Medical Device Outsourced Manufacturing Market by Device Type (IVD (Equipment, Consumable), Diabetes, Respiratory, Cardiovascular, Personal Care, Endoscopy, Dental, Ophthalmology, Devices) Class of Device, Services, Procedure - Forecast to 2026

Market Growth Outlook Summary

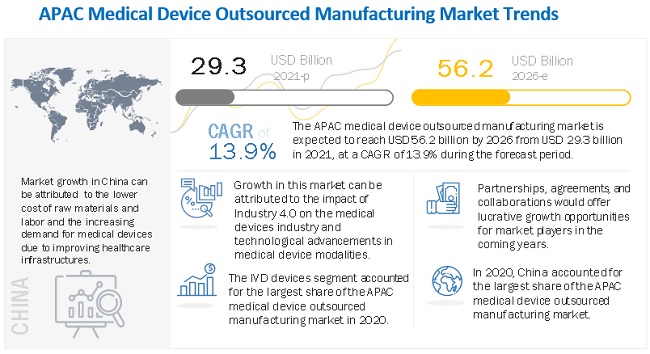

The global medical device outsourced manufacturing market growth forecasted to transform from $29.3 billion in 2021 to $56.2 billion by 2026, driven by a CAGR of 13.9%. The medical device outsourced manufacturing market is mainly driven by the overall growth of the medical devices market, mainly due to the rising disease prevalence, life expectancy, and geriatric population. Technological advancements have prompted end users to overhaul or update their manufacturing systems. As this is a costly process, they look to outsource contract manufacturing. However, medical device outsourced manufacturing market growth is impeded by the growing consolidation in the medical devices market. To develop their own manufacturing capabilities and save costs, Larger players are focusing on acquiring smaller players and CMOs themselves. This may affect the overall medical device outsourced manufacturing market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Device Outsourced Manufacturing Market Dynamics

Driver: Impact of Industry 4.0 on the medical devices industry

Innovation in Class III medical devices is on the rise, consequent to the growing development and production of complex products such as pacemakers and implantable medical devices. Medical device companies face challenges in manufacturing Class III devices in high volumes, given the complexity of the assembly and test processes. Furthermore, both the devices and processes must meet regulatory compliance for component traceability and verification, storage, and access. With the level of complexity involved in producing a Class III device in these volumes, automated production and manufacturing are a necessity. As a result, OEMs are leveraging the expertise of electronic manufacturing services, seeking automation, high-quality manufacturing systems, and regulatory compliance.

Industry 4.0 technologies—including cloud computing, machine-to-machine communication, and cyber-physical systems—enable advanced automation that helps overcome these production challenges. The increased connectivity and data-gathering capabilities of these technologies make it possible to build high-volume, regulation-compliant manufacturing processes with efficient inventory and production management.

Governments in several APAC countries are encouraging players to integrate 4.0 in their manufacturing processes to further boost the development of technologically advanced medical devices. For instance, Thailand’s 4.0 growth model created an innovative center to increase the development and manufacturing of medtech devices. The Intellectual Property Innovation-driven Entrepreneurship Center (IP-IDE) maintains its own data pool and patent information, which is further shared with small & medium-sized enterprises (SMEs) to develop newer technologies. With the IP-IDE center, the Thai government aims to encourage Thai medical device companies to innovate and expand across domestic as well as foreign markets.

With the increasing adoption of Industry 4.0 technologies in manufacturing critical and sophisticated medical devices and enhancing the technology pool that it brings to the table, the medical device outsourced manufacturing market is expected to grow significantly during the forecast period.

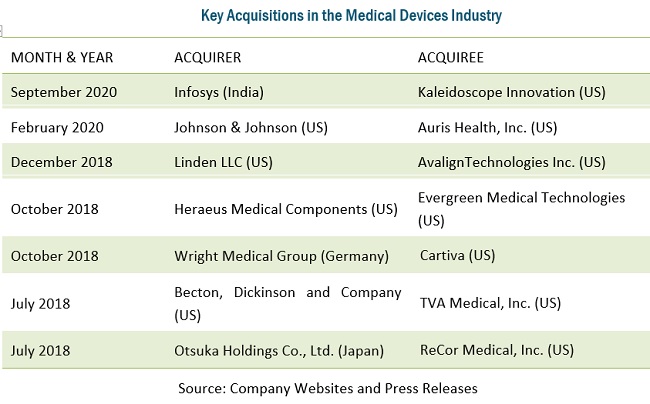

Restraint: Consolidation in the medical devices market

Big medical device manufacturers are currently actively investing in acquiring small and medium-sized specialized companies to enhance their internal capabilities. This may limit outsourcing to CMOs, given that acquirers will have the capabilities to carry out manufacturing in-house. One example of this is Linden’s acquisition of AvalignTechnologies Medical in December 2018, which provided Linden with expanded opportunities for future growth and greatly added to its capabilities.

Other medical device companies are also acquiring CMOs to reduce their expenses for contract manufacturing. This is leading to a shift in medical device manufacturing. In 2017, Nordson (US) acquired Vention Medical’s (US) advanced technology business segment. This segment has expertise in designing, developing, and manufacturing minimally invasive interventional delivery devices, catheters, and advanced components. This development will shift a minute share of medical device manufacturing from CMOs to OEMs.

To know about the assumptions considered for the study, download the pdf brochure

Opportunity: Growing healthcare expenditure in the APAC region

Emerging economies such as China and India offer significant growth opportunities for players in the medical device outsourced manufacturing market. Their huge patient base, growing healthcare awareness, and improvements in healthcare infrastructure have enabled a favorable environment for the overall growth of the healthcare market. These countries also have comparatively lenient regulations compared to their developed counterparts.

In addition, the increasing healthcare expenditure in these countries and rising healthcare costs have increased the adoption of medical devices. This is also a major factor driving the preference for home healthcare. With such visible growth prospects, many global medical device outsourced manufacturers are investing in these emerging markets. The low cost of manufacturing in these countries also provides an added advantage for players; this has attracted a number of companies to establish manufacturing facilities in these regions.

