Large Format Display Market Size, Share, Industry Growth, Trends & Analysis by Offering, Type, Technology (Direct-View LED, LED-backlit LCD), Size, Brightness, Installation Location, Application (Retail, Hospitality, Sports, Education), Region

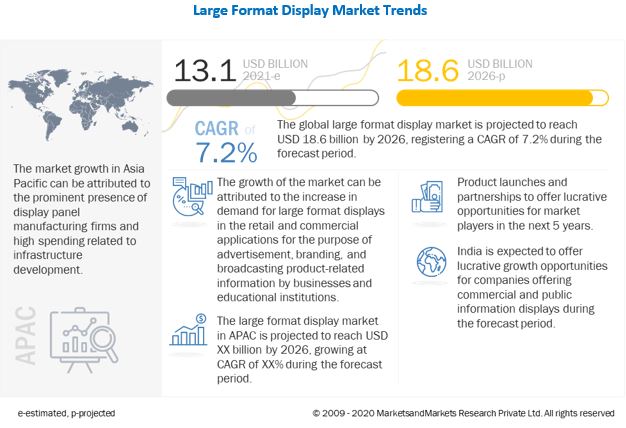

[282 Pages Report] The global format display market Size, Share, Industry Growth, Trends & Analysis is estimated to be USD 13.1 billion in 2021 and projected to reach USD 18.6 billion by 2026; at a CAGR of 7.2%. Key factors fueling the growth of this market include the high adoption of signage and interactive displays by end users from the commercial sector, technological innovations and advancements related to large format displays, surged demand for 4K and 8K high-resolution commercial-grade large-screen displays from the education, healthcare, and sports & entertainment verticals, and increased investments by emerging economies in real estate and public infrastructure development projects.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Large Format Market

The large format display market includes key companies such as Samsung Electronics, LG Electronics, Sharp Corporation, Leyard Optoelectronic, Sony Corporation, Barco, Panasonic Corporation, Shanghai Goodview Electronics, AU Optronics, ViewSonic, and Unilumin. These companies have their manufacturing facilities and corporate offices spread across various countries across Asia Pacific, Europe, North America, and RoW. The large format display products manufactured by these companies are purchased by several stakeholders for various applications. COVID-19 not only impacted the operations of the various large format display manufacturers companies but also affected the businesses of their suppliers and distributors. The fail in export shipments and slow domestic demand for large format display products in comparison to pre COVID-19 levels is also expected to negatively impact and slightly stagnate the demand for large format displays in short term.

Large Format Display Market Dynamics

Driver: Technological innovations and advancements related to large format displays

The advent of new display technologies, such as OLED displays, microLED displays, and electronic paper displays (EPDs), has accelerated the growth of the global display industry at a rapid pace. Samsung Electronics (South Korea), LG Electronics (South Korea), and Sharp (Japan) are a few companies that design and manufacture advanced display technologies, including microLED and OLED displays. The development of a direct-view fine-pixel pitch large format LED display that delivers bright images with ultra-high-definition (UHD) resolution, as well as provide other benefits such as improved stability, higher flexibility, greater energy efficiency, enhanced durability, has driven the demand for large format displays. Some major manufacturers of direct-view fine-pixel pitch LED displays are Leyard (US), Sony (Japan), and Samsung Electronics (South Korea) who offer premium displays for signage applications.

Restraint: Preference for online advertising and digital broadcasting triggered by COVID-19

The number of active individuals on the internet is increasing at a faster rate globally; therefore, advertising companies target this growing audience base through online promotions. Further, the outbreak and rapid spread of COVID-19 has resulted in increased adoption of online advertising and broadcasting methods owing to the rising use of e-commerce platforms by consumers. Moreover, the pandemic has also hit the economic activities of several retail businesses worldwide. As a result, these businesses target online advertisements more than ever, with the declining budget for in-store advertisements and other offline advertisements and broadcasting methods. This is expected to eventually affect the requirement for large format displays for advertisement and marketing purposes in the near term.

Opportunity: Increased deployment of displays that enable contactless engagement to prevent the spread of COVID-19

COVID-19 has adversely impacted the global economy. As governments worldwide struggle to contain the virus and businesses work on different strategies to survive and grow, consumer behavior is also constantly changing. The pandemic has brought a change in the attitude of people while buying different products and services. The pandemic has encouraged businesses to accelerate the use of voice-based or audio-visual interfaces in physical places such as retail stores, restaurants, airports, and museums to interact with consumers. Businesses are also opting for temperature-sensing digital signage kiosks, which feature large screens that display dynamic digital information such as rules, waiting times, and important instructions, as well as have optional touch-free dispensers, temperature monitors, etc.

Challenges: Prevailing security issues associated with commercial signage displays

As a result of several advancements in signage hardware and software components, the number of signage applications of large format displays has grown tremendously over the past few years. A number of private and public organizations have adopted large format displays for broadcasting messages, real-time information, advertisements, product information, etc. However, the increasing use of these displays has also led to a rise in cyber threats in the form of phishing, ransomware attacks, malware downloads, etc. For instance, in 2018, a ransomware attack at the Bristol Airport in the UK took all the flight information screens offline, targeting the administrative systems of the airport and creating disruptions in airport services.

Services segment is expected to register the highest CAGR during the forecast period

Services segment for large format display market is expected to register the highest CAGR during the forecast period by offering. The services segment is expected to witness the highest CAGR in the large format display market during the forecast period owing to the rising need for display consulting and maintenance services for hardware devices and other services that are repeatedly required by customers throughout the operational life of digital display systems as these displays get adopted in several industries for multiple applications.

Video wall segment is expected to witness higher CAGR growth during the forecast period

The video wall segment of large format display market is expected to witness the highest CAGR growth during the forecast period, by type, owing to their growing use by consumer-driven organizations in different applications, including retail, corporate, public places, sports & entertainment. Additionally, the growing focus of display manufacturers, such as LG, Planar, NanoLumens, and Unilumin, on developing fine-pixel direct-view LED displays for commercial applications including corporate, command centers, and retail is also expected to boost the growth of the market for video walls.

The direct-view fine-pixel LED display segment is expected to witness higher CAGR growth during the forecast period

The direct-view fine-pixel LED display segment of the large format display market is expected to register higher CAGR growth during the forecast period by technology, owing to the rapid adoption of video wall displays based on this technology in various commercial applications due to their falling prices. Moreover, the strong focus on the development of all-in-one fine-pixel direct-view LED displays that come in a single screen design with pre-configured connected LED display panels could increase the penetration of these displays in retail outlets, museums, convention centers, corporate offices, and other public places, propelling the market growth.

