Fishmeal & Fish Oil Market by Type (Fishmeal, Fish Oil), Source (Salmon & Trout, Marine Fish, Crustaceans, Tilapia, Carps), Livestock Application (Aquatic Animals, Swine, Poultry, Cattle, Pets), Industrial Application & Region - Global Forecast to 2027

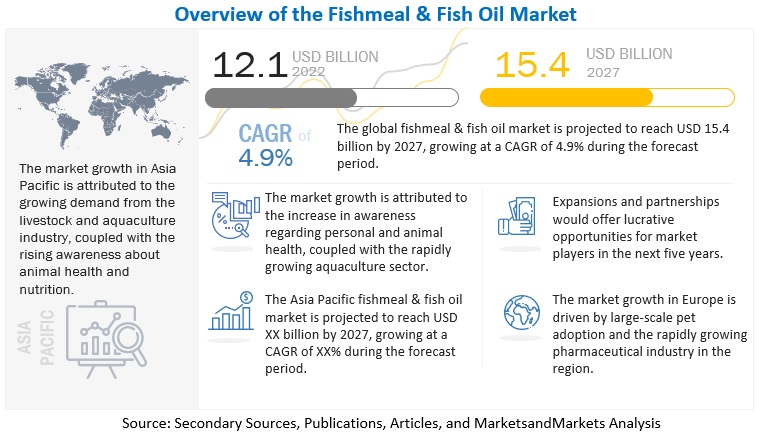

The fishmeal & fish oil market size is predicted to grow at a CAGR of 4.9% between 2022 and 2027, reaching a value of $15.4 billion by 2027 from a projection of $12.1 billion in 2022. Fishmeal & fish oil are included in livestock feed to enhance their nutritional content and enable the livestock animals to meet their nutritional requirements, which also boosts their immunity and provides a range of health benefits. They cater to a range of livestock animals such as aquatic animals, swine, poultry, cattle, and pets.

The fishmeal & fish oil are also gaining significant traction in the industry with the increasing consciousness regarding livestock nutrition and rising pet humanization trend which has contributed towards increased spending on health focused feed ingredient such as fishmeal & fish oil.

Fishmeal & fish oil are also used extensively in industrial applications such as fertilizers, aquaculture, and pharma applications. The rise in awareness with regards to personal health has significantly enhanced their applicability across various pharma products owing to their rich omega-3 fatty acid content along with EPA and DHA which are effective against a range of health issues such as cardiovascular disease and many other chronic diseases.

To know about the assumptions considered for the study, Request for Free Sample Report

Fishmeal & Fish Oil Market Dynamics

Drivers: Increasing awareness about livestock and pet health and nutrition

In Indonesia, Australia, Vietnam, Taiwan, and Korea, awareness regarding the health and nutrition of pets and livestock have increased significantly in recent years. In July 2019, scientists from Australia and Vietnam discovered that supplementing animal feed with fish oil enhances milk yield and is also an effective way to enhance long-chain fatty acids (n-3 LC-PUFA) in dairy products. Increasing consumer awareness regarding potential health benefits offered by fish oil and fishmeal products in animal feed is driving demand in Asia Pacific region. The poultry and cattle population is increasing significantly in Asia Pacific, which presents significant business opportunities for fishmeal and fish oil manufacturers.

The rise in pet humanization trends in Asia Pacific has increased the demand for premium pet food ingredients and products, which deliver multifunctional health benefits. The spending on health-focused pet food ingredients is rising, with the increasing awareness and disposable income among pet owners. Fish oil products are increasingly being used in pet food products to supplement the health, growth, development, and nutrition of pets. An official representative of Fable (US), a premium pet brand, stated in December 2020 that the company witnessed unprecedented growth owing to increased pet adoption and spending on pet nutrition and welfare. As pet ownership increases in the region and the focus on pet health and nutrition continues to gain traction, the Asia Pacific pet food industry will continue to present significant business opportunities for fishmeal & fish oil market manufacturers.

Restraints: Rampant and unsustainable fishing practices by fishmeal and fish oil manufacturers threatening marine resources

Fishmeal and fish oil companies operating in the Asia Pacific region pose a serious threat to marine resources as tons of fish caught through unsustainable fishing practices are emptying the fish reserves in the region. These fish are majorly being used to produce fishmeal and fish oil products. As the income from fishmeal and fish oil products has risen steadily, unsustainable fishing practices, such as juvenile fishing, have increased significantly, especially in India, which have posed a serious threat to fish stocks in recent years.

Opportunities: Growing pharmaceutical industry

In recent years, the pharmaceutical industry in Asia Pacific has grown significantly. Countries, such as China, India, and other key markets are presenting significant business opportunities in the fishmeal & fish oil market to manufacturers of fishmeal and fish oil products. Due to the rising awareness in Asia Pacific about personal health and nutrition, there has been a significant rise in demand for organic pharmaceutical products. The demand for fishmeal and fish oil products has surged, as a result, which offers a host of health benefits with regards to heart, eyes, cognition and immunity.

Challenges: Rise in environmental and social challenges to sourcing raw materials for fishmeal and fish oil production

The rise in demand for fishmeal and fish oil from various industries has put a lot of stress on fishing practices around the world. Fishing practices have increased, and so have juvenile fishing practices. Asia Pacific, being one of the major producers and suppliers of fishmeal and fish oil products and raw materials, has witnessed a significant increase in these unsustainable fishing practices, which have posed many environmental and social challenges in recent years. The International Fishmeal and Fish Oil Organization (IFFO) partnered with Global Aquaculture Alliance (GAA) in 2018 to enhance the understanding of fisheries in Asia and identify improvements that can be made to encourage responsible supplies of fishmeal that will reduce the alarming rate of increase in environmental and social challenges in the region.

