Gelcoat Market by Resin Type (Polyester, Vinyl Ester, Epoxy, and Others), End-use Industry (Marine, Transportation, Wind-Energy, Construction, and Others), and Region - Global Forecast to 2025

The gelcoat market is projected to reach USD 1,808 million by 2025, at a CAGR of 13.2%. The gelcoat industry is growing due to the rise in demand for high performance composite materials, globally. The demand for gelcoats is expected to decline in 2020 due to COVID-19. However, the end of lockdown and recovery in the end-use industries will stimulate the demand during the forecast period.

Impact of COVID-19 on Global Gelcoat Market

COVID-19 has negatively affected the demand for composites across various end-use industries such as marine, transportation, wind energy, and construction, which intern reduced the consumption of gelcoats. The disruption in the supply chain resulting in delays or non-arrival of raw materials, disrupted financial flows, and growing absenteeism among production line workers have compelled marine and automobile manufacturers to operate at zero or partial capacities. This is leading to reduced demand for gelcoats.

Increasing demand from the automotive & transportation industry to drive the demand for composites

The automotive & transportation industry has the second largest share in the gelcoat market in terms of volume. The industry commits to comply with stringent regulations such as the Corporate Average Fuel Efficiency (CAFE) standards and the European Emission Standards (EES) by the US and European governments. To reduce carbon dioxide (CO2) emissions, which have an adverse effect on the global climate, the automakers in these regions are focusing on the production of lightweight vehicles with composites to comply with the government regulations and enhance the fuel efficiency of vehicles. Gelcoats are used to coat these composites components to protect them and increase aesthetic appeal.

Shift toward closed molding process is a major restrain for the gelcoat market

Open molding is widely employed for the manufacturing of bathtubs, spas, shower stalls, decks, boat hulls, and others. This process involves a spray up process and a hand lay-up process along with the use of gelcoats. Gelcoat is mostly not used in the closed molding process. The closed molding process includes the vacuum infusion process (VIP), light resin transfer moulding (LRTM), closed cavity bag moulding (CCBM), and other processes. The use of closed molding processes is increasing to attend mass production and increase dimensional precision in the composite industry.

Growing demand from APAC region is an excellent opportunity in the composites market

The market for gelcoat is mainly concentrated in North America and Europe. However, in recent years, there has been a significant shift toward emerging economies in APAC. The growth of the end-use industries such as transportation, wind energy, and construction in key countries such as China, India, and Japan is expected to drive the demand for gelcoat in the next five years. China is the largest market for gelcoat in APAC, and currently, transportation and construction industries account for a major share of the market. China has a strong wind energy industry with the highest number of wind installations across the globe. The wind energy industry in the country offers growth opportunities for the gelcoat market. In addition, the government initiatives in India to enhance the country’s manufacturing sector are expected to generate a positive impact on the growth of the wind energy and transportation industries. This, in turn, is expected to drive the demand for gelcoat in the country.

Government regulations pose the challenge for gelcoat manufacturers

Styrene is the dominant monomer in polyester resin-based gelcoats, and high styrene emission has been an important point of concern for health and safety of individuals at the workplace. This poses a challenge for market growth. Many rules and regulations have been set up by the governments of different countries to lower the styrene emissions from resins and gelcoats, thereby, reducing its impact on human health and the environment. For instance, the Environment Protection Agency (EPA) has established National Emission Standards for Hazardous Air Pollutants (NESHAPs), generally called Maximum Achievable Control Technology Standards (MACT) standards. These standards set up lower limits for Hazardous Air Pollutants (HAPs) generated by a particular industry to a maximum achievable degree.

The marine end-use industry to account for the largest market share, in terms of value and volume, during the forecast period

The marine end-use industry is the largest consumer of gelcoats in terms of value. Composites are corrosion-resistant and are not subject to fatigue damage. Gelcoat offers various useful properties such as chemical resistance, corrosion resistance, high gloss, and UV resistance. As a result, its use is increasing in various industries such as wind energy, transportation, marine, and construction. Glass fiber reinforced plastics are widely used in the marine industry. Entire decks and complete ship hulls for powerboats or sailing/motor yachts are completely made up of high-quality glass fiber reinforced plastics.

The polyester-based resin segment accounted for a major share of the gelcoat market in terms of value and volume during the forecast period.

