Low Migration Inks Market by Process (Gravure, Flexography, Off-Set, Digital), End-Use Industry (Food & Beverages, Pharmaceutical, Cosmetics), and Region (North America, Asia Pacific, Europe, Rest of the World) - Global Forecast to 2022

Low Migration Inks Market size is projected to reach USD 2.72 Billion by 2022, at a CAGR of 8.4% during the forecast period. In this study, 2016 has been considered as the base year, and 2017–2022 as the forecast period for estimating the market size of low migration inks.

Objectives of the Study:

- To analyze and forecast the low migration inks market, in terms of both volume and value

- To define, describe, and segment the low migration inks market by process and end-use industry

- To forecast the size of each market segment for various regions, such as Asia Pacific, North America, Europe, and the Rest of the world

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the low migration inks market

- To analyze competitive developments, such as expansions, mergers & acquisitions, contracts, agreements, and new product developments in the low migration inks market

- To strategically profile key players and comprehensively analyze their core competencies

Research Methodology:

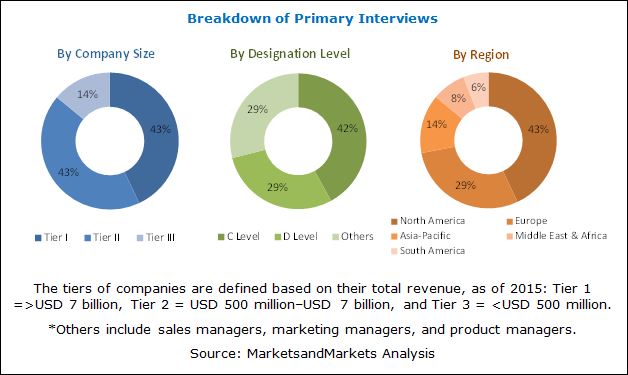

This study aims to estimate the market size for low migration inks market in 2017 and provide market forecast till 2022. It offers a detailed qualitative and quantitative analysis of the market. Various secondary sources, including the European Carton Makers Association (ECMA), European Food Standard Agency (EFSA), European Printing Ink Association Member of CEPE (EuPIA), and US Food and Drug Administration (FDA) have been referred to identify and collect information useful for an extensive and commercial study of the low migration inks market. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information, as well as to assess growth prospects of the low migration inks market.

To know about the assumptions considered for the study, download the pdf brochure

Low Migration Inks Market Ecosystem

Key manufacturers of low migration inks include Sun Chemical Corporation (US), Flint (Luxembourg), hubergroup Deutschland (Germany), Siegwerk Druckfarben (Germany), TOYO INK. (US), Agfa-Gevaert (Belgium), ALTANA (Germany), epple Druckfarben (Germany), and INX International Ink. (US). These manufacturers focus on improving their product portfolio and increasing their regional presence by adopting strategies such as new product development, mergers & acquisitions, expansions, and partnerships.

Key Target Audience

- Manufacturers of Low Migration Inks

- Traders, Distributors, and Suppliers of Low Migration Inks

- Regional Manufacturers' Associations for Low Migration Inks

- Government and Regional Agencies and Research Organizations

Scope of the Low Migration Inks Market report:

The low migration inks market has been classified into the following segments:

Based on Process:

- Gravure

- Flexography

- Off-set

- Digital

Based on End-Use Industry:

- Food & Beverage

- Pharmaceuticals

- Cosmetics

Based on Region:

- Asia Pacific

- North America

- Europe

- Rest of the World

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Product Analysis

Product Matrix that offers a detailed comparison of product portfolio of each company

- Regional Analysis

Further breakdown of a region with respect to a particular country

- Company Information

Detailed analysis and profiling of additional market players (up to five)

The low migration inks market is projected to reach USD 2.72 Billion by 2022 from USD 1.82 Billion in 2017, at a CAGR of 8.4% between 2017 and 2022. Migration of inks is a major issue in applications such as food, beverages, and cosmetics. Inks with high molecular weight are used for printing and labeling to avoid contamination in these products. Inks with high molecular weight using selected components are used for printing on food & beverage, pharmaceuticals, tobacco, and cosmetics packaging to ensure the accepted migration limits for suitable packaging structure. The growth of this market is mainly driven by the regulations for end-use industries such as food & beverages and pharmaceuticals.