By type, fish oil is likely to account for the fastest growth rate during the forecast period.

Based on type, fish oil account for the fastest growing segment in the fishmeal & fish oil market. Fish oil finds extensive applications across a range of livestock and other industrial applications such as pharmaceutical, nutraceutical and fertilizers owing to their rich nutrient content and desirable health benefits. Owing to their multifunctional properties and increasing acceptability across various industries, they are likely to witness significant growth opportunities over the forecasted period.

By source, crustaceans are projected to witness the fastest growth rate during the forecast period.

Based on source, crustaceans account for the fastest growing segment in the fishmeal & fish oil market. Fishmeal & fish oil find extensive applications in crustacean diet as one of the primary sources of dietary protein. Crustacean meal contains significant amount of fishmeal and with growing crustacean culturing due to increased demand for seafood globally, especially shrimps and lobsters, they are likely to witness significant growth opportunities over the forecasted period.

By livestock application, the swine segment is projected to account for the fastest growth rate over the forecast period

By livestock application, swine accounts for the fastest growth rate over the forecasted period owing to the rapidly growing swine industry, especially in Asia Pacific region. Fishmeal & fish oil are associated with a range of desirable health benefits in swine breeding which have contributed to its acceptability and growing demand in swine sector in recent years. The growing swine industries in Asia Pacific region, particularly the Chinese swine sector, is likely to contribute strongly to the growth of fishmeal & fish oil industry over the forecasted period.

By industrial application, pharma segment is projected to witness the fastest growth rate during the forecast period.

Based on industrial application, pharma segment is likely to account for the fastest growing segment in the fishmeal & fish oil market. The positive perception and rich nutrient content of fishmeal & fish oil coupled with growing awareness with regards to personal health and nutrition are contributing strongly to the growing acceptance and increasing application of fishmeal & fish oil in the pharma industry.

To know about the assumptions considered for the study, download the pdf brochure

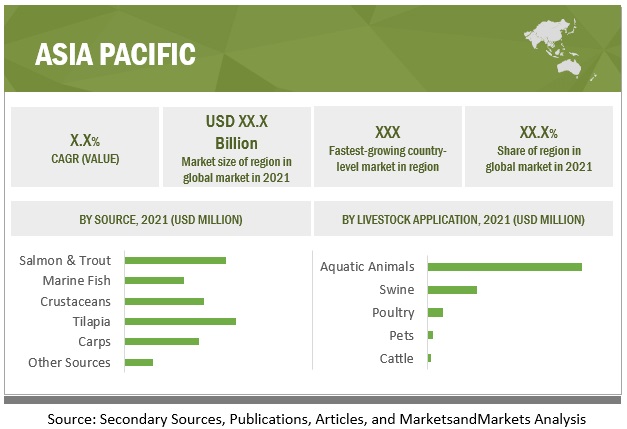

Asia Pacific accounted for the largest and fastest growing region for the fishmeal & fish oil market. The region is witnessing a significant rise in awareness with regards to health and nutrition of livestock and pet animals, which is propelling the demand for health-focused feed ingredient such as fishmeal & fish oil. Fishmeal & fish oil are associated with a range of health benefits such as skin and coat health, immune health, joint health, cognitive health among others in livestock and pet animals. Many countries in Asia Pacific region such as Thailand and Vietnam, which are important markets for fishmeal and fish oil, are large-scale producers of shrimps and have rapidly growing aquaculture industry which are also likely to contribute strongly to the growth of market in the Asia Pacific region over the forecasted period.

Key Market Players in the Fishmeal & Fish Oil Market:

Key players in this market include FKS Multi Agro (Indonesia), Mukka Proteins Limited (India), Arbee (India), Sandakan Fishmeal Sdn Bhd (Malaysia), Wudi Deda Agriculture Co., Ltd. (China), Raj Fishmeal and Oil Company (India), Asia Fish Oil Corporation (Vietnam), Dai Dai Thanh Seafoods (Vietnam), Pattani Fish Meal (1988) Co., Ltd. (Thailand) and Austevoll Seafood ASA (Norway).

Scope of the Fishmeal & Fish Oil Market Report

|

Report Metric |

Details |

|

Market size valuation in 2022 |

USD 12.1 billion |

|

Market revenue forecast in 2027 |

USD 15.4 billion |

|

Progress rate |

CAGR of 4.9% |

|

Segments covered |

Type, source, livestock application, and industrial application |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Target Audience:

- Key companies engaged in fishmeal & fish oil processing

- Key manufacturers of fishmeal & fish oil

- Traders, distributors, and suppliers in the fishmeal & fish oil market

- Traders and suppliers of raw materials to the fishmeal & fish oil industry

- Fish farmers

-

Related government authorities, commercial R&D institutions, and other regulatory bodies

- Food and Agriculture Organization (FAO)

- Agricultural Universities

- Organization for Economic Cooperation and Development (OECD)

- The Marine Ingredients Organisation (IFFO)

- European Market Observatory for Fisheries and Aquaculture Product

- Animal Feed Manufacturers Association (AFMA)

Fishmeal & Fish Oil Market Report Segmentation:

This research report categorizes the market based on type, source, industrial application, livestock application, and region

|

Segment |

Subsegment |

|

By Type |

|

|

By Source |

|

|

By Livestock Application |

|

|

By Industrial Application |

|

|

By Region |

|

Recent Developments in the Fishmeal & Fish Oil Market

- In February 2022, The Scoular Company (US) launched a new fishmeal facility in Myanmar to increase its production capacity in the country. This launch resulted from the rising demand for fishmeal in Myanmar and other Asian countries.

