Medical Device Cleaning Market by Process (Precleaning, Automatic, Manual Cleaning, Disinfection), Type (Non-Enzymatic, Enzymatic), Application (Surgical, Endoscope, Ultrasound, Dental Instruments), End User (Hospitals, Clinics) & Region - Global Forecast to 2027

Market Growth Outlook Summary

The global medical device cleaning market growth forecasted to transform from $2.3 billion in 2022 to $2.9 billion by 2027, driven by a CAGR of 5.2%. Market growth is primarily driven by the increasing number of surgical procedures, a rise in hospital-acquired infections, and an aging population. However, safety concerns regarding the reprocessing of instruments may hinder growth during the forecast period.

Medical Device Cleaning Market Trends

To learn more about the study's assumptions, request a free sample report.

Medical Device Cleaning Market Dynamics

Driver: Rising Prevalence of Hospital-Acquired Infections

Hospital-acquired infections (HAIs) pose significant health risks globally, with types including CLABSIs, catheter-associated UTIs, and ventilator-associated pneumonia. Notable bacteria linked to HAIs include C. difficile and MRSA. Key statistics reveal:

- Approximately 687,000 HAIs were reported in US acute care hospitals in 2021, with about 72,000 associated deaths.

- 4.2% of hospitalized patients in the US experienced HAIs in 2020.

- Europe sees nearly 3.5 million annual HAIs.

- WHO estimates indicate that 7% of hospitalized patients in developed and 10% in developing countries acquire at least one infection.

Implementing infection control policies, like UV disinfection and routine cleaning of instruments, can significantly reduce HAIs.

Growth in Surgical Procedures

The global increase in surgical procedures drives demand for medical devices. For example, the International Society of Aesthetic Plastic Surgery reported a 4% increase in surgical procedures in 2017. Additionally, the National Spinal Cord Injury Statistical Center noted approximately 17,000 new spinal cord injury cases annually in the US. The rise in obesity also contributes to increased cardiovascular and orthopedic surgeries, further boosting the demand for effective medical device cleaning solutions.

Opportunity: Healthcare Expenditure and Medical Tourism in Emerging Markets

Countries like India, China, Brazil, and others in Southeast Asia present significant growth opportunities in the medical device cleaning market. These regions are home to vast patient populations and are experiencing a rise in healthcare facilities, public demand for improved hospital care, and increased healthcare spending, all contributing to market expansion.

Restraint: Safety Concerns of Reprocessed Instruments

While reprocessing medical devices can reduce costs, safety concerns regarding the cleaning process can lead to surgical-site infections (SSIs). Difficulties in cleaning complex instruments can exacerbate this issue, causing many healthcare providers to favor single-use devices for safety.

Studies have shown that current cleaning techniques for endoscopes are inconsistent, leading to a preference for single-use options in many hospitals.

Challenge: Cleaning Complex Medical Devices

Cleaning advanced medical devices effectively is challenging. For instance, automated endoscope reprocessors (AERs) must be user-friendly and reliable to prevent infection risks. The hospitals and clinics segment leads the market, driven by a surge in healthcare facilities and the high incidence of HAIs.

Disinfectant Segment Dominates the Industry

The global medical device cleaning market is segmented by process, with disinfection accounting for the largest share in 2021 due to the increasing demand for high-level disinfectants that effectively suppress pathogens.

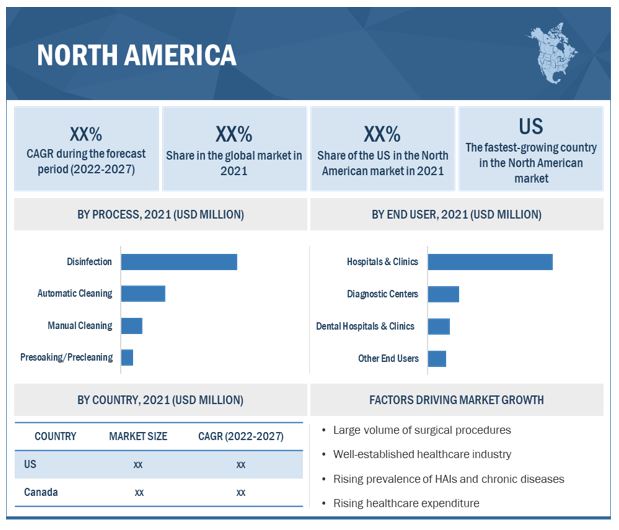

North America Leads the Market

Regionally, North America holds the largest market share and is expected to continue growing rapidly. The Asia Pacific region presents significant opportunities due to rising healthcare spending and initiatives promoting advanced cleaning technologies.

