MEA Cloud Computing Market by Offering (Service Model (laaS, PaaS, and SaaS)), Deployment Mode (Public Cloud, Private Cloud, and Hybrid Cloud), Vertical (BFSI, Energy and Utilities, and Manufacturing) and Region - Forecast to 2028

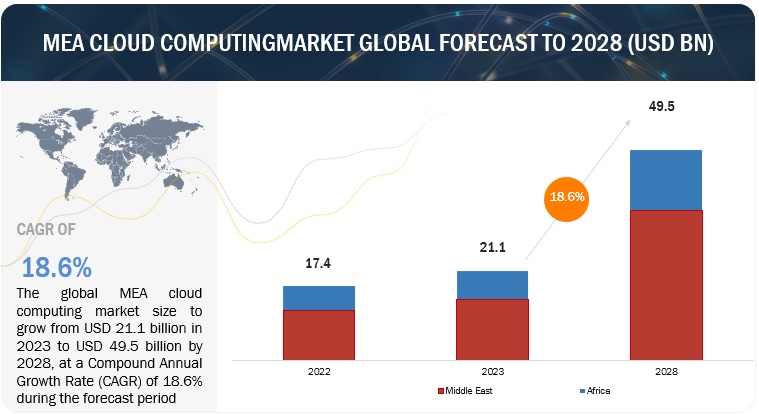

[293 Pages Report] The MEA Cloud Computing Market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 18.6 % during the forecast period, to reach USD 49.5 billion by 2028 from USD 21.1 billion in 2023. Cloud providers were offering advanced AI and machine learning services, making it easier for MEA organizations to leverage these technologies for insights and automation in various industries, including healthcare, finance, and manufacturing.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

MEA Cloud Computing Market Dynamics

Drivers: Growing Demand for Scalability and Flexibility

The increasing demand for scalability and flexibility in IT infrastructure is a key driver in the cloud computing market. Organizations across industries are leveraging cloud solutions to easily scale their computing resources up or down based on demand, optimizing costs and enhancing operational efficiency. This scalability also enables businesses to adapt quickly to changing market conditions, ensuring they can meet customer needs effectively. The MEA cloud computing market is driven by the increasing adoption of digital transformation initiatives across various industries in the region. Organizations are recognizing the need to modernize their IT infrastructure and leverage cloud services to enhance agility, scalability, and cost-efficiency.

Restraints: Security and Data Privacy Concerns

Security and data privacy concerns represent a significant restraint in the cloud computing market. Organizations worry about the safety of their sensitive data when migrating to the cloud, especially given the rising number of cyber threats and data breaches. Compliance with data protection regulations such as GDPR and HIPAA adds complexity and cost to cloud adoption, making it crucial for cloud service providers to continually enhance their security measures.

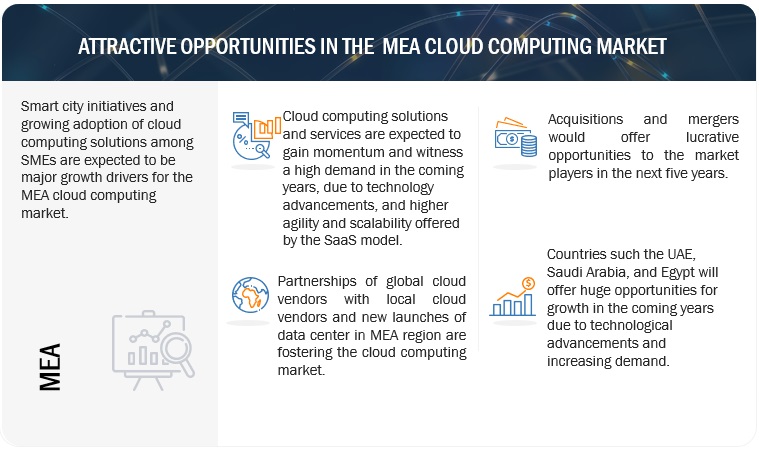

Opportunities: Integration of Emerging Technologies

The cloud computing market presents a significant opportunity in the integration of emerging technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT). Cloud platforms provide the necessary infrastructure and tools for businesses to harness the potential of these technologies. By leveraging the cloud's computational power and scalability, organizations can process vast amounts of data, extract valuable insights, and automate processes. This integration enhances decision-making, enables the development of innovative products and services, and drives competitive advantage. As businesses recognize the transformative potential of AI, ML, and IoT, cloud providers that offer robust support for these technologies are well-positioned to capture a growing market share.

Challenges: Vendor Lock-In and Interoperability

Vendor lock-in and interoperability challenges represent formidable obstacles in the cloud computing landscape. Once an organization commits to a specific cloud service provider, migrating to another platform can be a complex and costly endeavor. This lock-in can limit an organization's flexibility and bargaining power, potentially leading to higher costs in the long run. Additionally, ensuring seamless integration and data portability across different cloud environments, including public, private, and hybrid clouds, is a complex task. To address this challenge, industry stakeholders must work towards standardization and the adoption of open-source technologies that promote interoperability. Organizations should also carefully evaluate their cloud strategies to minimize vendor lock-in risks and maintain the flexibility to adapt to changing business needs and technology trends.

