoption for out-patient diagnostic procedures have expanded their application horizons.

MID-SLICE CT

Mid-slice CT scanners offer 32- and 64-slice capabilities in a single rotation. As compared to low-slice CT scanners, these acquire images much faster and feature significant diagnostic accuracy and a larger application base (such as detection of coronary stenosis, kidney stones, appendicitis, and spinal stenosis). The growth in the CT scanner market is expected to be propelled by factors such as availability of significant clinical data to validate clinical efficacy of 64-slice CT scanners in cardiology, vascular imaging, and neurology applications; growing adoption of 64- & 32-slice CT devices in oncology, trauma, and critical care; ongoing technological advancements in this field; and modernization of healthcare infrastructure & services across emerging countries.

LOW-SLICE CT

Low-slice CT scanners offer single-plane CT imaging or multi-slice imaging capabilities with 4, 8, or 16 slices in a single rotation. These include multi-slice CT devices and conventional CT scanners. Market growth for low-slice CT is driven by the significant use of these scanners for major clinical applications (such as pulmonary imaging, urological imaging, intra-operative imaging, and image-guided surgical procedures), large installation base for low-slice CT scanners across major healthcare markets, affordable product pricing (as compared to medium- & high-slice devices), and greater market preference for low-slice devices across emerging countries (due to the optimal imaging capabilities, need of limited operational skills, and product affordability).

CONE BEAM CT (CBCT)

Cone beam CT scanners use a single or multiple X-ray sources that focus on the target area, forming a focused cone beam. These devices are used for specific applications in the fields of dentistry, endodontics, maxillofacial surgeries, and otolaryngology, among others. The growing market demand for CBCT scanners can be attributed to the increasing applications of CBCT technology in human diagnostic applications (such as dental implants, maxillofacial surgeries, and neck surgeries), procedural advantages offered by CBCT (such as limited radiation exposure, affordable product costs, and low scanning time), rising market demand for cosmetic dentistry & aesthetic procedures (coupled with the rising trend of medical tourism across emerging countries), and ongoing product development & commercialization of innovative CBCT devices across major healthcare markets.

Critical questions the report answers:

- What would be key clinical areas for CBCT-based procedures during next decade; how its market would grow in coming years?

- Emerging countries have immense growth opportunities for CT scanners industry, will this scenario continue?

- Which of the application segment will poise the highest/fastest revenue impact during the forecast period?

- Portable devices are witnessing significant growth potential in CT scanner market; how market relevant stationary CT scanners would be during coming decade?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Physicians largely depend on radiologists for the effective evaluation of CT scan examinations. Therefore, technical skill and on-hand experience of radiologists are critical to ensuring the optimal use of CT devices for effective and accurate disease diagnosis and for image-guided interventions. Poorly captured images may lead to incorrect interpretation or unnecessary repetition of CT scan examinations during a specific disease diagnosis. A well-trained radiologist, on the other hand, is able to interpret the scanned image in order to document the presence of any medical abnormalities as mandated by relevant professional organizations or respective regulatory authorities in the country. There is a significant gap between growth in the number of CT device installations and availability of target workforce capable of accurate data interpretation at a country-level. For instance, the number of CT & MRI scans in U.K. increased by 29% and 26%, respectively during 2012-2015, however, the number of consultant radiologists to interpret the image data increased by ~5% in the country during the same period. The dearth of radiologists with required technical skills and experience for accurate interpretation of CT imaging data is expected to restrain the optimal adoption of CT scanners across respective countries during the forecast period.

Key players in the CT Scanner Market include General Electric Company (US), Siemens (Germany), Philips (Netherlands), Toshiba (Japan), Hitachi (Japan), Shimadzu (Japan), Samsung (South Korea), Neusoft Medical Systems (China), Medtronic (Ireland), and Shenzhen (Hong Kong), among others.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 CT Scanner Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Major Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Opportunity Indicators

2.2.1 Introduction

2.2.1.1 Geriatric Population

2.2.1.2 Incidence and Prevalence of Cancer

2.2.1.3 Burden of Cardiovascular Diseases (CVDS)

2.2.1.4 Healthcare Expenditure Patterns

2.3 CT Scanner Market Estimation Methodology

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 CT Scanner Market Overview (2017)

4.2 Geographic Analysis: Market, By End User (2017 vs 2022)

4.3 Geographic Analysis: Market, By Application (2017 vs 2022)

4.4 Geographical Analysis: Market, By Technologies (2017)

4.5 Geographic Snapshot: Market (2017-2022)

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 CT Scanner Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements

5.2.1.2 Growing Patient Emphasis on Effective and Early Disease Diagnosis

5.2.1.3 Rising Prevalence of Target Diseases

5.2.1.4 Increasing Patient Preference for Minimally Invasive Diagnostic Procedures

5.2.1.5 Procedural Benefits Offered By Computed Tomography

5.2.2 Restraints

5.2.2.1 Significant Installation and Maintenance Costs

5.2.2.2 Uncertain Reimbursement Scenario Across Developing Nations

5.2.2.3 Dearth of Well-Trained and Skilled Healthcare Professionals

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Growing Market Preference for Multimodal Diagnostic Imaging Systems

5.2.3.3 Ongoing Market Shift Towards Image-Guided Medical Interventions

5.2.4 Challenges

5.2.4.1 Growing Adoption of Refurbished CT Scanners

6 CT Scanner Market, By Type (Page No. - 50)

6.1 Introduction

6.2 Stationary CT Scanners

6.2.1 Floor vs Ceiling Mounted Stationary CT Scanners

6.3 Portable CT Scanners

7 CT Scanner Market, By Device Architecture (Page No. - 56)

7.1 Introduction

7.2 C-Arm CT Scanners

7.3 O-Arm CT Scanners

8 CT Scanner Market, By Technology (Page No. - 60)

8.1 Introduction

8.2 High-Slice CT

8.3 Mid-Slice CT

8.4 Low-Slice CT

8.5 Cone Beam CT (CBCT)

9 CT Scanner Market, By Application (Page No. - 67)

9.1 Introduction

9.2 Human Applications

9.2.1 Diagnostic Applications

9.2.1.1 Cardiology Applications

9.2.1.2 Oncology Applications

9.2.1.3 Neurology Applications

9.2.1.4 Other Diagnostic Applications

9.2.2 Intraoperative Applications

9.3 Veterinary Applications

9.4 Research Applications

10 CT Scanner Market, By End User (Page No. - 79)

10.1 Introduction

10.2 Hospitals and Diagnostic Centers

10.3 Research Laboratories, Academic Institutes, & Cros

10.4 Ambulatory Care Centers

10.5 Veterinary Clinics and Hospitals

10.6 Other End Users

11 Global CT Scanner Market, By Region (Page No. - 88)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.3 Europe

11.4 Asia-Pacific

11.5 Rest of the World

12 Competitive Landscape (Page No. - 108)

12.1 Overview

12.2 Global CT Scanner Market

12.2.1 CT Scanner Market Ranking (As of 2016)

12.2.2 Competitive Leadership Mapping (2017)

12.2.2.1 Vendor Inclusion Criteria

12.2.2.2 Visionary Leaders

12.2.2.3 Innovators

12.2.2.4 Dynamic Differentiators

12.2.2.5 Emerging Companies

12.2.3 Product Offering Scorecard

12.2.4 Business Strategy Scorecard

*Top 25 Companies Analyzed for This Studies are - Koninklijke Philips N.V. (Netherlands), GE Healthcare (Part of General Electric Co., U.S.), Toshiba Corporation (Japan), Siemens AG (Germany), Hitachi Ltd. (Japan), Shimadzu Corporation (Japan), Samsung Electronics Co., Ltd. (South Korea), Neusoft Medical Systems Co., Ltd. (China), Medtronic PLC (Ireland), Shenzhen Anke High-Tech Co., Ltd. (Hong Kong), Accuray Incorporated (U.S.), Planmed (Finland), Koning Corporation (U.S.), Carestream Health Inc. (U.S.), Pointnix Co. Ltd (South Korea), Epica Medical Innovations (U.S.), Scanco Medical AG (Switzerland), AB-CT - Advanced Breast-CT GmbH (Germany), Brainlab AG (Germany), Curvebeam (U.S.) Imaging Sciences International LLC (U.S.), Genoray Co., Ltd. (Korea), United-Imaging (China), Xoran Technologies, LLC. (U.S.), Trivitron Healthcare Private Limited (India)

13 Company Profiles (Page No. - 113)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

13.1 GE Healthcare (A Subsidiary of General Electric Company)

13.2 Siemens AG

13.3 Koninklijke Philips N.V.

13.4 Toshiba Corporation

13.5 Hitachi Ltd

13.6 Shimadzu Corporation

13.7 Samsung Electronics Co., Ltd.

13.8 Neusoft Corporation

13.9 Medtronic PLC

13.10 Shenzhen Anke High-Tech Co., Ltd.

13.11 Accuray Incorporated

13.12 Planmed Oy

13.13 Koning Corporation

13.14 Carestream Health, Inc.

13.15 Pointnix Co., Ltd.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 165)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (61 Tables)

Table 1 U.S.: Annual Maintenance Costs of Major CT Scanner Manufacturers (2016)

Table 2 Global CT Scanner Market Size, By Type, 2015–2022 (USD Million)

Table 3 U.S CT Scanner Market Size By Type, 2015-2022 (USD Million)

