Marine Composites Market by Type (Metal Matrix, Ceramic Matrix, and Polymer Matrix), Polymer Matrix Composite (Fiber (Glass, Carbon), Resin (Polyester, Epoxy)), Vessel Type (Power Boats, Sailboats, Cruise Ships), Application, and Region - Global Forecast to 2027

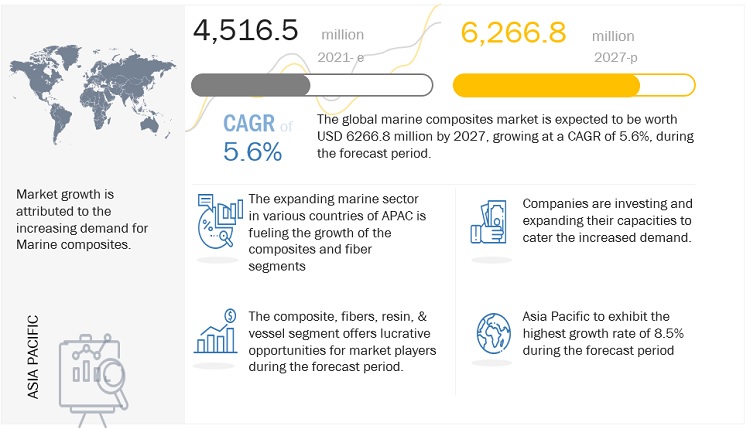

[129 Pages Report] The global marine composite market size is estimated to be USD 4,516.5 million in 2021 and projected to reach USD 6,266.8 million by 2027, at a CAGR of 5.6%. Growth of the market can be attributed to the high demand for marine composites from the power boats segment due to the growing recreational boating market in Europe and North America. Moreover, Growth of the market can be attributed to the high demand for marine composites from the power boats segment due to the growing recreational boating market in Europe and North America. The market has witnessed significant growth over the last few years due to the increasing demand for lightweight and corrosion-resistant boats is also expected to drive the growth of the market in the near future.

Global Marine Composites Market Trends

e-estimated; p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Marine Composites Market Dynamics

DRIVERS: Growing demand for high-speed, power, and luxury boats and yachts.

Due to its superior resistant property, marine composites have made significant progress in the marine industry globally. Racing powerboats with better performance and increased driver safety are made with hybrid composites. Fiber reinforced plastic composites are used in the production of structural components such bow modules, hatch coverings, deckhouses, and king posts. Technological innovations to minimize manufacturing cycle time are expected to propel demand in the marine sector. High-speed boats, fishing boats, ship components, naval vessels, high-capacity trawlers, and sailboats are manufactured using composite materials. Composite materials have the potential to reduce maintenance and fabrication costs, enhance aesthetic appeal, increase reliability, and reduce the component weight. These factors are major drivers for Marine Composites market.

RESTRAINT: Requirement of high initial Capital investment

The High cost of raw material and huge expenditure in the processing of marine composite are the major restraint for the growth of marine composites market. The high cost of carbon fibre and the accessibility of new, highly efficient, and lightweight alloys are predicted to restrain market expansion. The marine composites market is anticipated to face challenges from the need for high capital costs and concerns regarding reparability and recyclability.

OPPORTUNITIES: Significant growth of the maritime industry across the globe

Due to their ability to withstand intense pressure from winds, waves, and tides as well as keep their physical properties when submerged in seawater, composite materials, such as fiber-reinforced composites, are finding increased use. Marine composites are used for a variety of things, including grating, shafts, ducting, and hull shells. Superior qualities including increased fuel efficiency, lighter weight, durability, and design flexibility provide marine composites a competitive edge over traditional materials. Additionally, various product innovations, such as the development of marine composites using renewable materials and vacuum infusion, are acting as another growth-inducing factor. These composites improve stiffness, dampen vibrations, repel water, and resist abrasion and impact.