To learn more about the study's assumptions, download the PDF brochure.

Prominent players in the medical device cleaning market include 3M Company, Steris PLC, Metrex Research, LLC, Ecolab Inc., Getinge Group, Cantel Medical Corporation, Advanced Sterilization Products, Integra Lifesciences Holdings Corporation, Ruhof Corporation, and Sklar Surgical Instruments.

Scope of the Medical Device Cleaning Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 2.3 billion |

|

Projected Revenue by 2027 |

USD 2.9 billion |

|

Revenue Growth Rate |

CAGR of 5.2% |

|

Market Driver |

Growing prevalence of hospital-acquired infections |

|

Market Opportunity |

Increasing healthcare expenditure and medical tourism in emerging economies |

This research categorizes the global medical device cleaning market to forecast revenue and analyze trends in various submarkets:

By Process

-

Disinfection

- High-level Disinfectants

- Intermediate-level Disinfectant

- Low-level Disinfectant

-

Automatic Cleaning

- Enzymatic Detergents

- Non-Enzymatic Detergents

-

Manual Cleaning

- Enzymatic

- Non-Enzymatic

-

Presoak/Precleaning

- Enzymatic

- Non-Enzymatic

By Application

- Surgical Instruments

- Endoscopes

- Ultrasound Probes

- Dental Instruments

- Other Instruments (diagnostic tools like stethoscopes and clinical thermometers)

By End Users

- Hospitals and Clinics

- Diagnostic Centers

- Dental Clinics and Hospitals

- Other End Users (medical institutions and surgical centers)

By Devices

- Critical

- Semi-critical

- Non-critical

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- The Middle East & Africa

Recent Developments in the Medical Device Cleaning Industry

- In January 2021, STERIS agreed to acquire Cantel, enhancing its infection prevention product portfolio.

- In February 2021, Getinge partnered with researchers at the University of Gothenburg for innovation and sustainability efforts.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKETS COVERED

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY SOURCES

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

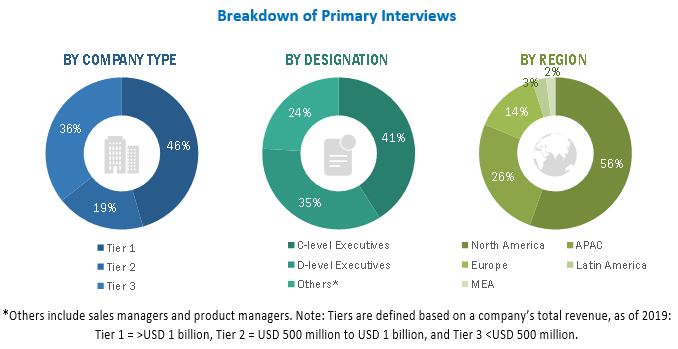

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

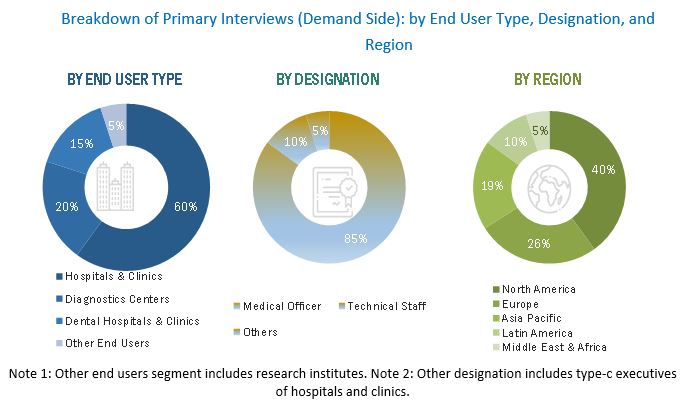

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

FIGURE 5 SUPPLY-SIDE ANALYSIS: MEDICAL DEVICE CLEANING INDUSTRY

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS OF MARKET (2021)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 LIMITATIONS

