Latin American Flow Cytometry Market by Technology (Cell-based, Bead-based), Product & Service (Analyzer, Sorter, Consumables, Software), Application (Research, (Clinical- Cancer, Hematology), Industrial), End User (Biotech, Hospitals) - Forecast to 2027

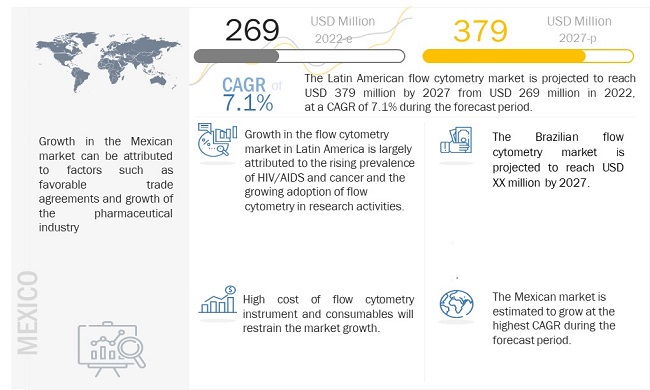

[207 Pages Report] The Latin American flow cytometry market is projected to reach USD 379 million by 2027, at a CAGR of 7.1% during the forecast period. The market growth can be attributed to factors such as increasing adoption of flow cytometry techniques in research activities. Besides, a rise in the prevalence of Cancer, HIV/ AIDS in the region has led to increase in research for drug development against these diseases. Such research activities involve the use of flow cytometry techniques. Moreover, top players in this market are consistently focusing on innovating to develop technologically superior flow cytometry instruments and software. These factors are expected to propel the growth of flow cytometry market in Latin America. However, these technologically advanced products are expensive. Thus, high cost of flow cytometry instruments and consumables is expected to restrain market growth to a certain extent.

Attractive Opportunities in the Latin American Flow Cytometry Market

To know about the assumptions considered for the study, Request for Free Sample Report

Latin American Flow Cytometry Market Dynamics

Drivers: Increasing incidence of cancer and HIV/AIDS

Diagnostic/ Prognostic information on clinical research on cancer and HIV/ AIDS can be derived using flow cytometry. Besides this, flow cytometry has applications such as the enumeration of helper T-cells (CD4 cells) in HIV infections, determining DNA content, and profiling tumor cells in breast cancer, lymphoma, leukemia, and other malignancies. The fast-growing burden of cancer has led to a rise in the demand for oncology testing services (including cytometric analysis procedures). Moreover, factors such as growing lifestyle changes, unhygienic living conditions, and unsafe sexual behaviors have increased the risk of HIV infections. Therefore, the growing incidence of AIDS is expected to increase the use of diagnostic testing worldwide, in turn, driving the demand for flow cytometry products & services during the forecast period.

Opportunities: Adoption of recombinant DNA technology for antibody production

Conventionally, the hybridoma technique was used to produce antibodies used for flow cytometry experiments. This technique involves the fusion of antibody-secreting cells to immortalized cells for producing hybridoma cell lines that produce a single antibody type. However, a major restraint in this technique was that one cell line could produce only one type of antibody. On the other hand, recombinant technology is a less expensive, versatile, and consistent technique. Thus, the financial affordability and simple workflow have increased the adoption of synthetic/recombinant DNA technology. This inherent advantage of rDNA technology makes it very useful in fluorescence-based antibody production. Thus, recombinant DNA technology is expected to offer significant growth opportunities for key flow cytometry reagent manufacturers.

Challenges: Shortage of well-trained and skilled professionals

The operation of flow-cytometry instrumentation demands expertise and in-depth technical know-how about different control parameters, the range of available fluorescent-labeled compounds, protocols to design flow cytometry experiments, commonly-used reagents, and specific data analysis solutions. Flow cytometry techniques rely on operator’s analytical process flow, including pipetting volume, sample integrity, and incubation time. A wide array of data outputs that require reviewing expertise is generated by technologically advanced and highly complex flow cytometers. However, the absence of such expertise among researchers and clinicians limits the adoption of these advanced instruments. Besides, as per the opinion of most end users, they face difficulties finding expert trainers in the flow cytometry field in emerging Latin American countries. Thus, a shortage of expert professionals is expected to restrain the market to a certain extent.

