LTCC Market and HTCC Market by Process Type (LTCC, HTCC), Material Type (Glass-Ceramic, Ceramic), End-use Industry (Automotive, Telecommunications, Aerospace & Defense, Medical), Region (Asia Pacific, North America, Europe, MEA, LA) - Global Forecast to 2024

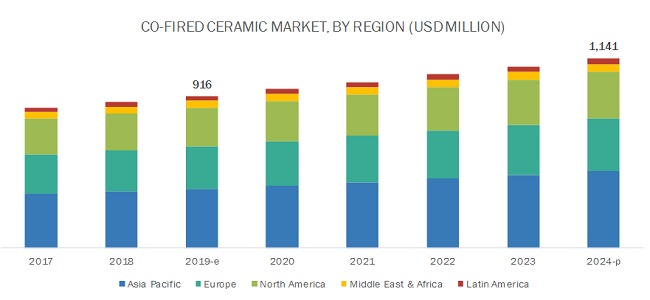

[119 Pages Report] The LTCC market and HTCC market is projected to grow from USD 916 million in 2019 to USD 1.1 billion by 2024, at a CAGR of 4.5 % between 2019 and 2024. The market is growing due to the high demand from the automotive, telecommunications, aerospace & defense, and medical end-use industries.

The automotive end-use industry is expected to witness high CAGR between 2019 and 2024

Co-fired ceramics are finding increasing application in the automotive segment. This growing use of co-fired ceramic in the automotive industry is mainly due to the demand for high performance and compact electronic components. The co-fired ceramic is used in the form of LTCC and HTCC in various applications in the automotive industry. The co-fired ceramic is used widely in engine control units, transmission control units, electronic power steering, engine management system, antilock brake systems, airbag control modules, LEDs (automotive lighting), entertainment & navigation systems, pressure control modules, pressure sensor, radar modules, and various sensor modules in vehicles.

LTCC segment is projected to account for a significant share in the overall LTCC market and HTCC market during the forecast period.

The LTCC process segment dominated the LTCC market and HTCC market. This is due to the high demand for LTCC components in automotive, telecommunications, aerospace & defense, medical industries. The LTCC process allows metallization with conductive materials such as silver, gold, and copper at a lower temperature compared to the HTCC process. The LTCC process offers properties such as low-loss of electric signals, high component density, increased functionality, excellent stability, and reliability.

Asia Pacific is expected to lead the LTCC market and HTCC market during the forecast period.

Asia Pacific is the largest and the fastest-growing LTCC market and HTCC market. The automotive and telecommunications are the major consumers of co-fired ceramic in the region. Presence of a large number of co-fired ceramic manufacturers makes the region the most important market for co-fired ceramic. The growth is also attributed to the high demand for co-fired ceramic in the automotive, telecommunications, industrial, consumer electronics, and aerospace & defense end-use industries. The continuous rise in the manufacturing of technologically advanced electronic products has resulted in high demand for co-fired ceramic in the region. This increasing demand for technologically advanced electronic products for use in various applications has led to innovations and developments in the electronics industry of Asia Pacific region.

Some of the key players in the LTCC market and HTCC market are KYOCERA Corporation (Japan), DowDuPont Inc. (US), Murata Manufacturing Co., Ltd. (Japan), KOA Corporation (Japan), Hitachi Metals, Ltd. (Japan), Yokowo Co., Ltd. (Japan), NGK SPARK PLUG CO., LTD. (Japan), MARUWA Co., Ltd. (Japan), Micro Systems Technologies (Switzerland), TDK Corporation (Japan), and NIKKO COMPANY (Japan). The key strategies adopted by the major players for enhancing their business revenue are new product developments, partnerships, and acquisition.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Process Type, Material Type, End-use Industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and Latin America |

|

Companies |

KYOCERA Corporation (Japan), DowDuPont Inc. (US), Murata Manufacturing Co., Ltd. (Japan), KOA Corporation (Japan), TDK Corporation (Japan), Hitachi Metals, Ltd. (Japan), Yokowo Co., Ltd. (Japan), NGK SPARK PLUG CO., LTD. (Japan), MARUWA Co., Ltd. (Japan), Micro Systems Technologies (Switzerland), and NIKKO COMPANY (Japan) |

This research report categorizes the LTCC market and HTCC marketbased on process type, material type, end-use industry, and region.

