Medical Engineered Materials Market by Type (Medical plastics, medical foams, medical films, medical elastomers, medical adhesives), Application (Medical device, disposables, medical wearables, advanced wound care), and Region - Global Forecast to 2025

Updated on : April 16, 2024

Medical Engineered Materials Market

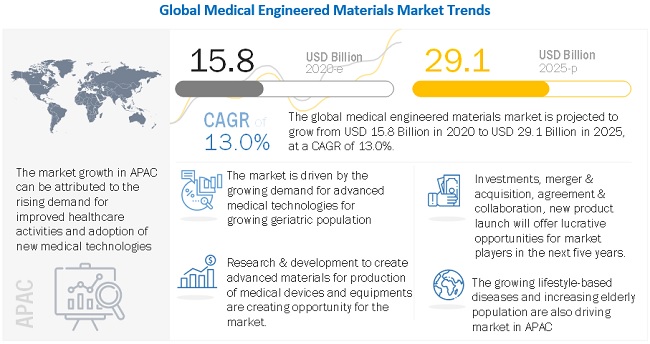

The global medical engineered materials market was valued at USD 15.8 billion in 2020 and is projected to reach USD 29.1 billion by 2025, growing at 13.0% cagr from 2020 to 2025. The growing demand for medical engineered materials is due to increasing healthcare investments and growing aging population in APAC, the Middle East & Africa, and South America, and growing demand for improvement in healthcare establishments are driving the medical engineered materials market. The market is primarily constrained by strict regulatory standards and a drawn-out clearance process. The industry for medical engineered materials is facing significant challenges related to disposal of medical waste.

The demand for medical plastics is predicted to increase as a result of expanding healthcare infrastructure in developing nations and an increase in the prevalence of chronic diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Medical engineered materials Market

The medical engineered materials are used mainly in healthcare sector for manufacturing of medical devices and equipments. They are also used in production of disposables, advanced wound care products, and wearables.

- The outbreak of COVID-19 has led to rising concerns over hygiene, leading to an increased demand for PPE kits, gloves, masks, and drapes. Shortfalls in capacity have prompted healthcare facilities to boost and expand their infrastructure to meet the demands of an increasing patient inflow. The demand for PPE kits and masks has risen from all quarters of the medical sector as well as from the common public.

- A shortage of and limited access to supplies such as gloves, medical masks, respirators, goggles, face shields, gowns, and aprons had left doctors, nurses, and other frontline workers dangerously ill-equipped to care for COVID-19 patients. Companies have been working to provide the required volume of masks and other essentials for healthcare workers. For instance, Apple (US) donated 2 million masks to the US in March 2020. Similarly, Microsoft has shipped 15,000 pairs of protective goggles, as well as infrared thermometers, medical caps, and protective suits to various countries.

- Medical devices such as ventilators, thermal scanners, patient care systems, and related equipment will grow at a faster pace than others during the pandemic. Ventilators are critical devices in fight against Covid pandemic, which necessitates a quicker supply of raw materials such as plastics, adhesives, and elastomers, their proper and timely logistical support, and regulatory approvals. Diagnostic instruments & devices such as thermal scanners are equipment designed to diagnose and monitor medical conditions are also in greater demand due to their requirement in diagnosing initial onset of the disease.

Medical Engineered Materials Market Dynamics

Driver: Rising geriatric population demands advanced medical technologies and devices

Medical devices and equipment are used in various diagnostic, procedural, and surgical applications. Medical engineered materials are used in manufacturing these devices and equipment. Changing demographics such as the aging population and new strains of diseases are driving the demand for engineered materials in medical devices. Growth in the aging population, globally, is having a significant impact on product design and manufacture. In addition, demand for comfortable design is growing among the elderly population. New materials, such as soft-touch TPEs and technologies, including overmolding, are some of the new innovations, which would drive the demand for medical engineered materials during the forecast period.

Restrain: Time consuming regulatory procedures

Government control over prices of medical devices, varied regulations, and time-consuming approval processes are some of the restraining factors for the medical engineered materials market. Governments control the cost of the healthcare facilities to ensure that the facilities are available to all. This price pressure exists across all nodes of the value chain. As a result, medical device manufacturers and raw material suppliers need to control their costs. This reduces the profit margin of these players, along with restructuring their costs. The global healthcare industry is highly regulated. Medical device approval authorities monitor device safety and performance in various methods and provide product clearance in different time periods.

Opportunity: R&D to create advanced materials

Engineered materials play an important role in the manufacturing of medical devices and equipment. Medical engineered materials are customized to suit the need of a particular device. The need for customized products according to the requirements to provide properties such as biodegradability, radio-opacity, and antimicrobial properties is creating high growth opportunities for the market. The use of engineered materials in the medical industry has increased manifold in the last decade. These engineered materials are replacing traditional materials such as metals, ceramics, and glass.

