Level Transmitter Market Size, Share, Statistics, Industry Growth Analysis Report by Technology (Capacitance, Radar, Ultrasonic, Differential Pressure, Magnetostrictive, Radiometric), Industry (Oil & Gas, Chemicals, Water & Wastewater, Power), and Region -2025

Updated on : November 28, 2024

The Level Transmitter Market is witnessing robust demand and growth, primarily driven by the expanding industrial sector and the increasing need for precise measurement and monitoring of liquid and solid levels in various applications. Key trends influencing this market include the rising adoption of smart sensors and the integration of IoT technology, which enhance data accuracy and real-time monitoring capabilities. As industries prioritize automation and efficiency, the future of the level transmitter market appears bright, with continuous innovations aimed at improving reliability and ease of use. This growth trajectory is expected to open new opportunities across sectors such as oil and gas, water treatment, and food and beverage, further solidifying the role of level transmitters in modern industrial processes.

Level Transmitter Market Size

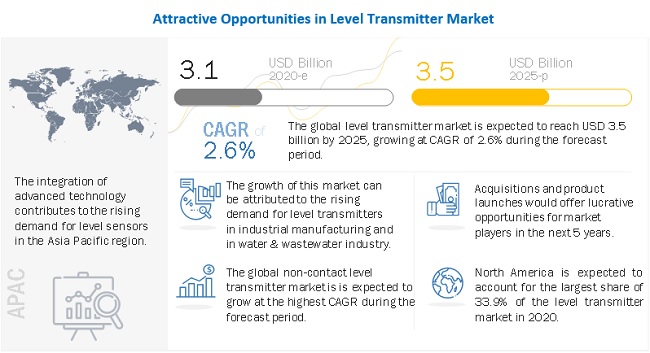

The global level transmitter market size is projected to experience a CAGR of 2.6% and grow from USD 3.1 billion in 2020 to USD 3.5 billion by 2025. The market's growth can be attributed to an increased demand for level transmitters in the pharmaceutical and food and beverage industries, as well as a greater emphasis on industrial automation and resource optimization. Regulatory requirements for industrial safety have also contributed to the market's growth, as have advancements in wireless level transmitter technology. Despite these advancements, the market still faces challenges, such as difficulties associated with high-level measurement in tanks with floating roofs.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the Level transmitter market

COVID-19 has severely impacted the global economy and all the industries throughout the globe. This is mainly due to the disruptions in the supply chain across the globe. The economies across the world have declined as there is a major decline in the demand for products. The production across industries has been limited due to the pandemic resulting in the shortage of raw material. The decline in exports and the disruptions in the supply chain are the major factors contributing to the decline in production. The level transmitter industry is thus getting affected by COVID-19. This has resulted in a lower estimated year-on-year growth rate for 2020 as compared with 2019.

Level Transmitter Market Dynamics :

DRIVERS : High focus on industrial automation and optimum utilization of resources

Maintaining the quality of a final product by monitoring raw materials and regulating production processes precisely are extremely important for a manufacturing firm to become successful. Several manufacturers have started adopting automated process control technologies for faster, better, and cheaper production. Industrial automation reduces operational cost, improves product quality, increases productivity, and addresses industrial health and safety-related issues across various process industries. Both discrete and process industries have directed their focus on bringing in the best practices to reduce wastage and increase plant efficiency. The way ahead for increasing efficiency and optimizing manufacturing processes lies in utilizing the plant data, such as real-time production data, to make better business and operational decisions. Thus, there is an increasing focus on incorporating systems and software, including level transmitters, that could make this job easier.

RESTRAINT: Network congestion in continuous level measurement

A level transmitter performs the operation of level measurement and communicates the measured data over a network to remote monitoring systems. Automation in factories is achieved by employing computers across the production process. Thus, in continuous level measurement, a large volume of data is generated, which can result in network congestion. Excessive data may lead to a slowdown of systems that are used across the industry, affecting the flow of data communication.

OPPORTUNITIES : Growing demand for radar level transmitter

Radar level transmitters witness high demand from process industries as they are extremely reliable, highly accurate, and best suited for unstable process conditions. Radar level technology facilitates level measurement in almost every application involving solids and liquids. Radar level transmitters also work well with boiling surfaces, recirculating fluids, propeller mixers, and aeration tanks. Hence, they are used in nearly 90% of level measurement applications. Guided wave radar technology also offers several benefits in processes that are subject to dust, as well as foam and heavy vapors. Wherever there is a need for interface measurement (such as oil on water), the technology allows the measuring signal to penetrate the upper product and provide a measurement of the lower product.