APAC is projected to register the largest market share of the large format display market in 2026

Asia Pacific is projected to register the largest market share of the large format display industry in 2026. APAC is witnessing dynamic changes in the adoption of new technologies and advancements in the retail and infrastructure sectors. China, South Korea, and Japan are the early adopters of large format display products in APAC. However, countries such as India, Australia, Singapore, Thailand, and Malaysia are expected to witness rapid growth in the large format display market owing to the increased infrastructure developments, infusion of foreign investment in several sectors, including retail, transportation, hospitality, healthcare, education, utility, and manufacturing, and government spending in improving public and private infrastructure and services. Owing to low labor costs in the APAC region, the overall installation cost of digital display systems is significantly low. This has led to the emergence of APAC as one of the potentially favorable markets for large format displays.

The recent COVID-19 pandemic is expected to slightly negatively impact the global large format display industry. The entire supply chain got disrupted due to a limited supply of parts during the first quarter of 2020. For instance, the outbreak of COVID-19 in China resulted in lockdown measures which included the shutdown of manufacturing facilities and warehouses and affected the global exports and shipments of various industries. The lockdown measures announced in several countries across the globe as they got impacted by the COVID-19 pandemic also led to a fall in the domestic and export demand for commercial products including large format displays in these countries.

Key Market Players

The large format display companies such as such as Samsung Electronics (South Korea), LG Electronics (South Korea), Leyard Optoelectronic (parent company of Planar Systems, Inc.) (US), Sharp Corporation (Japan), and Sony (Japan). These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, joint ventures, expansions, and acquisitions to strengthen their position in the market.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2026 |

|

Base Year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Offering, By Type, By Technology, By Installation Location, By Display Brightness, By Display Size, By Application, and By Region |

|

Geographic Regions Covered |

APAC, North America, Europe, and RoW (includes Middle East, Africa, and South America) |

|

Companies Covered |

The major players include Samsung Electronics (South Korea), LG Electronics (South Korea), Sharp Corporation (Japan), Leyard Optoelectronic (China), and Sony Corporation (Japan) (Total 25 companies) |

This report categorizes the large format display market based on offering, type, technology, display size, display brightness, installation location, application, and region available at the regional and global level

By Offering

- Displays

- Controllers, Mounts, and Other Accessories

- Services

By Type

- Standalone Display

- Video Wall

By Technology

- LED-backlit LCD

- Direct-view Large-pixel LED

- Direct-view Fine-pixel LED

- OLED

- Projection Cube

By Display Size

- Below 40 Inches

- Between 40 and 60 Inches

- Between 60 and 90 Inches

- Between 90 and 120 Inches

- Above 120 Inches

By Display Brightness

- Below 500 Nits

- Between 501 and 1,000 Nits

- Between 1,001 and 2,000 Nits

- Between 2,001 and 3,000 Nits

- Above 3,001 Nits

By Installation Location

- Indoor

- Outdoor

By Application

- Commercial

- Institutional

- Infrastructure

- Industrial

By Region

- APAC

- North America

- Europe

- Middle East, Africa, and South America

Recent Developments

- In November 2020, Sharp launched the new massive 8K ultra-HD professional LCD. The new display is packed in 33 million pixels and has a color filter with a wider color gamut and optimized LED backlight phosphors, enabling it to deliver brilliant clarity and reproduce improved grading of red, blue, and green in the pixels.

- In September 2020, LG launched its new microLED signage solution—LG MAGNIT—in the key markets of the Americas, Europe, APAC, and the Middle East. The new signage solution features a premium, large-scale display of 163 inches, making it a great microLED solution for applications including commercial and public places, convention centers, luxury boutiques, control rooms, and museums.

- In June 2020, Planar announced updates for its TVF Series of LED video wall displays. The new 0.9-millimeter pixel pitch model comes with an improved power design and supports high-resolution video walls. The updated model delivers exceptional visual performance and follows simple installation and maintenance.

- In June 2020, Sony launched the new 55- to 85-inch BRAVIA 4K HDR BZ40H models of professional displays. The models come in different sizes, including 55 inches, 65 inches, 75 inches, and 85 inches, featuring an embedded 4K HDR processor and TRILUMINOS display technology.

- In February 2020, Samsung launched the new QLED 8K SMART signage, the world’s first 8K display capable of 24/7 operation. The newly launched signage offers exceptional picture quality and is designed to be wall-mounted. The QLED 8K signage is available in various sizes for different business needs and is equipped with the AI quantum processor 8K.

Frequently Asked Questions (FAQ):

What is the current size of the global large format display market?

The global large format display market is estimated to be USD 13.1 billion in 2021 and is projected to reach USD 18.6 billion by 2026, at a CAGR of 7.2%. Major factors driving the growth of the large format display market include the high adoption of signage and interactive displays by end users from the commercial sector, technological innovations and advancements related to large format displays, surged demand for 4K and 8K high-resolution commercial-grade large-screen displays from the education, healthcare, and sports & entertainment verticals, and increased investments by emerging economies in real estate and public infrastructure development projects.

Who are the key players in the global large format display market?

Companies such as Samsung Electronics (South Korea), LG Electronics (South Korea), Sharp Corporation (Japan), Leyard Optoelectronic (Planar) (US), and Sony (Japan) fall under the key players category. These companies cater to the requirements of their customers by providing advanced large format display solutions with a presence in multiple countries.

What is the COVID-19 impact on large format display suppliers?

The shutdown of manufacturing facilities globally combined with strict restrictions over social movement in various COVID-19 affected countries impacted the operations of large format display and related components manufacturing facilities. Additionally, the first quarter of 2020 also witnessed disruption in global supply chain operations and logistics-related services due to limited air and road movement. This is expected to have had a global impact on the large format display market. Additionally, COVID-19 has led to a delay in the upcoming launches and developments in large format display products by some extent. All these factors resulted in marginal dip of market size of the large format displays. The rapid increase in the demand for large format displays in infrastructure and healthcare sector is expected to have a positive impact on the large format display market.

What are the opportunities for the existing players and for those who are planning to enter various stages of the large format display value chain?

There are various opportunities for the existing players to enter the value chain of large format display industry. Some of these include the high adoption of smart signage products triggered by the spread of coronavirus, the increasing deployment of displays that enable contactless engagement to prevent the spread of COVID-19, and the rapid transformation of retail stores into smart digital stores. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT TYPE AND TECHNOLOGY LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT BRIGHTNESS LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

1.2.7 INCLUSIONS AND EXCLUSIONS AT INSTALLATION LOCATION LEVEL

1.3 SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LARGE FORMAT DISPLAY MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 LARGE FORMAT DISPLAY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key participants in primary processes across value chain of large format display ecosystem

2.1.2.3 Key data from primary sources

2.1.2.4 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BASED ON SALES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION OF COMPANIES BASED ON SALES

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size using bottom-up approach (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size using top-down approach (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 LARGE FORMAT DISPLAY MARKET: PRE- AND POST- COVID-19 SCENARIO ANALYSIS, 2017 TO 2026 (USD BILLION)

TABLE 1 IMPACT ANALYSIS OF COVID-19 ON LARGE FORMAT DISPLAY MARKET, BY SCENARIO, 2017–2026 (USD BILLION)