The polyester resin-based gelcoats accounted for a larger share in the composites market. Polyester resins are less expensive and possess properties such as good corrosion resistance, fast curing, durability, tolerance to temperature, and low thermal expansion. Polyester resins used in gelcoats offer durability for molds and parts. Traditional gelcoats are available in white, neutral, and clear textures; and tooling gelcoats are available in colors such as orange and black. The demand for polyester based-gelcoats is expected to see a decline in 2020 due to the pandemic.

Though declined demand will impact the revenue of resin suppliers, they are expected to increase their profit margin from plummeting crude oil prices.

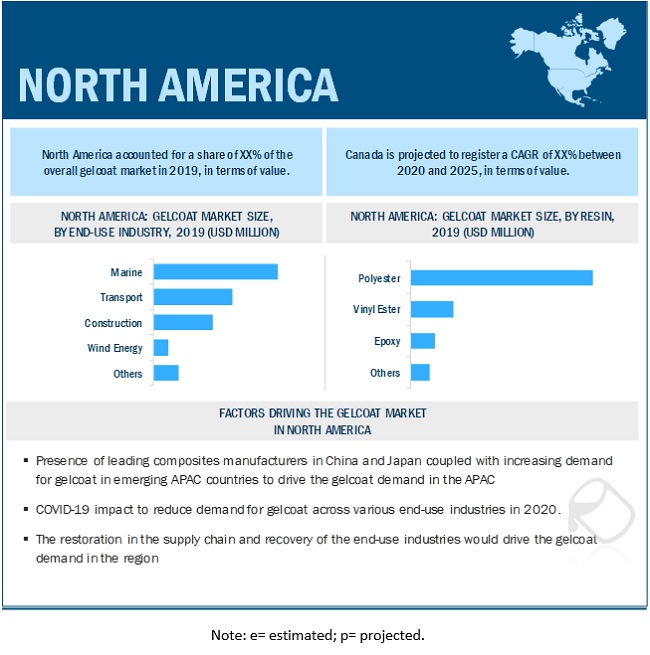

North America held the largest market share in the composites market

North America accounted for a major share of the overall gelcoat market, in terms of both value and volume, in 2018. The trend is expected to be the same during the forecast period. The growing marine and transportation industries are propelling the market in the region. The country has presence of some prominent gelcoat manufacturers such HK Research Corporation ,Ineos, Polynt Reichold, and Interplactic Corporation. as North America is the most affected region by COVID-19 globally and is expected to show largest decline between 2019 and 2020 due to reduced demand for gelcoats from aerospace & defense, wind energy, marine and automotive industries.

Key Market Players in Gelcoat Market

The key players in the global gelcoat market are: HK Research Corporation (US), Scott Bader (UK), Ineos (UK), Bufa Composite Systems Gmbh (Germany), Allnex (Germany), Alpha Owens Corning (US), Polynt Reichold (US), Turkuaz Polyester (Turkey), Poliya Composites Resins and Polymers (Turkey), Interplastic Corportion(US)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the gelcoat industry. The study includes an in-depth competitive analysis of these key players in the gelcoat market, with their company profiles, recent developments, and key market strategies.

Gelcoat Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016-2025 |

|

Base year |

2019 |

|

Forecast period |

2020-2025 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Fiber Type, Resin Type, End-Use Industry and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

HK Research Corporation (US), Scott Bader, Ineos (UK), Bufa Composite Systems Gmbh (Germany), Allnex (Germany), Alpha Owens Corning (US), Polynt Reichold (US) , and among others., among others |

This research report categorizes the composites market based on resin type, end-use industry, and region.

By Resin Type:

- Polyester

- Vinyl Ester

- Epoxy

- Others

By End-use Industry:

- Marine

- Wind Energy

- Transportation

- Construction

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments in Gelcoat Market

- In February 2020, The Polynt Group announced that it is going to establish it’s fully owned subsidiary by name Polynt Composites Turkey. This development will help the company to expand its gelcoat business in Turkey.

- In November 2018, Ashland entered into a distribution partnership with Velox (Germany) for distribution of gelcoats, vinyl ester resin, bonding pastes, polyester resins, fire retardant resins, and additives. The partnership helped the company increase the sales of its products in the Nordic region.