The low migration inks market can be segmented on the basis of process such as gravure, flexography, off-set, and digital. These are majorly used in food & beverages, pharmaceuticals, and cosmetic packaging and labeling. Conventional inks tend to transfer from the print side to the packed side if there is absence of effective barrier. To avoid this, low migration inks are used. The migration of inks depends on many factors, such as the type of substrate on which these inks are used, packaging design, logistics, and printing processes used.

The flexography segment is expected to grow at the highest CAGR, in terms of both value and volume. The gravure process is dominant in Asia Pacific, but the trend is expected to change in this region in the coming years. Flexography is majorly used in regions such as Europe, North America, and South America. Owing to this, the flexography process segment is expected to grow at the highest CAGR. Flexography process is faster as compared to gravure and can be used on paper, plastics, pouches, and metal, among others. These advantages of flexography are expected to drive the low migration inks market in this segment.

Asia Pacific, Europe, and North America are the key low migration inks markets. The market in the Europe region is anticipated to grow at the highest CAGR between 2017 and 2022, in terms of both value and volume. This growth is mainly attributed to the increasing regulations in this region, especially on the food & beverages industry for packaging and labeling applications. Increasing awareness among end users due to contamination is further driving the demand for low migration inks in Europe and North America.

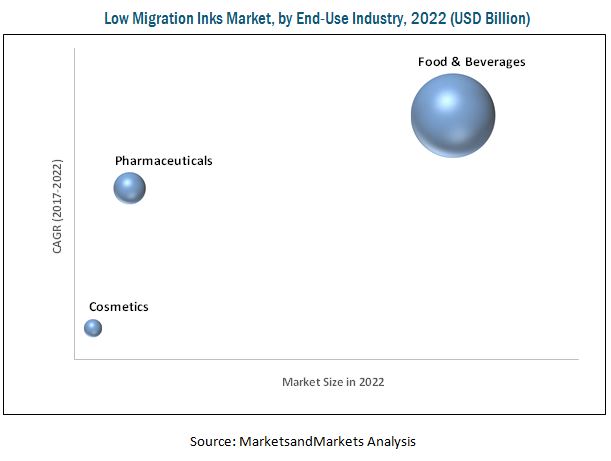

The food & beverages segment accounted for the largest share of the low migration inks market in 2016 and the trend is expected to continue during the forecast period. Various regulations for labeling and packaging on the food & beverages industry lead to the requirement of low migration inks. Owing to the regulations, printing manufacturers are now demanding low migration inks. This is expected to drive the market for low migration inks for food & beverages end-use segment.

The high prices of low migration inks over conventional inks act as a restraint for this market. Government regulations for use of inks in packaging and labeling applications for food & beverages and pharmaceuticals in regions such as Europe and North America act as a driver for this market. Sun Chemical Corporation (US), Flint (Luxembourg), hubergroup Deutschland (Germany), Siegwerk Druckfarben (Germany), TOYO INK. (US), Agfa-Gevaert (Belgium), ALTANA (Germany), epple Druckfarben (Germany), and INX International Ink. (US) are the leading companies in the low migration inks market. These companies are expected to account for a significant market share in the near future.

Frequently Asked Questions (FAQ):

How big is the Low Migration Inks Market ?

Low Migration Inks Market size is projected to reach USD 2.72 Billion by 2022, at a CAGR of 8.4% during the forecast period.

Who leading market players in Low Migration Inks Market?

Sun Chemical Corporation (US), Flint (Luxembourg), hubergroup Deutschland (Germany), Siegwerk Druckfarben (Germany), TOYO INK. (US), Agfa-Gevaert (Belgium), ALTANA (Germany), epple Druckfarben (Germany), and INX International Ink. (US) are the leading companies in the low migration inks market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in Low Migration Inks Market

4.2 Market, By Region

4.3 Market, By Process and Region

4.4 Market Attractiveness

4.5 Market, By End-USE Industry

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Government Regulations for Packaging and Labeling of Food and Beverages

