Machine Automation Controller Market by Controller Type (DCS, PLC, Industrial PC), Form Factor (IP65, IP20), Industry (Oil & Gas, Energy & Power, Food & Beverages, Chemicals, Automotive), and Geography - Global Forecast to 2025-2036

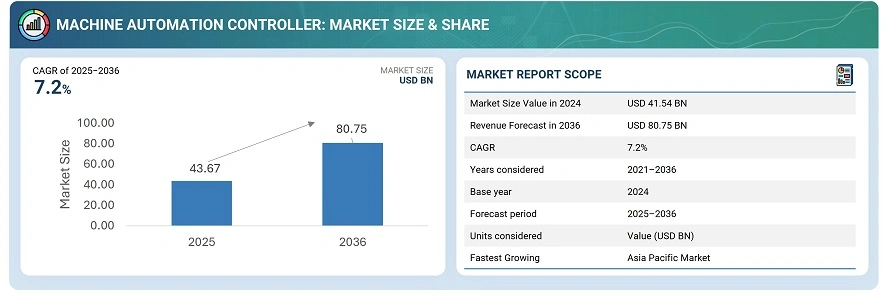

The global machine automation controller market was valued at USD 41.54 billion in 2024 and is projected to reach USD 80.75 billion by 2035, growing at a CAGR of 7.2% between 2025 and 2036.

The primary driving factor for the machine automation controller market is the accelerating global demand for industrial automation and smart manufacturing. This push is fueled by the need for manufacturers across all sectors to achieve greater operational efficiency, higher production quality, and better flexibility in response to customized product demands. The integration of Industry 4.0 technologies, particularly the use of Industrial IoT (IIoT), further drives the market by requiring controllers (like PLCs and PACs) that can manage complex, data-rich processes and facilitate seamless communication between field devices and cloud platforms. Finally, rising labor costs and the necessity for improved worker safety incentivize companies to invest in highly automated systems, placing the controller at the heart of this technological transformation.

To achieve productivity improvement goals, manufacturing companies are increasingly striving to automate their production processes with the help of advanced machine automation controllers. A highly competitive industrial ecosystem and growing customer demands with minimum tolerance to defect have compelled companies to automate their production line. Using automation systems, companies are able to perform a smooth transition from traditional manufacturing approach to a more advanced and effective one. Also, adopting automation will help companies improve their overall equipment effectiveness (OEE) and expand its manufacturing capacity in a more cost effective manner. Also, automation helps companies produce more in less time, resulting in increased output and enhanced overall productivity.

Market by Controller Type

Distributed Control System (DCS)

By Controller Type, Distributed Control System (DCS) holds the largest share of the machine automation controller market, due to their proven effectiveness in managing highly complex, large-scale, and mission-critical operations within process industries. DCS provide a centralized supervisory framework that integrates multiple subsystems, ensuring optimal resource allocation, robust safety, and reliable plant performance. Their widespread adoption in industries such as oil & gas, chemicals, energy & power, and water treatment reflects the need for seamless scalability and the ability to monitor and control vast networks of equipment in real-time.

Industrial PC

The industrial PC segment is expected to grow at a significant CAGR during the forecast period, driven by their flexibility, processing power, and role in enabling digital transformation. IPCs are particularly well-suited for advanced manufacturing environments that require robust data handling, edge computing, and integration with next-generation technologies like IIoT, machine vision, and artificial intelligence. Their modular architecture and compatibility with modern operating systems make them a preferred choice for both brownfield upgrades and new automation projects. As manufacturers demand more intelligent and connected automation solutions to boost productivity and agility, the adoption of IPCs continues to surge across discrete and hybrid industries, cementing their position as the fastest-growing controller segment in the market.

Market by Form Factor

IP65

By form factor, the IP65 segment is expected to hold the largest share of the machine automation controller market, due to their robust protection against dust and water, making them ideal for harsh industrial environments commonly found in process industries such as oil & gas, chemicals, and metals & mining. These controllers can withstand exposure to high moisture, particulate contamination, and intense washdowns, ensuring reliable operation and minimal downtime in demanding field conditions. Their suitability for outdoor, wet, and rugged applications drives widespread adoption across both greenfield and brownfield automation projects.

