Medical Alert Systems Market Size, Share, Statistics and Industry Growth Analysis Report by Offering, System Type, Connection Type (Wired, Wireless), Technology, Distribution Channel (Pharmacies, Online Sales, Hypermarkets), Application and Geography - Global Growth Driver and Industry Forecast to 2026

Updated on : Oct 23, 2024

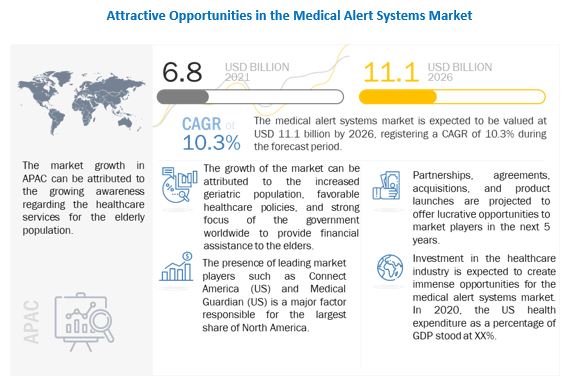

The medical alert systems market size is projected to reach USD 11.1 billion by 2026 from USD 8.2 billion by 2023, it is expected to growing at a CAGR of 10.3 % during the forecast period.

The market has been witnessing significant growth over the past years, mainly owing to the increased geriatric population, favorable healthcare policies and strong focus on financial assistance to considerably boost the medical alert systems market in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Medical Alert Systems Market:

The medical alert systems industry is expected to grow between 2021 and 2026 owing to the rising demand for personal health monitoring systems by home-based users and nurse call systems by hospitals and clinics due to COVID-19. The integration between remote patient monitoring platforms and healthcare facilities will help offer remote access through telehealth platforms to essential healthcare services while improving safety and health outcomes for patients statewide. This has essentially gained importance amid the COVID-19 pandemic because they offer patients safer, more accessible options for preventive, routine, and chronic care. Furthermore, these services help reduce the burden on hospitals and healthcare providers, improving outcomes for the vulnerable populations they serve.

Medical Alert Systems Market Outlook and Overview:

The global medical alert systems market is poised for significant growth, driven by the increasing demand for emergency response solutions among seniors and individuals with health issues. The market, valued at USD 8.2 billion by 2023, is projected to reach USD 11.1 billion by 2026, registering a compound annual growth rate (CAGR) of 10.3% during forecast period. This growth is fueled by the rising geriatric population, technological advancements in medical alert systems, and government initiatives promoting digital healthcare solutions. The market is also expected to witness increased adoption of IoT and AI-powered solutions, further enhancing the safety and security of users.

Medical Alert Systems Market Dynamics:

Driver: Increasing geriatric population globally along with the high level of health literacy among older people

The increasing geriatric population and the high level of health literacy across the world are the key factors for the escalated demand for medical alert systems, which can be used by senior citizens, disabled people, or by people with brain illnesses to receive prompt help in emergencies. Under the health literacy program, people are trained on making smart healthcare choices, improving their communication with doctors or emergency responders, etc. Elderly people are often prone to falls. Additionally, for family members of active seniors, it has become highly essential to track their location, monitor their activities, remind them about medication, and so on. Also, for people with mild cognitive illness who suffer from disorientation, location tracking or geo-fencing are the critical features offered by life-saving solutions such as medical alert systems. All these factors propel the medical alert systems market growth.

Restraint: Stringent regulatory processes and increased testing requirements for product approval

The medical alert systems market is highly affected by legislation and initiatives such as increasing clinical trial requirements for new products. Over the years, the medical device approval guidelines and regulations across the world have become more stringent, aiming to minimize errors associated with medical devices. After receiving many cases regarding safety-related issues and errors in medical devices, regulatory authorities, such as the Medicines and Healthcare products Regulatory Agency (MHRA), has made the regulatory processes more stringent and increased testing requirements for the approval of new products. Currently, medical alert system manufacturers must submit design validations to MHRA before the product is launched in the market for sale. These regulatory aspects are likely to obstruct the growth of the market during the forecast period.

Opportunity: Revolution brought by emerging technologies such as IoT and AI

The revolution brought by emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI) has provided tremendous opportunities to the players in the market. State-of-the-art technologies can be used to create a difference in the medical alert system market, and the stakeholders can leverage it by timely implementation. AI-driven systems, along with predictive analytics, help in automatic fall detection and wanderer control, as well as provide notification to caregivers. Companies such as Xsens (Netherlands), Xander Kardian (US), and Qventus (US) have built AI-powered fall detectors for elderly individuals. CarePredict (US), an AI-driven health technology company, uses AI to detect any change in the activity and behavior patterns among the elders and helps them in independent living. The impact of such technologies is remarkable and has a humungous potential soon in the medical alert systems market.

Challenge: Supply chain disruptions caused due to outbreak of COVID-19

The outbreak of the COVID-19 pandemic has affected the global supply chain of the medical device industry owing to the lockdowns imposed across many countries during the first and second quarters of 2020. The supply chain of medical devices is complex and depends on several suppliers from disparate locations to synchronize with each other. The shortage of even a single component can hold up an entire production line, resulting in inventory and cashflow backlogs. Unless the entire supply chain of the medical device market is operational and functioning smoothly, their production is challenged and constrained.

