Asia Pacific Single-cell Analysis Market Size by Cell Type (Human, Animal, Microbial), Product (Reagent, Assays, Instruments), Technique (Flow Cytometry, NGS, PCR), Application (Cancer, Stemcell, IVF), End User (Academic, Research Labs) - Forecast to 2025

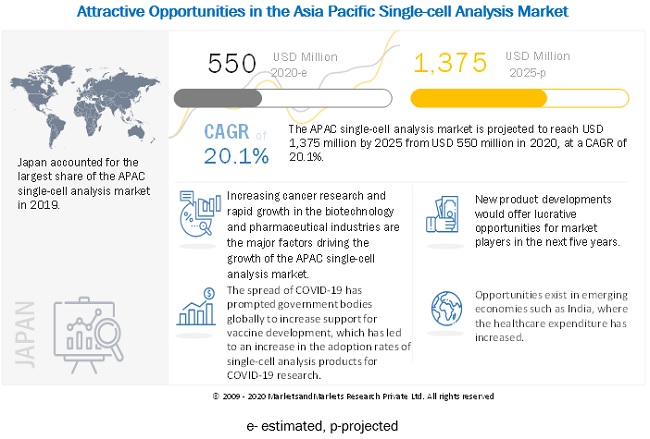

The size of Asia Pacific Single-cell Analysis Market in terms of revenue was estimated to be worth USD 550 million in 2020 and is poised to reach USD 1,375 million by 2025, growing at a CAGR of 20.1% from 2020 to 2025. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Asia Pacific single-cell analysis market growth is driven by the growing focus on personalized medicine, increasing R&D in the pharmaceutical and biotechnology industries for complex diseases, growth in stem cell research, and the increasing frequency of pandemics.

To know about the assumptions considered for the study, Request for Free Sample Report

Asia Pacific Single-cell Analysis Market Dynamics

Driver: Increasing R&D in the pharmaceutical and biotechnology industries for complex diseases

Pharmaceutical and biotechnology companies are major end users in the Asia Pacific single-cell analysis market. Single-cell analysis is carried out in the research and production of all biopharmaceutical products. Growth in the pharmaceutical and biotechnology sector across the Asia Pacific region serves as a direct driver for associated markets such as single-cell analysis.

Pharmaceutical and biotechnology companies utilize single-cell analysis products to achieve their clinical research goals. Biopharmaceutical companies focus on developing targeted therapies, especially for the treatment of cancer, complex diseases, and rare genetic disorders. As companies are focusing on developing targeted therapies, the need for single-cell analysis products has become imperative for determining the genetic profile of patients enrolled in clinical trials. Similarly, pharmaceutical companies are utilizing single-cell analysis instruments such as NGS technologies for biomarker research, which is a segment that has the potential to grow at a high CAGR in the coming years.

Opportunity: High growth potential of single-cell sequencing

Single-cell sequencing (SCS) helps understand the transcriptional stochasticity and cellular heterogeneity in more detail. It assists in the investigation of small groups of differentiating cells and circulating tumor cells. It also demonstrates the heterogeneity of gene expressions, interaction and regulations of gene regulatory networks, characteristics of putative cancer stem cells, gene expression profiles of intracellular compartments, mRNA locations, and allele-specific gene expression. Advancements in single-cell sequencing have improved the detection and analysis of infectious disease outbreaks, antibiotic drug-resistant strains, food-borne pathogens, and microbial diversities in the environment.

Trend: Integration of microfluidics in single-cell analysis

Currently, the isolation and analysis of circulating tumor cells (CTCs) and cells that are present in low quantities in the body is a major challenge faced by researchers and clinicians. Advances in microfluidics technology have provided robust solutions for the isolation and analysis of single cells. Moreover, microfluidic chips are easy to use and provide reliable and efficient isolation of single cells from a small sample volume.

Microfluidics has various advantages in single-cell analysis, including reduced reagent consumption, increased throughput, and ease of efficient automation. Citing the potential of this technology in single-cell analysis, various research studies are being performed for evaluating the performance of microfluidic chips in analyzing other types of cells.

The top players—Merck Millipore (US), Danaher Corporation (US), QIAGEN N.V. (Netherlands), Becton, Dickinson and Company (US), and Thermo Fisher Scientific, Inc. (US)—in the Asia Pacific single-cell analysis market accounted for a combined majority market share in 2019. There is a high degree of competition among the market players. Only major companies can afford high-capital investments as well as the high cost of R&D and manufacturing. Moreover, this will prevent new entrants from entering this market. Furthermore, the top players in this market are large and well-established and enjoy a high degree of brand loyalty.

