Light Field Market by Technology (Hardware (Imaging Solutions, Light Field Displays), Software), Vertical (Media & Entertainment, Healthcare, Architecture, Industrial, Defense), and Region(North America, APAC, Europe, and RoW) (2021-2026)

Updated on : October 22, 2024

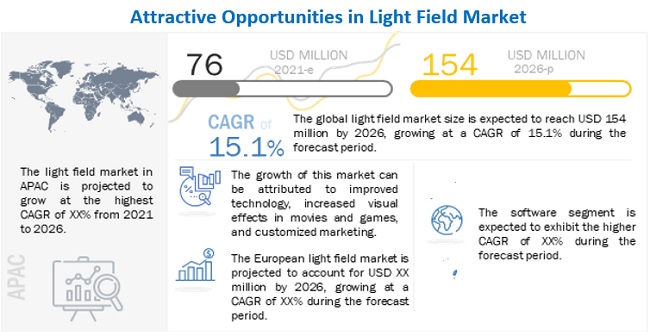

The Global light field market size is projected to reach USD 154 million by 2026 from an estimated USD 76 million in 2021, Growing at a CAGR of 15.1% from 2021 to 2026.

Improved visual effects technology in movies and games, customized marketing, escalated need for prototyping and medical imaging are among the factors driving the growth of the light field industry .

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Light Field Market

In 2020, COVID-19 had a negative effect on the light field market, resulting in decreased shipments of light field and the revenues generated from them. As a result, a drop was witnessed in the growth trend of the market during the first half of 2020. This trend is expected to discontinue in the latter half of the year as the demand is expected to increase due to the growing demand from media & entertainment vertical.

The COVID-19 pandemic has substantially impacted the value chain of the light field market. The US, China, and Japan, which have been adversely affected by the pandemic, account for a significant share of the global light field manufacturing. The healthcare, industrial, and architecture are witnessing a low demand, which is expected to continue for the short term due to the global slowdown.

Market Dynamics

Driver: Improving visual effects technology in movies and games

VR companies and Hollywood studios demand light field technology in cinematic and next-gen content. The entertainment industry is rapidly adopting VFX, which is commonly known as visual effects, for creating visually enhanced imagery with the help of animation and computer graphics. Animators, game developers, and moviemakers prefer VFX in scenarios where they technically want to depict something that cannot be shot in a live environment and that should be simulated in a virtual world or animation software. In this scenario, 3D animation software or tools play a vital role in depicting the scene that needs to appear real. VFX mainly uses the camera mapping technique for creating visual effects. Currently, 3D animation software plays a crucial role in this scenario, in which still images are taken and processed using various 3D animation tools. In addition, the adoption rate of VFX technique is growing at a faster pace, offering new professional opportunities for animators and visual effect artists. 3D mapping and modeling software tools play a vital role in implementing 3D animation in mobile applications and games. 3D animation brings more interactive, realistic, and user-friendly interfaces to the users, increasing the visibility of games and other mobile applications using this technology. The rising adoption of smart devices spurs the demand for advanced 3D-supported mobile games and applications further; these offer superior user experiences for commercial users. Gaming platforms such as Sony PlayStation, Microsoft Xbox, and Nintendo leverage 3D animation and motion capture technology for creating gaming environments that can digitally replicate the users’ movements. These factors primarily fuel the use of 3D animation techniques in the entertainment industry, thereby driving the overall light field market growth.

Restraint: Increasing software corruption and privacy concerns

The animation industry continues to be exposed to corruption and piracy risks. The software installation of companies is targeted, and pirated copies are sold in the market. Consequently, the industry suffers huge financial losses. To control piracy, companies have developed surveillance and monitoring programs to inhibit the illegal downloading of 3D mapping and modeling software. This, in turn, has encouraged users to use legal digital content. In recent years, government norms and regulatory reforms have been implemented to mitigate piracy threats. However, there is a need to adopt flexible business plans to develop mitigation strategies and undertake proactive measures by forming anti-piracy cells and spreading awareness. For instance, in India, states such as Tamil Nadu and Maharashtra have taken initiatives to spread public awareness against piracy. However, in various countries, the only regulatory policy to prevent piracy is to block sites and impose penalty on illegal users.

