Lactose-Free Products Market by Type (Milk, Cheese, Yogurt, Ice-cream, Confectionery products), Form (Lactose-free, No added sugar/ Reduced sugar claims, Reduced lactose), Category (Organic, Inorganic), and Region - Global Forecast to 2025

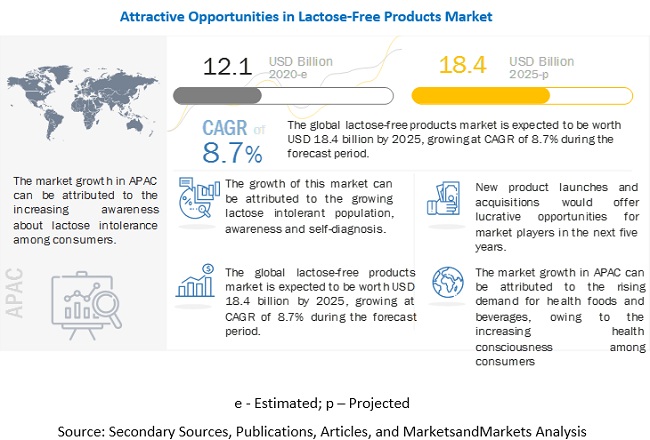

[205 Pages Report] According to MarketsandMarkets, the lactose-free products market is estimated to be valued at USD 12.1 billion in 2020 and is projected to reach USD 18.4 billion by 2025, recording a CAGR of 8.7 %, in terms of value. Factors such as the increasing awareness of lactose intolerance among consumers across regions and the growing demand for reduced added sugar or no added sugar products are projected to drive the growth of the lactose-free products industry during the forecast period. However, the growth of the lactose-free products market is inhibited by factors, such as high cost of lactose-free products and stiff competition from plant-based alternatives.

Market Dynamics

Drivers: Growing lactose intolerant population, awareness and self-diagnosis

According to the National Center for Biotechnology Information (NCBI), nearly 65% of the global population is prone to lactose intolerance. Thus, this has led to an increase in the production of lactose-free products. It has also been observed that lactose intolerance is witnessed in nearly 90% of adults in East Asia. In addition, the increase in health awareness and wellness concerns among consumers is a key factor that is projected to drive the growth and demand for lactose-free products. Moreover, according to the US National Library of Medicine, lactose intolerance is prevalent in adults, and 30 million adults in the US have symptoms of lactose intolerance by the age of 20 years. However, in African Americans, the problem of lactose intolerance can occur early at the age of 2 years.

The sales of lactose-free products have increased significantly in Europe and the US in recent years due to the increase in self-diagnosed cases of lactose intolerance among consumers. However, lactose-free products are gaining traction in the Asia Pacific region, as consumers are becoming more concerned about their health and investing in self-diagnosis in the region, which is projected to support the growth of the lactose-free market during the forecast period.

Restraints: High price of lactose-free products

For the production of lactose-free milk, the milk has to be treated with ultra-high temperature (UHT) method of the pasteurization process for increasing its shelf-life and improving the consistency of milk while turning it into lactose-free milk. For turning the normal milk to lactose-free milk, the milk is treated with lactase enzymes for breaking the complex lactose disaccharide into two simple sugars, namely, glucose and (monosaccharides) galactose. This process of converting the milk into lactose-free milk increases the price of lactose-free dairy products as compared to normal packaged dairy products. Due to these factors, lactose-free milk is offered under the premium product category, which caters to a smaller consumer population, wherein ordinary milk is a commodity offered at cost-effective prices, due to which it is consumed by a large-scale population.