Table 4 Stationary CT Scanner Market Size, By Region, 2015–2022 (USD Million)

Table 5 Portable CT Scanner Market Size, By Region, 2015–2022 (USD Million)

Table 6 Global CT Scanner Market Size, By Device Architecture, 2015-2022 (USD Million)

Table 7 C-Arm CT Scanner Market Size, By Region, USD Million (2015-2022)

Table 8 O-Arm CT Scanner Market Size, By Region, 2015-2022 (USD Million)

Table 9 Global CT Scanner Market Size, By Technology, 2017–2022 (USD Million)

Table 10 U.S CT Scanner Market Size By Technology, 2015-2022 (USD Million)

Table 11 High-Slice CT Market Size, By Region, 2017–2022 (USD Million)

Table 12 Mid-Slice CT Market Size, By Region, 2017–2022 (USD Million)

Table 13 Low-Slice CT Market Size, By Region, 2017–2022 (USD Million)

Table 14 Cone Beam CT Market Size, By Region, 2017–2022 (USD Million)

Table 15 Global CT Scanner Market Size, By Application, 2015-2022 (USD Million)

Table 16 Global Market Size for Human Applications, By Type, 2015-2022 (USD Million)

Table 17 Market Size for Human Application, By Region, 2015-2022 (USD Million)

Table 18 Global Market Size for Diagnostic Applications, By Type, 2015-2022 (USD Million)

Table 19 Market Size for Diagnostic Applications, By Region, 2015-2022 (USD Million)

Table 20 Market Size for Cardiology Applications, By Region, 2015-2022 (USD Million)

Table 21 Market Size for Oncology Applications, By Region, 2015-2022 (USD Million)

Table 22 Market Size for Neurology Applications, By Region, 2015-2022 (USD Million)

Table 23 CT Scanner Market Size for Other Diagnostic Applications, By Region, 2015-2022 (USD Million)

Table 24 Market Size for Intraoperative Applications, By Region, 2015-2022 (USD Million)

Table 25 Market Size for Veterinary Applications, By Region, 2015-2022 (USD Million)

Table 26 Market Size for Research Applications, By Region, 2015-2022 (USD Million)

Table 27 Global CT Scanner Market Size, By End User, 2017–2022 (USD Million)

Table 28 CT Scanner Market Size for Hospitals and Diagnostic Centers, By Region, 2017–2022 (USD Million)

Table 29 Market Size for Research Laboratories, Academic Institutes, & Cros, By Region, 2015–2022 (USD Million)

Table 30 Market Size for Ambulatory Care Centers, By Region, 2017–2022 (USD Million)

Table 31 Market Size for Veterinary Clinics and Hospitals, By Region, 2017–2022 (USD Million)

Table 32 Market Size for Other End Users, By Region, 2017–2022 (USD Million)

Table 33 CT Scanner Market Size, By Region, 2015-2022 (USD Million)

Table 34 North America: CT Scanner Market Size, By Product Type, 2015-2022 (USD Million)

Table 35 North America: Market Size, By Techology, 2015-2022 (USD Million)

Table 36 North America: Market Size, By Device Architecture, 2015-2022 (USD Million)

Table 37 North America: Market Size, By Application, 2015-2022 (USD Million)

Table 38 North America: Market Size for Human Application, By Type, 2015-2022 (USD Million)

Table 39 North America: CT Scanner Market Size for Human Diagnostic Application, By Type, 2015-2022 (USD Million)

Table 40 North America: CT Scaner Market Size, By End User, 2015-2022 (USD Million)

Table 41 Europe: CT Scanner Market Size, By Product Type, 2015-2022 (USD Million)

Table 42 Europe: Market Size, By Techology, 2015-2022 (USD Million)

Table 43 Europe: Market Size, By Device Architecture, 2015-2022 (USD Million)

Table 44 Europe: CT Scanner Market Size, By Application, 2015-2022 (USD Million)

Table 45 Europe: Market Size for Human Application, By Type, 2015-2022 (USD Million)

Table 46 Europe: Market Size for Human Diagnostic Application, By Type, 2015-2022 (USD Million)

Table 47 Europe: Market Size, By End User, 2015-2022 (USD Million)

Table 48 Asia-Pacific: CT Scanner Market Size, By Product Type, 2015-2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Techology, 2015-2022 (USD Million)

Table 50 Asia-Pacific: Market Size, By Device Architecture, 2015-2022 (USD Million)

Table 51 Asia-Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 52 Asia-Pacific: CT Scanner Market Size for Human Application, By Type, 2015-2022 (USD Million)

Table 53 Asia-Pacific: Market Size for Human Diagnostic Application, By Type, 2015-2022 (USD Million)

