Marine Collagen Market by Type (Type I, Type III), Application (Nutraceuticals, Cosmetic, Medical), Source (Skin, scales, and muscles, Bones & tendons), Animal and Region – Trends and Global Forecast to 2026

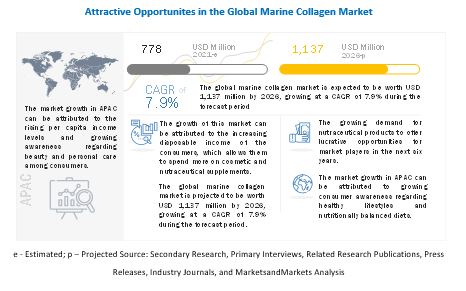

[247 Pages Report] According to MarketsandMarkets, the global marine collagen market size is estimated to be valued at USD 778 million in 2021 and projected to reach USD 1,137 million by 2026, recording a CAGR of 7.9% during the forecast period. The market is strongly driven by the growing millennial population, shifting consumer preferences, augmentation of beauty and personal care industry, and increase in supplementary income among consumers. The convergence of major industry trends is giving rise to new opportunities for key players in the industry, as the market size is witnessing substantial increase.

The market in the developing regions is well-positioned for strong growth in the coming years. Regions witnessing steadfast economic development such as the Asia Pacific, are presenting promising prospects for the growth and expansion of the marine collagen market. Manufacturers across the globe are investing in prospective areas and hightailing the manufacturing extent of marine collagen in order to meet the rising demand worldwide.

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers : Growing demand for marine collagen in the cosmetics industry

Marine collagen helps fight the formation of wrinkles, accelerate the skin renewal process, and maintain the structure and strength of the hair. This makes it the most preferred ingredient in cosmetic products, especially for skin-care and hair-care applications. The usage of marine collagen is expected to propel at a robust pace, as consumers are becoming increasingly aware of the benefits offered by the beauty and personal care industry.

Restraints: High import duty on collagen products

High duty on the import of collagen or products thereof is restraining the market growth, as it leads to an increase in the cost of products, which cannot be afforded in the competitive market. Moreover, European and North American countries rely on the import of collagen for manufacturing various products. High import duty thus limits the market growth in the region.

Opportunities: Rise in number of end-use applications

The rise in number of end-use applications, owing to the multifunctional attributes of marine collagen, is projected to create lucrative opportunities for growth. Marine collagen is now being incorporated into the medical, dental, and pharmacological fields, it is also used as adequate support for drugs, and is a natural biomaterial with astringent and wound healing properties. Thus, the manifold applications of marine collagen in nutraceutical, cosmetic, and medical fields presents a prospective market for overall growth of marine collagen as an ingredient.

Challenges: High manufacturing cost of marine collagen compared to other collagen sources

The overall manufacturing process for marine collagen is cost-effective; however, it is comparatively expensive than extraction of bovine and porcine collagen. The advantage of costing for other collagen sources such as bovine collagen would certainly restrict the growth of marine collagen in the global market. Hence, the incorporation of marine collagen in various food products is difficult as its use makes them high-value products, which are not easily preferred in the market.

Asia Pacific is projected to account for the largest market during the forecast period

Asia Pacific is projected to dominate the market during the forecast period. This dominance is attributable to the rising millennial population in Asian countries, the increasing supplementary income, surging internet penetration which has led to awareness regarding beauty and wellness trends, and high demand of cosmetic and nutraceutical products in countries like China and Japan. These are some of the major factors driving the growth of the marine collagen market.

Key Market Players:

Key market players include Ashland (US), Darling Ingredients (US), Nitta Gelatin (US), Gelita (Germany), Italgelatine (Italy), Nippi Collagen (Canada), Weishardt (France), Titan Biotech Limited (India), Amicogen (South Korea), Rousselot (Netherlands), Seagarden (Norway), Lapi Gelatine (Italy), Connoils (US), Foodmate (China), Cobiosa (Spain), BHN (Japan), Certified Nutraceuticals (US), Jellagen (UK), Copalis

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2016–2021 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments Covered |

|

|

Regions covered |

|

|

Companies studied |

Ashland (US), Darling Ingredients (US), Nitta Gelatin (US), Gelita (Germany), Italgelatine (Italy), Nippi Collagen (Canada), Weishardt (France), Titan Biotech Limited (India), Amicogen (South Korea), Seagarden (Norway), Lapi Gelatine (Italy), Tai Ai Peptide Group (China), Hangzhou Nutrition Biotechnology (China), ETChem (China), BHN (Japan), Certified Nutraceuticals (US), Jellagen (UK), NutraChoice (Malaysia), Ningbo Nutrition Food Technology (China), Ming Chyi Biotechnology (Taiwan) |

This research report categorizes the marine collagen market based on type, source, animal, application and region.