CHALLENGES: Difficulties associated with High-level measurement in tanks with floating roof

Storage tanks comprising explosive materials, such as gasoline, naphtha, and organic chemicals, are built with a roof that floats directly on the liquid. This prevents the accumulation of vapors, reduces the risk of fire or explosion, limits evaporation, and decreases both product loss and air pollution. However, the floating roof has some challenges pertaining to the detection of high-level measurement and overfilling of tanks and containers. Since the roof is a solid object, traditional level switches, such as tuning forks or ultrasonic gap switches, cannot be used to measure liquids.

Level Transmitter Market Segmentation :

Water & Wastewater industry to grow at the fastest rate during the forecast period”

Water and wastewater treatment includes the processing of drinking water, and domestic and industrial wastewater. In various stages of wastewater treatment, level monitoring is required. Supply level transmitters are widely used in drinking water plants for various applications. Bank filtration is another process where level transmitters find application. In developed nations such as the US, the UK, and Germany, industrial and municipal wastewater treatment is a major market because of strict government regulations. Stringent regulations regarding the treatment of wastewater in various industries will support the demand for automation solutions, including level transmitters.

Contact level transmitter to hold the largest share of level transmitter market by 2025

Contact level transmitters are available in magnetostrictive, hydrostatic, capacitive, and guided wave radar sensing technologies. Among them, differential pressure/hydrostatic technology is the most used for contact level transmitters. The key advantage of these level transmitters is that they require no compensation for changes in density, dielectric, or conductivity of a fluid. Contact level transmitters are less costly than non-contact level transmitters.

To know about the assumptions considered for the study, download the pdf brochure

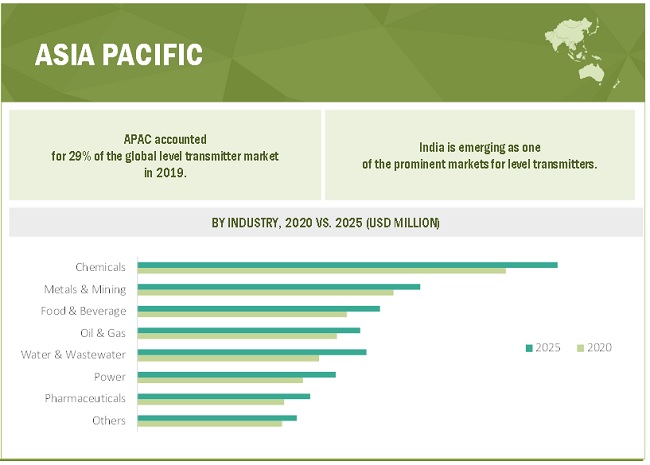

“Level transmitter market in APAC to grow at the highest CAGR”

The region has an established base of process industries, healthcare, petrochemicals, chemicals, and power industries. India and China are considered as huge markets for level transmitters, owing to large-scale urbanization and rapid economic growth in these countries. China and India are witnessing high industrial growth. Moreover, the food & beverages and chemicals industries are developing in the region. These industries are water-intensive; thus, the treatment facilities for the aforementioned industries are expected to generate greater demand for level transmitters.

Top Level Transmitter Companies - Key Market Players:

Endress+Hauser (Switzerland), VEGA (Germany), Emerson Electric (US), Siemens (Germany), and KROHNE (Germany) ABB (Switzerland), Honeywell (US), Yokogawa (Japan), AMETEK (US), Magnetrol (US), Schneider Electric (France) are a few major Level transmitter Companies.

.

Level Transmitter Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 3.1 Billion |

| Projected Market Size | USD 3.5 Billion |

| Growth Rate | 2.6%. CAGR |

|

Market Size Available for Years |

2016–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | High focus on industrial automation and optimum utilization of resources |

| Key Market Opportunity | Growing demand for radar level transmitter |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Contact level transmitter |

This research report categorizes the level transmitter market by technology, type, end user, and region.

