Flexographic Ink Market by Technology (Water, Solvent, and UV Based), Resin Type (Nitrocellulose, Polyamides, Polyurethane, Acrylic), Application (Corrugated Cardboards, Flexible Packaging, Tags & Labels, Folding Cartons) - Global Forecast to 2022

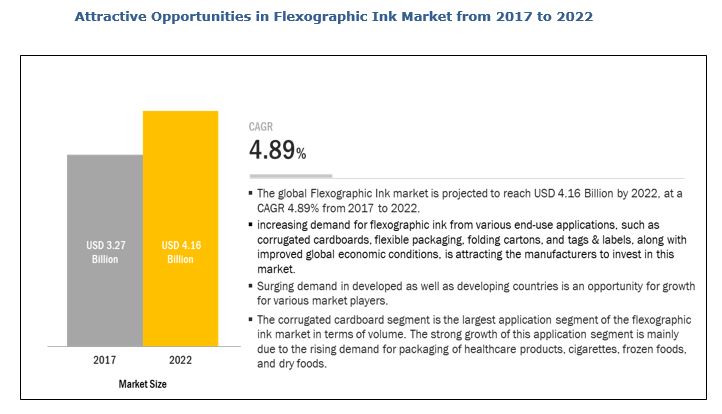

[137 Pages Report] The flexographic ink market is projected to grow from USD 3.27 Billion in 2017 to USD 4.16 Billion by 2022, at a CAGR of 4.89% during the forecast period. In this study, 2016 has been considered as the base year to estimate the size of the flexographic ink market. The base year considered for this study is 2016 and the forecast period is from 2017 to 2022.

In 2017, the Flexographic Ink market in the by technology, the water-based flexographic ink segment accounted for more than 50% share, in terms of volume, of the overall flexographic ink market in 2016. The water-based flexographic inks find applications in printing paper, corrugated cardboards, textiles, foils, plastics, and food packaging, as they offer advantages, such as less flammability, low VOC emissions, and stable viscosity during printing.

The corrugated cardboard segment is the largest application segment of the flexographic ink market in terms of volume. The strong growth of this application segment is mainly due to the rising demand for packaging of healthcare products, cigarettes, frozen foods, and dry foods.

Market Dynamics

Driver

Growing demand for printing ink from packaging industry

The demand for flexographic printing ink from packaging industry is increasing with the rising interest of packaging manufactures to develop attractive packaging. This leads to an increased demand for printing inks. According to the World Packaging Organization, the annual turnover of the packaging industry is estimated to be at around USD 500 billion in 2016.

The strong growth of the packaging industry is due to high demand from end-user industry, enabling product presentation & differentiation, competitive rivalry, and enhancement of the shelf-life of the product. The Packaging Industry which is main consumer of printing ink has witnessed a growth of approximately 12.5% annually. Rising demand for printing inks in packaging application products, such as tags and labels, flexible packaging, and folding cartons, is estimated to drive the global printing ink market.

Restraint

Mature market in developed countries

Packaging industry in developed economies such as North America, Europe and Japan is at mature phase of the market life cycle. There is minor scope for development in this region. Manufacturers tend to shift their production units in developing region as compared to developed economies to take advantage of untapped market.

According to industry experts, flexographic ink market in developed countries has saturated, and growing at lower growth rate as compared to other developing regions such as Asia-pacific and South America. The printing ink manufacturers are responding to the global competitive challenges by establishing production units in the developing countries, where the production cost very low.

The market for flexographic ink has been witnessing slow growth in the mature regions of the world is due to number of factors such as maximum penetration of packaging industry, reduced advertising in the traditional media due to the rise of electronic publishing, and growing demand of internet. This has been hampering the growth of flexographic ink market in developed countries.

Challenge

The balancing act: Lower cost and improve performance of flexographic ink

Flexographic ink manufacturers want to lower the cost of their production but need the same performance. The main expectation of ink manufacturers from resin suppliers are stable price support, better quality supply, sufficient quantity offer, and technical discussion/exchange.

Managing the ups and downs of raw material prices by flexographic ink manufacturers takes significant resources, which could be better spent on developing new opportunities with ink manufacturers.

The main challenges in the ink industry are to satisfy different quality requirements from each customer and to assist each customer; and finding the best ways to handle high raw material costs in a competitive resin market environment.