CHALLENGES: High competition from other players from the market

The competitive rivalry among manufacturers is high as the market is characterized by the presence of a large number of global and regional players. Expensive production prices may hamper the growth and development of the market. The key players have undertaken various initiatives such as technology innovations, research and development, partnerships, and mergers and acquisitions to manufacture cost-effective and lightweight products. In the upcoming years, the market is expected to experience new growth prospects due to the adoption of new technical breakthroughs in product creation. The demand is being increased by an expansion in boat supply shops and boat dealerships worldwide. Composite boat building materials are gaining popularity along with technology.

Power boats is estimated to be the largest segment of the marine composites market in 2027

Based on vessel type, the marine composites market is segmented into power boats, sailboats, cruise ships, and others. Power boats is estimated to be the largest segment of the marine composites market in 2027 owing to the growing demand for marine composites for yachts and racing boats. Power boats has one or more engines that propel the vessel over the top of the water. Power boats high speed and performance can be attributed to their hull technology and powerful engine. The increase in the inclination towards marine composites owning to the better properties than that of other alternatives, and rise in demand for high speed, power boats and accelerate the market growth.

Gglass fiber is expected to dominate the marine composites market during the forecast period

This growth is attributed to its better properties and lower prices than those of carbon fiber composites. Ever since their development, glass fiber composites have been the main type of marine composites used for boat building, globally. Because of its Lightweight, high strength, corrosion endurance, dimensional steadiness, component consolidation and tooling minimizations, low moisture absorption, high dielectric strength, minimal finishing required, low moderate tooling cost, and design versatility are the benefits and characteristics of glass fibre reinforced composites are employed in the marine industry and piping industries.

Polyester resin dominated the polymer matrix composite by resin type market during the forecast period

The high market share of polyester resin is because polyester resin provides excellent properties, such as these do not expand with high temperature and exhibit good mechanical, electrical, and high heat resistance properties. In addition, these are available at lower prices than epoxy and vinyl ester resins. polymer matrix composite provides all necessary characteristics such as high strength, excellent corrosion resistance, lightweight, and impact resistance, which makes it more suitable to use in shipbuilding in general.

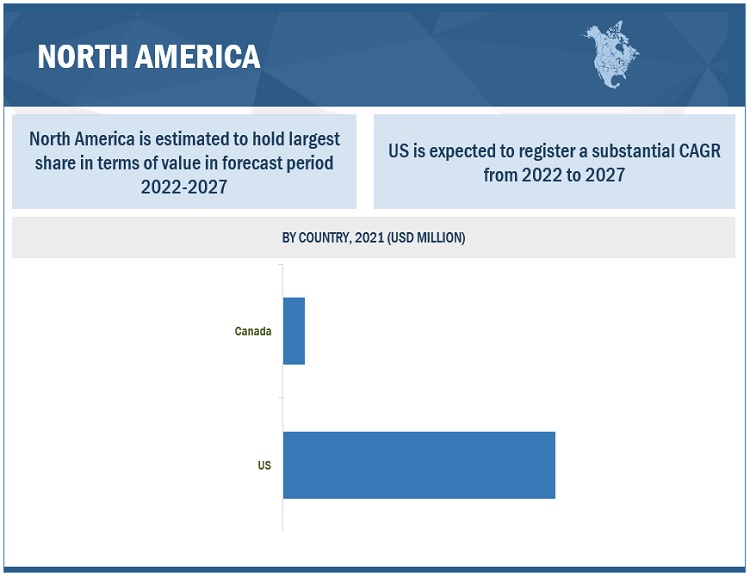

North American region is projected to dominate the marine composites market

The North American region is projected to dominate the marine composites market, in terms of value between 2022 and 2027. This is primarily due to increasing recreation boating in this region, especially in the US. North America is one of the mature markets the demand in North America is driven by the robust growth in powerboats and recreational boats owing to the high spending power in the region. The presence of major manufacturers of marine composites in the North American region is another factor expected to support the growth of the market in the coming years.