3.1 PRE-COVID-19 SCENARIO

3.2 REALISTIC SCENARIO (POST-COVID-19)

3.3 PESSIMISTIC SCENARIO (POST-COVID-19)

3.4 OPTIMISTIC SCENARIO (POST-COVID-19)

FIGURE 9 MARKET FOR DIRECT-VIEW FINE-PIXEL LED DISPLAYS TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 10 COMMERCIAL APPLICATION TO HOLD LARGEST SIZE OF LARGE FORMAT DISPLAY MARKET IN 2026

FIGURE 11 DISPLAYS WITH BRIGHTNESS BETWEEN 1,001 AND 2,000 NITS TO REGISTER HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET DURING FORECAST PERIOD

FIGURE 12 LARGE FORMAT DISPLAYS INSTALLED AT INDOOR LOCATIONS TO ACCOUNT FOR LARGER MARKET SHARE IN 2026

FIGURE 13 LARGE FORMAT DISPLAY MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN LARGE FORMAT DISPLAY MARKET

FIGURE 14 GROWING ADOPTION OF LARGE FORMAT DISPLAYS FOR ADVERTISEMENT, BRANDING, AND BROADCASTING INFORMATION BY BUSINESSES AND INSTITUTIONS IN COMMERCIAL AND INFRASTRUCTURE SECTORS TO BOOST MARKET GROWTH

4.2 LARGE FORMAT DISPLAY MARKET, BY DISPLAY SIZE

FIGURE 15 DISPLAYS BETWEEN 60 AND 90 INCHES TO ACCOUNT FOR LARGEST SIZE OF LARGE FORMAT DISPLAY MARKET IN 2026

4.3 LARGE FORMAT DISPLAY MARKET, BY TYPE

FIGURE 16 VIDEO WALLS TO HOLD LARGER MARKET SHARE THAN STANDALONE DISPLAYS IN 2026

4.4 LARGE FORMAT DISPLAY MARKET, BY OFFERING

FIGURE 17 SERVICES SEGMENT TO REGISTER HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET FROM 2021 TO 2026

4.5 LARGE FORMAT DISPLAY MARKET IN APAC, BY TECHNOLOGY AND COUNTRY

FIGURE 18 LED-BACKLIT LCD TECHNOLOGY AND CHINA TO ACCOUNT FOR LARGEST SHARE OF LARGE FORMAT DISPLAY MARKET IN APAC, BY TECHNOLOGY AND COUNTRY, RESPECTIVELY, IN 2026

4.6 LARGE FORMAT DISPLAY MARKET, BY GEOGRAPHY

FIGURE 19 INDIA TO EXHIBIT HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: LARGE FORMAT DISPLAY MARKET

5.2.1 DRIVERS

5.2.1.1 High adoption of signage and interactive displays by end users from commercial sector

5.2.1.2 Technological innovations and advancements related to large format displays

5.2.1.3 Surged demand for 4K and 8K high-resolution commercial-grade large-screen displays from education, healthcare, and sports & entertainment verticals

5.2.1.4 Increased investments by emerging economies in real estate and public infrastructure development projects

FIGURE 21 LARGE FORMAT DISPLAY MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Preference for online advertising and digital broadcasting triggered by COVID-19

5.2.2.2 Availability of low-cost and highly reliable substitute technologies

FIGURE 22 LARGE FORMAT DISPLAY MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 High adoption of smart signage products triggered by spread of coronavirus

5.2.3.2 Rapid transformation of retail stores into smart digital stores

5.2.3.3 Increased deployment of displays that enable contactless engagement to prevent spread of COVID-19

FIGURE 23 LARGE FORMAT DISPLAY MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Designing robust large format displays suitable for outdoor environments

5.2.4.2 Prevailing security issues associated with commercial signage displays

FIGURE 24 NUMBER OF GLOBAL DISTRIBUTED DENIAL OF SERVICE ATTACKS, 2018–2023

FIGURE 25 LARGE FORMAT DISPLAY MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 26 ANALYSIS OF LARGE FORMAT DISPLAY VALUE CHAIN

5.4 AVERAGE SELLING PRICE TREND

FIGURE 27 AVERAGE SELLING PRICE TREND OF DISPLAY TECHNOLOGIES IN LARGE FORMAT DISPLAY MARKET, 2017–2026

5.5 MARKET MAP

TABLE 2 LARGE FORMAT DISPLAY MARKET: ECOSYSTEM

FIGURE 28 KEY PLAYERS IN LARGE FORMAT DISPLAY ECOSYSTEM

5.6 CASE STUDY ANALYSIS

5.6.1 SAMSUNG DISPLAYS ENABLE SEAMLESS CONNECTION OF ONLINE AND ON-SITE STUDENTS

5.6.2 LARGE LED DISPLAYS OF NANOLUMENS PROVIDE HISTORICAL FEEL OF MUSEUM TO STUDENTS AT PHOENIX COLLEGE

5.6.3 SAMSUNG SMART DISPLAYS ACCELERATE FULL DIGITALIZATION OF DRIVE-THRU OF MCDONALD’S

5.7 REGULATIONS LANDSCAPE

5.8 PATENTS LANDSCAPE

FIGURE 29 NUMBER OF PATENTS RELATED TO LARGE FORMAT DISPLAYS PUBLISHED FROM 2011 TO 2020

FIGURE 30 CONTRIBUTION OF TOP 10 COMPANIES IN PATENT PUBLICATION FROM 2011 TO 2020

TABLE 3 KEY PATENTS PUBLISHED BETWEEN 2018 AND 2020

5.9 TECHNOLOGY ANALYSIS

5.10 TRADE ANALYSIS

TABLE 4 EXPORT DATA OF TOP 10 COUNTRIES FOR PRODUCTS CLASSIFIED UNDER HS CODE 852872 FROM 2015 TO 2019 (USD MILLION)

TABLE 5 IMPORT DATA OF TOP 10 COUNTRIES FOR PRODUCTS CLASSIFIED UNDER HS CODE 852872 FROM 2015 TO 2019 (USD MILLION)

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 31 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES MODEL WITH THEIR WEIGHTED AVERAGE AND IMPACT ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 32 REVENUE SHIFT FOR LARGE FORMAT DISPLAY MARKET

6 LARGE FORMAT DISPLAY MARKET, BY OFFERING (Page No. - 85)

6.1 INTRODUCTION

FIGURE 33 SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET FROM 2021 TO 2026

TABLE 7 LARGE FORMAT DISPLAY MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 8 LARGE FORMAT DISPLAY MARKET, BY OFFERING, 2021–2026 (USD MILLION)