APAC is expected to grow at the highest CAGR during the forecast period.

Asia-Pacific is the fastest-growing flexographic ink market, registering a CAGR of 5.77%, in terms of volume, between 2017 and 2022. Presence of some of the fast-growing economies such as China, India, South Korea and rising demand for convenient packaging solutions are some of the factors responsible for the growth of flexographic ink Market in Asia-Pacific region. Rapidly increasing e-commerce market in the region also helped to grow flexible ink market in the Asia-Pacific. According to internet retailer, e-commerce growth in Asia-Pacific was USD 142.42 billion in 2014 and surged to USD 220 billion in 2015. This strong growth is driven by increased GDP, increasing standard of living, increased per capita income, rising upper middle-class populations. All these online orders require the flexible packaging to support the shipment.

Please visit 360Quadrants to see the vendor listing of Top 21 Flexible Packaging Companies, Worldwide 2023

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2015–2022 |

|

Base year considered |

2016 |

|

Forecast period |

2017–2022 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Flexographic Ink Market by Technology (Water, Solvent, and UV Based), Resin Type (Nitrocellulose, Polyamides, Polyurethane, Acrylic), Application (Corrugated Cardboards, Flexible Packaging, Tags & Labels, Folding Cartons) |

|

Geographies covered |

North America, Europe, APAC, MEA, and South America |

|

Companies covered |

DIC Corporation (Japan), Siegwerk Druckfarben AG & Co. KGaA (Germany), Toyo Ink SC Holdings Co., Ltd.(Japan), Sakata Inx Corporation (Japan), Flint Group (Luxembourg), T&K Toka Co. Ltd. (Japan), The Braden Sutphin Ink Company (US), Alden & Ott Printing Inks Company (US), Nazdar Company Inc. (US), and Color Resolutions International (US) |

This research report categorizes the flexographic ink market on the basis of resin type, technology, application, and region.

Flexographic ink market, by Resin Type:

- Polyurethanes

- Acrylic

- Polyamides

- Nitrocellulose

- Others

Flexographic ink market, by Technology:

- Water-based

- Solvent-based

- UV-curable

Flexographic ink market, by Application:

- Flexible Packaging

-

Rigid Packaging

- Corrugated Cardboards

- Folding Cartons

- Tags & labels

- Paper printing

Flexographic ink market, by Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

Key Market Players

The major players in the Flexographic Ink market are DIC Corporation (Japan), Siegwerk Druckfarben AG & Co. KGaA (Germany), Toyo Ink SC Holdings Co., Ltd. (Japan), Sakata Inx Corporation (Japan), Flint Group (Luxembourg), T&K Toka Co. Ltd. (Japan), The Braden Sutphin Ink Company (US), Alden & Ott Printing Inks Company (US), Nazdar Company Inc. (US), and Color Resolutions International (US).

Major strategies identified in the global market include the following:

- Expansions

- New product launches

- Acquisitions

- Agreements

Recent Developments

- In April 2016, Siegwerk launched the first LED UV flexographic inks which found application in food and pharmaceutical packaging applications.

- In March 2015, Toyo Ink SC Holdings Co., Ltd. has merged two of its own wholly-owned subsidiaries Toyo Ink Chemicals Taiwan Co., Ltd. and Toyo Ink Taiwan Co., Ltd. into a single operating entity.

- In February 2015, Toyo Ink SC Holdings Co., Ltd. has established the wholly-owned subsidiary Toyo Ink Turkey Kimya Sanayi A.ª. in Istanbul, Turkey. It started functioning from January 12, 2015. It incurred paid-in capital of USD 1.74 million.

Key Questions Addressed by the Report

- Who are the major market players in the Flexographic Ink market?

- What are the regional growth trends and the largest revenue-generating regions for the Flexographic Ink market?

- Which are the significant regions for different industries that are projected to witness remarkable growth for the Flexographic Ink market?

- What are the major types of Flexographic Ink that are projected to gain maximum market revenue and share during the forecast period?