Medical Alert Systems Market Segmentation:

Mobile based PERS (Personal Emergency Response System) in product segment for medical alert systems market to grow with highest CAGR during the forecast period.

The medical alert systems market is witnessing a trend occurring over the past few years with the new technology replacing the traditional medical alert systems. Mobile-based PERS or mPERS are likely to lead the market in the coming years as the adoption of smartphones in recent years has increased to a great extent. mPERS come with smart wearables that can be worn on the wrist or as a necklace. mPERS devices provide mobility to senior citizens by allowing them to maintain their independent lifestyle by providing access to the device wherever they go. Several factors such as built-in sensors, fall detection algorithms, use of mobile phone app, and faster response time accelerate demand for mobile-based PERS. The evolution of the industry will continue to bring new and dynamic trends in the years to come.

Wireless connection type segment to have the largest size during the forecast period.

Wireless medical alert systems are increasingly being adopted at present owing to the mobility and advancements in mPERS devices, as well as due to the rising adoption of smart devices. These factors have led to the development of wireless systems, accounting for a larger market share. Another factor for the larger market share of wireless medical alert systems is the surging demand for wireless systems by the elderly seniors who want to maintain an active lifestyle while securing themselves for emergencies. These factors have led to the high growth rate of wireless systems during the forecast period.

Home based users are expected to capture the largest market share during the forecast period.

Home-based users held the largest share of the medical alert systems market in 2020, and a similar trend is likely to be observed during the forecast period. Medical alert systems are increasingly adopted by home-based users owing to the increasing elderly population, a strong focus of such population on maintaining their independence and provide peace of mind to their family members. Also, many senior people suffer from a health condition or are at risk of falling, creating the need for timely emergency response, which has resulted in the rising use of medical alert systems by home-based users.

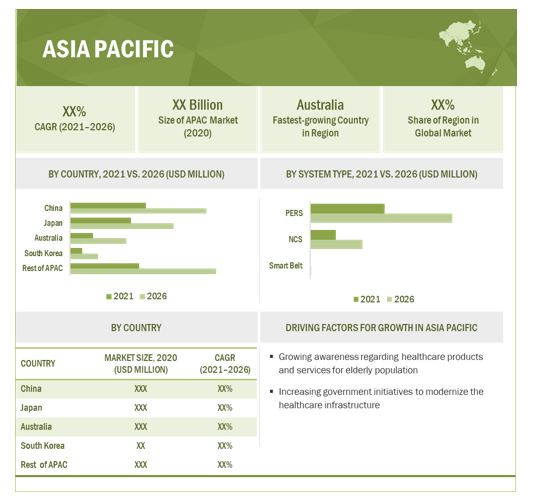

By Region, medical alert systems market in APAC to grow with highest CAGR during the forecast period.

The APAC region is expected to record the highest CAGR during the forecast period. This growth can be attributed to various healthcare reforms undertaken by the governments in countries such as China, India, and South Korea, with a significant size of the elderly population. The rising healthcare awareness and increasing per capita expenditure on healthcare are among a few major factors driving the market in APAC. PERS monitoring is much more affordable than in-person monitoring; hence, caregivers find it better to take care of the elderly. Growing medical tourism in developing countries of APAC, such as China and India, is likely to provide new market opportunities to advanced and sophisticated medical alert systems during the forecast period. Further, the surging demand for quality medical care is expected to propel the medical alert systems market growth in this region during the forecast period.

Medical Alert Systems Companies - Market Key Players

Philips (Netherlands) ,Connected America (US) ,Valued Relationships (US) ,Medical Guardian (US) ,ADT (US) Guardian Alarm (US), Bay Alarm Medical (US), MobileHelp (US), Alert1 (US), and LifeFone (US) are medical alert systems companies operating in the market.

Medical Alert Systems Market Scope

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 6.8 Billion |

| Projected Market Size | USD 11.1 Billion |

| Growth Rate | 10.3% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Increasing geriatric population globally along with the high level of health literacy among older people |

| Key Market Opportunity | Revolution brought by emerging technologies such as IoT and AI |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Wireless connection type Segment |

| Highest CAGR Segment | Mobile based PERS Segment |

| Largest Application Market Share |

Home-Based users Application |

This research report categorizes the medical alert systems market based on system type, offering, technology, connection type, distribution channel, application, and region.