- In September 2019, Ineos completes the acquisition of Ashland’s composite business segment that offers gelcoat. The agreement helped the company consolidate its product portfolio

- In September 2018, Bufa Composite Systems GmbH developed a new conductive gelcoat, which is capable of eliminating electrostatic charges. It also increases the component quality, as it provides protection against dust and dirt buildup. The new product launch helped the company enhance its tooling capabilities

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the gelcoat market?

High demand from end-use industries due to superior performance properties of composites coated with gelcoat has driving the market.

Which is the fastest-growing region-level market for gelcoats?

APAC is the fastest-growing gelcoat market due to the presence of major composite manufacturers and the burgeoning growth of various end-use industries.

What are the factors contributing to the final price of gelcoats?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of gelcoats.

What are the challenges in the gelcoat market?

Government regulations regarding pollution is the major challenge in the gelcoat market.

Which type of resin holds the largest market share?

Polyester resin-based gelcoat hold the largest share due to low cost and ease of manufacturing.

How is the gelcoat market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

HK Research Corporation (US), Scott Bader, Ineos (UK), Bufa Composite Systems Gmbh (Germany), Allnex (Germany), Alpha Owens Corning (US), Polynt Reichold (US), among others

Which resins are used in gelcoats?

Polyester, epoxy, and vinyl ester are the major resins used in manufacturing gelcoats.

What are the major end-use industries for composites?

The major end-use industries for composites are wind energy, transportation, construction & infrastructure, marine, and pipes & tanks

What is the biggest restraint in the composites market?

Shift towards closed molding processes is restraining market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 GELCOAT MARKET SEGMENTATION

1.3.1 REGIONS COVERED

FIGURE 2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 GELCOAT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY SIDE ANALYSIS

FIGURE 4 MARKET NUMBER ESTIMATION

2.2.2 SEGMENT ANALYSIS

2.2.3 SEGMENT ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 GELCOAT MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 6 POLYESTER TO BE THE LARGEST RESIN FOR GELCOAT

FIGURE 7 MARINE END-USE INDUSTRY ACCOUNTED FOR THE MAXIMUM SHARE IN THE GELCOAT MARKET IN 2019

FIGURE 8 US ACCOUNTS FOR LARGEST SHARE OF THE GELCOAT MARKET

FIGURE 9 APAC TO WITNESS THE HIGHEST GROWTH IN GELCOAT MARKET

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN THE GELCOAT MARKET

FIGURE 10 GELCOAT MARKET PROJECTED TO WITNESS HIGH GROWTH BETWEEN 2020 AND 2025

4.2 GELCOAT MARKET, BY END-USE INDUSTRY & REGION

FIGURE 11 MARINE TO BE LEADING CONSUMER OF GELCOAT

4.3 GELCOAT MARKET, BY RESIN

FIGURE 12 POLYESTER TO DOMINATE THE OVERALL GELCOAT MARKET

4.4 GELCOAT MARKET, BY COUNTRY

FIGURE 13 CHINA TO REGISTER THE HIGHEST CAGR IN THE GELCOAT MARKET

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES GOVERNING THE GELCOAT MARKET

5.1.1 DRIVERS

5.1.1.1 Growing use of composites in various industries

5.1.1.2 Useful properties offered by gelcoat

5.1.1.3 Increase in demand for gelcoat in transportation industry

5.1.2 RESTRAINTS

5.1.2.1 Shift toward closed molding process affecting use of gelcoat

5.1.2.2 Cracking of gelcoat

5.1.2.3 Disruption in supply chain and logistics due to COVID-19

5.1.2.4 Lower capacity utilization and liquidity crunch due to COVID-19

5.1.3 OPPORTUNITIES

5.1.3.1 Growing wind energy industry

5.1.3.2 Growing demand from the APAC region

5.1.4 CHALLENGES

5.1.4.1 Government regulations for styrene emission

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 GELCOAT MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 THREAT OF NEW ENTRANTS