- In September 2021, The Scoular Company (US) launched its brand, Encompass, to offer fishmeal for aquaculture and pet animals. This strategic initiative was undertaken due to the rise in demand for health-focused pet food ingredients, such as fishmeal, owing to the increasing global pet humanization trend.

- In October 2020, FKS Multi Agro (Indonesia) announced its plans to invest USD 234 million, which it raised as a loan from various local and foreign banks as part of its aggressive expansion plans to grow its animal feed business and strengthen its distribution system across the country.

- In September 2020, GC Reiber Oil (Norway) launched VivoMega Platinum, a range of premium quality fish oils containing an EPA+DHA level of 850 mg/g and offering significant health benefits. The product launch witnessed the rise in demand for premium quality fish oil with multifunctional health benefits, owing to the rise in health consciousness among modern-day consumers.

Frequently Asked Questions (FAQ):

Which are the major industrial application of fishmeal & fish oil considered in this study and which segments are projected to have promising growth rates in the future?

All the major industrial application of fishmeal & fish oil such as aquaculture, pharma and fertilizers are considered in the scope of the study. Aquaculture is currently the dominant segment, due to the growing awareness with regards to aquaculture nutrition and desirable characteristics of fishmeal & fish oil in enhancing immunity, digestibility, nutrient content, and palatability of aquaculture diets. The pharma segment is witnessing the fastest growth rate in the industrial application segment, owing to the rising awareness with regards to personal health and nutrition and growing acceptability of fishmeal & fish oil in pharma products owing to their desirable health characteristics. Fishmeal & fish oil are considered effective against a range of health issues such as cardiovascular diseases, cognitive health issues and inflammatory disorders such as asthma, eczema, psoriasis, and Crohn's disease which increases their applicability in the pharma industry.

I am interested in the South American market for aquaculture and pharma segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the South American market for various segments can be provided on various aspects including market size, forecast, market dynamics, company profiles & competitive landscape. Exclusive insights on below South American countries will be provided:

- Peru

- Colombia

Also, you can let us know if there are any other countries of your interest

What are some of the drivers fuelling the growth of the fishmeal & fish oil market?

Global fishmeal & fish oil market is characterized by the following drivers:

Drivers: Significant rise in aging population

Fish oil rich in omega-3 and omega-6 fatty acid content is in significant demand across Asia Pacific, owing to the large aging population in the region. The consumption of fish oil is known to benefit immunity, the heart, digestive system, bones, and joints. All these relate especially to the aging population. Asia Pacific has a large aging population. It is estimated that by 2050, one in four people in Asia Pacific will be over 60 years old, according to a report published by Asian Development Bank (ADB) in 2022. This amounts to approximately 1.3 billion people across China, Sri Lanka, Thailand, Vietnam, and Indonesia. All these factors present significant business opportunities for fishmeal and fish oil manufacturers.

Fishmeal and fish oil find extensive applications in various dietary supplements and nutraceutical products that are targeted toward providing a range of health benefits to the aging population. Owing to the higher demand for organic pharmaceutical products, coupled with the high digestibility of fishmeal and fish oil products that suit the requirements of the aging population, fishmeal and fish oil products are witnessing significant demand. To exploit these opportunities, many pharmaceutical companies are launching newer products. For instance, Jacobson Pharma (Hong Kong) launched Smartfish Health Nutrition products, which are rich in fish oil and omega-3 fatty acid content, in China and other Asia Pacific countries, such as Hong Kong, Macau, and Taiwan. These products would provide a range of health benefits to the aging population.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market are FKS Multi Agro (Indonesia), Mukka Proteins Limited (India), Arbee (India), Sandakan Fishmeal Sdn Bhd (Malaysia), Wudi Deda Agriculture Co., Ltd. (China), Raj Fishmeal and Oil Company (India), Asia Fish Oil Corporation (Vietnam), Dai Dai Thanh Seafoods (Vietnam), Pattani Fish Meal (1988) Co., Ltd. (Thailand) and Austevoll Seafood ASA (Norway). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 FISHMEAL & FISH OIL MARKET MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 FISHMEAL & FISH OIL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key primary insights

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE – BOTTOM-UP (BASED ON SOURCE, BY REGION)

2.2.2 APPROACH TWO – TOP-DOWN (BASED ON GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 2 GLOBAL FISHMEAL AND FISH OIL MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 4 FISHMEAL & FISH OIL MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 5 MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 6 MARKET, BY LIVESTOCK APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET, BY INDUSTRIAL APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 8 MARKET, BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN FISHMEAL AND FISH OIL MARKET