The rising healthcare expenditure in the APAC region has also resulted in the higher adoption of medical devices utilized in hospitals, diagnostic laboratories, pharma and biotech companies, and academic & research institutions. Governments across this region have also been launching new healthcare initiatives, such as the Ayushman Bharat-National Health Protection Scheme (AB-PMJAY) in India and Healthy China 2030 in China. Additionally, growth in the healthcare expenditures in Thailand and Malaysia stems from healthcare inflation combined with constant expansion in the central government’s budget allocation to the health ministry. The rising healthcare expenditure is expected to increase the purchasing power of end users, such as hospitals and diagnostic laboratories, for high-end medical devices, resulting in an increased demand for medical devices. Hence, the rising demand for medical devices will support the growth of contract manufacturing services during the forecast period.

Challenge: Balancing technological capabilities against costs

Constant innovation in the medical device industry is crucial to compete in an increasingly complex market. For CMOs offering services to companies, innovation in the industry requires that CMOs also update and improve their capabilities. As a result, CMOs have become more flexible, active, and focused on meeting customer needs. Some of the major capabilities adopted by CMOs in the last few years include process automation, lab automation, robotics, and automated manufacturing. These capabilities help CMOs speed up manufacturing, lower the margin of errors, and attract more customers.

These improvements in CMO capabilities can also be expected to attract clients from both the key/established player base as well as emerging companies looking for real-time and low-cost services. Some of the key players providing automation services in the medical device outsourced manufacturing market are Sanmina Corporation (US), Celestica Inc. (US), Plexus Corp. (US), Flex Ltd. (Singapore), and Benchmark Electronics (US).

However, all of this comes at a significant cost. CMOs face significant challenges in matching today’s technology desires while balancing strong cost pressures. Every feature and benefit needs to be balanced against the cost to result in a successful value-based solution. A key area of change is addressing the current fast-paced data-driven environment while ensuring sufficient technological prowess and improvement. For example, miniaturization is a critical trend in the medical devices industry and a prominent area of innovation. To capitalize on this trend—and retain an edge in an increasingly competitive market—contract manufacturers are compelled to make huge investments in favor of updating or developing the required technological expertise.

In addition, they must also match the prevailing industry and regulatory standards, which, given the pace of technological advancement, is also a prominent challenge for players in this market. This is particularly evident for Asian CMOs, which have been unable to enter the more developed European and North American medical device manufacturing industries due to their stringent regulations and quality standards.

Cardiovascular segment of medical device outsourced manufacturing market is expected to witness fastest growth in the forecast period.

Based on device type, the market is broadly segmented into IVD devices, diagnostic imaging devices, cardiovascular devices, drug delivery devices, orthopedic devices, respiratory care devices, ophthalmology devices, surgical devices, diabetes care devices, dental devices, endoscopy devices, gynecology/urology devices, personal care devices, neurology devices, and other devices. Cardiovascular segment is expected to witness fastest growth in the forecast period. With the prevalence of cardiovascular diseases on the rise, the demand for medical devices that can treat conditions of the heart and blood vessels will continue to grow. At the same time, the complexity of the devices will follow a similar trend. They will become smaller, incorporate more components made from various materials, require stringent tolerance analyses, and demand innovative packaging and sterilization solutions. Subsequently, not all OEMs possess innovative and sophisticated product manufacturing capabilities, thereby driving the demand for medical device outsourced manufacturing.

Device development and manufacturing services segment accounted for the largest share of APAC medical device outsourced manufacturing market

Based on service, the market is segmented into device development and manufacturing services, quality management services, packaging and assembly services and other services. The device development and manufacturing services segment dominated this market. The increasing adoption of contract manufacturing services in the medical device industry, growth in the medical devices market (especially in the single-use disposable medical devices market), and improving device development and manufacturing capabilities are the major factors responsible for the large share of this segment.

Class III segment of medical device outsourced manufacturing market is expected to witness fastest growth in the forecast period.

Based on the class of device, the APAC market is segmented into Class I, Class II, and Class III medical devices. The manufacturing of Class III devices requires sophisticated and advanced technologies owing to the risks these devices pose to patients if not utilized in the intended way. The primary difference is that in addition to the general controls of Class I devices and special controls of Class II devices, all Class III devices require premarket approval, including a comprehensive scientific review to ensure their safety and effectiveness. The high growth rate of this market segment is fueled by the increasing adoption of innovative technologies by medical device outsourced manufacturing companies to manufacture high-end Class III medical devices.

Production segment accounted for the largest share of APAC medical device outsourced manufacturing market

Based on process, the APAC medical device outsourced manufacturing market is broadly segmented into production, prototyping, pilot production, design for manufacturing, process evaluation, validation, project management, packaging, and assembly. The production segment accounted for the largest share of the medical device outsourced manufacturing market. The large share of this segment can be attributed to the growing number of medical device companies outsourcing their production tasks to minimize manufacturing costs.

China accounted for the largest share of the medical device outsourced manufacturing market

Geographically, the market has been segmented into China, Japan, India, South Korea, Malaysia & Singapore, Australia & New Zealand, and the Rest of Asia Pacific. China accounted for the largest market share of the medical device outsourced manufacturing market, followed by Japan. China's dominant share is mainly driven by the lower cost of raw material and labor than other Asia Pacific countries, increasing demand for medical devices due to the improving healthcare infrastructure, the adoption of technologically advanced products, and the less stringent regulatory scenario compared to most developed countries.

Some of the key players operating in this market includes Flex, Ltd. (Singapore), Jabil, Inc. (US), TE Connectivity, Ltd. (Switzerland), Sanmina Corporation (US), Nipro Corporation (Japan), Celestica International (Canada), Plexus Corporation (US), Benchmark Electronics, Inc. (US), Integer Holdings Corporation (US), Gerresheimer Ag (Germany), West Pharmaceutical Services, Inc. (US), Nortech Systems, Inc. (US), Consort Medical PLC (UK), Kimball Electronics Inc. (US), and Teleflex Incorporated (US). Other players operating in the market include Nordson Corporation (US), Tecomet, Inc. (US), SMC Ltd. (US), Nemera (France), and Tessy Plastics Corporation (US), among others.

