Global LED Displays, Lighting and Fixtures Market (2011-2016) : Analysis and Forecast by Product (Surface Mounted Display, Conventional LED Walls; HBLED, Color LED, Fixed And Portable Fixtures), by Applications (Backlighting, Signage, General Lighting, Automotive Lighting) and by Geography

The global LED market has witnessed rapid growth due to the demand for efficient displays, lighting, and fixtures along with the rising awareness levels about energy conservation. The LED display market is broad in terms of end-user applications and includes notebook PCs, LCD TVs, handsets signals, and many more. The major segments in the lighting market are general lighting, automotive lighting, signs and billboard lighting, with general lighting accounting for approximately 75% of the total lighting market. The construction of new green buildings as well as retrofitting the existing buildings in order to make them green is increasing the demand for energy efficient lighting fixtures and, in turn, driving the lighting fixtures market.

A light-emitting diode (LED) is a semiconductor light source. LEDs are used as indicator lamps in many devices and increasingly used for other lighting. Introduced as a practical electronic component in 1962, early LEDs emitted low-intensity red light, but modern versions are available across the visible, ultraviolet, and infrared wavelengths, with high brightness.

In general, a flat-surface uncoated LED semiconductor chip will emit light only perpendicular to the semiconductor's surface, and a few degrees to the side, in a cone shape referred to as the light cone, cone of light or the escape cone. The maximum angle of incidence is referred to as the critical angle. When this angle is exceeded, photons no longer penetrate the semiconductor but get reflected both - internally inside the semiconductor crystal and externally off the surface of the crystal as if it were a mirror.

Many LED semiconductor chips are potted in clear or colored molded plastic shells. The plastic shell has three purposes:

- Mounting the semiconductor chip in devices is easier to accomplish.

- The tiny fragile electrical wiring is physically supported and protected from damage.

- The plastic acts as a refractive intermediary between the relatively high-index semiconductor and low-index open air

In a market scenario where rapid changes are the order of the day, an in-depth and well analyzed report on low-power consuming LED displays, lighting and fixtures would help stakeholders to understand market size estimates and the changing market trends. A professional analysis will be conducted for the market forecasts along with the market drivers and inhibitors; and stakeholders will also benefit in understanding the various submarkets profiled in detail in the same report. In this report, estimates of the display, lighting and fixtures market and its various submarkets by type, application and major market players have been included. The report also provides a geographic split with regards to each of the submarkets and applications.

Scope of the report

This LED Display, lighting and fixture market research report categorizes the global market on the basis of types and applications, forecasting revenue and analyzing trends in the LED Display, lighting and fixture market.

On the basis of application market

The existing LED market is relatively wide in terms of end-use applications and encompasses display backlighting applications like notebook PCs, LCD TVs, and handsets; lighting applications like general lighting applications, automotive applications and display applications like video walls and signage displays.

On the basis of Geography

- North America, Europe, Asia-Pacific, and ROW are covered in the report.

- North America comprises the U.S., Canada, and Mexico Europe includes U.K., Germany, France, Italy, and the rest of Europe.

- Asia-Pacific is inclusive of China, India, Japan, and others.

- ROW is segmented into Africa, Middle East, and others.

Each section will provide market data, market drivers, trends and opportunities, key players, and competitive outlook. This report will also provide market tables for covering the sub-segments and micro-markets. In addition, the report also provides more than 20 company profiles covering all the sub-segments such as overview, products & services, financials, strategy, and developments.

Customer Interested in this report also can view

-

LED Lighting Market by Installation Type (New Installation and Retrofit Installation), End-Use Application (Indoor Lighting and Outdoor Lighting), Product Type (Lamps and Luminaires), and Geography - Global Forecast to 2022

LED market can be segmented into its major application segments, i.e. display, lighting, and fixtures. With the rapid adoption of LED backlights in LCD TVs and monitors, the industry is undergoing a boom in investment, and there are new entrants. The industry possesses high growth potential led by general lighting and automotive segments. This rapid growth has been enabled by the ongoing cost reductions and improvements in LED performance. Developments in manufacturing, materials, and packaging have all contributed to the increased output and falling prices of LED devices, which, in turn, had made the widespread adoption in display backlights possible.

