Liquid Ring Compressors Market by Type (Single-stage, Two-stage), Material Type (Stainless Steel, Cast Iron), Flow Rate (25 – 600 M3H; 600 – 3,000 M3H; 3,000 – 10,000 M3H; Over 10,000 M3H), Application, and Region - Global Forecast to 2026

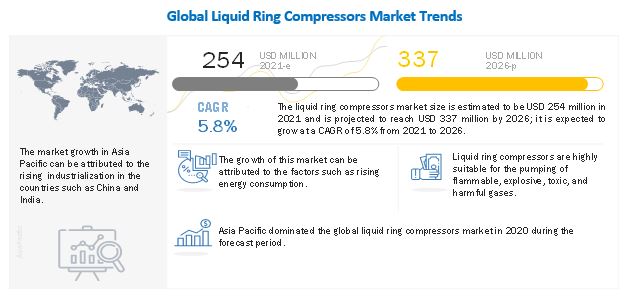

[185 Pages Report] The liquid ring compressors market size is estimated to be USD 254 million in 2021 and is projected to reach USD 337 million by 2026; it is expected to grow at a CAGR of 5.8% from 2021 to 2026, owing to an increase in demand of liquid ring compressors in oil & gas industry. In addition, the oil & gas segment accounted for the largest market share in terms of value, in 2020.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global liquid ring compressors market

The pandemic is estimated to have an impact on various factors of the value chain of the liquid ring compressors market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is seen on the various application segments of liquid ring compressors market.

Due to the pandemic, the demand for petroleum and petroleum products fell substantially as global economic activity halted. The decline in demand, combined with an unexpected rise in supply, resulted in a drop in crude oil prices, which had a subsequent effect on refined petroleum product prices. Also, for the years 2020 and 2021, the global petroleum demand was estimated to decline compared to 2019 levels. This, in turn, has affected the growth of the liquid ring compressors market in oil & gas industry. Moreover, the US has been adversely affected by the COVID-19 pandemic as compared to other countries across the globe. The growth of the liquid ring compressor market in the country is expected to be slow during the forecast period due to the impact of the pandemic.

Liquid ring compressors Market Dynamics

Driver: Low maintenance and operational cost

Liquid ring pumps can be employed for vacuum as well as compression jobs, which makes them popular across various industries. As with liquid, the pump uses its impeller to compress the gas. These pumps can be employed for applications such as vacuum distillation, moisture extraction, vacuum condensation, air or ash handling, evaporation, mineral beneficiation, and for separating water from paper pulp. Compared to other mechanical pumps, liquid ring compressors need minimal maintenance because they are driven by the liquid ring technology and have only one rotating part, the impeller, which reduces the need for regular maintenance.

Opportunity: Growing demand for environment-friendly compressors

With rising emission levels and increasing usage of fuel in compressed air systems, the demand for eco-friendly compressors has increased. Liquid ring compressors can achieve long-term savings and ensure a cleaner environment. Environment-friendly liquid ring compressors need less fuel and make less noise compared to rotary compressors. These pumps are made up of durable materials to withstand volatile gases and vapors without affecting their performance. As the gases are compressed at the same temperature in the cavity, the pump is capable of pumping explosive gases safely. All these factors have created better growth opportunities for the liquid ring compressors market during the forecast period.

Challenge: Adherence to strict quality standards

A majority of the industrialized nations have imposed stringent rules and regulations, which must be adhered to during the use of compressors, to limit the emission of contaminants by air & gas compressors and to prevent health hazards due to contaminated compressed air. The contamination of compressed air is a major problem for several industries, such as food & beverage and chemicals. A safer compressed air supply is required to maintain efficient and cost-effective production.

By type, two-stage segment is expected to grow at a faster rate during the forecast period

Two-stage liquid ring compressors have the same working mechanism as the single-stage ones, but in the case of the former, the pre-compressed pumping medium from the first stage is conveyed to a second compression stage and compressed again. The two-stage pumps are more efficient at much higher vacuum levels. They are also better suited for handling solvents at much higher levels of vacuum.

By material type, stainless steel is expected to grow at a faster rate during the forecast period

Liquid ring compressors made from stainless steel are used in various applications such as pharmaceutical, food manufacturing, oil & gas, and power generation. This segment is growing owing to the high cavitation resistance of stainless steel that enhances the life expectancy of liquid ring compressors.