Level transmitter market By Technology :

- Capacitive

- Ultrasonic

- Radar

- Differential Pressure/Hydrostatic

- Magnetostrictive

- Radiometric

- Others (Laser, Displacer, and Potentiometric)

By Type:

- Contact

- Non-Contact

By Industry:

- Oil & Gas

- Chemicals

- Water & Wastewater

- Food & Beverages

- Pharmaceuticals

- Power

- Metals & Mining

- Others (Paper & Pulp, Cement, Textiles, Glass, Agriculture, and Marine)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Level transmitter Industry

- In September 2020, Endress+Hauser expanded its presence in the Middle East with the establishment of Endress+Hauser Middle East. The new organization, headquartered in Dubai, UAE, will lead and support all regional solutions, sales, and service activities, including Endress+Hauser sales centers and sales representatives in the Middle East region

- In August 2020, Siemens launched Sitrans LR250 PLA (polypropylene lens antenna), a radar level measurement transmitter that can be used for inventory management and critical process control. This solution can be used for chemicals level measurement within a nominal pressure and temperature environment.

- In November 2019, Vega extended its radar portfolio with the launch of 80 GHz radar level sensors for the water and wastewater industry.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the level transmitter market during 2020-2025?

The global level transmitter market is expected to record the CAGR of 2.6% from 2020–2025.

Does this report include the impact of COVID-19 on the level transmitter market?

Yes, the report includes the impact of COVID-19 on the level transmitter market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the level transmitter market?

Growing demand for level transmitters in pharmaceuticals and food & beverages, high focus on industrial automation and optimum utilization of resources, increased regulatory emphasis on industrial safety, development of wireless level transmitters are some of the driving factors for the level transmitter market.

Which are the significant players operating in the level transmitter market?

Endress+Hauser (Switzerland), VEGA (Germany), Emerson Electric (US), Siemens (Germany), and KROHNE (Germany), ABB (Switzerland), Honeywell (US), Yokogawa (Japan), AMETEK (US), Magnetrol (US), Schneider Electric (France) are some of the major companies operating in the level transmitter market.

Which region will lead the level transmitter market in the future?

APAC is expected to lead the level transmitter market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 LEVEL TRANSMITTER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY & PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): SUMMATION OF REVENUE OF PRODUCTS/SOLUTIONS/SERVICES OF LEVEL TRANSMITTER MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 3 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 4 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 COVID-19 IMPACT ANALYSIS ON MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 7 DIFFERENTIAL PRESSURE TECHNOLOGY ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2019

FIGURE 8 OIL & GAS HELD LARGEST SHARE OF LEVEL TRANSMITTER MARKET IN 2019

FIGURE 9 NON-CONTACT TYPE TO REGISTER HIGHER CAGR IN LEVEL TRANSMITTER MARKET DURING FORECAST PERIOD

FIGURE 10 APAC TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR LEVEL TRANSMITTER MARKET

FIGURE 11 MARKET EXPECTED TO FIND HUGE GROWTH OPPORTUNITIES IN APAC

4.2 MARKET, BY TECHNOLOGY

FIGURE 12 MARKET FOR RADAR EXPECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.3 MARKET, BY INDUSTRY

FIGURE 13 OIL & GAS INDUSTRY EXPECTED TO HOLD LARGEST SIZE OF MARKET IN 2025

4.4 MARKET, BY TYPE

FIGURE 14 CONTACT LEVEL TRANSMITTER EXPECTED TO CONTINUE TO HOLD LARGER SHARE OF LEVEL TRANSMITTER MARKET DURING FORECAST PERIOD

4.5 LEVEL TRANSMITTER MARKET, BY GEOGRAPHY

FIGURE 15 NORTH AMERICA EXPECTED TO HOLD LARGEST SIZE OF MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

FIGURE 16 IMPACT OF DRIVERS ON LEVEL TRANSMITTER MARKET

5.2.1.1 Growing demand for level transmitters in pharmaceuticals and food & beverages industries

5.2.1.2 High focus on industrial automation and optimum utilization of resources

5.2.1.3 Increased regulatory emphasis on industrial safety

5.2.1.4 Development of wireless level transmitters

5.2.2 RESTRAINTS

FIGURE 17 IMPACT OF RESTRAINTS ON LEVEL TRANSMITTER MARKET

5.2.2.1 Network congestion in continuous level measurement

5.2.3 OPPORTUNITIES

FIGURE 18 IMPACT OF OPPORTUNITIES ON LEVEL TRANSMITTER MARKET

5.2.3.1 Increasing demand for level measurement solutions for space applications

5.2.3.2 Growing demand for radar level transmitters

5.2.4 CHALLENGES

FIGURE 19 IMPACT OF CHALLENGES ON LEVEL TRANSMITTER MARKET

5.2.4.1 Difficulties associated with high-level measurement in tanks with floating roofs

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 GLOBAL MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 21 MARKET: ECOSYSTEM