FIGURE 9 GROWING DEMAND FROM LIVESTOCK AND AQUACULTURE INDUSTRY COUPLED WITH INCREASING HEALTH AWARENESS

4.2 ASIA PACIFIC: MARKET, BY SOURCE AND COUNTRY

FIGURE 10 CHINA AND TILAPIA ACCOUNTED FOR SIGNIFICANT SHARE IN 2021

4.3 MARKET, BY TYPE

FIGURE 11 FISHMEAL SEGMENT TO DOMINATE MARKET BY 2027

4.4 MARKET, BY LIVESTOCK APPLICATION

FIGURE 12 AQUATIC ANIMALS SEGMENT TO DOMINATE MARKET BY 2027

4.5 MARKET, BY REGION AND SOURCE

FIGURE 13 ASIA PACIFIC AND SALMON & TROUT TO ACCOUNT FOR SIGNIFICANT SHARE BY 2027

4.6 FISHMEAL & FISH OIL MARKET MARKET, BY INDUSTRIAL APPLICATION

FIGURE 14 AQUACULTURE SEGMENT TO DOMINATE MARKET BY 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 FISHMEAL AND FISH OIL MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Significant rise in aging population

5.2.1.2 Increasing awareness about livestock and pet health and nutrition

5.2.1.3 Increasing incorporation of fishmeal and fish oil in swine and poultry diets

5.2.1.4 Need for improving productivity and environmental performance of aquaculture

5.2.2 RESTRAINTS

5.2.2.1 Unsustainable fishing practices by fishmeal and fish oil manufacturers

5.2.2.2 Increasing allergic and toxic reactions from consuming herring and anchovies

5.2.3 OPPORTUNITIES

5.2.3.1 Growing pharmaceutical industry

5.2.3.2 Rising demand for organic fertilizers

5.2.3.3 Sustainable intensification of aquaculture

5.2.4 CHALLENGES IN THE FISHMEAL & FISH OIL MARKET

5.2.4.1 Environmental and social challenges

5.2.4.2 Excessive use of alternative feed ingredients

5.2.4.3 Microbial contamination in aquafeed

6 INDUSTRY TRENDS (Page No. - 58)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING

6.2.3 PRODUCTION & PROCESSING

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 16 VALUE CHAIN ANALYSIS OF THE MARKET

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 17 MARKET: SUPPLY CHAIN

6.4 TECHNOLOGY ANALYSIS

6.4.1 NOVEL MOLECULAR TECHNOLOGIES

6.4.2 OTHER TECHNOLOGIES

6.5 PRICING ANALYSIS: FISHMEAL & FISH OIL MARKET

6.5.1 AVERAGE SELLING PRICE, BY SOURCE

FIGURE 18 GLOBAL: AVERAGE SELLING PRICE, BY SOURCE

TABLE 3 FISHMEAL AND FISH OIL: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

TABLE 4 FISHMEAL: AVERAGE SELLING PRICE (ASP), BY REGION, 2020–2022 (USD/TON)

TABLE 5 FISH OIL: AVERAGE SELLING PRICE (ASP) BY REGION, 2020–2022 (USD/TON)

TABLE 6 FISHMEAL AND FISH OIL: AVERAGE SELLING PRICE (ASP), BY COMPANY, 2020–2022 (USD/TON)

6.6 MARKET MAPPING AND ECOSYSTEM OF FISHMEAL AND FISH OIL

6.6.1 DEMAND SIDE

6.6.2 SUPPLY SIDE

FIGURE 19 FISHMEAL AND FISH OIL: MARKET MAP

FIGURE 20 MARKET: ECOSYSTEM MAPPING IN FEED AND ANIMAL NUTRITION

TABLE 7 MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.8 FISHMEAL & FISH OIL MARKET: PATENT ANALYSIS

FIGURE 22 NUMBER OF PATENTS GRANTED RELATED TO FISHMEAL BETWEEN 2012 AND 2021

FIGURE 23 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 24 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 8 PATENTS PERTAINING TO FISHMEAL, 2021–2022

6.9 TRADE DATA: MARKET

6.9.1 TRADE DATA: FATS AND OILS AND THEIR FRACTIONS OF FISH OTHER THAN LIVER OILS

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF FATS AND OILS AND THEIR FRACTIONS OF FISH OTHER THAN LIVER OILS, 2021 (KG)

TABLE 10 TOP 10 IMPORTERS AND EXPORTERS OF FATS AND OILS AND THEIR FRACTIONS OF FISH OTHER THAN LIVER OILS, 2020 (KG)

6.10 CASE STUDIES

TABLE 11 CHAROEN POKPHAND PCL: 100% CERTIFIED FISHMEAL BY 2022

TABLE 12 AUSTEVOLL SEAFOOD ASA: ADOPTION OF SUSTAINABILITY

6.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 FISHMEAL & FISH OIL MARKET: PORTER’S FIVE FORCES ANALYSIS

6.11.1 DEGREE OF COMPETITION

6.11.2 BARGAINING POWER OF SUPPLIERS

6.11.3 BARGAINING POWER OF BUYERS

6.11.4 THREAT OF SUBSTITUTES

6.11.5 THREAT OF NEW ENTRANTS

6.12 KEY CONFERENCES & EVENTS IN FISHMEAL AND FISH OIL MARKET, 2022–2023

TABLE 14 KEY CONFERENCES & EVENTS, BY REGION

6.13 TARIFF & REGULATORY LANDSCAPE

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.13.1 NORTH AMERICA

6.13.1.1 US

6.13.1.2 United States Department of Agriculture (USDA)

6.13.1.3 National Oceanic and Atmospheric Administration (NOAA)

6.13.2 EUROPE

6.13.2.1 UK

6.13.2.2 European Fishmeal and Fish Oil Producers (EFFOP)

6.13.3 ASIA PACIFIC

6.13.3.1 China

6.13.3.2 India

6.13.3.3 Malaysia

6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 25 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 18 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR FISHMEAL AND FISH OIL (%)