Scope of the Medical Device Outsourced Manufacturing Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$29.3 billion |

|

Projected Revenue Size by 2026 |

$56.2 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 13.9% |

|

Market Drivers |

Impact of Industry 4.0 on the Medical Devices Industry |

|

Market Opportunities |

Growing Healthcare Expenditure in the APAC Region |

The research report categorizes the medical device outsourced manufacturing market to forecast revenue and analyze trends in each of the following submarkets:

By Device Type

-

IVD Devices

- IVD Consumables

- IVD Equipment

- Diagnostic Imaging Devices

- Cardiovascular Devices

-

Drug Delivery Devices

- Infusion Sets and Administration Sets

- Syringes

- Inhalers

- Autoinjectors & Pen Injectors

- Orthopedic Devices

- Ophthalmology Devices

- Diabetes Care Devices

- Dental Devices

- Endoscopy Devices

- Respiratory Care Devices

- Surgical Devices

- Gynaecology/Urology Devices

- Personal Care

- Neurology Devices

- Other Devices

By Services Type

-

Device Development and Manufacturing Services

- Device Engineering Services

- Process Development Services

-

Device Manufacturing Services

- LSR Molding

- Thermoplastic Injection Molding

- Extrusion Tubes

- CNC Machining and Laser Cutting & 3D printing

- Cleaning and Finishing

- Electronic Manufacturing Services

- Others

-

Quality Management Services

- Packaging Validation Services

- Inspection and Testing Services

- Sterilization Services

-

Packaging & Assembly By Type

- Primary & Secondary Packing

- Labelling

- Others

- Other Services

By Class of Device

- Class II Medical Devices

- Class I Medical Devices

- Class III Medical Devices

By Process Evaluation

- Process Evaluation

- Design for Manufacturing

- Prototyping

- Validation

- Project Management

- Pilot Production

- Production

- Assembly

- Packaging

By Region

- Asia-Pacific

- China

- Japan

- Malaysia & Singapore

- India

- Australia & New Zealand

- South Korea

- Rest of APAC

Recent Developments

- In November 2020, Nipro Corporation (Japan) acquired Venari Medical’s (Ireland) exclusive sales rights for a vascular treatment device developed by Venari Medical in Japan and overseas

- In October 2020, Nemera (France) acquired Copernicus (Poland) to become a leading patient-centric drug device combination solutions company. This acquisition will bolster the company’s production capabilities and expand its product portfolio

- In September 2020, Nipro Corporation established its sales offices in Xi'an, Wuhan, Hefei, and Xiamen. The new offices will further strengthen the company’s sales and service network in China to provide more community-based, meticulous services and respond to the needs of the medical scene, thereby enhancing the presence of the “Nipro brand”

- In January 2020, Nipro Asia Pte Ltd. (Singapore) acquired JMI Marketing (Bangladesh) to secure a large market share in Bangladesh’s rapidly growing economy for disposable medical devices, including infusion sets, syringes, and IV catheters

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical device outsourced manufacturing market?

The global medical device outsourced manufacturing market boasts a total revenue value of $56.2 billion by 2026.

What is the estimated growth rate (CAGR) of the global medical device outsourced manufacturing market?

The global medical device outsourced manufacturing market has an estimated compound annual growth rate (CAGR) of 13.9% and a revenue size in the region of $29.3 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION: FLEX, LTD.

FIGURE 7 SUPPLY-SIDE ANALYSIS: APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET (2020)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET (2020–2025)

FIGURE 10 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 11 MARKET DATA TRIANGULATION METHODOLOGY

FIGURE 12 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 13 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 14 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 GEOGRAPHIC SNAPSHOT: APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET OVERVIEW

FIGURE 18 INCREASING ADOPTION OF CONTRACT MANUFACTURING SERVICES TO DRIVE THE MARKET GROWTH

4.2 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE

FIGURE 19 INFUSION SETS AND ADMINISTRATION SETS COMMANDED THE LARGEST SHARE OF THE MARKET IN 2020

4.3 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: GEOGRAPHIC MIX

FIGURE 20 CHINA TO WITNESS THE HIGHEST GROWTH IN THE MARKET DURING THE FORECAST PERIOD

4.4 COUNTRY MIX: ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

FIGURE 21 CHINA DOMINATED THE APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

TABLE 3 MARKET DYNAMICS: IMPACT ANALYSIS

5.2 MARKET DRIVERS

5.2.1 GROWTH IN THE MEDICAL DEVICES MARKET

FIGURE 22 ASIA PACIFIC: GDP GROWTH RATE (%), 2018 VS. 2023 (FORECAST)

5.2.2 TECHNOLOGICAL ADVANCEMENTS IN MEDICAL DEVICE MODALITIES

FIGURE 23 FACTORS DRIVING THE DEMAND FOR CONTRACT MANUFACTURING

5.2.3 IMPACT OF INDUSTRY 4.0 ON THE MEDICAL DEVICES INDUSTRY

5.3 MARKET RESTRAINTS

5.3.1 CONSOLIDATION IN THE MEDICAL DEVICES MARKET

TABLE 4 KEY ACQUISITIONS IN THE MEDICAL DEVICES INDUSTRY

5.4 MARKET OPPORTUNITIES

5.4.1 GROWING HEALTHCARE EXPENDITURE IN THE APAC REGION

FIGURE 24 ASIA PACIFIC: HEALTHCARE EXPENDITURE PER CAPITA (2002 VS. 2010 VS. 2018)

5.4.2 INCREASED LIFE EXPECTANCY

FIGURE 25 ESTIMATED INCREASE IN THE GERIATRIC POPULATION, BY REGION, 2019 VS. 2050

TABLE 5 AVERAGE LIFE EXPECTANCY (YEARS), 2023 (FORECAST)

5.5 MARKET CHALLENGES

5.5.1 BALANCING TECHNOLOGICAL CAPABILITIES AGAINST COSTS

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 26 PORTER’S FIVE FORCES ANALYSIS (2020): ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

TABLE 6 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT FROM NEW ENTRANTS

5.6.1.1 Growth in the overall medical device industry

5.6.1.2 Industry demand for compact, cost-effective, and non-invasive devices

5.6.1.3 Consolidation

5.6.1.4 Poor financing environment

5.6.1.5 Proficient management teams

5.6.1.6 Stringent regulatory environment

5.6.2 THREAT FROM SUBSTITUTES

5.6.2.1 Undesirability of existing portfolios

5.6.2.2 Combination and integration of multiple technologies

5.6.2.3 Availability of alternatives

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.3.1 Big medical device contract manufacturing companies