In 2019, consumables segment accounted for the largest share of the Asia Pacific single-cell analysis industry, by product

Based on product, the Asia Pacific single-cell analysis market is segmented into consumables and instruments. The consumables segment includes beads, microplates, reagents, assay kits, and other consumables. The instruments segment includes flow cytometers, NGS systems, PCR instruments, spectrophotometers, microscopes, cell counters, HCS systems, microarrays, and other instruments. The consumables segment accounted for the largest market share in 2019. This segment is also expected to register the highest CAGR during the forecast period. The large share and high growth of this segment can primarily be attributed to the frequent purchase of these products as compared to instruments, which are considered as a one-time investment, and their wide applications in research and exosome analysis.

In 2019, human cells segment accounted for the largest share in the Asia Pacific single-cell analysis industry, by cell type

The Asia Pacific single-cell analysis market is segmented into human cells, animal cells, and microbial cells based on cell type. The human cells segment accounted for the largest market share in 2019, owing to the high adoption of human cells to develop novel cancer therapies.

Japan is the largest market for Asia Pacific single-cell analysis industry

The Asia Pacific single-cell analysis market is segmented into Japan, China, India, South Korea, Singapore, Australia, Southeast Asia, and the Rest of Asia Pacific. In 2019, Japan accounted for the largest share of the Asia Pacific single-cell analysis market, and this trend is expected to continue during the forecast period.

In terms of market share, China closely followed Japan in 2019. However, in the next five years, the share of Japan is expected to increase in the APAC single-cell analysis market as it is estimated to witness higher CAGR than China. This can be attributed to the large geriatric population, increasing life science research activities, and growing focus on personalized medicine in Japan.

Some key players in the Asia Pacific single-cell analysis market (2020- 2025)

- Merck Millipore

- Danaher Corporation

- QIAGEN N.V.

- Becton, Dickinson and Company

- Thermo Fisher Scientific, Inc.

Scope of the Asia Pacific Single-cell Analysis Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$550 million |

|

Projected Revenue Size by 2025 |

$1,375 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 20.1% |

|

Market Driver |

Increasing R&D in the pharmaceutical and biotechnology industries for complex diseases |

|

Market Opportunity |

High growth potential of single-cell sequencing |

This report categorizes the Asia Pacific single-cell analysis market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables

- Beads

- Microplates

- Reagents

- Assay Kits

- Immunoassays

- Cell-based Assays

- Other Consumables

- Instruments

- Flow Cytometers

- NGS Systems

- PCR Instruments

- Spectrophotometers

- Microscopes

- Cell Counters

- HCS Systems

- Microarrays

- Other Instruments

By Cell Type

- Human Cells

- Animal Cells

- Microbial Cells

By Technique

- Flow Cytometry

- Next-generation Sequencing

- Polymerase Chain Reaction

- Microscopy

- Mass Spectrometry

- Other Techniques

By Application

- Research Applications

- Cancer

- Immunology

- Neurology

- Stem Cell

- Other Research Applications

- Medical Applications

- Noninvasive Prenatal Diagnosis

- In Vitro Fertilization

- Circulating Tumor Cell Detection

By End User

- Academic & Research Laboratories

- Biotechnology & Pharmaceutical Companies

- Hospitals & Diagnostic Laboratories

- Cell Banks & IVF Centers

By Region

- Japan

- China

- India

- South Korea

- Singapore

- Australia

- Southeast Asia

- Rest of Asia Pacific

Recent Developments of Asia Pacific Single-cell Analysis Industry:

- In September 2020, Lonza (Switzerland) launched Promega Corporation (US) launched the Spectrum Compact CE System.

- In March 2020, Fluidigm Corporation (US) opened a new Center of Excellence (CoE) for Imaging Mass Cytometry (IMC) in Singapore, together with the Singapore Immunology Network (SIgN), part of the Agency for Science, Technology and Research.

- In January 2020, Takara Bio (Japan) opened the Center for Gene and Cell Processing II for the research and manufacturing of regenerative medicine products in Kusatsu.

Frequently Asked Questions (FAQ):

What are the recent trends affecting the Asia Pacific single-cell analysis market?