Based on type, the market has been segmented as follows:

- Type I

- Type III

- Other types (Other types include Type II, Type IV, and Type V)

Based on source, the market has been segmented as follows:

- Skin, scales, and muscles

- Bones and tendons

- Other sources (Other sources include cartilage, fins, and parts of sponges)

Based on animal, the market has been segmented as follows:

- Fish

- Other animals (Other animals include jellyfish, sea urchin waste, mollusks, sponges, and other invertebrates)

Based on application, the market has been segmented as follows:

- Nutraceuticals

- Cosmetics

- Medical

- Other applications (Other applications include feed, dairy products, and processed food)

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments

- Jan 2021, Darling Ingredients introduced Peptan, marine collagen peptides under its Rousselot brand. This product would help the company enter the nutricosmetics and dietary supplements market.

- Jan 2021, Ashland acquired the personal care business of Schülke & Mayr GmbH (Germany). The acquisition would provide strategic positioning as a premier specialty additives supplier and would strengthen the company’s consumer business portfolio.

Frequently Asked Questions (FAQ):

Does the report covers the market size and estimations for the country level markets for marine collagen?

The report has overall number at regional and country level. The further country wise analysis can be further provided as a customization. Please let us know your geography/regional preferences.

Does the scope cover marine collagen used in medical and pharmaceutical applications?

The report covers marine collagen used in medical and pharmaceutical applications as given under by application segment.

Is it possible to provide further segmentation and analysis of marine collagen?

Yes, further country level analysis can be provided for marine collagen market on the basis of sources.

We are looking for quantification at each stage in the supply chain. Can this be provided?

The report covers value chain analysis and supply chain analysis at global levels. Further drill down at regional level can be provided for required products.

Can you provide estimation for countries of Middle Eastern region?

We can provide additional country wise estimation for different regions, such as: Egypt, Sudan, Turkey, Jordan, Oman, and Saudi Arabia. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 2 MARINE COLLAGEN MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.3.1 SUPPLY SIDE:

2.3.2 DEMAND SIDE:

FIGURE 4 DATA TRIANGULATION: SUPPLY AND DEMAND SIDES

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 OPTIMISTIC SCENARIO

2.6.2 REALISTIC SCENARIO

2.6.3 PESSIMISTIC SCENARIO

2.6.4 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 5 COVID-19: GLOBAL PROPAGATION

FIGURE 6 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 7 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT: SCENARIO ASSESSMENT

FIGURE 8 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 9 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 57)

TABLE 2 MARINE COLLAGEN MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 10 MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 12 MARKET, BY SOURCE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MARKET, BY ANIMAL, 2021 VS. 2026 (USD MILLION)

FIGURE 14 MARKET SHARE, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 BRIEF OVERVIEW OF THE GLOBAL MARKET

FIGURE 15 GROWING DEMAND FOR COLLAGEN IN BEAUTY AND PERSONAL CARE PRODUCTS TO DRIVE THE GROWTH OF THE MARINE COLLAGEN MARKET

4.2 MARINE COLLAGEN MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 16 THE US IS ESTIMATED TO BE THE LARGEST MARKET GLOBALLY FOR MARINE COLLAGEN IN 2021

4.3 NORTH AMERICA: MARKET FOR MARINE COLLAGEN, BY TYPE AND COUNTRY

FIGURE 17 THE US IS THE LARGEST MARKET FOR MARINE COLLAGEN IN NORTH AMERICA

4.4 MARKET FOR MARINE COLLAGEN, BY TYPE AND REGION

FIGURE 18 TYPE I SEGMENT ESTIMATED TO DOMINATE THE GLOBAL MARKET IN 2021

4.5 MARKET FOR MARINE COLLAGEN, BY APPLICATION

FIGURE 19 NUTRACEUTICALS SEGMENT PROJECTED TO DOMINATE THE GLOBAL MARKET BY 2026

4.6 MARKET FOR MARINE COLLAGEN, BY SOURCE

FIGURE 20 SKIN, SCALES, AND MUSCLES SEGMENT PROJECTED TO DOMINATE THE GLOBAL MARKET BY 2026

4.7 MARKET FOR MARINE COLLAGEN, BY ANIMAL

FIGURE 21 FISH SEGMENT ESTIMATED TO DOMINATE THE GLOBAL MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 66)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MARKET FOR MARINE COLLAGEN: MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Consumer inclination toward a healthy lifestyle and high protein consumption

FIGURE 23 US: DAILY PER CAPITA ANIMAL PROTEIN SUPPLY, 2013-2017 (GRAMS)

FIGURE 24 US: CONSUMER INTEREST IN PROTEINS, 2019

FIGURE 25 DAILY PER CAPITA PROTEIN SUPPLY, BY KEY COUNTRY, 2013-2017 (GRAMS)