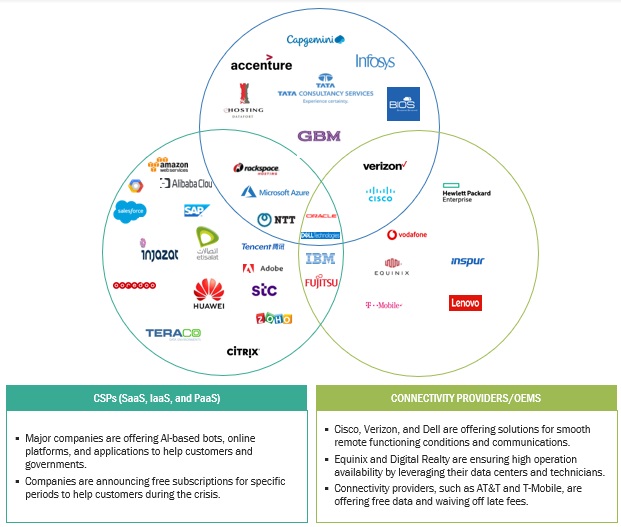

MEA Cloud Computing Market Ecosystem

By IaaS ,Storage and warehouse segment to hold the largest market size during the forecast period

Storage and warehouse services in Infrastructure as a Service (IaaS) cloud computing refer to the scalable and on-demand provisioning of virtualized storage resources and data warehouses in the cloud. IaaS providers offer users the flexibility to store, manage, and retrieve data without the need to invest in physical hardware. These services encompass various storage options, such as block, object, and file storage, as well as data warehousing solutions designed for efficient data analysis and reporting.

By deployment mode , public cloud cloud segment to hold the largest market size during the forecast period

A public cloud in the context of cloud computing refers to a shared IT infrastructure and computing resources provided by a third-party cloud service provider. These resources are accessible to the general public or a wide range of customers via the internet. Public clouds offer advantages such as scalability, flexibility, and cost-efficiency, as they enable organizations to access and pay for computing services as needed, eliminating the need for them to own and manage physical infrastructure. Users can deploy, operate, and oversee applications, storage, and other IT assets within a highly scalable and virtualized environment. This makes public clouds a popular choice for businesses aiming to harness cloud technology for tasks like hosting websites and applications or managing data storage and analysis.

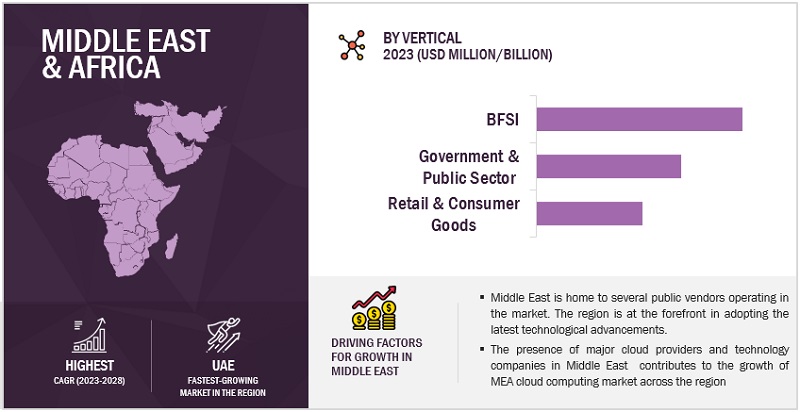

Middle East to grow at the highest CAGR during the forecast period

The Middle East has been experiencing significant growth in the field of cloud computing in recent years. This growth can be attributed to various factors, including increased adoption of digital technologies, government initiatives to promote cloud adoption, and a growing startup ecosystem. Several countries in the Middle East have launched initiatives to promote cloud adoption. For example, the United Arab Emirates (UAE) launched the "UAE Cloud First Policy" to encourage government entities to prioritize cloud solutions. Similarly, Saudi Arabia has its "Cloud-First" strategy, aiming to accelerate the adoption of cloud services across government agencies. Major cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have established data centers or availability zones in the Middle East region. These data centers improve the availability and latency of cloud services, making it more attractive for businesses in the region to migrate to the cloud. The Middle East, based on countries such as Saudi Arabia, UAE, Qatar, Israel, Turkey and other countries (Oman, Kuwait, and Bahrain).

MEA Cloud Computing Companies

The MEA cloud computing market is dominated by companies such as Microsoft (US), AWS (US), IBM (US), Google (US), Alibaba Cloud (China), Oracle (US), SAP (Germany), Salesforce (US), Etisalat (UAE), eHosting DataFort (UAE), Injazat Data Systems (UAE), STC Cloud (Saudi Arabia), Insomea Computer Solutions (Tunisia), CloudBox Tech (SA), Ooredoo (Qatar), Gulf business Machines (UAE), Intertec Systems (UAE), Fujitsu (Japan), Huawei (China), Comprehensive Computing Innovations (Lebanon), Compro (Turkey), Teraco Data Environment (SA), Liquid Intelligence Technologies (SA), Zonke Tech (SA), Cloud4Rain (Egypt), Infosys (India), TCS(India), Malomatia (Qatar), Cicso (US), and Orixcom (UAE). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Offering (Service Model), Deployment Model, Verticals, and Region |