5.2.1.2 Rising Demand for Lightweight Packaging for Food and Beverages

5.2.2 Restraints

5.2.2.1 High Cost of Low Migration Inks

5.2.3 Opportunities

5.2.3.1 Increasing USE of Low Migration Inks in Digital Printing Process

5.2.3.2 Personal Hygiene and Cosmetics Products to Be Subject to Stringent Regulations

5.2.4 Challenges

5.2.4.1 Hygiene Factors Affecting the Migration of Inks

5.2.4.2 Limited Availability of Raw Material and Its Fluctuating Cost

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.4.3 Outlook of Packaging and Printing Inks Industries

6 Low Migration Inks Market, By Process (Page No. - 37)

6.1 Introduction

6.2 Flexography Process

6.3 Gravure Process

6.4 Offset Process

6.5 Digital Process

7 Low Migration Inks Market, By End-USE Industry (Page No. - 43)

7.1 Introduction

7.2 Food & Beverage

7.3 Pharmaceutical

7.4 Cosmetic

8 Low Migration Inks, By Region (Page No. - 49)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 U.K.

8.3.3 France

8.3.4 Switzerland

8.3.5 Rest of Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 Rest of Asia-Pacific

8.5 Rest of the World (RoW)

8.5.1 Brazil

8.5.2 Saudi Arabia

8.5.3 UAE

8.5.4 Others

9 Competitive Landscape (Page No. - 75)

9.1 Introduction

9.2 Market Ranking Analysis

10 Company Profiles (Page No. - 77)

10.1 Sun Chemical Corporation

10.2 Siegwerk Druckfarben

10.3 Toyo Ink Europe

10.4 Flint

10.5 Agfa-Gevaert

10.6 Altana

10.7 Hubergroup Deutschland

10.8 Epple Druckfarben

10.9 Inx International Ink

10.10 Zeller+Gmelin

10.11 Other Companies

10.11.1 Durst

10.11.2 Hapa

10.11.3 Ruco Printing Inks

10.11.4 KAO Collins

10.11.5 T&K Toka

10.11.6 Nazdar

10.11.7 Wikoff Color Corporation

10.11.8 KAO Chimigraf

10.11.9 Epson America

10.11.10 Inks Dubuit

10.11.11 Fujifilm

10.11.12 HP

10.11.13 Marabu

10.11.14 Jänecke+Schneemann Druckfarben

10.11.15 Spgprints

11 Appendix (Page No. - 98)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (78 Tables)

Table 1 Trends and Forecast of GDP, 2016–2022 (USD Billion)

Table 2 Sales Volume of Inks in Europe, 2016 (Kiloton)

Table 3 Market Size, By Process, 2015–2022 (Kiloton)

Table 4 Low Migration Inks Market Size, By Process, 2015–2022 (USD Million)

Table 5 Low Migration Inks Market Size in Flexography Process, By Region, 2015–2022 (Kiloton)

Table 6 Market Size in Flexography Process, By Region, 2015–2022 (USD Million)

Table 7 Market Size in Gravure Process, By Region, 2015–2022 (Kiloton)

Table 8 Market Size in Gravure Process, By Region, 2015–2022 (USD Million)

Table 9 Market Size in Offset Process, By Region, 2015–2022 (Kiloton)

Table 10 Market Size in Offset Process, By Region, 2015–2022 (USD Million)

Table 11 Market Size in Digital Process, By Region, 2015–2022 (Kiloton)

Table 12 Market Size in Digital Process, By Region, 2015–2022 (USD Million)

Table 13 Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 14 Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 15 Market Size in Food & Beverage, By Region, 2015–2022 (Kiloton)

Table 16 Market Size in Food & Beverage, By Region, 2015–2022 (USD Million)

Table 17 Market Size in Pharmaceutical, By Region, 2015–2022 (Kiloton)

Table 18 Market Size in Pharmaceutical, By Region, 2015–2022 (USD Million)

Table 19 Market Size in Cosmetic, By Region, 2015–2022 (Kiloton)

Table 20 Market Size in Cosmetic, By Region, 2015–2022 (USD Million)

Table 21 Market Size, By Region, 2015–2022 (Kiloton)

Table 22 Market Size, By Region, 2015–2022 (USD Million)

Table 23 North America: Market Size, By Country, 2015–2022 (Kiloton)