Based on Process Type, the LTCC market and HTCC markethas been segmented as follows:

- LTCC (Low-Temperature Co-Fired Ceramic)

- HTCC (High-Temperature Co-Fired Ceramic)

Based on Material Type, the LTCC market and HTCC markethas been segmented as follows:

- Glass-ceramic

- Ceramic

Based on End-User Industry, the LTCC market and HTCC markethas been segmented as follows:

- Automotive

- telecommunications

- Aerospace & Defense

- Medical

- Others (Industrial, and Consumer Electronics)

Based on the Region, the LTCC market and HTCC markethas been segmented as follows:

- Asia Pacific (APAC)

- North America

- Europe

- Middle East & Africa (MEA)

- Latin America

Recent Developments

- In June 2018, KYOCERA Corporation developed a new ultra-small robust ceramic UHF RFID Tag for tracing surgical instruments for the medical market. The product is made up of LTCC with an embedded antenna which helps in withstanding high temperatures up to 5432-degree Fahrenheit. The product helps in faster checkup in an operation theater that helps in saving time and cost. Thus, increasing the demand for LTCC.

- In May 2017, KYOCERA Corporation developed an ultra-small ceramic package, utilizing a proprietary multilayer structure with a built-in RFID antenna. These RFID packages consist of Low-Temperature Co-Fired Ceramic (LTCC), which helps in giving low-loss and high-frequency benefits. This product has increased its demand for a wide range of products, thus resulting in the expansion of the LTCC market and HTCC market.

- In July 2017, KYOCERA Corporation acquired VIA Electronic GmbH which helped the KOA Corporation to extend its LTCC market and HTCC market. This acquisition made KOA Corporation efficient in providing customized LTCC multilayer substrates. Thus, this acquisition helped the company to get market recognition due to the production of high product quality and process stability.

- In December 2015, Hitachi Metals, Ltd. developed a ceramic package substrate that enhances data processing capability ten times higher in information technology equipment. The Internet of things has driven the demand for technology, which requires an LTCC substrate to improve its performance. This ceramic package can form thin film layers which have excluded the use of silicon interposer, and a process step from the flow. These benefits result in the low cost of manufacturing.

Key Questions Addressed by the Report

- Which are the major end-use industries of co-fired ceramic?

- Which process type is majorly used in co-fired ceramic?

- Which material type is majorly used in co-fired ceramic?

- Which largest and fastest-growing regional LTCC market and HTCC market?

- What are the major strategies adopted by leading market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 LTCC Market and HTCC Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Key Industry Insights

2.1.3.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the LTCC Market and HTCC Market

4.2 LTCC Market and HTCC Market, By End-Use Industry and Region

4.3 LTCC Market and HTCC Market, By Process Type

4.4 LTCC Market and HTCC Market, By Material Type

4.5 LTCC Market and HTCC Market, By Country

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Miniaturized and High-Performance Electronic Devices

5.2.1.2 Higher Demand for Ceramic Substrates Than Traditional Substrates in High-Frequency Applications

5.2.2 Restraints

5.2.2.1 Issues Related to Reparability

5.2.3 Opportunities

5.2.3.1 Growing Demand for Nanotechnology and High-End Computing Systems

5.2.4 Challenges

5.2.4.1 High Price of Raw Materials

5.3 Porters Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview and Key Trends (Page No. - 37)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Trends in Aerospace Industry

6.4 Trends in Automotive Industry

7 LTCC Market and HTCC Market, By Process Type (Page No. - 41)

7.1 Introduction

7.2 LTCC

7.2.1 LTCC is One of the Most Widely Used Co-Fired Ceramic Process Types

7.3 HTCC

7.3.1 HTCC Components Can Withstand Higher Radio Frequencies

8 LTCC Market and HTCC Market, By Material Type (Page No. - 47)

8.1 Introduction

8.2 Glass-Ceramic Material

8.2.1 Low Cost and High Performance of Glass-Ceramic Material are Driving the Market

8.3 Ceramic Material

8.3.1 High Performance in Extreme Temperature Increases the Demand for Ceramic Materials in the LTCC Market and HTCC Market