5.5 PORTER’S FIVE FORCE ANALYSIS

TABLE 1 IMPACT OF EACH FORCE ON LEVEL TRANSMITTER MARKET

5.6 CASE STUDY

5.7 TECHNOLOGY ANALYSIS

5.8 PRICING ANALYSIS

TABLE 2 AVERAGE SELLING PRICE BASED ON LEVEL TRANSMITTER TECHNOLOGY

5.9 TRADE ANALYSIS

TABLE 3 IMPORT, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 4 EXPORT BY COUNTRY, 2015–2019 (USD MILLION)

5.10 PATENT ANALYSIS

5.11 STANDARDS & REGULATORY LANDSCAPE

6 LEVEL TRANSMITTER MARKET, BY POSITIONING (Page No. - 64)

6.1 INTRODUCTION

FIGURE 22 MARKET, BY POSITIONING

6.2 FLOAT

6.2.1 FLOAT LEVEL TRANSMITTER ARE USED IN APPLICATIONS INVOLVING WATER, OIL, CHEMICALS, AND OTHER LIQUID MATERIALS

6.3 SUBMERSIBLE

6.3.1 SUBMERSIBLE LEVEL TRANSMITTERS ARE USED FOR INSTANTANEOUS LEVEL MONITORING

7 LEVEL TRANSMITTER MARKET, BY MONITORING METHOD (Page No. - 66)

7.1 INTRODUCTION

7.2 POINT LEVEL MEASUREMENT

7.2.1 POINT LEVEL MONITORING IS SUITABLE FOR PROCESS TANKS, STORAGE TANKS, SILOS, AND PIPELINES IN PROCESS INDUSTRIES

7.3 CONTINUOUS LEVEL MEASUREMENT

7.3.1 CONTINUOUS LEVEL MEASUREMENT IS USED IN INDUSTRIES WHERE HIGH-ACCURACY LEVEL MEASUREMENT IS CRUCIAL

8 LEVEL TRANSMITTER MARKET, BY TYPE (Page No. - 67)

8.1 INTRODUCTION

FIGURE 23 NON-CONTACT LEVEL TRANSMITTER SEGMENT EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 5 LEVEL TRANSMITTER MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 6 MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.2 CONTACT LEVEL TRANSMITTER

8.2.1 CONTACT LEVEL TRANSMITTERS MOSTLY USE HYDROSTATIC SENSING TECHNOLOGY

TABLE 7 CONTACT MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 8 CONTACT MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 9 CONTACT MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 10 CONTACT MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

8.3 NON-CONTACT LEVEL TRANSMITTER

8.3.1 NON-CONTACT LEVEL TRANSMITTERS ARE WIDELY DEPLOYED IN PROCESS INDUSTRIES

TABLE 11 NON-CONTACT MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 12 NON-CONTACT L MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 13 NON-CONTACT MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 14 NON-CONTACT MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9 LEVEL TRANSMITTER MARKET, BY TECHNOLOGY (Page No. - 73)

9.1 INTRODUCTION

FIGURE 24 RADAR TECHNOLOGY IS ESTIMATED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 16 MARKET, BY TECHNOLOGY, 2020–2025 (USD MILLION)

9.2 CAPACITIVE

9.2.1 CAPACITIVE LEVEL TRANSMITTERS ARE DESIGNED TO MEASURE LEVELS OF VARIOUS LIQUIDS AND SOLIDS

TABLE 17 CAPACITIVE MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 18 CAPACITIVE MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.3 ULTRASONIC

9.3.1 ULTRASONIC LEVEL TRANSMITTERS ARE EASY TO INSTALL ON TANKS

TABLE 19 ULTRASONIC LEVEL TRANSMITTER , BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 20 ULTRASONIC LEVEL TRANSMITTER , BY INDUSTRY, 2020–2025 (USD MILLION)

9.4 RADAR

TABLE 21 RADAR MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 22 MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.4.1 CONTACT (GUIDED WAVE RADAR)