Technology advancements to pioneer highly power-efficient and cost-effective lighting are driving the growth of overall emerging LED lighting technologies market. This enables growth in new applications, and it appears that this cycle will continue for the next five years. Looking forward, it is expected that the LED markets revenue will accelerate after 2013 - 2014 in well established backlighting application market as well as growing lighting application market, as backlighting will reach its highest penetration and lighting market will pick up due to its high efficiency and long life span.

The global LED market is dominated by companies from the U.S. like Cree, Philips Lumileds, from Europe like OSram Opto Semiconductor (Germany) and Japan like Nichia Toyoda Gosei, but South Korea-based companies like Seoul Semiconductor, Samsung LED, LG Innotek, and China-based manufacturers have been constantly growing during the last decade while they were mainly serving as suppliers for the companies based in America and Europe.

Display applications are the major source of revenue for LED applications; whereas backlighting applications hold most of the shares of the overall LED display market. The LED market for lighting applications is expected to grow at a comparatively higher rate than display applications after 2014. The increasing awareness regarding conservation of energy and reduction of carbon emission has significantly driven the LED market for lighting applications. Street and architectural lighting are the key revenue contributors to lighting market.

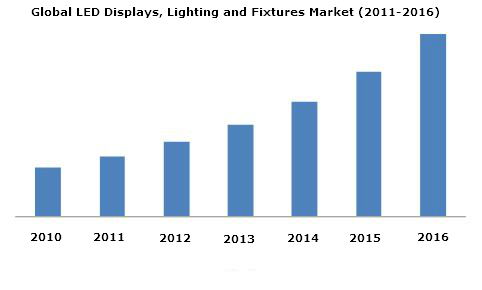

Global LED Display, Lighting and Fixture Market Revenue 2011 - 2016 ($Million)

Source: MarketsandMarkets Analysis

The global LED display, lighting and fixtures market is expected to grow from $10,530.00 million in 2011 to $31,561.55 million in 2016, at a CAGR of 24.8% from 2011 to 2016. LED display contributes for the largest share of the overall the LED display, lighting and fixtures market generated around $5,400.00 million in 2010 and is expected to generate $12,490.53 million in 2016 at a CAGR of 15.0% from 2011 to 2016.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 KEY DATA POINTS TAKEN FROM SECONDARY SOURCES