9 LTCC Market and HTCC Market, By End-Use Industry (Page No. - 52)

9.1 Introduction

9.2 Automotive

9.2.1 Ability to Sustain Harsh Environments is One of the Key Factors Enabling the Extensive Use of Co-Fired Ceramic in This Industry

9.3 Telecommunications

9.3.1 Growing Wireless Applications are Driving the Market in the Telecommunications End-Use Industry

9.4 Aerospace & Defense

9.4.1 High Strength Co-Fired Ceramic Materials are Used in the Aerospace & Defense Industry

9.5 Medical

9.5.1 Co-Fired Ceramic is Used in Hearing Aids and Pacemakers

9.6 Others

10 LTCC Market and HTCC Market, By Region (Page No. - 60)

10.1 Introduction

10.2 Asia Pacific

10.2.1 China

10.2.1.1 With the Worlds Largest Electronics Manufacturing Cluster, China is A Key LTCC Market and HTCC Market

10.2.2 Japan

10.2.2.1 Increasing Urbanization and Industrialization is Supporting the Market Growth

10.2.3 South Korea

10.2.3.1 Strong Focus on the Electronics Industry Growth is Driving the Market

10.2.4 Taiwan

10.2.4.1 Presence of Prominent Electronics Industry in Taiwan is Boosting the Market for Co-Fired Ceramics

10.2.5 Rest of Asia Pacific

10.3 Europe

10.3.1 Germany

10.3.1.1 The Growing Automotive Manufacturing Sector is Positively Impacting the Market

10.3.2 France

10.3.2.1 Presence of Industrial Hubs and High Level of Labor Productivity are Driving the Market

10.3.3 UK

10.3.3.1 The UK is A Lucrative Market for Co-Fired Ceramic Due to the Presence of Automotive Giants in the Country

10.3.4 Italy

10.3.4.1 The Growing Automotive and Industrial Sectors are Fostering the Market Growth

10.3.5 Poland

10.3.5.1 Presence of Automotive and Aviation Industry is Fueling the Market in Poland

10.3.6 Rest of Europe

10.4 North America

10.4.1 US

10.4.1.1 Stable Growth of the Consumer Electronics Industry is A Major Boost for the Market

10.4.2 Canada

10.4.2.1 Canada is the Second-Largest Market in North America Due to the Growing Telecommunications Industry

10.5 Middle East & Africa (MEA)

10.5.1 UAE

10.5.1.1 End-Use Industries Such as Telecommunications and Aerospace & Defense Generate High Demand for Co-Fired Ceramic

10.5.2 Saudi Arabia

10.5.2.1 Government Spending on Urban Development Projects is Driving the Market

10.5.3 Rest of Mea

10.6 Latin America

10.6.1 Brazil

10.6.1.1 The Fast-Growing Automotive Industry in the Country Offers High Growth Potential for the LTCC Market and HTCC Market

10.6.2 Mexico

10.6.2.1 The Growing Demand for Electronic Products is Expected to Help in the Market Growth

10.6.3 Rest of Latin America

11 Competitive Landscape (Page No. - 86)

11.1 Introduction

11.2 Competitive Leadership Mapping

11.2.1 Terminology/Nomenclature

11.2.1.1 Visionary Leaders

11.2.1.2 Dynamic Differentiators

11.2.1.3 Emerging Companies

11.2.1.4 Innovators

11.2.2 Strength of Product Portfolio

11.2.3 Business Strategy Excellence

11.2.4 Market Ranking

11.3 Competitive Scenario

11.3.1 New Product Development

11.3.2 Partnership

11.3.3 Acquisition

12 Company Profiles (Page No. - 92)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Kyocera Corporation

12.2 DowDuPont Inc.

12.3 Murata Manufacturing Co., Ltd.

12.4 KOA Corporation

12.5 Hitachi Metals, Ltd.

12.6 TDK Corporation

12.7 Yokowo Co., Ltd.

12.8 NGK Spark Plug Co., Ltd.

12.9 Maruwa Co., Ltd.

12.10 Micro Systems Technologies

12.11 Nikko Company

12.12 Other Companies

12.12.1 API Technologies Corp

12.12.2 ACX Corp.

12.12.3 Schenzhen Sunlord Electronics Co., Ltd.

12.12.4 SOAR Technology Co., Ltd.

12.12.5 Schott Electronic Packaging

12.12.6 ECRI Microelectronics

12.12.7 Selmic OY

12.12.8 Natel Engineering Co., Ltd.

12.12.9 Adtech Ceramics

12.12.10 Egide

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 114)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (73 Tables)