- Which is the major application where Flexographic Ink are used that will be accounting for the majority of the revenue over the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.4 Year Considered for the Study

1.5 Currency

1.6 Package Size

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Flexographic Ink Market

4.2 Flexographic Ink Market, By Application

4.3 Flexographic Ink Market: Developed vs Developing Countries

4.4 Asia-Pacific Flexographic Ink Market, By Application and Country

4.5 India and China to Grow at Faster Rate in Flexographic Ink Market

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand for Flexographic Printing Ink From Packaging Industry

5.2.1.2 Increased Demand for UV-Curable Inks

5.2.1.3 New Ink Resin Technologies

5.2.2 Restraints

5.2.2.1 Mature Market in Developed Countries

5.2.2.2 Unstable Prices of Raw Materials

5.2.3 Opportunities

5.2.3.1 Water-Based Flexographic Ink Replacing Solvent-Based Inks

5.2.3.2 Growing Importance of UV-Curable Technology in Food Packaging

5.2.4 Challenges

5.2.4.1 Packaging and Printing Regulations

5.2.4.2 Shifting of Market From Print Media to Digital Media

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Porter’s Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

6.3 Patent Details

6.3.1 Introduction

6.3.2 Patent Details

7 Flexographic Ink Market, By Resin Type (Page No. - 44)

7.1 Introduction

7.2 Polyamides Resin

7.2.1 Reactive Polyamides

7.2.2 Non-Reactive Polyamides

7.2.2.1 Co-Solvent Polyamides

7.2.2.2 Alcohol Soluble Polyamides

7.2.3 Nitrocellulose

7.2.3.1 RS Nitrocellulose

7.2.3.2 SS Nitrocellulose

7.2.4 Polyurethane

7.2.5 Acrylic Resins

7.2.5.1 Acrylic Solution Resins

7.2.5.2 Acrylic Aqueous Emulsions

7.2.5.3 Acrylic Nad

7.2.5.4 Water-Based Inks

7.2.6 Other Resins

8 Flexographic Ink Market, By Technology (Page No. - 53)

8.1 Introduction

8.2 Water-Based Technology

8.3 Solvent Based Technology

8.4 UV-Curable Technology

9 Flexographic Ink Market, By Application (Page No. - 60)

9.1 Introduction

9.2 Flexible Packaging

9.3 Rigid Packaging

9.3.1 Corrugated Cardboard

9.4 Folding Cartons

9.5 Tags & Labels

9.6 Paper Printing

10 Flexographic Ink Market, By Region (Page No. - 67)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 China

10.2.2 Japan

10.2.3 India

10.2.4 South Korea

10.2.5 Vietnam

10.2.6 Thailand

10.2.7 Indonesia

10.2.8 Rest of Asia-Pacific

10.3 Europe

10.3.1 Germany

10.3.2 Russia

10.3.3 France

10.3.4 U.K.

10.3.5 Italy

10.3.6 Turkey

10.3.7 Spain

10.3.8 Rest of Europe

10.4 North America

10.4.1 U.S.

10.4.2 Canada

10.4.3 Mexico

10.5 Middle East & Africa

10.5.1 Iran

10.5.2 Saudi Arabia

10.5.3 Africa

10.5.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape (Page No. - 105)