|

Regions covered |

Middle East and Africa |

|

List of Companies in MEA Cloud Computing |

Microsoft (US), AWS (US), IBM (US), Google (US), Alibaba Cloud (China), Oracle (US), SAP (Germany), Salesforce (US), Etisalat (UAE), eHosting DataFort (UAE), Injazat Data Systems (UAE), STC Cloud (Saudi Arabia), Insomea Computer Solutions (Tunisia), CloudBox Tech (SA), Ooredoo (Qatar), Gulf business Machines (UAE), Intertec Systems (UAE), Fujitsu (Japan), Huawei (China), Comprehensive Computing Innovations (Lebanon), Compro (Turkey), Teraco Data Environment (SA), Liquid Intelligence Technologies (SA), Zonke Tech (SA), Cloud4Rain (Egypt), Infosys (India), TCS(India), Malomatia (Qatar), Cicso (US), and Orixcom (UAE). |

This research report categorizes the MEA cloud computing market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Offering:

-

Service Model

- IaaS

- PaaS

- SaaS

Based on the IaaS application:

- Computation

- Storage and warehousing

- Recovery & backup

- Others

Based on the PaaS application:

- Data management

- Application development & platforms

- Analytics and reporting

- Integration and orchestration

- Application testing and quality

- Others

Based on the SaaS application:

- Customer relationship management

- Enterprise resource management

- Human capital management

- Others content management

- Collaboration and productivity suites

- Supply chain management

- Others

Based on the Deployment Mode:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on the vertical:

- BFSI

- Telecommunications

- IT and ITeS

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Other Verticals

Based on regions:

-

Middle East

- Saudi Arabia

- UAE

- Qatar

- Israel

- Turkey

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Egypt

- Nigeria

- Rest of Africa

Recent Developments

- In May 2023, Microsoft announced a suite of new AI solutions and enhancements to Microsoft Cloud for Nonprofit. These advancements are specifically crafted to revolutionize the nonprofit industry, redefining how fundraisers engage with donors, manage campaigns, and optimize operations.

- In May 2023, SAP collaborated with IBM and announced that IBM Watson technology would be embedded into SAP solutions to offer new AI-driven insights and automation. It also helps to fuel innovation and create more efficient and effective user experiences across SAP solution portfolios.

- In September 2022,At Dreamforce, Salesforce introduced Salesforce Customer 360 to provide companies with powerful automation and intelligence technologies to drive efficient growth and deliver personalized customer experiences.

- In September 2022, IBM announced the general availability of IBM LinuxONE Bare Metal Servers. With this new solution, the LinuxONE platform may now be deployed in an off-premises Infrastructure as a Service (IaaS) model while enjoying all the advantages, including core consolidation, resultant software license savings, and decreased energy consumption to support sustainability goals.

- In September 2022, A new feature from Google Cloud allows users to significantly reduce the cold start time of Cloud Run and Cloud Functions. This is named startup CPU boost for Cloud Run and Cloud Functions 2nd gen.

Frequently Asked Questions (FAQ):

What is the projected market value of the MEA cloud computing market?

The MEA cloud computing market size is expected to grow from USD 21.1 billion in 2023 to USD 49.5 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 18.6% during the forecast period.

Which region has the highest market share in the MEA cloud computing market?

Middle East region has the higher market share in the MEA cloud computing market.

Which service model is expected to witness high adoption in the coming years?

IaaS is expected to witness the highest rate adoption in five years, as large enterprises are investing more in this service model.

Which are the major vendors in the MEA cloud computing market?

Microsoft, IBM, Google, AWS, Alibaba Cloud, Oracle, Salesforce, and SAP are major vendors in MEA cloud computing market.

What are some of the drivers in MEA cloud computing market?

The embracing of cloud computing solutions across the Middle East and Africa .

Business expansion by market leaders in the Middle East and Africa to cater to untapped clientele

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONDRIVERS- Digital transformation across the government services sector pushing cloud adoption- Rise of e-commerce and online retail is creating fertile grounds for cloud computing- A thriving data center ecosystem in the MEA is driving the popularity of cloud hosting services- Rapidly growing fintech landscape is driving the demand for cloud infrastructure servicesRESTRAINTS- High prevalence of pirated cloud software across MEA- Negative perceptions of SMEs towards public cloud hampering cloud adoption strategiesOPPORTUNITIES- Rising affinity towards digital health is augmenting cloud adoption- Conducive environment for SaaS vendors is propelling cloud migration- Expansion of telecom operators into the cloud services spaceCHALLENGES- Issues related to disruptive cloud breaches- Acute shortage of skilled cloud technology professionals in the MEA- Poor digital infrastructure hindering migration to cloud

-

5.2 CASE STUDY ANALYSISCASE STUDY 1: CLOUD SERVICE DEPLOYMENTCASE STUDY 2: CONNECTIVITYCASE STUDY 3: CLOUD MIGRATIONCASE STUDY 4: PERFORMANCE ENHANCEMENT WITH CLOUD PLATFORM