9.4.1.1 Contact radar level transmitters Leverage microwave pulses for level measurement

TABLE 23 GUIDED WAVE RADAR LEVEL TRANSMITTER MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 24 MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.4.2 NON-CONTACT

9.4.2.1 Non-contact radar level transmitters are versatile and do not require physical contact with media

TABLE 25 NON-CONTACT RADAR MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 26 NON-CONTACT RADAR MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.5 DIFFERENTIAL PRESSURE/HYDROSTATIC

9.5.1 DIFFERENTIAL PRESSURE/HYDROSTATIC LEVEL TRANSMITTERS LIKELY TO HOLD LARGEST MARKET SHARE FROM 2020 TO 2025

TABLE 27 DIFFERENTIAL PRESSURE/HYDROSTATIC MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 28 DIFFERENTIAL PRESSURE/HYDROSTATIC MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.6 MAGNETOSTRICTIVE

9.6.1 MAGNETOSTRICTIVE LEVEL TRANSMITTERS WORK WELL WITH CLEAN LIQUIDS AND ARE ACCURATE AND ADAPTABLE TO WIDE VARIATIONS IN FLUID DENSITIES

TABLE 29 MAGNETOSTRICTIVE LEVEL TRANSMITTER MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 30 MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

9.7 RADIOMETRIC

9.7.1 RADIOMETRIC LEVEL TRANSMITTERS ARE MOSTLY USED IN METALS AND MINING INDUSTRY

TABLE 31 RADIOMETRIC LEVEL TRANSMITTER MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 32 RADIOMETRIC LEVEL TRANSMITTER , BY INDUSTRY, 2020–2025 (USD MILLION)

9.8 OTHERS

TABLE 33 MARKET FOR OTHER TECHNOLOGIES, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 34 MARKET FOR OTHER TECHNOLOGIES, BY INDUSTRY, 2020–2025 (USD MILLION)

10 LEVEL TRANSMITTER MARKET, BY INDUSTRY (Page No. - 89)

10.1 INTRODUCTION

FIGURE 25 OIL & GAS INDUSTRY IS ESTIMATED TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2025

TABLE 35 MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 36 MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

10.2 OIL & GAS

10.2.1 OIL & GAS INDUSTRY TO CONTINUE TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 37 MARKET FOR OIL & GAS INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 38 MARKET FOR OIL & GAS INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 39 MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 40 MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 41 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 LEVEL TRANSMITTER MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 43 RADAR LEVEL TRANSMITTER MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 44 MARKET FOR OIL & GAS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

10.3 CHEMICALS

10.3.1 INCREASING DEMAND FOR MEASUREMENT ACCURACY IN CHEMICAL INDUSTRY EXPECTED TO BOOST LEVEL TRANSMITTER DEMAND

TABLE 45 MARKET FOR CHEMICALS INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 46 MARKET FOR CHEMICALS INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 47 MARKET FOR CHEMICALS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 48 MARKET FOR CHEMICALS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 49 MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 51 MARKET FOR CHEMICALS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 52 RADAR LEVEL TRANSMITTER MARKET FOR CHEMICALS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

10.4 WATER & WASTEWATER

10.4.1 WASTEWATER MANAGEMENT REGULATIONS TO SPUR DEMAND FOR LEVEL TRANSMITTERS

TABLE 53 MARKET FOR WATER & WASTEWATER INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 54 MARKET FOR WATER & WASTEWATER INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 55 MARKET FOR WATER & WASTEWATER INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 56 MARKET FOR WATER & WASTEWATER INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 57 RADAR LEVEL TRANSMITTER MARKET FOR WATER & WASTEWATER INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 58 MARKET FOR WATER & WASTEWATER INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 59 MARKET FOR WATER & WASTEWATER INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 60 MARKET FOR WATER & WASTEWATER INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

10.5 FOOD & BEVERAGES

10.5.1 NEED FOR CONTINUOUS LEVEL MONITORING AND MEASUREMENT OF FLOW OF INGREDIENTS IN FOOD & BEVERAGES INDUSTRY SUBSTANTIATE DEMAND FOR LEVEL TRANSMITTERS

TABLE 61 LEVEL TRANSMITTER MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 62 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 63 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 64 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 65 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 66 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 67 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 68 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