1.5.3 KEY DATA POINTS TAKEN FROM PRIMARY SOURCES

1.5.4 ASSUMPTIONS MADE FOR THIS REPORT

1.5.5 PRIMARY RESEARCH CONTRIBUTORS

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.2 MARKET DEFINITION

3.3 MARKET DYNAMICS OF LED DISPLAY MARKET

3.3.1 MARKET DRIVERS

3.3.1.1 High quality picture images

3.3.1.2 Power efficiency

3.3.2 MARKET RESTRAINTS

3.3.2.1 Higher cost than its substitute

3.3.2.2 Shortage of the metalorganic chemical vapor deposition (MOCVD) tool

3.4 MARKET DYNAMICS OF LED LIGHTING & FIXTURE MARKET

3.4.1 DRIVERS

3.4.1.1 High efficiency of LED fixtures

3.4.1.2 Dimmability

3.4.1.3 Longer life span

3.4.1.4 Increasing green construction

3.4.2 RESTRAINTS

3.4.2.1 Lack of availability & cost of raw materials

3.4.2.2 High initial cost

3.4.3 OPPORTUNITIES

3.4.3.1 Growing demand in backlighting

3.4.3.2 Incandescent bulb loss is LEDs gain

3.5 WINNING IMPERATIVES

3.5.1 BACKWARD & FORWARD INTEGRATION STRATEGY

3.6 BURNING ISSUES

3.6.1 LACK OF INDUSTRY STANDARDS

3.6.2 OVERSUPPLY RATIO

3.7 PRICE ANALYSIS

3.7.1 LED LIGHTING COST ANALYSIS

3.7.2 LED DOWNLIGHT FIXTURE COST ANALYSIS

3.7.2.1 Cost breakdown for components that make up a downlight recessed fixture

4 LED DISPLAY, LIGHTING & FIXTURES PRODUCT MARKET

4.1 INTRODUCTION

4.2 LED DISPLAY MARKET

4.2.1.1 Conventional LED display

4.2.1.2 Surface mounted device

4.3 LED LIGHTING & FIXTURES MARKET

4.3.1 LED LIGHTING MARKET

4.3.2 LED FIXTURE MARKET

5 APPLICATIONS MARKET

5.1 LED DISPLAY APPLICATIONS MARKET

5.1.1 BACKLIGHTING

5.1.1.1 Television

5.1.1.2 Mobile phones

5.1.1.3 Laptop

5.1.1.4 Monitor

5.1.1.5 Others

5.1.2 SIGNAGE

5.1.2.1 Outdoor signage

5.1.2.2 Indoor signage

5.2 LED LIGHTING APPLICATION MARKET

5.2.1 LED GENERAL LIGHTING MARKET

5.2.1.1 Indoor general lighting LED market

5.2.1.1.1 Residential indoor LED lighting

5.2.1.1.2 Commercial indoor LED lighting

5.2.1.1.3 Industrial indoor LED lighting

5.2.1.1.4 Other indoor LED lighting

5.2.1.2 Outdoor general LED lighting market

5.2.1.2.1 Architectural outdoor LED lighting

5.2.1.2.2 LED street lighting

5.2.1.2.3 LED traffic lighting

5.2.1.2.4 Other outdoor LED lighting

5.2.2 AUTOMOTIVE LED LIGHTING

5.2.2.1 Automotive interior LED lighting

5.2.2.1.1 Dashboard LED lighting

5.2.2.1.2 Ambient LED lighting

5.2.2.2 Automotive exterior LED lighting

5.2.2.2.1 Headlamps LED lighting

5.2.2.2.2 Taillight LED lighting

5.3 LED LIGHTING FIXTURE MARKET

5.3.1 ARCHITECTURAL LED LIGHTING FIXTURE

5.3.2 COMMERCIAL LED LIGHTING FIXTURE

5.3.3 LED STREET LIGHTING FIXTURE

5.3.4 RETAIL & REFRIGRATOR LED LIGHTING FIXTURE

5.3.5 RESIDENTIAL LED LIGHTING FIXTURE

5.3.6 OTHER LED LIGHTING FIXTURE APPLICATIONS

6 GEOGRAPHIC ANALYSIS

6.1 LED DISPLAY MARKET, BY GEOGRAPHY