Opportunities: Availability of lactose-free products with added health benefits

The increase in innovations in lactose-free dairy products has led to a rise in health benefits offered by lactose-free dairy products, which represents key growth opportunities for the lactose-free dairy market. The claims in lactose-free dairy products, such as gluten-free and low/no/reduced sugar, help in expanding the consumer base. The innovations are being witnessed around digestive health, such as lactose-free milk products with probiotics. For instance, Activia is a probiotic yogurt introduced by Danone Company S.A. (France), which contains probiotics that improve digestive health. Probiotics are bacteria that have been scientifically studied and proved that if they are consumed in sufficient amounts, they help in providing health benefits beyond basic nutrition. In addition, The Coca-Cola Company (US) under its brand Fairlife LLC provided lactose-free milk with Omega-3, which helps in improving brain health. These innovations are projected to drive the growth of the market.

Dairy manufacturers are capitalizing on this trend to expand their consumer base by promoting easy digestion, lower fat, and sugar content, developing a variety of products by mixing lactose-free ingredients with healthy ingredients, such as vitamins, proteins, and fibers, for providing a wide range of choice to consumers. The inclination of consumers toward healthy choices of food & beverages is increasing globally. The willingness of consumers to pay extra for food & beverages with health features is growing. This creates growth opportunities for lactose-free products in the dairy industry during the forecast period.

Challenges: Stiff competition from plant-based alternatives

Lactose intolerant consumers across the world have become conscious about their health, as they are aware of allergies or gastrointestinal diseases caused by the intake of lactose in their bodies. The major challenges for lactose-free products are plant-based alternatives as the demand for plant-based products is increasing and their availability in the market is rising as compared to that of lactose-free products. For instance, plant-based milk, such as soy milk, rice milk, almond milk, coconut-based milk, cashew milk, and oat milk, are increasingly present in the market. Therefore, lactose intolerant population focuses on opting for plant-based products as an alternative for lactose-free products. Furthermore, plant-based products have high nutritional value. For instance, soy milk is original plant-based milk, which constitutes 8 grams of carbohydrates, 7 grams of protein, and 100 calories in an 8-ounce pour. It is also a preferred alternative for those adhering to a diet lower in fats as it contains only 4 grams of fat with only 5 grams of saturated fat and is also low in sugar. Almond milk is one of the most widely consumed plant-based milk in North America, the EU, and Australia. In addition, doctors suggest that almond milk is an effective alternative for children and adults who suffer from allergies or intolerances to milk. However, people are shifting their interest from dairy products to plant-based products, as they are turning vegan these days. In addition, various health experts recommend plant-based diets to people who have heart problems, such as high blood pressure, diabetes, and other health conditions.

By type, the milk segment is projected to account for the largest share in the lactose-free products market during the forecast period

Lactose- free milk is a rich source of protein, calcium, phosphorus, vitamin B12, riboflavin, and vitamin D. Lactose-free milk is produced by adding lactase to regular cow’s milk. The lactose-free milk tastes sweeter than regular milk because during the process of production lactase is added to lactose-free milk that helps in breaking down of lactose into two sugar forms namely; glucose and galactose. This is the key factor driving the growth of milk segment in market.

By form, no added sugar or reduced sugar claims segment is projected to be the fastest growing segment in the lactose-free products market during the forecast period

By form, the no added sugar or reduced sugar claims segment is projected to be the fastest-growing segment. Due to the increase in awareness about health concerns, such as obesity and diabetes, consumers witness a high demand for no added sugar or reduced sugar products. For catering to the changing demands of consumers, many players in the dairy industry are focusing on introducing lactose-free dairy products with reduced added sugar or no added sugar claims. The trend of using reduced added sugar or no added sugar drives the lactose-free products market.

