Lubricating Oil Additives Market by Type, Application (Engine Oil, Hydraulic Fluid, Gear Oil, Metal Working Fluid, Transmission Fluid, Grease, Compressor Oil), Sector (Automotive & Industrial), and Region - Global Forecast to 2026

Updated on : September 02, 2025

Lubricating Oil Additives Market

The global lubricating oil additives market was valued at USD 18.2 billion in 2021 and is projected to reach USD 20.4 billion by 2026, growing at 2.3% cagr from 2021 to 2026. Lubricating oil additives are used to enhance the performance of finished lubricants. Several individual and combinations of additives are formulated to increase the performance of base stocks according to industry and OEM standards. Factors such as increasing demand from the automotive and industrial sector are the major driving factors of the market. Whereas drive towards alternative fuels, rising competition from unorganized and fragmented market, and reduction in the use of metal parts by automakers are the major restraints for the lubricating oil additives. Increasing demand for renewable energy is a major opportunity. APAC is the key market for lubricating oil additives, globally, in terms of value. It is also the fastest-growing region in the lubricating oil additives market. Whereas North America is the second-largest market for lubricating oil additives, globally, in terms of value, followed by Europe.

Attractive Opportunities in the Lubricating Oil Additives Market

To know about the assumptions considered for the study, Request for Free Sample Report

Lubricating Oil Additives Market Dynamics

Driver: Demand for improved quality of industrial lubricants

The demand for improved quality of industrial lubricants acts as a major driver for the lubricating oil additives market. Higher quality products that can sustain under extreme temperatures and pressures are preferred by consumers primarily due to their extended durability and shelf life and improved performance of machinery and equipment. Most industrial lubricant manufacturers focus on the development of products that are anti-foaming, anti-oxidant, waterproof, rust-preventive, and non-toxic. There is a rising demand for quality industrial lubricants from the developing countries of Europe and North America. The use of high-quality industrial lubricants is cost-saving, as it reduces the frequency of replacing the lubricants.

Restraints: Drive towards alternative fuels

Global warming is a worldwide concern associated with the use of petroleum products. According to the Union of Concerned Scientists, collectively, cars and trucks account for approximately one-fifth of all US emissions, emitting approximately 24 pounds of carbon dioxide and other global-warming gases for every gallon of gas used. This has resulted in the development of various types of alternative fuels that can replace gasoline and lower environmental pollution. According to the U.S. Department of Energy, natural gas emits approximately 6% to 11% lower levels of GHGs than gasoline throughout the fuel lifecycle.

Opportunities: Increasing demand for renewable energy

The power industry is a large consumer of industrial lubricants and additives. The renewable energy sector is a steadily growing segment of the power generation industry. Currently, electricity generation by wind has been increasing at a greater pace because of concerns over the cost of petroleum and the effects of fossil fuel combustion on the climate and environment. According to the U.S. Energy Information Administration, wind energy was the source of 7% of the total US electricity generation. According to the International Renewable Energy Agency, globally installed wind-generation capacity offshore and onshore increased by nearly 75% during the past two decades and reached approximately 564 GW in 2018 from 7.5 gigawatts in 1997. Due to this, the number of wind turbines requiring lubricants for optimum operability is increasing. These turbines are being installed in remote and offshore locations. Thus, performance is paramount, as any gearbox or bearing failure could lead to a complex process difficult to resolve. Thus, with the rising number of wind turbines and improving gearbox and bearing technologies, the use of advanced lubrication is also increasing, leading to an increase in the demand for lubricant oil additives.

Challenges: Rising demand for hybrid and electric vehicles

A hybrid car is one that uses more than one means of propulsion such as combining a petrol or diesel engine with an electric motor for optimum power utilization and reduced CO2 emissions, whereas electric vehicles or BEVs use electricity stored in battery packs to power electric motors and turn wheels. The increasing number of hybrid vehicles is expected to reduce the demand for lubricants per vehicle by nearly half as per industry experts, which, in turn, is expected to reduce the demand for lubricant oil additives. Growing environmental concerns and policies to reduce the amount of pollution from vehicles is boosting the sale of hybrid and electric vehicles. France is set to ban all gasoline and diesel vehicles by 2040, and Mexico City has also announced plans to ban all diesel cars and vans by 2025.

“Anti-oxidants is estimated to be the fastest-growing type in the lubricating oil additives market between 2021 and 2026.”

Anti-oxidants are used as additives in lubricants for preventing degradation over time. Anti-oxidants help inhibit the oxidation process of oils as the mineral oils react with the oxygen of air forming organic acid. Some of the oxidation products such as peroxide, alcohols, acids, esters, aldehydes, and ketones increase the viscosity of oil, form sludge and varnish, and corrode the metallic parts that are prone to oxidation. Therefore, anti-oxidants are additives that help increase the oxidative resistance of base oil and also allow the lubricants to operate effectively at higher temperatures. The anti-oxidants used as additives are zinc dithiophosphate (ZDP), alkyl sulfides, aromatic sulfides, aromatic amines, and hindered phenols.

“Engine oil was the largest application for lubricating oil additives market in 2020”

Engine oils additives are designed to protect passenger car engine, heavy duty diesel engine, marine diesel engine, motorcycle engine, recreational vehicle engine, power tool engine, stationary natural gas engine, and others from mechanical wear and corrosion. It helps to enhance the vehicle’s performance by improving fuel efficiency. It also offers excellent lubrication at different temperatures and reduces environmental impact. Global engine oil consumption is expected to increase during the forecast period, and the quantity of additives added is expected to increase to meet stringent environmental norms. This is expected to drive the growth of the market between 2021 and 2026.

“Industrial was the second largest sector for lubricating oil additives market in 2020”

In the industrial sector, lubricating oil additives are used to formulate lubricants for different industrial applications such as gear oils, process oils, general industrial oils, hydraulic fluids, metalworking fluids, and others. The lubricating oil additives are used to minimize wear, reduce friction, dissipate heat, and remove abrasive particles from lubricants. They also provide excellent performance at low temperature, improve lubricity and lower tendency to form residues and improve thermal and oxidation resistance. The finished industrial lubricants usually contain 5% to 10% of additives. These additives include dispersants, anti-oxidants, anti-wear agents, corrosion inhibitors, extreme pressure additives, friction modifiers, emulsifiers, and others.