6.1.1 NORTH AMERICA

6.1.2 EUROPE

6.1.3 ASIA-PACIFIC

6.1.4 ROW

6.2 LED LIGHTING & FIXTURES MARKET, BY GEOGRAPHY

6.2.1 NORTH AMERICA

6.2.2 EUROPE

6.2.3 ASIA-PACIFIC

6.2.4 ROW

7 COMPETITIVE LANDSCAPE

7.1 INTRODUCTION

7.2 MERGER & ACQUISITION

7.3 COLLABORATION/PARTNERSHIP/AGREEMENT/ JOINT VENTURE

7.4 NEW PRODUCTS LAUNCH

8 COMPANY PROFILES

8.1 AVAGO TECHNOLOGIES LTD

8.1.1 OVERVIEW

8.1.2 PRODUCTS & SERVICES

8.1.3 FINANCIALS

8.1.4 STRATEGY

8.1.5 DEVELOPMENTS

8.2 BARCO NV

8.2.1 OVERVIEW

8.2.2 PRODUCTS & SERVICES

8.2.3 FINANCIALS

8.2.4 STRATEGY

8.2.5 DEVELOPMENTS

8.3 BRODWAX LIGHTING

8.3.1 OVERVIEW

8.3.2 PRODUCTS & SERVICES

8.3.3 FINANCIALS

8.3.4 STRATEGY

8.3.5 DEVELOPMENTS

8.4 COOPER LIGHTING INC.

8.4.1 OVERVIEW

8.4.2 PRODUCTS & SERVICES

8.4.3 FINANCIALS

8.4.4 STRATEGY

8.4.5 DEVELOPMENTS

8.5 CREE INC.

8.5.1 OVERVIEW

8.5.2 PRODUCTS & SERVICES

8.5.3 FINANCIALS

8.5.4 STRATEGY

8.5.5 DEVELOPMENTS

8.6 EPISTAR CORP

8.6.1 OVERVIEW

8.6.2 PRODUCTS & SERVICES

8.6.3 FINANCIALS

8.6.4 STRATEGY

8.6.5 DEVELOPMENTS

8.7 GE LIGHTING

8.7.1 OVERVIEW

8.7.2 PRODUCTS & SERVICES

8.7.3 FINANCIALS

8.7.4 STRATEGY

8.7.5 DEVELOPMENTS

8.8 IWASAKI ELECTRIC CO. LTD

8.8.1 OVERVIEW

8.8.2 PRODUCTS & SERVICES

8.8.3 FINANCIALS

8.8.4 STRATEGY

8.8.5 DEVELOPMENTS

8.9 LED ENGIN INC.

8.9.1 OVERVIEW

8.9.2 PRODUCTS & SERVICES

8.9.3 FINANCIALS

8.9.4 STRATEGY

8.9.5 DEVELOPMENTS

8.10 LG INNOTEK CO. LTD

8.10.1 OVERVIEW

8.10.2 PRODUCTS & SERVICES

8.10.3 FINANCIALS

8.10.4 STRATEGY

8.10.5 DEVELOPMENTS

8.11 NICHIA CORP

8.11.1 OVERVIEW

8.11.2 PRODUCTS & SERVICES

8.11.3 FINANCIALS

8.11.4 STRATEGY

8.11.5 DEVELOPMENTS

8.12 OSRAM OPTO SEMICONDUCTORS

8.12.1 OVERVIEW

8.12.2 PRODUCTS & SERVICES

8.12.3 FINANCIALS

8.12.4 STRATEGY

8.12.5 DEVELOPMENTS

8.13 PERKINELMER INC

8.13.1 OVERVIEW

8.13.2 PRODUCTS & SERVICES

8.13.3 FINANCIALS

8.13.4 STRATEGY

8.13.5 DEVELOPMENTS

8.14 PHILIPS LUMILEDS LIGHTING CO

8.14.1 OVERVIEW

8.14.2 PRODUCTS & SERVICES

8.14.3 FINANCIALS

8.14.4 STRATEGY

8.14.5 DEVELOPMENTS

8.15 SAMSUNG LED CO. LTD

8.15.1 OVERVIEW

8.15.2 PRODUCTS & SERVICES

8.15.3 FINANCIALS

8.15.4 STRATEGY

8.15.5 DEVELOPMENTS

8.16 SEOUL SEMICONDUCTOR CO. LTD

8.16.1 OVERVIEW

8.16.2 PRODUCTS & SERVICES

8.16.3 FINANCIALS

8.16.4 STRATEGY

8.16.5 DEVELOPMENTS

8.17 SHARP CORP

8.17.1 OVERVIEW

8.17.2 PRODUCTS & SERVICES

8.17.3 FINANCIALS

8.17.4 STRATEGY

8.17.5 DEVELOPMENTS

8.18 TOYODA GOSEI CO LTD

8.18.1 OVERVIEW

8.18.2 PRODUCT & SERVICES

8.18.3 FINANCIALS

8.18.4 STRATEGY

8.18.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 LED DISPLAY, LIGHTING & FIXTURES MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 2 INITIAL BULB COST ($) OF LIGHTING SOURCES