5.2.2 THREAT OF SUBSTITUTES

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 GELCOAT MARKET VALUE CHAIN

5.4 PRICE ANALYSIS

5.5 TECHNOLOGY DEVELOPMENT

5.6 NEW TECHNOLOGY AND IMPACT ANALYSIS

5.7 GROWTH INFLUENCING FACTORS, BY END-USE INDUSTRY

6 MACROECONOMIC OVERVIEW AND KEY TRENDS (Page No. - 51)

6.1 INTRODUCTION

6.1.1 TRENDS AND FORECAST OF GDP

TABLE 1 ANNUAL PERCENTAGE CHANGE OF GDP, BY REGION, APRIL 2020

6.1.2 IMPACT OF COVID-19 ON AEROSPACE INDUSTRY

TABLE 2 NUMBER OF AIRPLANE DELIVERIES, BY MANUFACTURER, 2019

6.1.2.1 Short-term strategies to manage cost structure and supply chains

6.1.2.2 New opportunities

6.2 IMPACT OF COVID-19 ON AUTOMOTIVE INDUSTRY

6.2.1 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

6.2.2 IMPACT ON ELECTRIC VEHICLE (EV) DEMAND DUE TO LOWER OIL PRICES

6.2.3 NEW OPPORTUNITIES

6.3 IMPACT OF COVID-19 ON WIND ENERGY INDUSTRY

6.3.1 SHORT-TERM STRATEGIES TO MANAGE COST STRUCTURE AND SUPPLY CHAINS

6.3.2 NEW OPPORTUNITIES

7 GELCOAT MARKET, BY RESIN (Page No. - 56)

7.1 INTRODUCTION

FIGURE 17 POLYESTER TO BE LEADING SEGMENT IN OVERALL MARKET

TABLE 3 GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 4 GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 5 GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 6 GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

7.2 IMPACT OF COVID-19 ON GELCOAT MARKET

7.3 POLYESTER

7.3.1 POLYESTER RESIN-BASED GELCOAT WIDELY USED FOR ITS OUTSTANDING PROPERTIES

FIGURE 18 APAC TO BE FASTEST-GROWING MARKET FOR POLYESTER RESIN-BASED GELCOAT

TABLE 7 POLYESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2016–2019 (KILOTON)

TABLE 8 POLYESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 POLYESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (KILOTON)

TABLE 10 POLYESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (USD MILLION)

7.4 VINYL ESTER

7.4.1 VINYL ESTER RESIN-BASED GELCOAT PREFERRED FOR ITS CORROSION RESISTANCE AND DURABILITY

TABLE 11 VINYL ESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2016–2029 (KILOTON)

TABLE 12 VINYL ESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2016–2029 (USD MILLION)

TABLE 13 VINYL ESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (KILOTON)

TABLE 14 VINYL ESTER RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (USD MILLION)

7.5 EPOXY

7.5.1 GELCOAT BASED ON EPOXY RESIN HAS VARIOUS THERMAL AND MECHANICAL PROPERTIES

TABLE 15 EPOXY RESIN-BASED GELCOAT MARKET, BY REGION, 2016–2019 (KILOTON)

TABLE 16 EPOXY RESIN-BASED GELCOAT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 EPOXY RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (KILOTON)

TABLE 18 EPOXY RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (USD MILLION)

7.6 OTHERS

TABLE 19 OTHER RESINS-BASED GELCOAT MARKET, BY REGION, 2016–2019 (KILOTON)

TABLE 20 OTHER RESINS-BASED GELCOAT MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 OTHER RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (KILOTON)

TABLE 22 OTHER RESIN-BASED GELCOAT MARKET, BY REGION, 2020–2025 (USD MILLION)

8 GELCOAT MARKET, BY END-USE INDUSTRY (Page No. - 67)

8.1 INTRODUCTION

FIGURE 19 MARINE TO BE LEADING END-USE INDUSTRY OF GELCOAT

TABLE 23 GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 24 GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 25 GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 26 GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

8.2 IMPACT OF COVID-19 ON END-USE INDUSTRIES

8.3 MARINE

8.3.1 MARINE IS THE MAJOR END-USE INDUSTRY OF GELCOAT

FIGURE 20 MARINE IS LARGEST END-USE INDUSTRY OF GELCOAT IN NORTH AMERICA

TABLE 27 GELCOAT MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 28 GELCOAT MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 GELCOAT MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 30 GELCOAT MARKET SIZE IN MARINE INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.4 TRANSPORTATION

8.4.1 USE OF FIBER REINFORCED COMPONENTS CONTRIBUTING TO DEMAND FOR GELCOAT

TABLE 31 GELCOAT MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 32 GELCOAT MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 GELCOAT MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 34 GELCOAT MARKET SIZE IN TRANSPORTATION INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.5 CONSTRUCTION