Recent trends affecting the APAC single-cell analysis market are the COVID-19 outbreak, increasing focus on vaccine development, and rapid growth in the biotechnology and biopharmaceutical industries.

What are the different cell types used for single-cell analysis?

Based on cell type, the APAC single-cell analysis market is segmented into human cells, animal cells, and microbial cells. The human cells segment accounted for the largest share of the APAC single-cell analysis market in 2019. The large share of this segment can be attributed to the high utilization of human cells in research laboratories and academic institutes.

Who are the key players in the Asia Pacific single-cell analysis market?

The key players in this market are: Becton, Dickinson and Company (US), Danaher Corporation (US), Merck Millipore (US), QIAGEN N.V. (Netherlands), Thermo Fisher Scientific, Inc. (US), General Electric Company (US), Promega Corporation (US), Illumina, Inc. (US), Bio-Rad Laboratories (US), Fluidigm Corporation (US), Agilent Technologies, Inc. (US), Tecan Group Ltd. (Switzerland), Sartorius AG (Germany), Luminex Corporation (US), Takara Bio (Japan), 10x Genomics (US), Fluxion Biosciences (US), Menarini Silicon Biosystems, Inc. (Italy), bioMérieux SA (France), Oxford Nanopore Technologies (UK), Cytek Biosciences (US), Corning Incorporated (US), Apogee Flow Systems Ltd. (UK), NanoCellect Biomedical (US), and On-chip Biotechnologies Co., Ltd. (Japan).

Who are the key end-users of the Asia Pacific single-cell analysis market?

Based on end user, the APAC single-cell analysis market is segmented into academic & research laboratories, biotechnology & pharmaceutical companies, hospitals & diagnostic laboratories, and cell banks & IVF centers. The academic & research laboratories segment accounted for the largest share of the APAC single-cell analysis market in 2019. The large share of this segment is primarily attributed to the growing funding for life science research and the increasing number of medical colleges and universities.

Which country is lucrative for the Asia Pacific single-cell analysis market?

Japan, China, and India, the emerging economies in the Asia Pacific region will be the lucrative markets for single-cell analysis products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

2.2 RESEARCH APPROACH

FIGURE 2 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET: RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

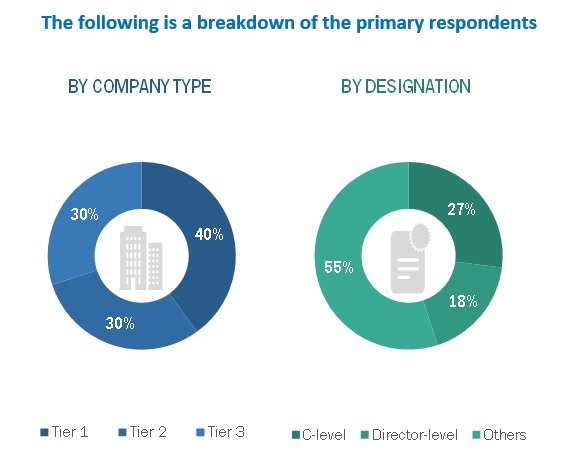

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE AND DESIGNATION

2.2.2.1 Key data from primary sources

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET: BOTTOM-UP APPROACH

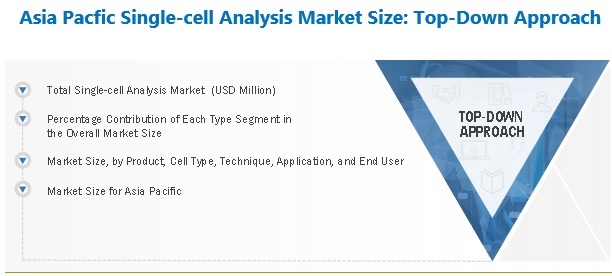

2.3.2 TOP-DOWN APPROACH

FIGURE 5 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 7 APAC SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 8 APAC SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 APAC SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 APAC SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 APAC SINGLE-CELL ANALYSIS MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 12 APAC SINGLE-CELL ANALYSIS MARKET, BY COUNTRY, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET OVERVIEW