Challenge: Medical waste management concerns

Medical wastes can be classified as waste containing infectious materials. It includes waste generated by healthcare facilities such as hospitals, laboratories, medical research facilities, and veterinary clinics. Plastics contribute significant amount of the medical wastes generated. On the one hand, the shift toward the use of disposables has increased the use of plastics, but on the other, it is generating more plastic wastes. Some single-use devices can also be reused after reprocessing. However, the fear of inadequately decontaminated products causing infection leads to the disposal of these products. Manufacturers have started recycling plastics, but its wastage is still a major challenge for the medical engineered materials market.

Medical plastics is estimated to be the largest market in the overall medical engineered materials market in 2020.

Medical plastics is the major largest segment amongst others in the market. Medical plastics are required in various applications in the healthcare field such as manufacturing of medical devices, tools, and diagnostic equipments which is responsible for the large market size. Growing healthcare infrastructure in emerging economies and increasing instances of chronic diseases are expected to drive the medical devices market, which, in turn, is likely to propel the demand for medical plastics.

Medical disposables is expected to be the largest medical engineered materials consuming sector in 2020.

The medical disposables segment is expected to account for the largest share in the overall market in 2020. Medical disposables are medical instruments which that are designed and developed to be disposed after one time or temporary use. Low cost, easy to process, biocompatible, and sterilizability are some of the leading attributes sought in medical disposables. Increased incidences of chronic diseases, changing lifestyle of the middle-income group, demand for better healthcare facilities, and an increase in the aging population are the major drivers for the market

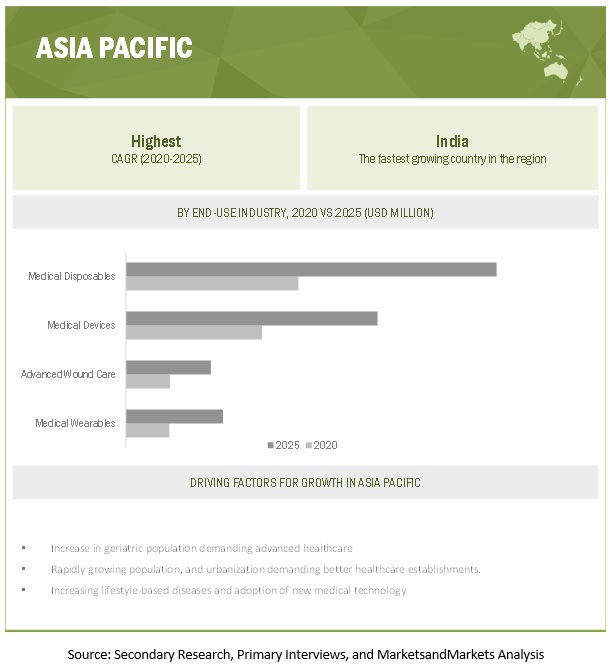

Based on region, APAC is projected to grow the fastest in the medical engineered materials market during the forecast period.

APAC is projected to be the fastest-growing market for medical engineered materials. The rising population, increased demand for better healthcare establishments, and increased lifestyle based diseases are driving the APAC medical engineered materials market. China is the largest market for medical engineered materials in the region. China is also a major producer and consumer of medical engineered materials in the region as it has a huge manufacturing base. Apart from China, India, Japan, and South Korea are projected to grow at a fast pace during the forecast period. In addition, increasing incorporation of digitization and other advanced technologies such as 3D printing for manufacturing of medical devices are responsible for the high growth of the market in this segment.

The recent COVID-19 pandemic has impacted the global healthcare industry as well as the economy of various economies. COVID-19 has led to rising concerns over hygiene, leading to an increased demand for PPE kits, gloves, masks, and drapes. Shortfalls in capacity have prompted healthcare facilities to boost and expand their infrastructure to meet the demands of an increasing patient inflow. The demand for PPE kits and masks has risen from all quarters of the medical sector as well as from the common public. Similarly, demand for devices and equipments such as ventilators, respirators, thermal scanners, and oximeters have also increased due to their requirement in treating and identifying Covid patients.

To know about the assumptions considered for the study, download the pdf brochure

Medical Engineered Materials Market Players

The key players profiled in this report include Evonik (Germany), Covestro (Germany), BASF (Germany), Solvay (Belgium), SABIC (Saudi Arabia), Trelleborg AB (Sweden), DSM (Netherlands), Celanese (US), and DuPont (US). These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2020 to enhance their regional presence and meet the growing demand for medical engineered materials from emerging economies.

Medical Engineered Materials Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Volume (Kiloton) and Value (USD) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

Evonik (Germany), BASF (Germany), Covestro (Germany), Solvay (Belgium), SABIC (Saudi Arabia) |

This research report categorizes the medical engineered materials market based on type, application, and region.