6.14.2 BUYING CRITERIA

TABLE 19 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

FIGURE 26 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 FISHMEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION (Page No. - 84)

7.1 INTRODUCTION

FIGURE 27 MARKET, BY INDUSTRIAL APPLICATION, 2022 VS. 2027

TABLE 20 MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 21 MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

7.2 AQUACULTURE

7.2.1 RISE IN AWARENESS ABOUT AQUACULTURE NUTRITION

TABLE 22 AQUACULTURE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 23 AQUACULTURE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PHARMA

7.3.1 GROWING NEED FOR IMPROVEMENT IN PHARMACEUTICALS

TABLE 24 PHARMA: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 25 PHARMA: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 FERTILIZERS

7.4.1 BOOST IN DEMAND FOR ORGANIC FERTILIZERS

TABLE 26 FERTILIZERS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 27 FERTILIZERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 FISHMEAL & FISH OIL MARKET, BY LIVESTOCK APPLICATION (Page No. - 90)

8.1 INTRODUCTION

FIGURE 28 MARKET, BY LIVESTOCK APPLICATION, 2022 VS. 2027

TABLE 28 MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 29 MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

8.2 AQUATIC ANIMALS

8.2.1 RISING DEMAND FOR PREMIUM AQUATIC FEED INGREDIENTS

TABLE 30 AQUATIC ANIMALS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 AQUATIC ANIMALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SWINE

8.3.1 GROWTH IN SWINE INDUSTRY IN ASIA PACIFIC

TABLE 32 SWINE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 33 SWINE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 POULTRY

8.4.1 GROWTH OF POULTRY TO BOOST CONSUMPTION OF FISHMEAL

TABLE 34 POULTRY: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 35 POULTRY: FISHMEAL & FISH OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 CATTLE

8.5.1 INCREASING FOCUS ON ENHANCING MILK YIELD AND CATTLE PERFORMANCE

TABLE 36 CATTLE: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 37 CATTLE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 PETS

8.6.1 RISING PET HUMANIZATION

TABLE 38 PETS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 PETS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 MARKET, BY SOURCE (Page No. - 98)

9.1 INTRODUCTION

FIGURE 29 MARKET, BY SOURCE, 2022 VS. 2027

TABLE 40 MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 41 FISHMEAL & FISH OIL MARKET, BY SOURCE, 2022–2027 (USD MILLION)

9.2 SALMON & TROUT

9.2.1 RISING HEALTH CONCERNS AND NEED FOR ESSENTIAL NUTRIENTS

TABLE 42 SALMON & TROUT: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 43 SALMON & TROUT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 MARINE FISH

9.3.1 GROWING DEMAND FOR PROTEIN-RICH FEED WITH HIGH DIGESTIBILITY RATE

TABLE 44 MARINE FISH: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 45 MARINA FISH: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 CRUSTACEANS

9.4.1 RICH SOURCE OF DIETARY PROTEINS

TABLE 46 CRUSTACEANS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 47 CRUSTACEANS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 TILAPIAS

9.5.1 PREFERENCE FOR COST-EFFECTIVE FISH PROTEINS

TABLE 48 TILAPIAS: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 49 TILAPIAS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 CARPS

9.6.1 RICH NUTRITIONAL PROFILE COUPLED WITH HIGHER DIGESTIBILITY

TABLE 50 CARPS: FISHMEAL & FISH OIL MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 CARPS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 OTHER SOURCES

TABLE 52 OTHER SOURCES: MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 53 OTHER SOURCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 MARKET, BY TYPE (Page No. - 107)

10.1 INTRODUCTION

FIGURE 30 MARKET, BY TYPE, 2022 VS. 2027

TABLE 54 MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 55 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 56 MARKET, BY TYPE, 2019–2021 (KT)

TABLE 57 MARKET, BY TYPE, 2022–2027 (KT)

10.2 FISHMEAL

10.2.1 RISING AWARENESS ABOUT HEALTH AND NUTRITION OF LIVESTOCK

TABLE 58 FISHMEAL MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 59 FISHMEAL MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 FISH OIL

10.3.1 HEALTH BENEFITS OF FISH OIL TO DRIVE CONSUMPTION

TABLE 60 FISH OIL MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 61 FISH OIL MARKET, BY REGION, 2022–2027 (USD MILLION)

11 FISHMEAL & FISH OIL MARKET, BY REGION (Page No. - 113)

11.1 INTRODUCTION

FIGURE 31 JAPAN TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 62 MARKET, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 64 MARKET, BY REGION, 2019–2021 (KT)

TABLE 65 MARKET, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY TYPE, 2019–2021 (KT)

TABLE 71 NORTH AMERICA: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 72 NORTH AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 77 NORTH AMERICA: FISHMEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Rising rate of pet adoption

TABLE 78 US: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 79 US: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 80 US: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 81 US: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 82 US: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 83 US: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing aquaculture industry

TABLE 84 CANADA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 85 CANADA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 86 CANADA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 87 CANADA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 88 CANADA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 89 CANADA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Large aging population and increasing cognitive health issues

TABLE 90 MEXICO: FISHMEAL & FISH OIL MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 91 MEXICO: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 92 MEXICO: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 93 MEXICO: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 94 MEXICO: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 95 MEXICO: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 32 EUROPE: REGIONAL SNAPSHOT