5.2.1.1.1 Health benefits

5.2.1.1.2 Better bioavailability as compared to other collagen types such as porcine and bovine collagen

TABLE 3 COLLAGEN PEPTIDE ABSORPTION IN THE BLOODSTREAM

5.2.1.1.3 Growing demand for Halal/Kosher certified products

5.2.1.2 Growing demand for marine collagen in the cosmetics industry

FIGURE 26 SALE OF BEAUTY PRODUCT COMPANIES, 2019 (USD BILLION)

5.2.1.2.1 Beauty benefits influencing the customer buying process

FIGURE 27 AMINO ACID COMPOSITION OF MARINE COLLAGEN

5.2.1.2.2 Usage of collagen in beauty and personal care products

5.2.1.3 Increase in R&D activities

FIGURE 28 GROWTH IN RESEARCH PAPER PUBLICATIONS ON MARINE COLLAGEN, 2002–2013

5.2.1.4 Increasing by-product utilization due to the growth of the fish processing industry

TABLE 4 TYPE I COLLAGEN YIELD FROM FISH WASTE

FIGURE 29 GLOBAL FISH PRODUCTION, 2015–2019, (MILLION METRIC TONS)

5.2.2 RESTRAINTS

5.2.2.1 High import duty

5.2.2.2 Side effects of marine collagen

5.2.3 OPPORTUNITIES

5.2.3.1 Immense opportunities in emerging economics

FIGURE 30 HEALTH EXPENDITURE PER CAPITA IN MAJOR ECONOMIES, 2018 (USD)

5.2.3.1.1 Rising middle-class income in emerging economies

FIGURE 31 PER CAPITA GDP, BY COUNTRY, 2019 (USD)

FIGURE 32 ANNUAL GDP GROWTH IN EMERGING ECONOMIES, 2011-2018

5.2.3.1.2 Aging population in Asian and European countries

FIGURE 33 COLLAGEN CONTENT BY AGE GROUPS (%)

5.2.3.2 Prevalence of allergies and asthma

TABLE 5 MARINE ANIMAL SPECIES AID IN COMBATING ALLERGY

5.2.3.3 Emerging applications of marine collagen

5.2.3.3.1 Rising demand for marine collagen for biomedical applications

5.2.3.3.2 Drug delivery by combining pharmaceutical ingredients with marine collagen

5.2.3.3.3 Encapsulated drug delivery

5.2.3.3.4 Funding for medical research related to collagen

5.2.3.3.5 Increasing use of marine collagen in the food & beverage industry

TABLE 6 USAGE LEVEL OF COLLAGEN PEPTIDES IN FOOD & BEVERAGE APPLICATION

5.2.3.4 Increase in demand for processed foods, providing an opportunity for collagen-infused functional foods

FIGURE 34 FUND ALLOCATION FOR THE FOOD PROCESSING INDUSTRY DEVELOPMENT IN INDIA (USD MILLION)

5.2.4 CHALLENGES

5.2.4.1 High manufacturing cost of marine collagen compared to other collagen sources

5.2.4.1.1 High raw material cost

FIGURE 35 MANUFACTURING THE COST STRUCTURE FOR PRODUCTION OF COLLAGEN

5.2.4.2 Stringent regulatory environment for collagen ingredients

5.2.4.3 Insufficient processing technologies

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 IMPACT OF COVID-19 ON SPORTS NUTRITION, WHICH IS ONE OF THE MAJOR APPLICATIONS OF COLLAGEN PROTEINS

5.3.2 COVID-19 IMPACT ON ANIMAL-SOURCED PROTEINS

5.3.2.1 Impact on meat & poultry products

5.3.3 COVID-19 IMPACT ON MARINE INGREDIENTS SUPPLY CHAIN AND AVAILABILITY OF RAW MATERIALS

5.3.4 COVID-19 TO DRIVE THE DEMAND FOR COLLAGEN SUPPLEMENTS AND COLLAGEN-INFUSED BEVERAGES

6 INDUSTRY TRENDS (Page No. - 85)

6.1 INTRODUCTION

FIGURE 36 MARINE COLLAGEN: EXTRACTION PROCESS AND APPLICATIONS

6.2 VALUE CHAIN ANALYSIS

FIGURE 37 MARINE COLLAGEN: VALUE CHAIN ANALYSIS

6.2.1 FISHERIES & RAW MATERIAL SOURCING

6.2.2 COLLECTION CENTERS

6.2.3 MANUFACTURING

6.2.4 DISTRIBUTION

6.2.5 END-PRODUCT MANUFACTURERS

6.3 TECHNOLOGY ANALYSIS

TABLE 7 MARINE COLLAGEN MARKET: TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS: MARINE COLLAGEN MARKET

TABLE 8 PRICING ANALYSIS, BY TYPE, 2020 (USD/KG)

FIGURE 38 MARKET FOR MARINE COLLAGEN: PRICING ANALYSIS, BY TYPE, 2016-2020 (USD/KG)

FIGURE 39 MARKET: GLOBAL AVERAGE SELLING PRICE (ASP), BY REGION, 2016-2020 (USD/KG)