Opportunity: Rising demand for HD viewing experience

Light field imaging is one of the most studied 3D imaging technologies because of its potential to create a natural viewing environment. After the evolution of the 3D technology, developments can be witnessed in terms of enhancing the content quality and improving the user-viewing experience. 3D technology has enabled providing high-definition (HD) content to enhance the viewing experience through advanced 3D-enabled devices such as 3D display units and VR devices. Apple’s latest light field patent describes the use of a camera array for immersive augmented reality (AR), live display walls, head-mounted displays, video conferencing, and similar applications based on a user’s point of view. HD 3D experience helps in acquiring more customers. It provides an enhanced visual experience in terms of reality, capturing attention, and increased emotional response. This improvement in the user-viewing experience would help various companies examine their products in detail and make further enhancements to make the products effective. In the current scenario, 3D technology has been widely used in media and entertainment, architectural and construction, and manufacturing industries. construction, and manufacturing industries. The increasing investments made in light field display technology are done keeping in mind the demand from the consumer, industrial, architectural, and medical verticals. These investments would aid technological advancements and improve viewing experiences. Consequently, HD viewing experience is expected to generate lucrative opportunities for the light field market.

Challenge: Lack of expertise and skilled workforce

Gaining technical expertise in developing light field projects is a challenging task and is a long-term process. The technicians involved in the rendering of light field imaging and the development of light field displays are expected to have the necessary skills and experience in 3D project development. According to the Media & Entertainment Skills Council (MESC), implementing light field technology in animation is a challenge since several animators lack the required skills. Therefore, it is essential to invest more in improving workforce skills and meeting the animation industry standards. Government and industry regulatory organizations have started taking significant initiatives to invest time and resources in enhancing the skills of animators. Hence, the use of light field technology requires knowledge of 3D imaging, modeling, rendering, and other related technologies. However, the lack of availability of a skilled workforce poses a challenge for the growth of the light field market.

Software segment is projected to register a higher CAGR from 2021 to 2026

The software used in light field market are responsible for rendering the images and making the input images, structure, and videos ready for the output of light field display. The software are under research and are so developed that the user can create virtual objects and 3D structures in the light field ecosystem without a light field camera and form 3D samples that can be viewed by the naked eyes. The software segment of light field market is expected to grow at a higher CAGR in the forecast period; the use of a light field camera is both costly and a tedious process, but can be improved by using light field software.

Media & entertainment segment is projected to register the highest CAGR from 2021 to 2026

The light field market is expected to dominate the media and entertainment vertical, with an increased focus on auto stereoscopy. Auto stereoscopy can display stereoscopic pictures on screens without the viewer wearing any 3D glasses. This technology works by utilizing motion parallax and wide viewing angles and provides viewers an illusion of 3D imaging. Presently, auto stereoscopy is used in AR and VR systems. AR technology is used to improve the perception of reality among viewers on screens or glasses. Similarly, VR technology also alters the real world with a simulated one on screens and glasses. The light field display development kit includes hardware, software, and support services, which enable businesses to create industry-leading mixed-reality products.

To know about the assumptions considered for the study, download the pdf brochure