TABLE 96 EUROPE: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 99 EUROPE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: MARKET, BY TYPE, 2019–2021 (KT)

TABLE 101 EUROPE: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 102 EUROPE: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.1 NORWAY

11.3.1.1 Well-established aquaculture industry and increasing exports

TABLE 108 NORWAY: FISHMEAL & FISH OIL MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 109 NORWAY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 110 NORWAY: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 111 NORWAY: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 112 NORWAY: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 113 NORWAY: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Large pet population

TABLE 114 UK: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 115 UK: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 116 UK: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 117 UK: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 118 UK: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 119 UK: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.3 ITALY

11.3.3.1 Rapidly growing pharmaceutical and aquaculture industries

TABLE 120 ITALY: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 121 ITALY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 122 ITALY: FISHMEAL & FISH OIL MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 123 ITALY: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 124 ITALY: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 125 ITALY: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Significant demand from fisheries and aquafeed industry

TABLE 126 FRANCE: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 127 FRANCE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 128 FRANCE: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 129 FRANCE: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 130 FRANCE: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 131 FRANCE: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.5 GERMANY

11.3.5.1 Rise in aging population and increasing pet adoption rate

TABLE 132 GERMANY: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 133 GERMANY: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 134 GERMANY: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 135 GERMANY: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 136 GERMANY: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 137 GERMANY: FISHMEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.6 NETHERLANDS

11.3.6.1 High pet adoption rate

TABLE 138 NETHERLANDS: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 139 NETHERLANDS: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 140 NETHERLANDS: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 141 NETHERLANDS: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 142 NETHERLANDS: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 143 NETHERLANDS: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 144 REST OF EUROPE: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 145 REST OF EUROPE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 146 REST OF EUROPE: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 147 REST OF EUROPE: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 148 REST OF EUROPE: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 149 REST OF EUROPE: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY TYPE, 2019–2021 (KT)

TABLE 155 ASIA PACIFIC: FISHMEAL & FISH OIL MARKET, BY TYPE, 2022–2027 (KT)

TABLE 156 ASIA PACIFIC: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

FIGURE 33 ASIA PACIFIC: REGIONAL SNAPSHOT

11.4.1 CHINA

11.4.1.1 Increasing meat consumption and rapidly growing livestock sector

TABLE 162 CHINA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 163 CHINA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 164 CHINA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 165 CHINA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 166 CHINA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 167 CHINA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Rising focus on protein-rich ingredients and pet health and nutrition

TABLE 168 INDIA: FISHMEAL & FISH OIL MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 169 INDIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 170 INDIA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 171 INDIA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 172 INDIA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 173 INDIA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Growing pharmaceutical industry and rising awareness about personal health

TABLE 174 JAPAN: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 175 JAPAN: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 176 JAPAN: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 177 JAPAN: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 178 JAPAN: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 179 JAPAN: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.4 VIETNAM

11.4.4.1 Large-scale shrimp production and rapidly growing aquaculture industry

TABLE 180 VIETNAM: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 181 VIETNAM: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 182 VIETNAM: FISHMEAL & FISH OIL MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 183 VIETNAM: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 184 VIETNAM: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 185 VIETNAM: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.5 THAILAND

11.4.5.1 Rapid growth in shrimp production

TABLE 186 THAILAND: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 187 THAILAND: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 188 THAILAND: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 189 THAILAND: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 190 THAILAND: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 191 THAILAND: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.6 AUSTRALIA & NEW ZEALAND

11.4.6.1 Increasing meat consumption

TABLE 192 AUSTRALIA & NEW ZEALAND: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 193 AUSTRALIA & NEW ZEALAND: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 194 AUSTRALIA & NEW ZEALAND: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 195 AUSTRALIA & NEW ZEALAND: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 196 AUSTRALIA & NEW ZEALAND: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND: FISHMEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.7 MALAYSIA

11.4.7.1 Ease of raw material availability and growing demand from aquaculture industry

TABLE 198 MALAYSIA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 199 MALAYSIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 200 MALAYSIA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 201 MALAYSIA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 202 MALAYSIA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 203 MALAYSIA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.8 INDONESIA

11.4.8.1 Extensive governmental support in expanding aquaculture industry

TABLE 204 INDONESIA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 205 INDONESIA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 206 INDONESIA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 207 INDONESIA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 208 INDONESIA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 209 INDONESIA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.9 MYANMAR

11.4.9.1 Significant investments by key global players

TABLE 210 MYANMAR: FISHMEAL & FISH OIL MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 211 MYANMAR: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 212 MYANMAR: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 213 MYANMAR: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 214 MYANMAR: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 215 MYANMAR: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.4.10 REST OF ASIA PACIFIC

TABLE 216 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 217 REST OF ASIA PACIFIC: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 218 REST OF ASIA PACIFIC: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 222 SOUTH AMERICA: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 223 SOUTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 224 SOUTH AMERICA: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 225 SOUTH AMERICA: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 226 SOUTH AMERICA: MARKET, BY TYPE, 2019–2021 (KT)

TABLE 227 SOUTH AMERICA: FISHMEAL & FISH OIL MARKET, BY TYPE, 2022–2027 (KT)

TABLE 228 SOUTH AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 229 SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 230 SOUTH AMERICA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 231 SOUTH AMERICA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 232 SOUTH AMERICA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 233 SOUTH AMERICA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.5.1 CHILE