2.4.1 METHODOLOGY-RELATED LIMITATIONS

2.5 RISK ASSESSMENT

2.6 STUDY ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 10 MEDICAL DEVICE CLEANING INDUSTRY, BY PROCESS, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 MARKET, BY DEVICE TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 14 REGIONAL SNAPSHOT: MARKET

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 MEDICAL DEVICE CLEANING INDUSTRY OVERVIEW

FIGURE 15 GROWING PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS TO DRIVE MARKET GROWTH

4.2 REGIONAL MIX: MARKET

FIGURE 16 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MEDICAL DEVICE CLEANING MARKET, BY TYPE AND COUNTRY (2021)

FIGURE 17 DISINFECTION SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2021

4.4 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4.5 MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 19 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Growing prevalence of hospital-acquired infections

5.2.1.2 Increasing number of surgical procedures

5.2.1.3 Rising prevalence of chronic diseases in geriatric population

FIGURE 20 GERIATRIC POPULATION AS PERCENTAGE OF TOTAL POPULATION, BY REGION

FIGURE 21 US: PROJECTED GROWTH IN NUMBER OF PEOPLE WITH CHRONIC CONDITIONS, 1995–2030

5.2.1.4 Regulatory requirements and compliance

5.2.1.5 Increasing outsourcing of sterilization services among pharmaceutical companies, hospitals, and medical device manufacturers

5.2.2 RESTRAINTS

5.2.2.1 Concerns regarding safety of reprocessed instruments

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing healthcare expenditure and medical tourism in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Cleaning and disinfection of advanced and complex medical devices

5.3 ASSESSMENT OF IMPACT OF COVID-19 ON ECONOMIC SCENARIO IN MEDICAL DEVICE CLEANING MARKET

6 MEDICAL DEVICE CLEANING INDUSTRY, BY PROCESS (Page No. - 65)

6.1 INTRODUCTION

TABLE 2 DISINFECTING MEDICAL EQUIPMENT MARKET BY PROCESS, 2020–2027 (USD MILLION)

6.2 DISINFECTION

TABLE 3 CLASSIFICATION OF MEDICAL EQUIPMENT AND REQUIRED LEVEL OF REPROCESSING

TABLE 4 EXAMPLES OF DISINFECTANTS FOR CLEANING INSTRUMENTS

TABLE 5 MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 6 MARKET FOR DISINFECTION PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.1 HIGH-LEVEL DISINFECTION

6.2.1.1 High-level disinfection is used to disinfect critical and semi-critical instruments

TABLE 7 HIGH-LEVEL DISINFECTION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.2 INTERMEDIATE-LEVEL DISINFECTION

6.2.2.1 Intermediate-level disinfectants are primarily used as surface disinfectants in dentistry

TABLE 8 INTERMEDIATE-LEVEL DISINFECTION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.2.3 LOW-LEVEL DISINFECTION

6.2.3.1 Low-level disinfection is used for cleaning non-critical instruments

TABLE 9 LOW-LEVEL DISINFECTION MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 AUTOMATIC CLEANING

TABLE 10 CLEANING PRODUCTS USED IN AUTOMATIC CLEANING PROCESS

TABLE 11 MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 12 MARKET FOR AUTOMATIC CLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1 ENZYMATIC DETERGENTS FOR AUTOMATIC CLEANING

6.3.1.1 Enzymatic detergents majorly remove organic contaminants

TABLE 13 EXAMPLES OF ENZYMATIC DETERGENTS USED FOR AUTOMATIC CLEANING OF INSTRUMENTS

TABLE 14 ENZYMATIC DETERGENTS MARKET FOR AUTOMATIC CLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 NON-ENZYMATIC DETERGENTS FOR AUTOMATIC CLEANING

6.3.2.1 Non-enzymatic detergents are used for automatic cleaning of instruments not recommended to be cleaned using enzymatic detergents

TABLE 15 EXAMPLES OF NON-ENZYMATIC DETERGENTS USED FOR AUTOMATIC CLEANING OF INSTRUMENTS

TABLE 16 NON-ENZYMATIC DETERGENTS MARKET FOR AUTOMATIC CLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 MANUAL CLEANING