IP20

The IP20 segment is expected to grow at a significant CAGR during the forecast period, owing to their suitability for clean, controlled environments such as manufacturing floors in the automotive, semiconductor, and electronics industries. These controllers deliver cost efficiencies and simple integration in applications where moisture and particle ingress are minimal. The increasing shift toward compact assembly lines, digitalized logistics, and modular automation is accelerating the deployment of IP20 solutions in advanced discrete manufacturing setups, supporting their rapid market expansion.

Market by Geography

Geographically, the machine automation controller market is expanding across North America, Europe, Asia Pacific, and the Rest of the World (ROW), including the Middle East, South America, and Africa. Asia Pacific is expected to grow at the highest CAGR, driven by rapid industrialization and expanding manufacturing bases across countries like China, India, Japan, and South Korea. The region’s strong demand for automation is propelled by the need to enhance productivity, reduce labor dependency, and improve quality in industries such as automotive, electronics, and food & beverages. Additionally, rising operational costs and an evolving regulatory environment are compelling companies to invest in advanced automation solutions. Increasing adoption of smart factories, coupled with government initiatives supporting Industry 4.0 and digital transformation, further accelerates growth and cements Asia Pacific’s position as the primary engine of expansion for the global market.

Market Dynamics

Driver: Increasing need to drive productivity in process industry

The increasing need to drive productivity in the process industry is a major growth driver for the machine automation controller market. Automation controllers enable continuous, round-the-clock operation with minimal downtime, allowing plants to maximize throughput and maintain consistent product quality. By minimizing human intervention, these controllers streamline complex production sequences, reduce process variability, and enhance operational efficiency. As a result, companies are able to meet rising demand, improve global competitiveness, and achieve higher profitability in highly dynamic industrial environments.

Restraint: High initial capital investment for SMEs

High initial capital investment remains a major restraint for small and medium-sized enterprises (SMEs) in adopting machine automation controllers, as the upfront costs of advanced equipment, installation, and integration can be prohibitive relative to their limited budgets. This financial barrier is compounded by ongoing maintenance expenses and the need for skilled personnel to operate and troubleshoot the systems. As a result, many SMEs hesitate to invest despite long-term benefits, slowing the pace of widespread automation across the sector and creating a competitive gap with larger organizations.

Opportunity: Demand for improved worker safety

The demand for improved worker safety is a key opportunity driving the growth of the machine automation controller market. Automation helps reduce worker exposure to hazardous tasks by taking over dangerous, repetitive, and physically demanding operations, thereby minimizing workplace injuries. Automated systems enable real-time monitoring and quick response to safety risks, ensuring safer work environments. Additionally, advancements in safety technologies integrated with automation improve compliance with regulations and enhance overall operational reliability, fostering greater adoption of automation solutions focused on protecting workers.

Challenge: Increasing cybersecurity threats

Increasing cybersecurity threats pose a significant challenge to the machine automation controller market as growing digitalization expands the attack surface for industrial systems. Advanced cyber-attacks, including ransomware, phishing, and sophisticated malware, target automated manufacturing environments with the potential to disrupt operations, compromise data integrity, and endanger safety. The convergence of operational technology (OT) and information technology (IT) introduces complex vulnerabilities requiring robust cybersecurity measures. Companies must adopt proactive strategies like zero trust architectures, continuous monitoring, and advanced threat detection to safeguard critical infrastructure and maintain operational resilience in the face of evolving cyber risks.

Future Outlook

Between 2025 and 2036, the machine automation controller market is expected to grow substantially as the demand for high-speed, precise, and integrated control systems is growing across industries such as automotive, electronics, food & beverages, and pharmaceuticals. Manufacturers are increasingly adopting automation controllers to enhance production efficiency, ensure real-time monitoring, and reduce operational costs through improved process synchronization. The rapid expansion of smart factories and the implementation of Industry 4.0 are fueling the integration of advanced technologies such as AI, IoT, and edge computing in control systems. Moreover, the need for seamless communication between robots, sensors, and machines is propelling demand for multi-axis and networked controllers. Rising labor costs, stringent safety regulations, and the global focus on digital transformation are further accelerating adoption. Additionally, the increasing use of cloud-based control platforms and predictive maintenance capabilities is expanding the market’s scope, driving continuous innovation and modernization in manufacturing environments.