By flow rate, 3000-10,000 m3/h segment is expected to register the highest CAGR during the forecast period

The high demand for liquid ring compressors with a flow rate of 3000-10,000 m3/h is due to the extensive use of these pumps in various industries such as oil & gas, petrochemical & chemical, pulp & paper, and power generation.

By application, the oil & gas segment accounted for the largest share of the market, in terms of value, in 2020

The global oil & gas industry is expected to witness significant investments in the coming years. These investments in the oil & gas sector in emerging economies, in addition to continuing developments in high crude oil-producing regions such as the Middle East and North America, are expected to drive the liquid ring compressors market for the oil & gas industry globally.

Asia Pacific is expected to register the highest CAGR during 2021-2026

Asia Pacific is attracting investors to set up their production facilities owing to the easy availability of raw materials and labor at low costs. Industrial activities are growing in this region owing to low manufacturing costs and support of local governments. Moreover, increasing investments in research and development activities are also driving the liquid ring compressors market in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key market players include Busch Vacuum Solutions (Germany), Flowserve Corporation (US), Atlas Copco (Sweden), Ingersoll Rand (US), DEKKER Vacuum Technologies, Inc. (US), Graham Corporation (US), Cutes Corp. (Taiwan), Zibo Zhaohan Vacuum Pump Co., Ltd (China), OMEL (Brazil), and Speck (Germany). These players have adopted product launches, agreements, acquisitions, mergers & acquisitions, and expansions as their growth strategies.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Type, Material Type, Flow Rate, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Busch Vacuum Solutions (Germany), Flowserve Corporation (US), Atlas Copco (Sweden), Ingersoll Rand (US), DEKKER Vacuum Technologies, Inc. (US), Graham Corporation (US), Cutes Corp. (Taiwan), Zibo Zhaohan Vacuum Pump Co., Ltd (China), OMEL (Brazil), Speck (Germany), SAFEM (Spain), Shandong Bozhong Vacuum Technology Co., Ltd. (China), Shandong CHINCO Pumps Co., Ltd. (China), Finder Pumps (Italy), Kakati (India), Guangdong Kenflo Pump Limited (China), Somarakis (US), Yantai VOLM Vacuum Technology Co., Ltd. (China), Garuda (India), Hobei Tonfun High-Tech Pump Co., LTD. (China), Pompetravaini (Italy). |

This research report categorizes the liquid ring compressors market based on type, material type, flow rate, application, and region.

Based on Type the liquid ring compressors market has been segmented as follows:

- Single-stage

- Two-stage

Based on Material Type, the liquid ring compressors market has been segmented as follows:

- Cast Iron

- Stainless Steel

- Others

Based on Flow Rate, the liquid ring compressors market has been segmented as follows:

- 25 – 600 M3H

- 600 – 3,000 M3H

- 3,000 – 10,000 M3H

- Over 10,000 M3H

Based on Application, the liquid ring compressors market has been segmented as follows:

- Petrochemical & Chemical

- Pharmaceutical

- Food Manufacturing

- Aircraft

- Automobile

- Water Treatment

- Oil & Gas

- Power Generation

- EPS and Plastics

- Pulp & Paper

- Others

Based on Region, the liquid ring compressors market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In May 2018, Busch Vacuum Solution launched the new series of Dolphin LM/LT vacuum pumps, which are liquid ring compressors. Dolphin LM models are single-stage vacuum pumps, whereas LT models are available in two-stage versions. They are used in processing technology, chemical and pharmaceutical processes, food technology applications, oil production and processing, and other industrial applications.

- In June 2020, Atlas Copco acquired Ovity Air Comprimé, a distributor of industrial air compressors and solutions for compressed air. This development has strengthened the geographical presence of Atlas in France.

Frequently Asked Questions (FAQ):

What is the current size of the global liquid ring compressors market?

The liquid ring compressors market size is estimated to be USD 254 million in 2021 and is projected to reach USD 337 million by 2026; it is expected to grow at a CAGR of 5.8% from 2021 to 2026.

Who are the leading players in the global liquid ring compressors market?

