Liquid Filtration Market by Fabric Material (Polymer, Cotton, and Metal), Filter Media (Woven, Nonwoven, and Mesh), End-User (Municipal Treatment, Food & Beverage, Metal & Mining, Chemical, and Pharmaceutical), Region - Global Forecast to 2024

Updated on : March 12, 2023

Liquid Filtration Market

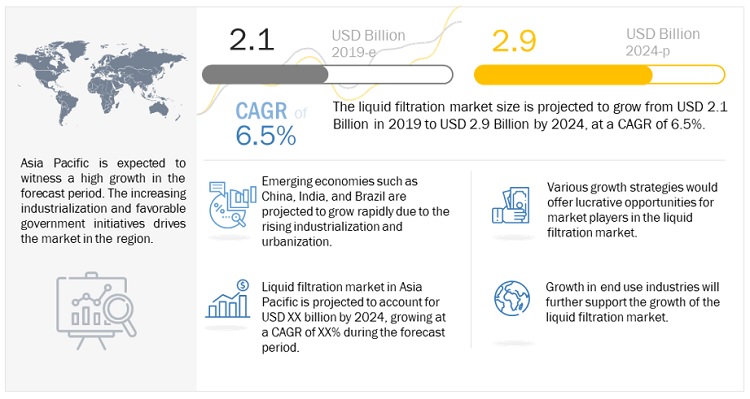

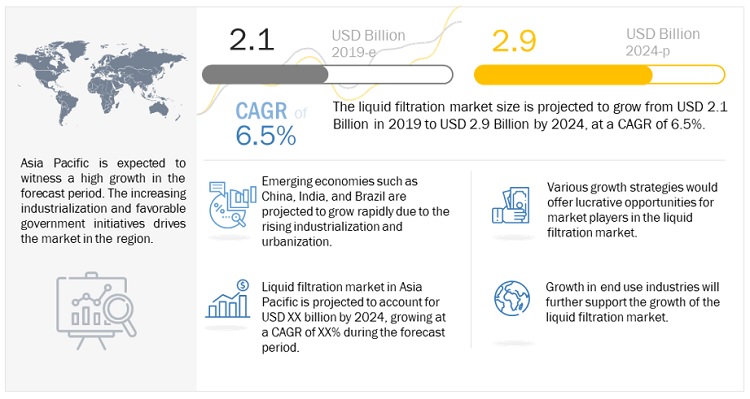

The liquid filtration market was valued at USD 2.1 billion in 2019 and is projected to reach USD 2.9 billion by 2024, growing at a cagr 6.5% from 2019 to 2024. This high growth of the market is primarily driven by strict regulations governing the treatment of industrial and municipal wastes and the growing industrialization and urbanization in the emerging regions.

Global Liquid Filtration Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Liquid Filtration Market Dynamics

Driver: Growing industrialization and urbanization

The growing industrialization and urbanization along with economic growth globally will drive the growth of various end use industries. This will drive the liquid filtration market. Liquid filtration market has excellent growth potential, as it involves both the municipal and industrial water treatment, and industrial process applications. Emerging and the developed regions are major business hubs of the liquid filtration market. For instance, manufacturing is one of the rapidly growing sectors for several developed and developing countries, including China, India, the US, Germany, Japan, South Korea, France, and Italy.

The growing urbanization is one of the key factors responsible for the growing demand of liquid filtration in the municipal sector. There is a large-scale migration of population from rural to urban areas—where most of the industries and service-related jobs are concentrated. Increasing urbanization further supports the growing demand for electricity, and products from food & beverage, chemical, pharmaceutical, oil & gas, and other industries. Thus, the inter-related trends of urbanization and industrialization are driving the liquid filtration market.

Restrain: Emerging alternatives and demand for renewable energy sources

Renewable energy from natural sources does not exhaust and can be constantly replenished. The use of renewable energy sources in various industries is gaining momentum, as it results in low environmental hazards. The growing global demand for clean energy is helping in the growth of the renewable energy sector that includes solar, wind, biomass, and hydropower. Power generation through renewable energy sources is rapidly increasing across the world. The growing use of renewable energy is affecting the use of coal for power generation, which is reducing the need for a filtration system. Most of the countries are preferring natural gas, solar energy, and wind energy over coal for power generation. According to the International Energy Agency (IEA), the share of renewables in global power generation is expected to reach around 30% by 2023 from 24% in 2017. In 2018, the demand for natural gas grew by 4.6% owing to demand from the power generation industry, according to the IEA. The global demand for natural gas is expected to reach more than 4.3 trillion cubic meters in 2024. Hence, the increasing use of alternative and renewable energy sources for power generation is adversely affecting the filtration industry, as most of these sources have low or no emissions.