Medical Alert Systems Market, by Offering

-

Hardware

- Console Unit

- Transmitter

- Wristband Transmitter

- Pendant Transmitter

- Battery

- Others

- Services (Subscription Revenue)

Market by System Type

-

Personal Emergency Response System (PERS)

- Home-based/Landline-based System

-

Mobile PERS

- Cellular Emergency Response System

- Wireless Emergency Response System

- GPS-based Emergency Response System

-

Nurse Calling System (NCS)

- Button-based Systems

- Integrated Communication Systems

- Mobile Systems

- Intercom Systems

- Smart Belt

Market, by Technology

- Two-way Voice Systems

- Unmonitored Medical Alert Systems

- Medical Alert Alarm (Button) System

- IP-based Systems

Market, by Distribution Channel

- Pharmacies

- Online Sales

- Hypermarkets

Market, by Connection Type

- Wired

- Wireless

Market, by Application

- Home-Based users

- Senior Living Facilities/Senior Care Centers

- Assisted Living Facilities

- Hospitals and Clinics

- Others (Nursing Homes, Retirement Homes, Mental Healthcare Centers)

Medical Alert Systems Market, by Geography

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Italy, Spain, and Rest of Europe)

- APAC (China, Japan, South Korea, India, Australia, and Rest of APAC)

- RoW (South America, and Middle East and Africa)

Recent Developments

- In February 2021, Connect America partnered with Urban Health Plan (US), a health center program in the US, to bring remote patient monitoring (RPM) services to patients living in the underserved communities of the Bronx, Queens, and Manhattan.

- In October 2020, MobileHelp launched Micro, an all-in-one mobile medical alert device that offers wearable comfort with its compact size and weight without sacrificing technology strengths. The product also features MobileHelp’s patented automatic fall detection and advanced location tracking technology.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the medical alert systems market?

The agreements, contracts, expansions, collaborations, and partnerships has been and continue to be some of the major strategies adopted by the key players to grow in the medical alert systems market.

Which is the emerging offering in the medical alert systems market?

Products and services are the dominant segments in the medical alert systems in terms of market share, while the product segment is witnessing the highest growth in the medical alert systems market.

Which is the key end-user industry of medical alert systems products?

Home based users have the highest market share in the end-user industry in the medical alert systems market.

Who are the major companies in the medical alert systems market?

Philips (Netherlands), Connected America (US), Valued Relationships (US), Medical Guardian (US), and ADT (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 GENERAL INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT PRODUCT LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT CONNECTION TYPE LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT END USER LEVEL

1.2.7 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

1.3 MARKET SEGMENTATION

1.3.1 MARKETS COVERED

FIGURE 1 MEDICAL ALERT SYSTEMS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 MEDICAL ALERT SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 Primary participants

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for obtaining market size using bottom-up analysis (demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for obtaining market size using top-down analysis (supply side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH 1

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH 2

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RISK ASSESSMENT

TABLE 1 RISK FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

3.1 SCENARIO ANALYSIS

FIGURE 9 PRE- AND POST-COVID-19 MEDICAL ALERT SYSTEMS MARKET SIZE, BY SCENARIO, 2017–2026

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 SMART BELTS TO EXHIBIT HIGHEST CAGR IN MEDICAL ALERT SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 11 MEDICAL ALERT SYSTEMS MARKET, BY CONNECTION TYPE, 2021–2026 (USD MILLION)

FIGURE 12 HOME-BASED USERS TO WITNESS LARGEST STAKE IN MEDICAL ALERT SYSTEMS MARKET IN 2026

FIGURE 13 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MEDICAL ALERT SYSTEMS MARKET

FIGURE 14 MOBILE-BASED PERS TO WITNESS HIGH ADOPTION DURING FORECAST PERIOD

4.2 MEDICAL ALERT SYSTEMS MARKET, BY END USER

FIGURE 15 HOME-BASED USERS TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.3 MEDICAL ALERT SYSTEMS MARKET, BY PRODUCT

FIGURE 16 PERS TO CAPTURE LARGER MARKET SHARE THAN NCS IN 2026

4.4 MEDICAL ALERT SYSTEMS MARKET, BY OFFERING

FIGURE 17 HARDWARE SEGMENT TO EXHIBIT HIGHER CAGR THAN SERVICES SEGMENT IN MARKET DURING FORECAST PERIOD

4.5 MEDICAL ALERT SYSTEMS MARKET, BY PRODUCT AND REGION

FIGURE 18 NORTH AMERICA AND PERS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2026

5 MARKET OVERVIEW (Page No. - 59)

5.1 MARKET DYNAMICS

FIGURE 19 MEDICAL ALERT SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increasing geriatric population globally, along with high level of health literacy among older people

FIGURE 20 GLOBAL AND REGION-WISE GROWTH OF POPULATION AGED 60 AND OLDER, BY REGION (2017 VS. 2050)

5.1.1.2 Rising adoption of life-saving and tracking systems by hospitals and general public in pandemic and post-pandemic scenarios