TABLE 3 COST ($) BREAKDOWN ANALYSIS OF LIGHTING FIXTURES

TABLE 4 LED DISPLAY, LIGHTING & FIXTURES MARKET REVENUE, BY TYPES, 2010 2016 ($MILLION)

TABLE 5 LED DISPLAY MARKET REVENUE, BY TYPES, 2010 2016 ($MILLION)

TABLE 6 LED DISPLAY MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 7 DISPLAY, BY SIZES

TABLE 8 CONVENTIONAL LED DISPLAY MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 9 SMD LED DISPLAY MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 10 LED LIGHTING & FIXTURES MARKET REVENUE, BY PRODUCTS, 2010 2016 ($MILLION)

TABLE 11 GLOBAL LED LIGHTING MARKET REVENUE, BY TYPES, 2010 2016 ($BILLION)

TABLE 12 LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 13 GLOBAL LED LIGHTING FIXTURES MARKET REVENUE, BY TYPES, 2010 2016 ($MILLION)

TABLE 14 LED LIGHTING FIXTURE MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 15 GLOBAL LED FIXED LIGHTING FIXTURES MARKET REVENUE, BY TYPES, 2010 2016 ($MILLION)

TABLE 16 LED DISPLAY MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 17 LED DISPLAY BACKLIGHTING MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 18 LED DISPLAY BACKLIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 19 LED DISPLAY BACKLIGHTING MARKET REVENUE FOR TELEVISIONS, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 20 LED DISPLAY BACKLIGHTING MARKET REVENUE FOR MOBILE PHONES, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 21 LED DISPLAY BACKLIGHTING MARKET REVENUE FOR LAPTOPS, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 22 LED DISPLAY BACKLIGHTING MARKET REVENUE FOR MONITORS, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 23 LED BACKLIGHTING DISPLAY MARKET REVENUE FOR OTHER APPLICATIONS, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 24 GLOBAL LED DISPLAY MARKET REVENUE FOR SIGNAGE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 25 LED DISPLAY MARKET REVENUE FOR SIGNAGE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 26 LED DISPLAY MARKET REVENUE FOR OUTDOOR SIGNAGE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 27 LED DISPLAY MARKET REVENUE FOR INDOOR SIGNAGE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 28 GLOBAL LED LIGHTING MARKET REVENUE, BY APPLICATION, 2010 2016 ($MILLION)

TABLE 29 LED LIGHTING APPLICATIONS MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 30 TOP 10 CONSTRUCTION MARKETS, BY COUNTRIES, 2009 & 2020

TABLE 31 GLOBAL LED GENERAL LIGHTING MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 32 LED GENERAL LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 33 INDOOR GENERAL LIGHTING LED MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 34 GENERAL INDOOR LIGHTING LED MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 35 RESIDENTIAL INDOOR LIGHTING LED MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 36 COMMERICIAL INDOOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 37 INDUSTRIAL INDOOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 38 OTHER INDOOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($MILLION)

TABLE 39 OUTDOOR GENERAL LIGHTING LED MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 40 GENERAL OUTDOOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 41 ARCHITECTURAL OUTDOOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 42 LED STREET LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 43 LED TRAFFIC LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 44 OTHER OUTDOOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 45 EDGE OF LED BASED BULBS OVER TRADITIONAL BULBS IN AUTOMOTIVES

TABLE 46 GLOBAL AUTOMOTIVE LED LIGHTING MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 47 GENERAL AUTOMOTIVE LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 48 GLOBAL AUTOMOTIVE INTERIOR LED LIGHTING MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 49 AUTOMOTIVE INTERIOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 50 AUTOMOTIVE DASHBOARD LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 51 AUTOMOTIVE AMBIENT LED LIGHTING MARKET REVEUNE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 52 GLOBAL AUTOMOTIVE EXTERIOR LED LIGHTING MARKET REVENUE, BY APPLICATION, 2010 2016 ($MILLION)