“APAC is estimated to be the largest lubricating oil additives market in 2020, in terms of value”

APAC was the largest consumer of lubricating oil additives in 2020, in terms of value, and is projected to register the highest CAGR during the forecast period. The high economic growth in the emerging countries and the increasing disposable income of people make APAC an attractive market for lubricating oil additives. The tremendous growth of industrial production increased trade, and the rise in the number of vehicles are primarily responsible for the high consumption of lubricating oil additives in the region. Moreover, growing investments in India’s manufacturing sector contribute to the increased demand for lubricating oil additives in the region. China, Japan, and India are the major markets for lubricating oil additives in the region. Additionally, government regulations are influencing the lubricating oil additives market which is further expected to boost the demand for lubricating oil additives during the forecast period.

In November 2020, Evonik Industries AG opened a new oil additives performance testing lab in Shanghai China. This new performance testing lab aims to serve customers in China and Asia Pacific region, this will strengthen Evonik’s commitment to support customers with formulation development, lab testing and performance demonstration in real-world conditions.

To know about the assumptions considered for the study, download the pdf brochure

Europe is estimated to be the third-largest lubricating oil additives market during the forecast period.

Europe is one of the leading markets for lubricating oil additives. The key countries in the European market include Italy, Spain & UK, which together hold a significant share of the overall European market. The lubricating oil additives market in Europe is heavily regulated, with REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) closely monitoring and issuing guidelines to ensure a high level of protection for the environment and human health from the risks that can be posed by chemicals. With the implementation of stringent environmental regulations in the EU and growing demand for additives in the European market, the market is expected to perform moderately in the years to come. To maintain a mid SAPS level has also became crucial for the lubricant manufacturers in this region.

Lubricating Oil Additives Market Players

The key market players profiled in the report include Afton Chemical Corporation (US), The Lubrizol Corporation (US), Chevron Oronite Company LLC (US), Infineum International Limited (US), and Evonik Industries AG (Germany).

Recent Developments in Lubricating Oil Additives Market

- In September 2020, Chevron Oronite Company LLC signed an agreement with quantiQ for the distribution of OLOA lubricant additives, OGA gasoline additives, PARATONE viscosity additives, and raw material intermediates and components including PIBSA, inhibitors, detergents, dispersants, and other chemicals.

- In September 2018, Afton Chemical Corporation completed the expansion of its chemical additive manufacturing facility in Jurong Island, Singapore. This has helped it to strengthen its presence in the Asian market.

- In November 2020, Evonik Industries AG opened a new oil additives performance testing lab in Shanghai, China. This new performance testing lab aims to serve customers in China and the APAC region. This is expected to strengthen Evonik’s commitment to support customers with formulation development, lab testing, and performance demonstration in real-world conditions.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of lubricating oil additives?

Increasing demand from the automotive and industrial sector is driving the lubricating oil additives market

What are different type of major applications of lubricating oil additives?

It is classified into ten categories- viscosity index improvers, dispersants, detergent, anti-oxidants, anti-wear agent, rust & corrosion inhibitors, friction modifiers, extreme pressure additives, pour point depressants, and others.

What is the biggest Restraint for lubricant oil additives?

Rise in demand for alternate fuels and growth in demand of hybrid vehicles are the major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 LUBRICATING OIL ADDITIVES MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 LUBRICATING OIL ADDITIVES: MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 LUBRICATING OIL ADDITIVES: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.2.4 LUBRICATING OIL ADDITIVES: MARKET DEFINITION AND INCLUSIONS, BY SECTOR

1.3 MARKET SCOPE

1.3.1 LUBRICATING OIL ADDITIVES: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews – demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS /GROWTH FORECAST

2.4.1 SUPPLY-SIDE

2.4.2 DEMAND-SIDE

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 48)

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 SIGNIFICANT OPPORTUNITIES IN THE LUBRICATING OIL ADDITIVES MARKET

4.2 LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION

4.3 APAC LUBRICATING OIL ADDITIVES MARKET, BY TYPE AND COUNTRY

4.4 LUBRICATING OIL ADDITIVES MARKET SIZE, SECTOR AND REGION

4.5 LUBRICATING OIL ADDITIVES MARKET ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand from the automotive sector

5.2.1.2 Demand for improved quality of industrial lubricants

5.2.2 RESTRAINTS

5.2.2.1 Drive towards alternative fuels

5.2.2.2 Rising competition from unorganized and fragmented market

5.2.2.3 Reduction in the use of metal parts by automakers

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for renewable energy

5.2.3.2 Increasing market opportunities in developing economies

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in prices of crude oil

5.2.4.2 Rising demand for hybrid and electric vehicles

5.2.4.3 Expensive R&D process to formulate additive package in compliance with stringent environmental regulations

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

5.4.1 RAW MATERIALS

5.4.2 MANUFACTURING

5.4.3 DISTRIBUTION

5.4.4 END-USE INDUSTRIES

5.5 CONSORTIUM & ASSOCIATION

5.6 PATENT ANALYSIS

5.6.1 INTRODUCTION

5.6.2 APPROACH

5.6.3 DOCUMENT TYPE

5.6.4 INSIGHTS

5.6.5 LEGAL STATUS OF PATENTS

5.6.6 JURISDICTION ANALYSIS

5.6.7 TOP APPLICANTS

5.7 TRADE DATA

5.7.1 IMPORT SCENARIO OF LUBRICATING OIL ADDITIVES

5.7.2 EXPORT SCENARIO OF LUBRICATING OIL ADDITIVES

5.8 TECHNOLOGY ANALYSIS

5.9 AVERAGE SELLING PRICES OF LUBRICATING OIL ADDITIVES

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.10.1 REVENUE SHIFTS & REVENUE POCKETS FOR LUBRICATING OIL ADDITIVE MANUFACTURERS

5.11 ECOSYSTEM/ MARKET MAP

5.12 CASE STUDIES

5.12.1 A CASE STUDY ON LUBRIZOL’S MOTOR OIL ADDITIVES FOR GENERAL MOTORS

5.12.2 A CASE STUDY ON MERCEDES-BENZ ENGINE OILS

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON LUBRICATING OIL ADDITIVES MARKET