FIGURE 13 INCREASING CANCER RESEARCH IS DRIVING THE GROWTH OF THE APAC SINGLE-CELL ANALYSIS MARKET

4.2 APAC SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 14 CONSUMABLES SEGMENT TO DOMINATE THE MARKET IN 2020

4.3 APAC SINGLE-CELL ANALYSIS MARKET SHARE, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 15 ACADEMIC & RESEARCH LABORATORIES TO ACCOUNT FOR THE LARGEST SHARE OF THE APAC SINGLE-CELL ANALYSIS MARKET DURING THE FORECAST PERIOD

4.4 APAC SINGLE-CELL ANALYSIS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 JAPAN IS THE LARGEST MARKET FOR SINGLE-CELL ANALYSIS IN APAC

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, TRENDS, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising prevalence of cancer

TABLE 1 PROJECTED INCREASE IN THE NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2035

5.2.1.2 Increasing R&D in the pharmaceutical and biotechnology industries for complex diseases

5.2.1.3 Growth in stem cell research

5.2.1.4 Growing focus on personalized medicine

5.2.2 RESTRAINTS

5.2.2.1 High cost of single-cell analysis products

5.2.3 OPPORTUNITIES

5.2.3.1 High growth potential of single-cell sequencing

5.2.4 TRENDS

5.2.4.1 Integration of microfluidics in single-cell analysis

5.2.5 CHALLENGES

5.2.5.1 Survival of small players and new entrants

5.3 IMPACT OF COVID-19 ON THE ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET

5.4 PRICING ANALYSIS

TABLE 2 PRICE OF SINGLE-CELL ANALYSIS PRODUCTS (2020)

5.5 VALUE CHAIN ANALYSIS

FIGURE 18 MAJOR VALUE IS ADDED DURING THE MANUFACTURING & ASSEMBLY PHASE

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 19 SUPPLY CHAIN ANALYSIS OF THE ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET

5.7 ECOSYSTEM ANALYSIS OF THE ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET

FIGURE 20 ECOSYSTEM: ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET

5.8 PESTLE ANALYSIS

6 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET, BY PRODUCT (Page No. - 58)

6.1 INTRODUCTION

TABLE 3 APAC SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 CONSUMABLES

TABLE 4 APAC SINGLE-CELL ANALYSIS CONSUMABLES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 5 APAC SINGLE-CELL ANALYSIS CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.2.1 BEADS

6.2.1.1 Wide application of beads in the isolation of RNA and DNA to drive market growth

TABLE 6 APAC SINGLE-CELL ANALYSIS MARKET FOR BEADS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2 MICROPLATES

6.2.2.1 Expansion of genomic technologies will increase the demand for microplates in the coming years

TABLE 7 APAC SINGLE-CELL ANALYSIS MARKET FOR MICROPLATES, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.3 REAGENTS

6.2.3.1 Advancements in single-cell genomics to increase the adoption of reagents

TABLE 8 APAC SINGLE-CELL ANALYSIS MARKET FOR REAGENTS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.4 ASSAY KITS

TABLE 9 APAC SINGLE-CELL ANALYSIS MARKET FOR ASSAY KITS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 APAC SINGLE-CELL ANALYSIS MARKET FOR ASSAY KITS, BY TYPE, 2018–2025 (USD MILLION)

6.2.4.1 Immunoassays

6.2.4.1.1 Innovation in immunoassays to drive the growth of this segment

TABLE 11 APAC SINGLE-CELL ANALYSIS MARKET FOR IMMUNOASSAYS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.4.2 Cell-based Assays

6.2.4.2.1 Rising R&D activities in pharma and biopharma companies will drive the demand for cell-based assay

TABLE 12 APAC SINGLE-CELL ANALYSIS MARKET FOR CELL-BASED ASSAYS, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.5 OTHER CONSUMABLES

TABLE 13 APAC SINGLE-CELL ANALYSIS MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 INSTRUMENTS

TABLE 14 APAC SINGLE-CELL ANALYSIS INSTRUMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 15 APAC SINGLE-CELL ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.3.1 FLOW CYTOMETERS

6.3.1.1 Technological advancements in flow cytometry to drive the growth of this segment

TABLE 16 APAC SINGLE-CELL ANALYSIS MARKET FOR FLOW CYTOMETERS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.2 NGS SYSTEMS

6.3.2.1 Advancements in NGS systems to support the market growth

TABLE 17 APAC SINGLE-CELL ANALYSIS MARKET FOR NGS SYSTEMS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.3 PCR INSTRUMENTS