Table 1 LTCC Market and HTCC Market Size, 20172024

Table 2 Trends and Forecast of GDP, 20172024 (USD Billion)

Table 3 Number of New Airplane Deliveries, By Region, 2018-2037

Table 4 Automotive Production, Million Units (20172018)

Table 5 LTCC Market and HTCC Market Size, By Process Type, 20172024 (USD Million)

Table 6 LTCC Market and HTCC Market Size, By Process Type, 20172024 (Kiloton)

Table 7 LTCC Market Size for Co-Fired Ceramic, By Region, 20172024 (USD Million)

Table 8 LTCC Market Size for Co-Fired Ceramic, By Region, 20172024 (Kiloton)

Table 9 HTCC Market Size for Co-Fired Ceramic, By Region, 20172024 (USD Million)

Table 10 HTCC Market Size for Co-Fired Ceramic, By Region, 20172024 (Kiloton)

Table 11 LTCC Market and HTCC Market Size, By Material Type, 20172024 (USD Million)

Table 12 LTCC Market and HTCC Market Size, By Material Type, 20172024 (Kiloton)

Table 13 Glass-Ceramic Material Market Size for Co-Fired Ceramic, By Region, 20172024 (USD Million)

Table 14 Glass-Ceramic Material Market Size for Co-Fired Ceramic, By Region, 20172024 (Kiloton)

Table 15 Ceramic Material Market Size for Co-Fired Ceramic, By Region, 20172024 (USD Million)

Table 16 Ceramic Material Market Size for Co-Fired Ceramic, By Region, 20172024 (Kiloton)

Table 17 LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (USD Million)

Table 18 LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 19 LTCC Market and HTCC Market Size in Automotive End-Use Industry, By Region, 20172024 (USD Million)

Table 20 LTCC Market and HTCC Market Size in Automotive End-Use Industry, By Region, 20172024 (Kiloton)

Table 21 LTCC Market and HTCC Market Size in Telecommunications End-Use Industry, By Region, 20172024 (USD Million)

Table 22 LTCC Market and HTCC Market Size in Telecommunications End-Use Industry, By Region, 20172024 (Kiloton)

Table 23 LTCC Market and HTCC Market Size in Aerospace & Defense End-Use Industry, By Region, 20172024 (USD Million)

Table 24 LTCC Market and HTCC Market Size in Aerospace & Defense End-Use Industry, By Region, 20172024 (Kiloton)

Table 25 LTCC Market and HTCC Market Size in Medical End-Use Industry, By Region, 20172024 (USD Million)

Table 26 LTCC Market and HTCC Market Size in Medical End-Use Industry, By Region, 20172024 (Kiloton)

Table 27 LTCC Market and HTCC Market Size in Other End-Use Industries, By Region, 20172024 (USD Million)

Table 28 LTCC Market and HTCC Market Size in Other End-Use Industries, By Region, 20172024 (Kiloton)

Table 29 LTCC Market and HTCC Market Size, By Region, 20172024 (USD Million)

Table 30 LTCC Market and HTCC Market Size, By Region, 20172024 (Kiloton)

Table 31 Asia Pacific: LTCC Market and HTCC Market Size, By Country, 20172024 (USD Million)

Table 32 Asia Pacific: LTCC Market and HTCC Market Size, By Country, 20172024 (Kiloton)

Table 33 Asia Pacific: LTCC Market and HTCC Market Size, By Process Type, 20172024 (USD Million)

Table 34 Asia Pacific: LTCC Market and HTCC Market Size, By Process Type, 20172024 (Kiloton)

Table 35 Asia Pacific: LTCC Market and HTCC Market Size, By Material Type, 20172024 (USD Million)

Table 36 Asia Pacific: LTCC Market and HTCC Market Size, By Material Type, 20172024 (Kiloton)