5.1.1.3 Surging implementation of smart and mobile emergency response systems in medical care

5.1.1.4 Ongoing technological advancements in medical alert systems

5.1.1.5 Supporting healthcare policies and financial assistance by governments worldwide for senior citizens

5.1.1.6 Growing inclination of elders toward independent living

FIGURE 21 IMPACT ANALYSIS: DRIVERS

5.1.2 RESTRAINTS

5.1.2.1 High rate of false alarms

5.1.2.2 Stringent regulatory processes and increased testing requirements for product approval

5.1.2.3 Lower acceptability among seniors for use of technology

FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

5.1.3 OPPORTUNITIES

5.1.3.1 Positive growth outlook for healthcare sector with rising expenditure on medical services

FIGURE 23 REGIONAL PERCENTAGE OF GDP SPEND ON HEALTHCARE, 1995–2024

5.1.3.2 Important revolution brought by emerging technologies such as IoT and AI

5.1.3.3 Untapped potential in developing countries

FIGURE 24 PERCENTAGE OF GDP SPEND ON HEALTHCARE ACROSS BRICS MEMBERS IN 2019

5.1.3.4 Rapid penetration of voice-based and mobile medical alert systems

5.1.3.5 Recent trend of assisted living centers and retirement homes designed for geriatric population

FIGURE 25 IMPACT ANALYSIS: OPPORTUNITIES

5.1.4 CHALLENGES

5.1.4.1 Integration of connected medical devices into established ecosystem

5.1.4.2 Cybersecurity risks posed by proliferation of connected medical devices

5.1.4.3 Supply chain disruptions caused due to outbreak of COVID-19

FIGURE 26 IMPACT ANALYSIS: CHALLENGES

5.2 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

FIGURE 27 REVENUE SHIFT IN MARKET

5.3 PRICE TREND ANALYSIS

FIGURE 28 AVERAGE SELLING PRICES OF DIFFERENT TYPES OF MEDICAL ALERT SYSTEMS, 2017–2026 (USD)

5.4 REGULATORY LANDSCAPE

5.4.1 US

5.4.2 UK

5.4.3 INDIA

TABLE 2 LIST OF COUNTRY-BASED POLICIES, STANDARDS, AND GUIDELINES RELATED TO MEDICAL DEVICES

5.5 VALUE CHAIN ANALYSIS

FIGURE 29 MEDICAL ALERT SYSTEMS MARKET: VALUE CHAIN ANALYSIS

5.6 ECOSYSTEM ANALYSIS

FIGURE 30 KEY PLAYERS IN MEDICAL ALERT SYSTEMS ECOSYSTEM

TABLE 3 MEDICAL ALERT SYSTEMS MARKET: ECOSYSTEM

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.8.1 INTEGRATION OF IOT AND AI INTO SENIOR HEALTHCARE

5.8.2 DETECTION OF FALLS USING MACHINE LEARNING APPROACH

5.8.3 ADOPTION OF SMART WEARABLES

5.8.4 RISE OF TELEMEDICINE

5.9 PATENT ANALYSIS

5.9.1 PUBLICATION TREND

FIGURE 32 NO. OF PATENTS GRANTED EACH YEAR BETWEEN 2011 AND 2020

5.9.2 JURISDICTION ANALYSIS

FIGURE 33 JURISDICTION ANALYSIS

5.9.3 TOP PATENT OWNERS

FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2020

TABLE 5 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

5.10 TRADE ANALYSIS

FIGURE 35 EXPORT SCENARIO FOR HS CODE: 851769-BASED PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 36 IMPORT SCENARIO FOR HS CODE: 851769-BASED PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

6 MEDICAL ALERT SYSTEMS MARKET, BY PRODUCT (Page No. - 85)

6.1 INTRODUCTION

FIGURE 37 PERSONAL EMERGENCY RESPONSE SYSTEM (PERS) TO ACCOUNT FOR LARGEST SIZE OF MEDICAL ALERT SYSTEMS MARKET IN 2026

TABLE 6 MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 7 MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 8 MARKET, BY PRODUCT, 2017–2020 (THOUSAND UNITS)

TABLE 9 MARKET, BY PRODUCT, 2021–2026 (THOUSAND UNITS)

6.2 PERSONAL EMERGENCY RESPONSE SYSTEM

TABLE 10 MARKET FOR PERS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 11 MARKET FOR PERS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 12 MARKET FOR PERS, BY END USER, 2017–2020 (USD MILLION)

TABLE 13 MARKET FOR PERS, BY END USER, 2021–2026 (USD MILLION)

TABLE 14 MARKET FOR PERS, BY CONNECTION TYPE, 2017–2020 (USD MILLION)

TABLE 15 MARKET FOR PERS, BY CONNECTION TYPE, 2021–2026 (USD MILLION)

TABLE 16 MARKET FOR PERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 MARKET FOR PERS, BY REGION, 2021–2026 (USD MILLION)

6.2.1 TRADITIONAL LANDLINE-BASED PERS

6.2.1.1 Traditional landline-based PERS proved to be user friendly

6.2.2 MOBILE-BASED PERS

6.2.2.1 Cellular emergency response system

6.2.2.1.1 Developments in communication technologies and protocols creating high demand for cellular PERS

6.2.2.2 Wireless emergency response system

6.2.2.2.1 Wireless PERS are gaining popularity owing to advances in medical technology

6.2.2.3 GPS-based emergency response system

6.2.2.3.1 GPS-based PERS devices are expected to witness highest growth rate in medical alert systems market during forecast period

6.3 NURSE CALLING SYSTEM (NCS)

TABLE 18 MARKET FOR NCS, BY TYPE, 2017–2020 (USD MILLION)

TABLE 19 MARKET FOR NCS, BY TYPE, 2021–2026 (USD MILLION)