Restraints: High instrument and consumables cost

Major end users of the flow cytometry instrument and consumables include clinical laboratories, large research facilities, and pharmaceutical companies. As these end users carry out simultaneous research studies, there is a significant increase in the capital cost associated with the procurement and maintenance of the devices. However, academic & research laboratories have restrictions on the research budget and thus, find it difficult to afford such instruments. Besides, the major suppliers of flow cytometry instruments and consumables in Latin America manufacture them outside the region. Thus, additional import costs are added to the prices of consumables (such as reagents and fluids) for transportation. This makes high product costs a restraint to the market growth to some extent.

The reagents and consumables subsegment of the product & service segment dominated the Latin American Flow Cytometry Market in 2021

Based on product & service, the flow cytometry market in Latin America is segmented into reagents and consumables, instruments, software, services, and accessories. In 2021, the reagents and consumables segment accounted for the largest share of the flow cytometry market in Latin America. The large share of this subsegment can be attributed to factors such as growing demand for flow cytometry reagents for diagnostic applications and growing research activities that use flow cytometry techniques.

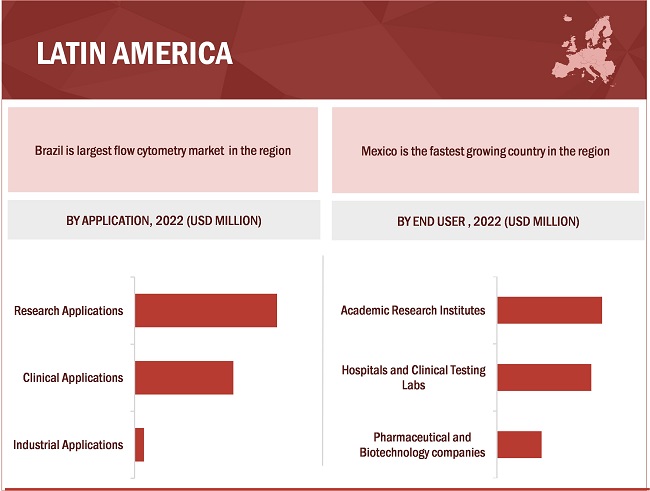

Brazil was the largest country-level market for Latin American Flow Cytometry Market in 2021.

Brazil accounted for the largest share of the Latin American Flow cytometry market. As a result of the well-established presence of key market players in the country ensuring increasing adoption of flow cytometry products, Brazil holds the largest share.

To know about the assumptions considered for the study, download the pdf brochure

Latin American Flow Cytometry Market Key Players

The key players in this market are Becton, Dickinson and Company (US), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), ), Cytek Biosciences, Inc. (US), Luminex Corporation (US), Bio-Rad Laboratories, Inc. (US), and Miltenyi Biotec GmbH (Germany).

Scope of the Latin American Flow Cytometry Market Report

|

Report Metrics |

Details |

|

Market Size value 2027 |

USD 379 million |

|

Growth Rate |

7.1% CAGR |

|

Largest Market |

Brazil (Country-Level Market) |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

Reagents & Consumables |

|

Forecasts up to |

2027 |

|

Market Segmentation |

Products & Service, Technology, Application, End User & Region |

|

Latin American Flow Cytometry Market Growth Drivers |

|

|

Latin American Flow Cytometry Market Growth Opportunities |

Adoption of recombinant DNA technology for antibody production |

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

|

Report Highlights |

|

This report categorizes the latin american flow cytometry market into the following segments and subsegments:

By Product & Service

- Reagents and Consumables

-

Instruments

-

Cell Analyzers

- High-range cell analyzers

- Mid-range cell analyzers

- Low-range cell analyzers

-

Cell Sorters

- High-range cell sorters

- Mid-range cell sorters

- Low-range cell sorters

-

Cell Analyzers

- Services

- Software

- Accessories

By Technology

- Cell-based Flow cytometry

- Bead-based Flow cytometry

By Application

-

Research Applications

-

Pharmaceutical and Biotechnology

- Drug discovery

- Stem cell research

- In vitro toxicity testing

- Immunology

- Cell sorting

- Apoptosis

- Cell cycle analysis

- Cell viability

- Cell counting

- Other Research applications

-

Pharmaceutical and Biotechnology

-

Clinical Applications

- Cancer

- Hematology

- Autoimmune diseases

- Organ and tissue transplantation

- Industrial Applications

By End User

- Academic Research Institutes

- Hospitals and Clinical Testing Laboratories

- Pharmaceutical and Biotechnology companies

By Country

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Rest of Latin America

Recent Developments

- In August 2022, BD (US) collaborated with Laboratory Corporation of America Holdings (Labcorp) (US) to develop flow cytometry-based companion diagnostics (CDx) for treatments against cancer and other diseases.

- In March 2021, Danaher Corporation (US) launched the CytoFLEX SRT Benchtop Cell Sorter, which is built on the principles of CytoFLEX to make multicolor applications accessible.

Frequently Asked Questions (FAQ):

Who are the key players in the Latin American Flow cytometry market?

The key players in the Latin American Flow cytometry market are Becton, Dickinson and Company (US), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), ), Cytek Biosciences, Inc. (US), Luminex Corporation (US), Bio-Rad Laboratories, Inc. (US), and Miltenyi Biotec GmbH (Germany).

Which product & service dominates the Latin American Flow cytometry market?

In 2021, Reagents & Consumables dominated the market. Factors such as the growing demand for flow cytometry reagents for diagnostic applications and growing research activities are driving the growth of this segment.

Which application segment of the Latin American Flow cytometry market is expected to witness the highest growth?

The research applications segment is expected to witness the highest growth during the forecast period. Growing adoption of flow cytometry in research areas such as stem cell research, cancer research, and drug discovery. are factors driving the growth of the research applications segment.

What is the market size for the Latin American Flow cytometry market?

The Latin American Flow cytometry market is estimated to grow from USD 379 million by 2027 from USD 269 million in 2022, at a CAGR of 7.1% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 LATIN AMERICAN FLOW CYTOMETRY MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

FIGURE 4 MARKET SIZE ESTIMATION (2021)

2.3 DATA TRIANGULATION APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 CAGR PROJECTIONS

2.4.1 SUPPLY-SIDE ANALYSIS

2.4.2 DEMAND-SIDE ANALYSIS

2.5 INSIGHTS FROM PRIMARY EXPERTS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 8 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 9 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 LATIN AMERICAN FLOW CYTOMETRY MARKET OVERVIEW

FIGURE 10 ADVANCEMENTS IN FLOW CYTOMETRY TECHNIQUES TO DRIVE MARKET GROWTH

4.2 LATIN AMERICAN FLOW CYTOMETRY MARKET SHARE, BY PRODUCT & SERVICE (2021)

FIGURE 11 REAGENTS AND CONSUMABLES SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

4.3 LATIN AMERICAN FLOW CYTOMETRY MARKET SHARE, BY TECHNOLOGY, 2022 VS. 2027

FIGURE 12 CELL-BASED FLOW CYTOMETRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 LATIN AMERICAN FLOW CYTOMETRY MARKET SHARE, BY END USER, 2022

FIGURE 13 ACADEMIC AND RESEARCH INSTITUTES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 LATIN AMERICAN FLOW CYTOMETRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of cancer and HIV/AIDS

TABLE 1 LATIN AMERICA: CANCER INCIDENCE, BY COUNTRY, 2020

TABLE 2 LATIN AMERICA: INCIDENCE OF HIV/AIDS, BY COUNTRY, 2021

5.2.1.2 Research activities such as drug discovery using flow cytometry techniques

5.2.1.3 Use of flow cytometry in regenerative medicine

5.2.1.4 Technological advancements such as multicolor fluorescence, compact design, and automation in flow cytometry instruments