Key Market Players

Top machine automation controller companies ABB (Switzerland), Honeywell International Inc. (US), Siemens (Germany), Yokogawa Electric Corporation (Japan), and Emerson Electric Co. (US).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.1.3.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Arriving at Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities for Machine Automaton Controller Market

4.2 Machine Automation Controller Market, By Controller Type

4.3 Market, By Form Factor

4.4 Market, By Industry & Region

4.5 Market, By Geography

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Focus on Reducing Overall Operational Cost

5.2.1.2 Increasing Need to Drive Productivity in Process Industry

5.2.1.3 Growing Use of Robots in Manufacturing Sector

5.2.2 Restraints

5.2.2.1 High Initial Capital Investment for SMES

5.2.2.2 Difficulty in Finding System Failure Results in Increased Downtime

5.2.3 Opportunities

5.2.3.1 Emergence of Industrial Internet of Things (IIoT)

5.2.3.2 Demand for Improved Worker Safety

5.2.4 Challenges

5.2.4.1 Increasing Cybersecurity Threats

5.2.4.2 Rising Digital Skill Gap in Workforce

5.3 Value Chain Analysis

6 Functions of Machine Automation Controllers (Page No. - 44)

6.1 Introduction

6.2 Logic Handling

6.2.1 Need for More Intelligent Controllers Fuels Demand for Logic Handling Functionality

6.3 Motion Control

6.3.1 Motion Control Emerged as Most Basic Functionality of Machine Automation Controller

6.4 Network Safety

6.4.1 Rising Security Threat Makes Network Safety Function A Necessity for Machine Automation Controllers

6.5 Machine Monitoring

6.5.1 Growing Awareness Toward Preventive Maintenance Makes Machine Monitoring an Important Function

6.6 Data Handling

6.6.1 Capability to Handle Large Amount of Data is an Important Functionality of Modern Machine Automation Controllers

6.7 Communication

6.7.1 Demand for Better Connectivity Among Automation Systems Drives Need for Communication

7 Types of Machine Automation Controllers (Page No. - 47)

7.1 Introduction

7.2 Modular

7.2.1 Growing Demand for Scalable Automation Control Solutions Drives Demand for Modular Controllers

7.2.1.1 Advantages of Modular Machine Automation Controller

7.2.1.2 Disadvantages of Modular Machine Automation Controller

7.3 Compact

7.3.1 Small Process and Manufacturing Facilities With Basic Automation Needs Boost Demand for Compact Controllers

7.3.1.1 Advantages of Compact Machine Automation Controller

7.3.1.2 Disadvantages of Compact Machine Automation Controller

8 Machine Automation Controller Market, By Controller Type (Page No. - 49)

8.1 Introduction

8.2 Distributed Control System (DCS)

8.2.1 Increasing Demand for Centralized Control Boosting Demand for DCS

8.3 Programmable Logic Controller (PLC)

8.3.1 Need for Efficient, Safe, and Reliable Execution of Plant Operations Drives Demand for PLC

8.4 Industrial PC

8.4.1 Growing Demand for Controllers With High Processing Power Fuels Demand for Industrial PC

9 Machine Automation Controller Market, By Form Factor (Page No. - 59)

9.1 Introduction

9.2 IP65

9.2.1 Demanding Industrial Environments Propel Need for IP65-Rated Machine Automation Controllers

9.3 IP20

9.3.1 Raising Industry Standards Drive Market for IP20-Rated Machine Automation Controllers

9.4 Others

9.4.1 Need for Automation Controllers With Different Ingress Protection as Per Customer’s Requirement Fuels Demand for Other Automation Controllers

10 Machine Automation Controller Market, By Industry (Page No. - 69)

10.1 Introduction

10.2 Process Industries

10.2.1 Oil & Gas

10.2.1.1 Modernization of Old Processes to Boost Demand for Automated Systems in Oil & Gas Industry

10.2.2 Energy & Power

10.2.2.1 Smart Grids Open New Market Opportunities for Machine Automation Controllers

10.2.3 Food & Beverages

10.2.3.1 Need for Higher Productivity and Strict Regulations Drives Demand for Automated Systems in Food & Beverages Industry

10.2.4 Chemicals

10.2.4.1 Increasing Automation in Chemicals Industry Drives Demand for Machine Automation Controllers

10.2.5 Pharmaceuticals

10.2.5.1 Growing Digitization and Automation of Drug Manufacturing Contribute to Growth of Machine Automation Controller Market