To know about the assumptions considered for the study, download the pdf brochure

The marine composites market is dominated by a few globally established players such as Toray Industries Inc. (Japan), Mitsubishi Rayon Co. Ltd. (Japan), Hexcel Corporation (US), Owens Corning (US), Gurit Holding (Switzerland), among others.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Million (USD) and Kiloton |

|

Segments covered |

By Composite Type (Metal Matrix Composite, Ceramic Matrix Composite, Polymer Matrix Composite), Polymer Matrix by fiber type (Glass Fiber, Carbon Fiber, Others), Polymer Matrix by resin type (Polyester, Vinyl Ester, Epoxy, Thermoplastic, Others), by Vessel Type (Power boats, Sailboats, Cruise Ships, Others) and by Region |

|

Geographies covered |

North America, Europe, APAC, MEA and Latin America |

|

Companies covered |

Owens Corning (US), Toray Industries, Inc. (Japan), SGL Group (Germany), Cytec Solvay Group (US), Teijin Limited (Japan), Mitsubishi Rayon Co. Ltd. (Japan), Hexcel Corporation (US), E. I. Du Pont de Nemours and Company (US), and Hyosung (South Korea) |

The research report categorizes the marine composite market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Composite Type

- Metal Matrix Composite (MMC)

- Ceramic Matrix Composite (CMC)

- Polymer Matrix Composite (PMC)

Polymer Matrix by Fiber Type

- Glass Fiber

- Carbon Fiber

- Others

- Aramid

- Natural Fibers

Polymer Matrix by Resin Type

- Polyester

- Vinyl Ester

- Epoxy

- Thermoplastic

- Others

- Phenolic

- Acrylic

Vessel Type

- Power Boats

- Sailboats

- Cruise Ships

- Others

- Cargo Vessels

- Naval Boats

- Jet Boats

- Personal Watercraft

By Region

- North America

- Europe

- APAC

- Latin America

- MEA

Recent Developments

- In May 2021, shipyard Brodrane Aa, a specialist in carbon-fibre vessels has modified and launch the ship, named the ‘Vision of the Fjords’. carbon fibre construction allows the battery-powered boat to navigate its route. This deal seen as one of the major deals in marine composites sector.

- In June 2020, Belfast Maritime Consortium led by Artemis Technologies has won a £33 million UK Government innovation grant to develop zero-emission ferries in the city, that will revolutionise the future of maritime transport, which will power by green energy, and it will reduce CO2 emissions.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the marine composites market during 2021-2027?

The global marine composites market is expected to record a CAGR of 5.6% from 2021–2027.

What are the driving factors for the marine composites?

Inherent advantages of marine composites, increasing investments in marine sector, high demand for composites in speed boats, yacht, rapid expansion of global marine transportation sector.

Which are the significant players operating in the marine composites market?

Owens Corning (US), Toray Industries, Inc. (Japan), SGL Group (Germany), Cytec Solvay Group (US), are some of the major companies operating in the flow battery market.

Which region will lead the marine composites market in the future?

North America is expected to lead the Marine composites market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Opportunities in the Marine Composites Market

4.2 Marine Composites Market, By Composite Type

4.3 Polymer Matrix Composites Market, By Fiber Type

4.4 Polymer Matrix Composites Market, By Resin Type

4.5 Marine Composites Market, By Vessel Type and Region

4.6 Marine Composites Market, By Country

4.7 Marine Composites Market Size, By Vessel Type

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in the Demand for High-Speed Boats

5.2.1.2 Better Properties of Marine Composites Than That of Other Alternatives

5.2.1.3 Design Flexibility of Vessels

5.2.1.4 Rise in Demand for Fuel-Efficient Vessels

5.2.2 Restraints

5.2.2.1 High Cost of Carbon Fiber

5.2.2.2 Availability of New High Strength and Lightweight Alloys

5.2.3 Opportunities

5.2.3.1 Growing Leisure Boat Market

5.2.3.2 Technological Advancements

5.2.4 Challenges

5.2.4.1 High Capital Cost

5.2.4.2 Concern About Reparability and Recyclability

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Suppliers

5.3.3 Bargaining Power of Buyers

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 Marine Composites Market, By Composite Type