TABLE 3 IMPORTANT TECHNOLOGICAL ADVANCEMENTS (2019–2022)

5.2.2 RESTRAINTS

5.2.2.1 High cost of instruments and consumables

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of recombinant DNA technology for antibody production

5.2.3.2 International collaborations in biotechnology

5.2.4 CHALLENGES

5.2.4.1 Shortage of well-trained and skilled professionals

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 15 SUPPLY CHAIN OF FLOW CYTOMETRY PRODUCTS & SERVICES

5.3.1 KEY INFLUENCERS

5.4 VALUE CHAIN ANALYSIS

FIGURE 16 LATIN AMERICAN FLOW CYTOMETRY MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM ANALYSIS

FIGURE 17 FLOW CYTOMETRY MARKET: ECOSYSTEM ANALYSIS

5.5.1 ROLE IN ECOSYSTEM

5.6 REGULATORY ANALYSIS

5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 4 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 FLOW CYTOMETRY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 COMPETITIVE RIVALRY AMONG EXISTING PLAYERS

5.7.2 BARGAINING POWER OF SUPPLIERS

5.7.3 BARGAINING POWER OF BUYERS

5.7.4 THREAT OF SUBSTITUTES

5.7.5 THREAT OF NEW ENTRANTS

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS FOR FLOW CYTOMETRY MARKET

5.9 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 6 FLOW CYTOMETRY MARKET: DETAILED LIST OF RELEVANT EVENTS AND CONFERENCES

5.10 TRADE DATA

TABLE 7 IMPORT DATA FOR FLOW CYTOMETRY INSTRUMENTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

TABLE 8 EXPORT DATA FOR FLOW CYTOMETRY INSTRUMENTS, BY COUNTRY, 2017–2021 (USD THOUSAND)

5.11 PRICING ANALYSIS

TABLE 9 GLOBAL AVERAGE COST OF FLOW CYTOMETERS, BY TYPE

TABLE 10 GLOBAL AVERAGE COST OF FLOW CYTOMETERS AND OTHER PRODUCTS, BY COMPANY 62

TABLE 11 IMPORT SHIPMENT DATA OF FLOW CYTOMETERS IN BRAZIL (2021)

5.11.1 COST OF FLOW CYTOMETRY SOFTWARE

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 19 KEY STAKEHOLDERS IN PHARMACEUTICAL COMPANIES AND THEIR INFLUENCE ON BUYING PROCESS

FIGURE 20 KEY BUYING CRITERIA FOR FLOW CYTOMETRY 2017–2021 (USD THOUSAND)

6 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE (Page No. - 64)

6.1 INTRODUCTION

TABLE 12 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

6.2 REAGENTS AND CONSUMABLES

6.2.1 GROWING R&D TO DRIVE MARKET GROWTH

TABLE 13 LATIN AMERICAN FLOW CYTOMETRY REAGENTS AND CONSUMABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 INSTRUMENTS

TABLE 14 LATIN AMERICAN FLOW CYTOMETRY INSTRUMENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 LATIN AMERICAN FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 CELL ANALYZERS

TABLE 16 LATIN AMERICAN FLOW CYTOMETRY-BASED CELL ANALYZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 17 LATIN AMERICAN FLOW CYTOMETRY-BASED CELL ANALYZERS MARKET, BY PRICE RANGE, 2020–2027 (USD MILLION)

6.3.1.1 High-range cell analyzers

6.3.1.1.1 Adoption of high-range cell analyzers among end users in larger economies to drive growth

TABLE 18 LATIN AMERICAN HIGH-RANGE CELL ANALYZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1.2 Mid-range cell analyzers

6.3.1.2.1 Availability of compact and high-performance analyzers to support growth

TABLE 19 LATIN AMERICAN MID-RANGE CELL ANALYZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.1.3 Low-range cell analyzers