Table 37 Asia Pacific: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (USD Million)

Table 38 Asia Pacific: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 39 Europe: LTCC Market and HTCC Market Size, By Country, 20172024 (USD Million)

Table 40 Europe: LTCC Market and HTCC Market Size, By Country, 20172024 (Kiloton)

Table 41 Europe: LTCC Market and HTCC Market Size, By Process Type, 20172024 (USD Million)

Table 42 Europe: LTCC Market and HTCC Market Size, By Process Type, 20172024 (Kiloton)

Table 43 Europe: LTCC Market and HTCC Market Size, By Material Type, 20172024 (USD Million)

Table 44 Europe: LTCC Market and HTCC Market Size, By Material Type, 20172024 (Kiloton)

Table 45 Europe: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (USD Million)

Table 46 Europe: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 47 North America: LTCC Market and HTCC Market Size, By Country, 20172024 (USD Million)

Table 48 North America: LTCC Market and HTCC Market Size, By Country, 20172024 (Kiloton)

Table 49 North America: LTCC Market and HTCC Market Size, By Process Type, 20172024 (USD Million)

Table 50 North America: LTCC Market and HTCC Market Size, By Process Type, 20172024 (Kiloton)

Table 51 North America: LTCC Market and HTCC Market Size, By Material Type, 20172024 (USD Million)

Table 52 North America: LTCC Market and HTCC Market Size, By Material Type, 20172024 (Kiloton)

Table 53 North America: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (USD Million)

Table 54 North America: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 55 MEA: LTCC Market and HTCC Market Size, By Country, 20172024 (USD Million)

Table 56 MEA: LTCC Market and HTCC Market Size, By Country, 20172024 (Kiloton)

Table 57 MEA: LTCC Market and HTCC Market Size, By Process Type, 20172024 (USD Million)

Table 58 MEA: LTCC Market and HTCC Market Size, By Process Type, 20172024 (Kiloton)

Table 59 MEA: LTCC Market and HTCC Market Size, By Material Type, 20172024 (USD Million)

Table 60 MEA: LTCC Market and HTCC Market Size, By Material Type, 20172024 (Kiloton)

Table 61 MEA: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (USD Million)

Table 62 MEA: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 63 Latin America: LTCC Market and HTCC Market Size, By Country, 20172024 (USD Million)

Table 64 Latin America: LTCC Market and HTCC Market Size, By Country, 20172024 (Kiloton)

Table 65 Latin America: LTCC Market and HTCC Market Size, By Process Type, 20172024 (USD Million)

Table 66 Latin America: LTCC Market and HTCC Market Size, By Process Type, 20172024 (Kiloton)

Table 67 Latin America: LTCC Market and HTCC Market Size, By Material Type, 20172024 (USD Million)

Table 68 Latin America: LTCC Market and HTCC Market Size, By Material Type, 20172024 (Kiloton)

Table 69 Latin America: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (USD Million)

Table 70 Latin America: LTCC Market and HTCC Market Size, By End-Use Industry, 20172024 (Kiloton)

Table 71 New Product Development, 20152018

Table 72 Partnership, 20152018

Table 73 Acquisition, 20152018

List of Figures (48 Figures)

Figure 1 LTCC Market and HTCC Market: Research Design

Figure 2 Market Size Estimation: Bottom-Up Approach

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 LTCC Market and HTCC Market: Data Triangulation

Figure 5 LTCC Process Type Accounted for the Largest Market Share in 2018

Figure 6 Glass-Ceramic Material Type Dominated the Co-Fired Ceramic Market in 2018

Figure 7 Automotive Was the Major End-Use Industry of Co-Fired Ceramic in 2018

Figure 8 China to Register the Highest CAGR in the LTCC Market and HTCC Market

Figure 9 Asia Pacific to Register the Highest CAGR

Figure 10 Growth Opportunities for LTCC Market and HTCC Market in Automotive Industry

Figure 11 Automotive Segment and Asia Pacific Accounted for the Largest Market Share

Figure 12 LTCC to Be the Dominating Segment of the LTCC Market and HTCC Market

Figure 13 Glass-Ceramic to Dominate the LTCC Market and HTCC Market

Figure 14 China to Be the Fastest-Growing LTCC Market and HTCC Market

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the LTCC Market and HTCC Market