6.3.3.1 PCR is used to amplify DNA and mRNA from single cells from gene expression

TABLE 18 APAC SINGLE-CELL ANALYSIS MARKET FOR PCR INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.4 SPECTROPHOTOMETERS

6.3.4.1 Spectrophotometers play an integral role in the life science industry

TABLE 19 APAC SINGLE-CELL ANALYSIS MARKET FOR SPECTROPHOTOMETERS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.5 MICROSCOPES

6.3.5.1 Government support for cell-based research to drive the adoption of microscopes

TABLE 20 APAC SINGLE-CELL ANALYSIS MARKET FOR MICROSCOPES, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.6 CELL COUNTERS

6.3.6.1 Technological advancements in flow cytometers are expected to hamper the growth of this segment

TABLE 21 APAC SINGLE-CELL ANALYSIS MARKET FOR CELL COUNTERS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.7 HCS SYSTEMS

6.3.7.1 Increasing need for determining cell toxicity in drug development and drug discovery to drive the adoption of HCS systems

TABLE 22 APAC SINGLE-CELL ANALYSIS MARKET FOR HCS SYSTEMS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.8 MICROARRAYS

6.3.8.1 Increasing demand for microarrays in the field of cancer research and personalized medicine to support market growth

TABLE 23 APAC SINGLE-CELL ANALYSIS MARKET FOR MICROARRAYS, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.9 OTHER INSTRUMENTS

TABLE 24 APAC SINGLE-CELL ANALYSIS MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2018–2025 (USD MILLION)

7 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE (Page No. - 79)

7.1 INTRODUCTION

TABLE 25 APAC SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

7.2 HUMAN CELLS

7.2.1 INCREASING CANCER RESEARCH & FUNDING TO PROPEL MARKET GROWTH

TABLE 26 APAC SINGLE-CELL ANALYSIS MARKET FOR HUMAN CELLS, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 ANIMAL CELLS

7.3.1 INCREASING ANIMAL CELL RESEARCH TO DRIVE MARKET GROWTH

TABLE 27 APAC SINGLE-CELL ANALYSIS MARKET FOR ANIMAL CELLS, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 MICROBIAL CELLS

7.4.1 RISING GOVERNMENT SUPPORT TO DETECT & COMBAT ANTIMICROBIAL RESISTANCE TO PROPEL MARKET GROWTH

TABLE 28 APAC SINGLE-CELL ANALYSIS MARKET FOR MICROBIAL CELLS, BY COUNTRY, 2018–2025 (USD MILLION)

8 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE (Page No. - 84)

8.1 INTRODUCTION

TABLE 29 APAC SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

8.2 FLOW CYTOMETRY

8.2.1 GROWING INCIDENCE & PREVALENCE OF CANCER TO SUPPORT MARKET GROWTH

TABLE 30 APAC SINGLE-CELL ANALYSIS MARKET FOR FLOW CYTOMETRY, BY COUNTRY, 2018–2025 (USD MILLION)

8.3 NEXT-GENERATION SEQUENCING

8.3.1 NGS IS THE FASTEST-GROWING SEGMENT IN THE APAC SINGLE-CELL ANALYSIS MARKET

TABLE 31 APAC SINGLE-CELL ANALYSIS MARKET FOR NEXT-GENERATION SEQUENCING, BY COUNTRY, 2018–2025 (USD MILLION)

8.4 POLYMERASE CHAIN REACTION

8.4.1 LATEST ADVANCEMENTS IN PCR TECHNIQUES TO SUPPORT MARKET GROWTH

TABLE 32 APAC SINGLE-CELL ANALYSIS MARKET FOR POLYMERASE CHAIN REACTION, BY COUNTRY, 2018–2025 (USD MILLION)

8.5 MICROSCOPY

8.5.1 INCREASING INVESTMENTS IN CELL BIOLOGY RESEARCH TO PROPEL MARKET GROWTH

TABLE 33 APAC SINGLE-CELL ANALYSIS MARKET FOR MICROSCOPY, BY COUNTRY, 2018–2025 (USD MILLION)

8.6 MASS SPECTROMETRY

8.6.1 LAUNCH OF NEW AND ADVANCED PRODUCTS TO SUPPORT MARKET GROWTH

TABLE 34 APAC SINGLE-CELL ANALYSIS MARKET FOR MASS SPECTROMETRY, BY COUNTRY, 2018–2025 (USD MILLION)