6.2 DISPLAYS

6.2.1 LEADING-EDGE TECHNOLOGIES SUCH AS FINE-PIXEL LED AND OLED TO BOOST DEMAND FOR DISPLAYS

6.3 CONTROLLERS, MOUNTS, AND OTHER ACCESSORIES

6.3.1 GROWING MARKET FOR DIRECT-VIEW FINE-PIXEL LED-BASED DISPLAYS TO DRIVE DEMAND FOR HIGH-END CONTROLLERS

6.4 SERVICES

6.4.1 INCREASING ADOPTION OF LARGE-SCREEN DISPLAY WALLS TO PROPEL MARKET FOR SERVICES IN NEAR FUTURE

7 LARGE FORMAT DISPLAY MARKET, BY TYPE AND TECHNOLOGY (Page No. - 90)

7.1 INTRODUCTION

FIGURE 34 VIDEO WALLS TO DOMINATE LARGE FORMAT DISPLAY MARKET DURING FORECAST PERIOD

TABLE 9 LARGE FORMAT DISPLAY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 10 LARGE FORMAT DISPLAY MARKET, BY TYPE, 2021–2026 (USD MILLION)

FIGURE 35 MARKET FOR LARGE FORMAT DISPLAYS BASED ON DIRECT-VIEW FINE-PIXEL LED TECHNOLOGY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 LARGE FORMAT DISPLAY MARKET, BY TECHNOLOGY, 2017–2020 (THOUSAND UNITS)

TABLE 12 LARGE FORMAT DISPLAY MARKET, BY TECHNOLOGY, 2021–2026 (THOUSAND UNITS)

TABLE 13 LARGE FORMAT DISPLAY MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 14 LARGE FORMAT DISPLAY MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2 VIDEO WALLS

7.2.1 PROJECTION OF HIGH DEMAND FOR OLED VIDEO WALLS WOULD FUEL MARKET GROWTH

TABLE 15 LARGE FORMAT DISPLAY MARKET FOR VIDEO WALLS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 16 LARGE FORMAT DISPLAY MARKET FOR VIDEO WALLS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.2.2 TECHNOLOGIES USED IN VIDEO WALL DISPLAYS

7.2.2.1 Narrow-bezel LED-backlit LCD

7.2.2.1.1 LCD panels offer 8K resolution for video walls

TABLE 17 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 19 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 20 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 21 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 22 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 23 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 24 NARROW-BEZEL LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2021–2026 (USD MILLION)

7.2.2.2 OLED

7.2.2.2.1 Market for OLED displays witnessed limited growth in past owing to their high cost

TABLE 25 OLED LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 OLED LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

7.2.2.3 Direct-view fine-pixel LED

7.2.2.3.1 Use of direct-view fine-pixel LED technology-based displays in video walls can offer flexible configuration, high resolution, and high brightness

TABLE 27 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 31 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 32 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 33 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 34 DIRECT-VIEW FINE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2021–2026 (USD MILLION)

7.2.2.4 Direct-view large-pixel LED

7.2.2.4.1 Direct-view large-pixel LED displays are designed for outdoor applications such as billboards and scoreboards

TABLE 35 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 38 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 39 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 40 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 41 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 42 DIRECT-VIEW LARGE-PIXEL LED LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2021–2026 (USD MILLION)

7.2.2.5 Projection cube

7.2.2.5.1 Developments in DLP technology have resulted in growing adoption of projection cube displays

TABLE 43 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 45 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 46 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 47 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 48 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 49 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 50 PROJECTION CUBE LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2021–2026 (USD MILLION)

7.3 STANDALONE DISPLAYS

TABLE 51 LARGE FORMAT STANDALONE DISPLAY MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 52 LARGE FORMAT STANDALONE DISPLAY MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

7.3.1 TECHNOLOGIES USED IN STANDALONE DISPLAYS

7.3.1.1 Standalone LED-backlit LCD

7.3.1.1.1 Falling prices and easy availability of LED-backlit LCD panels would keep their demand intact

TABLE 53 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 55 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 56 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 57 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 58 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 59 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 60 STANDALONE LED-BACKLIT LCD LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY END USER, 2021–2026 (USD MILLION)

7.3.1.2 OLED

7.3.1.2.1 Development and commercialization of transparent and curved OLED displays would stimulate demand for large format displays

TABLE 61 STANDALONE OLED LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 STANDALONE OLED LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3.1.3 E-paper

7.3.1.3.1 Introduction of colored electronic paper displays will create huge potential for EPD technology in architectural and commercial applications

8 LARGE FORMAT DISPLAY MARKET, BY DISPLAY SIZE (Page No. - 115)

8.1 INTRODUCTION

FIGURE 36 DISPLAYS HAVING SCREEN SIZES BETWEEN 90 AND 120 INCHES TO RECORD HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET DURING FORECAST PERIOD

TABLE 63 LARGE FORMAT DISPLAY MARKET, BY DISPLAY SIZE, 2017–2020 (USD MILLION)

TABLE 64 LARGE FORMAT DISPLAY MARKET, BY DISPLAY SIZE, 2021–2026 (USD MILLION)

8.2 BELOW 40 INCHES

8.2.1 RETAIL SPACES USE INTERACTIVE DISPLAYS OF LESS THAN 40 INCHES TO ENCOURAGE CUSTOMERS TO VISIT SHOPS BY DISPLAYING INFORMATION ABOUT PRODUCTS AND ATTRACTIVE OFFERS

8.3 BETWEEN 40 AND 60 INCHES

8.3.1 DISPLAYS WITH SIZES BETWEEN 40 AND 60 INCHES OFFER NARROW-BEZEL DESIGN AND DELIVER HIGH PICTURE CLARITY AND QUALITY WITH UHD 4K RESOLUTION

8.4 BETWEEN 60 AND 90 INCHES

8.4.1 DISPLAYS HAVING SIZES BETWEEN 60 AND 90 INCHES ARE DESIRABLE FOR INDOOR INTERACTIVE ENVIRONMENTS

8.5 BETWEEN 90 AND 120 INCHES

8.5.1 DEPLOYMENT OF INTERACTIVE DISPLAYS TO IMPROVE CUSTOMER INTERACTION AND COLLABORATION DISPLAYS TO INCREASE PRODUCTIVITY FOSTER LARGE FORMAT DISPLAY MARKET GROWTH

8.6 ABOVE 120 INCHES

8.6.1 ADOPTION OF LARGE FORMAT DISPLAYS BY END USERS FROM COMMERCIAL AND INFRASTRUCTURE SECTORS WOULD PROPEL MARKET GROWTH

9 LARGE FORMAT DISPLAY MARKET, BY BRIGHTNESS (Page No. - 120)

9.1 INTRODUCTION

FIGURE 37 DISPLAYS WITH BRIGHTNESS BETWEEN 1,001 AND 2,000 NITS TO REGISTER HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET DURING FORECAST PERIOD

TABLE 65 LARGE FORMAT DISPLAY MARKET, BY BRIGHTNESS, 2017–2020 (USD MILLION)

TABLE 66 LARGE FORMAT DISPLAY MARKET, BY BRIGHTNESS, 2021–2026 (USD MILLION)

9.2 UP TO 500 NITS

9.2.1 MODERN-DAY DISPLAYS UP TO 500 NITS OF BRIGHTNESS ARE MOSTLY BASED ON LED-BACKLIT LCD TECHNOLOGY

TABLE 67 LARGE FORMAT DISPLAY MARKET FOR UP TO 500 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 68 LARGE FORMAT DISPLAY MARKET FOR UP TO 500 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.3 501–1,000 NITS