6.5 ECOSYSTEM MAP & SUPPLY CHAIN

FIGURE 40 MARKET FOR MARINE COLLAGEN: SUPPLY CHAIN

TABLE 9 MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.5.1 MARKET: ECOSYSTEM VIEW

6.5.2 MARKET: MARKET MAP

6.5.2.1 Prominent companies

6.5.2.2 Small and medium-sized enterprises

6.5.2.3 End users (manufacturers/consumers)

6.5.2.4 Key influencers

6.6 YC-YCC SHIFT

FIGURE 41 REVENUE SHIFT FOR MARINE COLLAGEN MARKET

6.7 PATENT ANALYSIS

FIGURE 42 PATENT INSIGHTS (2018-2021)

FIGURE 43 MARINE COLLAGEN MARKET: PATENT ANALYSIS, BY DOCUMENT COUNT (2011-2020)

FIGURE 44 MARKET FOR MARINE COLLAGEN: PATENT ANALYSIS, BY APPLICANT, 2020

TABLE 10 KEY PATENTS PERTAINING TO MARINE COLLAGEN, 2018-2021

6.8 TRADE ANALYSIS

TABLE 11 EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

TABLE 12 RE-EXPORT DATA OF PEPTONES AND THEIR DERIVATIVES FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

TABLE 13 IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

TABLE 14 RE-IMPORT DATA OF PEPTONES AND THEIR DERIVATIVES FOR KEY COUNTRIES, 2020 (VALUE AND VOLUME)

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 15 MARINE COLLAGEN MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT OF SUBSTITUTES

6.9.5 THREAT OF NEW ENTRANTS

6.10 CASE STUDIES

6.10.1 PRODUCTION OF ODOR-FREE MARINE COLLAGEN

TABLE 16 MARINE COLLAGEN MARKET: DEODORIZED MARINE COLLAGEN

6.10.2 GROWING DEMAND FOR SUSTAINABLE AND INNOVATIVE SOURCES OF MARINE COLLAGEN FOR BIOMEDICAL APPLICATIONS

TABLE 17 MARKET FOR MARINE COLLAGEN: GROWING DEMAND FOR INNOVATIVE MARINE COLLAGEN SOURCES

6.10.3 RESEARCH ON EDIBLE JELLYFISH COLLAGEN TO IMPROVE COGNITIVE FUNCTIONS

TABLE 18 MARKET FOR MARINE COLLAGEN: EDIBLE JELLYFISH COLLAGEN TO IMPROVE COGNITIVE FUNCTIONS

6.11 REGULATORY FRAMEWORK

6.11.1 UNITED STATES

6.11.2 CANADA

6.11.3 EUROPE

6.11.4 UK

6.11.5 BRAZIL

7 MARINE COLLAGEN MARKET, BY APPLICATION (Page No. - 106)

7.1 INTRODUCTION

FIGURE 45 MARINE COLLAGEN MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 19 MARKET SIZE, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 20 MARKET SIZE, BY APPLICATION, 2021-2026 (USD MILLION)

7.1.1 COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET, BY APPLICATION (2018-2021)

7.1.1.1 Realistic scenario

TABLE 21 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.1.1.2 Optimistic scenario

TABLE 22 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.1.1.3 Pessimistic scenario

TABLE 23 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

7.2 NUTRACEUTICALS

7.2.1 OVERALL HEALTH BENEFITS OFFERED BY MARINE COLLAGEN MAKES IT A VIABLE INGREDIENT IN NUTRITIONAL SUPPLEMENTS

FIGURE 46 NUTRACEUTICALS: MARINE COLLAGEN MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 24 NUTRACEUTICALS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 NUTRACEUTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 COSMETICS

7.3.1 MARINE COLLAGEN DEPICTS ANTI-AGING PROPERTIES AND REDUCES WRINKLE FORMATION

TABLE 26 COSMETICS: MARINE COLLAGEN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 COSMETICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 MEDICAL

7.4.1 MARINE COLLAGEN USED FOR DIAGNOSIS IN THE DENTISTRY, ORTHOPEDIC, AND CARDIOVASCULAR INDUSTRIES

TABLE 28 MEDICAL DEVICES THAT USE COLLAGEN

TABLE 29 MEDICAL: MARINE COLLAGEN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 MEDICAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 OTHER APPLICATIONS

7.5.1 PROCESSED FOODS INFUSED WITH MARINE COLLAGEN GAINING POPULARITY AMONG CONSUMERS

TABLE 31 OTHER APPLICATIONS: MARINE COLLAGEN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 MARINE COLLAGEN MARKET, BY TYPE (Page No. - 115)

8.1 INTRODUCTION

TABLE 33 MARINE COLLAGEN TYPES AND SOURCES

FIGURE 47 MARKET FOR MARINE COLLAGEN, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 34 MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 36 MARKET SIZE, BY TYPE, 2016–2020 (TONNES)