5.14 MACROECONOMIC INDICATOR

5.14.1 GDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

5.15 LUBRICATING OIL ADDITIVES: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

5.15.1 NON-COVID-19 SCENARIO

5.15.2 OPTIMISTIC SCENARIO

5.15.3 PESSIMISTIC SCENARIO

5.15.4 REALISTIC SCENARIO

5.16 COVID-19 IMPACT

5.16.1 INTRODUCTION

5.16.2 COVID-19 HEALTH ASSESSMENT

5.16.3 COVID-19 ECONOMIC ASSESSMENT

5.16.3.1 COVID-19 Impact on the Economy—Scenario Assessment

6 LUBRICATING OIL ADDITIVES MARKET, BY TYPE (Page No. - 90)

6.1 INTRODUCTION

6.2 VISCOSITY INDEX IMPROVERS

6.2.1 INCREASING CONSUMPTION IN AUTOMOTIVE INDUSTRY DRIVES DEMAND FOR VISCOSITY INDEX IMPROVERS

6.3 DISPERSANTS

6.3.1 GASOLINE ENGINES AND HEAVY-DUTY DIESEL ENGINES WILL DRIVE DEMAND FOR DISPERSANTS

6.4 DETERGENTS

6.4.1 MIDDLE EAST & AFRICA IS FASTEST-GROWING MARKET FOR DETERGENTS SEGMENT

6.5 ANTI-OXIDANTS

6.5.1 DEMAND FOR LONGER OPERATING LIFE OF ENGINE WILL DRIVE THE MARKET FOR ANTI-OXIDANTS

6.6 ANTI-WEAR AGENT

6.6.1 ANTI-WEAR AGENTS PREVENT WEAR FROM SEIZURE OR SCUFFING OF METAL SURFACES

6.7 RUST & CORROSION INHIBITORS

6.7.1 RUST & CORROSION INHIBITORS PREVENTS RUST & RESINOUS BUILD-UP IN ENGINE

6.8 FRICTION MODIFIERS

6.8.1 FRICTION MODIFIERS ARE USED IN AUTOMATIC TRANSMISSION FLUIDS AND ENGINE OIL

6.9 EXTREME PRESSURE ADDITIVES

6.9.1 EXTREME PRESSURE ADDITIVES IMPROVE THE PERFORMANCE OF GEAR OILS

6.10 POUR POINT DEPRESSANTS (PPD)

6.10.1 APAC IS LARGEST MARKET FOR POUR POINT DEPRESSANTS

6.11 OTHERS

6.11.1 DEMAND FROM AUTOMOTIVE SECTOR TO DRIVE THE MARKET FOR OTHER LUBRICATING OIL ADDITIVES

7 LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION (Page No. - 114)

7.1 INTRODUCTION

7.2 ENGINE OIL

7.2.1 HIGH CONSUMPTION IN APAC AND EUROPE TO DRIVE THE MARKET

7.3 HYDRAULIC FLUID

7.3.1 HIGH DEMAND FROM NORTH AMERICA TO DRIVE THE MARKET IN HYDRAULIC FLUID APPLICATION

7.4 GEAR OIL

7.4.1 HIGH CONSUMPTION OF GEAR OIL IN DEVELOPED NATIONS DRIVING THE MARKET

7.5 METALWORKING FLUIDS

7.5.1 INDUSTRIAL SECTOR DRIVING LUBRICATING OIL ADDITIVES MARKET IN METALWORKING FLUIDS APPLICATION

7.6 TRANSMISSION FLUIDS

7.6.1 TRANSMISSION FLUIDS IS A MAJOR APPLICATION OF LUBRICATING OIL ADDITIVES

7.7 GREASE

7.7.1 HIGH CONSUMPTION OF GREASE IN DEVELOPING NATIONS IS DRIVING THE MARKET

7.8 COMPRESSOR OIL

7.8.1 DEMAND FOR COMPRESSOR OIL DRIVEN BY GROWING INDUSTRIAL SECTOR IN EMERGING ECONOMIES

7.9 OTHERS

7.9.1 DEVELOPMENT OF WIND POWER & HYDROPOWER O DRIVE DEMAND FOR TURBINE OIL SEGMENT

8 LUBRICATING OIL ADDITIVES MARKET, BY SECTOR (Page No. - 135)

8.1 INTRODUCTION

8.2 AUTOMOTIVE

8.2.1 HIGH CONSUMPTION IN APAC AND EUROPE TO DRIVE THE MARKET

8.3 INDUSTRIAL

8.3.1 HIGH DEMAND FROM APAC EXPECTED TO DRIVE THE MARKET IN THE INDUSTRIAL SECTOR

9 LUBRICATING OIL ADDITIVES MARKET, BY REGION (Page No. - 143)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY TYPE

9.2.2 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION

9.2.3 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY SECTOR

9.2.4 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY

9.2.4.1 US

9.2.4.1.1 Growth of the transportation industry to drive the lubricating oil additives market in the country

9.2.4.2 Canada

9.2.4.2.1 The aviation industry is expected to boost the demand for lubricating oil additives in the country

9.2.4.3 Mexico

9.2.4.3.1 Rising industrialization to propel market growth

9.3 APAC

9.3.1 APAC: LUBRICATING OIL ADDITIVES MARKET, BY TYPE

9.3.2 APAC: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION

9.3.3 APAC: LUBRICATING OIL ADDITIVES MARKET, BY SECTOR

9.3.4 APAC: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY

9.3.4.1 China

9.3.4.1.1 The country’s economic growth is a major driver for the lubricating oil additives market

9.3.4.2 Japan

9.3.4.2.1 Demand from the automotive sector to drive the lubricating oil additives market in Japan

9.3.4.3 India

9.3.4.3.1 Rising industrialization to drive the lubricating additives market

9.3.4.4 Indonesia

9.3.4.4.1 Rising demand from mining and construction industries to drive the market

9.3.4.5 South Korea

9.3.4.5.1 Automotive and marine industries driving the market in South Korea

9.4 EUROPE

9.4.1 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY TYPE

9.4.2 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION

9.4.3 EUROPE: LUBRICATING OIL ADDITIVES MARKET, BY SECTOR

9.4.4 EUROPE LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY

9.4.4.1 Germany

9.4.4.1.1 Rising government investments offer opportunities for market growth

9.4.4.2 UK

9.4.4.2.1 Stringent environmental norms are among the major drivers for the growth of the market

9.4.4.3 Italy

9.4.4.3.1 Growth in the automotive industry propelling the market

9.4.4.4 Spain

9.4.4.4.1 Well-established automotive sector to drive the demand for lubricating oil additives in the country

9.5 MIDDLE EAST & AFRICA

9.5.1 MIDDLE EAST & AFRICA LUBRICATING OIL ADDITIVES MARKET, BY TYPE

9.5.2 MIDDLE EAST & AFRICA LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION

9.5.3 MIDDLE EAST & AFRICA LUBRICATING OIL ADDITIVES MARKET, BY SECTOR

9.5.4 MIDDLE EAST & AFRICA LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY

9.5.4.1 UAE

9.5.4.1.1 The lubricating oil additives market in the country is influenced by the increasing demand from the industrial and automotive sectors