6.1 Introduction

6.2 Metal Matrix Composites (MMC)

6.2.1 Metal Matrix: Marine Composites Market, By Region

6.3 Ceramic Matrix Composites (CMC)

6.3.1 Ceramic Matrix: Marine Composites Market, By Region

6.4 Polymer Matrix Composites (PMC)

6.4.1 Polymer Matrix: Marine Composites Market, By Region

7 Marine Composites Market, Polymer Matrix Composite by Type

7.1 Introduction

7.2 Polymer Matrix Composites Market, By Fiber Type

7.2.1 Glass Fiber Marine Composites

7.2.1.1 Glass Fiber: Marine Composites Market, By Region

7.2.2 Carbon Fiber Marine Composites

7.2.2.1 Carbon Fiber: Marine Composites Market, By Region

7.2.3 Others

7.2.1.1 Others: Marine Composites Market, By Region

7.3 Polymer Matrix Composites Market, By Resin Type

7.3.1 Polyester Marine Composites

7.3.1.1 Polyester: Marine Composites Market, By Region

7.3.2 Vinyl Ester Marine Composites

7.3.2.1 Vinyl Ester: Marine Composites Market, By Region

7.3.3 Epoxy Marine Composites

7.3.3.1 Epoxy: Marine Composites Market, By Region

7.3.4 Thermoplastic Marine Composites

7.3.4.1 Thermoplastic: Marine Composites Market, By Region

7.3.5 Others

7.3.5.1 Others: Marine Composites Market, By Region

8 Marine Composites Market, By Vessel Type

8.1 Introduction

8.2 Power Boats

8.2.1 Power Boats: Marine Composites Market, By Region

8.2.1.2 Yachts

8.2.1.2.1 Yachts: Marine Composites Market, By Region

8.2.1.3 Catamarans

8.2.1.3.1 Catamarans: Marine Composites Market, By Region

8.2.1.4 Racing Boats

8.2.1.4.1 Racing Boats: Marine Composites Market, By Region

8.2.1.5 Others

8.2.1.5.1 Others: Marine Composites Market, By Region

8.3 Sailboats

8.3.1 Sailboats: Marine Composites Market, By Region

8.4 Cruise Ship

8.4.1 Cruise Ship: Marine Composites Market, By Region

8.5 Others

8.5.1 Others: Marine Composites Market, By Region

9 Marine Composites Market, By Region

9.1 Introduction

9.2 North America

9.2.1 By Country

9.2.2 By Fiber Type

9.2.3 By Resin Type

9.2.4 By Vessel Type

9.2.5 US

9.2.5.1 US: Marine Composite Market by Fiber Type

9.2.6 Canada

9.2.6.1 Canada: Marine Composite Market by Fiber Type

9.3 Europe

9.3.1 By Country

9.3.2 By Fiber Type

9.3.3 By Resin Type

9.3.4 By Vessel Type

9.3.6 Italy

9.3.6.1 Italy: Marine Composite Market by Fiber Type

9.3.7 Germany

9.3.7.1 Germany: Marine Composite Market by Fiber Type

9.3.8 France

9.3.8.1 France: Marine Composite Market by Fiber Type

9.3.9 UK

9.3.9.1 UK: Marine Composite Market by Fiber Type

9.3.10 Netherlands

9.3.10.1 Netherlands: Marine Composite Market by Fiber Type

9.3.11 Russia

9.3.11.1 Russia: Marine Composite Market by Fiber Type

9.3.12 Spain

9.3.12.1 Spain: Marine Composite Market by Fiber Type

9.3.13 Rest of Europe

9.4 APAC

9.4.1 By Country

9.4.2 By Fiber Type

9.4.3 By Resin Type

9.4.4 By Vessel Type

9.4.5 China

9.4.5.1 China: Marine Composite Market by Fiber Type

9.4.6 Japan

9.4.6.1 Japan: Marine Composite Market by Fiber Type

9.4.7 South Korea

9.4.7.1 South Korea: Marine Composite Market by Fiber Type

9.4.8 Australia

9.4.8.1 Australia: Marine Composite Market by Fiber Type

9.4.9 India

9.4.9.1 India: Marine Composite Market by Fiber Type

9.4.10 Rest of APAC

9.5 Latin America

9.5.1 By Country

9.5.2 By Fiber Type

9.5.3 By Resin Type

9.5.4 By Vessel Type

9.5.5 Brazil

9.5.5.1 Brazil: Marine Composite Market by Fiber Type

9.5.6 Argentina