9.3.1 EVER-CHANGING LANDSCAPE OF SELF–SERVICE SYSTEMS PROMPTS HOSPITALITY CENTERS TO ADOPT DISPLAYS WITH BRIGHTNESS OF 501 TO 1,000 NITS

TABLE 69 LARGE FORMAT DISPLAY MARKET FOR 501–1,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 70 LARGE FORMAT DISPLAY MARKET FOR 501–1,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.4 1,001–2,000 NITS

9.4.1 SUCCESSFUL DEVELOPMENT OF MICROLED DISPLAYS WITH VARIETY OF SIZES AND CONFIGURATIONS WOULD FUEL MARKET GROWTH IN NEAR FUTURE

TABLE 71 LARGE FORMAT DISPLAY MARKET FOR 1,001–2,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 72 LARGE FORMAT DISPLAY MARKET FOR 1,001–2,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.5 2,001–3,000 NITS

9.5.1 SIGNIFICANT DEMAND OBSERVED FOR LCD DISPLAYS WITH 2,001 TO 3,000 NITS OF BRIGHTNESS DUE TO BETTER RESOLUTION OFFERED BY THEM THAN LARGE-PIXEL DIRECT-VIEW LED DISPLAYS

TABLE 73 LARGE FORMAT DISPLAY MARKET FOR 2,001–3,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 74 LARGE FORMAT DISPLAY MARKET FOR 2,001–3,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

9.6 MORE THAN 3,000 NITS

9.6.1 INCREASED USE OF LARGE-SCREEN DISPLAYS WITH MORE THAN 3,000 NITS OF BRIGHTNESS IN OUTDOOR ADVERTISING, CONCERTS, AND SPORTS EVENTS WILL AUGMENT MARKET GROWTH

TABLE 75 LARGE FORMAT DISPLAY MARKET FOR MORE THAN 3,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 76 LARGE FORMAT DISPLAY MARKET FOR MORE THAN 3,000 NITS OF BRIGHTNESS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10 LARGE FORMAT DISPLAY MARKET, BY INSTALLATION LOCATION (Page No. - 128)

10.1 INTRODUCTION

FIGURE 38 OUTDOOR SEGMENT TO REGISTER HIGHER CAGR IN LARGE FORMAT DISPLAY MARKET DURING FORECAST PERIOD

TABLE 77 LARGE FORMAT DISPLAY MARKET, BY INSTALLATION LOCATION, 2017–2020 (USD MILLION)

TABLE 78 LARGE FORMAT DISPLAY MARKET, BY INSTALLATION LOCATION, 2021–2026 (USD MILLION)

10.2 INDOOR

10.2.1 INTRODUCTION OF TOUCHSCREEN WAYFINDING DISPLAYS AND INTERACTIVE DISPLAYS HAS OFFERED MORE INTUITIVE EXPERIENCE TO USERS IN THESE MARKETS

TABLE 79 LARGE FORMAT DISPLAY MARKET FOR INDOOR LOCATIONS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 80 LARGE FORMAT DISPLAY MARKET FOR INDOOR LOCATIONS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

10.3 OUTDOOR

10.3.1 OUTDOOR DIGITAL DISPLAYS ARE DESIGNED FOR USE IN PUBLIC PLACES AND TRANSPORTATION HUBS, SPORTS VENUES, AND HOSPITALITY CENTERS

TABLE 81 LARGE FORMAT DISPLAY MARKET FOR OUTDOOR LOCATIONS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 82 LARGE FORMAT DISPLAY MARKET FOR OUTDOOR LOCATIONS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11 LARGE FORMAT DISPLAY MARKET, BY APPLICATION (Page No. - 133)

11.1 INTRODUCTION

FIGURE 39 INFRASTRUCTURE APPLICATION TO EXHIBIT HIGHEST CAGR IN LARGE FORMAT DISPLAY MARKET DURING FORECAST PERIOD

TABLE 83 LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 84 LARGE FORMAT DISPLAY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 COMMERCIAL

TABLE 85 LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 86 LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 87 LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 88 LARGE FORMAT DISPLAY MARKET FOR COMMERCIAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.2.1 RETAIL

11.2.1.1 Increasing focus of retail outlets on adopting direct-view LED technology-based large format displays to enrich in-store shopping experience of customers

TABLE 89 LARGE FORMAT DISPLAY MARKET FOR RETAIL, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 90 LARGE FORMAT DISPLAY MARKET FOR RETAIL, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.2.2 CORPORATE

11.2.2.1 Growing use of large-screen interactive displays in corporate environment to efficiently exhibit important events and performance data for visitors and employees

TABLE 91 LARGE FORMAT DISPLAY MARKET FOR CORPORATE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 92 LARGE FORMAT DISPLAY MARKET FOR CORPORATE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.2.3 HEALTHCARE

11.2.3.1 Elevating demand for digital signage displays from healthcare facilities to inform about upcoming events and vaccination schedules at public locations

TABLE 93 LARGE FORMAT DISPLAY MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 94 LARGE FORMAT DISPLAY MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.2.4 HOSPITALITY

11.2.4.1 Surging deployment of large-sized display solutions at entrances and lobbies of hotels to welcome and engage visitors

TABLE 95 LARGE FORMAT DISPLAY MARKET FOR HOSPITALITY, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 96 LARGE FORMAT DISPLAY MARKET FOR HOSPITALITY, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.2.5 GOVERNMENT, COMMAND AND CONTROL CENTERS

11.2.5.1 Rising utilization of large format displays in command and control centers to get clear view of places under radar and improve decision-making

TABLE 97 LARGE FORMAT DISPLAY MARKET FOR GOVERNMENT, COMMAND AND CONTROL CENTERS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 98 LARGE FORMAT DISPLAY MARKET FOR GOVERNMENT, COMMAND AND CONTROL CENTERS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.3 INFRASTRUCTURE

TABLE 99 LARGE FORMAT DISPLAY MARKET IN INFRASTRUCTURE APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 100 LARGE FORMAT DISPLAY MARKET IN INFRASTRUCTURE APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 101 LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 102 LARGE FORMAT DISPLAY MARKET FOR INFRASTRUCTURE APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.3.1 TRANSPORTATION HUBS AND PUBLIC SPACES

11.3.1.1 Growing adoption of cloud-based digital display systems to provide travel schedules and reservation information in real-time to boost market growth

TABLE 103 LARGE FORMAT DISPLAY MARKET FOR TRANSPORTATION AND PUBLIC SPACES, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 104 LARGE FORMAT DISPLAY MARKET FOR TRANSPORTATION AND PUBLIC SPACES, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.3.2 SPORTS AND ENTERTAINMENT

11.3.2.1 Rising deployment of commercial displays to engage fans and communicate relevant, targeted information to audience would ensure market growth