11.5.1.1 Increasing aquaculture industry and rising demand for high-quality fishmeal

TABLE 234 CHILE: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 235 CHILE: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 236 CHILE: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 237 CHILE: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 238 CHILE: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 239 CHILE: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.5.2 BRAZIL

11.5.2.1 Increased spending on health-focused pet food ingredients

TABLE 240 BRAZIL: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 241 BRAZIL: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 242 BRAZIL: FISHMEAL & FISH OIL MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 243 BRAZIL: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 244 BRAZIL: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 245 BRAZIL: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.5.3 ECUADOR

11.5.3.1 Rising aging population

TABLE 246 ECUADOR: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 247 ECUADOR: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 248 ECUADOR: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 249 ECUADOR: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 250 ECUADOR: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 251 ECUADOR: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.5.4 REST OF SOUTH AMERICA

TABLE 252 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 253 REST OF SOUTH AMERICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 254 REST OF SOUTH AMERICA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 255 REST OF SOUTH AMERICA: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 256 REST OF SOUTH AMERICA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 257 REST OF SOUTH AMERICA: FISHMEAL & FISH OIL MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 258 REST OF THE WORLD: MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 259 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 260 REST OF THE WORLD: MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 261 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 262 REST OF THE WORLD: MARKET, BY TYPE, 2019–2021 (KT)

TABLE 263 REST OF THE WORLD: MARKET, BY TYPE, 2022–2027 (KT)

TABLE 264 REST OF THE WORLD: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 265 REST OF THE WORLD: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 266 REST OF THE WORLD: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 267 REST OF THE WORLD: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 268 REST OF THE WORLD: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 269 REST OF THE WORLD: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.6.1 AFRICA

11.6.1.1 Growing aquaculture industry

TABLE 270 AFRICA: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 271 AFRICA: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 272 AFRICA: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 273 AFRICA: FISHMEAL & FISH OIL MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 274 AFRICA: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 275 AFRICA: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Rapidly increasing aging population and increasing awareness about pet health

TABLE 276 MIDDLE EAST: MARKET, BY SOURCE, 2019–2021 (USD MILLION)

TABLE 277 MIDDLE EAST: MARKET, BY SOURCE, 2022–2027 (USD MILLION)

TABLE 278 MIDDLE EAST: MARKET, BY LIVESTOCK APPLICATION, 2019–2021 (USD MILLION)

TABLE 279 MIDDLE EAST: MARKET, BY LIVESTOCK APPLICATION, 2022–2027 (USD MILLION)

TABLE 280 MIDDLE EAST: MARKET, BY INDUSTRIAL APPLICATION, 2019–2021 (USD MILLION)

TABLE 281 MIDDLE EAST: MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 201)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 282 STRATEGIES ADOPTED BY KEY PLAYERS

12.3 MARKET SHARE ANALYSIS, 2021

TABLE 283 FISHMEAL & FISH OIL MARKET SHARE ANALYSIS, 2021

12.4 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 34 FIVE-YEAR TOTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017–2021 (USD BILLION)

12.5 MARKET: EVALUATION QUADRANT, BY KEY PLAYERS

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 35 MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.5.5 MARKET: PRODUCT FOOTPRINT, 2021 (KEY PLAYERS)

TABLE 284 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

TABLE 285 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

TABLE 286 COMPANY FOOTPRINT, BY LIVESTOCK APPLICATION (KEY PLAYERS)

TABLE 287 COMPANY FOOTPRINT, BY INDUSTRIAL APPLICATION (KEY PLAYERS)

TABLE 288 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

TABLE 289 OVERALL, COMPANY FOOTPRINT (KEY PLAYERS)

12.6 FISHMEAL & FISH OIL MARKET: EVALUATION QUADRANT, BY OTHER PLAYERS

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 36 MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

TABLE 290 ARKET: COMPETITIVE BENCHMARKING, 2021 (OTHER PLAYERS)

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES

TABLE 291 MARKET: NEW PRODUCT LAUNCHES, 2020–2021

12.7.2 OTHERS

TABLE 292 MARKET: OTHERS, 2022

13 COMPANY PROFILES (Page No. - 217)

(Business overview, Products/Services/Solutions offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 FKS MULTI AGRO

TABLE 293 FKS MULTI AGRO: BUSINESS OVERVIEW

FIGURE 37 FKS MULTI AGRO: COMPANY SNAPSHOT

TABLE 294 FKS MULTI AGRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 295 FKS MULTI AGRO: OTHERS

13.1.2 MUKKA PROTEINS LIMITED

TABLE 296 MUKKA PROTEINS LIMITED: FISHMEAL & FISH OIL MARKET BUSINESS OVERVIEW

FIGURE 38 MUKKA PROTEINS LIMITED: COMPANY SNAPSHOT

TABLE 297 MUKKA PROTEINS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.3 ARBEE

TABLE 298 ARBEE: BUSINESS OVERVIEW

TABLE 299 ARBEE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.4 SANDAKAN FISHMEAL SDN BHD

TABLE 300 SANDAKAN FISHMEAL SDN BHD: BUSINESS OVERVIEW

TABLE 301 SANDAKAN FISHMEAL SDN BHD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.5 WUDI DEDA AGRICULTURE CO., LTD.