8.5.1 GELCOAT USED IN CONSTRUCTION DUE TO ITS RESISTANCE TO CORROSION, WATER, CHEMICALS, AND UV RAYS

TABLE 35 GELCOAT MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 36 GELCOAT MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 GELCOAT MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 38 GELCOAT MARKET SIZE IN CONSTRUCTION INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.6 WIND ENERGY

8.6.1 GELCOAT WIDELY USED IN DIFFERENT APPLICATIONS IN WIND ENERGY INDUSTRY

TABLE 39 GELCOAT MARKET SIZE IN WIND ENERGY INDUSTRY, BY REGION, 2016–2019 (KILOTON)

TABLE 40 GELCOAT MARKET SIZE IN WIND ENERGY INDUSTRY, BY REGION, 2016–2019, (USD MILLION)

TABLE 41 GELCOAT MARKET SIZE IN WIND ENERGY INDUSTRY, BY REGION, 2020–2025 (KILOTON)

TABLE 42 GELCOAT MARKET SIZE IN WIND ENERGY INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

8.7 OTHERS

TABLE 43 GELCOAT MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2019 (KILOTON)

TABLE 44 GELCOAT MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 GELCOAT MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2025 (KILOTON)

TABLE 46 GELCOAT MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 2020–2025 (USD MILLION)

9 GELCOAT MARKET, BY REGION (Page No. - 80)

9.1 INTRODUCTION

FIGURE 21 INDIA TO REGISTER THE HIGHEST CAGR

TABLE 47 GELCOAT MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 48 GELCOAT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 GELCOAT MARKET SIZE, BY REGION, 2020–2025 (KILOTON)

TABLE 50 GELCOAT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.2 REGIONAL IMPACT OF COVID-19

9.3 NORTH AMERICA

FIGURE 22 NORTH AMERICA: GELCOAT MARKET SNAPSHOT

TABLE 51 NORTH AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 52 NORTH AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 53 NORTH AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 54 NORTH AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 56 NORTH AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 57 NORTH AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 58 NORTH AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 60 NORTH AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 62 NORTH AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.3.1 US

9.3.1.1 Growing composites industry is propelling US gelcoat market

TABLE 63 US: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 64 US: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 65 US: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 66 US: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 67 US: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 68 US: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 69 US: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 70 US: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Marine industry is the major driver for the gelcoat market in Canada

TABLE 71 CANADA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 72 CANADA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 73 CANADA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 74 CANADA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 75 CANADA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 76 CANADA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 77 CANADA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 78 CANADA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4 EUROPE

FIGURE 23 EUROPE: GELCOAT MARKET SNAPSHOT

TABLE 79 EUROPE: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 80 EUROPE: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 82 EUROPE: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 83 EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 84 EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 86 EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 87 EUROPE: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 88 EUROPE: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 89 EUROPE: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 90 EUROPE: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Germany is the leading consumer of gelcoat in Europe

TABLE 91 GERMANY: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 92 GERMANY: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 93 GERMANY: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 94 GERMANY: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 95 GERMANY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 96 GERMANY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 97 GERMANY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 98 GERMANY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.2 ITALY

9.4.2.1 Growing demand for high-strength driving the market in Italy

TABLE 99 ITALY: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 100 ITALY: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 101 ITALY: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 102 ITALY: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 103 ITALY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 104 ITALY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 105 ITALY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 106 ITALY: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.3 FRANCE

9.4.3.1 Marine and transportation industries generate high demand for gelcoat in France

TABLE 107 FRANCE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 108 FRANCE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 109 FRANCE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 110 FRANCE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.4 UK

9.4.4.1 Transportation industry is a major end user of gelcoat in UK

TABLE 111 UK: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 112 UK: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 113 UK: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 114 UK: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.4.5 REST OF EUROPE

TABLE 115 REST OF EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 116 REST OF EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 117 REST OF EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 118 REST OF EUROPE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5 APAC

FIGURE 24 APAC: GELCOAT MARKET SNAPSHOT

TABLE 119 APAC: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 120 APAC: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 121 APAC: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 122 GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 123 APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 124 APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 125 APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 126 APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 127 APAC: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 128 APAC: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 129 APAC: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 130 APAC: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.5.1 CHINA