TABLE 37 MARKET SIZE, BY TYPE, 2021–2026 (TONNES)

8.2 TYPE I

8.2.1 ANTI-AGING AND WRINKLE REDUCTION QUALITIES MAKE TYPE I MARINE COLLAGEN A HIGHLY SOUGHT-AFTER INGREDIENT IN THE COSMETIC AND BEAUTY INDUSTRIES

FIGURE 48 TYPE I: MARINE COLLAGEN MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 38 TYPE I: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 TYPE I: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 TYPE I: MARKET SIZE, BY REGION, 2016–2020 (TONNES)

TABLE 41 TYPE I: MARKET SIZE, BY REGION, 2021–2026 (TONNES)

8.3 TYPE III

8.3.1 RISING HEALTH CONCERNS AMONG CONSUMERS FUELLING THE DEMAND FOR TYPE III MARINE COLLAGEN

TABLE 42 TYPE III: MARINE COLLAGEN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 TYPE III: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 TYPE III: MARKET SIZE, BY REGION, 2016–2020 (TONNES)

TABLE 45 TYPE III: MARKET SIZE, BY REGION, 2021–2026 (TONNES)

8.4 OTHER TYPES

8.4.1 TYPE II, IV, AND V MARINE COLLAGEN SHOWCASING DIVERSE FUNCTIONALITIES

TABLE 46 OTHER TYPES: MARKET SIZE FOR MARINE COLLAGEN, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 OTHER TYPES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 48 OTHER TYPES: MARKET SIZE, BY REGION, 2016–2020 (TONNES)

TABLE 49 OTHER TYPES: MARKET SIZE, BY REGION, 2021–2026 (TONNES)

9 MARINE COLLAGEN MARKET, BY ANIMAL (Page No. - 124)

9.1 INTRODUCTION

FIGURE 49 MARKET FOR MARINE COLLAGEN, BY ANIMAL, 2021 VS. 2026

TABLE 50 MARKET SIZE, BY ANIMAL, 2016–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY ANIMAL, 2021–2026 (USD MILLION)

9.2 FISH

9.2.1 FISH OFFERS HIGH YIELD OF COLLAGEN COMPARED TO OTHER MARINE SOURCES

FIGURE 50 FISH: MARINE COLLAGEN MARKET, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 52 FISH: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 FISH: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 OTHER ANIMALS

9.3.1 JELLYFISH COLLAGEN IS ONE OF THE SUSTAINABLE AND ALTERNATIVE SOURCES OF MARINE COLLAGEN

TABLE 54 OTHER ANIMALS: MARKET SIZE FOR MARINE COLLAGEN, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 OTHER ANIMALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MARINE COLLAGEN MARKET, BY SOURCE (Page No. - 129)

10.1 INTRODUCTION

TABLE 56 MARINE ANIMALS AS A SOURCE OF COLLAGEN

FIGURE 51 MARINE COLLAGEN MARKET, BY SOURCE, 2021 VS. 2026 (USD MILLION)

TABLE 57 MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 58 MARKET SIZE, BY SOURCE, 2021-2026 (USD MILLION)

10.2 SKIN, SCALES, AND MUSCLES

10.2.1 LEAST AMOUNT OF SAFETY ISSUES AND EASE OF EXTRACTION FUELLING THE DEMAND FOR COLLAGEN SOURCED FROM FISH SKIN AND SCALES

FIGURE 52 SKIN, SCALES, AND MUSCLES: MARKET FOR MARINE COLLAGEN, BY REGION, 2021 VS. 2026 (USD MILLION)

TABLE 59 SKIN, SCALES, AND MUSCLES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 60 SKIN, SCALES, AND MUSCLES: MARKET SIZE,BY REGION, 2021–2026 (USD MILLION)

10.3 BONES & TENDONS

10.3.1 COLLAGEN SOURCED FROM BONES ENTAILS MAXIMUM MEDICAL AND HEALTH BENEFITS

TABLE 61 BONES & TENDONS: MARINE COLLAGEN MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 BONES & TENDONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 OTHER SOURCES

10.4.1 CARTILAGE ACTS AS A VIABLE SOURCE OF TYPE II MARINE COLLAGEN

TABLE 63 OTHER SOURCES: MARKET SIZE FOR MARINE COLLAGEN, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 OTHER SOURCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 MARINE COLLAGEN MARKET, BY REGION (Page No. - 136)

11.1 INTRODUCTION

FIGURE 53 CHINA AND JAPAN TO RECORD THE SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

TABLE 65 MARKET SIZE FOR MARINE COLLAGEN, BY REGION, 2016–2020 (USD MILLION)

TABLE 66 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 67 MARKET SIZE, BY REGION, 2016–2020 (TONNES)

TABLE 68 MARKET SIZE, BY REGION, 2021–2026 (TONNES)

11.1.1 COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET, BY REGION

11.1.1.1 Realistic scenario

TABLE 69 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.2 Optimistic scenario