Opportunity: Increase in wastewater treatment due to depleting freshwater resources

Global freshwater reserves are decreasing rapidly due to increasing water pollution. Fluctuation in rainfall is causing depletion of freshwater reserves, which is further affecting water demand for both industrial and household applications. Increasing industrialization in developing countries such as India, China, Indonesia, and Taiwan require huge water resources in various industrial processes. These industrial processes generate a large amount of wastewater. Water harvesting, wastewater treatment, and reuse of water are gaining importance in the global industrial sector due to water scarcity. This is expected to provide opportunities to the liquid filter media manufacturers.

Challenge: Dependency on the industrial catalysts

Industrial catalysts are necessary for enhancing the performance of the liquid filtration process. These catalysts are costly, and it is challenging to maintain them. Further, these catalysts operate in accordance with particle size, which adds to the complexity of the process. Therefore, these issues and the intricacy surrounding the industrial catalysts needed in the liquid filtration industry can hinder the growth of the liquid filtration market.

Polymer segment to grow the fastest amongst fabric materials in the liquid filtration market

Based on fabric material, polymeric segment is the largest and the fastest growing in the overall liquid filtration market. Polymeric fabric is widely used in the liquid filter media owing to its excellent properties such as high thermal resistance, high tenacity, and low water absorption. Continuous R&D on polymer materials to improve their properties will further support the growth of this segment.

Nonwoven segment is estimated to be the largest segment amongst filter media in the overall liquid filtration market

Based on filter media type, the nonwoven filter media is projected to account for the highest market share during the forecast period. The nonwoven segment is further categorized as melt blown, needle felt, and others. The properties of nonwoven filter media such as versatile structure, economical price, and high strength are the major factors driving their growth.

Industrial treatment segment is projected to grow at a highest CAGR amongst end users in the liquid filtration market

On the basis of end-user, the liquid filtration market is broadly segmented into municipal treatment and industrial treatment. Industrial treatment is further segmented into food & beverage, chemical, metal & mining, pharmaceutical, and others. The growing demand of the liquid filter media in several end use industries is driving the liquid filtration market.

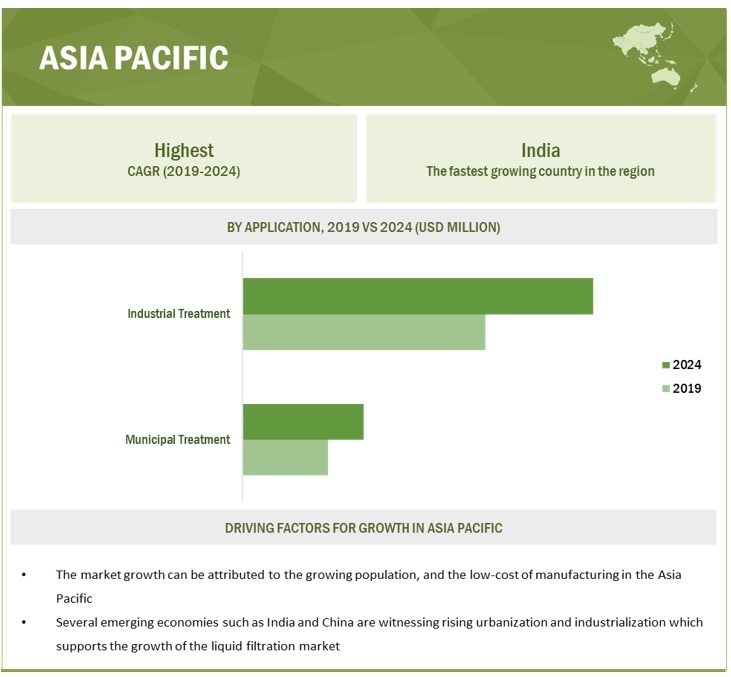

Asia Pacific is projected to account for the largest market share of the overall liquid filtration market

Asia Pacific is the largest and fastest-growing region for the liquid filtration market. The high growth in the region can be attributed to the rapidly growing population and the increasing investments in the industrial sector of the region. Further, rising industrialization, low-cost labor, and the increasing consumer purchasing power is driving the market growth of in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major vendors in the liquid filtration market are Lydall, Inc. (US), Ahlstrom-Munksjo (Finland), Freudenberg Filtration Technologies (Germany), Kimberly-Clark Corporation (US), Valmet (Finland), Hollingsworth & Vose (US), Sefar AG (Switzerland), Clear Edge (US), Fibertex Nonwovens (Denmark), Johns Manville (US).