11.1 Overview

11.2 New Product Launches

11.3 Partnerships

11.3.1 Partnerships, 2014–2016

11.4 Mergers & Acquisitions

11.5 Expansions

11.6 Market Share Analysis

12 Company Profiles (Page No. - 111)

12.1 DIC Corporation

12.1.1 Business Overview

12.1.2 Products Offered

12.1.3 Recent Developments

12.1.4 SWOT Analysis

12.1.5 MnM View

12.2 Siegwerk Druckfarben AG & Co. KGaA

12.2.1 Company Overview

12.2.2 Products Offered

12.2.3 Recent Developments

12.2.4 SWOT Analysis

12.2.5 MnM View

12.3 Toyo Ink SC Holdings Co., Ltd.

12.3.1 Business Overview

12.3.2 Products Offered

12.3.3 Recent Developments

12.3.4 SWOT Analysis

12.3.5 MnM View

12.4 Sakata Inx Corporation

12.4.1 Business Overview

12.4.2 Products Offered

12.4.3 Recent Developments

12.4.4 SWOT Analysis

12.4.5 MnM View

12.5 Flint Group

12.5.1 Business Overview

12.5.2 Products Offered

12.5.3 Recent Developments

12.5.4 SWOT Analysis

12.5.5 MnM View

12.6 T&K Toka Co. Ltd.

12.6.1 Business Overview

12.6.2 Products Offered

12.6.3 MnM View

12.7 The Braden Sutphin Ink Company

12.7.1 Business Overview

12.7.2 Products Offered

12.8 Alden & Ott Printing Inks Company

12.8.1 Business Overview

12.8.2 Products Offered

12.9 Nazdar Company Inc.

12.9.1 Business Overview

12.9.2 Products Offered

12.10 Color Resolutions International

12.10.1 Business Overview

12.10.2 Products Offered

12.11 Other Players

12.11.1 Gellner Industrial LLC.

12.11.2 Satish Chemicals

12.11.3 Zeen Enterprises

12.11.4 Rupa Colour Inks

12.11.5 Messe Düsseldorf GmbH

12.11.6 Shivam Inks

12.11.7 Monarch Color Corporation

12.11.8 Needham Inks Ltd.

12.11.9 Actega GmbH

12.11.10 Altana AG

12.11.11 American Inks and Coating Corp.

12.11.12 Colorcon Inc.

12.11.13 Cromos S.A. Tintas Graficas

12.11.14 E. I. Du Pont De Nemours And Co.

12.11.15 Fujifilm North America Corp.

12.11.16 Huber Group

12.11.17 Kao Chimigraf

12.11.18 Letong Chemical Co., Ltd.

12.11.19 Ruco Druckfarben A.M. Ramp & Co. GmbH

12.11.20 Sicpa SA

12.11.21 Tokyo Printing Ink Mfg. Co., Ltd

12.11.22 Wikoff Color Corp.

12.11.23 Xinxiang Wende Xiangchuan Printing Ink Co., Ltd

12.11.24 Zeller + Gmelin GmbH & Co. Kg

13 Appendix (Page No. - 130)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (98 Tables)

Table 1 Flexographic Ink Market Snapshot, 2017–2022

Table 2 Flexographic Ink Market, By Resin Type, 2015–2022 (KT)

Table 3 Flexographic Ink Market, By Resin Type, 2015–2022 (USD Million)

Table 4 Polyamide Resin Market Size, By Region, 2015–2022 (KT)

Table 5 Polyamide Resin Market Size, By Region, 2015–2022 (USD Million)

Table 6 Nitrocellulose Resin Market Size, By Region, 2015–2022 (KT)

Table 7 Nitrocellulose Resin Market Size, By Region, 2015–2022 (USD Million)

Table 8 Polyurethane Resin Market Size, By Region, 2015–2022 (KT)

Table 9 Polyurethane Resin Market Size, By Region, 2015–2022 (USD Million)

Table 10 Acrylic Resin Market Size, By Region, 2015–2022 (KT)

Table 11 Acrylic Resin Market Size, By Region, 2015–2022 (USD Million)

Table 12 Other Resins Market Size, By Region, 2015–2022 (KT)

Table 13 Other Resins Market Size, By Region, 2015–2022 (USD Million)

Table 14 Flexographic Ink Market Size, By Technology, 2015–2022 (KT)

Table 15 Flexographic Ink Market Size, By Technology, 2015–2022 (USD Million)

Table 16 Water-Based Technology: Flexographic Ink Market Size, By Region, 2015–2022 (KT)

Table 17 Water-Based Technology: Flexographic Ink Market Size, By Region, 2015–2022 (USD Million)

Table 18 Solvent-Based Technology: Flexographic Ink Market Size, By Region, 2015–2022 (KT)

Table 19 Solvent-Based Technology: Flexographic Ink Market Size, By Region, 2015–2022 (USD Million)

Table 20 UV-Curable Technology: Flexographic Ink Market Size, By Region, 2015–2022 (KT)

Table 21 UV-Curable Technology: Flexographic Ink Market Size, By Region, 2015–2022 (USD Million)

Table 22 Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 23 Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 24 Flexographic Ink Market Size in Flexible Packaging, By Region, 2015–2022 (KT)

Table 25 Flexographic Ink Market Size in Flexible Packaging, By Region, 2015–2022 (USD Million)

Table 26 Flexographic Ink Market Size in Corrugated Cardboard, By Region, 2015–2022 (KT)

Table 27 Flexographic Ink Market Size in Corrugated Cardboard, By Region, 2015–2022 (USD Million)

Table 28 Flexographic Ink Market Size in Folding Cartons, By Region, 2015–2022 (KT)

Table 29 Flexographic Ink Market Size in Folding Cartons, By Region, 2015–2022 (USD Million)