5.6.3.2 Institutional technology providers

5.6.3.3 Substantially innovative technologies

5.6.3.4 Dysfunctional companies

5.6.3.5 Academic inventors

5.6.4 BARGAINING POWER OF BUYERS

5.6.4.1 Few buyers and many sellers

5.6.4.2 Buy-out threat

5.6.4.3 Demand for new pipeline services

5.6.4.4 Point of differentiation

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.6.5.1 Similar spectrum of services offered

5.6.5.2 Similar funding source

5.6.5.3 Self-funded big contract manufacturers

5.6.5.4 Highly fragmented industry

5.7 REGULATORY ANALYSIS

5.7.1 NORTH AMERICA

5.7.1.1 US

TABLE 7 US: CLASSIFICATION OF MEDICAL EQUIPMENT

TABLE 8 US: TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

5.7.1.2 Canada

TABLE 9 CANADA: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

5.7.2 EUROPE

TABLE 10 EUROPE: LEVEL OF RISK, TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

5.7.3 ASIA PACIFIC

5.7.3.1 Japan

TABLE 11 JAPAN: TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

5.7.3.2 China

TABLE 12 CHINA: TIME, COST, AND COMPLEXITY OF THE REGISTRATION PROCESS

5.7.3.3 India

5.8 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN: ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 28 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: SUPPLY CHAIN (2020)

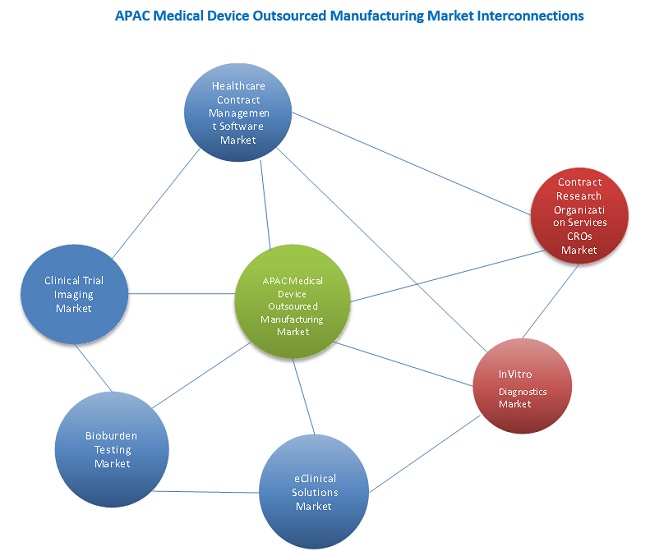

5.10 ECOSYSTEM MAPPING

FIGURE 29 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: ECOSYSTEM (2020)

FIGURE 30 COVID-19 IMPACT ON THE IVD ECOSYSTEM, 2020

5.11 KEY MARKETS FOR IMPORT AND EXPORT (TRADE ANALYSIS FOR MEDICAL DEVICES)

TABLE 13 IMPORT VALUE OF MEDICAL DEVICES FOR TOP 10 COUNTRIES IN 2018

FIGURE 31 VALUE OF MEDICAL EQUIPMENT EXPORTS FROM CHINA, 2008–2019

5.12 COVID-19 IMPACT

6 INDUSTRY TRENDS (Page No. - 86)

6.1 INCREASING CONSOLIDATION OF OEMS AND CMOS

TABLE 14 KEY EXAMPLES OF OEM CONSOLIDATION IN THE LAST 5 YEARS

TABLE 15 KEY EXAMPLES OF CMO CONSOLIDATION

6.2 GROWING INTEREST OF PRIVATE EQUITY FIRMS IN MEDICAL DEVICE CONTRACT MANUFACTURING

TABLE 16 KEY ACQUISITIONS BY PRIVATE EQUITY FIRMS

6.3 OUTSOURCING OF MEDICAL DEVICE CONTRACT MANUFACTURING SERVICES

TABLE 17 EXAMPLES OF KEY COLLABORATIONS AND AGREEMENTS

7 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE (Page No. - 90)

7.1 INTRODUCTION

TABLE 18 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

7.2 IVD DEVICES

TABLE 19 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 20 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 IVD CONSUMABLES

7.2.1.1 Increased accessibility and demand for reagents & kits and increasing volume of IVD tests performed are the key factors driving market growth

TABLE 21 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD CONSUMABLES, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 IVD EQUIPMENT

7.2.2.1 Advances in life sciences research to support market growth

TABLE 22 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD EQUIPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 DIAGNOSTIC IMAGING DEVICES

7.3.1 ADOPTION OF NEW AND ADVANCED DIAGNOSTIC IMAGING SYSTEMS IN DEVELOPING COUNTRIES TO SUPPORT MARKET GROWTH

TABLE 23 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DIAGNOSTIC IMAGING DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 CARDIOVASCULAR DEVICES

7.4.1 RISING PREVALENCE OF CARDIOVASCULAR DISEASES TO DRIVE THE DEMAND FOR CONTRACT MANUFACTURING SERVICES

TABLE 24 PREVALENCE OF CARDIOVASCULAR DISEASES IN ASIA PACIFIC COUNTRIES, 2015–2035

TABLE 25 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR CARDIOVASCULAR DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 DRUG DELIVERY DEVICES

TABLE 26 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 27 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.1 INFUSION DEVICES AND ADMINISTRATION SETS

7.5.1.1 Rising incidence of chronic diseases & growing number of surgical procedures to drive market growth

TABLE 28 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR INFUSION DEVICES AND ADMINISTRATION SETS, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.2 SYRINGES

7.5.2.1 Growing demand for syringes among patients and healthcare professionals to drive market growth

TABLE 29 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR SYRINGES, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.3 INHALERS

7.5.3.1 High prevalence of asthma and COPD to drive market growth

TABLE 30 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR INHALERS, BY COUNTRY, 2019–2026 (USD MILLION)

7.5.4 AUTOINJECTORS & PEN INJECTORS

7.5.4.1 Increasing focus on developing technologically advanced autoinjectors to drive the market

TABLE 31 RECENT APPROVALS FOR AUTOINJECTORS & PEN INJECTORS ACROSS THE GLOBE

TABLE 32 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR AUTOINJECTORS & PEN INJECTORS, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 ORTHOPEDIC DEVICES