TABLE 17 MANUAL CLEANING PRODUCTS AVAILABLE IN THE MARKET

TABLE 18 MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 19 MARKET FOR MANUAL CLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.4.1 ENZYMATIC DETERGENTS FOR MANUAL CLEANING

6.4.1.1 Enzymatic detergents are widely used in manual cleaning

TABLE 20 EXAMPLES OF ENZYMATIC DETERGENTS USED FOR MANUAL CLEANING OF INSTRUMENTS

TABLE 21 ENZYMATIC DETERGENTS MARKET FOR MANUAL CLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.4.2 NON-ENZYMATIC DETERGENTS FOR MANUAL CLEANING

6.4.2.1 Non-enzymatic detergents assure complete cleaning of instruments

TABLE 22 EXAMPLES OF NON-ENZYMATIC DETERGENTS USED FOR MANUAL CLEANING OF INSTRUMENTS

TABLE 23 NON-ENZYMATIC DETERGENTS MARKET FOR MANUAL CLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 PRESOAKING/PRECLEANING

TABLE 24 PRESOAKING/PRECLEANING PRODUCTS AVAILABLE IN THE MARKET

TABLE 25 MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 26 MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.5.1 ENZYMATIC DETERGENTS FOR PRESOAKING/PRECLEANING

6.5.1.1 Enzymatic detergents reduce need for lengthy manual scrubbing

TABLE 27 EXAMPLES OF ENZYMATIC DETERGENTS USED FOR PRESOAKING/PRECLEANING OF INSTRUMENTS

TABLE 28 ENZYMATIC DETERGENTS MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

6.5.2 NON-ENZYMATIC DETERGENTS FOR PRESOAKING/PRECLEANING

6.5.2.1 Non-enzymatic detergents prevent adhesion of bioburden on medical instruments

TABLE 29 EXAMPLES OF NON-ENZYMATIC DETERGENTS USED FOR PRESOAKING/PRECLEANING OF INSTRUMENTS

TABLE 30 NON-ENZYMATIC DETERGENTS MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY COUNTRY, 2020–2027 (USD MILLION)

7 MEDICAL DEVICE CLEANING INDUSTRY, BY APPLICATION (Page No. - 85)

7.1 INTRODUCTION

TABLE 31 DISINFECTING MEDICAL EQUIPMENT MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

7.2 SURGICAL INSTRUMENTS

7.2.1 GROWING NUMBER OF SURGERIES PERFORMED WORLDWIDE TO DRIVE SEGMENT GROWTH

TABLE 32 MARKET FOR SURGICAL INSTRUMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 ENDOSCOPES

7.3.1 LARGE VOLUME OF ENDOSCOPIC SURGERIES DRIVING DEMAND FOR EFFECTIVE CLEANING AND DISINFECTION OF ENDOSCOPES

TABLE 33 MARKET FOR ENDOSCOPES, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 ULTRASOUND PROBES

7.4.1 HIGH PREVALENCE OF ULTRASOUND-RELATED INFECTIONS TO DRIVE SEGMENT GROWTH

TABLE 34 MARKET FOR ULTRASOUND PROBES, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 DENTAL INSTRUMENTS

7.5.1 RISING INCIDENCE OF DENTAL DISEASES TO DRIVE SEGMENT GROWTH

TABLE 35 MARKET FOR DENTAL INSTRUMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 OTHER INSTRUMENTS

TABLE 36 MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2020–2027 (USD MILLION)

8 MEDICAL DEVICE CLEANING INDUSTRY, BY DEVICE TYPE (Page No. - 92)

8.1 INTRODUCTION

TABLE 37 DISINFECTING MEDICAL EQUIPMENT MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

8.2 CRITICAL DEVICES

8.2.1 MEDICAL DEVICE CLEANING PRODUCTS ARE WIDELY USED FOR CRITICAL DEVICES

TABLE 38 MARKET FOR CRITICAL DEVICES, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 SEMI-CRITICAL DEVICES

8.3.1 CLEANING AND STERILIZATION ARE RECOMMENDED FOR SEMI-CRITICAL DEVICES

TABLE 39 MARKET FOR SEMI-CRITICAL DEVICES, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 NON-CRITICAL DEVICES

8.4.1 CLEANING AND LOW OR INTERMEDIATE-LEVEL DISINFECTION ARE RECOMMENDED FOR NON-CRITICAL DEVICES

TABLE 40 MARKET FOR NON-CRITICAL DEVICES, BY COUNTRY, 2020–2027 (USD MILLION)