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2024 |

|

Base year |

2018 |

|

Forecast period |

2019-2024 |

|

Units considered |

Value (USD Billion, Million, and Thousand) |

|

Segments |

Fabric Material, Filter Media, End-user, and Region |

|

Regions |

North America, APAC, Europe, South America, and the Middle East & Africa |

|

Companies |

Ahlstrom-Munksjo (Finland), Lydall, Inc. (US), Valmet (Finland), Kimberly-Clark (US), Freudenberg Filtration Technologies (Germany), and others |

This research report categorizes the liquid filtration market based on fabric material, filter media, end-user, and region.

On the basis of fabric material, the liquid filtration market has been segmented as follows

- Polymer

- Cotton

- Metal

On the basis of filter media, the liquid filtration market has been segmented as follows

-

Woven

- Multifilament

- Monofilament

-

Nonwoven

- Needle Felt

- Melt Blown

- Others (wet-laid and spun bond )

- Mesh

On the basis of end-user, the liquid filtration market has been segmented as follows

- Municipal Treatment

-

Industrial Treatment

- Food & beverage

- Metal & mining

- Chemical

- Pharmaceutical

- Others (power generation, pulp & paper, and textile)

On the basis of region, the liquid filtration market has been segmented as follows

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2018, Fibertex Nonwovens (Denmark) invested in a nonwovens production line for filter media, which will use various polymers, such as polyurethane (PU), polyvinylidene fluoride (PVDF), and polyamide (PA), during the manufacturing process.

- In June 2018, Ahlstrom-Munksjo (Finland) invested USD 32 million in its filtration & performance business to increase its manufacturing capacity as well as product capabilities. With this investment, the company is planning to expand its production capacity in the Turin (Italy) plant.

- In January 2017, Lydall, Inc. (US) acquired the MGF Gutsche GmbH & Co. KG (Germany). Gutsche is a leader in the production of nonwoven needle punch material for industrial filtration applications. This acquisition strengthened its position as a premier provider of filter media products.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of liquid filtration market?

The growth of this market can be attributed to the growing industrialization and urbanization and the stringent regulations pertaining to the treatment of municipal and industrial waste.

Who are the major manufacturers of liquid filter media?

Major manufacturers include Lydall, Inc. (US), Ahlstrom-Munksjo (Finland), Freudenberg Filtration Technologies (Germany), Kimberly-Clark Corporation (US), Valmet (Finland), Hollingsworth & Vose (US), Sefar AG (Switzerland), Clear Edge (US), Fibertex Nonwovens (Denmark), Johns Manville (US), among others.

What will be the growth prospects of the liquid filtration market?

Increasing demand for wastewater treatment due to the rising water scarcity will offer significant growth opportunities for the liquid filtration market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.3.1 Liquid Filtration Market Analysis Through Primary Interviews

2.3.2 Liquid Filtration Market Analysis Through Secondary Sources

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Liquid Filtration Market

4.2 Liquid Filtration Market, By Filter Media

4.3 Liquid Filtration Market, By Fabric Material

4.4 Liquid Filtration Market, By End User

4.5 Liquid Filtration Market, By Country

4.6 APAC Liquid Filtration Market, By End User and Country, 2018

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Stringent Regulations Pertaining to Emission and Treatment of Industrial and Municipal Waste