6.3.1.3.1 Low-range analyzers widely adopted among price-sensitive end users

TABLE 20 LATIN AMERICAN LOW-RANGE CELL ANALYZERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2 CELL SORTERS

TABLE 21 LATIN AMERICAN FLOW CYTOMETRY-BASED CELL SORTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 22 LATIN AMERICAN FLOW CYTOMETRY-BASED CELL SORTERS MARKET, BY PRICE RANGE, 2020–2027 (USD MILLION)

6.3.2.1 High-range cell sorters

6.3.2.1.1 High cost and budgetary limitations to restrain growth

TABLE 23 LATIN AMERICAN HIGH-RANGE CELL SORTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2.2 Mid-range cell sorters

6.3.2.2.1 Cost-efficiency and frequent product launches for mid-range sorters to drive growth

TABLE 24 LATIN AMERICAN MID-RANGE CELL SORTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.3.2.3 Low-range cell sorters

6.3.2.3.1 Research facilities and small-scale diagnostic labs to be major end users of low-range sorters

TABLE 25 LATIN AMERICAN LOW-RANGE CELL SORTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 SERVICES

6.4.1 FLOW CYTOMETRY SERVICES ENSURE WORKFLOW CONTINUITY AND MAXIMIZE PERFORMANCE

TABLE 26 LATIN AMERICAN FLOW CYTOMETRY SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 SOFTWARE

6.5.1 TECHNOLOGICAL ADVANCEMENTS IN SOFTWARE TO DRIVE MARKET GROWTH

TABLE 27 LATIN AMERICAN FLOW CYTOMETRY SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.6 ACCESSORIES

6.6.1 PROCEDURAL BENEFITS OFFERED BY FLOW CYTOMETRY ACCESSORIES TO SUPPORT MARKET GROWTH

TABLE 28 LATIN AMERICAN FLOW CYTOMETRY ACCESSORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY TECHNOLOGY (Page No. - 77)

7.1 INTRODUCTION

TABLE 29 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

7.2 CELL-BASED FLOW CYTOMETRY

7.2.1 GROWING TECHNOLOGICAL ADVANCEMENTS IN CELL-BASED ASSAYS TO DRIVE GROWTH

TABLE 30 LATIN AMERICAN CELL-BASED FLOW CYTOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 BEAD-BASED FLOW CYTOMETRY

7.3.1 HIGH RELIABILITY AND MEASUREMENT CONSISTENCY TO SUPPORT GROWTH

TABLE 31 LATIN AMERICAN BEAD-BASED FLOW CYTOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY END USER (Page No. - 81)

8.1 INTRODUCTION

TABLE 32 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

8.2 ACADEMIC AND RESEARCH INSTITUTES

8.2.1 INCREASING RESEARCH ACTIVITIES EXPECTED TO DRIVE GROWTH

TABLE 33 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR ACADEMIC AND RESEARCH INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 HOSPITALS AND CLINICAL TESTING LABORATORIES

8.3.1 USE OF FLOW CYTOMETRY TECHNIQUES IN CANCER DIAGNOSTICS TO DRIVE MARKET GROWTH

TABLE 34 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR HOSPITALS AND CLINICAL TESTING LABORATORIES, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

8.4.1 INCREASING INVESTMENTS IN DRUG DISCOVERY AND DEVELOPMENT TO SUPPORT MARKET GROWTH

TABLE 35 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

9 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY APPLICATION (Page No. - 86)

9.1 INTRODUCTION

TABLE 36 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

9.2 RESEARCH APPLICATIONS

TABLE 37 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

9.2.1 PHARMACEUTICAL AND BIOTECHNOLOGY

TABLE 39 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.1.1 Drug discovery

9.2.1.1.1 Growing use of flow cytometry instruments in drug discovery cycle to support growth

TABLE 41 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.1.2 Stem cell research

9.2.1.2.1 Increasing focus on stem cell research to drive demand for flow cytometry products

TABLE 42 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR STEM CELL RESEARCH, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.1.3 In vitro toxicity testing

9.2.1.3.1 Growing adoption of flow cytometry in drug discovery and development to support growth

TABLE 43 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR IN VITRO TOXICITY TESTING, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.2 IMMUNOLOGY