The leading companies in the liquid ring compressors market include Busch Vacuum Solutions (Germany), Flowserve Corporation (US), Atlas Copco (Sweden), Ingersoll Rand (US), DEKKER Vacuum Technologies, Inc. (US), Graham Corporation (US), Cutes Corp. (Taiwan), Zibo Zhaohan Vacuum Pump Co., Ltd (China), OMEL (Brazil), and Speck (Germany) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVE OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 LIQUID RING COMPRESSORS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 INCLUSIONS & EXCLUSIONS

1.4.1 LIQUID RING COMPRESSORS MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 LIQUID RING COMPRESSORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 2 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR LIQUID RING COMPRESSORS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE ANALYSIS OF LIQUID RING COMPRESSORS MARKET

FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE ANALYSIS OF LIQUID RING COMPRESSORS MARKET (2/2)

2.3.2.1 Calculations for supply-side analysis

2.3.3 FORECAST

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5 DATA TRIANGULATION

FIGURE 7 LIQUID RING COMPRESSORS MARKET: DATA TRIANGULATION

2.5.1 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.5.2 LIMITATIONS

2.5.3 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 PETROCHEMICAL & CHEMICAL TO BE LARGEST APPLICATION SEGMENT

FIGURE 9 CAST IRON TO BE LARGEST SEGMENT OF LIQUID RING COMPRESSORS MARKET

FIGURE 10 600-3000 M3/H SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE LIQUID RING VACUUM PUMPS MARKET

FIGURE 11 SINGLE STAGE SEGMENT TO ACCOUNT FOR THE LARGEST SHARE OF THE LIQUID RING VACUUM PUMPS MARKET

FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN LIQUID RING COMPRESSORS MARKET

FIGURE 13 GROWING INDUSTRIALIZATION IN EMERGING ECONOMIES TO BOOST MARKET GROWTH

4.2 LIQUID RING COMPRESSORS MARKET, BY APPLICATION

FIGURE 14 PETROCHEMICAL & CHEMICAL SEGMENT TO LEAD LIQUID RING COMPRESSORS MARKET DURING FORECAST PERIOD

4.3 LIQUID RING COMPRESSORS MARKET, BY FLOW RATE

FIGURE 15 FLOW RATE OF 600-3000 M3/H TO BE LARGEST SEGMENT IN 2020

4.4 LIQUID RING VACUUM PUMPS MARKET, BY MATERIAL

FIGURE 16 CAST IRON TO BE THE LARGEST SEGMENT OF THE MARKET IN 2020

4.5 LIQUID RING COMPRESSORS MARKET, BY REGION

FIGURE 17 ASIA PACIFIC TO LEAD LIQUID RING COMPRESSORS MARKET DURING FORECAST PERIOD

4.6 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET, BY TYPE AND COUNTRY, 2020

FIGURE 18 CHINA AND TWO-STAGE SEGMENT TO ACCOUNT FOR LARGEST SHARES

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LIQUID RING COMPRESSORS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in energy consumption

FIGURE 20 GLOBAL ELECTRICITY CONSUMPTION, 2016–2020

FIGURE 21 ELECTRICITY GENERATION OF SOME MAJOR COUNTRIES, 2016–2020

FIGURE 22 ELECTRICITY GENERATION FROM NUCLEAR POWER PLANTS, 2017–2019

FIGURE 23 ELECTRICITY GENERATION FROM COAL POWER PLANTS, 2017–2019

5.2.1.2 Low maintenance and operational cost

5.2.1.3 Gas transportation sector gaining momentum

FIGURE 24 US: NATURAL GAS EXPORT, 2016–2020

FIGURE 25 IMPACT OF DRIVERS ON LIQUID RING COMPRESSORS MARKET

5.2.2 RESTRAINTS

5.2.2.1 Declining LNG imports in Japan and South Korea

FIGURE 26 JAPAN: LNG IMPORT, 2019–2020

5.2.2.2 Rising issues regarding water conservation

FIGURE 27 IMPACT OF RESTRAINTS ON LIQUID RING COMPRESSORS MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for environment-friendly compressors

5.2.3.2 Industrialization in emerging economies to increase demand for liquid ring compressors

FIGURE 28 IMPACT OF OPPORTUNITIES ON LIQUID RING COMPRESSORS MARKET

5.2.4 CHALLENGES

5.2.4.1 Adherence to stringent quality standards

5.2.4.2 Impact of COVID-19 on liquid ring compressors market

FIGURE 29 IMPACT OF DRIVERS ON LIQUID RING COMPRESSORS MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 LIQUID RING COMPRESSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 1 LIQUID RING COMPRESSORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM

FIGURE 31 LIQUID RING COMPRESSORS ECOSYSTEM

TABLE 2 LIQUID RING COMPRESSORS: ECOSYSTEM

5.5 REGULATORY LANDSCAPE

5.5.1 EEMUA PUB NO 151 - LIQUID RING COMPRESSORS

5.5.2 PIP RESP004 - LIQUID RING COMPRESSORS SPECIFICATION

5.5.3 PIP RESP004 - LIQUID RING COMPRESSORS SPECIFICATION

5.5.4 API STD 681 - LIQUID RING COMPRESSORS FOR PETROLEUM, CHEMICAL, AND GAS INDUSTRY SERVICES

5.5.5 DS/EN 1012-1 - COMPRESSORS AND VACUUM PUMPS - SAFETY REQUIREMENTS - PART 1: AIR COMPRESSORS

5.5.6 EN 1012-2 - COMPRESSORS AND VACUUM PUMPS - SAFETY REQUIREMENTS - PART 2: VACUUM PUMPS

5.5.7 DS/EN 1012-3 - COMPRESSORS AND VACUUM PUMPS - SAFETY REQUIREMENTS - PART 3: PROCESS COMPRESSORS

5.5.8 PRESSURE EQUIPMENT SAFETY - EU DIRECTIVE 87/404/EC, SIMPLE PRESSURE VESSELS

5.5.9 ENVIRONMENT - EN ISO 2151:2004, NOISE TEST CODE FOR COMPRESSORS AND VACUUM PUMPS

5.6 TECHNOLOGY ANALYSIS

5.7 VALUE CHAIN ANALYSIS

FIGURE 32 LIQUID RING COMPRESSORS VALUE CHAIN ANALYSIS

5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.7.2 COMPONENT MANUFACTURERS

5.7.3 LIQUID RING COMPRESSORS MANUFACTURERS/ASSEMBLERS

5.7.4 DISTRIBUTERS (BUYERS)/END USERS AND POST-SALES SERVICES

6 LIQUID RING COMPRESSORS PATENT ANALYSIS (Page No. - 62)

6.1 INTRODUCTION

6.2 METHODOLOGY

6.3 DOCUMENT TYPE

FIGURE 33 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

FIGURE 34 PUBLICATION TRENDS - LAST 10 YEARS

6.4 INSIGHTS

FIGURE 35 LEGAL STATUS OF PATENTS

6.5 JURISDICTION ANALYSIS

FIGURE 36 TOP JURISDICTION- BY DOCUMENT

FIGURE 37 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 3 PATENTS BY GARDNER DENVER NASH LLC.

TABLE 4 PATENTS BY WOODWARD, INC.

TABLE 5 PATENTS BY EDWARDS LTD.

TABLE 6 TOP 10 PATENT OWNERS (US) IN LAST 10 Y EARS

7 COVID-19 IMPACT ON LIQUID RING COMPRESSORS ECOSYSTEM (Page No. - 67)

7.1 INTRODUCTION

7.2 EFFECT OF COVID-19 ON LIQUID RING COMPRESSOR APPLICATION SEGMENTS

7.2.1 OIL & GAS

FIGURE 38 PRODUCER PRICE INDEX (PPI) FOR CRUDE PETROLEUM, DECEMBER 2019 - AUGUST 2020

7.2.2 PHARMACEUTICAL

7.2.3 FOOD MANUFACTURING

7.2.4 POWER GENERATION

FIGURE 39 ANNUAL AVERAGE GROWTH RATES OF ELECTRICITY DEMAND IN SELECTED COUNTRIES/REGIONS, 2019-2020

7.3 EFFECT OF COVID-19 ON REGIONS

7.3.1 ASIA PACIFIC

7.3.2 EUROPE

7.3.3 NORTH AMERICA

7.3.4 MIDDLE EAST & AFRICA

7.3.5 SOUTH AMERICA

8 LIQUID RING COMPRESSORS MARKET, BY TYPE (Page No. - 71)

8.1 INTRODUCTION

FIGURE 40 SINGLE SEGMENT TO LEAD LIQUID RING COMPRESSORS MARKET DURING FORECAST PERIOD

TABLE 7 LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 8 LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