7.6.1 CONSOLIDATION IN THE ORTHOPEDIC DEVICES MARKET TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 33 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR ORTHOPEDIC DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 RESPIRATORY CARE DEVICES

7.7.1 COVID-19 TO BOOST THE DEMAND FOR CONTRACT MANUFACTURING OF RESPIRATORY CARE DEVICES

TABLE 34 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR RESPIRATORY CARE DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.8 OPHTHALMOLOGY DEVICES

7.8.1 INCREASING PREVALENCE OF OPHTHALMIC DISEASES & TECHNOLOGICAL ADVANCEMENTS IN OPHTHALMIC DEVICES TO SUPPORT MARKET GROWTH

TABLE 35 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR OPHTHALMOLOGY DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.9 SURGICAL DEVICES

7.9.1 INCREASE IN THE NUMBER OF SURGICAL PROCEDURES WILL DRIVE SEGMENTAL GROWTH

TABLE 36 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR SURGICAL DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.10 DIABETES CARE DEVICES

7.10.1 RISING PREVALENCE OF DIABETES TO DRIVE THE DEMAND FOR DIABETES DEVICES AND CONSUMABLES

FIGURE 32 ADULT POPULATION VS. DIABETIC POPULATION VS. IMPAIRED GLUCOSE TOLERANCE, 2019 VS. 2030 VS. 2045 (SOUTHEAST ASIA)

TABLE 37 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DIABETES CARE DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.11 DENTAL DEVICES

7.11.1 RISING INCIDENCE OF DENTAL DISEASES, COUPLED WITH THE INCREASING ADOPTION OF TECHNOLOGICALLY ADVANCED DENTAL DIAGNOSTIC DEVICES, TO DRIVE MARKET GROWTH

TABLE 38 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DENTAL DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.12 ENDOSCOPY DEVICES

7.12.1 GROWTH IN THIS MARKET IS DRIVEN BY THE RISING PATIENT PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES

TABLE 39 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR ENDOSCOPY DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.13 GYNECOLOGY/UROLOGY DEVICES

7.13.1 GROWING AWARENESS AND PREVENTIVE CHECK-UPS FOR LATE-PHASE DIAGNOSIS OF STDS WILL PROPEL THE GYNECOLOGY/UROLOGY DEVICES SEGMENT

TABLE 40 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR GYNECOLOGY/UROLOGY DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.14 PERSONAL CARE DEVICES

7.14.1 SHIFT IN CONSUMPTION PATTERN TOWARDS PREMIUM PERSONAL CARE PRODUCTS TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 41 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PERSONAL CARE DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.15 NEUROLOGY DEVICES

7.15.1 RISING GLOBAL BURDEN OF NEUROLOGICAL DISEASES WILL DRIVE GROWTH IN THIS SEGMENT

TABLE 42 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR NEUROLOGY DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

7.16 OTHER DEVICES

TABLE 43 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR OTHER DEVICES, BY COUNTRY, 2019–2026 (USD MILLION)

8 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE (Page No. - 115)

8.1 INTRODUCTION

FIGURE 33 STAGES INVOLVED IN THE CONTRACT MANUFACTURING OF MEDICAL DEVICES

TABLE 44 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

8.2 DEVICE DEVELOPMENT AND MANUFACTURING SERVICES

TABLE 45 ASIA PACIFIC DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 46 ASIA PACIFIC DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1 DEVICE MANUFACTURING SERVICES

TABLE 47 ASIA PACIFIC DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 48 ASIA PACIFIC DEVICE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.1 Electronic manufacturing services

8.2.1.1.1 Rising demand for miniaturization and more complex medical products to drive growth in the electronic manufacturing services segment

TABLE 49 ASIA PACIFIC ELECTRONIC MANUFACTURING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.2 CNC machining and laser cutting & 3D printing services

8.2.1.2.1 Extensive applications of CNC machining, laser cutting, and 3D printing in the manufacturing of medical devices and components to drive market growth

TABLE 50 ASIA PACIFIC CNC MACHINING AND LASER CUTTING & 3D PRINTING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.3 Extrusion tubing services

8.2.1.3.1 Rising utility of extrusion tubing in minimally invasive surgical applications to drive market growth

TABLE 51 ASIA PACIFIC EXTRUSION TUBING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.4 LSR molding services

8.2.1.4.1 Ability of LSR molding to produce consistent parts from cycle to cycle—a key factor driving market growth

TABLE 52 ASIA PACIFIC LSR MOLDING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.5 Thermoplastic injection molding services

8.2.1.5.1 Long tooling time and high cost could restrain the growth of the thermoplastic injection molding services segment

TABLE 53 ASIA PACIFIC THERMOPLASTIC INJECTION MOLDING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.6 Cleaning and finishing services

8.2.1.6.1 High-quality cleaning and finishing needed to meet the regulatory requirements for sterility and hygiene of medical devices to drive market growth

TABLE 54 ASIA PACIFIC CLEANING AND FINISHING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.1.7 Other device manufacturing services

TABLE 55 ASIA PACIFIC OTHER DEVICE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.2 DEVICE ENGINEERING SERVICES

8.2.2.1 Complexity of device engineering services to drive the demand for this market

TABLE 56 ASIA PACIFIC DEVICE ENGINEERING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.2.3 PROCESS DEVELOPMENT SERVICES

8.2.3.1 Need to meet functionality, usability, and regulatory objectives of medical devices to drive market growth

FIGURE 34 MEDICAL DEVICE PROCESS DEVELOPMENT SERVICES

TABLE 57 ASIA PACIFIC PROCESS DEVELOPMENT SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 QUALITY MANAGEMENT SERVICES

TABLE 58 ASIA PACIFIC QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 ASIA PACIFIC QUALITY MANAGEMENT SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3.1 PACKAGING VALIDATION SERVICES

8.3.1.1 Increasing product safety concerns for medical devices are a major factor driving the demand for packaging validation services

TABLE 60 ASIA PACIFIC PACKAGING VALIDATION SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3.2 INSPECTION & TESTING SERVICES