10.6 PHARMACEUTICALS

10.6.1 LEVEL TRANSMITTERS USED TO MEET STRICT REQUIREMENTS FOR HYGIENE IN PHARMACEUTICALS INDUSTRY

FIGURE 26 APPLICATIONS OF LEVEL TRANSMITTERS IN PHARMACEUTICALS INDUSTRY

TABLE 69 MARKET FOR PHARMACEUTICALS INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 70 MARKET FOR PHARMACEUTICALS INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 71 MARKET FOR PHARMACEUTICALS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 MARKET FOR PHARMACEUTICALS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 73 RADAR LEVEL TRANSMITTER MARKET FOR PHARMACEUTICALS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 74 MARKET FOR PHARMACEUTICALS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 75 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 76 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

10.7 POWER

10.7.1 GROWING USE OF LEVEL TRANSMITTERS IN COAL POWER PLANTS, HYDROPOWER STATIONS, AND BIOGAS PLANTS FUELS MARKET GROWTH

TABLE 77 APPLICATIONS OF LEVEL TRANSMITTERS IN POWER INDUSTRY

TABLE 78 MARKET FOR POWER INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 79 MARKET FOR POWER INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 80 MARKET FOR POWER INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 81 MARKET FOR POWER INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 82 RADAR LEVEL TRANSMITTER MARKET FOR POWER INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 83 RADAR LEVEL TRANSMITTER MARKET FOR POWER INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 84 MARKET FOR POWER INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 85 MARKET FOR POWER INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

10.8 METALS & MINING

10.8.1 LEVEL TRANSMITTER CAN BE USED IN EVERY STAGE OF METAL PRODUCTION

TABLE 86 APPLICATIONS OF LEVEL TRANSMITTERS IN METALS & MINING INDUSTRY

TABLE 87 MARKET FOR METALS & MINING INDUSTRY, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 88 MARKET FOR METALS & MINING INDUSTRY, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 89 MARKET FOR METALS & MINING INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 90 MARKET FOR METALS & MINING INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 91 RADAR LEVEL TRANSMITTER MARKET FOR METALS & MINING INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 92 MARKET FOR METALS & MINING INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 93 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 94 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

10.9 OTHERS

TABLE 95 MARKET FOR OTHER INDUSTRIES, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 96 MARKET FOR OTHER INDUSTRIES, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 97 MARKET FOR OTHERS INDUSTRY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 98 MARKET FOR OTHERS INDUSTRY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 99 RADAR LEVEL TRANSMITTER MARKET FOR OTHER INDUSTRIES, BY TYPE, 2016–2019 (USD MILLION)

TABLE 100 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 101 MARKET FOR OTHER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 102 MARKET FOR OTHER INDUSTRIES, BY REGION, 2020–2025 (USD MILLION)

11 GEOGRAPHICAL ANALYSIS (Page No. - 120)

11.1 INTRODUCTION

FIGURE 27 LEVEL TRANSMITTER MARKET: BY REGION

FIGURE 28 MARKET IN INDIA TO GROW AT HIGHEST CAGR GLOBALLY DURING FORECAST PERIOD

TABLE 103 MARKET, BY REGION 2016–2019 (USD MILLION)

TABLE 104 MARKET, BY REGION 2020–2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA LEVEL TRANSMITTER MARKET SNAPSHOT

TABLE 105 MARKET IN NORTH AMERICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 106 MARKET IN NORTH AMERICA, BY INDUSTRY, 2020–2025 (USD MILLION)

11.2.1 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

11.2.2 US

11.2.2.1 Demand from oil & gas industry substantiates market growth in US

11.2.3 CANADA

11.2.3.1 Environmental protection laws to propel adoption of level transmitters in oil & gas industry in Canada

11.2.4 MEXICO

11.2.4.1 Adoption of level transmitters in refineries to provide growth opportunities

TABLE 107 NORTH AMERICA LEVEL TRANSMITTER MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 108 MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

11.3 EUROPE

FIGURE 30 EUROPE LEVEL TRANSMITTER MARKET SNAPSHOT

TABLE 109 MARKET IN EUROPE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 110 MARKET IN EUROPE, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 111 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 112 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