5.2.1.2 Growing Industrialization and Urbanization

5.2.2 Restraints

5.2.2.1 Emerging Alternatives and Demand for Renewable Energy Sources

5.2.3 Opportunities

5.2.3.1 Increase in Wastewater Treatment Due to Depleting Freshwater Resources

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicator

5.4.1 Global GDP Trends and Forecasts

6 Liquid Filtration Market, By Fabric Material (Page No. - 39)

6.1 Introduction

6.2 Polymer

6.2.1 Polymers Have Better Physical Properties Than Other Fabric Materials

6.3 Cotton

6.3.1 Cotton is an Environmentally Friendly Material and Does Not Cause Pollution

6.4 Metal

6.4.1 Metal is Suitable in High-Pressure and High-Temperature Conditions

7 Liquid Filtration Market, By Filter Media (Page No. - 44)

7.1 Introduction

7.2 Woven

7.2.1 Monofilament

7.2.1.1 Flexibility is A Major Characteristic of Monofilament Filter Media

7.2.2 Multifilament

7.2.2.1 Multifilament Filter Media are Uv-Resistant and Can Be Customized According to Applications

7.3 Nonwoven

7.3.1 Melt Blown

7.3.1.1 Random Fiber Orientation and Low-To-Moderate Web Strength of Melt Blown are Boosting Their Demand

7.3.2 Needle Felt

7.3.2.1 Good Strength-Elongation Ratio and Permeability Characteristics are Making Needle Felt Suitable for Various Applications

7.3.3 Others

7.4 Mesh

7.4.1 Mesh is Extremely Chemical-Resistant

8 Liquid Filtration Market, By End User (Page No. - 50)

8.1 Introduction

8.2 Municipal Treatment

8.2.1 Increasing Global Population and Urbanization are Resulting in High Municipal Waste

8.3 Industrial Treatment

8.3.1 Food & Beverage

8.3.1.1 Stringent Hygiene Standards in the Food & Beverage Industry are Boosting the Market

8.3.2 Metal & Mining

8.3.2.1 Steady Growth of the Metal & Mining Industry is Fueling the Growth of the Liquid Filtration Market

8.3.3 Chemical

8.3.3.1 Stringent Environmental Norms in the Industry are Creating New Challenges for the Chemical Companies

8.3.4 Pharmaceutical

8.3.4.1 Water Filtration is Crucial to Obtain High-Quality Products in This Segment

8.3.5 Others

9 Liquid Filtration Market, By Region (Page No. - 58)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 The Power Plants Sector is Expected to Generate Demand for Liquid Filter Media

9.2.2 India

9.2.2.1 Government Initiatives About Wastewater Recycling and the Development of the Power Generation Industry are Propelling the Market

9.2.3 Japan

9.2.3.1 The Development of the Food & Beverage and Pharmaceutical Industries is Driving the Market

9.2.4 Australia

9.2.4.1 Increased Demand From the Metal & Mining and Food & Beverage Industries is Driving the Market

9.2.5 Rest of APAC

9.3 North America

9.3.1 US

9.3.1.1 Presence of A Strong Food & Beverage Industry and Stringent Government Regulations Pertaining to Environmental Safety are Boosting the Market

9.3.2 Canada

9.3.2.1 An Increase in Investments in the Power Generation Industry is Favorable for Market Growth

9.3.3 Mexico

9.3.3.1 The Country has A Large Food & Beverage Industry, Which Generates High Demand for Filtration Systems

9.4 Europe

9.4.1 Germany

9.4.1.1 Strong Industrial Base is Likely to Drive the Liquid Filtration Market in Germany

9.4.2 UK

9.4.2.1 Growth of the Chemical and Mining Industries is Expected to Spur the Market

9.4.3 France

9.4.3.1 Well-Developed Industrial Infrastructure is Expected to Lead the Market Growth

9.4.4 Russia

9.4.4.1 Increasing Industrial Output is Estimated to Drive the Market

9.4.5 Spain

9.4.5.1 The Food & Beverage Industry and Water Treatment Norms Will Drive the Market

9.4.6 Italy

9.4.6.1 Rapid Industrialization is Expected to Drive the Demand for Liquid Filtration

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Increasing Chemical and Mining Production is Expected to Spur the Demand for Liquid Filter Media

9.5.2 UAE

9.5.2.1 The UAE is One of the Most Water-Stressed Countries in the World

9.5.3 Qatar

9.5.3.1 The Metal & Mining and Chemical Industries are Expected to Lead the Liquid Filtration Market in Qatar

9.5.4 South Africa

9.5.4.1 The Food & Beverage and Mining Industries are Boosting the Market

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 With A Growing Industrial Sector, Brazil is A Lucrative Market for Liquid Filter Media

9.6.2 Chile

9.6.2.1 The Strong Growth of the Industrial Sector is Helping in the Market Growth

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 96)

10.1 Overview

10.2 Competitive Leadership Mapping, 2018

10.2.1 Visionary Players

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Players

10.3 Strength of Product Portfolio

10.4 Business Strategy Excellence

10.5 Ranking of Key Players

10.6 Competitive Scenario

10.6.1 Investment & Expansion

10.6.2 Merger & Acquisition

11 Company Profiles (Page No. - 103)

11.1 Ahlstrom-Munksjo

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2 Lydall, Inc.