Table 30 Flexographic Ink Market Size in Tags & Labels, By Region, 2015–2022 (KT)

Table 31 Flexographic Ink Market Size in Tags & Labels, By Region, 2015–2022 (USD Million)

Table 32 Flexographic Ink Market Size, By Region, 2015–2022 (KT)

Table 33 Flexographic Ink Market Size, By Region, 2015–2022 (USD Million)

Table 34 Asia-Pacific: Flexographic Ink Market Size, By Country, 2017–2022 (KT)

Table 35 Asia-Pacific: Flexographic Ink Market Size, By Country, 2017–2022 (USD Million)

Table 36 China: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 37 China: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 38 Japan: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 39 Japan: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 40 India: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 41 India: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 42 South Korea: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 43 South Korea: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 44 Vietnam: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 45 Vietnam: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 46 Thailand: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 47 Thailand: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 48 Indonesia: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 49 Indonesia: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 50 Rest of Asia-Pacific: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 51 Rest of Asia-Pacific: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 52 Europe: Flexographic Ink Market Size, By Country, 2015–2022 (KT)

Table 53 Europe: Flexographic Ink Market Size, By Country, 2015–2022 (USD Million)

Table 54 Germany: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 55 Germany: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 56 Russia: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 57 Russia: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 58 France: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 59 France: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 60 U.K.: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 61 U.K.: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 62 Italy: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 63 Italy: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 64 Turkey: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 65 Turkey: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 66 Spain: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 67 Spain: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 68 Rest of Europe: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 69 Rest of Europe: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 70 North America: Flexographic Ink Market Size, By Country, 2015–2022 (KT)

Table 71 North America: Flexographic Ink Market Size, By Country, 2014–2021 (USD Million)

Table 72 U.S.: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 73 U.S.: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 74 Canada: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 75 Canada: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 76 Mexico: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 77 Mexico: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 78 Middle East & Africa: Flexographic Ink Market Size, By Country, 2015–2022 (KT)

Table 79 Middle East and Africa: Flexographic Ink Market Size, By Country, 2015–2022 (USD Million)

Table 80 Iran: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 81 Iran: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 82 Saudi Arabia: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 83 Saudi Arabia: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 84 Africa: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 85 Africa: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 86 Rest of Middle East & Africa: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 87 Rest of Middle East & Africa: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 88 South America: Flexographic Ink Market Size, By Country, 2015–2022 (KT)

Table 89 South America: Flexographic Ink Market Size, By Country, 2015–2022 (USD Million)

Table 90 Brazil: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 91 Brazil: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 92 Argentina: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 93 Argentina: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 94 Rest of South America: Flexographic Ink Market Size, By Application, 2015–2022 (KT)

Table 95 Rest of South America: Flexographic Ink Market Size, By Application, 2015–2022 (USD Million)

Table 96 New Product Launches, 2014–2016

Table 97 Mergers & Acquisitions, 2014–2016

Table 98 Expansions, 2014-2016

List of Figures (108 Figures)

Figure 1 Flexographic Ink Market Segmentation

Figure 2 Flexographic Ink Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Flexographic Ink Market: Data Triangulation

Figure 6 Research Assumptions

Figure 7 UV-Curable Technology to Register the Highest CAGR Between 2017 and 2022

Figure 8 Tags & Labels to Be the Fastest-Growing Application Between 2017 and 2022

Figure 9 Europe Was the Largest Market for Flexographic Ink in 2016

Figure 10 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players Between 2017 and 2022

Figure 11 Tags & Labels to Witness the Highest CAGR Between 2017 and 2022

Figure 12 Flexographic Ink Market to Register High CAGR in Developing Countries Than Developed Countries

Figure 13 Tags & Labels Accounted for the Largest Share in Asia-Pacific Flexographic Ink Market, in 2016

Figure 14 India is Projected to Register Highest CAGR During Forecast Period in the Flexographic Ink Market

Figure 15 Drivers, Restraints, Opportunities, and Challenges in the Flexographic Ink Market

Figure 16 Plastic Film Segment to Lead the Market for Flexible Plastic Packaging, By Material, 2017–2022 (USD Billion)

Figure 17 Stand-Up Pouches Segment to Lead the Market for Flexible Plastic Packaging, By Type, 2017–2022 (USD Billion)