TABLE 70 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.1.1.3 Pessimistic scenario

TABLE 71 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARINE COLLAGEN MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 54 NORTH AMERICA: MARINE COLLAGEN MARKET SNAPSHOT

TABLE 72 NORTH AMERICA: MARKET SIZE FOR MARINE COLLAGEN, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (TONNES)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (TONNES)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY ANIMAL, 2016–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY ANIMAL, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 The US is the leading market for marine collagen in North America

TABLE 84 US: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 85 US: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 86 US: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 87 US: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 High prevalence of diabetes among consumers augmenting the demand for marine collagen

TABLE 88 CANADA: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 89 CANADA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 90 CANADA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 91 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Mexico presents lucrative opportunities for growth in the cosmetics sector

TABLE 92 MEXICO: MARKET SIZE FOR MARINE COLLAGEN, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 93 MEXICO: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 MEXICO: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 95 MEXICO: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3 EUROPE

FIGURE 55 EUROPE: MARINE COLLAGEN MARKET SNAPSHOT

TABLE 96 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY TYPE, 2016–2020 (TONNES)

TABLE 101 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (TONNES)

TABLE 102 EUROPE: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY ANIMAL, 2016–2020 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY ANIMAL, 2021–2026 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Inclination of people toward health-based products

TABLE 108 GERMANY: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 109 GERMANY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 110 GERMANY: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 111 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3.2 UK

11.3.2.1 Increase in the geriatric population leading to the growth of the marine collagen market

TABLE 112 UK: MARINE COLLAGEN MARKET SIZE, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 113 UK: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 114 UK: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 115 UK: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Cosmetic industry skyrocketing the demand for marine collagen

TABLE 116 FRANCE: MARKET SIZE FOR MARINE COLLAGEN, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 117 FRANCE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 FRANCE: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 119 FRANCE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Rise in demand for fortified food products

TABLE 120 ITALY: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 121 ITALY: MARKET SIZE, BY APPLICATION,2021–2026 (USD MILLION)

TABLE 122 ITALY: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 123 ITALY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Marine collagen viewed as an optimum nutraceutical ingredient in the domestic market

TABLE 124 SPAIN: MARKET SIZE FOR MARINE COLLAGEN, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 125 SPAIN: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 126 SPAIN: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 127 SPAIN: MARKET SIZE, BY TYPE,2021–2026 (USD MILLION)

11.3.6 NORWAY

11.3.6.1 Personal care and beauty sector upscaling the demand for marine collagen

TABLE 128 NORWAY: MARINE COLLAGEN MARKET SIZE, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 129 NORWAY: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 130 NORWAY: MARKET SIZE, BY TYPE,2016–2020 (USD MILLION)

TABLE 131 NORWAY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.3.7 REST OF EUROPE

11.3.7.1 Awareness regarding personal care and beauty among consumers driving the global market

TABLE 132 REST OF EUROPE: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 133 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 134 REST OF EUROPE: MARKET SIZE, BY TYPE,2016–2020 (USD MILLION)

TABLE 135 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 56 ASIA PACIFIC: MARINE COLLAGEN MARKET SNAPSHOT

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (TONNES)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (TONNES)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY SOURCE,2016–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY ANIMAL, 2016–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY ANIMAL, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Wide coastline bordering China makes it a hub for manufacturing marine-derived ingredients

TABLE 148 CHINA: MARKET SIZE FOR MARINE COLLAGEN, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 149 CHINA: MARKET SIZE, BY APPLICATION,2021–2026 (USD MILLION)

TABLE 150 CHINA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 151 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Demand for marine collagen fueled by surging internet penetration among the millennial population

TABLE 152 INDIA: MARINE COLLAGEN MARKET SIZE, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 153 INDIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 154 INDIA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 155 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Regulatory enforcements benefiting manufacturers

TABLE 156 JAPAN: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 157 JAPAN: MARKET SIZE, BY APPLICATION,2021–2026 (USD MILLION)

TABLE 158 JAPAN: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 159 JAPAN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 South Korean market driven by cosmetic applications of marine collagen

TABLE 160 SOUTH KOREA: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 161 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 162 SOUTH KOREA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 163 SOUTH KOREA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4.5 MALAYSIA

11.4.5.1 Rising cases of diabetes and obesity propelling the demand for marine collagen

TABLE 164 MALAYSIA: MARKET SIZE FOR MARINE COLLAGEN, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 165 MALAYSIA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 166 MALAYSIA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 167 MALAYSIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4.6 AUSTRALIA & NEW ZEALAND

11.4.6.1 High prevalence of cardiovascular diseases propels the demand for marine collagen

TABLE 168 AUSTRALIA & NEW ZEALAND: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 169 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 170 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 171 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

11.4.7.1 Religious restrictions and inclination toward personal care contribute to the growth of the marine collagen market