10.2.6 Metals & Mining

10.2.6.1 Rising Safety Concerns for Workers Fuel Demand for Automation in Metals & Mining Industry

10.2.7 Pulp & Paper

10.2.7.1 Steady Growth in Demand for Paper Products to Fuel Market for Machine Automation Controllers

10.2.8 Others

10.2.8.1 Increasing Need for Usable Water for Drinking and Industrial Use Contribute to Growth of Machine Automation Controller Market

10.3 Discrete Industries

10.3.1 Automotive

10.3.1.1 Increase in Competition and Need for More Output at Optimum Cost Fuel Machine Automation Controller Market

10.3.2 Aerospace & Defense

10.3.2.1 Process Optimization Drives Machine Automation Controller Market in Aerospace & Defense Industry

10.3.3 Semiconductor & Electronics

10.3.3.1 Increasing Need for High-Quality Electronic Products Boosts Implementation of Automation in Semiconductor & Electronics

Industry

10.3.4 Medical Devices

10.3.4.1 Higher Quality and Strict Regulatory Demands Drive Medical Device Manufacturers Toward Automation

11 Geographic Analysis (Page No. - 90)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Growing Trend of Automation in Production Facilities in US Pharmaceuticals Companies Fuels Demand for Machine Automation Controllers

11.2.2 Canada

11.2.2.1 Rising Demand for Automation in Oil & Gas to Create Growth Opportunities for Machine Automation Controllers

11.2.3 Mexico

11.2.3.1 Modernization of Power Distribution Grids Boosts Demand for Machine Automation Controllers in Mexico

11.3 Europe

11.3.1 UK

11.3.1.1 Supportive Initiatives By the UK Government

11.3.2 France

11.3.2.1 Increasing Adoption of Automation By Process Industries in France

11.3.3 Germany

11.3.3.1 Highly Automated Industrial Ecosystem Makes Germany an Attractive Market for Machine Automation Controllers

11.3.4 Rest of Europe

11.3.4.1 Expansion of Manufacturing Capabilities to Drive Machine Automation Controller Market

11.4 APAC

11.4.1 China

11.4.1.1 China is an Attractive Investment Hub for Machine Automation Controller Market Players

11.4.2 Japan

11.4.2.1 Positive Outlook for Implementation of Automation Technology Makes Japan an Ideal Market for Machine Automation Controllers

11.4.3 South Korea

11.4.3.1 Presence of State-Of-The-Art Automated Manufacturing Infrastructure to Offer Growth Avenues for Machine Automation Controller Market

11.4.4 India

11.4.4.1 Growing Pharmaceutical Industry in India to Drive Demand for Machine Automation Controllers

11.4.5 Rest of APAC

11.4.5.1 Emerging Southeast Asian Economies Drive Demand for Machine Automation Controllers

11.5 RoW

11.5.1 Latin America

11.5.1.1 Favorable Government Policies for Manufacturing Companies to Drive Demand for Machine Automation Controllers

11.5.2 Middle East

11.5.2.1 Growing Aerospace Industry in Middle East to Boost Machine Automation Controller Market

11.5.3 Africa

11.5.3.1 Rising Automotive and Electronics Manufacturing to Drive Machine Automation Controller Market in Africa

12 Competitive Landscape (Page No. - 112)

12.1 Overview

12.2 Market Ranking Analysis for Machine Automation Controller Manufacturers

12.3 Competitive Leadership Mapping, 2018

12.3.1 Visionary Leaders

12.3.2 Dynamic Differentiators

12.3.3 Innovators

12.3.4 Emerging Companies

12.4 Strength of Product Portfolio

12.5 Business Strategy Excellence

12.6 Competitive Situations and Trends

12.6.1 Product Launches

12.6.2 Contracts

12.6.3 Acquisitions

12.6.4 Agreements, Partnerships, and Joint Ventures

12.6.5 Expansions

13 Company Profiles (Page No. - 127)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 Key Players

13.1.1 ABB

13.1.2 Emerson

13.1.3 Siemens

13.1.4 Schneider Electric

13.1.5 Yokogawa

13.1.6 Advantech

13.1.7 Delta Electronics

13.1.8 Honeywell

13.1.9 Mitsubishi Electric

13.1.10 Omron

13.1.11 Rockwell Automation

13.1.12 Robert Bosch

13.1.13 Beckhoff Automation

13.1.14 Kollmorgen

13.1.15 Kontron

13.2 Other Key Players

13.2.1 Acs India

13.2.2 Hollysys Automation

13.2.3 Iei Integration

13.2.4 Logic Supply

13.2.5 Iei Integration

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 164)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (66 Tables)