8.7 OTHER TECHNIQUES

TABLE 35 APAC SINGLE-CELL ANALYSIS MARKET FOR OTHER TECHNIQUES, BY COUNTRY, 2018–2025 (USD MILLION)

9 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET, BY APPLICATION (Page No. - 92)

9.1 INTRODUCTION

TABLE 36 APAC SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

9.2 RESEARCH APPLICATIONS

TABLE 37 GLOBAL NUMBER OF CLINICAL TRIALS, BY THERAPEUTIC AREA (AS OF OCTOBER 2019)

FIGURE 21 APAC SINGLE-CELL ANALYSIS MARKET FOR RESEARCH APPLICATIONS, BY TECHNIQUE, 2020

TABLE 38 APAC SINGLE-CELL ANALYSIS MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 APAC SINGLE-CELL ANALYSIS MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2025 (USD MILLION)

9.2.1 CANCER RESEARCH

9.2.1.1 Rising incidence of cancer to support market growth

TABLE 40 APAC SINGLE-CELL ANALYSIS MARKET FOR CANCER RESEARCH, BY COUNTRY, 2018–2025 (USD MILLION)

9.2.2 IMMUNOLOGY RESEARCH

9.2.2.1 High incidence of infectious diseases and growing demand for advanced vaccines to propel market growth

TABLE 41 APAC SINGLE-CELL ANALYSIS MARKET FOR IMMUNOLOGY RESEARCH, BY COUNTRY, 2018–2025 (USD MILLION)

9.2.3 NEUROLOGY RESEARCH

9.2.3.1 Increasing incidence of neurological disorders to boost market growth

TABLE 42 APAC SINGLE-CELL ANALYSIS MARKET FOR NEUROLOGY RESEARCH, BY COUNTRY, 2018–2025 (USD MILLION)

9.2.4 STEM CELL RESEARCH

9.2.4.1 Rising investments in stem cell research to drive the growth of this application segment

TABLE 43 APAC SINGLE-CELL ANALYSIS MARKET FOR STEM CELL RESEARCH, BY COUNTRY, 2018–2025 (USD MILLION)

9.2.5 OTHER RESEARCH APPLICATIONS

TABLE 44 APAC SINGLE-CELL ANALYSIS MARKET FOR OTHER RESEARCH APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

9.3 MEDICAL APPLICATIONS

FIGURE 22 APAC SINGLE-CELL ANALYSIS MARKET FOR MEDICAL APPLICATIONS, BY TECHNIQUE, 2020

TABLE 45 APAC SINGLE-CELL ANALYSIS MARKET FOR MEDICAL APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 APAC SINGLE-CELL ANALYSIS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2018–2025 (USD MILLION)

9.3.1 NONINVASIVE PRENATAL DIAGNOSIS

9.3.1.1 Rising prevalence of genetic diseases to drive market growth

TABLE 47 APAC SINGLE-CELL ANALYSIS MARKET FOR NONINVASIVE PRENATAL DIAGNOSIS, BY COUNTRY, 2018–2025 (USD MILLION)

9.3.2 IN VITRO FERTILIZATION

9.3.2.1 Increasing demand for in vitro fertilization procedures to support the growth of this application segment

TABLE 48 APAC SINGLE-CELL ANALYSIS MARKET FOR IN VITRO FERTILIZATION, BY COUNTRY, 2018–2025 (USD MILLION)

9.3.3 CIRCULATING TUMOR CELL DETECTION

9.3.3.1 Rising prevalence of cancer to contribute to the growth of this segment

TABLE 49 APAC SINGLE-CELL ANALYSIS MARKET FOR CIRCULATING TUMOR CELL DETECTION, BY COUNTRY, 2018–2025 (USD MILLION)

10 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET, BY END USER (Page No. - 107)

10.1 INTRODUCTION

TABLE 50 APAC SIGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2 ACADEMIC & RESEARCH LABORATORIES

10.2.1 ACADEMIC & RESEARCH LABORATORIES ARE THE LARGEST END USERS OF SINGLE-CELL ANALYSIS PRODUCTS

TABLE 51 APAC SINGLE-CELL ANALYSIS MARKET FOR ACADEMIC & RESEARCH LABORATORIES, BY COUNTRY, 2018–2025 (USD MILLION)