9.5.4.2 Iran

9.5.4.2.1 Iran is the largest lubricating oil additives market in the Middle East & Africa

9.5.4.3 Turkey

9.5.4.3.1 Turkey is the third-largest lubricating oil additives market in the Middle East & Africa

9.6 SOUTH AMERICA

9.6.1 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY TYPE

9.6.2 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY APPLICATION

9.6.3 SOUTH AMERICA LUBRICATING OIL ADDITIVES MARKET, BY SECTOR

9.6.4 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET, BY COUNTRY

9.6.4.1 Brazil

9.6.4.1.1 Brazil is the largest lubricating oil additives market in South America

9.6.4.2 Argentina

9.6.4.2.1 Increasing vehicle sales to drive the market

10 COMPETITIVE LANDSCAPE (Page No. - 207)

10.1 INTRODUCTION

10.2 STRATEGIES ADOPTED BY KEY PLAYERS

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY LUBRICATING OIL ADDITIVE MANUFACTURERS

10.3 MARKET SHARE ANALYSIS

10.3.1 RANKING OF KEY MARKET PLAYERS

10.3.2 MARKET SHARE OF KEY PLAYERS, 2020

10.3.2.1 The Lubrizol Corporation

10.3.2.2 Chevron Oronite Company LLC

10.3.2.3 Afton Chemical Corporation

10.3.2.4 Infineum International Limited

10.3.2.5 Evonik Industries AG

10.3.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2016-2020

10.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

10.5 COMPANY EVALUATION QUADRANT (TIER 1)

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.6 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

10.6.1 PROGRESSIVE COMPANIES

10.6.2 DYNAMIC COMPANIES

10.6.3 STARTING BLOCKS

10.7 COMPETITIVE SITUATION AND TRENDS

10.7.1 PRODUCT LAUNCHES

10.7.2 DEALS

10.7.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 223)

11.1 MAJOR PLAYERS

11.1.1 BASF SE

11.1.1.1 Products offered

11.1.1.2 Recent developments

11.1.1.2.1 BASF SE: Other developments

11.1.1.3 MnM view

11.1.1.3.1 Key strengths/right to win

11.1.1.3.2 Strategic choices made

11.1.1.3.3 Weaknesses and competitive threats

11.1.2 CHEVRON ORONITE COMPANY LLC

11.1.2.1 Products offered

11.1.2.2 Recent developments

11.1.2.2.1 Chevron Oronite Company LLC: New product launches

11.1.2.2.2 Chevron Oronite Company LLC: Other developments

11.1.2.3 MnM view

11.1.2.3.1 Key strengths/right to win

11.1.2.3.2 Strategic choices made

11.1.2.3.3 Weaknesses and competitive threats

11.1.3 THE LUBRIZOL CORPORATION

11.1.3.1 Products offered

11.1.3.2 Recent developments

11.1.3.2.1 The Lubrizol Corporation: New product launches

11.1.3.3 MnM view

11.1.3.3.1 Key strengths/right to win

11.1.3.3.2 Strategic choices made

11.1.3.3.3 Weaknesses and competitive threats

11.1.4 AFTON CHEMICAL CORPORATION

11.1.4.1 Products offered

11.1.4.2 Recent developments

11.1.4.2.1 Afton Chemical Corporation: Other developments

11.1.4.3 MnM view

11.1.4.3.1 Key strengths/right to win

11.1.4.3.2 Strategic choices made

11.1.4.3.3 Weaknesses and competitive threats

11.1.5 EVONIK INDUSTRIES AG

11.1.5.1 Products offered

11.1.5.2 Recent developments

11.1.5.2.1 Chevron Oronite Company LLC: Other developments

11.1.5.3 MnM view

11.1.5.3.1 Key strengths/right to win

11.1.5.3.2 Strategic choices made

11.1.5.3.3 Weaknesses and competitive threats

11.1.6 LANXESS AG

11.1.6.1 Products offered

11.1.6.2 Recent developments

11.1.6.2.1 LANXESS AG: Deals

11.1.6.2.2 LANXESS AG: Other developments

11.1.6.3 MnM view

11.1.6.3.1 Key strengths/right to win

11.1.6.3.2 Strategic choices made

11.1.6.3.3 Weaknesses and competitive threats

11.1.7 CRODA INTERNATIONAL PLC

11.1.7.1 Products offered

11.1.7.2 MnM view

11.1.7.2.1 Key strengths/right to win

11.1.7.2.2 Strategic choices made

11.1.7.2.3 Weaknesses and competitive threats

11.1.8 INFINEUM INTERNATIONAL LIMITED

11.1.8.1 Products offered

11.1.8.2 MnM view

11.1.8.2.1 Key strengths/right to win

11.1.8.2.2 Strategic choices made

11.1.8.2.3 Weaknesses and competitive threats

11.1.9 ADEKA CORPORATION

11.1.9.1 Business overview

11.1.9.2 Products offered

11.1.9.3 MnM view

11.1.9.3.1 Right to win

11.1.9.3.2 Strategic choices made

11.1.9.3.3 Weaknesses and competitive threats

11.1.10 BRB INTERNATIONAL

11.1.10.1 Products offered

11.1.10.2 Recent developments

11.1.10.2.1 BRB International: Other developments

11.1.10.3 MnM view

11.1.10.3.1 Key strengths/right to win

11.1.10.3.2 Strategic choices made

11.1.10.3.3 Weaknesses and competitive threats

11.2 STARTUPS AND SMES

11.2.1 INTERNATIONAL PETROLEUM AND ADDITIVES COMPANY (IPAC)

11.2.2 TIANHE CHEMICALS

11.2.3 VANDERBILT CHEMICALS, LLC

11.2.4 MOL-LUB LTD.

11.2.5 ENI SPA

11.2.6 CLARIANT AG

11.2.7 JINZHOU KANGTAI LUBRICANT ADDITIVES CO., LTD.

11.2.8 EUROLUB GMBH

11.2.9 WUXI SOUTH PETROLEUM ADDITIVES CO., LTD.

11.2.10 DORF KETAL

11.2.11 CERION NANOMATERIALS

11.2.12 SHAMROCK SHIPPING AND TRADING LTD.

11.2.13 JINZHOU RUNDA CHEMICAL CO., LTD.

11.2.14 MIDCONTINENTAL CHEMICAL COMPANY

11.2.15 WYNN’S

12 ADJACENT & RELATED MARKETS (Page No. - 272)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 LUBRICANTS MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 LUBRICANTS MARKET