Medical Engineered Materials Market by Type:

- Medical Plastics

- Medical Foams

- Medical Films

- Medical Adhesives

- Medical Elastomer

Medical Engineered Materials Market by Application:

-

MEDICAL DEVICES

- DIAGNOSTIC EQUIPMENT

- SURGICAL EQUIPMENT

- DENTAL TOOLS

- OTHERS

-

MEDICAL DISPOSABLES

- SURGICAL INSTRUMENT & SUPPLIES

- DIAGNOSTIC & LABORATORY DISPOSABLES

- MEDICAL & LABORATORY GLOVES

- OTHERS

-

MEDICAL WEARABLES

- SMART WATCH

- ACTIVITY MONITOR

- PATCHES

- OTHERS

-

ADVANCED WOUNDCARE

- DRESSINGS

- DEVICES & ACCESSORIES

- GRAFT & MATRICES

- OTHERS

Medical Engineered Materials Market by Region:

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The medical engineered materials market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In October 2020, Covestro invested to build a new construction line in Thailand to produce polycarbonate films. This investment is expected to strengthen the company's position in APAC.

- In June 2020, BASF The company invested USD 10 billion for the construction of verbund site in Zhanjiang, Guangdong. The plants will produce engineered plastics and thermoplastic polyurethane (TPU) to serve the increasing needs of various growth industries in the southern China market and throughout Asia.

- In October 2019, SABIC launched its Polycarbonate (PC) based on certified renewable feedstock, providing SABIC and its customers with a solution that has the potential to reduce both CO2 emissions and the use of fossil feedstock during production. The certified PC resin is useful for applications in all market segments, such as automotive, consumer, electronics and electrical, building & construction, and healthcare.

- In April 2018, Evonik developed a new variety of RESOMER Composites. These bioresorbable polymers enhance the performance of applications and encourage faster patient healing.

Frequently Asked Questions (FAQ):

What is the current size of the global medical engineered materials market?

Global medical engineered materials market size is estimated USD 29.1 billion by 2025 from USD 15.8 billion in 2020, at a CAGR of 13.0%.

Are there any regulations for medical engineered materials?

Several countries in Europe and North America have introduced regulations for healthcare sector. For e.g., in the European Union, the manufacturer uses Conformité Européene (CE) mark on the device after receiving the CE certificate from the regulatory body. In the US, FDA Center for Devices and Radiological Health (CDRH) regulates devices, which are inserted into the body.

Who are the winners in the global medical engineered materials market?

Companies such as Evonik, Covestro, BASF, SABIC, Solvay, Celanese Corporation, DuPont, DSM, Trelleborg, and Eastman Chemical Company fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What is the COVID-19 impact on medical engineered materials manufacturers?

Industry experts believe that COVID-19 could affect healthcare sector globally. A shortage of and limited access to supplies such as gloves, medical masks, respirators, goggles, face shields, gowns, and aprons had left doctors, nurses, and other frontline workers dangerously ill-equipped to care for COVID-19 patients. Deficits in volume have prompted healthcare facilities to boost and expand their infrastructure to meet the demands of an increasing patient inflow.

What are some of the drivers in the market?

The increasing requirement of customized products for aging population and growing healthcare sector in emerging economies are driving the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 MEDICAL ENGINEERED MATERIALS MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.3 PRIMARY LIST

2.1.3.1 Key industry insights

2.1.3.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.3.1 MEDICAL ENGINEERED MATERIALS MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

2.4 LIMITATIONS

2.5 ASSUMPTIONS

2.6 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6.1 SUPPLY SIDE

2.6.2 DEMAND SIDE

3 EXECUTIVE SUMMARY (Page No. - 35)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MEDICAL ENGINEERED MATERIALS MARKET

4.2 MEDICAL ENGINEERED MATERIALS MARKET, BY TYPE

4.3 MEDICAL ENGINEERED MATERIALS MARKET, BY APPLICATION

4.4 MEDICAL ENGINEERED MATERIALS MARKET, BY MAJOR COUNTRIES

4.5 APAC MEDICAL ENGINEERED MATERIALS MARKET, BY TYPE AND COUNTRY, 2019

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising geriatric population demands advanced medical technologies and devices

5.2.1.2 Growing healthcare investments in emerging economies

5.2.1.3 shift toward minimally invasive surgical procedures

5.2.2 RESTRAINTS

5.2.2.1 time consuming regulatory procedures

5.2.3 OPPORTUNITIES

5.2.3.1 R&D to CREATE advanced materials

5.2.3.2 Development of patient-specific equipment using 3D printing

5.2.4 CHALLENGES

5.2.4.1 Medical waste management concerns

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TARIFFS & REGULATIONS

5.4.1 TARIFFS

5.4.2 REGULATIONS

5.4.2.1 US

5.4.2.2 Europe

5.4.3 COUNTRY-WISE REGULATIONS

5.5 TRADE DATA

5.5.1 TOP 10 IMPORTERS OF MEDICAL GOODS, 2019

5.5.1.1 Top 10 Medical Exporters of Medical Goods, 2019

5.6 MACROECONOMIC ANALYSIS

5.7 CASE STUDY ANALYSIS

5.8 TECHNOLOGY ANALYSIS:

5.8.1 INTEGRATION OF MEDICAL WEARABLES WITH NOVEL TECHNOLOGIES SUCH AS IOT, ADVANCED TECHNOLOGIES, DATA ANALYTICS, AND MATERIAL SCIENCE