9.2.2.1 Growing prevalence of infectious and autoimmune diseases to support growth

TABLE 44 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR IMMUNOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.3 CELL SORTING

9.2.3.1 Technologically advanced cell sorters to drive market growth

TABLE 45 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CELL SORTING, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.4 APOPTOSIS

9.2.4.1 Growing use of apoptosis assays to support growth

TABLE 46 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR APOPTOSIS, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.5 CELL CYCLE ANALYSIS

9.2.5.1 Use of flow cytometry to detect chromosomal abnormalities to drive growth

TABLE 47 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CELL CYCLE ANALYSIS, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.6 CELL VIABILITY

9.2.6.1 Growing use of cell viability assays in research to drive growth

TABLE 48 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CELL VIABILITY, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.7 CELL COUNTING

9.2.7.1 Flow cytometry permits easy differentiation of cells via scattering or staining

TABLE 49 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CELL COUNTING, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.8 OTHER RESEARCH APPLICATIONS

TABLE 50 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR OTHER RESEARCH APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 CLINICAL APPLICATIONS

TABLE 51 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.1 CANCER

9.3.1.1 Growing use of flow cytometry techniques in cancer prediction to drive growth

TABLE 53 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR CANCER, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.2 HEMATOLOGY

9.3.2.1 Increasing use of flow cytometry in hematology applications to drive growth

TABLE 54 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR HEMATOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.3 AUTOIMMUNE DISEASES

9.3.3.1 Adoption of flow cytometry for autoimmune disease diagnostics to drive growth

TABLE 55 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR AUTOIMMUNE DISEASES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.4 ORGAN AND TISSUE TRANSPLANTATION

9.3.4.1 Growing demand for organ transplants to drive market growth

TABLE 56 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR ORGAN TRANSPLANTATION, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.5 OTHER CLINICAL APPLICATIONS

TABLE 57 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR OTHER CLINICAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 INDUSTRIAL APPLICATIONS

9.4.1 ADOPTION OF FLOW CYTOMETRY TECHNIQUES IN FOOD AND DAIRY INDUSTRIES TO DRIVE GROWTH

TABLE 58 LATIN AMERICAN FLOW CYTOMETRY MARKET FOR INDUSTRIAL APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

10 LATIN AMERICAN FLOW CYTOMETRY MARKET, BY COUNTRY (Page No. - 104)

10.1 INTRODUCTION

TABLE 59 LATIN AMERICA: FLOW CYTOMETRY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 LATIN AMERICA: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 61 LATIN AMERICA: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 62 LATIN AMERICA: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 LATIN AMERICA: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 LATIN AMERICA: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 LATIN AMERICA: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 66 LATIN AMERICA: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 LATIN AMERICA: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 LATIN AMERICA: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 69 LATIN AMERICA: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2 BRAZIL

10.2.1 WELL-ESTABLISHED PRESENCE OF KEY MARKET PLAYERS ENSURING ADOPTION OF FLOW CYTOMETRY PRODUCTS

TABLE 70 BRAZIL: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 71 BRAZIL: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 72 BRAZIL: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 BRAZIL: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 BRAZIL: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 BRAZIL: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 76 BRAZIL: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 77 BRAZIL: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 78 BRAZIL: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 BRAZIL: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 MEXICO

10.3.1 FAVORABLE TRADE AGREEMENTS TO SUPPORT AVAILABILITY OF FLOW CYTOMETRY PRODUCTS

TABLE 80 MEXICO: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 81 MEXICO: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 82 MEXICO: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 MEXICO: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 MEXICO: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 MEXICO: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 MEXICO: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 MEXICO: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 MEXICO: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 MEXICO: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ARGENTINA

10.4.1 GROWING RESEARCH INITIATIVES TO SUPPORT MARKET GROWTH

TABLE 90 ARGENTINA: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 91 ARGENTINA: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 92 ARGENTINA: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 ARGENTINA: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 ARGENTINA: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 ARGENTINA: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 96 ARGENTINA: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 ARGENTINA: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 ARGENTINA: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 ARGENTINA: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 COLOMBIA