TABLE 105 LARGE FORMAT DISPLAY MARKET FOR SPORTS AND ENTERTAINMENT, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 106 LARGE FORMAT DISPLAY MARKET FOR SPORTS AND ENTERTAINMENT, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.4 INSTITUTIONAL

TABLE 107 LARGE FORMAT DISPLAY MARKET FOR INSTITUTIONAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 108 LARGE FORMAT DISPLAY MARKET FOR INSTITUTIONAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 109 LARGE FORMAT DISPLAY MARKET FOR INSTITUTIONAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 110 LARGE FORMAT DISPLAY MARKET FOR INSTITUTIONAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.4.1 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.4.1.1 Increasing inclination of financial institutions to utilize large-sized displays to exhibit stock-related information

TABLE 111 LARGE FORMAT DISPLAY MARKET FOR BFSI, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 112 LARGE FORMAT DISPLAY MARKET FOR BFSI, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.4.2 EDUCATION

11.4.2.1 Growing installation of interactive displays with multi-touch points helps schools and colleges to deliver high-quality user experience and increase audience involvement

TABLE 113 LARGE FORMAT DISPLAY MARKET FOR EDUCATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 114 LARGE FORMAT DISPLAY MARKET FOR EDUCATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.5 INDUSTRIAL

TABLE 115 LARGE FORMAT DISPLAY MARKET FOR INDUSTRIAL APPLICATION, BY END USER, 2017–2020 (USD MILLION)

TABLE 116 LARGE FORMAT DISPLAY MARKET FOR INDUSTRIAL APPLICATION, BY END USER, 2021–2026 (USD MILLION)

TABLE 117 LARGE FORMAT DISPLAY MARKET FOR INDUSTRIAL APPLICATION, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 118 LARGE FORMAT DISPLAY MARKET FOR INDUSTRIAL APPLICATION, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.5.1 MANUFACTURING

11.5.1.1 Elevating demand for large format displays to present real-time data for lean production, communicate site information, and improve safety awareness would support large format market growth in manufacturing sector

TABLE 119 LARGE FORMAT DISPLAY MARKET FOR MANUFACTURING, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 120 LARGE FORMAT DISPLAY MARKET FOR MANUFACTURING, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.5.2 AUTOMOTIVE

11.5.2.1 Rising use of digital displays to highlight current in-stock vehicles throughout showroom to promote large format display market growth in automotive industry

TABLE 121 LARGE FORMAT DISPLAY MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 122 LARGE FORMAT DISPLAY MARKET FOR AUTOMOTIVE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.5.3 OIL AND GAS

11.5.3.1 Escalating requirement for large format displays in oil & gas industry to improve decision-making through high-quality operational monitoring and extraction modeling would stimulate market growth

TABLE 123 LARGE FORMAT DISPLAY MARKET FOR OIL AND GAS, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 124 LARGE FORMAT DISPLAY MARKET FOR OIL AND GAS, BY TECHNOLOGY, 2021–2026 (USD MILLION)

11.6 MOST IMPACTED END USER IN LARGE FORMAT DISPLAY MARKET DUE TO COVID-19

11.6.1 SPORTS AND ENTERTAINMENT

FIGURE 40 PRE- AND POST-COVID-19 COMPARISON OF LARGE FORMAT DISPLAY MARKET FOR SPORTS AND ENTERTAINMENT

TABLE 125 LARGE FORMAT DISPLAY MARKET FOR SPORTS AND ENTERTAINMENT, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2026 (USD BILLION)

11.6.1.1 Impact analysis

11.7 LEAST IMPACTED END USER IN LARGE FORMAT DISPLAY MARKET BY COVID-19

11.7.1 MANUFACTURING

FIGURE 41 PRE- AND POST-COVID-19 COMPARISON OF LARGE FORMAT DISPLAY MARKET FOR MANUFACTURING

TABLE 126 LARGE FORMAT DISPLAY MARKET FOR MANUFACTURING, BY PRE- AND POST-COVID-19 SCENARIO, 2017–2026 (USD MILLION)

11.7.1.1 Impact analysis

12 GEOGRAPHIC ANALYSIS (Page No. - 161)

12.1 INTRODUCTION

FIGURE 42 APAC WOULD BE FASTEST-GROWING MARKET FOR LARGE FORMAT DISPLAYS FROM 2021 TO 2026

TABLE 127 LARGE FORMAT DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 128 LARGE FORMAT DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 43 SNAPSHOT OF LARGE FORMAT DISPLAY MARKET IN NORTH AMERICA

TABLE 129 LARGE FORMAT DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 130 LARGE FORMAT DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 131 LARGE FORMAT DISPLAY MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 132 LARGE FORMAT DISPLAY MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 High adoption of large format display products, such as billboards, scoreboards, staging displays, and direct-view LED displays, in sports & entertainment sector to accelerate market growth in US

12.2.2 CANADA

12.2.2.1 Rapid deployment of interactive displays and interactive kiosks in retail and public spaces propel Canadian market growth

12.2.3 MEXICO

12.2.3.1 Increased penetration of display solutions for managing and delivering targeted updated content across multiple stations to foster market growth in Mexico

12.2.4 IMPACT OF COVID-19 ON NORTH AMERICA

12.2.4.1 Growing adoption of portable medical devices and imaging equipment as part of measures to combat against COVID-19 to spur market growth for embedded displays in region

FIGURE 44 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIO FOR LARGE FORMAT DISPLAY IN NORTH AMERICA, 2017–2026 (USD BILLION)

TABLE 133 LARGE FORMAT DISPLAY MARKET IN NORTH AMERICA, BY PRE-COVID-19 AND POST-COVID-19 SCENARIO, 2017–2026 (USD BILLION)

12.2.4.2 Impact of COVID-19 on US

12.2.4.3 Impact of COVID-19 on Canada

12.2.4.4 Impact of COVID-19 on Mexico

12.3 EUROPE

FIGURE 45 SNAPSHOT OF LARGE FORMAT DISPLAY MARKET IN EUROPE

TABLE 134 LARGE FORMAT DISPLAY MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 135 LARGE FORMAT DISPLAY MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 136 LARGE FORMAT DISPLAY MARKET IN EUROPE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 137 LARGE FORMAT DISPLAY MARKET IN EUROPE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Video wall market in Germany to witness incremental growth due to increasing adoption of DOOH advertising by various businesses

12.3.2 FRANCE

12.3.2.1 Large-screen displays deployed at airports to provide real-time information on flight travel status, as well as for applications such as entertainment, advertisement, and printing boarding passes

12.3.3 UK

12.3.3.1 Healthcare and education sectors to promote demand for large format display solutions in UK

12.3.4 SPAIN

12.3.4.1 Transformation of traditional retail stores into smart digital retail stores across Spain to create opportunity for large format display market

12.3.5 ITALY

12.3.5.1 Retail stores and quick-service restaurants to provide significant growth opportunities to digital display providers

12.3.6 REST OF EUROPE

12.3.7 IMPACT OF COVID-19 ON EUROPE

12.3.7.1 Lifting up of lockdown measures to allow people to travel to other countries within EU boundaries would drive demand for digital signage in transportation vertical