Table 1 Market, By Controller Type, 2015–2024 (USD Billion)

Table 2 Market for DCS, By Process Industry, 2015–2024 (USD Billion)

Table 3 Market for DCS, By Region, 2015–2024 (USD Billion)

Table 4 Market for PLC, By Process Industry, 2015–2024 (USD Billion)

Table 5 Market for PLC, By Region, 2015–2024 (USD Billion)

Table 6 Market for Industrial PC, By Process Industry, 2015–2024 (USD Billion)

Table 7 Market for Industrial PC, By Discrete Industry, 2015–2024 (USD Billion)

Table 8 Market for Industrial PC, By Region, 2015–2024 (USD Billion)

Table 9 Market, By Form Factor, 2015–2024 (USD Million)

Table 10 Market for IP65, By Industry, 2015–2024 (USD Million)

Table 11 Market for IP65, By Process Industry, 2015–2024 (USD Million)

Table 12 Market for IP65, By Discrete Industry, 2015–2024 (USD Million)

Table 13 Market for IP20, By Industry, 2015–2024 (USD Million)

Table 14 Market for IP20, By Process Industry, 2015–2024 (USD Million)

Table 15 Market for IP20, By Discrete Industry, 2015–2024 (USD Million)

Table 16 Market for Others, By Industry, 2015–2024 (USD Million)

Table 17 Market for Others, By Process Industry, 2015–2024 (USD Million)

Table 18 Market for Others, By Discrete Industry, 2015–2024 (USD Million)

Table 19 Market, By Industry, 2015–2024 (USD Billion)

Table 20 Market, By Process Industry, 2015–2024 (USD Billion)

Table 21 Market for Process Industry, By Region, 2015–2024 (USD Billion)

Table 22 Market for Oil & Gas Industry, By Controller Type, 2015–2024 (USD Billion)

Table 23 Market for Oil & Gas Industry, By Region, 2015–2024 (USD Billion)

Table 24 Market for Energy & Power Industry, By Controller Type, 2015–2024 (USD Billion)

Table 25 Market for Energy & Power Industry, By Region, 2015–2024 (USD Billion)

Table 26 Market for Food & Beverages Industry, By Controller Type, 2015–2024 (USD Billion)

Table 27 Market for Food & Beverages Industry, By Region, 2015–2024 (USD Billion)

Table 28 Market for Chemicals Industry, By Controller Type, 2015–2024 (USD Billion)

Table 29 Market for Chemicals Industry, By Region, 2015–2024 (USD Billion)

Table 30 Market for Pharmaceuticals Industry, By Controller Type, 2015–2024 (USD Billion)

Table 31 Market for Pharmaceuticals Industry, By Region, 2015–2024 (USD Billion)

Table 32 Market for Metals & Mining Industry, By Controller Type, 2015–2024 (USD Billion)

Table 33 Market for Metals & Mining Industry, By Region, 2015–2024 (USD Billion)

Table 34 Market for Pulp & Paper Industry, By Controller Type, 2015–2024 (USD Billion)

Table 35 Market for Pulp & Paper Industry, By Region, 2015–2024 (USD Billion)

Table 36 Market for Others, By Controller Type, 2015–2024 (USD Billion)

Table 37 Market for Others, By Region, 2015–2024 (USD Billion)

Table 38 Market, By Discrete Industry, 2015–2024 (USD Billion)

Table 39 Market for Discrete Industry, By Region, 2015–2024 (USD Billion)

Table 40 Market for Automotive Industry, By Controller Type, 2015–2024 (USD Billion)

Table 41 Market for Automotive Industry, By Region, 2015–2024 (USD Billion)

Table 42 Market for Aerospace & Defense Industry, By Region, 2015–2024 (USD Billion)

Table 43 Market for Semiconductor & Electronics Industry, By Region, 2015–2024 (USD Billion)

Table 44 Market for Medical Devices Industry, By Region, 2015–2024 (USD Billion)