10.5.1 GROWING RESEARCH ACTIVITIES IN ONCOLOGY AND ORGAN TRANSPLANTATION TO SUPPORT MARKET GROWTH

TABLE 100 COLOMBIA: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 101 COLOMBIA: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 102 COLOMBIA: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 COLOMBIA: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 COLOMBIA: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 COLOMBIA: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 106 COLOMBIA: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 COLOMBIA: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 COLOMBIA: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 COLOMBIA: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 CHILE

10.6.1 GROWING AWARENESS THROUGH CONFERENCES TO DRIVE MARKET GROWTH

TABLE 110 CHILE: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 111 CHILE: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 112 CHILE: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 CHILE: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 CHILE: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 CHILE: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 CHILE: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 CHILE: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 CHILE: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 CHILE: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

10.7 REST OF LATIN AMERICA

TABLE 120 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 121 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 122 REST OF LATIN AMERICA: FLOW CYTOMETRY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 REST OF LATIN AMERICA: FLOW CYTOMETRY CELL ANALYZERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 124 REST OF LATIN AMERICA: FLOW CYTOMETRY CELL SORTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 126 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 REST OF LATIN AMERICA: FLOW CYTOMETRY MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 133)

11.1 INTRODUCTION

11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

TABLE 130 LATIN AMERICAN FLOW CYTOMETRY MARKET: STRATEGIES ADOPTED

11.3 REVENUE ANALYSIS

FIGURE 21 REVENUE ANALYSIS FOR KEY COMPANIES (2019–2021)

11.4 MARKET SHARE ANALYSIS

FIGURE 22 LATIN AMERICAN FLOW CYTOMETRY MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

TABLE 131 LATIN AMERICAN FLOW CYTOMETRY MARKET: DEGREE OF COMPETITION

11.5 LIST OF KEY PLAYERS

TABLE 132 DEMAND-SIDE PLAYERS

TABLE 133 SUPPLY-SIDE PLAYERS

11.6 COMPANY EVALUATION MATRIX

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 23 FLOW CYTOMETRY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

11.7 COMPETITIVE BENCHMARKING

TABLE 134 PRODUCT & SERVICE FOOTPRINT OF COMPANIES

11.8 COMPETITIVE SCENARIO AND TRENDS

TABLE 135 PRODUCT LAUNCHES AND ENHANCEMENTS (JANUARY 2019–OCTOBER 2022)

TABLE 136 DEALS (JANUARY 2019–OCTOBER 2022)

12 COMPANY PROFILES (Page No. - 144)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 BD (BECTON, DICKINSON AND COMPANY)

TABLE 137 BD: BUSINESS OVERVIEW

FIGURE 24 BD: COMPANY SNAPSHOT (2021)

12.1.2 DANAHER CORPORATION

TABLE 138 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 25 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.3 THERMO FISHER SCIENTIFIC, INC.

TABLE 139 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 26 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2021)

12.1.4 AGILENT TECHNOLOGIES, INC.

TABLE 140 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 27 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2021)

12.1.5 SONY BIOTECHNOLOGY INC. (A SUBSIDIARY OF SONY GROUP CORPORATION)

TABLE 141 SONY GROUP CORPORATION: BUSINESS OVERVIEW

FIGURE 28 SONY GROUP CORPORATION: COMPANY SNAPSHOT (2021)

12.1.6 BIO-RAD LABORATORIES INC.

TABLE 142 BIO-RAD LABORATORIES INC.: BUSINESS OVERVIEW

FIGURE 29 BIO-RAD LABORATORIES INC.: COMPANY SNAPSHOT (2021)

12.1.7 MILTENYI BIOTEC

TABLE 143 MILTENYI BIOTEC: BUSINESS OVERVIEW

12.1.8 ENZO BIOCHEM, INC.

TABLE 144 ENZO BIOCHEM, INC.: BUSINESS OVERVIEW

FIGURE 30 ENZO BIOCHEM, INC.: COMPANY SNAPSHOT (2021)