Figure 16 LTCC Market and HTCC Market: Porters Five Forces Analysis

Figure 17 Trends and Forecast of GDP, 20182024 (USD Billion)

Figure 18 New Airplane Deliveries, By Region, 2018-2037

Figure 19 Automotive Production in Key Countries, Million Units (2017 vs 2018)

Figure 20 LTCC to Be the Widely Used Process Type for Co-Fired Ceramic

Figure 21 LTCC (Low Temperature Co-Fired Ceramic) Process

Figure 22 Asia Pacific to Register the Highest CAGR for LTCC Process Type

Figure 23 HTCC (High Temperature Co-Fired Ceramic) Process

Figure 24 Glass-Ceramic to Be the Widely Used Material Type for Co-Fired Ceramic

Figure 25 Asia Pacific to Register the Highest CAGR in the Glass-Ceramic Material Segment

Figure 26 Automotive to Be the Major End-Use Industry of Co-Fired Ceramic

Figure 27 Asia Pacific to Register the Highest CAGR in Automotive End-Use Industry

Figure 28 China to Grow at the Highest Growth Rate

Figure 29 Asia Pacific: LTCC Market and HTCC Market Snapshot

Figure 30 Europe: LTCC Market and HTCC Market Snapshot

Figure 31 North America: LTCC Market and HTCC Market Snapshot

Figure 32 Companies Adopted Acquisition, Partnership, and New Product Development as Key Growth Strategies Between 2015 and 2018

Figure 33 Co-Fired Ceramic (Global) Competitive Leadership Mapping, 2018

Figure 34 Kyocera Corporation: Company Snapshot

Figure 35 Kyocera Corporation: SWOT Analysis

Figure 36 DowDuPont: Company Snapshot

Figure 37 DowDuPont: SWOT Analysis

Figure 38 Murata Manufacturing: Company Snapshot

Figure 39 Murata Manufacturing: SWOT Analysis

Figure 40 KOA Corporation: Company Snapshot

Figure 41 KOA Corporation: SWOT Analysis

Figure 42 Hitachi Metals: Company Snapshot

Figure 43 Hitachi Metals: SWOT Analysis

Figure 44 TDK Corporation: Company Snapshot

Figure 45 Yokowo: Company Snapshot

Figure 46 NGK Spark Plug: Company Snapshot

Figure 47 Maruwa: Company Snapshot

Figure 48 Nikko Company: Company Snapshot

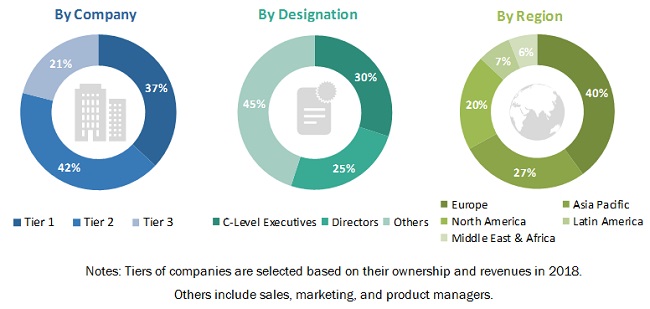

The study involved four major activities in estimating the current LTCC market size and HTCC market size. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of market segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The LTCC market and HTCC marketcomprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this marke is characterized by the development of various industries such as aerospace & defense, automotive, telecommunications, medical, and others. The supply side is characterized by advancements in technology across diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total LTCC market and HTCC marketsize. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation process, as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in aerospace & defense, automotive, telecommunications, medical, and other end-use industries.

Objectives of the Report

- To define, describe, and forecast the market size of co-fired ceramic, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide detailed information about the technological advancements influencing the growth of the market

- To forecast the market based on process type, material type, and end-use industry

- To define, describe, and forecast the market based on five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as acquisition, new product development, and partnership in the market

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Europe LTCC market and HTCC market

- Further breakdown of Rest of Asia Pacific LTCC market and HTCC market

- Further breakdown of Rest of Latin America LTCC market and HTCC market

- Further breakdown of Rest of MEA LTCC market and HTCC market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in LTCC Market