5.8.2 3D PRINTING

5.9 AVERAGE SELLING PRICE

5.10 ECOSYSTEM

5.11 IMPACT OF COVID-19 ON MEDICAL ENGINEERED MATERIALS MARKET

5.11.1 COVID-19

5.11.2 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

5.11.3 IMPACT ON END-USE INDUSTRIES

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.12.1 MEDICAL PLASTICS USED IN WEARABLE MATERIALS AND ROBOTICS WILL IMPACT GROWTH

5.13 VALUE CHAIN ANALYSIS

5.13.1 RAW MATERIAL SUPPLIERS

5.13.2 RESIN MANUFACTURERS

5.13.3 DISTRIBUTORS/CONVERTORS

5.13.4 OEM/MEDICAL DEVICE MANUFACTURERS

5.14 PATENT ANALYSIS

6 MEDICAL ENGINEERED MATERIALS MARKET, BY TYPE (Page No. - 68)

6.1 INTRODUCTION

6.2 MEDICAL PLASTICS

6.2.1 USE IN MEDICAL DEVICES MANUFACTURING TO DRIVE THE DEMAND

6.2.2 ENGINEERING PLASTICS

6.2.3 HIGH-PERFORMANCE PLASTICS

6.2.4 SILICONE

6.3 MEDICAL FOAMS

6.3.1 BIOCOMPATIBILITY AND NON-TOXIC NATURE TO DRIVE THE DEMAND

6.3.2 FLEXIBLE FOAMS

6.3.3 RIGID FOAMS

6.3.4 SPRAY FOAMS

6.4 MEDICAL FILMS

6.4.1 NECESSITY IN WOUND CARE AND PACKAGING TO DRIVE THE DEMAND

6.4.2 POLYURETHANE (PU) FILMS

6.4.3 SILICONE FILMS

6.4.4 POLYAMIDE FILMS

6.4.5 OTHERS

6.5 MEDICAL ELASTOMERS

6.5.1 RESILIENCE AND FLEXIBILITY PROPERTIES TO DRIVE MARKET GROWTH

6.5.2 THERMOSET ELASTOMERS

6.5.3 THERMOPLASTIC ELASTOMERS

6.6 MEDICAL ADHESIVES

6.6.1 USE OF ADHESIVES IN MEDICAL DEVICE MANUFACTURING AND DRESSINGS TO DRIVE THE MARKET

7 MEDICAL ENGINEERED MATERIALS MARKET, BY APPLICATION (Page No. - 79)

7.1 INTRODUCTION

7.2 MEDICAL DEVICES

7.2.1 GROWING POPULATION AND INCREASE IN THE NUMBER OF HOSPITALS AND TREATMENT CLINICS TO DRIVE THE MEDICAL DEVICES MARKET

7.2.2 DIAGNOSTIC EQUIPMENT

7.2.3 SURGICAL EQUIPMENT

7.2.4 DENTAL TOOLS

7.2.5 OTHERS

7.3 MEDICAL DISPOSABLES

7.3.1 GROWING CONCERN REGARDING THE SPREAD OF DISEASES THROUGH CONTACT TO DRIVE THE MARKET

7.3.2 SURGICAL INSTRUMENTS & SUPPLIES

7.3.3 DIAGNOSTIC & LABORATORY DISPOSABLES

7.3.4 MEDICAL & LABORATORY ACCESSORIES

7.3.5 OTHERS

7.4 MEDICAL WEARABLES

7.4.1 INCREASING AWARENESS OF LIVING FIT AND HEALTHY LIFE TO DRIVE THE MARKET

7.4.2 SMART WATCH

7.4.3 ACTIVITY MONITOR

7.4.4 PATCHES

7.4.5 OTHERS

7.5 ADVANCED WOUND CARE

7.5.1 TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF WOUND CARE ARE DRIVING THE MARKET

7.5.2 DRESSINGS

7.5.3 DEVICES & ACCESSORIES

7.5.4 GRAFT & MATRICES

7.5.5 OTHERS

8 MEDICAL ENGINEERED MATERIALS MARKET, BY REGION (Page No. - 91)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 Availability of advanced healthcare infrastructure to drive the market