8.2 SINGLE-STAGE

8.2.1 LOW COST OF SINGLE-STAGE LIQUID RING COMPRESSORS TO INCREASE DEMAND

8.3 TWO-STAGE

8.3.1 HIGH EFFICIENCY AT HIGHER VACUUM LEVELS TO DRIVE MARKET

9 LIQUID RING COMPRESSORS MARKET, BY MATERIAL TYPE (Page No. - 74)

9.1 INTRODUCTION

FIGURE 41 CAST IRON SEGMENT TO LEAD LIQUID RING COMPRESSORS MARKET DURING FORECAST PERIOD

TABLE 9 LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2017–2019 (USD MILLION)

TABLE 10 LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.2 CAST IRON

9.2.1 LOW COST OF CAST IRON TO PROPEL MARKET GROWTH

9.3 STAINLESS STEEL

9.3.1 HIGH CORROSION RESISTANCE AND LOW CAVITATION OF STAINLESS STEEL TO PROPEL MARKET

10 LIQUID RING COMPRESSORS MARKET, BY FLOW RATE (Page No. - 77)

10.1 INTRODUCTION

FIGURE 42 600-3000 M3/H SEGMENT TO LEAD LIQUID RING COMPRESSORS MARKET DURING FORECAST PERIOD

TABLE 11 LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2017–2019 (USD MILLION)

TABLE 12 LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2020–2026 (USD MILLION)

10.2 25-600 M3/H

10.2.1 INCREASING DEMAND FROM PLASTIC MANUFACTURING AND MEDICAL TECHNOLOGIES SECTORS TO SUPPORT MARKET GROWTH

10.3 600-3,000 M3/H AND 3,000-10,000 M3/H

10.3.1 HIGH DEMAND FROM PULP & PAPER, OIL & GAS, POWER GENERATION, AND CHEMICAL INDUSTRIES TO FUEL SEGMENT GROWTH

10.4 ABOVE 10,000 M3/H

10.4.1 HIGH DEMAND FROM MINERAL ORE PROCESSING INDUSTRY TO DRIVE MARKET

11 LIQUID RING COMPRESSORS MARKET, BY APPLICATION (Page No. - 80)

11.1 INTRODUCTION

FIGURE 43 PETROCHEMICAL & CHEMICAL SEGMENT TO LEAD LIQUID RING COMPRESSORS MARKET DURING FORECAST PERIOD

TABLE 13 LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 14 LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

11.2 PETROCHEMICAL & CHEMICAL

11.2.1 INCREASING DEMAND FOR PLASTICS AND FERTILISERS TO DRIVE MARKET

11.3 FOOD MANUFACTURING

11.3.1 GROWING POPULATION BASE AND CHANGING CONSUMER LIFESTYLE TO ENHANCE DEMAND

11.4 AIRCRAFT

11.4.1 GROWTH OF AIRCRAFT INDUSTRY TO FUEL DEMAND FOR LIQUID RING COMPRESSORS

11.5 AUTOMOBILE

11.5.1 GROWING MIDDLE-CLASS POPULATION FUELING AUTOMOBILE INDUSTRY

11.6 PHARMACEUTICAL

11.6.1 GROWING PRODUCTION OF MEDICINES AND VACCINES DUE TO COVID-19 TO DRIVE MARKET

11.7 WATER TREATMENT

11.7.1 DEVELOPMENT OF WATER TREATMENT PLANTS TO BOOST DEMAND FOR LIQUID RING COMPRESSORS

11.8 OIL & GAS

11.8.1 GROWING INVESTMENTS IN CRUDE OIL IN MIDDLE EAST AND NORTH AMERICA TO SPUR MARKET GROWTH

11.9 POWER GENERATION

11.9.1 GROWING POPULATION AND INCREASED GLOBAL DEMAND FOR POWER TO BOOST MARKET

11.10 PULP & PAPER

11.10.1 INCREASED REQUIREMENT OF PAPER AND PAPERBOARD FOR PACKAGING APPLICATIONS

11.11 EPS & PLASTIC

11.11.1 GROWING USAGE OF PLASTICS TO BOOST DEMAND

11.12 OTHERS

12 LIQUID RING COMPRESSORS MARKET, BY REGION (Page No. - 87)

12.1 INTRODUCTION

FIGURE 44 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

TABLE 15 GLOBAL: LIQUID RING COMPRESSORS MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 16 GLOBAL: LIQUID RING COMPRESSORS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.2 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SNAPSHOT

TABLE 17 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 18 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 19 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2017–2019 (USD MILLION)

TABLE 20 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2020–2026 (USD MILLION)

TABLE 21 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2017–2019 (USD MILLION)

