Marketing Attribution Software Market by Component (Solution and Services), Attribution Type (Single Source, Multi Source, and Probabilistic or Algorithmic), Organization Size, Deployment Type, Vertical, and Region - Global Forecast to 2023

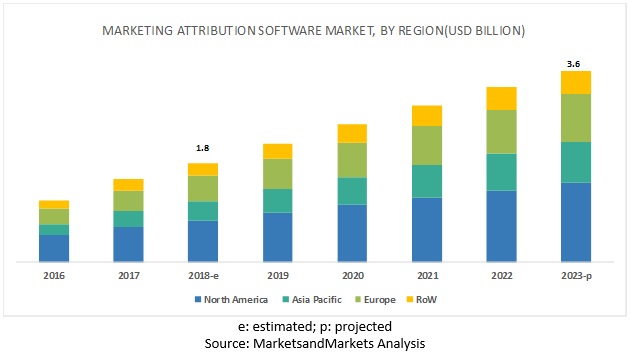

[153 Pages Report] The global marketing attribution software market size to grow from USD 1.8 billion in 2018 to USD 3.6 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.4% during the forecast period. The major growth drivers for the market include rising need to optimize the marketing spend and effective tracking of customer behavior for targeted marketing activities.

Multi-source attribution segment to hold the largest market size during the forecast period

Multi-source attribution assigns credit to each channel involved in the final lead conversion. It tracks the entire customer journey and attributes credit to multiple touchpoints, which include all sources, such as ads, social posts to webinars, and eNewsletters. This attribution type does not measure the actual contribution of different channels and is complex to implement. Multi-source attribution has 6 different models, namely, linear, time decay, U-shaped, W-shaped, full path, and custom models.

Cloud segment to grow at a higher CAGR rate during the forecast period

The cloud-based deployment model permits users to access the software from anywhere or any device, such as personal computers, laptops, and mobiles. The cloud deployment model offers easy deployment options, minimum costs, easy upgradeability and accessibility, and no initial capital outlay for purchasing the software. Furthermore, it reduces Information Technology (IT) budgets, lowers financial risks, and increases flexibility. Organizations demand solutions to efficiently manage and repurpose their web-based content, along with integrating it with other systems, such as customer relationship management and marketing resource management. This, in turn, empowers organizations to strengthen their marketing endeavors cost-effectively. SMEs consider and prefer cloud-based marketing attribution solutions, as they help them reduce operational cost and increase productivity.

Telecom and IT vertical to hold the largest market size during the forecast period

Enterprises in the telecom and IT vertical are focusing on effectively targeting new users and decreasing attribution rate of the existing customers. Moreover, they are emphasizing on implementing effective marketing campaigns to increase its subscriber base, thus are targeting users via different online channels. Following the fierce competition in the market, enterprises need result-oriented marketing strategy in place for acquiring maximum users and have a competitive edge over its competitors. The increase in the number of internet and mobile devices is said to have fueled the growth of the telecom and IT vertical in the marketing attribution software market. Marketing attribution solutions help telecom and IT enterprises to analyze effective digital channel to optimize its marketing spends and improve user experience. This vertical is at the forefront of leveraging marketing attribution solutions, due to the emerging need for effectively targeting an audience via a right communication channel. The global telco providers are embracing marketing attribution strategies to facilitate their marketing campaigns and improve end-user experience.

North America to account for the largest market size during the forecast period

North America is expected to hold the largest market size and dominate the global marketing attribution software market from 2018 to 2023. The region majorly has a high concentration of large multinational companies, which largely contribute to the growth of the market. APAC is expected to provide lucrative opportunities for the marketing attribution software vendors, owing to the increasing demand for the consistent data-driven marketing solutions among enterprises in the region. The increasing number of government regulations and compliances in various regions could affect the adoption of marketing attribution software.

Key Market Players For Marketing Attribution Software Market

Major vendors offering marketing attribution solution and services across the globe include Adobe (US), Google (US), SAP (Germany), Visual IQ (US), Oracle (US), Rockerbox (US), Neustar (US), Engagio (US), LeadsRx (US), LeanData (US), Singular (US), Marketing Attribution (US), Attribution (US), CaliberMind (US), WIZALY (France), OptiMine (US), Analytic Partners (US), Merkle (US), Fospha (UK), and IRI (US).