9.5.6.1 Argentina: Marine Composite Market by Fiber Type

9.5.7 Rest of Latin America

9.6 MEA

9.6.1 By Country

9.6.2 By Fiber Type

9.6.3 By Resin Type

9.6.4 By Vessel Type

9.6.5 South Africa

9.6.5.1 South Africa: Marine Composite Market by Fiber Type

9.6.6 Turkey

9.6.6.1 Turkey: Marine Composite Market by Fiber Type

9.6.7 Saudi Arabia

9.6.7.1 Saudi Arabia: Marine Composite Market by Fiber Type

9.6.8 Rest of MEA

10 Competitive Landscape

10.1 Introduction

10.2 Competitive Leadership Mapping (Dive Figure)

10.2.1 Dynamic Differentiators (Strength and business figure)

10.2.2 Innovators

10.2.3 Visionary Leaders

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Portfolio of Product Offering

10.3.2 Business Strategy Excellence

10.4 Market Ranking

10.5 Competitive Scenario

10.2.1 New Product Launches

10.2.2 Expansions

10.2.3 Acquisitions

10.2.4 Agreements

11 Company Profiles

(Overview, Financial*, Products & Services, Strategy, and Developments)

11.1 Toray Industries Inc.

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 SWOT Analysis

11.1.4 Winning Imperatives

11.1.5 Current focus and Strategies

11.1.6 Threat from Competition

11.1.7 Toray Industries Right to Win

11.2 Mitsubishi Rayon Co. Ltd.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 SWOT Analysis

11.2.4 Winning Imperatives

11.2.5 Current focus and Strategies

11.2.6 Threat from Competition

11.2.7 Mitsubishi Rayon’s Right to Win

11.3 Hexcel Corporation

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 SWOT Analysis

11.3.4 Winning Imperatives

11.3.5 Current focus and Strategies

11.3.6 Threat from Competition

11.3.7 Hexcel Corporation’s Right to Win

11.4 Owens Corning

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 SWOT Analysis

11.4.4 Winning Imperatives

11.4.5 Current focus and Strategies

11.4.6 Threat from Competition

11.4.7 Owens Corning’s Right to Win

11.5 Cytec Solvay Group

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 SWOT Analysis

11.5.4 Winning Imperatives

11.5.5 Current focus and Strategies

11.5.6 Threat from Competition

11.5.7 Cytec Solvay’s Right to Win

11.6 E. I. Du Pont De Nemours and Company

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Winning Imperatives

11.7 Gurit Holding

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Winning Imperatives

11.8 SGL Group

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Winning Imperatives

11.9 Teijin Limited

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Winning Imperatives

11.10 Hyosung

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Winning Imperatives

11.11 Other Companies

11.11.1 Zoltek Companies Inc.

11.11.2 Tatneft Alabuga Fiberglass

11.11.3 Premier Composite Technologies

11.11.4 Advanced Custom Manufacturing

11.11.5 Aeromarine Industries Ltd.

11.11.6 Airborne

11.11.7 GMS Composites

11.11.8 Composites One

11.11.9 Hexion

11.11.10 Marine Concepts

*Details Might Not Be Captured in Case of Unlisted Companies

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (131 Tables)

Table 1 Marine Composites Market Size, 2016–2023

Table 2 Marine Composites Market Size, By Composite Type, 2016–2023 (USD Million)

Table 3 Marine Composites Market Size, By Composite Type, 2016–2023 (Kiloton)

Table 4 Marine Composites Market Size of Metal Matrix Composite Type, By Region 2016–2023 (USD Million)