TABLE 302 WUDI DEDA AGRICULTURE CO., LTD.: BUSINESS OVERVIEW

TABLE 303 WUDI DEDA AGRICULTURE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.6 RAJ FISHMEAL AND OIL COMPANY

TABLE 304 RAJ FISHMEAL AND OIL COMPANY: BUSINESS OVERVIEW

TABLE 305 RAJ FISHMEAL AND OIL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.7 ASIA FISH OIL CORPORATION

TABLE 306 ASIA FISH OIL CORPORATION: BUSINESS OVERVIEW

TABLE 307 ASIA FISH OIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.8 DAI DAI THANH SEAFOODS

TABLE 308 DAI DAI THANH SEAFOODS: BUSINESS OVERVIEW

TABLE 309 DAI DAI THANH SEAFOODS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.9 PATTANI FISH MEAL (1988) CO., LTD.

TABLE 310 PATTANI FISH MEAL (1988) CO., LTD.: FISHMEAL & FISH OIL MARKET BUSINESS OVERVIEW

TABLE 311 PATTANI FISH MEAL (1988) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.10 AUSTEVOLL SEAFOOD ASA

TABLE 312 AUSTEVOLL SEAFOOD ASA: BUSINESS OVERVIEW

FIGURE 39 AUSTEVOLL SEAFOOD ASA: COMPANY SNAPSHOT

TABLE 313 AUSTEVOLL SEAFOOD ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.11 THE SCOULAR COMPANY

TABLE 314 THE SCOULAR COMPANY: BUSINESS OVERVIEW

TABLE 315 THE SCOULAR COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 316 THE SCOULAR COMPANY: NEW PRODUCT LAUNCHES

TABLE 317 THE SCOULAR COMPANY: OTHERS

13.1.12 GC REIBER OIL

TABLE 318 GC REIBER OIL: BUSINESS OVERVIEW

TABLE 319 GC REIBER OIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 320 GC REIBER OIL: NEW PRODUCT LAUNCHES

TABLE 321 GC REIBER OIL: OTHERS

13.1.13 CRODA INTERNATIONAL PLC

TABLE 322 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

FIGURE 40 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 323 CRODA INTERNATIONAL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 324 CRODA INTERNATIONAL PLC: OTHERS

13.1.14 OCEANA GROUP LIMITED

TABLE 325 OCEANA GROUP LIMITED: BUSINESS OVERVIEW

FIGURE 41 OCEANA GROUP LIMITED: COMPANY SNAPSHOT

TABLE 326 OCEANA GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.1.15 OMEGA PROTEIN CORPORATION

TABLE 327 OMEGA PROTEIN CORPORATION: FISHMEAL & FISH OIL MARKET BUSINESS OVERVIEW

TABLE 328 OMEGA PROTEIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

*Details on Business overview, Products/Services/Solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 SÜRSAN A.Þ.

13.2.2 FRITZ KÖSTER HANDELSGESELLSCHAFT AG

13.2.3 TASA

13.2.4 TRIPLENINE

13.2.5 CORPESCA S.A.

13.2.6 FF SKAGEN A/S

13.2.7 ABKHAZMORPROM

13.2.8 PIONEER FISHING

13.2.9 MAXLAND GROUP

13.2.10 GOLD FIN INTERNATIONAL

14 ADJACENT AND RELATED MARKETS (Page No. - 261)

14.1 INTRODUCTION

TABLE 329 ADJACENT MARKETS TO FISHMEAL & FISH OIL MARKET

14.2 LIMITATIONS

14.3 MARINE COLLAGEN MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 330 MARINE COLLAGEN MARKET, BY TYPE, 2021–2026 (USD MILLION)

14.4 AQUAFEED MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 331 AQUAFEED MARKET, BY FORM, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 264)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

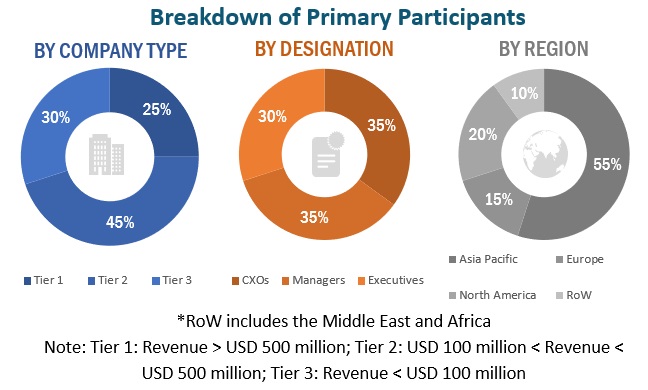

The study involved four major activities in estimating fishmeal & fish oil market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to, to identify and collect information. various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), IFFO – The Marine Ingredients Organization and European Fishmeal and Fish Oil Producers (EFFOP), and academic references pertaining to fishmeal and fish oil, were referred to identify and collect information for this study.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the fishmeal & fish oil market.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of fishmeal & fish oil supplied by different market players, and key market dynamics such as drivers, restraints, opportunities, burning issues, industry trends, and key player strategies.

In the complete market engineering process, top-down and bottom-up approaches were extensively used along with several data triangulation methods to conduct market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Fishmeal & Fish Oil Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall fishmeal & fish oil market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Fishmeal & Fish Oil Market Report Objectives

- To describe and forecast the market, in terms of type, source, livestock application, industrial application, and region.

- To describe and forecast the market, in terms of value, by region– North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the fishmeal & fish oil market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the market.

Available Customizations:

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European fishmeal & fish oil market into Poland, Spain, and other EU countries.

- Further breakdown of the Rest of South American market into Peru and Colombia.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fishmeal & Fish Oil Market