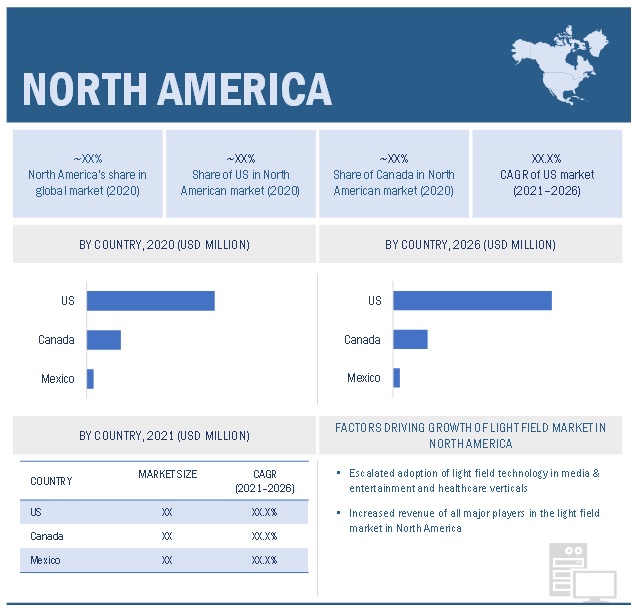

North America to lead CMM market in 2020

Presently, the light field market in North America is the largest revenue contributor compared to other regions; organizations are extensively investing in light field and 3D imaging for technological advancements to fuel the market growth in North America. This region has been amenable toward adopting light field and 3D imaging in companies to enhance visualization and augmented customer experience. North America has been a predominantly receptive market toward the adoption of light field–based 3D imaging. There has been an expansive use of light field and 3D imaging technologies and solutions in this region. Moreover, in this region, organizations are extensively investing in light field and 3D imaging for technological advancements to fuel the market growth. Light field and 3D imaging technologies are being adapted by North America-based companies for enhancing visualization and augmented experience.

Key Market Players

Avegant (US), FoVI 3D (US), OTOY (US), Japan Display (Japan), Raytrix (Germany), Fathom Optics (US), NVIDIA (US), Light Field Lab (US), Holografika (Hungary), Leia (US), Quidient (US), are among a few major players in the light field companies.

Light Field Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 76 Million |

| Revenue Forecast in 2026 | USD 154 Million |

| Growth Rate | 15.1% |

|

Years considered to provide market size |

2018–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

|

Top Companies in North America |

|

| Key Market Driver | Increasing necessity of data centers due to rising adoption of cloud platforms |

| Key Market Opportunity | Rising demand for HD viewing experience |

| Largest Growing Region | North America |

| Largest Market Share Segment | Hardware segment |

| Highest CAGR Segment | Media & entertainment segment |

This research report segments the light field market based on technology, vertical, and geography.

By Technology:

-

Hardware

- Imaging Solutions

- Light Field Displays

- Software

By Vertical

- Media & Entertainment

- Healthcare

- Architecture

- Industrial

- Defense

- Others

By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Recent Developments in Light Field Industry :

- In August 2021, Leia launched 3D Lume Pad, a high-performance Android 10.8-inch tablet that projects images in true 3D off - and deeper into - the screen, visible with the naked eye. the Lume Pad supports all the apps and features of a premium tablet and, with the touch of a button, converts photos and videos to 3D in real time for streaming, creating content, and sharing. It also makes 2D and 3D apps and games a more immersive experience.

- In August 2021, Gameloft Business Solutions and Leia Inc. partnered to implement their gaming solution with Asphalt Nitro 2 on the Lume Pad. Gameloft Business Solutions provides customized gaming packages and subscription-based offers with carrier billing solutions in 148 countries globally.

- In July 2021, Light Field Lab selected Walt & Company as a Public Relations Agency of Record. Walt & Company has experience in working across home and commercial entertainment and AR and VR industries. It will work as an extension of the Light Field Lab team to manage various communications services, including product and market leadership campaigns, media and analyst relations, industry leadership positioning, media event activations, and editorial services.

- In April 2021, Leia partnered with Unity as a Verified Solutions Partner (VSP). Unity is the world’s leading platform for creating and operating real-time 3D (RT3D) content.

- In January 2021, Fathom Optics (formerly Lumii, Inc.) launched a light field technology software that brings a printed 3D and motion graphics package, which does not require specialty inks or substrates or any additional materials such as lenticulars or foils. It is based on light field technology, originally developed for digital 3D displays.

Frequently Asked Questions (FAQ):

Which are the major companies in the light field market? What are their major strategies to strengthen their market presence?