TABLE 53 AUTOMOTIVE EXTERIOR LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 54 AUTOMOTIVE HEADLAMP LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 55 AUTOMOTIVE TAILLIGHT LED LIGHTING MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 56 GLOBAL LED LIGHTING FIXTURE MARKET REVENUE, BY APPLICATIONS, 2010 2016 ($MILLION)

TABLE 57 LED LIGHTING FIXTURE APPLICATION MARKET REVENUE, BY GEOGRAPHY, 2011 2016 ($MILLION)

TABLE 58 ARCHITECTURAL LED LIGHTING FIXTURE MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 59 COMMERCIAL LED LIGHTING FIXTURE MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 60 LED STREET LIGHTING FIXTURE MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 61 RETAIL & REFRIGRATOR LED LIGHTING FIXTURE MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 62 RESIDENTIAL LED LIGHTING FIXTURE MARKET REVENUE, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 63 OTHER LED LIGHTING FIXTURE APPLICATIONS MARKET, BY GEOGRAPHY, 2010 2016 ($MILLION)

TABLE 64 AVAGOS BUSINESS-MAJOR PRODUCTS, APPLICATIONS & ITS END CUSTOMERS

LIST OF FIGURES

FIGURE 1 EVOLUTION OF LED APPLICATION

FIGURE 2 LED DISPLAY, LIGHTING & FIXTURES MARKET SEGMENTATION

FIGURE 3 IMPACT ANALYSIS OF MARKET DRIVERS & RESTRAINTS OF LED DISPLAY MARKET

FIGURE 4 IMPACT ANALYSIS OF MARKET DRIVERS & RESTRAINTS OF LED LIGHTING & FIXTURE MARKET

FIGURE 5 LUMINAIRE EFFICIENCY (LUMENS/WATT)

FIGURE 6 INCANDESCENT GLOBAL BAN ROAD MAP

FIGURE 7 LED LAMP (60 W EQUIVALENT INCANDESCENT LAMP) PRICE TREND, BY GEOGRAPHY, 2011 2016

FIGURE 8 VALUE CHAIN FOR LED DISPLAY, LIGHTING & FIXTURES

FIGURE 9 LED DISPLAY & LIGHTING FIXTURE, MARKET PENETRATION OVER TIME, 2005 - 2014

FIGURE 10 LED DISPLAY MARKET CLASSIFICATION, BY TYPES

FIGURE 11 COMPARISON OF LED WITH OTHER PROMINENT LIGHTING SOURCES

FIGURE 12 LED LIGHTING MARKET SEGMENTATION, BY TYPES

FIGURE 13 ADVANTAGES OF LED OVER TRADITIONAL BULBS

FIGURE 14 LED FIXTURE OVERVIEW

FIGURE 15 LED LIGHTING FIXTURE SEBMENTATION, BY TYPES

FIGURE 16 LIFE CYCLE FOR BACKLIGHTING APPLICATIONS, 2010

FIGURE 17 GLOBAL LED LIGHTING MARKET REVENUE, BY APPLICATIONS, 2011 2016

FIGURE 18 NORTH AMERICA: LED DISPLAY MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 19 EUROPE: LED DISPLAY MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 20 ASIA-PACIFIC: LED DISPLAY MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 21 ROW: LED DISPLAY MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 22 NORTH AMERICA: LED LIGHTING & FIXTURES MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 23 EUROPE: LED LIGHTING & FIXTURES MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 24 ASIA-PACIFIC: LED LIGHTING & FIXTURES MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 25 ROW: LED LIGHTING & FIXTURES MARKET REVENUE, 2010 2016 ($MILLION)

FIGURE 26 KEY GROWTH STRATEGIES, 2008 - 2011

FIGURE 27 REVENUE GROWTH, 2009 2010 ($MILLION)

FIGURE 28 AVAGOS BUSINESS BREAK UP, 2010

Growth opportunities and latent adjacency in Global LED Displays, Lighting and Fixtures Market