12.1.9 SYSMEX CORPORATION

TABLE 145 SYSMEX CORPORATION: BUSINESS OVERVIEW

FIGURE 31 SYSMEX CORPORATION: COMPANY SNAPSHOT (2021)

12.1.10 LUMINEX CORPORATION (A DIASORIN COMPANY)

TABLE 146 DIASORIN S.P.A.: BUSINESS OVERVIEW

FIGURE 32 DIASORIN S.P.A.: COMPANY SNAPSHOT (2021)

12.1.11 BIOMÉRIEUX SA

TABLE 147 BIOMÉRIEUX SA: BUSINESS OVERVIEW

FIGURE 33 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2021)

12.1.12 SARTORIUS AG

TABLE 148 SARTORIUS AG.: BUSINESS OVERVIEW

FIGURE 34 SARTORIUS AG: COMPANY SNAPSHOT (2021)

12.1.13 UNION BIOMETRICA, INC.

TABLE 149 UNION BIOMETRICA, INC.: BUSINESS OVERVIEW

12.1.14 TAKARA BIO, INC.

TABLE 150 TAKARA BIO, INC.: BUSINESS OVERVIEW

FIGURE 35 TAKARA BIO, INC.: COMPANY SNAPSHOT (2021)

12.1.15 CYTEK BIOSCIENCES

TABLE 151 CYTEK BIOSCIENCES: BUSINESS OVERVIEW

FIGURE 36 CYTEK BIOSCIENCES, INC.: COMPANY SNAPSHOT (2021)

12.1.16 APOGEE FLOW SYSTEMS LTD.

TABLE 152 APOGEE FLOW SYSTEMS LTD.: BUSINESS OVERVIEW

12.1.17 BIOLEGEND, INC. (PART OF PERKINELMER)

TABLE 153 BIOLEGEND, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 199)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

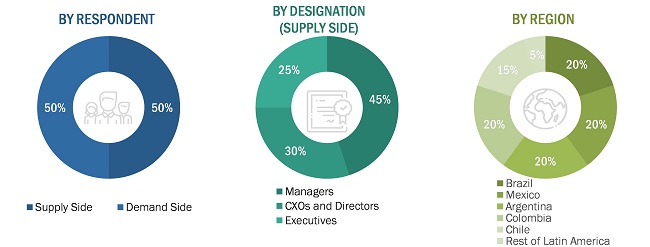

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information to analyze the Latin American Flow cytometry market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study included corporate filings (such as annual reports, SEC filings, and financial statements), research journals, press releases, and trade, business, and professional associations. These secondary sources were used to identify and collect useful information for this extensive, technical, and commercial study of the flow cytometry market in Latin America. Secondary research was mainly used to obtain key information about the industry’s total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, market trends, and key developments by both public and private organizations in the Latin American Flow cytometry market.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the Latin American Flow cytometry market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from academic and research institutes, hospitals and clinical testing laboratories, pharmaceutical and biotechnology companies and experts from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across five major countries, namely, Brazil, Mexico, Argentina, Colombia, Chile, and the Rest of Latin American region. Approximately 50% of the primary interviews were conducted with each- the supply-side and demand-side participants. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 =

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The Latin American market size of the flow cytometry market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the Latin American flow cytometry market were identified through secondary research.

- The research methodology included a study of the regulatory filings (such as annual and quarterly financial reports) of the key market players and interviews with industry experts for key insights into the flow cytometry market in Latin America.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the expected macro-indicators affecting the market growth of the respective segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get validated quantitative and/or qualitative data.

- The above-mentioned data was consolidated and added to detailed inputs, analyzed, and presented in this report.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, and forecast the Latin American flow cytometry market based on technology, product & service, application, end user, and countries in the region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges), along with the current trends

- To strategically analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall flow cytometry market in Latin America

- To analyze the opportunities in the Latin American flow cytometry market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments for the Latin American region, as well as for the country-wise segmentation

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze competitive developments such as acquisitions, new product launches, and expansions in the flow cytometry market in Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Latin American Flow Cytometry Market