Table 5 Marine Composites Market Size in Metal Matrix Composite Type, By Region 2016–2023 (Kiloton)

Table 6 Marine Composites Market Size in Ceramic Matrix Composite Type, By Region 2016–2023 (USD Million)

Table 7 Marine Composites Market Size in Ceramic Matrix Composite Type, By Region 2016–2023 (Kiloton)

Table 8 Marine Composites Market Size in Polymer Matrix Composite Type, By Region 2016–2023 (USD Million)

Table 9 Marine Composites Market Size in Polymer Matrix Composite Type, By Region 2016–2023 (Kiloton)

Table 10 Other Matrix Composites Market Size, By Region, 2016–2023 (USD Million)

Table 11 Other Matrix Composites Market Size, By Region, 2016–2023 (Kiloton)

Table 12 Market Size of Polymer Matrix Composites, By Fiber Type, 2016–2023 (USD Million)

Table 13 Market Size of Polymer Matrix Composites, By Fiber Type, 2016–2023 (Kiloton)

Table 14 Market Size of Glass Fiber Marine Composites, By Region, 2016–2023 (USD Million)

Table 15 Market Size of Glass Fiber Marine Composites, By Region, 2016–2023 (Kiloton)

Table 16 Market Size of Carbon Fiber Marine Composites, By Region, 2016–2023 (USD Million)

Table 17 Market Size of Carbon Fiber Marine Composites, By Region, 2016–2023 (Kiloton)

Table 18 Other Fiber Marine Composites Market Size, By Region, 2016–2023 (USD Million)

Table 19 Other Fiber Marine Composites Market Size, By Region, 2016–2023 (Kiloton)

Table 20 Market Size of Polymer Matrix Composite, By Resin Type, 2016–2023 (USD Million)

Table 21 Market Size of Polymer Matrix Composite, By Resin Type, 2016–2023 (Kiloton)

Table 22 Market Size of Polyester Marine Composites, By Region, 2016–2023 (USD Million)

Table 23 Market Size of Polyester Marine Composites, By Region, 2016–2023 (Kiloton)

Table 24 Market Size of Vinyl Ester Marine Composites, By Region, 2016–2023 (USD Million)

Table 25 Market Size of Vinyl Ester Marine Composites, By Region, 2016–2023 (Kiloton)

Table 26 Market Size of Epoxy Marine Composites, By Region, 2016–2023 (Us Million)

Table 27 Market Size of Epoxy Marine Composites, By Region, 2016–2023 (Kiloton)

Table 28 Market Size of Thermoplastic Marine Composites, By Region, 2016–2023 (USD Million)

Table 29 Market Size of Thermoplastic Marine Composites, By Region, 2016–2023 (Kt)

Table 30 Other Resin Marine Composites Market Size, By Region, 2016–2023 (USD Million)

Table 31 Other Resin Marine Composites Market Size, By Region, 2016–2023 (Kiloton)

Table 32 Market Size, By Vessel Type, 2016–2023 (USD Million)

Table 33 Market Size, By Vessel Type, 2016–2023 (Kiloton)

Table 34 Market Size in Power Boats, By Region, 2016–2023 (USD Million)

Table 35 Market Size in Power Boats, By Region, 2016–2023 (Kiloton)

Table 36 Market Size in Yachts, By Region, 2016–2023 (USD Million)

Table 37 Market Size in Yachts, By Region, 2016–2023 (Kiloton)

Table 38 Market Size in Catamarans, By Region, 2016–2023 (USD Million)

Table 39 Market Size in Catamarans, By Region, 2016–2023 (Kiloton)

Table 40 Market Size in Racing Boats, By Region, 2016–2023 (USD Million)

Table 41 Market Size in Racing Boats, By Region, 2016–2023 (Kiloton)

Table 42 Market Size in Sailboats, By Region, 2016–2023 (USD Million)

Table 43 Market Size in Sailboats, By Region, 2016–2023 (Kiloton)

Table 44 Market Size in Cruise Ship, By Region, 2016–2023 (USD Million)