11.3.1 IMPACT OF COVID-19 ON LEVEL TRANSMITTER MARKET IN EUROPE

11.3.2 GERMANY

11.3.2.1 Demand from manufacturing favoring level transmitter market growth in Germany

11.3.3 UK

11.3.3.1 Stringent water industry regulations driving implementation of level transmitters in UK

11.3.4 FRANCE

11.3.4.1 Food & beverages sector boosting level transmitter market growth in France

11.3.5 REST OF EUROPE

11.4 APAC

FIGURE 31 APAC LEVEL TRANSMITTER MARKET SNAPSHOT

TABLE 113 MARKET IN APAC, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 114 MARKET IN APAC, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 115 APAC MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 116 MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

11.4.1 IMPACT OF COVID-19 ON LEVEL TRANSMITTER MARKET IN APAC

nbsp; 11.4.2 CHINA

11.4.2.1 Expanding chemicals, food & beverages, and pharmaceuticals industries offer lucrative opportunities for level transmitter market players in China

11.4.3 INDIA

11.4.3.1 India to be fastest-growing market for level transmitters globally during forecast period

11.4.4 JAPAN

11.4.4.1 Pharmaceuticals industry generating substantial demand for level transmitters in Japan

11.4.5 REST OF APAC

11.5 REST OF THE WORLD (ROW)

TABLE 117 MARKET IN ROW, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 118 MARKET IN ROW, BY INDUSTRY, 2020–2025 (USD MILLION)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Middle East & Africa likely to dominate market in RoW during forecast period

11.5.2 SOUTH AMERICA

TABLE 119 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 120 ROW LEVEL TRANSMITTER MARKET, BY REGION, 2020–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 139)

12.1 INTRODUCTION

12.1.1 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 32 MARKET: MARKET SHARE ANALYSIS (2019)

12.2 MARKET SHARE ANALYSIS OF PLAYERS, 2019

TABLE 121 MARKET SHARE OF TOP FIVE PLAYERS IN LEVEL TRANSMITTER MARKET IN 2019

12.3 COMPETITIVE LEADERSHIP MAPPING, 2019

12.3.1 STARS

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE

12.3.4 PARTICIPANT

FIGURE 33 MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.3.5 LEVEL TRANSMITTER MARKET: PRODUCT FOOTPRINT

TABLE 122 PRODUCT FOOTPRINT OF COMPANIES

TABLE 123 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 124 REGIONAL FOOTPRINT OF COMPANIES

12.3.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2019

12.3.6.1 Progressive companies

12.3.6.2 Responsive companies

12.3.6.3 Dynamic companies

12.3.6.4 Starting blocks

FIGURE 34 LEVEL TRANSMITTER MARKET (GLOBAL), SME EVALUATION QUADRANT, 2019

12.4 COMPETITIVE SITUATIONS AND TRENDS

12.4.1 EXPANSION AND PARTNERSHIPS

TABLE 125 EXPANSION AND PARTNERSHIPS, 2018–2020

12.4.2 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 126 PRODUCT LAUNCHES AND DEVELOPMENTS, 2018–2020

13 COMPANY PROFILES (Page No. - 150)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 KEY PLAYERS

13.1.1 ABB

FIGURE 35 ABB: COMPANY SNAPSHOT

13.1.2 AMETEK

FIGURE 36 AMETEK: COMPANY SNAPSHOT

13.1.3 EMERSON ELECTRIC

FIGURE 37 EMERSON ELECTRIC: COMPANY SNAPSHOT

13.1.4 ENDRESS+HAUSER

FIGURE 38 ENDRESS+HAUSER: COMPANY SNAPSHOT

13.1.5 HONEYWELL INTERNATIONAL

FIGURE 39 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

13.1.6 KROHNE MESSTECHNIK

13.1.7 SIEMENS

FIGURE 40 SIEMENS: COMPANY SNAPSHOT

13.1.8 SCHNEIDER ELECTRIC

FIGURE 41 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

13.1.9 VEGA GRIESHABER

13.1.10 YOKOGAWA ELECTRIC

FIGURE 42 YOKOGAWA ELECTRIC: COMPANY SNAPSHOT

13.2 OTHER KEY PLAYERS

13.2.1 MAGNETROL INTERNATIONAL

13.2.2 DWYER INSTRUMENTS

13.2.3 WIKA

13.2.4 SOR INC.

13.2.5 SPECTRIS (OMEGA ENGINEERING)

13.2.6 BÜRKERT

13.2.7 GF PIPING SYSTEMS

13.2.8 L&J TECHNOLOGIES

13.2.9 VIATRAN

13.2.10 MONITOR TECHNOLOGIES LLC

13.2.11 MATSUSHIMA MEASURE TECH

13.2.12 TRUMEN TECHNOLOGIES

13.2.13 JAYCEE TECHNOLOGIES PVT. LTD.

13.2.14 FILPRO SENSORS PVT. LTD.

13.2.15 SPINK CONTROLS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 182)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 TANK LEVEL MONITORING SYSTEM MARKET, BY PRODUCT & COMPONENT