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM

-

5.5 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- AI & ML- Edge Computing- IoT- Augmented RealityADJACENT TECHNOLOGIES- Blockchain- Big Data & Analytics- DevOps

-

5.6 PRICING ANALYSISINTRODUCTIONAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

-

5.7 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MEA CLOUD COMPUTING MARKET

-

5.8 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.10 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- MIDDLE EAST- AFRICA

- 6.1 INTRODUCTION

-

6.2 SERVICE MODELSERVICE MODELS: MEA CLOUD COMPUTING MARKET DRIVERSINFRASTRUCTURE AS A SERVICE- Adoption of IaaS to noticeably increase in MEA among large enterprises due to security and reduced cost of hardware resourcesPLATFORM AS A SERVICE- PaaS to offer rich tools to end users for developing cloud-based solutions on uniform platformSOFTWARE AS A SERVICE- SaaS to help modernize businesses of SMEs with service model at low cost

-

7.1 INTRODUCTIONIAAS: MEA CLOUD COMPUTING MARKET DRIVERS

-

7.2 PRIMARY STORAGEINCREASING NEED TO MANAGE BIG DATA AND ANALYTICS, MEDIA PROCESSING, AND CONTENT MANAGEMENT TO FUEL GROWTH

-

7.3 DISASTER RECOVERY & BACKUPNEED FOR COST-EFFICIENCY, SCALABILITY, AND RELIABILITY IN CLOUD COMPUTING AMONG SMES TO DRIVE MARKET

-

7.4 ARCHIVINGCLOUD-BASED ARCHIVING TO BOOST DATA MANAGEMENT EFFICIENCY AND SECURITY

-

7.5 COMPUTERISING PREFERENCE FOR SMOOTH RECEIVING, ANALYZING, AND STORING DATA BETWEEN BUSINESS APPS AND WEB TO DRIVE MARKET

-

8.1 INTRODUCTIONPAAS: MEA CLOUD COMPUTING MARKET DRIVERS

-

8.2 APPLICATION DEVELOPMENT AND PLATFORMSNEED FOR BUSINESS AND IT TEAMS TO COLLABORATE AND DELIVER NEW WEB AND MOBILE APPLICATIONS TO BOOST GROWTH

-

8.3 APPLICATION TESTING AND QUALITYGROWING PREFERENCE FOR EFFECTIVE TESTING STRATEGY SYSTEMS, USER INTERFACES, AND APIS TO DRIVE MARKET

-

8.4 ANALYTICS AND REPORTINGAWARENESS ABOUT COMPREHENSIVE BUSINESS METRICS IN NEAR-REAL-TIME TO SUPPORT BETTER DECISION-MAKING

-

8.5 INTEGRATION AND ORCHESTRATIONINTEGRATION AND ORCHESTRATION TO AID AUTOMATION AND SYNCHRONIZATION OF DATA IN REAL-TIME

-

8.6 DATA MANAGEMENTNEED TO ENSURE ACCESSIBILITY, RELIABILITY, AND TIMELINESS OF DATA FOR USERS TO DRIVE SEGMENT’S GROWTH

-

9.1 INTRODUCTIONSAAS: MEA CLOUD COMPUTING MARKET DRIVERS

-

9.2 CUSTOMER RELATIONSHIP MANAGEMENTCRM TO ENABLE ENTERPRISES TO STORE AND UTILIZE CUSTOMER DATA AT SCALE

-

9.3 ENTERPRISE RESOURCE MANAGEMENTGROWING NEED FOR FLEXIBLE BUSINESS PROCESS TRANSFORMATION TO DRIVE MARKET GROWTH

-

9.4 HUMAN CAPITAL MANAGEMENTNEED FOR EFFECTIVE STUDY OF VARIOUS ASPECTS OF EMPLOYEE MANAGEMENT TO DRIVE MARKET

-

9.5 CONTENT MANAGEMENTRISING PREFERENCE FOR INFORMATION MANAGEMENT, RESPONSIVENESS, AND SCALABILITY TO FUEL MARKET

-

9.6 COLLABORATION AND PRODUCTIVITY SUITESSHARING OF DOCUMENTS AND FILES TO BE MADE EASY BY DEPLOYMENT OF COLLABORATION AND PRODUCTIVITY SUITES

-

9.7 SUPPLY CHAIN MANAGEMENTNEED TO IMPROVE SUPPLY CHAIN OPERATIONS FOR DIFFERENT CAPITAL-INTENSIVE INDUSTRY REQUIREMENTS TO DRIVE GROWTH

- 9.8 OTHERS

-

10.1 INTRODUCTIONDEPLOYMENT MODES: MEA CLOUD COMPUTING MARKET DRIVERS

-

10.2 PUBLIC CLOUDLOWER COSTS AND EASY DEPLOYMENT TO BE MAJOR DRIVING FACTORS OF PUBLIC CLOUD ADOPTION

-

10.3 PRIVATE CLOUDCORPORATES TO OPT FOR PRIVATE CLOUD DUE TO SECURITY CONCERNS CAUSED BY INCREASING NUMBER OF CYBERATTACKS