Table 54 Asia-Pacific By End User, 2015-2022 (USD Million)

Table 55 Rest of the World: CT Scanner Market Size, By Product Type, 2015-2022 (USD Million)

Table 56 Rest of the World: Market Size, By Techology, 2015-2022 (USD Million)

Table 57 Rest of the World: Market Size, By Device Architecture, 2015-2022 (USD Million)

Table 58 Rest of the World: Market Size, By Application, 2015-2022 (USD Million)

Table 59 Rest of the World: CT Scanner Market Size for Human Application, By Type, 2015-2022 (USD Million)

Table 60 Rest of the World: Market Size for Human Diagnostic Application, By Type, 2015-2022 (USD Million)

Table 61 Rest of the World: CT Scanner Market Size, By End User, 2015-2022 (USD Million)

List of Figures (51 Figures)

Figure 1 Research Design

Figure 2 Increase in Aging Population, By Country (2010 vs 2015)

Figure 3 Percentage Increase in Geriatric Population, By Region (1980–2010 vs 2010–2040)

Figure 4 Global Burden of Cancer, By Region (2005–2030)

Figure 5 Number of New Cancer Cases, By Country (2012 vs 2020)

Figure 6 Cardiovascular Diseases Burden: By Region (2005–2030)

Figure 7 Bottom-Up Approach

Figure 8 Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Assumptions of the Research Study

Figure 11 CT Scanner Market Size, By Type, 2017 vs 2022 (USD Million)

Figure 12 Market Size, By Technology, 2017 vs 2022 (USD Million)

Figure 13 CT Scanner Market Size, By Device Architecture, 2017 vs 2022 (USD Million)

Figure 14 Market Size, By Application 2017 vs 2022 (USD Million)

Figure 15 Market Size, By End User, 2017 vs 2022 (USD Million)

Figure 16 Geographical Snapshot of the Global Market

Figure 17 Increasing Global Prevalence of Targeted Diseases to Drive Growth in the CT Scanner Market

Figure 18 Hospitals & Diagnostic Centers to Dominate the Global Market Across All Regions in 2017

Figure 19 Human Diagnostic Applications Segment to Dominate the Global Market Across All Regions in 2017

Figure 20 North America to Dominate All Major CT Scanner Technology Segments in 2017

Figure 21 North America to Dominate the Global Market During the Forecast Period

Figure 22 Technological Innovation Coupled With Rising Preference for Minimally Invasive Surgeries to Drive the Market Growth for CT Scanners

Figure 23 Annual Healthcare Expenditure (% GDP): Developed vs Developing Countries (2010–2015)

Figure 24 Stationary CT Scanner Market to Dominate the Global Market During 2017-2022

Figure 25 O-Arm CT Scanners to Dominate the Global Market During the Forecast Period

Figure 26 High Slice CT Technology to Dominate the Global Market During the Forecast Period

Figure 27 North America to Lead the Market for Cone Beam CT Technology During 2017-2022

Figure 28 Human Application to Dominate the Global Market During 2017-2022

Figure 29 Cardiology to Lead the CT Scanner Market for Diagnostic Application During 2017-2022

Figure 30 North America to Dominate the Market for Veterinary Application During the Forecast Period

Figure 31 Hospitals and Diagnostics to Dominate the End User CT Scanner Market During 2017-2022

Figure 32 North America to Dominate the Market for Ambulatory Care Centers During 2017-2022

Figure 33 North America to Lead the CT Scanner Market for Vetrinary Clinics and Hospitals During the Forecast Period

Figure 34 North America: Market Snapshot (2017-2022)

Figure 35 Europe: CT Scanner Market Snapshot (2017-2022)

Figure 36 Asia-Pacific: Market Snapshot (2017-2022)

Figure 37 Rest of the World: Market Snapshot (2017-2022)

Figure 38 Global CT Scanner Market Ranking (As of 2016)

Figure 39 Competitive Leadership Benchmarking

Figure 40 General Electric Company: Company Snapshot (2016)

Figure 41 Siemens AG: Company Snapshot (2016)

Figure 42 Koninklijke Philips N.V.: Company Snapshot (2016)

Figure 43 Toshiba Corporation: Company Snapshot (2016)

Figure 44 Hitachi Ltd: Company Snapshot (2015)

Figure 45 Shimadzu Corporation: Company Snapshot (2015)

Figure 46 Samsung Electronics Co., Ltd.: Company Snapshot (2016)

Figure 47 Neusoft Corporation: Company Snapshot (2016)

Figure 48 Medtronic PLC: Company Snapshot (2016)

Figure 49 Fullshare Holdings Ltd.: Company Snapshot (2016)

Figure 50 Accuray Incorporated: Company Snapshot (2016)

Figure 51 ONEX Corporation: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in CT Scanner Market