9.5.1.1 Presence of many gelcoat manufacturers helping the market growth

TABLE 131 CHINA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 132 CHINA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 133 CHINA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 134 CHINA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 135 CHINA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 136 CHINA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 137 CHINA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 138 CHINA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5.2 INDIA

9.5.2.1 Growing focus on wind energy industry propelling the market

TABLE 139 INDIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 140 INDIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 141 INDIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 142 INDIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5.3 JAPAN

9.5.3.1 Presence of major composites manufacturers contributes to market growth

TABLE 143 JAPAN: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 144 JAPAN: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 145 JAPAN: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 146 JAPAN: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 147 JAPAN: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 148 JAPAN: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 149 JAPAN: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 150 JAPAN: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.5.4 REST OF APAC

TABLE 151 REST OF APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 152 REST OF APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 153 REST OF APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 154 REST OF APAC: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6 LATIN AMERICA

TABLE 155 LATIN AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 156 LATIN AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 157 LATIN AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 158 LATIN AMERICA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 159 LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 160 LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 161 LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 162 LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 163 LATIN AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 164 LATIN AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 165 LATIN AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 166 LATIN AMERICA: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.6.1 BRAZIL

9.6.1.1 Growing number of wind energy installations driving the market in Brazil

TABLE 167 BRAZIL: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 168 BRAZIL: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 169 BRAZIL: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 170 BRAZIL: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 171 BRAZIL: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 172 BRAZIL: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 173 BRAZIL: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 174 BRAZIL: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6.2 MEXICO

9.6.2.1 Marine and transportation generate high demand for gelcoat in Mexico

TABLE 175 MEXICO: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 176 MEXICO: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 177 MEXICO: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 178 MEXICO: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.6.3 REST OF LATIN AMERICA

TABLE 179 REST OF LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 180 REST OF LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 181 REST OF LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 182 REST OF LATIN AMERICA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.7 MEA

TABLE 183 MEA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 184 MEA: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 185 MEA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 186 MEA: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 187 MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 188 MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 189 MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 190 MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

TABLE 191 MEA: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 192 MEA: GELCOAT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 193 MEA: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (KILOTON)

TABLE 194 MEA: GELCOAT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

9.7.1 UAE

9.7.1.1 UAE is fast-growing market for gelcoat in MEA

TABLE 195 UAE: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (KILOTON)

TABLE 196 UAE: GELCOAT MARKET SIZE, BY RESIN, 2016–2019 (USD MILLION)

TABLE 197 UAE: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (KILOTON)

TABLE 198 UAE: GELCOAT MARKET SIZE, BY RESIN, 2020–2025 (USD MILLION)

TABLE 199 UAE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 200 UAE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 201 UAE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 202 UAE: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.7.2 SAUDI ARABIA

9.7.2.1 Major demand for gelcoat generated from construction industry in Saudi Arabia

TABLE 203 SAUDI ARABIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 204 SAUDI ARABIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 205 SAUDI ARABIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 206 SAUDI ARABIA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

9.7.3 REST OF MEA

TABLE 207 REST OF MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (KILOTON)

TABLE 208 REST OF MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 209 REST OF MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (KILOTON)

TABLE 210 REST OF MEA: GELCOAT MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 143)