-

10.4 HYBRID CLOUDHYBRID CLOUD TO HELP MANAGE COST BY OPTIMIZING RESOURCE USAGE

-

11.1 INTRODUCTIONVERTICALS: MEA CLOUD COMPUTING MARKET DRIVERS

-

11.2 BFSIRISING DEMAND FOR AGILITY IN BANKING PROCESSES TO BOOST CLOUD COMPUTING ADOPTION IN BFSI SECTOR

-

11.3 ENERGY AND UTILITIESREGULATORY STANDARDS AND CONVERGENCE OF IT IN ENERGY AND UTILITIES TO FUEL DEMAND FOR CLOUD COMPUTING SOLUTIONS

-

11.4 GOVERNMENT AND PUBLIC SECTORGOVERNMENT INITIATIVES AND INVESTMENTS IN LATEST TECHNOLOGIES, SUCH AS AI, ML, AND IOT, TO FOSTER CLOUD ADOPTION

-

11.5 HEALTHCARE AND LIFE SCIENCESINCREASED DEMAND FOR EFFECTIVE SYSTEM MANAGEMENT IN HEALTHCARE SECTOR TO BOOST DEMAND FOR CLOUD COMPUTING

-

11.6 MANUFACTURINGRISING NEED TO MAINTAIN SEAMLESS MANUFACTURING PROCESSES TO AMPLIFY DEMAND FOR CLOUD COMPUTING

-

11.7 RETAIL AND CONSUMER GOODSRETAILERS SHIFTING BUSINESS OPERATIONS ONLINE TO CONTINUE BUSINESSES DURING LOCKDOWNS TO BOOST CLOUD COMPUTING DEMAND

-

11.8 TELECOMMUNICATIONSHUGE DATA GENERATION IN TELECOMMUNICATION INDUSTRY TO DRIVE DEMAND FOR CLOUD-BASED SYSTEMS FOR DATA MANAGEMENT

-

11.9 IT AND ITESIT AND ITES COMPANIES INVEST IN NEW TECHNOLOGIES TO SPUR INNOVATION AND ATTRACT CONSUMERS

-

11.10 MEDIA AND ENTERTAINMENTHYBRID OR MULTI-CLOUD DEPLOYMENTS ALLOW WORKLOADS TO BE SHIFTED ACROSS PUBLIC AND PRIVATE INFRASTRUCTURES

- 11.11 OTHER VERTICALS

- 12.1 INTRODUCTION

-

12.2 MIDDLE EASTMIDDLE EAST: MEA CLOUD COMPUTING MARKET DRIVERSUNITED ARAB EMIRATES- Rapid technological proliferation and huge IT spending to drive growth of cloud computing in UAE- UAE cloud computing benefits, by industry verticals- UAE cloud computing limitations and barriers, by industry vertical- UAE cloud computing market driversSAUDI ARABIA- Robust government initiatives and smart city projects in KSA to foster cloud computing growthQATAR- Rapid pace of digital transformation and data center development by leading cloud vendors to drive cloud computing marketBAHRAIN- Robust connectivity and commitment to digital transformation drive the rapid adoption of cloud technologies in BahrainREST OF MIDDLE EAST

-

12.3 AFRICAAFRICA: MEA CLOUD COMPUTING MARKET DRIVERSSOUTH AFRICA- Growing number of SMEs in retail and consumer goods vertical and ICT industry to boost cloud computing growth in South AfricaEGYPT- Strategic partnerships of local cloud vendors with leading cloud service providers to drive cloud computing growth in EgyptNIGERIA- Scalability to be crucial in Nigeria’s dynamic business environmentREST OF AFRICA

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- 13.3 HISTORICAL BUSINESS SEGMENT REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

-

13.5 MEA CLOUD COMPUTING: COMPARISON LANDSCAPE OF BRANDS/PRODUCTSMEA CLOUD COMPUTING: TRENDING PRODUCTS/BRAND COMPARISON

-

13.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 STARTUP AND SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.8 COMPETITIVE BENCHMARKING

-

13.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

14.1 MAJOR PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewALIBABA CLOUD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developmentsSAP- Business overview- Products/Solutions/Services offered- Recent developmentsSALESFORCE- Business overview- Products/Solutions/Services offered- Recent developmentsETISALAT- Business overview- Products/Solutions/Services offered- Recent developmentsINJAZAT DATA SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSEHOSTING DATAFORTSTC CLOUDOOREDOOGULF BUSINESS MACHINESINTERTEC SYSTEMSFUJITSUHUAWEICISCOINFOSYSTCSCOMPROTERACO DATA ENVIRONMENTSLIQUID INTELLIGENT TECHNOLOGIESCOMPREHENSIVE COMPUTING INNOVATIONSINSOMEA COMPUTER SOLUTIONSCLOUDBOX TECHZONKE TECHCLOUD4RAINMALOMATIAORIXCOM

- 15.1 INTRODUCTION

- 15.2 EDGE COMPUTING MARKET - GLOBAL FORECAST TO 2028

- 15.3 SERVERLESS ARCHITECTURE MARKET - GLOBAL FORECAST TO 2025

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MEA CLOUD COMPUTING MARKET SIZE AND GROWTH RATE, 2018–2022 (USD MILLION, Y-O-Y%)