Table 45 Market Size in Cruise Ship, By Region, 2016–2023 (Kiloton)

Table 46 Market Size in Other Vessel Types, By Region, 2016–2023 (USD Million)

Table 47 Market Size in Other Vessel Types, By Region, 2016–2023 (Kiloton)

Table 48 Market Size, By Region, 2018–2023 (USD Million)

Table 49 Market Size, By Region, 2018–2023 (Kiloton)

Table 50 North America: Market Size, By Country, 2016–2023 (USD Million)

Table 51 North America: Market Size, By Country, 2016–2023 (Kiloton)

Table 52 North America: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 53 North America: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 54 North America: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 55 North America: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 56 North America: Market Size, By Vessel Type, 2016–2023 (USD Million)

Table 57 North America: Market Size, By Vessel Type, 2016–2023 (Kiloton)

Table 58 US: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 59 US: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 60 Canada: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 61 Canada: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 62 Europe: Market Size, By Country, 2016–2023 (USD Million)

Table 63 Europe: Market Size, By Country, 2016–2023 (Kiloton)

Table 64 Europe: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 65 Europe: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 66 Europe: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 67 Europe: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 68 Europe: Market Size, By Vessel Type, 2016–2023 (USD Million)

Table 69 Europe: Market Size, By Vessel Type, 2016–2023 (Kiloton)

Table 70 Italy: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 71 Italy: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 72 Germany: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 73 Germany: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 74 France: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 75 France: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 76 UK: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 77 UK: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 78 Netherlands: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 79 Netherlands: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 80 Russia: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 81 Russia: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 82 Spain: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 83 Spain: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 84 APAC: Market Size, By Country, 2016–2023 (USD Million)

Table 85 APAC: Market Size, By Country, 2016–2023 (Kiloton)

Table 86 APAC: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 87 APAC: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 88 APAC: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 89 APAC: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 90 APAC: Market Size, By Vessel Type, 2016–2023 (USD Million)

Table 91 APAC: Market Size, By Vessel Type, 2016–2023 (Kiloton)

Table 92 China: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 93 China: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 94 Japan: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 95 Japan: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 96 South Korea: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 97 South Korea: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 98 Australia: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 99 Australia: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 100 India: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 101 India: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 102 Latin America: Market Size, By Country, 2016–2023 (USD Million)

Table 103 Latin America: Market Size, By Country, 2016–2023 (Kiloton)

Table 104 Latin America: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 105 Latin America: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 106 Latin America: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 107 Latin America: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 108 Latin America: Market Size, By Vessel Type, 2016–2023 (USD Million)

Table 109 Latin America: Market Size, By Vessel Type, 2016–2023 (Kiloton)

Table 110 Brazil: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 111 Brazil: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 112 Argentina: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 113 Argentina: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 114 MEA: Market Size, By Country, 2016–2023 (USD Million)

Table 115 MEA: Market Size, By Country, 2016–2023 (Kiloton)

Table 116 MEA: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 117 MEA: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 118 MEA: Market Size, By Resin Type, 2016–2023 (USD Million)

Table 119 MEA: Market Size, By Resin Type, 2016–2023 (Kiloton)

Table 120 MEA: Market Size, By Vessel Type, 2016–2023 (USD Million)

Table 121 MEA: Market Size, By Vessel Type, 2016–2023 (Kiloton)

Table 122 South Africa: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 123 South Africa: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 124 Turkey: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 125 Turkey: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 126 South Arabia: Market Size, By Fiber Type, 2016–2023 (Kiloton)

Table 127 South Arabia: Market Size, By Fiber Type, 2016–2023 (USD Million)

Table 128 New Product Launches, 2014–2018

Table 129 Expansions, 2014–2018

Table 130 Acquisitions, 2014–2018

Table 131 Agreements, 2014–2018

List of Figures (58 Figures)

Figure 1 Marine Composites Market Segmentation

Figure 2 Marine Composites Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Marine Composites Market: Data Triangulation