9 MEDICAL DEVICE CLEANING INDUSTRY, BY END USER (Page No. - 97)

9.1 INTRODUCTION

TABLE 41 DISINFECTING MEDICAL EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 HOSPITALS AND CLINICS

9.2.1 HOSPITALS AND CLINICS ARE LARGEST END USERS OF MEDICAL DEVICE CLEANING PRODUCTS

TABLE 42 MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 DIAGNOSTIC CENTERS

9.3.1 GROWING NUMBER OF PRIVATE IMAGING CENTERS TO SUPPORT MARKET GROWTH

TABLE 43 MARKET FOR DIAGNOSTIC CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 DENTAL HOSPITALS AND CLINICS

9.4.1 GROWING DENTAL TOURISM INDUSTRY DRIVING DEMAND FOR MEDICAL DEVICE CLEANING PRODUCTS

TABLE 44 MARKET FOR DENTAL HOSPITALS AND CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

9.5 OTHER END USERS

TABLE 45 MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

10 MARKET, BY REGION (Page No. - 103)

10.1 INTRODUCTION

FIGURE 22 GEOGRAPHICAL SNAPSHOT OF MEDICAL DEVICE CLEANING MARKET

TABLE 46 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 GLOBAL MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 23 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY SNAPSHOT

TABLE 48 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MEDICAL DEVICE CLEANING INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 US to dominate North American market during forecast period

TABLE 57 US: MACROECONOMIC INDICATORS

TABLE 58 US: MEDICAL DEVICE CLEANING INDUSTRY, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 59 US: MEDICAL DEVICE CLEANING MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 60 US: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 61 US: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 62 US: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 63 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 US: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 65 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 High incidence of HAIs and stringent regulatory standards for healthcare providers to drive market growth in Canada

TABLE 66 CANADA: MACROECONOMIC INDICATORS

TABLE 67 CANADA: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 68 CANADA: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 CANADA: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 70 CANADA: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 71 CANADA: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 72 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 73 CANADA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 74 CANADA: DISINFECTING MEDICAL EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

FIGURE 24 EUROPE: MEDICAL DEVICE CLEANING MARKET SNAPSHOT

TABLE 75 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 High prevalence of HAIs to support market growth

TABLE 84 GERMANY: MACROECONOMIC INDICATORS

TABLE 85 GERMANY: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 86 GERMANY: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 GERMANY: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 88 GERMANY: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 89 GERMANY: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 90 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Favorable government initiatives to support market growth in France

TABLE 93 FRANCE: MACROECONOMIC INDICATORS

TABLE 94 FRANCE: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 95 FRANCE: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 FRANCE: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 97 FRANCE: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 98 FRANCE: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 99 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 100 FRANCE: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 101 FRANCE: DISINFECTING MEDICAL EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Strong regulatory structure supports medical device cleaning practices in UK

TABLE 102 UK: MACROECONOMIC INDICATORS

TABLE 103 UK: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 104 UK: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 UK: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 106 UK: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 107 UK: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 108 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 UK: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 110 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Large geriatric population in Italy to support market growth

TABLE 111 ITALY: MACROECONOMIC INDICATORS

TABLE 112 ITALY: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 113 ITALY: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 ITALY: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 115 ITALY: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 116 ITALY: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 117 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 118 ITALY: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 119 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Government focus on improving healthcare infrastructure to support market growth in Spain

TABLE 120 SPAIN: MACROECONOMIC INDICATORS

TABLE 121 SPAIN: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 122 SPAIN: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 SPAIN: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 124 SPAIN: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 125 SPAIN: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 126 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 127 SPAIN: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 128 SPAIN: DISINFECTING MEDICAL EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 129 ROE: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 130 ROE: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 ROE: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 132 ROE: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 133 ROE: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 134 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 135 ROE: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 136 ROE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: MEDICAL DEVICE CLEANING MARKET SNAPSHOT

TABLE 137 APAC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 138 APAC: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 139 APAC: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 APAC: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 141 APAC: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 142 APAC: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 143 APAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 144 APAC: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 145 APAC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Japan to dominate Asia Pacific market during forecast period