- TABLE 4 MEA CLOUD COMPUTING MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y%)

- TABLE 5 MEA CLOUD COMPUTING MARKET: ECOSYSTEM

- TABLE 6 MEA CLOUD COMPUTING MARKET: PRICING LEVELS

- TABLE 7 PATENTS FILED, 2013–2023

- TABLE 8 TOP 20 PATENT OWNERS IN MEA CLOUD COMPUTING MARKET, 2013–2023

- TABLE 9 LIST OF PATENTS IN MEA CLOUD COMPUTING MARKET, 2021–2023

- TABLE 10 MEA CLOUD COMPUTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 14 MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 15 INFRASTRUCTURE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 INFRASTRUCTURE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 PLATFORM AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 PLATFORM AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 SOFTWARE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 SOFTWARE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 22 MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 23 PRIMARY STORAGE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 PRIMARY STORAGE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 DISASTER RECOVERY & BACKUP: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 DISASTER RECOVERY & BACKUP: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 ARCHIVING: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 ARCHIVING: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 COMPUTE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 COMPUTE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 32 MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 33 APPLICATION DEVELOPMENT AND PLATFORMS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 APPLICATION DEVELOPMENT AND PLATFORMS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 APPLICATION TESTING AND QUALITY: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 APPLICATION TESTING AND QUALITY: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 ANALYTICS AND REPORTING: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 ANALYTICS AND REPORTING: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 INTEGRATION AND ORCHESTRATION: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 INTEGRATION AND ORCHESTRATION: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 DATA MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 DATA MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 44 MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 45 CUSTOMER RELATIONSHIP MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 CUSTOMER RELATIONSHIP MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 ENTERPRISE RESOURCE MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 ENTERPRISE RESOURCE MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 HUMAN CAPITAL MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 HUMAN CAPITAL MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 CONTENT MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 CONTENT MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 COLLABORATION AND PRODUCTIVITY SUITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 COLLABORATION AND PRODUCTIVITY SUITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 SUPPLY CHAIN MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 SUPPLY CHAIN MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 OTHER SAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 OTHER SAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 60 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 61 PUBLIC CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 PUBLIC CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 PRIVATE CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 PRIVATE CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 HYBRID CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 HYBRID CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 68 MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 69 BFSI: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 BFSI: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 ENERGY AND UTILITIES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 ENERGY AND UTILITIES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 GOVERNMENT AND PUBLIC SECTOR: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 GOVERNMENT AND PUBLIC SECTOR: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 HEALTHCARE AND LIFE SCIENCES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 HEALTHCARE AND LIFE SCIENCES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 MANUFACTURING: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 MANUFACTURING: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 RETAIL AND CONSUMER GOODS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 RETAIL AND CONSUMER GOODS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 TELECOMMUNICATIONS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 TELECOMMUNICATIONS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 IT AND ITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 IT AND ITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 MEDIA AND ENTERTAINMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 MEDIA AND ENTERTAINMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 OTHER VERTICALS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 88 OTHER VERTICALS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 MEA CLOUD COMPUTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 MEA CLOUD COMPUTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 92 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 94 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 95 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 96 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 97 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 98 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 100 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 102 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 104 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 TELECOMMUNICATIONS: UAE CLOUD COMPUTING MARKET, 2018–2022 (USD MILLION)

- TABLE 106 TELECOMMUNICATIONS: UAE CLOUD COMPUTING MARKET, 2023–2028 (USD MILLION)

- TABLE 107 IT/ITES: UAE CLOUD COMPUTING MARKET, BY SUB-VERTICAL, 2018–2022 (USD MILLION)

- TABLE 108 IT/ITES: UAE CLOUD COMPUTING MARKET, BY SUB-VERTICAL, 2023–2028 (USD MILLION)

- TABLE 109 UAE: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 110 UAE: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 111 UAE: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 112 UAE: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 113 UAE: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 114 UAE: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 115 UAE: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 116 UAE: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 117 UAE: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 118 UAE: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 119 UAE: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 120 UAE: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 121 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 122 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 123 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 124 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 125 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 126 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 127 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 128 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 129 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 130 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 131 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 132 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 133 QATAR: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 134 QATAR: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 135 QATAR: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 136 QATAR: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 137 QATAR: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 138 QATAR: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 139 QATAR: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 140 QATAR: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 141 QATAR: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 142 QATAR: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 143 QATAR: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 144 QATAR: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 145 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 146 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 147 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 148 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 149 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 150 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 151 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 152 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 153 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 154 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 156 BAHRAIN: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 160 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 161 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 162 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 167 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 168 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 169 AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 170 AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 171 AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 172 AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 173 AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 174 AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 175 AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 176 AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 177 AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 178 AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 179 AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 180 AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 181 AFRICA: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 182 AFRICA: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 183 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 184 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 185 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 186 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 187 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 188 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 189 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 190 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 191 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 192 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 193 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 194 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 195 EGYPT: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 196 EGYPT: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 197 EGYPT: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 198 EGYPT: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 199 EGYPT: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 200 EGYPT: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 201 EGYPT: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 202 EGYPT: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 203 EGYPT: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 204 EGYPT: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 205 EGYPT: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 206 EGYPT: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 207 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 208 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 209 NIGERIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 210 NIGERIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 211 NIGERIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 212 NIGERIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 213 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 214 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 215 NIGERIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 216 NIGERIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 217 NIGERIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 218 NIGERIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 219 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018–2022 (USD MILLION)