8.2.2 CANADA

8.2.2.1 Innovative R&D activities likely to drive the market

8.2.3 MEXICO

8.2.3.1 Growing Mexican economy to influence the medical engineered materials market

8.3 APAC

8.3.1 CHINA

8.3.1.1 New healthcare projects due to large population to drive the medical engineered materials market

8.3.2 JAPAN

8.3.2.1 The large aging population in the country to influence the market

8.3.3 INDIA

8.3.3.1 Rising standard of living and new healthcare facilities in urban and rural areas to drive the market

8.3.4 SOUTH KOREA

8.3.4.1 Cutting edge technologies to drive the market

8.3.5 AUSTRALIA

8.3.5.1 Increasing chronic diseases are likely to influence the medical engineered materials market

8.3.6 REST OF APAC

8.4 EUROPE

8.4.1 GERMANY

8.4.1.1 Manufacturing of dental instruments gives boost to the market

8.4.2 FRANCE

8.4.2.1 Foreign investments in medical sector to drive the market

8.4.3 UK

8.4.3.1 Healthcare-related new infrastructural projects to boost the market

8.4.4 ITALY

8.4.4.1 Growing geriatric population to drive the medical engineered materials market

8.4.5 SPAIN

8.4.5.1 Government initiatives to support the medical engineered materials market

8.4.6 RUSSIA

8.4.6.1 Resolution passed by the government to support the medical engineered materials market

8.4.7 REST OF EUROPE

8.5 MIDDLE EAST & AFRICA

8.5.1 SAUDI ARABIA

8.5.1.1 Government initiatives to support the growth of the market

8.5.2 UAE

8.5.2.1 High income population of the UAE drives the demand for better healthcare services

8.5.3 SOUTH AFRICA

8.5.3.1 New government policies will support the medical engineered materials market

8.5.4 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 BRAZIL

8.6.1.1 Demand for better healthcare services to drive the market

8.6.2 ARGENTINA

8.6.2.1 Cosmetic and aesthetic surgery to boost the market

8.6.3 REST OF SOUTH AMERICA

9 COMPETITIVE LANDSCAPE (Page No. - 133)

9.1 OVERVIEW

9.2 REVENUE ANALYSIS OF TOP PLAYERS

9.3 MARKET SHARE, 2019

9.4 MARKET RANKING

9.4.1 EVONIK

9.4.2 COVESTRO

9.4.3 BASF

9.4.4 SABIC

9.4.5 SOLVAY

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STAR

9.5.2 PERVASIVE

9.5.3 PARTICIPANTS

9.6 COMPANY EVALUATION MATRIX, 2019

9.7 KEY MARKET DEVELOPMENTS

9.7.1 INVESTMENT & EXPANSION

9.7.2 MERGER & ACQUISITION

9.7.3 NEW PRODUCT/TECHNOLOGY LAUNCH

9.7.4 AGREEMENT & COLLABORATION

9.7.5 PARTNERSHIP

10 COMPANY PROFILES (Page No. - 147)

10.1 EVONIK

10.1.1 BUSINESS OVERVIEW

10.1.2 EVONIK: BUSINESS OVERVIEW

10.1.3 PRODUCTS OFFERED

10.1.4 RECENT DEVELOPMENTS

10.1.5 CURRENT FOCUS AND STRATEGIES

10.1.6 THREAT FROM COMPETITION

10.1.7 EVONIK’S RIGHT TO WIN

10.2 COVESTRO

10.2.1 BUSINESS OVERVIEW

10.2.2 COVESTRO: BUSINESS OVERVIEW

10.2.3 PRODUCTS OFFERED

10.2.4 RECENT DEVELOPMENTS

10.2.5 CURRENT FOCUS AND STRATEGIES

10.2.6 THREAT FROM COMPETITION

10.2.7 RIGHT TO WIN

10.3 BASF

10.3.1 BUSINESS OVERVIEW

10.3.2 BASF: BUSINESS OVERVIEW

10.3.3 PRODUCTS OFFERED

10.3.4 RECENT DEVELOPMENTS

10.3.5 RIGHT TO WIN

10.3.6 STRATEGIC CHOICES MADE

10.3.7 WEAKNESS AND COMPETITIVE THREAT

10.4 SABIC

10.4.1 BUSINESS OVERVIEW

10.4.2 SABIC: BUSINESS OVERVIEW

10.4.3 PRODUCTS OFFERED

10.4.4 RECENT DEVELOPMENTS

10.4.5 CURRENT FOCUS AND STRATEGIES

10.4.6 THREAT FROM COMPETITION

10.4.7 SABIC’S RIGHT TO WIN

10.5 SOLVAY

10.5.1 BUSINESS OVERVIEW

10.5.2 SOLVAY: BUSINESS OVERVIEW

10.5.3 PRODUCTS OFFERED

10.5.4 RECENT DEVELOPMENTS

10.5.5 CURRENT FOCUS AND STRATEGIES

10.5.6 THREAT FROM COMPETITION

10.5.7 SOLVAY’S RIGHT TO WIN

10.6 TRELLEBORG AB

10.6.1 BUSINESS OVERVIEW