TABLE 22 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 23 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 24 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 25 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 26 ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.2.1 CHINA

12.2.1.1 Growing population and increasing investment in power sector to augment market growth

TABLE 27 CHINA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 28 CHINA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2.2 SOUTH KOREA

12.2.2.1 Increasing spending on water and wastewater infrastructures to propel demand

TABLE 29 SOUTH KOREA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 30 SOUTH KOREA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2.3 INDIA

12.2.3.1 Growth in conventional energy generation to increase demand for liquid ring compressors

TABLE 31 INDIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 32 INDIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2.4 JAPAN

12.2.4.1 Growth in pharmaceutical sector to enhance demand for liquid ring compressors

TABLE 33 JAPAN: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 34 JAPAN: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2.5 AUSTRALIA & NEW ZEALAND

12.2.5.1 Growth in power sector to boost market

TABLE 35 AUSTRALIA & NEW ZEALAND: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 36 AUSTRALIA & NEW ZEALAND: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2.6 SOUTHEAST ASIA

12.2.6.1 Exploration of oil reserves in Thailand and growth in power sector to support market growth

TABLE 37 SOUTHEAST ASIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 38 SOUTHEAST ASIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.2.7 REST OF ASIA PACIFIC

TABLE 39 REST OF ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 40 REST OF ASIA PACIFIC: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 46 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 42 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2017–2019 (USD MILLION)

TABLE 44 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2020–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2017–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 48 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 50 NORTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.3.1 US

12.3.1.1 Increased shale gas exploration activities to boost demand

TABLE 51 US: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 52 US: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.3.2 CANADA

12.3.2.1 Investment in water & wastewater treatment projects to increase use of liquid ring compressors

TABLE 53 CANADA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 54 CANADA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Ongoing industrialization and population growth to fuel demand

TABLE 55 MEXICO: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 56 MEXICO: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4 EUROPE

FIGURE 47 EUROPE: LIQUID RING COMPRESSORS MARKET SNAPSHOT

TABLE 57 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 58 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 59 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2017–2019 (USD MILLION)

TABLE 60 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2020–2026 (USD MILLION)

TABLE 61 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2017–2019 (USD MILLION)

TABLE 62 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 63 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 64 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 65 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 66 EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.4.1 GERMANY

12.4.1.1 Investment in oil & gas supply infrastructure to drive market

TABLE 67 GERMANY: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 68 GERMANY: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4.2 FRANCE

12.4.2.1 Automobiles and chemicals & petrochemicals industries boosting market

TABLE 69 FRANCE: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 70 FRANCE: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4.3 UK

12.4.3.1 Growth in food & beverage industry to create demand for liquid ring compressors

TABLE 71 UK: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 72 UK: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4.4 RUSSIA

12.4.4.1 Rising automotive sector to increase demand for liquid ring compressors

TABLE 73 RUSSIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 74 RUSSIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4.5 TURKEY

12.4.5.1 Low cost of single-stage liquid ring compressors to contribute to market growth

TABLE 75 TURKEY: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 76 TURKEY: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4.6 SCANDINAVIA

12.4.6.1 Growing power consumption leading to huge demand for liquid ring compressors

TABLE 77 SCANDINAVIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 78 SCANDINAVIA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.4.7 REST OF EUROPE

TABLE 79 REST OF EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 80 REST OF EUROPE: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

TABLE 81 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 82 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 83 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2017–2019 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2020–2026 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2017–2019 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 91 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 92 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 93 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2017–2019 (USD MILLION)

TABLE 94 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY FLOW RATE, 2020–2026 (USD MILLION)

TABLE 95 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2017–2019 (USD MILLION)

TABLE 96 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 97 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 98 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 99 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 100 SOUTH AMERICA: LIQUID RING COMPRESSORS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 135)

13.1 KEY PLAYERS’ STRATEGIES

TABLE 101 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2021

13.2 REVENUE ANALYSIS

FIGURE 48 REVENUE SHARE ANALYSIS IN LIQUID RING COMPRESSORS MARKET

13.3 MARKET SHARE ANALYSIS

FIGURE 49 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS VS. OTHER PLAYERS IN LIQUID RING COMPRESSORS MARKET, 2020