TABLE 20 MARKET FOR NCS, BY END USER, 2017–2020 (USD MILLION)

TABLE 21 MARKET FOR NCS, BY END USER, 2021–2026 (USD MILLION)

TABLE 22 MARKET FOR NCS, BY CONNECTION TYPE,2017–2020 (USD MILLION)

TABLE 23 MARKET FOR NCS, BY CONNECTION TYPE, 2021–2026 (USD MILLION)

TABLE 24 MARKET FOR NCS, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 MARKET FOR NCS, BY REGION, 2021–2026 (USD MILLION)

6.3.1 BUTTON-BASED SYSTEMS

6.3.1.1 Button-based systems allow patients in hospitals or healthcare settings to alert nurses or healthcare staff in medical emergencies

6.3.2 INTEGRATED COMMUNICATION SYSTEMS

6.3.2.1 Integrated communication systems enable end users to access real-time routing of text messages, calls, and clinical data

6.3.3 MOBILE SYSTEMS

6.3.3.1 Mobile nurse call systems enable easy communication between healthcare staff and doctors

6.3.4 INTERCOM SYSTEMS

6.3.4.1 Intercom systems are used inside healthcare facilities to transmit audio and video signals

6.4 SMART BELT

6.4.1 SMART BELTS TO REGISTER HIGHEST CAGR IN MEDICAL ALERT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 26 MARKET FOR SMART BELT, BY END USER, 2017–2020 (USD MILLION)

TABLE 27 MARKET FOR SMART BELT, BY END USER, 2021–2026 (USD MILLION)

TABLE 28 MARKET FOR SMART BELT, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 MARKET FOR SMART BELT, BY REGION, 2021–2026 (USD MILLION)

7 MEDICAL ALERT SYSTEMS MARKET, BY OFFERING (Page No. - 100)

7.1 INTRODUCTION

FIGURE 38 MARKET FOR HARDWARE TO GROW AT HIGHER CAGR FROM 2021 TO 2026

TABLE 30 MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 31 MARKET, BY OFFERING, 2021–2026 (USD MILLION)

7.2 HARDWARE

7.2.1 CONSOLE UNIT

7.2.1.1 Technological advancements have resulted in development of smart console units that can be connected to VoIP or 4G LTE network for faster communication

7.2.2 TRANSMITTER

7.2.2.1 Transmitter is battery-powered, lightweight, and waterproof button providing excellent communication capabilities

7.2.3 WRISTBAND TRANSMITTER

7.2.3.1 Wristband transmitter is most common easy-to-use on-the-go medical alert system

7.2.4 PENDANT TRANSMITTER

7.2.4.1 Pendant transmitters are available with fall detection option and are user-friendly

7.2.5 SENSORS

7.2.5.1 Sensors play crucial role in saving user’s life and unnecessary hospitalization costs

7.3 SERVICES

7.3.1 SUBSCRIPTION-BASED MONITORING

7.3.1.1 Surged demand for subscription-based services to ensure security and safety of elderly person

7.3.2 MOBILE APPLICATION-BASED MONITORING

7.3.2.1 Increased penetration and popularity of smartphones resulted in rising demand for mobile application-based monitoring services

8 MEDICAL ALERT SYSTEMS MARKET, BY CONNECTION TYPE (Page No. - 105)

8.1 INTRODUCTION

FIGURE 39 MARKET, BY CONNECTION TYPE

FIGURE 40 WIRELESS MEDICAL ALERT SYSTEMS TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 32 MARKET, BY CONNECTION TYPE, 2017–2020 (USD MILLION)

TABLE 33 MARKET, BY CONNECTION TYPE, 2021–2026 (USD MILLION)

8.2 WIRED

8.2.1 WIRED MEDICAL ALERT SYSTEMS ARE SUITABLE FOR SENIORS WITH SEDENTARY LIFESTYLE

TABLE 34 WIRED MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 35 WIRED MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

8.3 WIRELESS

8.3.1 PENETRATION OF WIRELESS MEDICAL ALERT SYSTEMS AMONG ELDERLY INDIVIDUALS IS HIGHER THAN WIRED MEDICAL ALERT SYSTEMS

TABLE 36 WIRELESS MEDICAL ALERT SYSTEM MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 37 WIRELESS MEDICAL ALERT SYSTEM MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

9 COMMUNICATION TECHNOLOGIES USED IN MEDICAL ALERT SYSTEMS (Page No. - 110)

9.1 INTRODUCTION

9.2 TWO-WAY VOICE SYSTEMS

9.2.1 TWO-WAY VOICE SYSTEMS PROVIDE REAL-TIME ACCESS TO TEXT MESSAGES, CALLS, AND CLINICAL DATA

9.3 UNMONITORED MEDICAL ALERT SYSTEMS

9.3.1 UNMONITORED SYSTEMS ENABLE SUBSCRIPTION-FREE, TWO-WAY COMMUNICATION WITH EMERGENCY CONTACT PERSON OR SERVICE PROVIDER