10.3 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

10.3.1 GROWTH IN DRUG DISCOVERY ACTIVITIES TO SUPPORT MARKET GROWTH

TABLE 52 APAC SINGLE-CELL ANALYSIS MARKET FOR BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

10.4 HOSPITALS & DIAGNOSTIC LABORATORIES

10.4.1 HIGH PREVALENCE OF INFECTIOUS & CHRONIC DISEASES TO DRIVE THE ADOPTION OF SINGLE-CELL ANALYSIS PRODUCTS

TABLE 53 APAC SINGLE-CELL ANALYSIS MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2018–2025 (USD MILLION)

10.5 CELL BANKS & IVF CENTERS

10.5.1 RISING DEMAND FOR PERSONALIZED & REGENERATIVE MEDICINE TO SUPPORT MARKET GROWTH

TABLE 54 APAC SINGLE-CELL ANALYSIS MARKET FOR CELL BANKS & IVF CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

11 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET, BY REGION (Page No. - 114)

11.1 INTRODUCTION

TABLE 55 APAC: SINGLE-CELL ANALYSIS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 APAC: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 57 APAC: SINGLE-CELL ANALYSIS CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 APAC: SINGLE-CELL ANALYSIS INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 APAC: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 60 APAC: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 APAC: SINGLE-CELL ANALYSIS MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 APAC: SINGLE-CELL ANALYSIS MARKET FOR MEDICAL APPLICATIONS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 63 APAC: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 64 APAC: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.1 JAPAN

11.1.1.1 Rising geriatric population and growing focus on personalized medicine to propel market growth in Japan

TABLE 65 JAPAN: CANCER INCIDENCE, BY TYPE, 2018 VS. 2025

TABLE 66 JAPAN: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 67 JAPAN: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 68 JAPAN: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 69 JAPAN: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 JAPAN: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.2 CHINA

11.1.2.1 Growing focus on cancer therapeutics-related research to bolster market growth

TABLE 71 CHINA: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 72 CHINA: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 73 CHINA: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 74 CHINA: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 CHINA: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.3 INDIA

11.1.3.1 Increasing government support for stem cell-based therapies to propel market growth

TABLE 76 INDIA: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 77 INDIA: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 78 INDIA: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 79 INDIA: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 INDIA: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.4 SOUTHEAST ASIA

11.1.4.1 Growing presence of key players to fuel market growth

TABLE 81 SOUTHEAST ASIA: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 82 SOUTHEAST ASIA: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 83 SOUTHEAST ASIA: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 84 SOUTHEAST ASIA: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 SOUTHEAST ASIA: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.5 SOUTH KOREA

11.1.5.1 Growing pharmaceutical and biotechnology industry to drive the market in South Korea

TABLE 86 SOUTH KOREA: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 87 SOUTH KOREA: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 88 SOUTH KOREA: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 89 SOUTH KOREA: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 SOUTH KOREA: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.6 AUSTRALIA

11.1.6.1 Increasing investments in research activities to offer significant growth opportunities for market players in Australia

TABLE 91 AUSTRALIA: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 92 AUSTRALIA: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 93 AUSTRALIA: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 94 AUSTRALIA: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 AUSTRALIA: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.7 SINGAPORE

11.1.7.1 Increasing incidence and prevalence of cancer to support market growth

TABLE 96 SINGAPORE: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 97 SINGAPORE: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 98 SINGAPORE: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 99 SINGAPORE: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 SINGAPORE: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.1.8 REST OF ASIA PACIFIC

TABLE 101 ROAPAC: SINGLE-CELL ANALYSIS MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 102 ROAPAC: SINGLE-CELL ANALYSIS MARKET, BY CELL TYPE, 2018–2025 (USD MILLION)

TABLE 103 ROAPAC: SINGLE-CELL ANALYSIS MARKET, BY TECHNIQUE, 2018–2025 (USD MILLION)

TABLE 104 ROAPAC: SINGLE-CELL ANALYSIS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 105 ROAPAC: SINGLE-CELL ANALYSIS MARKET, BY END USER, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 139)

12.1 OVERVIEW

FIGURE 23 KEY DEVELOPMENTS IN THE ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET

12.2 MARKET SHARE ANALYSIS

FIGURE 24 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET SHARE, BY KEY PLAYER (2019)

12.3 COMPANY EVALUATION QUADRANT

12.3.1 LIST OF EVALUATED VENDORS

12.3.2 STARS

12.3.3 EMERGING LEADERS

12.3.4 PERVASIVE PLAYERS

12.3.5 PARTICIPANTS

FIGURE 25 ASIA PACIFIC SINGLE-CELL ANALYSIS MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

12.4 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2019)