The major companies in light field market are – Avegant (US), FoVI 3D (US), OTOY (US), Japan Display (Japan), Raytrix (Germany). The major strategies adopted by these players are product launches and partnerships.

Which is the potential market for light field market in terms of the region?

The North American region is expected to dominate the light field market owing to the increasing demand from media & entertainment.

What are the opportunities for new market entrants?

There are significant opportunities in the light field market which include increased demand for HD viewing experience and evolved artificial intelligence technologies.

What are the drivers and opportunities for the light field market?

Factors such as improved visual effects technology in movies and games, customized marketing, escalated need for prototyping and medical imaging are driving the market. Moreover, increased demand for HD viewing experience and evolved artificial intelligence technologies are expected to create lucrative opportunities in light field market.

Who are the major consumers of light field that are expected to drive the growth of the market in the next 5 years?

The major consumers of light field for media & entertainment, healthcare, and architecture verticals are expected to have a significant share in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 1 LIGHT FIELD MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

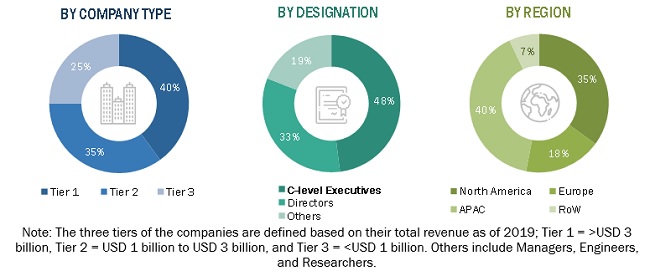

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM PRODUCTS/SOLUTIONS/SERVICES OF LIGHT FIELD MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTION FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RESULTS

3 EXECUTIVE SUMMARY (Page No. - 36)

FIGURE 7 COVID-19 IMPACT ANALYSIS ON LIGHT FIELD MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 HARDWARE SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 9 MEDIA & ENTERTAINMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 LIGHT FIELD MARKET TO WITNESS HIGHEST CAGR IN APAC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN LIGHT FIELD MARKET

FIGURE 11 INCREASING DEMAND FROM MEDIA & ENTERTAINMENT VERTICAL IS DRIVING LIGHT FIELD MARKET

4.2 MARKET, BY TECHNOLOGY

FIGURE 12 HARDWARE SEGMENT TO HOLD LARGER SHARE IN LIGHT FIELD MARKET FROM 2021 TO 2026

4.3 LIGHT FIELD MARKET, BY VERTICAL AND REGION

FIGURE 13 MEDIA & ENTERTAINMENT VERTICAL AND NORTH AMERICA ACCOUNTED FOR LARGEST SHARES OF LIGHT FIELD MARKET IN 2020

4.4 MARKET, BY GEOGRAPHY

FIGURE 14 US HELD LARGEST SHARE OF LIGHT FIELD MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 LIGHT FIELD MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Improving visual effects technology in movies and games

5.2.1.2 Customized marketing

5.2.1.3 Rising need for prototyping and medical imaging

FIGURE 16 DRIVERS OF LIGHT FIELD MARKET AND THEIR IMPACTS

5.2.2 RESTRAINTS

5.2.2.1 Increasing software corruption and privacy concerns

FIGURE 17 RESTRAINTS FOR MARKET AND THEIR IMPACTS

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for HD viewing experience

5.2.3.2 Development of artificial intelligence technologies

FIGURE 18 OPPORTUNITIES FOR LIGHT FIELD MARKET AND THEIR IMPACTS

5.2.4 CHALLENGES

5.2.4.1 Lack of expertise and skilled workforce

FIGURE 19 CHALLENGES FOR MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: LIGHT FIELD MARKET

6 APPLICATIONS OF LIGHT FIELD TECHNOLOGY (Page No. - 50)

6.1 INTRODUCTION

6.2 ILLUMINATION ENGINEERING

6.3 LIGHT FIELD RENDERING

6.4 SYNTHETIC APERTURE PHOTOGRAPHY

6.5 3D DISPLAY

6.6 BRAIN IMAGING

7 LIGHT FIELD MARKET, BY TECHNOLOGY (Page No. - 52)

7.1 INTRODUCTION

FIGURE 21 HARDWARE SEGMENT TO HOLD LARGER SHARE IN LIGHT FIELD MARKET DURING FORECAST PERIOD

TABLE 2 LIGHT FIELD MARKET, BY TECHNOLOGY, 2018–2020 (USD MILLION)