Adobe has established itself as a strong brand among the leading players in the market attribution software market. The company is strengthening its product portfolio by introducing new products and updating the existing products with new capabilities. It focuses on delivering services to content creators, digital media professionals, and web application developers. The company constantly invests in R&D activities to strengthen its solutions. For instance, in 2017, the company has invested 16.8% on revenue on R&D activities. It has adopted inorganic growth strategies, such as acquisitions and partnerships, to strengthen its offerings and presence in the market attribution software market. For instance, in October 2018, the company acquired Marketo to offer a combination of Adobe Experience Cloud’s analytics, personalization, and content capabilities with Marketo’s lead management, account-based marketing, and revenue attribution technology to its customers.

Scope of the report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Attribution Type, Component, Organization Size, Deployment Type, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Adobe (US), Google (US), SAP (Germany), Visual IQ (US), Oracle (US), Rockerbox (US), Neustar (US), Engagio (US), LeadsRx (US), LeanData (US), , Singular (US), Marketing Attribution (US), Attribution (US), CaliberMind (US), WIZALY (France), OptiMine (US), Analytic Partners (US), Merkle (US), Fospha (UK), and IRI (US). |

This research report categorizes the market to forecast revenues and analyze trends in each of the following sub markets:

On the basis of attribution Type, the marketing attribution software market has been segmented as follows:

- Single-source Attribution

- Multi-source Attribution

- Probabilistic or Algorithmic Attribution

On the basis of Component, the market has been segmented as follows:

- Solution

- Services

On the basis of Organization size, the market has been segmented as follows:

- SMEs

- Large Enterprises

On the basis of Deployment types, the market has been segmented as follows:

- Cloud

- On-premises

On the basis of Verticals, the marketing attribution software market has been segmented as follows:

- Retail

- Fast-moving Consumer Goods and Consumer Packaged Goods

- Computing Products and Consumer Electronics

- Telecom and IT

- BFSI

- Media and Entertainment

- Healthcare

- Travel and Hospitality

- Others (Education, Government and Transportation)

On the basis of Regions, the marketing attribution software market has been segmented as follows:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe

- APAC

- Australia and New Zealand (ANZ)

- China

- India

- Rest of APAC

- MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates (UAE)

- Rest of MEA

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Key questions addressed by the report

- What are the major challenges faced while deploying marketing attribution solutions in different application area?

- Where and to what extent organizations need marketing attribution solutions?

- What are key industry trends in marketing attribution software market?

- What is the level of preparedness of enterprises to deal with unforeseen business risks?

- What are the challenges faced by marketing attribution solutions providers while integrating innovative technologies with a client’s existing IT infrastructure?

Frequently Asked Questions (FAQ):

What is Marketing attribution software?

Which marketing attribution type are expected to have the highest adoption in coming years?

What region are expected to have the highest adoption of marketing attribution software ?

Which marketing attribution type are expected to have the highest adoption in coming years?

Who are the top vendors in marketing attribution software market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Marketing Attribution Software Market

4.2 Market in North America, By Vertical and Country

4.3 Market: Major Countries

5 Market Overview and Industry Trends (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Need to Optimize the Marketing Spend

5.2.1.2 Effective Tracking of Customer Behavior for Targeted Marketing Activities

5.2.2 Restraints

5.2.2.1 Data Privacy and Protection of Personal Data Critical to Marketing Attribution Software Adoption

5.2.3 Opportunities

5.2.3.1 Growing Adoption of Ai and Big Data Analytics in Marketing Activities

5.2.3.2 Increasing Number of Marketing Channels to Reach the End Customers

5.2.4 Challenges

5.2.4.1 Selection of A Relevant Attribution Model and Vendor

5.2.4.2 Integrating Marketing Attribution Software With Other Business Applications

5.3 Industry Trends

5.3.1 Use Case 1: Adobe

5.3.2 Use Case 2: SAP

5.3.3 Use Case 3: Cake & Accelerize

5.4 Attribution Models

5.4.1 First Touch Attribution

5.4.2 Last Touch Attribution

5.4.3 Linear Attribution

5.4.4 Time Decay Attribution

5.4.5 U-Shaped (Position-Based) Attribution

5.4.6 W-Shaped Attribution

5.4.7 Probabilistic Or Algorithmic Attribution

6 Marketing Attribution Software Market, By Component (Page No. - 43)

6.1 Introduction

6.2 Solution

6.2.1 Growing Need to Effectively Track Customer Behavior for Targeted Marketing Activities Likely to Drive the Adoption of Marketing Attribution Solutions Among Enterprises