Figure 18 Flexography Technology Projected to Account for the Largest Share in Flexible Plastic Packaging Through 2022

Figure 19 Food & Beverage Segment is Expected to Lead the Market for Flexible Plastic Packaging Through 2022

Figure 20 Asia-Pacific: Largest Market for Flexible Plastic Packaging in 2016

Figure 21 Developing Economies Offer Attractive Opportunities in the Flexible Plastic Packaging Market

Figure 22 Plastic Film Segment Dominated the Flexible Plastic Packaging Market in 2016

Figure 23 Stand-Up Pouches Segment to Grow at the Highest Rate in Flexible Plastic Packaging Market During the Forecast Period in Asia-Pacific

Figure 24 APAC Food & Beverage Segment to Record the Highest CAGR in Flexible Plastic Packaging Market From 2017 to 2022

Figure 25 Food & Beverage Segment Registered the Highest Demand for Flexible Plastic Packaging in the Asia-Pacific Market in 2016

Figure 26 Market in India is Projected to Grow at the Highest Rate in Flexible Plastic Packaging Market From 2017 to 2022

Figure 27 Flexible Plastic Packaging has Evolved Significantly Since Early 1800s

Figure 28 Flexible Plastic Packaging Market Dynamics

Figure 29 Food Consumption in the U.S.

Figure 30 Global Consumption of Butter, 2012–2020

Figure 31 Global Consumption of Cheese, 2012–2020

Figure 32 Growth Rate of Total Retail Sales of Consumer Goods in China, 2015

Figure 33 Urban Population Percentage in Emerging Countries

Figure 34 Flexible Plastic Packaging Market: Impact Analysis of Drivers and Restraints

Figure 35 Food & Beverage Segment is Projected to Account for the Largest Share in Corrugated Boxes Market By 2021

Figure 36 Asia-Pacific is Projected to Dominate the Global Corrugated Boxes Market By 2021

Figure 37 China is Projected to Grow at the Highest CAGR in Corrugated Boxes Market From 2016 to 2021

Figure 38 Flexography Printing for Corrugated Boxes is Projected to Dominate the Market By 2021

Figure 39 Key Market Players Adopted Mergers & Acquisitions as the Key Strategy in Corrugated Boxes Market From 2011 to 2016

Figure 40 Emerging Economies Offer Attractive Opportunities in the Corrugated Boxes Market

Figure 41 Flexography Printing is Estimated to Capture the Largest Share in the Emerging Asia-Pacific Market in 2016

Figure 42 China is Projected to Be the Fastest-Growing Country for Corrugated Boxes From 2016 to 2021

Figure 43 Asia-Pacific is Estimated to Occupy the Largest Market Share Among All Regions in 2016

Figure 44 Emerging Markets to Grow Faster Than Developed Markets, 2016-2021

Figure 45 Global Corrugated Boxes Market Snapshot, By End-Use Industry, 2016

Figure 46 Evolution of Corrugated Boxes

Figure 47 Corrugated Boxes Market Segmentation

Figure 48 Growing Demand From the Food & Beverage Sector is the Key Driver for the Corrugated Boxes Market

Figure 49 Annual Sales in Retail Food & Beverage Stores in the U.S., 2011-2015

Figure 50 Consumer Electronic Devices Market, 2012 vs 2015

Figure 51 Waste Generation, By Material, 2012

Figure 52 B2C E-Commerce Sales in the U.S., 2011-2014

Figure 53 Production of Bottles and Glassware in India, 2001-2005

Figure 54 Carbon Sequestered (Metric Ton of Co2 Equivalents) Per Wet Short Ton of Material Landfilled, 2012

Figure 55 Emerging Economies Offer Attractive Opportunities in the Security Labels Market

Figure 56 Branding Captured the Largest Share in the Emerging Asia-Pacific Market in 2015

Figure 57 China Projected to Be the Fastest-Growing Country for Security Labels During the Forecast Period

Figure 58 Europe Occupied the Largest Market Share , in Terms of Value, Among All Regions in 2014

Figure 59 Emerging Markets to Grow Faster Than Developed Markets, 2015–2020

Figure 60 Evolution of Security Labels

Figure 61 Market Segmentation

Figure 62 Drivers, Restraints, Opportunities, and Challenges

Figure 63 Global Retail E-Commerce Sales From 2013 to 2018

Figure 64 Manufacturing & Service Sectors Snapshot

Figure 65 Pharmaceutical Market Size From 2005 to 2014 (USD Billion)