12.4.1 APAC

12.4.1.1 By country

12.4.1.2 By End-use

12.4.2 NORTH AMERICA

12.4.2.1 By country

12.4.2.2 By End-use

12.4.3 EUROPE

12.4.3.1 By country

12.4.3.2 By End-use

12.4.4 MIDDLE EAST & AFRICA

12.4.4.1 By Country

12.4.4.2 By End-use

12.4.5 SOUTH AMERICA

12.4.5.1 By Country

12.4.5.2 By End-use

13 APPENDIX (Page No. - 302)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (332 Tables)

TABLE 1 LUBRICATING OIL ADDITIVES MARKET: RISK ASSESSMENT

TABLE 2 RISE IN NUMBER OF MOTOR VEHICLES IN USE

TABLE 3 NUMBER OF NATURAL GAS VEHICLES (NGV) AND STATIONS IN 2019

TABLE 4 LUBRICATING OIL ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 LIST OF ASSOCIATION PROMOTING LUBRICATING OIL ADDITIVES

TABLE 6 GRANTED PATENTS ACCOUNT FOR 18% OF ALL PATENTS BETWEEN 2010 AND 2020

TABLE 7 TOP 10 PATENT OWNERS IN US, 2010-2020

TABLE 8 LUBRICATING OIL ADDITIVES IMPORTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 9 LUBRICATING OIL ADDITIVES EXPORTS, BY REGION, 2017-2020 (USD MILLION)

TABLE 10 AVERAGE SELLING PRICES OF LUBRICATING OIL ADDITIVES, BY REGION, (USD/KG)

TABLE 11 LUBRICATING OIL ADDITIVES MARKET: ECOSYSTEM

TABLE 12 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2018 – 2026 (USD BILLION)

TABLE 13 LUBRICATING OIL ADDITIVES MARKET: MARKET FORECAST SCENARIOS, 2018-2026 (USD MILLION)

TABLE 14 LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 15 LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 16 LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 17 LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 18 VISCOSITY INDEX IMPROVERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 VISCOSITY INDEX IMPROVERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 20 VISCOSITY INDEX IMPROVERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 21 VISCOSITY INDEX IMPROVERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 22 DISPERSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 DISPERSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 24 DISPERSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 25 DISPERSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 26 DETERGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 DETERGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 28 DETERGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 29 DETERGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 30 ANTI-OXIDANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 ANTI-OXIDANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 32 ANTI-OXIDANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 33 ANTI-OXIDANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 34 ANTI-WEAR AGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 ANTI-WEAR AGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 36 ANTI-WEAR AGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 37 ANTI-WEAR AGENTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 38 RUST & CORROSION INHIBITORS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 RUST & CORROSION INHIBITORS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 RUST & CORROSION INHIBITORS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 41 RUST & CORROSION INHIBITORS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 42 FRICTION MODIFIERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 FRICTION MODIFIERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 44 FRICTION MODIFIERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 45 FRICTION MODIFIERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 46 EXTREME PRESSURE ADDITIVES: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 EXTREME PRESSURE ADDITIVES: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 48 EXTREME PRESSURE ADDITIVES: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 49 EXTREME PRESSURE ADDITIVES: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 50 POUR POINT DEPRESSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 POUR POINT DEPRESSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 POUR POINT DEPRESSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 53 POUR POINT DEPRESSANTS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 54 OTHERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 OTHERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 56 OTHERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 57 OTHERS: LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 58 LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 59 LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 60 LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 61 LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 62 LUBRICATING OIL ADDITIVES MARKET SIZE IN ENGINE OIL, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 LUBRICATING OIL ADDITIVES MARKET SIZE IN ENGINE OIL, BY REGION, 2020–2026 (USD MILLION)

TABLE 64 LUBRICATING OIL ADDITIVES MARKET SIZE IN ENGINE OIL, BY REGION, 2016–2019 (KILOTON)

TABLE 65 LUBRICATING OIL ADDITIVES MARKET SIZE IN ENGINE OIL, BY REGION, 2020–2026 (KILOTON)

TABLE 66 LUBRICATING OIL ADDITIVES MARKET SIZE IN HYDRAULIC FLUID, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 LUBRICATING OIL ADDITIVES MARKET SIZE IN HYDRAULIC FLUID, BY REGION, 2020–2026 (USD MILLION)

TABLE 68 LUBRICATING OIL ADDITIVES MARKET SIZE IN HYDRAULIC FLUID, BY REGION, 2016–2019 (KILOTON)

TABLE 69 LUBRICATING OIL ADDITIVES MARKET SIZE IN HYDRAULIC FLUID, BY REGION, 2020–2026 (KILOTON)

TABLE 70 LUBRICATING OIL ADDITIVES MARKET SIZE IN GEAR OIL, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 LUBRICATING OIL ADDITIVES MARKET SIZE IN GEAR OIL, BY REGION, 2020–2026 (USD MILLION)

TABLE 72 LUBRICATING OIL ADDITIVES MARKET SIZE IN GEAR OIL, BY REGION, 2016–2019 (KILOTON)

TABLE 73 LUBRICATING OIL ADDITIVES MARKET SIZE IN GEAR OIL, BY REGION, 2020–2026 (KILOTON)

TABLE 74 LUBRICATING OIL ADDITIVES MARKET SIZE IN METALWORKING FLUIDS, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 LUBRICATING OIL ADDITIVES MARKET SIZE IN METALWORKING FLUIDS, BY REGION, 2020–2026 (USD MILLION)

TABLE 76 LUBRICATING OIL ADDITIVES MARKET SIZE IN METALWORKING FLUIDS, BY REGION, 2016–2019 (KILOTON)

TABLE 77 LUBRICATING OIL ADDITIVES MARKET SIZE IN METALWORKING FLUIDS, BY REGION, 2020–2026 (KILOTON)

TABLE 78 LUBRICATING OIL ADDITIVES MARKET SIZE IN TRANSMISSION FLUIDS, BY REGION, 2016–2019 (USD MILLION)

TABLE 79 LUBRICATING OIL ADDITIVES MARKET SIZE IN TRANSMISSION FLUIDS, BY REGION, 2020–2026 (USD MILLION)

TABLE 80 LUBRICATING OIL ADDITIVES MARKET SIZE IN TRANSMISSION FLUIDS, BY REGION, 2016–2019 (KILOTON)

TABLE 81 LUBRICATING OIL ADDITIVES MARKET SIZE IN TRANSMISSION FLUIDS, BY REGION, 2020–2026 (KILOTON)

TABLE 82 LUBRICATING OIL ADDITIVES MARKET SIZE IN GREASE, BY REGION, 2016–2019 (USD MILLION)