6.3 Services

6.3.1 Integration and Implementation Services

6.3.1.1 Increased Need Among Enterprises to Adopt Automated Marketing Solutions for Measuring Impact of Existing Marketing Campaigns and Optimizing Marketing Spend Likely to Drive the Adoption of Integration and Implementation Services

6.3.2 Advisory Services

6.3.2.1 Growing Need to Adopt the Right Marketing Attribution Model for Effective Marketing Activities Likely to Propel the Adoption of Advisory Services Among Enterprises

6.3.3 Support and Maintenance

6.3.3.1 Focus on Upgrading Existing Technology With the Pace of Technological Advancements to Drive the Growth of Support and Maintenance Services

7 Market, By Attribution Type (Page No. - 50)

7.1 Introduction

7.2 Single-Source Attribution

7.2.1 Growing Need to Identify Effective Digital Channel for Marketing Activities Likely to Propel the Growth of Single-Source Attribution Type in the Market

7.3 Multi-Source Attribution

7.3.1 Increased Need to Identify Multiple Digital Channels for Improved Lead Conversion Likely to Drive Adoption of Multi-Source Attribution Type in the Market

7.4 Probabilistic Or Algorithmic Attribution

7.4.1 Precise Identification of Different Digital Channels Following Complex Customer Buying Behavior to Propel the Adoption of Probabilistic Or Algorithmic Attribution Model

8 Market, By Deployment Type (Page No. - 55)

8.1 Introduction

8.2 On-Premises

8.2.1 Security Concerns Among Enterprises to Drive the Adoption of the On-Premises Deployment Type

8.3 Cloud

8.3.1 Scalability and Cost-Effectiveness of Cloud-Based Marketing Attribution Solutions to Drive Its Adoption

9 Market, By Organization Size (Page No. - 59)

9.1 Introduction

9.2 Small and Medium-Sized Enterprises

9.2.1 Need for Cost-Effective Solutions Offering High Scalability and Enhanced System Performance to Drive Adoption of Marketing Attribution Solutions Among SMES

9.3 Large Enterprises

9.3.1 Need for Competitive Edge in the Market Likely to Drive the Marketing Attribution Market Among Large Enterprises

10 Marketing Attribution Software Market, By Vertical (Page No. - 63)

10.1 Introduction

10.2 Retail

10.2.1 Heavy Internet Penetration Across Regions and Customer Reliance on Online Platforms to Fuel the Adoption of Marketing Attribution Solutions Among Enterprises in the Retail Vertical

10.3 FMCG and Consumer Packaged Goods

10.3.1 Increased Use of Digital Platforms By Customers to Drive the Adoption of Marketing Attribution Solutions Among Enterprises in the Arena of FMCG and CPG

10.4 Computing Products and Consumer Electronics

10.4.1 High Competition and Dynamic Customer Requirements During Purchase of Goods Likely to Propel the Adoption of Marketing Attribution Solutions Among Enterprises for Effective Target Marketing and Marketing Spend Optimization

10.5 Telecom and IT

10.5.1 Significant Increase in Internet Penetration, Dynamic Customer Needs, and Fierce Competition Likely to Drive the Adoption of Marketing Attribution Solutions Among Telcos and It Companies

10.6 Banking, Financial Services, and Insurance

10.6.1 Aggressive Shift of BFSI Enterprises to Digital Mode for Enhanced Customer Experience and Ease of Business Along With Fierce Competition to Propel the Adoption of Marketing Attribution Solutions

10.7 Media and Entertainment

10.7.1 Increased Need to Enhance Customer Experience and Effectively Measure Effective Marketing Channels to Drive Market