10.6.2 TRELLEBORG AB: BUSINESS OVERVIEW

10.6.3 PRODUCTS OFFERED

10.6.4 RECENT DEVELOPMENTS

10.6.5 MNM VIEW

10.7 DUPONT

10.7.1 BUSINESS OVERVIEW

10.7.2 DSM: BUSINESS OVERVIEW

10.7.3 PRODUCTS OFFERED

10.7.4 RECENT DEVELOPMENTS

10.7.5 MNM VIEW

10.8 DSM

10.8.1 BUSINESS OVERVIEW

10.8.2 DSM: BUSINESS OVERVIEW

10.8.3 PRODUCTS OFFERED

10.8.4 RECENT DEVELOPMENTS

10.8.5 MNM VIEW

10.9 EASTMAN CHEMICAL COMPANY

10.9.1 BUSINESS OVERVIEW

10.9.2 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

10.9.3 PRODUCTS OFFERED

10.9.4 RECENT DEVELOPMENTS

10.9.5 MNM VIEW

10.10 CELANESE CORPORATION

10.10.1 BUSINESS OVERVIEW

10.10.2 CELANESE CORPORATION: BUSINESS OVERVIEW

10.10.3 PRODUCTS OFFERED

10.10.4 RECENT DEVELOPMENTS

10.10.5 MNM VIEW

10.11 OTHER KEY PLAYERS

10.11.1 HUNTSMAN CORPORATION

10.11.2 TRINSEO

10.11.3 TEKNOR APEX

10.11.4 ARKEMA

10.11.5 3M

10.11.6 HENKEL

10.11.7 BAXTER INTERNATIONAL

10.11.8 NITTO DENKO

10.11.9 MOMENTIVE PERFORMANCE MATERIALS INC.

10.11.10 SEKISUI CHEMICAL

10.11.11 RECTICEL

10.11.12 ETHICON

10.11.13 B.BRAUN

10.11.14 ENSINGER

10.11.15 RTP COMPANY

11 ADJACENT/RELATED MARKETS (Page No. - 186)

11.1 LIMITATIONS

11.2 ADVANCED WOUND CARE MARKET

11.2.1 ADVANCED WOUND CARE MARKET, MARKET OVERVIEW

11.2.2 ADVANCED WOUND CARE MARKET, BY PRODUCT

11.2.2.1 Dressings

11.2.2.2 Devices & accessories

11.2.2.3 Grafts & matrices

11.2.2.4 Topical agents

11.2.3 ADVANCED WOUND CARE MARKET, BY WOUND TYPE

11.2.3.1 Surgical & traumatic wounds

11.2.3.2 Diabetic foot ulcers

11.2.3.3 Pressure ulcers

11.2.3.4 Venous leg ulcers

11.2.3.5 Burns & other wounds

11.2.4 ADVANCED WOUND CARE MARKET, BY END-USER

11.2.4.1 Hospitals, ASCS, and wound care centers

11.2.4.2 Home care settings

11.2.4.3 Other end users

11.2.5 ADVANCED WOUND CARE MARKET, BY REGION

11.2.5.1 APAC

11.2.5.2 North America

11.2.5.3 Europe

11.2.5.4 Latin America

11.2.5.5 Middle East & Africa

11.3 MEDICAL WEARABLES MARKET

11.3.1 CLINICAL-GRADE WEARABLES MARKET, BY DEVICE TYPE

11.3.1.1 Vital sign monitoring devices

11.3.1.2 Glucose monitoring devices & insulin pumps

11.3.1.3 Fetal monitoring & obstetric devices

11.3.1.4 Neuromonitoring devices

11.3.1.5 Sleep monitoring devices

11.3.2 CLINICAL-GRADE WEARABLES MARKET, BY PRODUCT

11.3.2.1 Patches

11.3.2.2 Smartwatches

11.3.2.3 Activity monitors & wristbands

11.3.2.4 Other clinical-grade wearables

11.3.3 CLINICAL-GRADE WEARABLES MARKET, BY END-USER

11.3.3.1 Long-term care centers, assisted-living facilities, and nursing homes

11.3.3.2 Hospitals

11.3.3.3 Ambulatory care centers

11.3.3.4 Home care settings

11.3.4 CLINICAL-GRADE WEARABLES MARKET, BY REGION

11.3.4.1 APAC

11.3.4.2 North America

11.3.4.3 Europe

11.3.4.4 Middle East & Africa

11.3.4.5 Latin America

12 APPENDIX (Page No. - 207)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (132 TABLES)

TABLE 1 MEDICAL ENGINEERED MATERIALS MARKET: INCLUSIONS & EXCLUSIONS

TABLE 2 REGION-WISE TRENDS FOR GERIATRIC POPULATION

TABLE 3 CURRENT HEALTHCARE EXPENDITURE AS A % OF GDP

TABLE 4 NUMBER OF WTO MEMBERS PER AVERAGE MFN APPLIED TARIFF BAND AND AVERAGE MFN TARIFF

TABLE 5 LEGAL FRAMEWOK AND REGULATORY AUTHORITIES FOR MEDICAL DEVICES IN MAJOR COUNTRIES

TABLE 6 TOP 10 IMPORTERS OF MEDICAL GOODS

TABLE 7 TOP 10 EXPORTERS OF MEDICAL GOODS

TABLE 8 MACROECONOMIC ANALYSIS OF MAJOR COUNTRIES

TABLE 9 LIST OF PATENTS BY TERUMO CORP.

TABLE 10 LIST OF PATENTS BY COOK BIOTECH INC.

TABLE 11 LIST OF PATENTS BY TORAY INDUSTRIES.

TABLE 12 LIST OF PATENTS BY ETHICON ENDO-SURGERY LLC

TABLE 13 LIST OF PATENTS BY CAMBRIDGE POLYMER GROUP, INC.