8.3.2.1 Need to meet compliance standards at manufacturing sites driving the growth of this segment

TABLE 61 ASIA PACIFIC INSPECTION & TESTING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3.3 STERILIZATION SERVICES

8.3.3.1 Rising complexity of sterility standards to drive market growth

TABLE 62 ASIA PACIFIC STERILIZATION SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 PACKAGING AND ASSEMBLY SERVICES

FIGURE 35 FINAL ASSEMBLY SERVICES IN THE GLOBAL VALUE CHAIN OF MEDICAL DEVICES

TABLE 63 ASIA PACIFIC PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC PACKAGING AND ASSEMBLY SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4.1 PRIMARY & SECONDARY PACKAGING

8.4.1.1 Growth in the primary and secondary packaging segment propelled by the need for adherence to regulations and patient safety

TABLE 65 ASIA PACIFIC PRIMARY AND SECONDARY PACKAGING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4.2 LABELING

8.4.2.1 Rising incidence of export bans and product recalls due to improper labeling to boost growth in this segment

TABLE 66 ASIA PACIFIC LABELING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4.3 OTHER PACKAGING AND ASSEMBLY SERVICES

TABLE 67 ASIA PACIFIC OTHER PACKAGING AND ASSEMBLY SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 OTHER MEDICAL DEVICE CONTRACT MANUFACTURING SERVICES

TABLE 68 ASIA PACIFIC OTHER MEDICAL DEVICE CONTRACT MANUFACTURING SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE (Page No. - 137)

9.1 INTRODUCTION

TABLE 69 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

9.2 COMPARISON OF DEVICE CLASSIFICATIONS, BY COUNTRY/REGION

9.2.1 US

9.2.1.1 Class I: General controls

9.2.1.2 Class II: General controls with special controls

9.2.1.3 Class III: General controls, special controls, and premarket approval

9.2.2 CANADA

9.2.3 EUROPEAN UNION AND EUROPEAN FREE TRADE ASSOCIATION

9.2.3.1 Class Is: Non-invasive devices

9.2.3.2 Class Im: Low-risk measuring devices

9.2.3.3 Class IIa devices

9.2.3.4 Class IIb devices

9.2.3.5 Class III devices

9.2.4 ASIA PACIFIC

9.2.4.1 China

9.2.4.2 India

9.2.4.3 Japan

9.2.4.4 Australia

9.3 CLASS II MEDICAL DEVICES

9.3.1 LARGE-VOLUME MANUFACTURING OF CLASS II MEDICAL DEVICES—A MAJOR FACTOR DRIVING MARKET GROWTH

TABLE 70 CLASS II MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 CLASS I MEDICAL DEVICES

9.4.1 SIMPLICITY OF DESIGN PROCESS IN CLASS I MEDICAL DEVICES TO DRIVE GROWTH IN THIS SEGMENT

TABLE 71 CLASS I MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 CLASS III MEDICAL DEVICES

9.5.1 UPDATED AND INNOVATIVE CAPABILITIES FOR MANUFACTURING CLASS III MEDICAL DEVICES TO DRIVE MARKET GROWTH

TABLE 72 CLASS III MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

10 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS (Page No. - 144)

10.1 INTRODUCTION

TABLE 73 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

10.2 PRODUCTION

10.2.1 GROWING NUMBER OF MEDICAL DEVICE COMPANIES OUTSOURCING THEIR PRODUCTION TASKS TO DRIVE GROWTH IN THIS SEGMENT

TABLE 74 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PRODUCTION PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.3 PROTOTYPING

10.3.1 AVAILABILITY OF SKILLED TECHNICIANS AND IMPROVED CAPABILITIES TO DRIVE SEGMENTAL GROWTH IN THE FORECAST PERIOD

TABLE 75 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PROTOTYPING PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.4 PILOT PRODUCTION

10.4.1 INCREASING EMPHASIS ON R&D TO OFFER HUGE OPPORTUNITIES FOR PILOT PRODUCTION TO CONTRACT MANUFACTURERS

TABLE 76 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PILOT PRODUCTION PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.5 DESIGN FOR MANUFACTURING

10.5.1 SIMPLIFIED AND REFINED DESIGN PROCESSES OFFERED BY MEDICAL DEVICE CONTRACT MANUFACTURERS TO DRIVE MARKET GROWTH

TABLE 77 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DESIGN FOR MANUFACTURING PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.6 PROCESS EVALUATION

10.6.1 REGULATORY MANDATES FOR THE DOCUMENTATION OF PROCESS EVALUATION TO CONTRIBUTE TO MARKET GROWTH IN THE COMING YEARS

TABLE 78 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PROCESS EVALUATION PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.7 VALIDATION

10.7.1 REQUIREMENT OF VALIDATION FOR MEDICAL DEVICES TO DRIVE SEGMENTAL GROWTH

TABLE 79 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR VALIDATION PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.8 PROJECT MANAGEMENT

10.8.1 EXPERTISE PROVIDED BY CONTRACT MANUFACTURERS FOR PROJECT MANAGEMENT WILL DRIVE GROWTH IN THIS SEGMENT

TABLE 80 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PROJECT MANAGEMENT PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.9 PACKAGING

10.9.1 AVAILABILITY OF A WIDE RANGE OF PACKAGING SERVICES WILL PROPEL GROWTH

TABLE 81 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR PACKAGING PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

10.10 ASSEMBLY

10.10.1 AVAILABILITY OF COST-EFFECTIVE ASSEMBLY SOLUTIONS TO DRIVE SEGMENTAL GROWTH

TABLE 82 ASIA PACIFIC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR ASSEMBLY PROCESSES, BY COUNTRY, 2019–2026 (USD MILLION)

11 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY (Page No. - 151)

11.1 INTRODUCTION

11.2 ASIA PACIFIC

TABLE 83 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 85 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 88 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 89 ASIA PACIFIC: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 ASIA PACIFIC: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 ASIA PACIFIC: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 ASIA PACIFIC: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.1 CHINA

11.2.1.1 Medical device contract manufacturing market in China is mainly driven by low labor costs

TABLE 94 CHINA: KEY MACROINDICATORS

TABLE 95 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 96 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 99 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 100 CHINA: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 CHINA: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 102 CHINA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 CHINA: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 CHINA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.2 JAPAN