TABLE 83 LUBRICATING OIL ADDITIVES MARKET SIZE IN GREASE, BY REGION, 2020–2026 (USD MILLION)

TABLE 84 LUBRICATING OIL ADDITIVES MARKET SIZE IN GREASE, BY REGION, 2016–2019 (KILOTON)

TABLE 85 LUBRICATING OIL ADDITIVES MARKET SIZE IN GREASE, BY REGION, 2020–2026 (KILOTON)

TABLE 86 LUBRICATING OIL ADDITIVES MARKET SIZE IN COMPRESSOR OIL, BY REGION, 2016–2019 (USD MILLION)

TABLE 87 LUBRICATING OIL ADDITIVES MARKET SIZE IN COMPRESSOR OIL, BY REGION, 2020–2026 (USD MILLION)

TABLE 88 LUBRICATING OIL ADDITIVES MARKET SIZE IN COMPRESSOR OIL, BY REGION, 2016–2019 (KILOTON)

TABLE 89 LUBRICATING OIL ADDITIVES MARKET SIZE IN COMPRESSOR OIL, BY REGION, 2020–2026 (KILOTON)

TABLE 90 LUBRICATING OIL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 91 LUBRICATING OIL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

TABLE 92 LUBRICATING OIL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (KILOTON)

TABLE 93 LUBRICATING OIL ADDITIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (KILOTON)

TABLE 94 LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 95 LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 96 LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 97 LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 98 LUBRICATING OIL ADDITIVES MARKET SIZE IN AUTOMOTIVE SECTOR, BY REGION, 2016–2019 (USD MILLION)

TABLE 99 LUBRICATING OIL ADDITIVES MARKET SIZE IN AUTOMOTIVE SECTOR, BY REGION, 2020–2026 (USD MILLION)

TABLE 100 LUBRICATING OIL ADDITIVES MARKET SIZE IN AUTOMOTIVE SECTOR, BY REGION, 2016–2019 (KILOTON)

TABLE 101 LUBRICATING OIL ADDITIVES MARKET SIZE IN AUTOMOTIVE SECTOR, BY REGION, 2020–2026 (KILOTON)

TABLE 102 LUBRICATING OIL ADDITIVES MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2016–2019 (USD MILLION)

TABLE 103 LUBRICATING OIL ADDITIVES MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2020–2026 (USD MILLION)

TABLE 104 LUBRICATING OIL ADDITIVES MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2016–2019 (KILOTON)

TABLE 105 LUBRICATING OIL ADDITIVES MARKET SIZE IN INDUSTRIAL SECTOR, BY REGION, 2020–2026 (KILOTON)

TABLE 106 LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 107 LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 108 LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 109 LUBRICATING OIL ADDITIVES MARKET SIZE, BY REGION, 2020–2026 (KILOTON)

TABLE 110 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 111 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 113 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 114 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 116 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 117 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 118 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 119 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 120 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 121 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 122 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 123 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 124 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 125 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 126 US: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 127 US: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 128 US: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 129 US: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 130 CANADA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 131 CANADA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 132 CANADA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 133 CANADA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 134 MEXICO: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 135 MEXICO: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 136 MEXICO: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 137 MEXICO: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 138 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 140 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 141 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 142 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 144 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 145 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 146 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 147 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 148 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 149 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 150 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 151 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 152 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 153 APAC: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 154 CHINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 155 CHINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 156 CHINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 157 CHINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 158 JAPAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 159 JAPAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 160 JAPAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 161 JAPAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 162 INDIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 163 INDIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 164 INDIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 165 INDIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 166 INDONESIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 167 INDONESIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 168 INDONESIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 169 INDONESIA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 170 SOUTH KOREA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 171 SOUTH KOREA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 172 SOUTH KOREA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 173 SOUTH KOREA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 174 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 175 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 176 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 177 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 178 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 179 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 180 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 181 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 182 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 183 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 184 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 185 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 186 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 187 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 188 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 189 EUROPE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 190 GERMANY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 191 GERMANY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 192 GERMANY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 193 GERMANY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 194 UK: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 195 UK: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 196 UK: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 197 UK: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 198 ITALY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 199 ITALY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 200 ITALY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 201 ITALY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 202 SPAIN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 203 SPAIN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 204 SPAIN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 205 SPAIN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 206 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 209 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 210 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 213 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 214 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 217 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 218 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 219 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 220 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 221 MIDDLE EAST & AFRICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020-2026 (KILOTON)

TABLE 222 UAE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 223 UAE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 224 UAE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 225 UAE: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 226 IRAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 227 IRAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 228 IRAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 229 IRAN: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 230 TURKEY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 231 TURKEY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 232 TURKEY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 233 TURKEY: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 234 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 235 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 236 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2016–2019 (KILOTON)

TABLE 237 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY TYPE, 2020–2026 (KILOTON)

TABLE 238 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 239 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 240 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2016–2019 (KILOTON)

TABLE 241 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY APPLICATION, 2020–2026 (KILOTON)

TABLE 242 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 243 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 244 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 245 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 246 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 247 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 248 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 249 SOUTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY COUNTRY, 2020–2026 (KILOTON)

TABLE 250 BRAZIL: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 251 BRAZIL: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 252 BRAZIL: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 253 BRAZIL: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 254 ARGENTINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (USD MILLION)

TABLE 255 ARGENTINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (USD MILLION)

TABLE 256 ARGENTINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2016–2019 (KILOTON)

TABLE 257 ARGENTINA: LUBRICATING OIL ADDITIVES MARKET SIZE, BY SECTOR, 2020–2026 (KILOTON)

TABLE 258 LUBRICATING OIL ADDITIVES MARKET: DEGREE OF COMPETITION

TABLE 259 LUBRICATING OIL ADDITIVES MARKET: APPLICATION FOOTPRINT

TABLE 260 LUBRICATING OIL ADDITIVES MARKET: COMPANY REGION FOOTPRINT

TABLE 261 LUBRICATING OIL ADDITIVES MARKET: NEW PRODUCT LAUNCHES (2018 TO 2021)

TABLE 262 LUBRICATING OIL ADDITIVES MARKET: DEALS (2018 TO 2021)

TABLE 263 LUBRICATING OIL ADDITIVES MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018 TO 2021)