12.4.1 PROGRESSIVE COMPANIES

12.4.2 STARTING BLOCKS

12.4.3 RESPONSIVE COMPANIES

12.4.4 DYNAMIC COMPANIES

FIGURE 26 SINGLE-CELL ANALYSIS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS, 2019

12.5 COMPETITIVE SCENARIO

12.5.1 PRODUCT LAUNCHES

TABLE 106 KEY PRODUCT LAUNCHES

12.5.2 ACQUISITIONS

TABLE 107 KEY ACQUISITIONS

12.5.3 EXPANSIONS

TABLE 108 KEY EXPANSIONS

12.5.4 AGREEMENTS

TABLE 109 KEY AGREEMENTS

12.5.5 PARTNERSHIPS

TABLE 110 KEY PARTNERSHIPS

13 COMPANY PROFILES (Page No. - 149)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1.1 BECTON, DICKINSON AND COMPANY

FIGURE 27 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2019)

13.1.2 DANAHER CORPORATION

FIGURE 28 DANAHER CORPORATION: COMPANY SNAPSHOT (2019)

13.1.3 MERCK MILLIPORE

FIGURE 29 MERCK MILLIPORE: COMPANY SNAPSHOT (2019)

13.1.4 THERMO FISHER SCIENTIFIC, INC.

FIGURE 30 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

13.1.5 QIAGEN N.V.

FIGURE 31 QIAGEN N.V.: COMPANY SNAPSHOT (2019)

13.1.6 10X GENOMICS

FIGURE 32 10X GENOMICS: COMPANY SNAPSHOT (2019)

13.1.7 PROMEGA CORPORATION

13.1.8 GE HEALTHCARE

FIGURE 33 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT (2019)

13.1.9 ILLUMINA, INC.

FIGURE 34 ILLUMINA, INC.: COMPANY SNAPSHOT (2019)

13.1.10 BIO-RAD LABORATORIES, INC.

FIGURE 35 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2019)

13.2 OTHER PLAYERS

FIGURE 36 FLUIDIGM CORPORATION: COMPANY SNAPSHOT (2019)

13.2.2 AGILENT TECHNOLOGIES, INC.

FIGURE 37 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2019)

13.2.3 TECAN GROUP LTD.

FIGURE 38 TECAN GROUP LTD.: COMPANY SNAPSHOT (2019)

13.2.4 SARTORIUS AG

FIGURE 39 SARTORIUS AG: COMPANY SNAPSHOT (2019)

13.2.5 LUMINEX CORPORATION

FIGURE 40 LUMINEX CORPORATION: COMPANY SNAPSHOT (2019)

13.2.6 TAKARA BIO INC.

FIGURE 41 TAKARA BIO INC.: COMPANY SNAPSHOT (2019)

13.2.7 BIOMÉRIEUX SA

FIGURE 42 BIOMÉRIEUX SA: COMPANY SNAPSHOT (2019)

13.2.8 CORNING INCORPORATED

FIGURE 43 CORNING INCORPORATED: COMPANY SNAPSHOT (2019)

13.2.9 OXFORD NANOPORE TECHNOLOGIES

13.2.10 CYTEK BIOSCIENCES

13.2.11 FLUXION BIOSCIENCES

13.2.12 MENARINI SILICON BIOSYSTEMS

13.2.13 APOGEE FLOW SYSTEMS LTD.

13.2.14 NANOCELLECT BIOMEDICAL

13.2.15 ON-CHIP BIOTECHNOLOGIES CO., LTD.

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 204)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the Asia Pacific single-cell analysis market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the Asia Pacific single-cell analysis market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the Asia Pacific single-cell analysis market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the APAC single-cell analysis market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, segment, and forecast the Asia Pacific single-cell analysis market by product, cell type, technique, application, end user, and country

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the Asia Pacific single-cell analysis market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To track and analyze company developments such as product launches, partnerships, expansions, and acquisitions in the Asia Pacific single-cell analysis market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Country Information

- Single-cell analysis market size and growth rate estimates for countries in the the Rest of Asia Pacific

Company profiles

- Additional five company profiles of players operating in the Asia Pacific single-cell analysis market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Asia Pacific Single-cell Analysis Market