10.8 Healthcare

10.8.1 Need to Optimize Marketing Spends and Identify Effective Digital Channels for Marketing Activities to Drive the Adoption of Marketing Attribution Solutions Among Enterprises

10.9 Travel and Hospitality

10.9.1 Need to Have Competitive Advantage and Effectively Carry Out Marketing Campaigns Among Enterprises Likely to Drive Growth in the Market

10.1 Others

11 Market, By Region (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 United States

11.2.1.1 Increasing Digital Channel Effectiveness is Driving the Marketing Attribution Market in the Us

11.2.2 Canada

11.2.2.1 Need for Measuring and Analyzing the Marketing Performance to Increase the Adoption of Marketing Attribution Solutions Among Organizations in Canada

11.3 Europe

11.3.1 United Kingdom

11.3.1.1 Growing Need to Analyze the Performance Metrics of Marketing Campaigns to Drive the Adoption of Marketing Attribution Solutions

11.3.2 Germany

11.3.2.1 Increased Need for Multi-Channel Marketing and Rise of Data Volume in the Arena of Marketing to Propel the Growth of the Marketing Attribution Software Market

11.3.3 France

11.3.3.1 Increased Awareness Among Enterprises to Understand How Digital Channels Work Together to Drive the Growth of Market

11.3.4 Rest of Europe

11.4 Asia Pacific

11.4.1 Australia and New Zealand

11.4.1.1 Need to Effectively Analyze the Complex Marketing Data is Likely to Fuel the Adoption of Marketing Attribution Solutions

11.4.2 China

11.4.2.1 Demand for Consistent Data-Driven Marketing Solutions Among Clients to Drive the Marketing Attribution Market

11.4.3 India

11.4.3.1 Increased Awareness Among Enterprises to Smoothen Their Marketing Activities Propelling the Adoption of Marketing Attribution Solutions

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Kingdom of Saudi Arabia

11.5.1.1 Increased Need to Quantify the Relative Impact of Marketing Revenue to Propel the Marketing Attribution Software Market in Ksa

11.5.2 United Arab Emirates

11.5.2.1 On-The-Go Marketing Fostered By Mobile Gadgets Across Different Marketing Channels to Boost the Need to Adopt Marketing Attribution Solutions Among Enterprises in the UAE

11.5.3 South Africa

11.5.3.1 Increasing Pressure on Marketing Teams to Improve Roi on Marketing Spends to Boost the Adoption of Marketing Attribution Solutions in South Africa

11.5.4 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Brazil

11.6.1.1 Need to Attribute Cross-Device Measurement Among Enterprises for Smart Spending and High Returns to Boost the Growth of the Market

11.6.2 Mexico

11.6.2.1 Improving Customer Experience Throughout the Buying Journey and Identifying Effective Marketing Channels to Propel the Adoption of Marketing Attribution Solutions

11.6.3 Rest of Latin America

12 Competitive Landscape (Page No. - 99)

12.1 Overview

12.2 Competitive Scenario

12.2.1 Product/Service/Solution Launches and Enhancements

12.2.2 Business Expansions

12.2.3 Acquisitions

12.2.4 Partnerships, Agreements, and Collaborations

13 Company Profiles (Page No. - 107)

(Business Overview, Products, Solutions & Platform, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.1 Adobe

13.2 Oracle

13.3 Google

13.4 SAP

13.5 Visual IQ

13.6 Analytic Partners

13.7 Attribution

13.8 Calibermind

13.9 Engagio

13.10 Fospha

13.11 IRI

13.12 LeadsRx

13.13 Leandata

13.14 Marketing Attribution

13.15 Merkle

13.16 Neustar

13.17 Optimine

13.18 Rockerbox

13.19 Singular

13.20 Wizaly

*Details on Business Overview, Products, Solutions & Platform, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 Appendix (Page No. - 145)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (69 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2017

Table 2 Factor Analysis

Table 3 Marketing Attribution Software Market Size, By Component, 2016–2023 (USD Million)

Table 4 Solution: Market Size, By Region, 2016–2023 (USD Million)

Table 5 Market Size, By Services, 2016–2023 (USD Million)

Table 6 Services: Market Size, By Region, 2016–2023 (USD Million)

Table 7 Integration and Implementation Services Market Size, By Region, 2016–2023 (USD Million)