11.2.2.1 Presence of key players in the country to drive market growth

TABLE 105 JAPAN: KEY MACROINDICATORS

TABLE 106 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 107 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 109 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 110 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 111 JAPAN: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 JAPAN: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 JAPAN: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 JAPAN: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 JAPAN: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.3 MALAYSIA & SINGAPORE

11.2.3.1 Increasing R&D activities and investments by established players in these countries to drive market growth

TABLE 116 MALAYSIA & SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 117 MALAYSIA & SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 MALAYSIA & SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 MALAYSIA & SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 120 MALAYSIA & SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 121 MALAYSIA & SINGAPORE: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 MALAYSIA & SINGAPORE: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 MALAYSIA & SINGAPORE: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 MALAYSIA & SINGAPORE: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 MALAYSIA & SINGAPORE: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.4 INDIA

11.2.4.1 Rising contract manufacturing capabilities in the country to drive the market

TABLE 126 INDIA: KEY MACROINDICATORS

TABLE 127 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 128 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 131 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 132 INDIA: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 INDIA: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 INDIA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 INDIA: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 INDIA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.5 AUSTRALIA & NEW ZEALAND

TABLE 137 AUSTRALIA & NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 138 AUSTRALIA & NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 139 AUSTRALIA & NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUF ACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 140 AUSTRALIA & NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 141 AUSTRALIA & NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 142 AUSTRALIA & NEW ZEALAND: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 AUSTRALIA & NEW ZEALAND: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 AUSTRALIA & NEW ZEALAND: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 AUSTRALIA & NEW ZEALAND: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 146 AUSTRALIA & NEW ZEALAND: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.6 SOUTH KOREA

11.2.6.1 High-value imports from other countries present opportunities for contract manufacturers in the country

TABLE 147 SOUTH KOREA: MEDICAL DEVICES AND EQUIPMENT UNITS (USD BILLION)

TABLE 148 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 149 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 151 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 152 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 153 SOUTH KOREA: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 SOUTH KOREA: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 SOUTH KOREA: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 SOUTH KOREA: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 SOUTH KOREA: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

11.2.7 REST OF ASIA PACIFIC (ROAPAC)

TABLE 158 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR IVD DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET FOR DRUG DELIVERY DEVICES, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY CLASS OF DEVICE, 2019–2026 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY SERVICE, 2019–2026 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: DEVICE DEVELOPMENT AND MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: DEVICE MANUFACTURING SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: QUALITY MANAGEMENT SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: PACKAGING AND ASSEMBLY SERVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MEDICAL DEVICE CONTRACT MANUFACTURING MARKET, BY PROCESS, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 188)

12.1 OVERVIEW

12.2 KEY PLAYER STRATEGIES

FIGURE 36 MARKET EVALUATION FRAMEWORK: EXPANSIONS DOMINATED THE APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET BETWEEN 2018–2021

12.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 37 TOP MARKET PLAYERS DOMINATE THE APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

12.4 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET SHARE (2020)

TABLE 168 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: DEGREE OF COMPETITION

12.5 MARKET SHARE ANALYSIS

FIGURE 38 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET SHARE, BY KEY PLAYER, 2020

12.6 COMPETITIVE LEADERSHIP MAPPING

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 39 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

12.7 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2020)

FIGURE 40 APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: SME/START-UP COMPANY EVALUATION MATRIX, 2020

12.8 PRODUCT FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

TABLE 169 COMPANY PRODUCT FOOTPRINT

TABLE 170 COMPANY SERVICE FOOTPRINT

12.9 COMPANY SERVICE FOOTPRINT

FIGURE 41 COMPANY SERVICE FOOTPRINT: APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET

12.10 COMPANY GEOGRAPHIC FOOTPRINT

FIGURE 42 GEOGRAPHIC REVENUE MIX: COMPARISON OF APAC MEDICAL DEVICE CONTRACT MANUFACTURING MARKET WITH THE AMERICAS AND EMEA (2020)

12.11 MEDICAL DEVICE CONTRACT MANUFACTURING MARKET: R&D EXPENDITURE

FIGURE 43 R&D EXPENDITURE OF KEY PLAYERS IN THE MEDICAL DEVICE CONTRACT MANUFACTURING MARKET (2019/2020)

12.12 COMPETITIVE SCENARIO

12.12.1 PRODUCT LAUNCHES

TABLE 173 PRODUCT LAUNCHES, 2018–2020

12.12.2 DEALS

TABLE 174 DEALS (JANUARY 2018– JANUARY 2021)

12.12.3 OTHER DEVELOPMENTS

TABLE 175 OTHER DEVELOPMENTS, 2018–2020

13 COMPANY PROFILES (Page No. - 205)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View, Right to win)*

13.1.1 JABIL INC.

TABLE 176 JABIL INC.: BUSINESS OVERVIEW

FIGURE 44 JABIL INC.: COMPANY SNAPSHOT (2020)

13.1.2 NIPRO CORPORATION

TABLE 177 NIPRO CORPORATION: BUSINESS OVERVIEW

FIGURE 45 NIPRO CORPORATION: COMPANY SNAPSHOT (2019)

13.1.3 FLEX, LTD.

TABLE 178 FLEX, LTD.: BUSINESS OVERVIEW

FIGURE 46 FLEX, LTD.: COMPANY SNAPSHOT (2019)

13.1.4 SANMINA CORPORATION

TABLE 179 SANMINA CORPORATION: BUSINESS OVERVIEW

FIGURE 47 SANMINA CORPORATION: COMPANY SNAPSHOT (2020)

13.1.5 NORDSON CORPORATION

TABLE 180 NORDSON CORPORATION: BUSINESS OVERVIEW

FIGURE 48 NORDSON CORPORATION: COMPANY SNAPSHOT (2020)

13.1.6 PLEXUS CORP.

TABLE 181 PLEXUS CORP.: BUSINESS OVERVIEW

FIGURE 49 PLEXUS CORP.: COMPANY SNAPSHOT (2020)

13.1.7 TE CONNECTIVITY LTD.

TABLE 182 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

FIGURE 50 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT (2020)