TABLE 3 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 HARDWARE

TABLE 4 LIGHT FIELD MARKET, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 5 MARKET, BY HARDWARE, 2021–2026 (USD MILLION)

7.2.1 IMAGING SOLUTIONS

7.2.1.1 Light field camera

7.2.1.2 Function

7.2.1.2.1 3D Modeling

7.2.1.2.2 3D Scanning

7.2.1.2.3 Layout and Animation

7.2.1.2.4 3D Rendering

7.2.1.2.5 Image Reconstruction

TABLE 6 LIGHT FIELD IMAGING SOLUTIONS MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 7 LIGHT FIELD IMAGING SOLUTIONS MARKET, BY VERTICAL, 2021–2026 (USD THOUSAND)

7.2.2 LIGHT FIELD DISPLAY

7.2.2.1 VR glasses

7.2.2.2 Light field projectors

7.2.2.3 Light field screens

FIGURE 22 MEDIA & ENTERTAINMENT SEGMENT TO DOMINATE LIGHT FIELD DISPLAYS MARKET DURING FORECAST PERIOD

TABLE 8 LIGHT FIELD DISPLAYS MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 9 LIGHT FIELD DISPLAYS MARKET, BY VERTICAL, 2021–2026 (USD THOUSAND)

7.3 SOFTWARE

FIGURE 23 MEDIA & ENTERTAINMENT SEGMENT TO DOMINATE LIGHT FIELD SOFTWARE MARKET DURING FORECAST PERIOD

TABLE 10 LIGHT FIELD SOFTWARE MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 11 LIGHT FIELD SOFTWARE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

8 LIGHT FIELD MARKET, BY VERTICAL (Page No. - 62)

8.1 INTRODUCTION

FIGURE 24 MEDIA & ENTERTAINMENT VERTICAL TO DOMINATE LIGHT FIELD MARKET DURING FORECAST PERIOD

TABLE 12 MARKET, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 13 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

8.2 MEDIA & ENTERTAINMENT

TABLE 14 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 15 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY HARDWARE, 2021–2026 (USD MILLION)

FIGURE 25 MEDIA & ENTERTAINMENT VERTICAL IN NORTH AMERICA TO DOMINATE LIGHT FIELD MARKET DURING FORECAST PERIOD

TABLE 16 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 17 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.3 HEALTHCARE

TABLE 18 MARKET IN HEALTHCARE VERTICAL, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 19 MARKET IN HEALTHCARE VERTICAL, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 20 MARKET IN HEALTHCARE VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 MARKET IN HEALTHCARE VERTICAL, BY REGION, 2021–2026 (USD MILLION)

8.4 ARCHITECTURE

FIGURE 26 LIGHT FIELD DISPLAY IN ARCHITECTURE VERTICAL TO DOMINATE LIGHT FIELD MARKET

TABLE 22 MARKET IN ARCHITECTURE VERTICAL, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 23 MARKET IN ARCHITECTURE VERTICAL, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 24 MARKET IN ARCHITECTURE VERTICAL, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 MARKET IN ARCHITECTURE VERTICAL, BY REGION, 2021–2026 (USD THOUSAND)

8.5 INDUSTRIAL

TABLE 26 MARKET IN INDUSTRIAL VERTICAL, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 27 MARKET IN INDUSTRIAL VERTICAL, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 28 MARKET IN INDUSTRIAL VERTICAL, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 29 MARKET IN INDUSTRIAL VERTICAL, BY REGION, 2021–2026 (USD THOUSAND)