9.4 MEDICAL ALERT ALARM (BUTTON) SYSTEMS

9.4.1 MEDICAL ALARMS PROVIDE CRUCIAL INFORMATION TO CLINICIANS TO MAKE DIAGNOSTIC AND TREATMENT-RELATED DECISIONS

9.5 VOIP-BASED SYSTEMS

9.5.1 VOIP-BASED MEDICAL ALERT SYSTEMS UTILIZE HIGH-SPEED INTERNET CONNECTION, ALLOWING PATIENTS TO ROUTE CALLS DIRECTLY TO THEIR ASSIGNED CAREGIVER

10 CHANNELS OF DISTRIBUTION TO MARKET MEDICAL ALERT SYSTEMS (Page No. - 112)

10.1 INTRODUCTION

10.2 PHARMACIES

10.2.1 PHARMACIES ARE WIDELY PREFERRED BY BOTH MANUFACTURERS AND CONSUMERS

10.3 ONLINE CHANNELS

10.3.1 EASE OF USE AND HIGH LEVELS OF CONVENIENCE HAVE MADE ONLINE SALES PROMINENT DISTRIBUTION CHANNEL

10.4 HYPERMARKETS

10.4.1 RISING PREFERENCE FOR ONLINE PURCHASING IS REDUCING MARKET SHARE OF HYPERMARKETS

11 MEDICAL ALERT SYSTEMS MARKET, BY END USER (Page No. - 114)

11.1 INTRODUCTION

FIGURE 41 ASSISTED LIVING FACILITIES TO REGISTER HIGHEST CAGR IN MARKET BETWEEN 2021 AND 2026

TABLE 38 MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 39 MARKET, BY END USER, 2021–2026 (USD MILLION)

11.2 HOSPITALS AND CLINICS

11.2.1 HIGH DEMAND FOR MEDICAL ALERT SYSTEMS IN HOSPITALS AND CLINICS TO SUPERVISE PATIENTS WITH BRAIN DISORDERS

11.3 HOME-BASED USERS

11.3.1 LARGEST MARKET SHARE OF HOME-BASED USERS DUE TO INDEPENDENCE OFFERED BY MEDICAL ALERT SYSTEMS AT LOWEST COST

TABLE 40 MARKET FOR HOME-BASED USERS, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 41 MARKET FOR HOME-BASED USERS, BY PRODUCT, 2021–2026 (USD MILLION)

11.4 SENIOR LIVING FACILITIES

11.4.1 ENHANCED SAFETY FEATURES, REDUCED BURDEN ON STAFF, AND IMPROVED MOBILITY STIMULATE DEMAND FROM SENIOR LIVING FACILITIES TO MAINTAIN ACTIVE LIFESTYLE OF USERS

TABLE 42 MARKET FOR SENIOR LIVING FACILITIES, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 43 MARKET FOR SENIOR LIVING FACILITIES, BY PRODUCT, 2021–2026 (USD MILLION)

11.5 ASSISTED LIVING FACILITIES

11.5.1 INCREASED NUMBER OF ASSISTED LIVING CENTERS PUSHING DEMAND FOR MEDICAL ALERT SYSTEMS

TABLE 44 MARKET FOR ASSISTED LIVING FACILITIES, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 45 MARKET FOR ASSISTED LIVING FACILITIES, BY PRODUCT, 2021–2026 (USD MILLION)

11.6 OTHERS

TABLE 46 MARKET FOR OTHER END USERS, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 47 MARKET FOR OTHER END USERS, BY PRODUCT, 2021–2026 (USD MILLION)

12 MEDICAL ALERT SYSTEMS MARKET, BY REGION (Page No. - 122)

12.1 INTRODUCTION

FIGURE 42 GEOGRAPHIC SNAPSHOT OF MEDICAL ALERT SYSTEMS MARKET, 2021–2026

FIGURE 43 APAC TO BE FASTEST-GROWING MARKET FOR MEDICAL ALERT SYSTEMS FROM 2021 TO 2026

TABLE 48 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 44 SNAPSHOT OF MEDICAL ALERT SYSTEMS MARKET IN NORTH AMERICA

FIGURE 45 US TO ACCOUNT FOR LARGEST SIZE OF NORTH AMERICAN MEDICAL ALERT SYSTEMS MARKET DURING FORECAST PERIOD

TABLE 50 MARKET IN NORTH AMERICA, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 51 MARKET IN NORTH AMERICA, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 US to capture largest share of North American market for medical alert systems market due to rising geriatric population

TABLE 56 MARKET IN US, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 57 MARKET IN US, BY OFFERING, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Canada to witness highest growth rate in North American market for medical alert systems

TABLE 58 MARKET IN CANADA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 59 MARKET IN CANADA, BY OFFERING, 2021–2026 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Mexican market growth is driven by rising need for improved medical infrastructure

TABLE 60 MARKET IN MEXICO, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 61 MARKET IN MEXICO, BY OFFERING, 2021–2026 (USD MILLION)