TABLE 172 REST OF ASIA PACIFIC: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 173 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 174 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 175 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 176 SOUTH AMERICA: MARINE COLLAGEN MARKET SIZE, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 178 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 179 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 180 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (TONNES)

TABLE 181 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (TONNES)

TABLE 182 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 183 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 184 SOUTH AMERICA: MARKET SIZE, BY ANIMAL, 2016–2020 (USD MILLION)

TABLE 185 SOUTH AMERICA: MARKET SIZE, BY ANIMAL, 2021–2026 (USD MILLION)

TABLE 186 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 187 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Government diligence over expanding the food processing industry contributing to the growth of the marine collagen market

TABLE 188 BRAZIL: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 189 BRAZIL: MARKET SIZE, BY APPLICATION,2021–2026 (USD MILLION)

TABLE 190 BRAZIL: MARKET SIZE, BY TYPE,2016–2020 (USD MILLION)

TABLE 191 BRAZIL: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.5.2 REST OF SOUTH AMERICA

11.5.2.1 Surging internet penetration presenting growth opportunities for the marine collagen market

TABLE 192 REST OF SOUTH AMERICA: MARKET SIZE FOR MARINE COLLAGEN, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 193 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 194 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 195 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 196 REST OF THE WORLD: MARKET SIZE, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 197 REST OF THE WORLD: MARKET SIZE, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 198 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 199 REST OF THE WORLD: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 200 REST OF THE WORLD: MARKET SIZE, BY TYPE,2016–2020 (TONNES)

TABLE 201 REST OF THE WORLD: MARKET SIZE, BY TYPE,2021–2026 (TONNES)

TABLE 202 REST OF THE WORLD: MARKET SIZE, BY SOURCE, 2016–2020 (USD MILLION)

TABLE 203 REST OF THE WORLD: MARKET SIZE, BY SOURCE, 2021–2026 (USD MILLION)

TABLE 204 REST OF THE WORLD: MARKET SIZE, BY ANIMAL, 2016–2020 (USD MILLION)

TABLE 205 REST OF THE WORLD: MARKET SIZE, BY ANIMAL, 2021–2026 (USD MILLION)

TABLE 206 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 207 REST OF THE WORLD: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.1 AFRICA

11.6.1.1 Nutraceutical supplements infused with marine collagen creating the highest demand

TABLE 208 AFRICA: MARINE COLLAGEN MARKET SIZE, BY APPLICATION,2016–2020 (USD MILLION)

TABLE 209 AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 210 AFRICA: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 211 AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Rising income levels and steadfast economic development contribute to the growth of the marine collagen market

TABLE 212 MIDDLE EAST: MARINE COLLAGEN MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 213 MIDDLE EAST: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 214 MIDDLE EAST: MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 215 MIDDLE EAST: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 199)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2019

TABLE 216 MARINE COLLAGEN MARKET: DEGREE OF COMPETITION

12.3 REVENUE ANALYSIS OF KEY PLAYERS, 2017-2019

FIGURE 57 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE MARKET, 2017–2019 (USD MILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.5 COMPANY EVALUATION QUADRANT: DEFINITIONS AND METHODOLOGY (OVERALL MARKET)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 58 MARINE COLLAGEN MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.5.5 PRODUCT FOOTPRINT

TABLE 217 MARINE COLLAGEN MARKET: COMPANY APPLICATION FOOTPRINT

TABLE 218 MARKET: COMPANY TYPE FOOTPRINT

TABLE 219 MARKET: COMPANY REGION FOOTPRINT

TABLE 220 MARKET: OVERALL COMPANY FOOTPRINT

12.6 COMPANY EVALUATION QUADRANT (START-UPS/SMES)

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 59 MARINE COLLAGEN MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2020

12.7 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

12.7.1 NEW PRODUCT LAUNCHES

TABLE 221 NEW PRODUCT LAUNCHES, 2021

12.7.2 DEALS

TABLE 222 MERGERS, ACQUISITIONS, AND JOINT VENTURES, 2021

13 COMPANY PROFILES (Page No. - 210)

13.1 KEY PLAYERS

(Business overview, Products offered, Product launches, deals, and other developments, SWOT analysis, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.1.1 ASHLAND