8.6 DEFENSE

FIGURE 27 LIGHT FIELD DISPLAY IN DEFENSE VERTICAL TO DOMINATE LIGHT FIELD MARKET DURING FORECAST PERIOD

TABLE 30 MARKET IN DEFENSE VERTICAL, BY HARDWARE, 2018–2020 (USD MILLION)

TABLE 31 MARKET IN DEFENSE VERTICAL, BY HARDWARE, 2021–2026 (USD MILLION)

TABLE 32 MARKET IN DEFENSE VERTICAL, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 33 MARKET IN DEFENSE VERTICAL, BY REGION, 2021–2026 (USD THOUSAND)

8.7 OTHERS

TABLE 34 LIGHT FIELD MARKET IN OTHER VERTICAL, BY HARDWARE, 2018–2020 (USD THOUSAND)

TABLE 35 MARKET IN OTHER VERTICAL, BY HARDWARE, 2021–2026 (USD MILLION)

FIGURE 28 OTHER VERTICAL IN NORTH AMERICA TO DOMINATE LIGHT FIELD MARKET DURING FORECAST PERIOD

TABLE 36 MARKET IN OTHER VERTICAL, BY REGION, 2018–2020 (USD THOUSAND)

TABLE 37 MARKET IN OTHER VERTICAL, BY REGION, 2021–2026 (USD THOUSAND)

9 GEOGRAPHIC ANALYSIS (Page No. - 77)

9.1 INTRODUCTION

FIGURE 29 LIGHT FIELD MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 38 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 MARKET, BY REGION, 2021–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: LIGHT FIELD MARKET SNAPSHOT

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

TABLE 40 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 41 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 42 MARKET IN NORTH AMERICA, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 43 MARKET IN NORTH AMERICA, BY VERTICAL, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 31 EUROPE: LIGHT FIELD MARKET SNAPSHOT

9.3.1 UK

9.3.2 GERMANY

9.3.3 FRANCE

9.3.4 REST OF EUROPE

TABLE 44 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 45 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 46 MARKET IN EUROPE, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 47 MARKET IN EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

9.4 APAC

FIGURE 32 APAC: LIGHT FIELD MARKET SNAPSHOT

9.4.1 CHINA

9.4.2 JAPAN

9.4.3 REST OF APAC (ROAPAC)

TABLE 48 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 49 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 50 MARKET IN APAC, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 51 MARKET IN APAC, BY VERTICAL, 2021–2026 (USD MILLION)

9.5 REST OF THE WORLD (ROW)

FIGURE 33 ROW: LIGHT FIELD MARKET SNAPSHOT

9.5.1 MIDDLE EAST & AFRICA

9.5.2 SOUTH AMERICA

TABLE 52 MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 53 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 54 MARKET IN ROW, BY VERTICAL, 2018–2020 (USD MILLION)

TABLE 55 MARKET IN ROW, BY VERTICAL, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 93)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS OF PLAYERS, 2020

TABLE 56 LIGHT FIELD MARKET: CONSOLIDATED

10.3 COMPETITIVE EVALUATION QUADRANT

10.3.1 STAR

10.3.2 EMERGING LEADER

10.3.3 PERVASIVE

10.3.4 PARTICIPANT

FIGURE 34 LIGHT FIELD MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

TABLE 57 COMPANY FOOTPRINT ANALYSIS OF TOP PLAYERS IN LIGHT FIELD MARKET

10.4 COMPETITIVE SITUATIONS AND TRENDS

10.4.1 PRODUCT LAUNCHES

TABLE 58 MARKET: PRODUCT LAUNCHES, JANUARY 2018 – JANUARY 2021

10.4.2 DEALS

TABLE 59 MARKET: DEALS. JANUARY 2018 – JANUARY 2021

11 COMPANY PROFILES (Page No. - 100)

11.1 KEY PLAYERS

(Business Overview, Products and Solutions Offered, Recent Developments, and MnM View)*