Figure 6 Polymer Matrix Composites to Dominate the Market of Marine Composites

Figure 7 Power Boats Segment to Lead the Market of Marine Composites

Figure 8 Carbon Fiber to Register the Highest CAGR in the Polymer Matrix Composites Market

Figure 9 Polyester to Be the Largest Resin Type Segment in the Polymer Matrix Composites Market

Figure 10 US to Continue Leading the Market of Marine Composites

Figure 11 North America Dominated the Market of Marine Composites

Figure 12 High Demand From the Power Boats Segment to Drive the Market, 2018–2023

Figure 13 Polymer Matrix Composite to Dominate the Market of Marine Composites

Figure 14 Carbon Fiber to Be the Fastest-Growing Fiber Type Segment of Polymer Matrix Composites Market

Figure 15 Polyester to Be the Largest Resin Type Segment

Figure 16 North America Lead the Marine Composites Market

Figure 17 China to Register the Highest Cagr in the Marine Composites Market

Figure 18 Power Boats to Be the Largest Vessel Type Segment

Figure 19 Overview of Factors Governing the Marine Composites Market

Figure 20 Marine Composites Market: Porter’s Five Forces Analysis

Figure 21 Polymer Matrix Composites to Dominate the Marine Composites Market

Figure 22 Glass Fiber Marine Composites to Dominate the Polymer Matrix Composites Market

Figure 23 Glass Fiber Marine Composites Market Size, By Region, 2018–2023 (USD Million)

Figure 24 North America to Be the Largest Carbon Fiber Marine Composites Market

Figure 25 Vinyl Ester to Be the Second-Largest Resin Type

Figure 26 North America to Dominate the Polyester Resin Marine Composites Market

Figure 27 Power Boat Vessel Type to Dominate the Marine Composites Market

Figure 28 North America to Be the Largest Marine Composites Market in Power Boats Segment

Figure 29 Europe to Be the Largest Market of Marine Composites in Sailboats Segment

Figure 30 Europe to Be the Largest Market of Marine Composites in Cruise Ships Segment

Figure 31 China to Be the Fastest-Growing Market of Marine Composites

Figure 32 North America: Marine Composites Market

Figure 33 Europe: Marine Composites Market

Figure 34 APAC: Marine Composites Market

Figure 35 Brazil to Dominate the Marine Composites Market in Latin America

Figure 36 South Africa to Be the Largest Marine Composites Market

Figure 37 Companies Adopted New Product Launches as the Key Growth Strategy Between 2014 and 2018

Figure 38 Marine Composite Market: Competitive Leadership Mapping, 2016

Figure 39 Toray Industries Inc.: Company Snapshot

Figure 40 Toray Industries Inc.: SWOT Analysis

Figure 41 Toray Industries Inc.: Business Strategy and Right to Win Factor

Figure 42 Mitsubishi Rayon Co. Ltd.: Company Snapshot

Figure 43 Mitsubishi Rayon Co. Ltd.: SWOT Analysis

Figure 44 Mitsubishi Rayon Co. Ltd.: Business Strategy and Right to Win Factor

Figure 45 Hexcel Corporation: Company Snapshot

Figure 46 Hexcel Corporation: SWOT Analysis

Figure 47 Hexcel Corporation: Business Strategy and Right to Win Factor

Figure 48 Owens Corning: Company Snapshot

Figure 49 Owens Corning: SWOT Analysis

Figure 50 Owens Corning: Business Strategy and Right to Win Factor

Figure 51 Cytec Solvay Group: Company Snapshot

Figure 52 Cytec Solvay Group: SWOT Analysis

Figure 53 Cytec Solvay Group: Business Strategy and Right to Win Factor

Figure 54 E.I. Du Pont De Nemours and Company: Company Snapshot

Figure 55 Gurit Holding: Company Snapshot

Figure 56 SGL Group: Company Snapshot

Figure 57 Teijin Limited: Company Snapshot

Figure 58 Hyosung: Company Snapshot

Growth opportunities and latent adjacency in Marine Composites Market

global marine composite market, consumption, growth and application

Market information on Global Marine Composite market