Table 45 Market, By Region, 2015–2024 (USD Billion)

Table 46 Market in North America, By Country, 2015–2024 (USD Billion)

Table 47 Market in North America, By Process Industry, 2015–2024 (USD Billion)

Table 48 Market in North America, By Discrete Industry, 2015–2024 (USD Billion)

Table 49 Market in North America, By Controller Type, 2015–2024 (USD Billion)

Table 50 Market in Europe, By Country, 2015–2024 (USD Billion)

Table 51 Market in Europe, By Process Industry, 2015–2024 (USD Billion)

Table 52 Market in Europe, By Discrete Industry, 2015–2024 (USD Billion)

Table 53 Market in Europe, By Controller Type, 2015–2024 (USD Billion)

Table 54 Market in APAC, By Country, 2015–2024 (USD Billion)

Table 55 Market in Europe, By Process Industry, 2015–2024 (USD Billion)

Table 56 Market in Europe, By Discrete Industry, 2015–2024 (USD Billion)

Table 57 Market in APAC, By Controller Type, 2015–2024 (USD Billion)

Table 58 Market in RoW, By Country, 2015–2024 (USD Billion)

Table 59 Market in RoW, By Process Industry, 2015–2024 (USD Billion)

Table 60 Market in RoW, By Discrete Industry, 2015–2024 (USD Billion)

Table 61 Market in RoW, By Controller Type, 2015–2024 (USD Billion)

Table 62 Product Launches (2016–2019)

Table 63 Contract (2016–2018)

Table 64 Acquisition (2016–2018)

Table 65 Agreement, Partnership, and Joint Venture (2016–2018)

Table 66 Expansion (2016–2018)

List of Figures (69 Figures)

Figure 1 Machine Automation Controller Market Segmentation

Figure 2 Market: Research Design

Figure 3 Bottom-Up Approach to Arrive at Market Size

Figure 4 Top-Down Approach to Arrive at Market Size

Figure 5 Data Triangulation

Figure 6 Assumptions for Research Study

Figure 7 Market Segmentation

Figure 8 DCS to Lead Market During Forecast Period

Figure 9 IP65-Rated Controller to Hold Larger Size of Market During 2019–2024

Figure 10 Market for Energy & Power Industry to Grow at Highest CAGR From 2019 to 2024

Figure 11 APAC to Hold Largest Share of Market By 2019

Figure 12 Increasing Need to Drive Productivity in Process Industry Driving Demand for Machine Automaton Controllers

Figure 13 DCS to Register Highest CAGR in Market From 2019 to 2024

Figure 14 IP65 to Hold Largest Share of Market By 2019

Figure 15 Oil & Gas and APAC to Hold Largest Share of Market By 2019

Figure 16 China to Hold Largest Share of Market By 2019

Figure 17 DROC: Machine Automaton Controller Market, 2019

Figure 18 Manufacturing and Assembly Stage Adds Major Value to Market

Figure 19 Functions of Machine Automation Controllers

Figure 20 Types of Machine Automation Controllers

Figure 21 Machine Automation Controller Market, By Controller Type

Figure 22 Working of DCS

Figure 23 APAC to Lead Machine Automation Controller Market for DCS During Forecast Period

Figure 24 Working of PLC

Figure 25 Food & Beverages to Grow at Highest CAGR From 2019 to 2024

Figure 26 Working of Industrial PC

Figure 27 Automotive to Lead Machine Automation Controller Market for Industrial PC During Forecast Period

Figure 28 Machine Automation Controller, By Form Factor

Figure 29 Process Industry to Hold Larger Size of Machine Automation Controller Market for IP65 During Forecast Period

Figure 30 Aerospace & Defense to Grow at Highest CAGR in Machine Automation Controller Market for IP65 From 2019 to 2024

Figure 31 Automotive to Hold Largest Size of Machine Automation Controller Market for IP20 During Forecast Period

Figure 32 Energy & Power to Grow at Highest CAGR in Machine Automation Controller Market for Others From 2019 to 2024

Figure 33 Machine Automation Controller Market, By Industry

Figure 34 APAC to Lead Market for Process Industry From 2019 to 2024

Figure 35 Market for DCS in Energy & Power Industry to Grow at Highest CAGR During Forecast Period