FIGURE 46 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIO FOR LARGE FORMAT DISPLAY MARKET IN EUROPE, 2017–2026 (USD BILLION)

TABLE 138 LARGE FORMAT DISPLAY IN EUROPE, BY PRE-COVID-19 AND POST-COVID-19 SCENARIO, 2017–2026 (USD BILLION)

12.3.7.2 Impact of COVID-19 on Germany

12.3.7.3 Impact of COVID-19 on France

12.3.7.4 Impact of COVID-19 on UK

12.3.7.5 Impact of COVID-19 on Rest of Europe

12.4 APAC

FIGURE 47 SNAPSHOT OF LARGE FORMAT DISPLAY MARKET IN ASIA PACIFIC

TABLE 139 LARGE FORMAT DISPLAY MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 140 LARGE FORMAT DISPLAY MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 141 LARGE FORMAT DISPLAY MARKET IN APAC, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 142 LARGE FORMAT DISPLAY MARKET IN APAC, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Strong focus on improving retail infrastructure in China to impact positively on large format display market growth

12.4.2 JAPAN

12.4.2.1 Increased popularity of digital display products, such as interactive displays and smart signage displays, fosters market growth in Japan

12.4.3 SOUTH KOREA

12.4.3.1 Significant presence of display companies, such as Samsung Display and LG Display, to drive development of advanced display technologies, enabling market growth in South Korea

12.4.4 INDIA

12.4.4.1 Rapid infrastructure developments in sports & entertainment sector of India to play significant role in stimulating growth of large format display market

12.4.5 AUSTRALIA

12.4.5.1 Quick installation of large-screen display solutions by major retail chains and shopping malls to accelerate growth of digital display market

12.4.6 REST OF APAC

12.4.7 IMPACT OF COVID-19 ON APAC

12.4.7.1 Falling export shipments of digital displays from various APAC countries led to decline in demand for digital signage

FIGURE 48 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIO FOR LARGE FORMAT DISPLAY MARKET IN APAC, 2017–2026 (USD BILLION)

TABLE 143 LARGE FORMAT DISPLAY MARKET IN APAC, BY PRE-COVID-19 AND POST-COVID-19 SCENARIO, 2017–2026 (USD BILLION)

12.4.7.2 Impact of COVID-19 on China

12.4.7.3 Impact of COVID-19 on Japan

12.4.7.4 Impact of COVID-19 on South Korea

12.4.7.5 Impact of COVID-19 on India

12.4.7.6 Impact of COVID-19 on Rest of APAC

12.5 REST OF THE WORLD (ROW)

TABLE 144 LARGE FORMAT DISPLAY MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 145 LARGE FORMAT DISPLAY MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 146 LARGE FORMAT DISPLAY MARKET IN ROW, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 147 LARGE FORMAT DISPLAY MARKET IN ROW, BY TECHNOLOGY, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST

12.5.1.1 Thriving retail sector to increase penetration of digital signages and video wall displays in Middle East

12.5.2 AFRICA

12.5.2.1 Limited availability of advanced technology-based solutions to hinder growth of large format display market in Africa

12.5.3 SOUTH AMERICA

12.5.3.1 Flourishing retail industry in Brazil to result in high adoption of large format displays in country

12.5.4 IMPACT OF COVID-19 ON REST OF THE WORLD (ROW)

12.5.4.1 Rising use of digital technologies in industries and growing tourism industry led economic growth of South Africa, thereby creating opportunity for large format display market

FIGURE 49 COMPARISON OF PRE-COVID-19 AND POST-COVID-19 SCENARIO FOR LARGE FORMAT DISPLAY MARKET IN ROW, 2017–2026 (USD BILLION)

TABLE 148 LARGE FORMAT DISPLAY MARKET IN ROW, BY PRE-COVID-19 AND POST-COVID-19 SCENARIO, 2017–2026 (USD BILLION)

12.5.4.2 Impact of COVID-19 on Middle East

12.5.4.3 Impact of COVID-19 on Africa

12.5.4.4 Impact of COVID-19 on South America

13 COMPETITIVE LANDSCAPE (Page No. - 194)

13.1 OVERVIEW

FIGURE 50 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGIES FROM JANUARY 2018 TO MARCH 2021

13.2 MARKET SHARE AND RANKING ANALYSIS

FIGURE 51 LARGE FORMAT DISPLAY MARKET: MARKET SHARE ANALYSIS

TABLE 149 LARGE FORMAT DISPLAY MARKET: DEGREE OF COMPETITION

TABLE 150 LARGE FORMAT DISPLAY MARKET: MARKET RANKING ANALYSIS

13.3 COMPANY REVENUE ANALYSIS, 2015–2019

FIGURE 52 FIVE-YEAR REVENUE SNAPSHOT OF KEY COMPANIES (USD BILLION)

13.4 COMPANY EVALUATION QUADRANT, 2020

13.4.1 STAR

13.4.2 PERVASIVE

13.4.3 EMERGING LEADER

13.4.4 PARTICIPANT

FIGURE 53 LARGE FORMAT DISPLAY MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2020

13.5 COMPETITIVE BENCHMARKING

FIGURE 54 PRODUCT FOOTPRINT (25 COMPANIES)

TABLE 151 COMPANY APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 152 COMPANY REGION FOOTPRINT (25 COMPANIES)

TABLE 153 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

FIGURE 55 MARKET SHARE/RANK (25 COMPANIES)

13.6 STARTUP/SME EVALUATION MATRIX, 2020

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 56 LARGE FORMAT DISPLAY MARKET (GLOBAL) STARTUP/SME EVALUATION MATRIX, 2020

13.7 COMPETITIVE SCENARIO AND TRENDS

13.7.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 154 LARGE FORMAT DISPLAY MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2018–MARCH 2021

13.7.2 DEALS

TABLE 155 LARGE FORMAT MARKET: DEALS, JANUARY 2018–MARCH 2021

14 COMPANY PROFILES (Page No. - 213)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products, Recent Developments, COVID-19 Related Developments, MnM View)*

14.2.1 SAMSUNG ELECTRONICS

TABLE 156 SAMSUNG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 57 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

TABLE 157 SAMSUNG ELECTRONICS: PRODUCTS OFFERED

TABLE 158 SAMSUNG ELECTRONICS: PRODUCT LAUNCHES

TABLE 159 SAMSUNG ELECTRONICS: DEALS

14.2.2 LG ELECTRONICS

TABLE 160 LG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 58 LG ELECTRONICS: COMPANY SNAPSHOT