13.3.1 INGERSOLL RAND

13.3.2 ATLAS COPCO

13.3.3 BUSCH VACUUM SOLUTIONS

13.3.4 FLOWSERVE CORPORATION

13.3.5 DEKKER VACUUM TECHNOLOGIES, INC.

TABLE 102 LIQUID RING COMPRESSORS MARKET: TYPE FOOTPRINT

TABLE 103 LIQUID RING COMPRESSORS MARKET: REGION FOOTPRINT

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STAR

13.4.2 PERVASIVE

13.4.3 EMERGING LEADER

13.4.4 PARTICIPANT

FIGURE 50 LIQUID RING COMPRESSORS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

13.5 COMPETITIVE LEADERSHIP MAPPING OF SME, 2020

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 STARTING BLOCKS

13.5.4 DYNAMIC COMPANIES

FIGURE 51 OTHER ADDITIONAL PLAYERS/SMES EVALUATION MATRIX FOR LIQUID RING COMPRESSORS MARKET

13.6 COMPETITIVE SCENARIO

TABLE 104 LIQUID RING COMPRESSORS MARKET: PRODUCT LAUNCH, 2018-2019

TABLE 105 LIQUID RING COMPRESSORS MARKET: DEALS, 2018-2021

TABLE 106 LIQUID RING COMPRESSORS MARKET: OTHER DEVELOPMENT, 2019

14 COMPANY PROFILES (Page No. - 146)

14.1 INGERSOLL RAND

(Business overview, Products/solutions/services offered, Recent developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

TABLE 107 INGERSOLL RAND: COMPANY OVERVIEW

FIGURE 52 INGERSOLL RAND: COMPANY SNAPSHOT

TABLE 108 INGERSOLL RAND: PRODUCT OFFERINGS

TABLE 109 INGERSOLL RAND: DEAL

14.2 ATLAS COPCO

TABLE 110 ATLAS COPCO: COMPANY OVERVIEW

FIGURE 53 ATLAS COPCO: COMPANY SNAPSHOT

TABLE 111 ATLAS COPCO: PRODUCT OFFERINGS

TABLE 112 ATLAS COPCO: DEALS

14.3 BUSCH VACUUM SOLUTIONS

TABLE 113 BUSCH VACUUM SOLUTIONS: COMPANY OVERVIEW

TABLE 114 BUSCH VACUUM SOLUTIONS: PRODUCT OFFERINGS

TABLE 115 BUSCH VACUUM SOLUTIONS: PRODUCT LAUNCH

TABLE 116 BUSCH VACUUM SOLUTIONS: DEAL

14.4 FLOWSERVE CORPORATION

TABLE 117 FLOWSERVE CORPORATION: COMPANY OVERVIEW

FIGURE 54 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

TABLE 118 FLOWSERVE CORPORATION: PRODUCT OFFERINGS

14.5 DEKKER VACUUM TECHNOLOGIES, INC.

TABLE 119 DEKKER VACUUM TECHNOLOGIES, INC.: COMPANY OVERVIEW

TABLE 120 DEKKER VACUUM TECHNOLOGIES, INC.: PRODUCT OFFERINGS

14.6 GRAHAM CORPORATION

TABLE 121 GRAHAM CORPORATION: COMPANY OVERVIEW

FIGURE 55 GRAHAM CORPORATION: COMPANY SNAPSHOT

TABLE 122 GRAHAM CORPORATION: PRODUCT OFFERINGS

TABLE 123 GRAHAM CORPORATION: OTHERS

14.7 CUTES CORP.

TABLE 124 CUTES CORP.: COMPANY OVERVIEW

TABLE 125 CUTES CORP.: PRODUCT OFFERINGS

14.8 ZIBO ZHAOHAN VACUUM PUMP CO., LTD

TABLE 126 ZIBO ZHAOHAN VACUUM PUMP CO., LTD: COMPANY OVERVIEW

TABLE 127 ZIBO ZHAOHAN VACUUM PUMP CO., LTD: PRODUCT OFFERINGS

14.9 OMEL

TABLE 128 OMEL: COMPANY OVERVIEW

TABLE 129 OMEL: PRODUCT OFFERINGS

14.10 SPECK

TABLE 130 SPECK: COMPANY OVERVIEW

TABLE 131 SPECK: PRODUCT OFFERINGS

14.11 OTHER PLAYERS

14.11.1 SAFEM

TABLE 132 SAFEM: COMPANY OVERVIEW

14.11.2 SHANDONG BOZHONG VACUUM TECHNOLOGY CO., LTD.

TABLE 133 SHANDONG BOZHONG VACUUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