12.2.4 IMPACT OF COVID-19 ON MEDICAL ALERT SYSTEMS MARKET IN NORTH AMERICA

12.3 EUROPE

FIGURE 46 SNAPSHOT OF MEDICAL ALERT SYSTEMS MARKET IN EUROPE

FIGURE 47 MARKET IN SPAIN TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 62 MARKET IN EUROPE, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 64 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 65 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 66 MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 67 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

12.3.1 UK

12.3.1.1 Rising awareness among elderly citizens regarding benefits of medical alert systems to boost market growth in UK

TABLE 68 MARKET IN UK, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 69 MARKET IN UK, BY OFFERING, 2021–2026 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Growing inclination of older adults toward independent living to accelerate market growth in Germany

TABLE 70 MARKET IN GERMANY, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 71 MARKET IN GERMANY, BY OFFERING, 2021–2026 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Increasing healthcare expenditure to fuel growth of medical alert systems market in France

TABLE 72 MARKET IN FRANCE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 73 MARKET IN FRANCE, BY OFFERING, 2021–2026 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Increasing elderly population, along with elevated demand for advanced technology, to propel growth of Italian medical alert systems market

TABLE 74 MARKET IN ITALY, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 75 MARKET IN ITALY, BY OFFERING, 2021–2026 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 Developing private healthcare sector in Spain providing opportunities to players in medical alert systems market

TABLE 76 MARKET IN SPAIN, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 77 MARKET IN SPAIN, BY OFFERING, 2021–2026 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 78 MARKET IN REST OF EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 79 MARKET IN REST OF EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

12.3.7 IMPACT OF COVID-19 ON MEDICAL ALERT SYSTEMS MARKET IN EUROPE

12.4 ASIA PACIFIC (APAC)

FIGURE 48 SNAPSHOT OF MEDICAL ALERT SYSTEMS MARKET IN APAC

FIGURE 49 AUSTRALIA TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 80 MARKET IN APAC, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 81 MARKET IN APAC, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 82 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 83 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 84 MARKET IN APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 85 MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Healthcare sector in China is expanding at faster rate, creating opportunity for affordable and easy-to-use medical technologies such as medical alert systems

TABLE 86 MARKET IN CHINA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 87 MARKET IN CHINA, BY OFFERING, 2021–2026 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Japan has almost 25% of population 65 years old and above, thereby creating growth opportunities for market players

TABLE 88 MARKET IN JAPAN, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 89 MARKET IN JAPAN, BY OFFERING, 2021–2026 (USD MILLION)

12.4.3 AUSTRALIA

12.4.3.1 Australian market is driven by high expenditure toward modern healthcare services

TABLE 90 MARKET IN AUSTRALIA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN AUSTRALIA, BY OFFERING, 2021–2026 (USD MILLION)

12.4.4 SOUTH KOREA

12.4.4.1 High penetration of technology among South Korean senior population has resulted in increased demand for medical devices such as medical alert systems

TABLE 92 MARKET IN SOUTH KOREA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 93 MARKET IN SOUTH KOREA, BY OFFERING, 2021–2026 (USD MILLION)

12.4.5 REST OF APAC

TABLE 94 MARKET IN REST OF APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 95 MARKET IN REST OF APAC, BY OFFERING, 2021–2026 (USD MILLION)

12.4.6 IMPACT OF COVID-19 ON MEDICAL ALERT SYSTEMS MARKET IN APAC

12.5 REST OF THE WORLD (ROW)

TABLE 96 MARKET IN ROW, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN ROW, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 98 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 100 MARKET IN ROW, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Middle East & Africa to account for larger market size in RoW region throughout forecast period

TABLE 102 MARKET IN MIDDLE EAST & AFRICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN MIDDLE EAST & AFRICA, BY OFFERING, 2021–2026 (USD MILLION)

12.5.2 SOUTH AMERICA

12.5.2.1 South America to exhibit higher CAGR in medical alert systems market in RoW during forecast period

TABLE 104 MARKET IN SOUTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 105 MARKET IN SOUTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 156)

13.1 INTRODUCTION

FIGURE 50 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGIES BETWEEN JANUARY 2018 AND MAY 2021

13.2 MARKET EVALUATION FRAMEWORK

TABLE 106 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MEDICAL ALERT SYSTEM MANUFACTURERS

13.2.1 PRODUCT PORTFOLIO

13.2.2 REGIONAL FOCUS

13.2.3 MANUFACTURING FOOTPRINT

13.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

13.3 MARKET SHARE ANALYSIS OF KEY COMPANIES, 2020

TABLE 107 MEDICAL ALERT SYSTEMS MARKET: DEGREE OF COMPETITION

TABLE 108 SHARE OF LEADING PLAYERS IN MARKET, 2020

TABLE 109 MARKET RANKING ANALYSIS: MARKET, 2020

13.4 HISTORICAL REVENUE ANALYSIS OF MAJOR PLAYERS IN MARKET

FIGURE 51 REVENUE ANALYSIS OF KEY COMPANIES FROM 2016 TO 2020 (USD BILLION)