11.3 Valmet

11.4 Kimberly-Clark Corporation

11.5 Freudenberg Filtration Technologies

11.6 Clear Edge

11.7 Fibertex Nonwovens

11.8 Hollingsworth & Vose

11.9 Johns Manville

11.10 Sefar AG

11.11 Other Companies

11.11.1 3M

11.11.2 American Fabric Filter

11.11.3 Autotech Nonwovens

11.11.4 Berry Global, Inc

11.11.5 Donaldson Filtration Solutions

11.11.6 Eagle Nonwovens, Inc

11.11.7 G. Bopp + Co. AG

11.11.8 GKD

11.11.9 Kavon Filter Products Co.

11.11.10 MANN+HUMMEL

11.11.11 Norafin Industries

11.11.12 Sandler AG

11.11.13 Schweitzer-Mauduit International, Inc

11.11.14 Twe Group

11.11.15 Yingkaimo Metal Net Co.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 123)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (65 Tables)

Table 1 GDP Percentage Change of Key Countries, 2019–2024

Table 2 Liquid Filtration Market Size, By Fabric Material, 2017–2024 (USD Million)

Table 3 Polymer: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 4 Cotton: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 5 Metal: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 6 Liquid Filtration Market Size, By Filter Media, 2017–2024 (USD Million)

Table 7 Monofilament: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 8 Multifilament: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 9 Melt Blown: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 10 Needle Felt: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 11 Other Filter Media: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 12 Mesh: Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 13 Liquid Filtration Market Size, By End User, 2017–2024 (USD Million)

Table 14 Liquid Filtration Market Size in Municipal Treatment, By Region, 2017–2024 (USD Million)

Table 15 Liquid Filtration Market Size in Food & Beverage, By Region, 2017–2024 (USD Million)

Table 16 Liquid Filtration Market Size in Metal & Mining, By Region, 2017–2024 (USD Million)

Table 17 Liquid Filtration Market Size in Chemical, By Region, 2017–2024 (USD Million)

Table 18 Liquid Filtration Market Size in Pharmaceutical, By Region, 2017–2024 (USD Thousand)

Table 19 Liquid Filtration Market Size in Other End-Use Industries, By Region, 2017–2024 (USD Thousand)

Table 20 Liquid Filtration Market Size, By Region, 2017–2024 (USD Million)

Table 21 APAC: Liquid Filtration Market Size, By Country, 2017–2024 (USD Million)

Table 22 APAC: Liquid Filtration Market Size, By Fabric Material, 2017–2024 (USD Million)

Table 23 APAC: Liquid Filtration Market Size, By Filter Media, 2017–2024 (USD Million)

Table 24 APAC: Liquid Filtration Market Size, By End User, 2017–2024 (USD Million)

Table 25 China: Liquid Filtration Market Size, By End User, 2017–2024 (USD Million)

Table 26 India: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 27 Japan: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 28 Australia: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 29 Rest of APAC: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 30 North America: Liquid Filtration Market Size, By Country, 2017–2024 (USD Million)

Table 31 North America: Liquid Filtration Market Size, By Fabric Material, 2017–2024 (USD Million)

Table 32 North America: Liquid Filtration Market Size, By Filter Media, 2017–2024 (USD Million)

Table 33 North America: Liquid Filtration Market Size, By End User, 2017–2024 (USD Million)

Table 34 US: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 35 Canada: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 36 Mexico: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 37 Europe: Liquid Filtration Market Size, By Country, 2017–2024 (USD Million)

Table 38 Europe: Liquid Filtration Market Size, By Fabric Material, 2017–2024 (USD Million)

Table 39 Europe: Liquid Filtration Market Size, By Filter Media, 2017–2024 (USD Million)

Table 40 Europe: Liquid Filtration Market Size, By End User, 2017–2024 (USD Million)

Table 41 Germany: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 42 UK: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 43 France: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 44 Russia: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 45 Spain: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 46 Italy: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 47 Rest of Europe: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 48 Middle East & Africa: Liquid Filtration Market Size, By Country, 2017–2024 (USD Million)

Table 49 Middle East & Africa: Liquid Filtration Market Size, By Fabric Material, 2017–2024 (USD Million)

Table 50 Middle East & Africa: Liquid Filtration Market Size, By Filter Media, 2017–2024 (USD Million)