TABLE 161 LG ELECTRONICS: PRODUCTS OFFERED

TABLE 162 LG ELECTRONICS: PRODUCT LAUNCHES

14.2.3 SHARP CORPORATION

TABLE 163 SHARP CORPORATION: BUSINESS OVERVIEW

FIGURE 59 SHARP CORPORATION: COMPANY SNAPSHOT

TABLE 164 SHARP CORPORATION: PRODUCTS OFFERED

TABLE 165 SHARP: PRODUCT LAUNCHES

TABLE 166 SHARP: DEALS

14.2.4 LEYARD OPTOELECTRONIC

TABLE 167 LEYARD OPTOELECTRONIC: BUSINESS OVERVIEW

FIGURE 60 LEYARD OPTOELECTRONIC: COMPANY SNAPSHOT

TABLE 168 LEYARD OPTOELECTRONIC: PRODUCTS OFFERED

TABLE 169 LEYARD: PRODUCT LAUNCHES

TABLE 170 LEYARD: DEALS

TABLE 171 LEYARD: OTHERS

14.2.5 SONY CORPORATION

TABLE 172 SONY CORPORATION: BUSINESS OVERVIEW

FIGURE 61 SONY CORPORATION: COMPANY SNAPSHOT

TABLE 173 SONY CORPORATION: PRODUCTS OFFERED

TABLE 174 SONY CORPORATION: PRODUCT LAUNCHES

TABLE 175 SONY CORPORATION: DEALS

14.2.6 BARCO NV

TABLE 176 BARCO: BUSINESS OVERVIEW

FIGURE 62 BARCO: COMPANY SNAPSHOT

TABLE 177 BARCO: PRODUCTS OFFERED

TABLE 178 BARCO: PRODUCT LAUNCHES

TABLE 179 BARCO: DEALS

14.2.7 PANASONIC CORPORATION

TABLE 180 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 63 PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 181 PANASONIC CORPORATION: PRODUCTS OFFERED

TABLE 182 PANASONIC: PRODUCT LAUNCHES

14.2.8 SHANGHAI GOODVIEW ELECTRONICS

TABLE 183 SHANGHAI GOODVIEW ELECTRONICS: BUSINESS OVERVIEW

TABLE 184 SHANGHAI GOODVIEW ELECTRONICS: PRODUCTS OFFERED

TABLE 185 SHANGHAI GOODVIEW ELECTRONICS: PRODUCT LAUNCHES

TABLE 186 SHANGHAI GOODVIEW ELECTRONICS: OTHERS

14.2.9 AU OPTRONICS

TABLE 187 AU OPTRONICS: BUSINESS OVERVIEW

FIGURE 64 AU OPTRONICS: COMPANY SNAPSHOT

TABLE 188 AU OPTRONICS: PRODUCTS OFFERED

TABLE 189 AU OPTRONICS: PRODUCT LAUNCHES

14.2.10 VIEWSONIC CORPORATION

TABLE 190 VIEWSONIC CORPORATION: BUSINESS OVERVIEW

TABLE 191 VIEWSONIC CORPORATION: PRODUCTS OFFERED

TABLE 192 VIEWSONIC: PRODUCT LAUNCHES

TABLE 193 VIEWSONIC: DEALS

14.3 OTHER PLAYERS

14.3.1 SHENZHEN ABSEN OPTOELECTRONIC CO., LTD.

14.3.2 SHENZHEN UNILUMIN GROUP CO., LTD.

14.3.3 E INK HOLDINGS

14.3.4 BENQ CORPORATION

14.3.5 DAKTRONICS

14.3.6 CHRISTIE DIGITAL SYSTEMS

14.3.7 DEEPSKY CORPORATION

14.3.8 TPV TECHNOLOGY

14.3.9 DELTA ELECTRONICS

14.3.10 MITSUBISHI ELECTRIC

14.3.11 AG NEOVO

14.3.12 PRYSM SYSTEMS

14.3.13 VTRON GROUP CO., LTD.

14.3.14 AOTO ELECTRONICS

14.3.15 SHENZHEN LIANTRONICS CO., LTD.

*Details on Business Overview, Products, Recent Developments, COVID-19 Related Developments, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 275)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 QUESTIONNAIRE FOR LARGE FORMAT DISPLAY MARKET

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

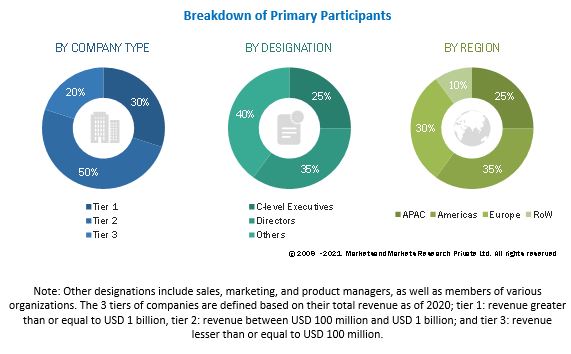

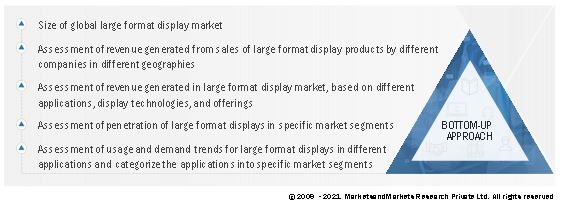

The study involved four major activities for estimating the size of the large format display market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the large format display market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the large format display market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involved the digital signage federation and society for information display (SID) association. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the large format display market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the large format display market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, APAC, and Middle East, Africa, and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the large format display market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the large format display market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to the large format display market including key OEMs, IDMs, and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Large Format Display Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides of the digital signage market.

Report Objectives

- To describe, segment, and forecast the overall size of the large format display market based on offering, type, technology, display size, display brightness, installation location, application, and region

- To describe, analyze, and forecast the market size for various segments with regard to 4 main regions—Asia Pacific (APAC), North America, Europe, and Rest of the World which includes Middle East, Africa, and South America

- To analyze and forecast the market size, in terms of value (USD million/billion), for the large format display market

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To briefly describe the large format display value chain

- To segment and forecast the large format display market size by offering (displays, controllers, mounts, and other accessories, and services)

- To segment and forecast the large format display market size by type (video wall and standalone display)

- To segment and forecast the large format display market size by technology (LED-backlit LCD, direct-view large-pixel LED, direct-view fine-pixel LED, OLED, and projection cube)

- To segment and forecast the large format display market size by display size (below 40 inches, between 40 and 60 inches, between 60 and 90 inches, between 90 and 120 inches, and above 120 inches)

- To segment and forecast the large format display market size by display brightness (below 500 nits, between 501 and 1,000 nits, between 1,001 and 2,000 nits, between 2,001 and 3,000 nits, and above 3,001 nits)

- To segment and forecast the large format display market size by installation location (indoor and outdoor)

- To segment and forecast the large format display market size for application (commercial, institutional, infrastructure, and industrial)

- To forecast the large format display market size in key regions, namely, North America, Asia Pacific (APAC), Europe, and the Middle East, Africa, and South America

- To analyze competitive developments such as product launches and developments, partnerships, acquisitions, contracts, expansions, and research and development (R&D) activities in the large format display market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of large format display market

- Estimation of the market size of the segments of the large format display market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Large Format Display Market