13.5 COMPETITIVE SITUATIONS AND TRENDS

13.5.1 PRODUCT LAUNCHES

TABLE 110 MARKET: PRODUCT LAUNCHES, JANUARY 2018–MAY 2021

13.5.2 DEALS

TABLE 111 MARKET: DEALS, JANUARY 2018– MAY 2021

13.6 COMPANY EVALUATION MATRIX, 2020

13.6.1 STAR

13.6.2 PERVASIVE

13.6.3 PARTICIPANT

13.6.4 EMERGING LEADER

FIGURE 52 MARKET (GLOBAL), COMPANY EVALUATION MATRIX (2020)

13.7 STARTUP/SME EVALUATION MATRIX, 2020

13.7.1 PROGRESSIVE COMPANY

13.7.2 RESPONSIVE COMPANY

13.7.3 DYNAMIC COMPANY

13.7.4 STARTING BLOCK

FIGURE 53 MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX (2020)

13.8 COMPETITIVE BENCHMARKING

TABLE 112 COMPANY END USER FOOTPRINT

TABLE 113 COMPANY REGION FOOTPRINT

TABLE 114 COMPANY FOOTPRINT

14 COMPANY PROFILES (Page No. - 172)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 PHILIPS

TABLE 115 PHILIPS: BUSINESS OVERVIEW

FIGURE 54 PHILIPS: COMPANY SNAPSHOT

14.2.2 CONNECT AMERICA

TABLE 116 CONNECT AMERICA: BUSINESS OVERVIEW

14.2.3 VALUED RELATIONSHIPS

TABLE 117 VALUED RELATIONSHIPS: BUSINESS OVERVIEW

14.2.4 MEDICAL GUARDIAN

TABLE 118 MEDICAL GUARDIAN: BUSINESS OVERVIEW

14.2.5 ADT

TABLE 119 ADT: BUSINESS OVERVIEW

FIGURE 55 ADT: COMPANY SNAPSHOT

14.2.6 GUARDIAN ALARM

TABLE 120 GUARDIAN ALARM: BUSINESS OVERVIEW

14.2.7 BAY ALARM MEDICAL

TABLE 121 BAY ALARM MEDICAL: BUSINESS OVERVIEW

14.2.8 MOBILEHELP

TABLE 122 MOBILEHELP: BUSINESS OVERVIEW

14.2.9 ALERT1

TABLE 123 ALERT1: BUSINESS OVERVIEW

14.2.10 LIFEFONE

TABLE 124 LIFEFONE: BUSINESS OVERVIEW

14.3 OTHER IMPORTANT PLAYERS

14.3.1 NORTEK CONTROL (NUMERA)

14.3.2 GALAXY MEDICAL ALERT SYSTEMS

14.3.3 RESPONSE NOW

14.3.4 LIFESTATION

14.3.5 RESCUE ALERT

14.3.6 BETTER ALERTS

14.3.7 INTERCALL SYSTEMS

14.3.8 LIVELY

14.3.9 CORNELL COMMUNICATIONS

14.3.10 BLUELINEA

14.3.11 ACTIVEPROTECTIVE

14.3.12 ALOE CARE HEALTH

14.3.13 VANGUARD WIRELESS

14.3.14 QMEDIC

14.3.15 TUNSTALL

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 206)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

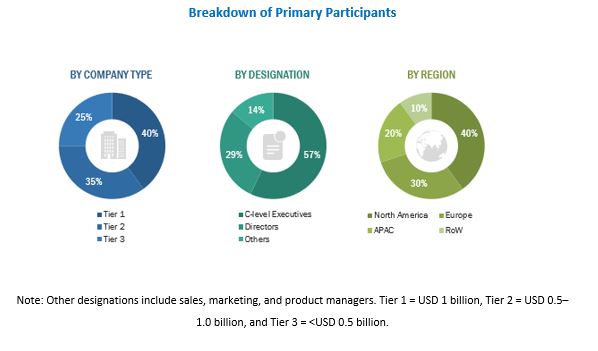

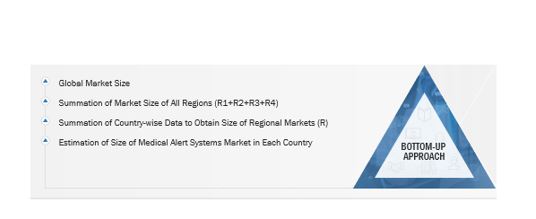

The study involved four major activities in estimating the current size of the medical alert systems market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include medical alert systems technology journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the medical alert systems market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the medical alert systems market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Medical Alert Systems Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the medical alert systems market, in terms of system types, offering, connection type, technology, distribution channel, application and region

- To provide the market size estimation for North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence market growth.

- To provide a detailed overview of the medical alert systems value chain

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends related to components, connectivity technologies, and applications that shape and influence the global medical alert systems market.

- To profile key players and comprehensively analyze their ranking based on their revenues and core competencies.

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market.

- To analyze competitive developments in the market, such as expansion, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 25)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Alert Systems Market

Does this report have data for subscription churn and subscription revenue. I am looking for the number of subscribers of all the players. Is that information available in the report? Thank you

I am making research on end-user experiences of Medical Alert System/Personal Emergency Response Systems and your market analyses would be very helpful. Would be interested in knowing best option available for this market.