- TABLE 220 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023–2028 (USD MILLION)

- TABLE 221 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018–2022 (USD MILLION)

- TABLE 222 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023–2028 (USD MILLION)

- TABLE 223 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018–2022 (USD MILLION)

- TABLE 224 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023–2028 (USD MILLION)

- TABLE 225 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018–2022 (USD MILLION)

- TABLE 226 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023–2028 (USD MILLION)

- TABLE 227 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018–2022 (USD MILLION)

- TABLE 228 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 229 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 230 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 231 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MEA CLOUD COMPUTING MARKET

- TABLE 232 MEA CLOUD COMPUTING MARKET: DEGREE OF COMPETITION

- TABLE 233 MEA CLOUD COMPUTING MARKET: COMPANY FOOTPRINT OF KEY PLAYERS

- TABLE 234 MEA CLOUD COMPUTING MARKET: COMPANY FOOTPRINT OF STARTUPS/SMES

- TABLE 235 MEA CLOUD COMPUTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 236 PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2023

- TABLE 237 DEALS, 2021–2023

- TABLE 238 MICROSOFT: BUSINESS OVERVIEW

- TABLE 239 MICROSOFT: SOLUTIONS OFFERED

- TABLE 240 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 241 MICROSOFT: DEALS

- TABLE 242 IBM: BUSINESS OVERVIEW

- TABLE 243 IBM: SOLUTIONS AND SERVICES OFFERED

- TABLE 244 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 IBM: DEALS

- TABLE 246 GOOGLE: BUSINESS OVERVIEW

- TABLE 247 GOOGLE: SOLUTIONS OFFERED

- TABLE 248 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 GOOGLE: DEALS

- TABLE 250 ALIBABA CLOUD: BUSINESS OVERVIEW

- TABLE 251 ALIBABA CLOUD: SOLUTIONS OFFERED

- TABLE 252 ALIBABA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 ALIBABA: DEALS

- TABLE 254 AWS: BUSINESS OVERVIEW

- TABLE 255 AWS: PLATFORM AND SERVICES OFFERED

- TABLE 256 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 257 AWS: DEALS

- TABLE 258 ORACLE: BUSINESS OVERVIEW

- TABLE 259 ORACLE: PRODUCT OFFERED

- TABLE 260 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 261 ORACLE: DEALS

- TABLE 262 SAP: BUSINESS OVERVIEW

- TABLE 263 SAP: PRODUCTS AND SERVICES OFFERED

- TABLE 264 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 SAP: DEALS

- TABLE 266 SALESFORCE: BUSINESS OVERVIEW

- TABLE 267 SALESFORCE: SOLUTIONS OFFERED

- TABLE 268 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 269 SALESFORCE: DEALS

- TABLE 270 ETISALAT: BUSINESS OVERVIEW

- TABLE 271 ETISALAT: SOLUTIONS OFFERED

- TABLE 272 ETISALAT: NEW PRODUCT DEVELOPMENTS

- TABLE 273 ETISALAT: DEALS

- TABLE 274 INJAZAT DATA SYSTEMS: BUSINESS OVERVIEW

- TABLE 275 INJAZAT DATA SYSTEMS: SERVICES OFFERED

- TABLE 276 INJAZAT DATA SYSTEMS: DEALS

- TABLE 277 EDGE COMPUTING MARKET, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 278 EDGE COMPUTING MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 279 EDGE COMPUTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 280 EDGE COMPUTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 281 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2018–2022 (USD MILLION)

- TABLE 282 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 283 EDGE COMPUTING MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 284 EDGE COMPUTING MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 285 SERVERLESS ARCHITECTURE MARKET, BY SERVICE TYPE, 2018–2025 (USD MILLION)

- TABLE 286 SERVERLESS ARCHITECTURE MARKET, BY DEPLOYMENT MODEL, 2018–2025 (USD MILLION)

- TABLE 287 SERVERLESS ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2018–2025 (USD MILLION)

- TABLE 288 SERVERLESS ARCHITECTURE MARKET, BY VERTICAL, 2018–2025 (USD MILLION)

- TABLE 289 SERVERLESS ARCHITECTURE MARKET, BY REGION, 2018–2025 (USD MILLION)

- FIGURE 1 MEA CLOUD COMPUTING MARKET: RESEARCH DESIGN

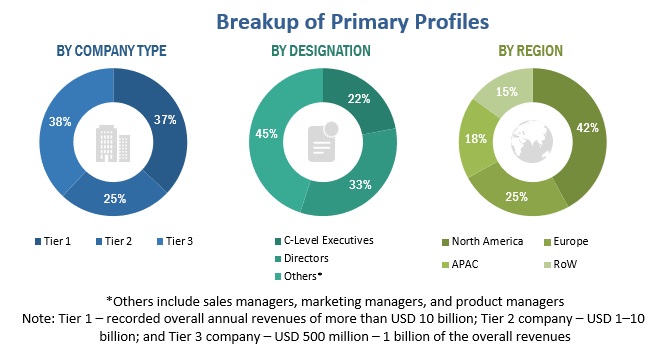

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MEA CLOUD COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF MEA CLOUD COMPUTING FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF MEA CLOUD COMPUTING VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