TABLE 223 ASHLAND: BUSINESS OVERVIEW

FIGURE 60 ASHLAND: COMPANY SNAPSHOT

TABLE 224 ASHLAND: PRODUCTS OFFERED

TABLE 225 DEALS, 2021

13.1.2 DARLING INGREDIENTS

TABLE 226 DARLING INGREDIENTS: BUSINESS OVERVIEW

FIGURE 61 DARLING INGREDIENTS: COMPANY SNAPSHOT

TABLE 227 DARLING INGREDIENTS: PRODUCTS OFFERED

TABLE 228 DARLING INGREDIENTS: NEW PRODUCT LAUNCHES, 2021

13.1.3 WEISHARDT

TABLE 229 WEISHARDT: BUSINESS OVERVIEW

TABLE 230 WEISHARDT: PRODUCTS OFFERED

13.1.4 GELITA

TABLE 231 GELITA: BUSINESS OVERVIEW

TABLE 232 GELITA: PRODUCTS OFFERED

13.1.5 NITTA GELATIN NA INC.

TABLE 233 NITTA GELATIN NA INC.: BUSINESS OVERVIEW

TABLE 234 NITTA GELATIN NA INC.: PRODUCTS OFFERED

13.1.6 NIPPI COLLAGEN NA INC. (NIPPI INC.)

TABLE 235 NIPPI COLLAGEN NA INC.: BUSINESS OVERVIEW

TABLE 236 NIPPI COLLAGEN NA INC.: PRODUCTS OFFERED

13.1.7 SEAGARDEN

TABLE 237 SEAGARDEN: BUSINESS OVERVIEW

TABLE 238 SEAGARDEN: PRODUCTS OFFERED

13.1.8 TITAN BIOTECH LIMITED

TABLE 239 TITAN BIOTECH LIMITED: BUSINESS OVERVIEW

FIGURE 62 TITAN BIOTECH LIMITED: COMPANY SNAPSHOT

TABLE 240 TITAN BIOTECH LIMITED: PRODUCTS OFFERED

13.1.9 ITALGELATINE

TABLE 241 ITALGELATINE: BUSINESS OVERVIEW

TABLE 242 ITALGELATINE: PRODUCTS OFFERED

13.2 START-UPS/SMES

13.2.1 JELLAGEN

TABLE 243 JELLAGEN: BUSINESS OVERVIEW

TABLE 244 JELLAGEN: PRODUCTS OFFERED

13.2.2 CERTIFIED NUTRACEUTICALS INC.

TABLE 245 CERTIFIED NUTRACEUTICALS INC.: BUSINESS OVERVIEW

TABLE 246 CERTIFIED NUTRACEUTICALS INC.: PRODUCTS OFFERED

13.2.3 ETCHEM

TABLE 247 ETCHEM: BUSINESS OVERVIEW

TABLE 248 ETCHEM: PRODUCTS OFFERED

13.2.4 NUTRACHOICE

TABLE 249 NUTRACHOICE: BUSINESS OVERVIEW

TABLE 250 NUTRACHOICE: PRODUCTS OFFERED

13.2.5 FORMULATOR SAMPLE SHOP

TABLE 251 FORMULATOR SAMPLE SHOP: BUSINESS OVERVIEW

TABLE 252 FORMULATOR SAMPLE SHOP: PRODUCTS OFFERED

13.2.6 NINGBO NUTRITION FOOD TECHNOLOGY

TABLE 253 NINGBO NUTRITION FOOD TECHNOLOGY: BUSINESS OVERVIEW

TABLE 254 NINGBO NUTRITION FOOD TECHNOLOGY: PRODUCTS OFFERED

13.2.7 AMICOGEN

13.2.8 HANGZHOU NUTRITION BIOTECHNOLOGY

13.2.9 BHN

13.2.10 TAI AI PEPTIDE GROUP

13.2.11 LAPI GELATINE

*Details on Business overview, Products offered, Product launches, deals, and other developments, SWOT analysis, MnM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 235)

14.1 INTRODUCTION

TABLE 255 ADJACENT MARKETS TO MARINE COLLAGEN

14.2 LIMITATIONS

14.3 COLLAGEN PEPTIDES MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

FIGURE 63 COLLAGEN PEPTIDES MARKET, 2018-2025 (USD MILLION)

TABLE 256 COLLAGEN PEPTIDES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

14.4 GELATIN MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

FIGURE 64 GELATIN MARKET, 2016–2023 (USD MILLION)

TABLE 257 GELATIN MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

15 APPENDIX (Page No. - 239)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 MARINE COLLAGEN MARKET: AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

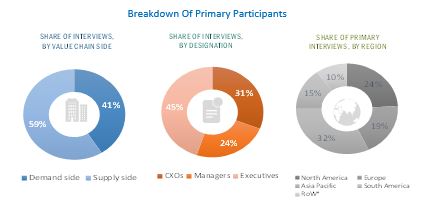

The study involved four major activities in estimating the marine collagen market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the marine collagen market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of marine collagen was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the marine collagen market, with respect to type, source, form, applicaton and regional markets, over a period, ranging from 2021 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Providing detailed information about the impact of COVID-19 on marine collagen supply chain and its impact on various stakeholders such as suppliers, manufacturers, and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the marine collagen market and impact of COVID-19 on the key vendors.

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the marine collagen market.

Available Customizations:

Geographical Analysis

- Further breakdown of the Rest of Europe marine collagen market, by key country

- Further breakdown of the Rest of Asia Pacific marine collagen market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of marine collagen

- Further bifurcation of marine collagen on the basis of product type; native collagen and hydrolyzed collagen

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine Collagen Market