TABLE 146 JAPAN: MACROECONOMIC INDICATORS

TABLE 147 JAPAN: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 148 JAPAN: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 JAPAN: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 150 JAPAN: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 151 JAPAN: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 152 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 153 JAPAN: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 154 JAPAN: DISINFECTING MEDICAL EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Large population and increasing number of healthcare facilities to drive market growth in China

TABLE 155 CHINA: MACROECONOMIC INDICATORS

TABLE 156 CHINA: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 157 CHINA: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 CHINA: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 159 CHINA: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 160 CHINA: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 161 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 162 CHINA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 163 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Improving healthcare infrastructure to drive market growth in India

TABLE 164 INDIA: MACROECONOMIC INDICATORS

TABLE 165 INDIA: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 166 INDIA: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 INDIA: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 168 INDIA: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 169 INDIA: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 170 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 171 INDIA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 172 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 173 ROAPAC: MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 174 ROAPAC: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 ROAPAC: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 176 ROAPAC: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 177 ROAPAC: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 178 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 179 ROAPAC: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 180 ROAPAC: DISINFECTING MEDICAL EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 IMPROVING HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET GROWTH IN LATIN AMERICA

TABLE 181 LATIN AMERICA: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 187 LATIN AMERICA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 GCC COUNTRIES ARE AMONG THE REGION’S LARGEST MARKETS FOR HEALTHCARE PRODUCTS

TABLE 189 MEA: MEDICAL DEVICE CLEANING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

TABLE 190 MEA: MARKET FOR DISINFECTION PROCESS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 MEA: MARKET FOR AUTOMATIC CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 192 MEA: MARKET FOR MANUAL CLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 193 MEA: MARKET FOR PRESOAKING/PRECLEANING PROCESS, BY DETERGENT TYPE, 2020–2027 (USD MILLION)

TABLE 194 MEA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 195 MEA: MARKET, BY DEVICE TYPE, 2020–2027 (USD MILLION)

TABLE 196 MEA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 169)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

11.3 COMPANY EVALUATION MATRIX

FIGURE 27 MEDICAL DEVICE CLEANING MARKET: COMPANY EVALUATION MATRIX, 2021

11.3.1 STARS

11.3.2 PERVASIVE PLAYERS

11.3.3 EMERGING LEADERS

11.3.4 PARTICIPANTS

11.4 COMPETITIVE SCENARIO

TABLE 197 PRODUCT LAUNCHES, 2019–2022

TABLE 198 DEALS, 2019–2022

TABLE 199 OTHER STRATEGIES, 2019–2022

12 COMPANY PROFILES (Page No. - 175)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 STERIS PLC

TABLE 200 STERIS PLC: BUSINESS OVERVIEW

FIGURE 28 STERIS PLC: COMPANY SNAPSHOT (2021)

12.1.2 GETINGE GROUP

TABLE 201 GETINGE AB: BUSINESS OVERVIEW

FIGURE 29 GETINGE AB: COMPANY SNAPSHOT (2021)

12.1.3 CANTEL MEDICAL CORPORATION (ACQUIRED BY STERIS)

TABLE 202 CANTEL MEDICAL CORPORATION: BUSINESS OVERVIEW

FIGURE 30 CANTEL MEDICAL CORPORATION: COMPANY SNAPSHOT (2020)

12.1.4 ECOLAB INC.

TABLE 203 ECOLAB INC.: BUSINESS OVERVIEW

FIGURE 31 ECOLAB INC.: COMPANY SNAPSHOT (2021)

12.1.5 3M COMPANY

TABLE 204 3M COMPANY: BUSINESS OVERVIEW

FIGURE 32 3M COMPANY: COMPANY SNAPSHOT (2021)

12.1.6 ADVANCED STERILIZATION PRODUCTS (FORTIVE CORPORATION)

TABLE 205 ADVANCED STERILIZATION PRODUCTS: BUSINESS OVERVIEW

12.1.7 RUHOF CORPORATION

TABLE 206 RUHOF CORPORATION: BUSINESS OVERVIEW

12.1.8 METREX RESEARCH, LLC

TABLE 207 METREX RESEARCH, LLC: BUSINESS OVERVIEW

12.1.9 INTEGRA LIFESCIENCES HOLDINGS CORPORATION

TABLE 208 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 33 INTEGRA LIFESCIENCES HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