TABLE 264 BASF SE: BUSINESS OVERVIEW

TABLE 265 CHEVRON ORONITE COMPANY LLC: BUSINESS OVERVIEW

TABLE 266 THE LUBRIZOL CORPORATION: BUSINESS OVERVIEW

TABLE 267 AFTON CHEMICAL CORPORATION: BUSINESS OVERVIEW

TABLE 268 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

TABLE 269 LANXESS AG: BUSINESS OVERVIEW

TABLE 270 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

TABLE 271 INFINEUM INTERNATIONAL LIMITED: BUSINESS OVERVIEW

TABLE 272 ADEKA CORPORATION.: BUSINESS OVERVIEW

TABLE 273 BRB INTERNATIONAL: BUSINESS OVERVIEW

TABLE 274 INTERNATIONAL PETROLEUM AND ADDITIVES COMPANY (IPAC): COMPANY OVERVIEW

TABLE 275 TIANHE CHEMICALS: COMPANY OVERVIEW

TABLE 276 VANDERBILT CHEMICALS, LLC: COMPANY OVERVIEW

TABLE 277 MOL-LUB LTD.: COMPANY OVERVIEW

TABLE 278 ENI SPA: COMPANY OVERVIEW

TABLE 279 CLARIANT AG: COMPANY OVERVIEW

TABLE 280 JINZHOU KANGTAI LUBRICANT ADDITIVES CO., LTD.: COMPANY OVERVIEW

TABLE 281 EUROLUB GMBH: COMPANY OVERVIEW

TABLE 282 WUXI SOUTH PETROLEUM ADDITIVES CO., LTD.: COMPANY OVERVIEW

TABLE 283 DORF KETAL: COMPANY OVERVIEW

TABLE 284 CERION NANOMATERIALS: COMPANY OVERVIEW

TABLE 285 SHAMROCK SHIPPING AND TRADING LTD.: COMPANY OVERVIEW

TABLE 286 JINZHOU RUNDA CHEMICAL CO., LTD.: COMPANY OVERVIEW

TABLE 287 MIDCONTINENTAL CHEMICAL COMPANY: COMPANY OVERVIEW

TABLE 288 WYNN’S: COMPANY OVERVIEW

TABLE 289 LUBRICANTS MARKET SIZE, BY REGION, 2016–2019 (KILOTON)

TABLE 290 LUBRICANTS MARKET SIZE, BY REGION, 2020-2025 (KILOTON)

TABLE 291 LUBRICANTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 292 LUBRICANTS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

TABLE 293 APAC: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 294 APAC: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 295 APAC: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 296 APAC: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 297 APAC: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 298 APAC: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

TABLE 299 APAC: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 300 APAC: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 301 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 302 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 303 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 304 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 305 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 306 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

TABLE 307 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 308 NORTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 309 EUROPE: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 310 EUROPE: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 311 EUROPE: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 312 EUROPE: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 313 EUROPE: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 314 EUROPE: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

TABLE 315 EUROPE: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 316 EUROPE: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 317 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 318 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 319 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 320 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 321 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 322 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

TABLE 323 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 324 MIDDLE EAST & AFRICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

TABLE 325 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (KILOTON)

TABLE 326 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (KILOTON)

TABLE 327 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 328 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY COUNTRY, 2020-2025 (USD MILLION)

TABLE 329 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 330 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (KILOTON)

TABLE 331 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 332 SOUTH AMERICA: LUBRICANTS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

LIST OF FIGURES (75 Figures)

FIGURE 1 LUBRICATING OIL ADDITIVES MARKET: RESEARCH DESIGN

FIGURE 2 BASE MARKET CALCULATION AND VALIDATION APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 – BOTTOM-UP (DEMAND SIDE)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – TOP-DOWN

FIGURE 6 LUBRICATING OIL ADDITIVES MARKET: DATA TRIANGULATION

FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY-SIDE

FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

FIGURE 9 VISCOSITY INDEX IMPROVERS TO BE LARGEST TYPE OF LUBRICATING OIL ADDITIVES

FIGURE 10 ENGINE OIL TO BE FASTEST-GROWING APPLICATION OF LUBRICATING OIL ADDITIVES

FIGURE 11 AUTOMOTIVE TO BE FASTEST-GROWING SECTOR OF LUBRICATING OIL ADDITIVES DURING THE FORECAST PERIOD

FIGURE 12 APAC ACCOUNTED FOR LARGEST SHARE OF LUBRICATING OIL ADDITIVES MARKET IN 2020

FIGURE 13 HIGH GROWTH EXPECTED IN EMERGING ECONOMIES DURING THE FORECAST PERIOD

FIGURE 14 APAC TO BE LARGEST LUBRICATING OIL ADDITIVES MARKET DURING THE FORECAST PERIOD

FIGURE 15 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN APAC

FIGURE 16 AUTOMOTIVE SECTOR TO DOMINATE LUBRICATING OIL ADDITIVES MARKET

FIGURE 17 INDIA TO BE FASTEST-GROWING LUBRICATING OIL ADDITIVES MARKET DURING THE FORECAST PERIOD

FIGURE 18 FACTORS IMPACTING THE LUBRICATING OIL ADDITIVES MARKET

FIGURE 19 GLOBAL: WIND ENERGY INSTALLED CAPACITY IN MEGAWATT (MW)

FIGURE 20 CRUDE OIL PRICES, 2016-2021

FIGURE 21 GLOBAL: ELECTRIC VEHICLE SALES, 2017-2019

FIGURE 22 LUBRICATING OIL ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 SUPPLY CHAIN OF LUBRICATING OIL ADDITIVES MARKET

FIGURE 24 PATENTS REGISTERED FOR LUBRICATING OIL ADDITIVES, 2010–2020

FIGURE 25 PATENT PUBLICATION TRENDS FOR LUBRICATING OIL ADDITIVES, 2010–2020

FIGURE 26 LEGAL STATUS OF LUBRICATING OIL ADDITIVE PATENTS

FIGURE 27 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

FIGURE 28 CHEVRON ORONITE COMPANY, LLC REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2010 AND 2020

FIGURE 29 LUBRICATING OIL ADDITIVES IMPORTS, BY KEY COUNTRIES, 2017–2020

FIGURE 30 LUBRICATING OIL ADDITIVES EXPORTS, BY KEY COUNTRIES, 2017–2020

FIGURE 31 AVERAGE SELLING PRICE, LUBRICATING OIL ADDITIVES, 2018-2026 (USD/KG)

FIGURE 32 REVENUE SHIFT FOR LUBRICATING OIL ADDITIVES MARKET

FIGURE 33 LUBRICATING OIL ADDITIVES MARKET: ECOSYSTEM

FIGURE 34 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 35 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 36 REVISED GDP FORECAST FOR SELECT G20 COUNTRIES IN 2021

FIGURE 37 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 38 ANTI-OXIDANTS PROJECTED TO BE FASTEST-GROWING SEGMENT DURING THE FORECAST PERIOD