Figure 66 Price Development for Paper and Plastic, 2007-2011

Figure 67 Growth in Global Vehicle Production From 2009 to 2014

Figure 68 Branding is Projected to Be the Fastest-Growing Market From 2015 to 2020

Figure 69 Bar Codes Segment is Estimated to Dominate the Security Labels Market in 2015

Figure 70 Facestock Segment is Estimated to Dominated the Market in 2015

Figure 71 Sheets Segment is Projected to Be the Fastest-Growing Market From 2015 to 2020

Figure 72 Food & Beverages Segment is Estimated to Dominate the Market in 2015

Figure 73 Global Laminated Labels Market Snapshot, By Application, 2015

Figure 74 Evolution of Laminated Labels

Figure 75 Laminated Label Market Segmentation

Figure 76 Market Dynamics

Figure 77 Leading FMCG Companies Sales in 2014

Figure 78 Revenue of the Worldwide Pharmaceuticals Market (2001-2014)

Figure 79 B2C E-Commerce Sales in the U.S. (2011-2014)

Figure 80 Production Output Index of Consumer Durables in the U.K. (2010-2014)

Figure 81 Price Development for Paper and Plastic (2007-2011)

Figure 82 Emerging Economies Offer Attractive Opportunities in the Laminated Label Market

Figure 83 Digital Printing Captured the Largest Share in the Emerging Asia-Pacific Market in 2015

Figure 84 China Projected to Be the Fastest-Growing Country for Laminated Labels From 2015 to 2020

Figure 85 Asia-Pacific Occupied the Largest Market Share Among All Regions in 2014

Figure 86 Emerging Markets to Grow Faster Than Developed Markets, 2015-2020

Figure 87 Japan Filed the Highest Number of Patents Between 2010 and 2016

Figure 88 Toyo Ink SC Holdings Co. Ltd. Registered the Highest Number of Patents Between 2014 and 2016

Figure 89 Acrylic Resin Dominates Flexographic Ink Market

Figure 90 Water-Based Flexographic Ink Dominates Flexographic Ink Market, By Technology, 2017–2022 (KT)

Figure 91 Tags & Labels to Register the Highest CAGR in Flexographic Ink Market, in Terms of Volume, Between 2017 and 2022

Figure 92 India is Emerging as the Leading Flexographic Ink Market

Figure 93 Asia-Pacific Market Snapshot: China Led the Asia-Pacific Flexographic Ink Market in 2016,

Figure 94 Europe Market Snapshot: Germany Accounts for the Largest Market Share in Europe,

Figure 95 North America Market Snapshot: Mexico is Projected to Register the Highest CAGR During Forecast Period

Figure 96 Companies Adopted New Product Launch and Expansion as the Key Growth Strategy Between 2014 and 2016

Figure 97 New Product Launches and Expansions Had the Highest Number of Strategic Developments in Flexographic Ink Market, 2014–2016

Figure 98 New Product Launches and Expansions Were the Key Strategies Between 2014 and 2016

Figure 99 DIC Corporation Was the Leading Player in Flexographic Ink Market in 2016

Figure 100 DIC Corporation: Company Snapshot

Figure 101 DIC Corporation: SWOT Analysis

Figure 102 Siegwerk Druckfarben AG & Co. KGaA: Company Snapshot

Figure 103 Siegwerk Druckfarben AG & Co. KGaA.: SWOT Analysis

Figure 104 Toyo Ink SC Holdings Co., Ltd.: Company Snapshot

Figure 105 Toyo Ink SC Holdings Co. Ltd.: SWOT Analysis

Figure 106 Sakata Inx Corporation: Company Snapshot

Figure 107 Sakata Inx Corporation: SWOT Analysis

Figure 108 Flint Group: SWOT Analysis

Growth opportunities and latent adjacency in Flexographic Ink Market

Flexographic Ink Market

Market data on global Flexographic printing process

General information on Flexographic Ink Market

Information on flexographic ink manufacturers from indias neighbouring countries like pakistan, nepal, bhutan, bangladesh

Digital ink market

Water, Solvent, and UV based Flexible Packaging, Tags & Labels, Folding Can. Nitrocellulose, Polyamides, Polyurethane, Acrylic inks