Table 8 Advisory Services Market Size, By Region, 2016–2023 (USD Million)

Table 9 Support and Maintenance Services Market Size, By Region, 2016–2023 (USD Million)

Table 10 Market Size, By Attribution Type, 2016–2023 (USD Billion)

Table 11 Single-Source Attribution: Market Size, By Region, 2016–2023 (USD Million)

Table 12 Multi-Source Attribution: Market Size, By Region, 2016–2023 (USD Billion)

Table 13 Probabilistic Or Algorithmic Attribution: Market Size, By Region, 2016–2023 (USD Billion)

Table 14 Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 15 On-Premises: Market Size, By Region, 2016–2023 (USD Million)

Table 16 Cloud: Market Size, By Region, 2016–2023 (USD Million)

Table 17 Market Size, By Organization Size, 2016–2023 (USD Million)

Table 18 Small and Medium Sized Enterprises: Market Size, By Region, 2016–2023 (USD Million)

Table 19 Large Enterprises: Marketing Attribution Software Market Size, By Region, 2016–2023 (USD Million)

Table 20 Market Size, By Vertical, 2016–2023 (USD Million)

Table 21 Retail: Market Size, By Region, 2016–2023 (USD Million)

Table 22 FMCG and Consumer Packaged Goods: Market Size, By Region, 2016–2023 (USD Million)

Table 23 Computing Products and Consumer Electronics: Market Size, By Region, 2016–2023 (USD Million)

Table 24 Telecom and IT: Market Size, By Region, 2016–2023 (USD Million)

Table 25 Banking, Financial Services, and Insurance: Market Size, By Region, 2016–2023 (USD Million)

Table 26 Media and Entertainment: Market Size, By Region, 2016–2023 (USD Million)

Table 27 Healthcare: Market Size, By Region, 2016–2023 (USD Million)

Table 28 Travel and Hospitality: Market Size, By Region, 2016–2023 (USD Million)

Table 29 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 30 Market Size, By Region, 2016–2023 (USD Million)

Table 31 North America: Marketing Attribution Software Market Size, By Component, 2016–2023 (USD Million)

Table 32 North America: Market Size, By Service Type, 2016–2023 (USD Million)

Table 33 North America: Market Size, By Attribution Type, 2016–2023 (USD Million)

Table 34 North America: Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 35 North America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 36 North America: Market Size, By Vertical, 2016–2023 (USD Million)

Table 37 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 38 Europe: Marketing Attribution Software Market Size, By Component, 2016–2023 (USD Million)

Table 39 Europe: Market Size, By Service Type, 2016–2023 (USD Million)

Table 40 Europe: Market Size, By Attribution Type, 2016–2023 (USD Million)

Table 41 Europe: Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 42 Europe: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 43 Europe: Market Size, By Vertical, 2016–2023 (USD Million)

Table 44 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 45 Asia Pacific: Marketing Attribution Software Market Size, By Component, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market Size, By Service Type, 2016–2023 (USD Million)

Table 47 Asia Pacific: Market Size, By Attribution Type, 2016–2023 (USD Million)

Table 48 Asia Pacific: Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 49 Asia Pacific: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size, By Vertical, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market Size, By Country, 2016–2023 (USD Million)

Table 52 Middle East and Africa: Marketing Attribution Software Market Size, By Component, 2016–2023 (USD Million)

Table 53 Middle East and Africa: Market Size, By Service Type, 2016–2023 (USD Million)

Table 54 Middle East and Africa: Market Size, By Attribution Type, 2016–2023 (USD Million)

Table 55 Middle East and Africa: Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 56 Middle East and Africa: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 57 Middle East and Africa: Market Size, By Vertical, 2016–2023 (USD Million)

Table 58 Middle East and Africa: Market Size, By Country, 2016–2023 (USD Million)

Table 59 Latin America: Marketing Attribution Software Market Size, By Component, 2016–2023 (USD Million)

Table 60 Latin America: Market Size, By Service Type, 2016–2023 (USD Million)

Table 61 Latin America: Market Size, By Attribution Type, 2016–2023 (USD Million)

Table 62 Latin America: Market Size, By Deployment Type, 2016–2023 (USD Million)