13.1.8 KIMBALL ELECTRONICS, INC.

TABLE 183 KIMBALL ELECTRONICS, INC.: BUSINESS OVERVIEW

FIGURE 51 KIMBALL ELECTRONICS, INC.: COMPANY SNAPSHOT (2020)

13.1.9 BENCHMARK ELECTRONICS INC.

TABLE 184 BENCHMARK ELECTRONICS INC.: BUSINESS OVERVIEW

FIGURE 52 BENCHMARK ELECTRONICS INC.: COMPANY SNAPSHOT (2020)

13.1.10 WEST PHARMACEUTICAL SERVICES, INC.

TABLE 185 WEST PHARMACEUTICAL SERVICES INC.: BUSINESS OVERVIEW

FIGURE 53 WEST PHARMACEUTICAL SERVICES INC.: COMPANY SNAPSHOT (2019)

13.2 OTHER PLAYERS

13.2.1 APTAR, INC.

TABLE 186 APTAR, INC.: BUSINESS OVERVIEW

FIGURE 54 APTAR, INC.: COMPANY SNAPSHOT (2020)

13.2.2 CARCLO PLC

TABLE 187 CARCLO PLC: BUSINESS OVERVIEW

FIGURE 55 CARCLO PLC: COMPANY SNAPSHOT (2019)

13.2.3 NOLATO GW, INC. (A PART OF NOLATO AB)

TABLE 188 NOLATO GW, INC.: BUSINESS OVERVIEW

FIGURE 56 NOLATO AB: COMPANY SNAPSHOT (2020)

13.2.4 GERRESHEIMER AG

TABLE 189 GERRESHEIMER AG: BUSINESS OVERVIEW

FIGURE 57 GERRESHEIMER AG: COMPANY SNAPSHOT (2020)

13.2.5 CELESTICA INC.

TABLE 190 CELESTICA INC.: BUSINESS OVERVIEW

FIGURE 58 CELESTICA INC.: COMPANY SNAPSHOT (2020)

13.2.6 INTEGER HOLDINGS CORPORATION

TABLE 191 INTEGER HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 59 INTEGER HOLDINGS CORPORATION: COMPANY SNAPSHOT (2019)

13.2.7 NORTECH SYSTEMS, INC.

TABLE 192 NORTECH SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 60 NORTECH SYSTEMS, INC.: COMPANY SNAPSHOT (2019)

13.2.8 CONSORT MEDICAL PLC

TABLE 193 RECIPHARM: BUSINESS OVERVIEW

FIGURE 61 RECIPHARM: COMPANY SNAPSHOT (2020)

13.2.9 NEMERA DEVELOPMENT S.A.

TABLE 194 NEMERA DEVELOPMENT S.A.: BUSINESS OVERVIEW

13.2.10 TESSY PLASTICS CORP

TABLE 195 TESSY PLASTICS CORP.: BUSINESS OVERVIEW

13.2.11 VIANT MEDICAL

TABLE 196 VIANT MEDICAL: BUSINESS OVERVIEW

13.2.12 MEHOW

TABLE 197 MEHOW: BUSINESS OVERVIEW

13.2.13 PHILLIPS-MEDISIZE (A MOLEX COMPANY)

TABLE 198 PHILLIPS-MEDISIZE CORPORATION: BUSINESS OVERVIEW

13.2.14 TEKNI-PLEX

TABLE 199 TEKNI-PLEX: BUSINESS OVERVIEW

13.2.15 PETER'S TECHNOLOGY

TABLE 200 PETER’S TECHNOLOGY: BUSINESS OVERVIEW

*Business Overview, Products Offered, Recent Developments, MnM View, Right to win might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 297)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This study involved four major activities in estimating the current APAC medical device outsourced manufacturing market size. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the usage of widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives.

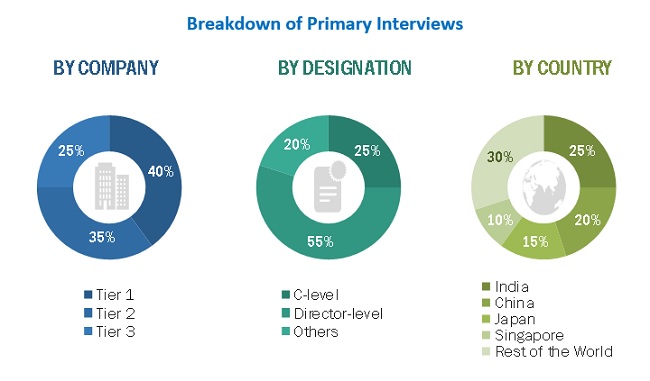

Primary Research

The APAC medical device outsourced manufacturing market comprises several stakeholders, such as raw material suppliers, manufacturers of medical equipment, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include professionals such as company vice presidents, company’s C-level executives, managers, product managers, department heads, professors, and research scientists. The primary sources from the supply side include key CEOs, VPs and managing directors, marketing heads/directors and sales directors, marketing managers, regional/area sales managers, export/import, heads/managers, and product managers/technology experts.

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the APAC medical device outsourced manufacturing market (value and volume). These approaches were also used extensively to estimate the size of various subsegments in the market. After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the medical device outsourced manufacturing industry.

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Approach to calculate the revenue of different players in the APAC medical device outsourced manufacturing market

The size of the APAC medical device outsourced manufacturing market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. Primary participants validated these percentage splits. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the countries, the APAC medical device outsourced manufacturing market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Objectives of the Study

- To define, describe, analyze, and forecast the APAC medical device outsourced manufacturing market by therapy, type, route of administration, end user and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall APAC medical device outsourced manufacturing market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in China, Japan, Malaysia & Singapore, India, Australia & New Zealand, South Korea, and the Rest of APAC

- To profile key players and comprehensively analyze their market ranking and core competencies in the APAC medical device outsourced manufacturing market

- To track and analyze competitive developments such as acquisitions, product launches, and expansions in the APAC medical device outsourced manufacturing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product and service matrix, which gives a detailed comparison of the portfolios of the top companies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Device Outsourced Manufacturing Market

How emerging markets offering revenue expansion opportunities in Medical Device Outsourced Manufacturing Market?

Which product segment is expected to shape the future of the Medical Device Outsourced Manufacturing Market?

Which geography would provide most opportunities in the Medical Device Outsourced Manufacturing Market?