12.1.10 SKLAR SURGICAL INSTRUMENTS

TABLE 209 SKLAR SURGICAL INSTRUMENTS: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 BIOTROL

TABLE 210 BIOTROL: BUSINESS OVERVIEW

12.2.2 ORO CLEAN CHEMIE AG

TABLE 211 ORO CLEAN CHEMIE AG: BUSINESS OVERVIEW

12.2.3 G9 CHEMICALS

TABLE 212 G9 CHEMICALS: BUSINESS OVERVIEW

12.2.4 PHARMAX LTD.

TABLE 213 PHARMAX LTD.: BUSINESS OVERVIEW

12.2.5 STRYKER CORPORATION

TABLE 214 STRYKER CORPORATION: BUSINESS OVERVIEW

FIGURE 34 STRYKER CORPORATION: COMPANY SNAPSHOT (2021)

12.2.6 MEDLINE INDUSTRIES, INC.

TABLE 215 MEDLINE INDUSTRIES, INC.: BUSINESS OVERVIEW

12.2.7 MEDALKAN

TABLE 216 MEDALKAN: BUSINESS OVERVIEW

12.2.8 MICROCARE MEDICALS

TABLE 217 MICROCARE MEDICALS: BUSINESS OVERVIEW

12.2.9 CONTEC, INC.

TABLE 218 CONTEC, INC.: BUSINESS OVERVIEW

12.2.10 MELAG MEDIZINTECHNIK GMBH & CO. KG

TABLE 219 MELAG MEDIZINTECHNIK GMBH & CO. KG: BUSINESS OVERVIEW

12.2.11 PAL INTERNATIONAL

TABLE 220 PAL INTERNATIONAL: BUSINESS OVERVIEW

12.2.12 MMM GROUP

TABLE 221 MMM GROUP: BUSINESS OVERVIEW

12.2.13 CASE MEDICAL, INC.

TABLE 222 CASE MEDICAL, INC.: BUSINESS OVERVIEW

12.2.14 GAMA HEALTHCARE LTD.

TABLE 223 GAMA HEALTHCARE LTD.: BUSINESS OVERVIEW

12.2.15 DR. WEIGERT

TABLE 224 DR. WEIGERT: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 230)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major approaches in estimating the current medical device cleaning market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the usage of widespread secondary sources; directories; databases (such as Factiva and Bloomberg); white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of this market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Some of the key secondary resources referred to in this study include:

- Association for Professionals in Infection Control and Epidemiology (APIC)

- Association of Surgical Technologies (AST)

- International Journal of Infection Control (IJIC)

- Department of Health and Infection Prevention Society (UK)

- Association of Medical Device Reprocessors (AMDR)

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include CEOs, consultants, subject-matter experts, directors, general managers, developers, and other key opinion leaders of the various companies that offer medical device cleaning products. Primary sources from the demand side include industry experts such as hospital directors, infection control practitioners, reprocessing technicians, and other medical professionals.

Primary research was conducted to identify segmentation types; industry trends; technology trends; key players; and key market dynamics such as drivers, restraints, opportunities, challenges, and key player strategies.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the medical device cleaning market was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the medical device cleaning businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the medical device cleaning market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of medical device cleaning products in the overall medical device cleanign market was obtained from secondary data and validated by primary participants to arrive at the total medical device cleaning market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall medical device cleaning market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

After complete market engineering with calculations for market statistics, market size estimations, market forecasting, market breakdown, and data triangulation, extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and further quantitative analysis was also done from all the numbers arrived at in the complete market engineering process to list key information throughout the report.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the medical device cleaning business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, and forecast the medical device cleaning market by process, application, end user, device and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall medical device cleaning market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the medical device cleaning market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies2 in the medical device cleaning market

- To track and analyze competitive developments such as partnerships, agreements, acquisitions, product launches, and expansions in the medical device cleaning market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Further segmentation of individual product segments by application

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific medical device cleanign market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe medical devcice cleaning market into Belgium, Russia, the Netherlands, Switzerland, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Device Cleaning Market

How much global revenue is the medical device cleaning market expected to generate in the future?