Table 63 Latin America: Market Size, By Organization Size, 2016–2023 (USD Million)

Table 64 Latin America: Market Size, By Vertical, 2016–2023 (USD Million)

Table 65 Latin America: Market Size, By Country, 2016–2023 (USD Million)

Table 66 Product/Service/Solution Launches and Enhancements, 2018

Table 67 Business Expansions, 2017–2018

Table 68 Acquisitions, 2017–2018

Table 69 Partnerships, Agreements, Collaborations, 2018

List of Figures (32 Figures)

Figure 1 Marketing Attribution Software Market: Research Design

Figure 2 Breakup of Primary Participants’ Profiles: By Company, Designation, and Region

Figure 3 Market: Bottom-Up And Top-Down Approaches

Figure 4 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 5 Multi-Source Attribution Segment to Hold the Highest Market Share in 2018

Figure 6 Support and Maintenance Services Segment to Account for the Highest Share in 2018

Figure 7 Increasing Need to Justify Marketing Spend to Drive the Marketing Attribution Software Market During the Forecast Period

Figure 8 Telecom and IT Vertical, and United States to Dominate the North American Market in 2018

Figure 9 India to Grow at the Highest CAGR in the Market During the Forecast Period

Figure 10 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 11 Most Widely Used Channels for Digital Marketing

Figure 12 Percentage of Advertising Spend Allocated to Various Channels

Figure 13 Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 14 Multi-Source Attribution Segment to Grow at the Highest CAGR During the Forecast Period

Figure 15 Cloud Deployment Type to Grow at A Higher CAGR During the Forecast Period

Figure 16 Small and Medium-Sized Enterprises Segment to Grow at A Higher CAGR During the Forecast Period

Figure 17 Retail Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 18 North America to Hold the Highest Share in 2018

Figure 19 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Key Developments in the Marketing Attribution Software Market, 2016–2018

Figure 23 Market Evaluation Framework

Figure 24 Adobe: Company Snapshot

Figure 25 SWOT Analysis: Adobe

Figure 26 Oracle: Company Snapshot

Figure 27 SWOT Analysis: Oracle

Figure 28 Google: Company Snapshot

Figure 29 SWOT Analysis: Google

Figure 30 SAP: Company Snapshot

Figure 31 SWOT Analysis: SAP

Figure 32 SWOT Analysis: Visual IQ

The study involved 4 major activities to estimate the current market size for marketing attribution software market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the market.

Secondary research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary research

The marketing attribution software market comprises several stakeholders, such as marketing attribution software vendors, digital marketing solution providers, managed service providers, marketing analytics vendors, advertising agencies, system integrators, consulting service providers, resellers and distributors, research organizations, government agencies, enterprise users, technology providers, venture capitalists, private equity firms, and startup companies. The demand side of the market consists of enterprises across industry verticals comprising Banking, Financial Services and Insurance (BFSI); media and entertainment; consumer goods and retail; healthcare and life sciences; manufacturing; telecom and Information Technology (IT); transportation and logistics; travel and hospitality; and energy and utilities. The supply side includes marketing attribution software providers offering marketing attribution solution and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

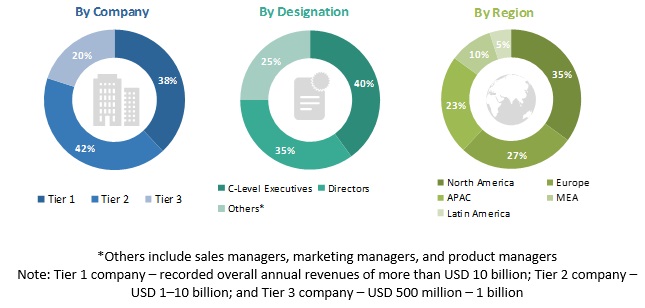

Following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the marketing attribution software market. These methods were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides.

Report objectives

- To define, describe, and forecast the marketing attribution software market by attribution type, component, deployment type, organization size, vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of the 5 main regional segments, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the marketing attribution software market

- To profile the key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze the competitive developments, such as agreements, alliances, joint ventures, and mergers and acquisitions, in the market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Marketing Attribution Software Market

Understand the Marketing Attribution Software Market.