14.11.3 SHANDONG CHINCO PUMPS CO., LTD.

TABLE 134 SHANDONG CHINCO PUMPS CO., LTD.: COMPANY OVERVIEW

14.11.4 FINDER PUMPS

TABLE 135 FINDER PUMPS: COMPANY OVERVIEW

14.11.5 KAKATI

TABLE 136 KAKATI: COMPANY OVERVIEW

14.11.6 GUANGDONG KENFLO PUMP LIMITED

TABLE 137 GUANGDONG KENFLO PUMP LIMITED: COMPANY OVERVIEW

14.11.7 SOMARAKIS

TABLE 138 SOMARAKIS: COMPANY OVERVIEW

14.11.8 YANTAI VOLM VACUUM TECHNOLOGY CO., LTD.

TABLE 139 YANTAI VOLM VACUUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

14.11.9 GARUDA

TABLE 140 GARUDA: COMPANY OVERVIEW

14.11.10 HOBEI TONFUN HIGH-TECH PUMP CO., LTD.

TABLE 141 HOBEI TONFUN HIGH-TECH PUMP CO., LTD.: COMPANY OVERVIEW

14.11.11 POMPETRAVAINI SPA

TABLE 142 POMPETRAVAINI SPA: COMPANY OVERVIEW

*Details on Business overview, Products/solutions/services offered, Recent developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 178)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

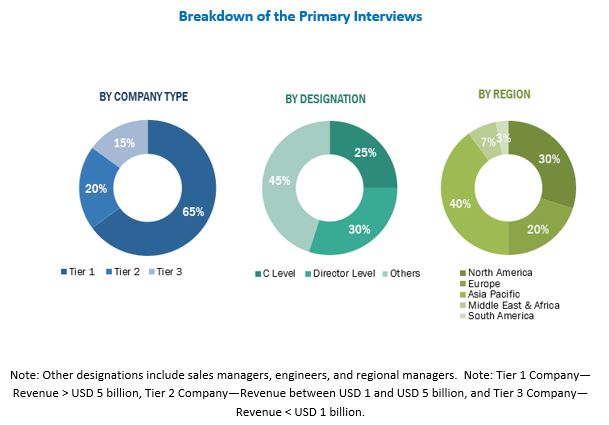

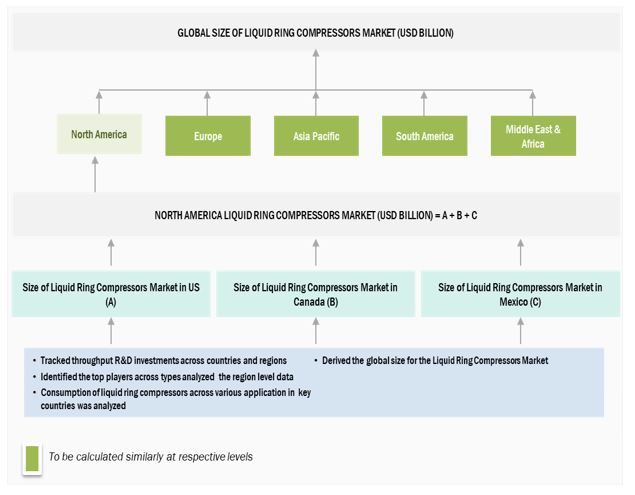

The study involved four major activities in estimating the current size of the liquid ring compressors market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the liquid ring compressors value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments.

Secondary Research

Secondary sources referred to for this research study include annual reports; press releases and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, liquid ring compressors manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments.

Primary Research

The liquid ring compressors market comprises several stakeholders, such as manufacturers of liquid ring compressors, traders; distributors; and suppliers of liquid ring compressors, building authorities, associations and industrial bodies, research and consulting firms, R&D institutions, investment banks and private equity firms, and manufacturers in end-use industries.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the liquid ring compressors market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the liquid ring compressors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the liquid ring compressors market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Liquid Ring Compressors Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the liquid ring compressors market in terms of value

- To define, describe, and forecast the market size by type, material type, flow rate, application, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, agreements, acquisitions, mergers & acquisitions, and expansions in the liquid ring compressors market

Competitive Intelligence

- To identify and profile the key players in the liquid ring compressors market

- To determine the top players offering various products in the liquid ring compressors market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Liquid Ring Compressors Market