14.3.1 INTRODUCTION

TABLE 127 TANK LEVEL MONITORING SYSTEM MARKET, BY PRODUCT, 2017–2025 (USD MILLION)

14.3.2 INVASIVE TYPE

14.3.2.1 Provides direct and reliable method to monitor various liquid types

TABLE 128 INVASIVE TANK LEVEL MONITORING SYSTEM MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 129 MARKET FOR AMERICAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 130 MARKET FOR NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 131 MARKET FOR EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 132 MARKET FOR APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 133 INVASIVE TANK LEVEL MONITORING SYSTEM MARKET FOR ROW, BY REGION, 2017–2025 (USD MILLION)

14.3.3 NON-INVASIVE TYPE

14.3.3.1 Non-invasive product type allows no-contact type of fluid sensing through using different technologies

TABLE 134 NON-INVASIVE TANK LEVEL MONITORING SYSTEM MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 135 MARKET FOR AMERICAS, BY REGION, 2017–2025 (USD MILLION)

TABLE 136 MARKET FOR NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 137 MARKET FOR EUROPE, BY COUNTRY 2017–2025 (USD MILLION)

TABLE 138 MARKET FOR APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 139 NON-INVASIVE TANK LEVEL MONITORING SYSTEM MARKET FOR ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 140 TANK LEVEL MONITORING SYSTEM MARKET, BY COMPONENT, 2017–2025 (USD MILLION)

14.4 TANK LEVEL MONITORING SYSTEM, BY COMPONENT

14.4.1 SENSORS

14.4.2 TRACKING DEVICES

14.4.3 POWER SUPPLY

14.4.4 MONITORING STATIONS

15 APPENDIX (Page No. - 189)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

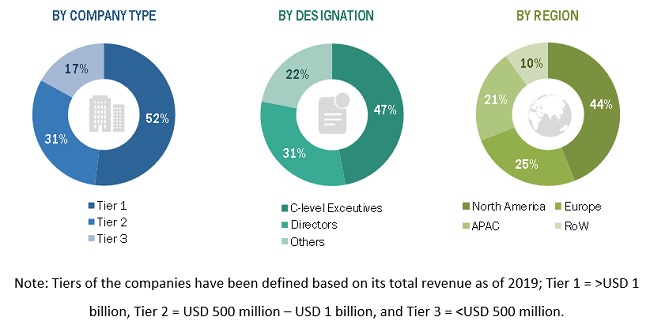

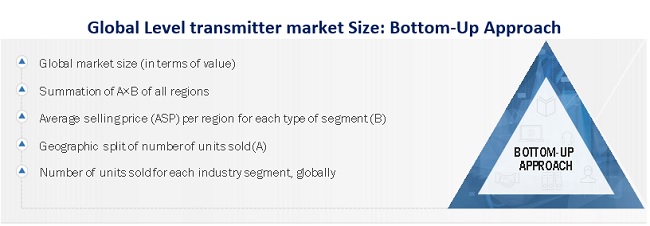

The study involved four major activities in estimating the current size of the level transmitter market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the level transmitter market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on manufacturing industries, as well as level transmitter products, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from level transmittervendors, such as Endress+Hauser (Switzerland), VEGA (Germany), Emerson Electric (US), Siemens (Germany), and KROHNE (Germany) ABB (Switzerland), Honeywell (US), Yokogawa (Japan), AMETEK (US), Magnetrol (US), Schneider Electric (France); system integrators, professional and managed service providers, industry associations, independent automation consultants and importers, distributors, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the level transmitter market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the level transmitter market, in terms of technology, by type, and end user

- To describe and forecast the market, in terms of value, with regard to four main regions: Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To describe and forecast the market, in terms of value, by end user

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of level transmitter

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the level transmitter market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the level transmitter

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, and acquisitions, adopted by key market players in the level transmitter market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Level Transmitter Market