Table 24 North America: Market Size, By Country, 2015–2022 (USD Million)

Table 25 North America: Market Size, By Process, 2015–2022 (Kiloton)

Table 26 North America: By Market Size, By Process, 2015–2022 (USD Million)

Table 27 North America: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 28 North America: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 29 U.S.: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 30 U.S.: Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 31 Canada: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 32 Canada: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 33 Mexico: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 34 Mexico: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 35 Europe: Market Size, By Country, 2015–2022 (Kiloton)

Table 36 Europe: By Market Size, By Country, 2015–2022 (USD Million)

Table 37 Europe: By Market Size, By Process, 2015–2022 (Kiloton)

Table 38 Europe: By Market Size, By Process, 2015–2022 (USD Million)

Table 39 Europe: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 40 Europe: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 41 Germany: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 42 Germany: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 43 U.K.: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 44 U.K.: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 45 France: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 46 France: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 47 Switzerland: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 48 Switzerland: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 49 Rest of Europe: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 50 Rest of Europe: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 51 Asia-Pacific: Market Size, By Country, 2015–2022 (Kiloton)

Table 52 Asia-Pacific: By Market Size, By Country, 2015–2022 (USD Million)

Table 53 Asia-Pacific: By Market Size, By Process, 2015–2022 (Kiloton)

Table 54 Asia-Pacific: By Market Size, By Process, 2015–2022 (USD Million)

Table 55 Asia-Pacific: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 56 Asia-Pacific: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 57 China: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 58 China: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 59 Japan: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 60 Japan: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 61 South Korea: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 62 South Korea: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 63 Rest of Asia Pacific: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 64 Rest of Asia Pacific: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 65 RoW: Market Size, By Country, 2015–2022 (Kiloton)

Table 66 RoW: By Market Size, By Region,2015–2022 (USD Billion)

Table 67 RoW: By Market Size, By Process, 2015–2022 (Kiloton)

Table 68 RoW: By Market Size, By Process, 2015–2022 (USD Million)

Table 69 RoW: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 70 RoW: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 71 Brazil: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 72 Brazil: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 73 Saudi Arabia: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 74 Saudi Arabia: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 75 UAE: Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 76 UAE: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

Table 77 Others: By Market Size, By End-USE Industry, 2015–2022 (Kiloton)

Table 78 Others: By Market Size, By End-USE Industry, 2015–2022 (USD Million)

List of Figures (23 Figures)

Figure 1 Low Migration Inks: Market Segmentation

Figure 2 Low Migration Inks Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Low Migration Inks Market: Data Triangulation

Figure 6 Food & Beverage to Be the Fastest-Growing End-USE Industry of Low Migration Inks Between 2017 and 2022

Figure 7 Flexography Process to Lead Low Migration Inks Market Between 2017 and 2022

Figure 8 Europe Dominated the Low Migration Inks Market in 2016

Figure 9 Low Migration Inks Market to Witness High Growth Rate Between 2017 and 2022

Figure 10 Europe to Be the Leading Low Migration Inks Market Between 2017 and 2022

Figure 11 Europe Accounted for the Largest Market Share in 2016

Figure 12 Europe to Be the Fastest-Growing Low Migration Inks Market Between 2017 and 2022

Figure 13 Food & Beverage to Account for the Largest Market Share Between 2017 and 2022

Figure 14 Drivers, Restraints, Opportunities, and Challenges in Low Migration Inks Market

Figure 15 Flexography to Be the Fastest-Growing Process in the Market Between 2017 and 2022

Figure 16 Food & Beverage to Be the Fastest-Growing End-USE Industry Between 2017 and 2022

Figure 17 Regional Snapshot (2017–2022): Rapidly Growing Markets are Emerging as New Hotspots

Figure 18 North America Market Snapshot: U.S. Dominates the Low Migration Inks Market

Figure 19 Europe Market Snapshot: Germany Dominates the Low Migration Inks Market

Figure 20 Market Ranking of Key Players, 2016

Figure 21 Siegwerk Druckfarben: Company Snapshot

Figure 22 Agfa-Gevaert: Company Snapshot

Figure 23 Altana: Company Snapshot

Growth opportunities and latent adjacency in Low Migration Inks Market