Figure 36 PLC to Hold Largest Size of Market for Food & Beverages Industry From 2019 to 2024

Figure 37 APAC to Lead Market for Chemicals Industry From 2019 to 2024

Figure 38 DCS to Lead Market for Metals & Mining Industry During Forecast Period

Figure 39 APAC to Dominate Market for Pulp & Paper Industry From 2019 to 2024

Figure 40 Automotive to Hold Largest Size of Market for Discrete Industry During Forecast Period

Figure 41 APAC to Dominate Market for Aerospace & Defense Industry From 2019 to 2024

Figure 42 Market, By Controller Type

Figure 43 North America: Market Snapshot

Figure 44 Automotive to Hold Largest Size of Market for Discrete Industry in North America From 2019 to 2024

Figure 45 Europe: Machine Automation Controller Snapshot

Figure 46 Market for Industrial PC to Grow at Highest CAGR During Forecast Period

Figure 47 APAC: Machine Automation Controller Market Snapshot

Figure 48 Energy & Power to Hold Largest Size of Market in APAC From 2019 to 2024

Figure 49 DCS to Dominate Market in APAC During Forecast Period

Figure 50 Automotive to Hold Largest Size of Market in RoW From 2019 to 2024

Figure 51 Product Launches Adopted as Key Growth Strategy By Major Players in Market During 2016–2018

Figure 52 Ranking of Top 5 Players: DCS (2018)

Figure 53 Ranking of Top 5 Players: PLC (2018)

Figure 54 Ranking of Top 5 Players: Industrial PC (2018)

Figure 55 Machine Automation Controller Market: Competitive Leadership Mapping, 2018

Figure 56 Market Evolution Framework: Product Launches Fueled Machine Automation Controller Market Growth During 2016–2018

Figure 57 Product Launches—Key Strategy Adopted By Market Players During 2016–2018

Figure 58 ABB: Company Snapshot

Figure 59 Emerson: Company Snapshot

Figure 60 Siemens: Company Snapshot

Figure 61 Schneider Electric: Company Snapshot

Figure 62 Yokogawa: Company Snapshot

Figure 63 Advantech: Company Snapshot

Figure 64 Delta Electronics: Company Snapshot

Figure 65 Honeywell: Company Snapshot

Figure 66 Mitsubishi Electric: Company Snapshot

Figure 67 Omron: Company Snapshot

Figure 68 Rockwell Automation: Company Snapshot

Figure 69 Robert Bosch: Company Snapshot

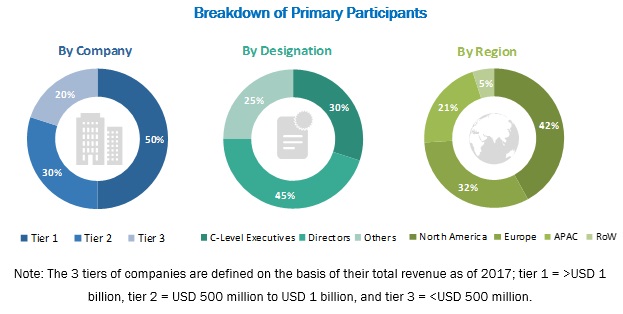

The study involved 4 major activities for estimating the current size of the machine automation controller market. An exhaustive secondary research was carried out to collect information on the market. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases [International Society for Automation (ISA), Measurement, Control, & Automation Association, Automation Industry Association (AIA), OneSource, and Factiva] have been used to identify and collect information for an extensive technical and commercial study of the machine automation controller market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects. Key players in the machine automation controller market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the machine automation controller market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the machine automation controller market, in terms of value, by controller type, form factor, and industry

- To describe and forecast the machine automation controller market, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To describe various functions of machine automation controllers, including logic handling, motion control, network safety, machine monitoring, data handling, and communication

- To elaborate on types of machine automation controllers—compact and modular

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the machine automation controller value chain

- To analyze opportunities for stakeholders in the machine automation controller market by identifying the high-growth segments

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall machine automation controller market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive growth strategies such as product launches, contracts, acquisitions, expansions, agreements, partnerships, and joint ventures in the machine automation controller market

1Micromarkets are defined as the further segments and subsegments of the machine automation controller market included in the report.

2Core competencies of the companies are defined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain their position in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific need. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Machine Automation Controller Market