TABLE 14 LIST OF PATENTS BY GEN HOSPITAL CORP.

TABLE 15 TOP 20 PATENT OWNERS (US) IN LAST 10 Y EARS

TABLE 16 MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 17 MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 18 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL PLASTICS SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 19 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL PLASTICS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL FOAMS SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 21 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL FOAMS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL FILMS SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 23 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL FILMS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL ELASTOMERS SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 25 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL ELASTOMERS SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL ADHESIVES SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 27 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL ADHESIVES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 29 MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 30 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL DEVICES SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 31 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL DEVICES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL DISPOSABLES SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 33 MEDICAL ENGINEERED MATERIALS MARKET SIZE MEDICAL DISPOSABLES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL WEARABLES SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 35 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR MEDICAL WEARABLES SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR ADVANCED WOUND CARE SEGMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 37 MEDICAL ENGINEERED MATERIALS MARKET SIZE FOR ADVANCED WOUND CARE SEGMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 39 MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 41 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 43 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 45 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 US: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 47 US: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 CANADA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 49 CANADA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 MEXICO: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 51 MEXICO: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 53 APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 55 APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 57 APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 CHINA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 59 CHINA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 JAPAN: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 61 JAPAN: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 62 INDIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 63 INDIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2 018–2025 (USD MILLION)

TABLE 64 SOUTH KOREA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 65 SOUTH KOREA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 66 AUSTRALIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 67 AUSTRALIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 REST OF APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 69 REST OF APAC: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 71 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 73 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 75 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 76 GERMANY: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 77 GERMANY: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 78 FRANCE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 79 FRANCE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 UK: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 81 UK: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 82 ITALY: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 83 ITALY: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 84 SPAIN: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 85 SPAIN: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 RUSSIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 87 RUSSIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 REST OF EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 89 REST OF EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 91 MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 93 MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 95 MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 96 SAUDI ARABIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 97 SAUDI ARABIA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 98 UAE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 99 UAE: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 SOUTH AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 101 SOUTH AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 REST OF MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 103 REST OF MIDDLE EAST & AFRICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 104 SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (KILOTON)

TABLE 105 SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 106 SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (KILOTON)

TABLE 107 SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 109 SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 110 BRAZIL: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 111 BRAZIL: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 112 ARGENTINA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 113 ARGENTINA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 114 REST OF SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (KILOTON)

TABLE 115 REST OF SOUTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 116 INVESTMENT & EXPANSION, 2018-2021

TABLE 117 MERGER & ACQUISITION, 2018-2021

TABLE 118 NEW PRODUCT/TECHNOLOGY LAUNCH, 2018-2021

TABLE 119 AGREEMENT & COLLABORATION, 2018–2021

TABLE 120 PARTNERSHIP, 2018–2021

TABLE 121 ADVANCED WOUND CARE MARKET SIZE, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 122 ADVANCED WOUND CARE MARKET SIZE, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 123 ADVANCED WOUND CARE MARKET SIZE, BY WOUND TYPE, 2016–2019 (USD MILLION)

TABLE 124 ADVANCED WOUND CARE MARKET SIZE, BY WOUND TYPE, 2020–2025 (USD MILLION)

TABLE 125 ADVANCED WOUND CARE MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 126 ADVANCED WOUND CARE MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

TABLE 127 ADVANCED WOUND CARE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 128 ADVANCED WOUND CARE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 129 CLINICAL-GRADE WEARABLES MARKET SIZE, BY DEVICE TYPE, 2018–2025 (USD MILLION)

TABLE 130 CLINICAL-GRADE WEARABLES MARKET SIZE, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 131 CLINICAL-GRADE WEARABLES MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 132 CLINICAL-GRADE WEARABLES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

LIST OF FIGURES (46 FIGURES)