Table 51 Middle East & Africa: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 52 Saudi Arabia: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 53 UAE: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 54 Qatar: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 55 South Africa: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 56 Rest of Middle East & Africa: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 57 South America: Liquid Filtration Market Size, By Country, 2017–2024 (USD Million)

Table 58 South America: Liquid Filtration Market Size, By Fabric Material, 2017–2024 (USD Million)

Table 59 South America: Liquid Filtration Market Size, By Filter Media, 2017–2024 (USD Million)

Table 60 South America: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 61 Brazil: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 62 Chile: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 63 Rest of South America: Liquid Filtration Market Size, By End User, 2017–2024 (USD Thousand)

Table 64 Investment & Expansion, 2018

Table 65 Merger & Acquisition, 2017

List of Figures (43 Figures)

Figure 1 Liquid Filtration Market Segmentation

Figure 2 Liquid Filtration Market: Research Design

Figure 3 Liquid Filtration Market: Bottom-Up Approach

Figure 4 Liquid Filtration Market: Top-Down Approach

Figure 5 Liquid Filtration Market: Data Triangulation

Figure 6 Liquid Filtration Market Analysis: Approach-1

Figure 7 Liquid Filtration Market Analysis: Approach-2

Figure 8 Nonwoven to Be the Largest Filter Media of the Liquid Filtration Market

Figure 9 Polymer to Be the Largest Fabric Material of Liquid Filtration

Figure 10 Food & Beverage to Be the Fastest-Growing End User of Liquid Filtration Market

Figure 11 APAC Liquid Filtration Market to Witness the Highest Growth Rate

Figure 12 Significant Growth Projected in the Market Between 2019 and 2024

Figure 13 Nonwoven to Be the Fastest-Growing Filter Media During the Forecast Period

Figure 14 Polymer to Lead the Fabric Material Segment

Figure 15 Industrial Treatment to Be the Larger End User Segment

Figure 16 India to Register the Fastest Growth

Figure 17 China and Municipal Treatment Segment Accounted for the Largest Shares in the APAC Market

Figure 18 Drivers, Restraints, and Opportunities in the Liquid Filtration Market

Figure 19 Increase in Natural Gas Production Worldwide, 2010–2018

Figure 20 Share of Wind and Solar Energy in Global Electricity Production

Figure 21 Liquid Filtration Market: Porter’s Five Forces Analysis

Figure 22 Polymer Segment to Register the Highest CAGR in the Liquid Filtration Market

Figure 23 Nonwoven to Register the Highest CAGR in the Liquid Filtration Market

Figure 24 Food & Beverage to Be the Fastest-Growing End User of Liquid Filtration

Figure 25 APAC to Be the Largest and Fastest-Growing Liquid Filtration Market

Figure 26 Liquid Filtration Market in India to Grow at the Fastest Rate

Figure 27 APAC: Liquid Filtration Market Snapshot

Figure 28 North America: Liquid Filtration Market Snapshot

Figure 29 Europe: Liquid Filtration Market Snapshot

Figure 30 Companies Adopted Investment & Expansion as the Key Growth Strategy Between 2017 and 2019

Figure 31 Liquid Filtration Market: Competitive Leadership Mapping, 2018

Figure 32 Ahlstrom-Munksjo Led the Market in 2018

Figure 33 Ahlstrom-Munksjo: Company Snapshot

Figure 34 Ahlstrom-Munksjo: SWOT Analysis

Figure 35 Lydall: Company Snapshot

Figure 36 Lydall: SWOT Analysis

Figure 37 Valmet: Company Snapshot

Figure 38 Valmet: SWOT Analysis

Figure 39 Kimberly-Clark Corporation: Company Snapshot

Figure 40 Kimberly-Clark Corporation: SWOT Analysis

Figure 41 Freudenberg Filtration Technologies: Company Snapshot

Figure 42 Freudenberg Filtration Technologies: SWOT Analysis

Figure 43 Fibertex Nonwovens: Company Snapshot

The study involved four major activities to estimate the current size of liquid filtration market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases.

Primary Research

The liquid filtration market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of municipal treatment, food & beverage, metal & mining, chemical, pharmaceutical, and other industries. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the liquid filtration market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food & beverage, metal & mining, chemical, pharmaceutical, power generation, and other industries.

Report Objectives:

- To analyze and forecast the size of the liquid filtration market only in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market by fabric material, filter media, and end user

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa along with their countries

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers, acquisitions, investments, and expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC liquid filtration market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Liquid Filtration Market