- FIGURE 10 SAAS SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 11 PUBLIC CLOUD TO DOMINATE DURING FORECAST PERIOD

- FIGURE 12 BANKING, FINANCIAL SERVICES, AND INSURANCE TO DOMINATE DURING FORECAST PERIOD

- FIGURE 13 MEA CLOUD COMPUTING MARKET: REGIONAL SNAPSHOT IN 2023

- FIGURE 14 INCREASING NEED TO SHIFT ENTERPRISE WORKLOADS TO CLOUD TO DRIVE MEA CLOUD COMPUTING MARKET

- FIGURE 15 SAAS TO DOMINATE MIDDLE EAST IN 2023

- FIGURE 16 SAAS SEGMENT TO HOLD LARGEST MARKET IN AFRICA IN 2023

- FIGURE 17 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MEA CLOUD COMPUTING MARKET

- FIGURE 19 VALUE CHAIN ANALYSIS: MEA CLOUD COMPUTING MARKET

- FIGURE 20 MEA CLOUD COMPUTING MARKET ECOSYSTEM

- FIGURE 21 MEA CLOUD COMPUTING MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 22 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 24 MEA CLOUD COMPUTING: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 SAAS TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 26 PRIMARY STORAGE TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 27 DATA MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 28 CUSTOMER RELATIONSHIP MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- FIGURE 29 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 30 RETAIL AND CONSUMER GOODS VERTICAL TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 31 MIDDLE EAST TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 32 MIDDLE EAST: MARKET SNAPSHOT

- FIGURE 33 AFRICA: MARKET SNAPSHOT

- FIGURE 34 HISTORICAL BUSINESS SEGMENT REVENUE ANALYSIS, 2020 TO 2022

- FIGURE 35 MEA CLOUD COMPUTING MARKET: MARKET SHARE ANALYSIS

- FIGURE 36 MEA CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 37 MEA CLOUD COMPUTING MARKET: EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- FIGURE 38 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 39 IBM: COMPANY SNAPSHOT

- FIGURE 40 GOOGLE: COMPANY SNAPSHOT

- FIGURE 41 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 42 AWS: COMPANY SNAPSHOT

- FIGURE 43 ORACLE: COMPANY SNAPSHOT

- FIGURE 44 SAP: COMPANY SNAPSHOT

- FIGURE 45 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 46 ETISALAT: COMPANY SNAPSHOT

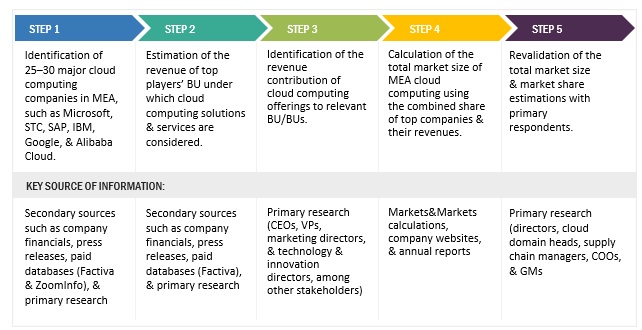

The study involved 4 major activities to estimate the current market size of MEA cloud computing. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, The Software Alliance, CCA, MENA Cloud Alliance, International Trade Administration (ITA), Telecommunications Industry Association, United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), Arab Information and Communication Technology Organization (AICTO) to identify and collect information useful for this technical, market-oriented, and commercial study of the MEA cloud computing market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing MEA cloud computing solutions. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the MEA cloud computing market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the MEA cloud computing market.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the MEA cloud computing market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Bottom-Up Approach

In the bottom-up approach, the adoption rate of MEA cloud computing solutions among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of MEA cloud computing solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the MEA cloud computing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major MEA cloud computing providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall MEA cloud computing market size and segments’ size were determined and confirmed using the study.

Definition

Cloud computing refers to the delivery of computing services, including but not limited to servers, storage, databases, networking, software, analytics, and intelligence, over the internet (the cloud) to offer faster innovation, flexible resources, and economies of scale. Cloud services can be provisioned and scaled up or down on-demand, allowing businesses and individuals to access and utilize computing resources without the need to invest in and maintain physical infrastructure.

Stakeholders

- Cloud Service Providers (CSPs)

- Networking companies

- Third-party providers

- Consultants/Consultancies/Advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information Technology (IT) infrastructure providers

- System Integrators (SIs)

- Support service providers

- Government and standardization bodies

- Data center providers

- Regional associations

- Independent software vendors

- Value-added resellers and distributors

Report Objectives

- To describe and forecast the MEA cloud computing market based on offering, deployment mode , verticals, and regions

- To forecast the market size of regional segments: Middle East (United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel,and Rest of Middle East) and Africa (South Africa, Egypt, Nigeria and Rest of Africa)

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MEA Cloud Computing Market