FIGURE 1 MEDICAL ENGINEERED MATERIALS MARKET: RESEARCH DESIGN

FIGURE 2 KEY DATA FROM PRIMARY SOURCES

FIGURE 3 MEDICAL ENGINEERED MATERIALS MARKET: BOTTOM-UP APPROACH

FIGURE 4 MEDICAL ENGINEERED MATERIALS MARKET: TOP-DOWN APPROACH

FIGURE 5 MEDICAL ENGINEERED MATERIALS MARKET: DATA TRIANGULATION

FIGURE 6 MEDICAL ENGINEERED MATERIALS MARKET ANALYSIS THROUGH SECONDARY SOURCES

FIGURE 7 MEDICAL ENGINEERED MATERIALS MARKET ANALYSIS

FIGURE 8 PRIMARY INSIGHTS FOR THE MEDICAL ENGINEERED MATERIALS MARKET

FIGURE 9 MEDICAL PLASTICS ACCOUNTED FOR THE LARGEST SHARE IN 2019

FIGURE 10 MEDICAL DISPOSABLES ACCOUNTED FOR THE LARGEST SHARE IN THE MEDICAL ENGINEERED MATERIALS MARKET IN 2019

FIGURE 11 APAC WAS THE LARGEST MEDICAL ENGINEERED MATERIALS MARKET IN 2019

FIGURE 12 HIGH GROWTH OPPORTUNITIES IN EMERGING ECONOMIES

FIGURE 13 MEDICAL PLASTICS TO BE THE LARGEST TYPE OF MEDICAL ENGINEERED MATERIAL

FIGURE 14 MEDICAL DISPOSABLES TO BE THE LARGEST APPLICATION OF MEDICAL ENGINEERED MATERIALS

FIGURE 15 INDIA TO RECORD THE FASTEST CAGR DURING THE FORECAST PERIOD

FIGURE 16 MEDICAL PLASTICS ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE MEDICAL ENGINEERED MATERIALS MARKET

FIGURE 18 MEDICAL ENGINEERED MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 AVERAGE SELLING PRICE VARIES AS PER THE TYPE OF MEDICAL ENGINEERED MATERIAL. THE PRICE IS HIGHLY IMPACTED BY THE FLUCTUATIONS IN THE RAW MATERIAL PRICES.

FIGURE 20 MEDICAL ENGINEERED MATERIALS ECOSYSTEM

FIGURE 21 PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

FIGURE 22 ROBOTICS AND WEARABLES TO DRIVE FUTURE GROWTH

FIGURE 23 NO. OF PATENTS YEAR-WISE IN LAST 10 YEARS.

FIGURE 24 TOP JURISDICTION, BY DOCUMENT

FIGURE 25 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NO OF PATENTS

FIGURE 26 MEDICAL PLASTICS TO BE THE LARGEST TYPE OF MEDICAL ENGINEERED MATERIAL

FIGURE 27 MEDICAL DISPOSABLES TO BE THE LARGEST TYPE OF THE MEDICAL ENGINEERED MATERIALS MARKET

FIGURE 28 APAC TO BE THE LARGEST AND FASTEST-GROWING MEDICAL ENGINEERED MATERIALS MARKET

FIGURE 29 NORTH AMERICA: MEDICAL ENGINEERED MATERIALS MARKET SNAPSHOT

FIGURE 30 APAC: MEDICAL ENGINEERED MATERIALS MARKET SNAPSHOT

FIGURE 31 EUROPE: MEDICAL ENGINEERED MATERIALS MARKET SNAPSHOT

FIGURE 32 COMPANIES ADOPTED NEW PRODUCT LAUNCH AS THE KEY GROWTH STRATEGY DURING 2018–2021

FIGURE 33 TOP 5 PLAYERS LED THE MEDICAL ENGINEERED MATERIALS MARKET IN 2019

FIGURE 34 MARKET RANKING OF KEY PLAYERS

FIGURE 35 PRODUCT FOOTPRINT ANALYSIS FOR TOP PLAYERS

FIGURE 36 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 EVONIK: COMPANY SNAPSHOT

FIGURE 38 COVESTRO: COMPANY SNAPSHOT

FIGURE 39 BASF: COMPANY SNAPSHOT

FIGURE 40 SABIC: COMPANY SNAPSHOT

FIGURE 41 SOLVAY: COMPANY SNAPSHOT

FIGURE 42 TRELLEBORG: COMPANY SNAPSHOT

FIGURE 43 DUPONT: COMPANY SNAPSHOT

FIGURE 44 DSM: COMPANY SNAPSHOT

FIGURE 45 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 46 CELANESE CORPORATION: COMPANY SNAPSHOT

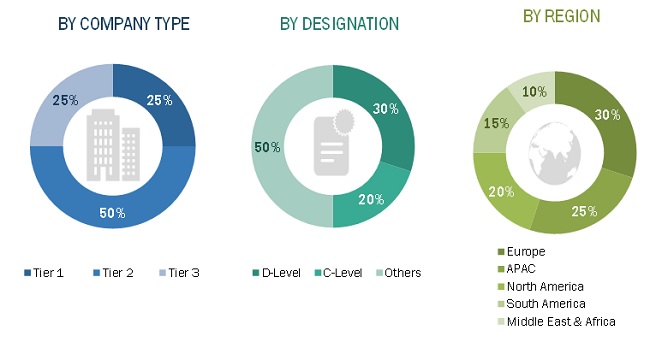

The study involved four major activities in estimating the current market size for Medical engineered materials . The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, OICA, CEFIC, food safety organizations, regulatory bodies, and databases.

Primary Research

The medical engineered materials market comprises several stakeholders such as raw material suppliers, distributors of medical engineered materials, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of medical OEM, compounders, manufacturer of medical devices and medical equipment. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical engineered materials market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, types, in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of medical engineered materials and their applications.

Objectives of the Study:

- To define and analyze the medical engineered materials market size in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type and application

- To forecast the size of the market with respect to five regions: Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments in the market, such as new product launch, investment & expansion, agreement & collaboration, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

- Notes: Micromarkets1 are the sub-segments of the Medical Engineered Materials market included in the report.

- Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the medical engineered materials market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Engineered Materials Market