FIGURE 39 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING MARKET FOR VISCOSITY INDEX IMPROVERS

FIGURE 40 NORTH AMERICA PROJECTED TO BE SECOND-LARGEST MARKET FOR DISPERSANTS

FIGURE 41 APAC IS PROJECTED TO BE LARGEST MARKET FOR DETERGENTS ADDITIVES DURING THE FORECAST PERIOD

FIGURE 42 APAC IS PROJECTED TO BE LARGEST MARKET FOR ANTI-OXIDANTS ADDITIVES BETWEEN 2021 AND 2026

FIGURE 43 APAC IS PROJECTED TO BE LARGEST MARKET FOR ANTI-WEAR AGENTS DURING THE FORECAST PERIOD

FIGURE 44 NORTH AMERICA IS PROJECTED TO BE SECOND-LARGEST MARKET FOR RUST & CORROSION INHIBITORS ADDITIVES

FIGURE 45 APAC IS PROJECTED TO BE LARGEST MARKET FOR FRICTION MODIFIERS ADDITIVES DURING THE FORECAST PERIOD

FIGURE 46 MIDDLE EAST & AFRICA PROJECTED TO BE FASTEST-GROWING MARKET FOR EXTREME PRESSURE ADDITIVES BETWEEN 2021 AND 2026

FIGURE 47 NORTH AMERICA PROJECTED TO BE SECOND-LARGEST MARKET FOR POUR POINT DEPRESSANTS DURING THE FORECAST PERIOD

FIGURE 48 APAC PROJECTED TO BE FASTEST-GROWING MARKET FOR OTHER TYPE OF LUBRICATING OIL ADDITIVES SEGMENT

FIGURE 49 ENGINE OIL TO BE LARGEST APPLICATION OF LUBRICATING OIL ADDITIVES DURING THE FORECAST PERIOD

FIGURE 50 APAC TO BE LARGEST LUBRICATING OIL ADDITIVES MARKET FOR ENGINE OIL APPLICATION

FIGURE 51 NORTH AMERICA TO BE SECOND-LARGEST LUBRICATING OIL ADDITIVES MARKET IN HYDRAULIC FLUID APPLICATION

FIGURE 52 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING LUBRICATING OIL ADDITIVES MARKET IN GEAR OIL APPLICATION

FIGURE 53 APAC TO BE LARGEST LUBRICATING OIL ADDITIVES MARKET IN METALWORKING FLUIDS APPLICATION

FIGURE 54 APAC TO BE LARGEST LUBRICATING OIL ADDITIVES MARKET IN TRANSMISSION FLUIDS APPLICATION

FIGURE 55 NORTH AMERICA IS ESTIMATED TO BE THE SECOND-LARGEST REGION FOR LUBRICATING OIL ADDITIVES MARKET IN GREASE APPLICATION IN 2021

FIGURE 56 APAC IS ESTIMATED TO BE THE LARGEST REGION FOR COMPRESSOR OIL APPLICATION IN THE LUBRICATING OIL ADDITIVES MARKET IN THE FORECAST PERIOD

FIGURE 57 NORTH AMERICA TO BE LARGEST LUBRICATING OIL ADDITIVES MARKET IN OTHER APPLICATIONS SEGMENT

FIGURE 58 AUTOMOTIVE TO BE LARGER CONSUMER OF LUBRICATING OIL ADDITIVES DURING THE FORECAST PERIOD

FIGURE 59 APAC TO BE LARGEST LUBRICATING OIL ADDITIVES MARKET IN AUTOMOTIVE SECTOR

FIGURE 60 MIDDLES EAST & AFRICA IS FASTEST-GROWING LUBRICATING OIL ADDITIVES MARKET IN INDUSTRIAL SECTOR

FIGURE 61 APAC TO BE THE FASTEST-GROWING LUBRICATING OIL ADDITIVES MARKET DURING THE FORECAST PERIOD

FIGURE 62 NORTH AMERICA: LUBRICATING OIL ADDITIVES MARKET SNAPSHOT

FIGURE 63 APAC: LUBRICATING OIL ADDITIVES MARKET SNAPSHOT

FIGURE 64 EUROPE: LUBRICATING OIL ADDITIVES MARKET SNAPSHOT

FIGURE 65 RANKING OF TOP FIVE PLAYERS IN THE LUBRICATING OIL ADDITIVES MARKET, 2020

FIGURE 66 LUBRICATING OIL ADDITIVES MARKET SHARE, BY COMPANY (2020)

FIGURE 67 REVENUE ANALYSIS OF KEY COMPANIES FOR THE PAST FIVE YEARS

FIGURE 68 LUBRICATING OIL ADDITIVES MARKET: COMPANY PRODUCT FOOTPRINT

FIGURE 69 LUBRICATING OIL ADDITIVES MARKET: TYPE FOOTPRINT

FIGURE 70 LUBRICATING OIL ADDITIVES MARKET: COMPANY EVALUATION QUADRANT, 2020

FIGURE 71 START-UP/SMES EVALUATION QUADRANT FOR LUBRICATING OIL ADDITIVES MARKET

FIGURE 72 BASF SE: COMPANY SNAPSHOT

FIGURE 73 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

FIGURE 74 LANXESS AG: COMPANY SNAPSHOT

FIGURE 75 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

The study involved four major activities to estimate the market size for lubricating oil additives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

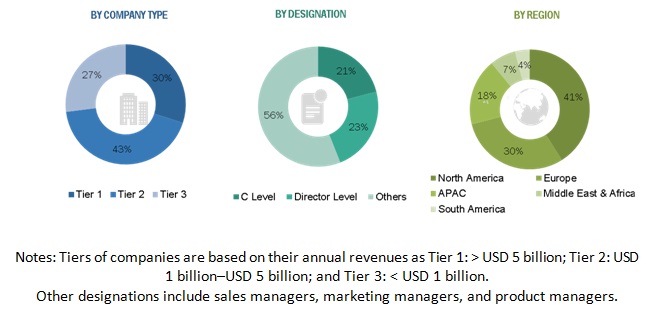

The lubricating oil additives market comprises several stakeholders such as raw material suppliers, manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use industries such as automotive, power generation, construction, and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the lubricating oil additives market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the lubricating oil additives market, in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities influencing the growth of the market

- To define, describe, and segment the lubricating oil additives market on the basis of type, application and sector

- To forecast the size of the market segments for regions such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To analyze competitive developments such as new product launch, expansion, merger & acquisition, and agreement in the lubricating oil additives market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lubricating Oil Additives Market