10.1 OVERVIEW

FIGURE 25 COMPANIES ADOPTED EXPANSION AND NEW PRODUCT LAUNCH AS KEY GROWTH STRATEGIES BETWEEN 2015 AND 2020

10.2 RECENT DEVELOPMENTS

10.2.1 EXPANSION

TABLE 211 EXPANSION, 2015—2020

10.2.2 AGREEMENT & PARTNERSHIP

TABLE 212 AGREEMENT & PARTNERSHIP, 2015—2020

10.2.3 NEW PRODUCT LAUNCH

TABLE 213 NEW PRODUCT LAUNCH, 2015—2020

10.2.4 MERGER & ACQUISITION

TABLE 214 MERGER & ACQUISITION, 2015—2020

10.3 MARKET RANKING OF TOP 5 PLAYERS IN GELCOAT MARKET

FIGURE 26 RANKING OF TOP FIVE PLAYERS IN GELCOAT MARKET

10.4 MARKET SHARE ANALYSIS IN GELCOAT MARKET

10.5 COMPETITIVE BENCHMARKING

10.5.1 TIER 1 COMPANIES

10.5.1.1 Dynamic differentiators

10.5.1.2 Innovators

10.5.1.3 Vanguard

10.5.1.4 Emerging

FIGURE 27 DIVE CHART

10.5.2 COMPETITIVE BENCHMARKING OF TIER 1 COMPANIES

10.5.2.1 Strength of product portfolio

FIGURE 28 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GELCOAT MARKET

10.5.2.2 Business strategy excellence

FIGURE 29 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GELCOAT MARKET

10.5.3 TIER 2 AND 3 COMPANIES

10.5.3.1 Dynamics differentiators

10.5.3.2 Innovators

10.5.3.3 Vanguard

10.5.3.4 Emerging companies

FIGURE 30 DIVE CHART

10.5.4 COMPETITIVE BENCHMARKING TIER 2 AND 3 COMPANIES

10.5.4.1 Strength of product portfolio

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN GELCOAT MARKET

10.5.4.2 Business strategy excellence

FIGURE 32 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN GELCOAT MARKET

11 COMPANY PROFILES (Page No. - 153)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 INEOS ENTERPRISE

FIGURE 33 INEOS ENTERPRISE: SWOT ANALYSIS

11.2 BUFA COMPOSITE SYSTEMS GMBH

FIGURE 34 BUFA COMPOSITE SYSTEMS GMBH: SWOT ANALYSIS

11.3 HK RESEARCH CORPORATION

FIGURE 35 HK RESEARCH CORPORATION: SWOT ANALYSIS

11.4 ALLNEX

FIGURE 36 ALLNEX: SWOT ANALYSIS

11.5 SCOTT BADER COMPANY

FIGURE 37 SCOTT BADER COMPANY: COMPANY SNAPSHOT

FIGURE 38 SCOTT BADER COMPANY: SWOT ANALYSIS

11.6 POLIYA COMPOSITES RESINS AND POLYMERS

11.7 INTERPLASTIC CORPORATION

11.8 ALPHA OWENS-CORNING (AOC) ALIANCYS

11.9 POLYNT-REICHHOLD GROUP

11.10 TURKUAZ POLYESTER

11.11 OTHER COMPANIES

11.11.1 SIKA ADVANCED RESINS

11.11.2 GRM SYSTEMS S.R.O.

11.11.3 SATYEN POLYMERS

11.11.4 VIKRAM RESINS AND POLYMERS

11.11.5 MADER GROUP

11.11.6 RESOLTECH

11.11.7 ZHEJIANG LEADER COMPOSITE CO., LTD.

11.11.8 CHANGZHOU HUAKE POLYMERS CO., LTD.

11.11.9 ETERNAL SYNTHETIC RESINS (CHANGSU) CO., LTD.

11.11.10 JIANGSU FULLMARK CHEMICALS CO. LTD. CHINA

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 179)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

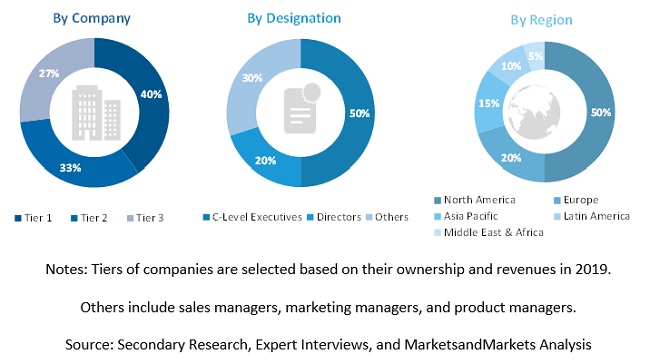

The study involves two major activities in estimating the current size of the gelcoat market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The gelcoat market comprises several stakeholders, such as raw material suppliers, manuafturers, end-product users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the transportation, wind energy, marine, and construction end-use industries. Advancements in technology and diverse applications in various end-use industries describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall gelcoat market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the automotive & transportation, wind energy, marine, and construction end-use industries.

Report Objectives

- To analyze and forecast the global gelcoat market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on resin type, and end-use industry

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC composites market

- Further breakdown of Rest of European composites market

- Further breakdown of Rest of North American composites market

- Further breakdown of Rest of MEA composites market

- Further breakdown of Rest of Latin American composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Gelcoat Market

General information on Gelcoat market with specific focus on EMEA region

Incomplete information. May be client wanted the sample and brochure of the report.