11.1.1 AVEGANT

TABLE 60 AVEGANT: BUSINESS OVERVIEW

11.1.2 FOVI 3D

TABLE 61 FOVI 3D: BUSINESS OVERVIEW

11.1.3 OTOY

TABLE 62 OTOY: BUSINESS OVERVIEW

11.1.4 JAPAN DISPLAY

TABLE 63 JAPAN DISPLAY: BUSINESS OVERVIEW

FIGURE 35 JAPAN DISPLAY: COMPANY SNAPSHOT

11.1.5 RAYTRIX

TABLE 64 RAYTRIX: BUSINESS OVERVIEW

11.1.6 FATHOM OPTICS

TABLE 65 FATHOM OPTICS: BUSINESS OVERVIEW

11.1.7 NVIDIA

TABLE 66 NVIDIA: BUSINESS OVERVIEW

FIGURE 36 NVIDIA: COMPANY SNAPSHOT

11.1.8 LIGHT FIELD LAB

TABLE 67 LIGHT FIELD LAB: BUSINESS OVERVIEW

11.1.9 HOLOGRAFIKA

TABLE 68 HOLOGRAFIKA: BUSINESS OVERVIEW

11.1.10 LEIA

TABLE 69 LEIA: BUSINESS OVERVIEW

11.1.11 QUIDIENT

TABLE 70 QUIDIENT: BUSINESS OVERVIEW

* Business Overview, Products and Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 APPLE INC.

11.2.2 SONY CORPORATION

11.2.3 GOOGLE LLC

11.2.4 TOSHIBA

11.2.5 K | LENS GMBH

11.2.6 CREAL

11.2.7 AYE3D

11.2.8 MOPIC LABS

11.2.9 PHOTONIC CRYSTAL CO.

11.2.10 LOOKING GLASS FACTORY

11.2.11 DIMENCO

11.2.12 WOOPTIX

11.2.13 POLIGHT

11.2.14 SURFACE OPTICS CORPORATION

12 ADJACENT & RELATED MARKET (Page No. - 129)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 AUGMENTED REALITY AND VIRTUAL REALITY MARKET

12.3.1 DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 AR MARKET BY REGION

TABLE 71 AUGMENTED REALITY MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 73 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 74 MARKET, BY REGION, 2020–2025 (USD MILLION)

12.3.3.1 North America

TABLE 75 AUGMENTED REALITY MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 76 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 77 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 78 AUGMENTED REALITY MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 79 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 80 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 81 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 82 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.2 Europe

TABLE 83 AUGMENTED REALITY MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 85 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 87 VIRTUAL REALITY MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

&nnbsp; TABLE 90 VR MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.3 APAC

TABLE 91 AUGMENTED REALITY MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 92 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 93 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 94 AUGMENTED REALITY MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 95 VIRTUAL REALITY MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 96 VIRTUAL REALITY MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 97 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 98 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.3.4 ROW

TABLE 99 AUGMENTED REALITY MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 100 AUGMENTED REALITY MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 101 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 102 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 103 VIRTUAL REALITY MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 104 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 105 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 106 VIRTUAL REALITY MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 107 AUGMENTED REALITY MARKET IN KSA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 108 MARKET IN KSA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 109 VIRTUAL REALITY MARKET IN KSA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 MARKET IN KSA, BY APPLICATION, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 146)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the size of the light field market. Exhaustive secondary research has been conducted to collect information on the light field market. In the next step, these findings, assumptions, and sizing have been validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches have been employed to estimate the complete market size. Following that, the market breakdown and data triangulation methods have been used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for the light field market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, associations (such as The Internet and Television Association (NCTA), and Optical Society (OSA)), and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the light field market. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall light field market and the market based on segments. The research methodology used to estimate the market size has been given below:

- Key players expected operating in the light field market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall expected light field market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the light field market.

Report Objectives:

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the light field market report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Light Field Market