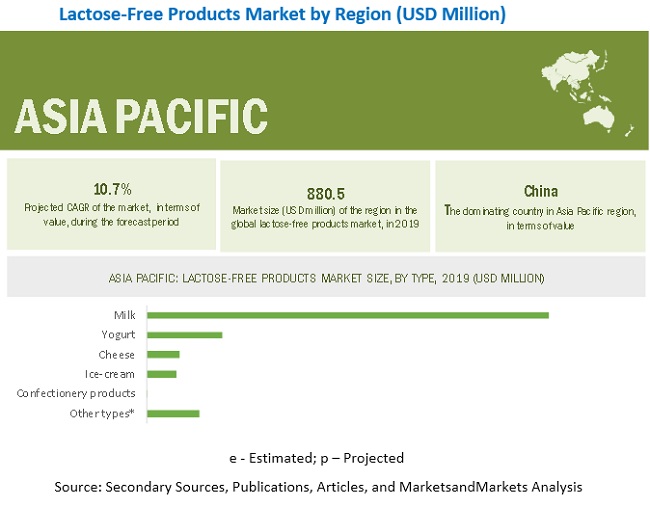

Asia Pacific is projected to account for the largest market share during the forecast period

The Asia Pacific region is projected to be the fastest-growing market during the forecast period. The significant growth of the economy in countries, rapid urbanization, an increase in demand for expensive and healthy food & beverage products, the increase in the westernization of consumer diets are some of the major factors driving the growth of lactose-free products in the region.

Key Market Players:

Gujarat Cooperative Milk Marketing Federation (India), Valio LTD (Finland), Danone Company S.A. (France), Nestle S.A. (Switzerland), The Coca-Cola Company (US), Johnson & Johnson Services, Inc. (US), General Mills, Inc. (US), Lifeway Foods, Inc. (US), Lala U.S. (US), Organic Valley (US).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

Type, form, category, and region |

|

Regions covered |

North America, Europe, Asia Pacific, South America and RoW |

|

Companies studied |

|

Target Audience:

- Raw milk suppliers

- Lactose-free dairy product manufacturers

- Milk manufacturers/suppliers

- Yogurt manufacturers/suppliers

- Cheese manufacturers/suppliers

- Ice-cream manufacturers/suppliers

- Confectionery manufacturers/suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Traders, distributors, and retail suppliers of lactose-free products

- Government and research organizations

- Associations, regulatory bodies, food safety agencies, and other industry-related bodies:

- l Food and Drug Administration (FDA)

- l European Food Safety Authority (EFSA)

- l United States Department of Agriculture (USDA)

- l Food Standards Australia New Zealand (FSANZ)

- l American Dairy Association (ADA)

- l Dietitians Association of Australia (DAA)

- l BC Dairy Association

Report Scope:

This research report categorizes the lactose-free products market based on type, form, category and region.

By Type

- Milk

- Plain

- Flavored

- Other milk types*

- Yogurt

- Set

- Drinking/ Ambient

- Regular

- Probiotic

- Other yogurt types**

- Cheese

- Cheddar

- Cottage

- Hard

- Soft

- Other cheese types***

- Ice cream

- Confectionery products

- Other types****

*Other milk types include sour milk products such as kefir and ayran.

**Other yogurt types include skyr, Greek yogurt, and cream yogurt.

***Other cheese types include cream cheese, curd cheese, and blue cheese.

****Other types include milk powder, infant milk formula, butter, spreads, and sour cream.

By Form

- Lactose-free

- No added sugar products/ reduced sugar claims

- Reduced lactose products

By Category

- Organic

- Inorganic

By Region

- North America

- Europe

- Asia Pacific

- South America

-

Rest of the World (RoW)

- Middle East

- Africa

Recent Developments

- In January 2020, The Coca-Cola Company acquired all the remaining stake in Fairlife LLC from its joint venture partner Select Milk Producers to meet the fast-changing demands of consumers for lactose-free products.

- In April 2020, Valio and Palmer Holland (US) entered into a joint venture to offer lactose-free powders in the US market.

- In May 2017, Danone launched a lactose-free product line, under its brand Activia, in Spain with several flavors for tapping the lactose-free market in the country.

- In April 2017, Danone acquired WhiteWave (US). This acquisition helped Danone in improving the company’s product line with brands, including Horizon Organic milk, which is WhiteWave’s top-selling product category, providing lactose-free milk.

Frequently Asked Questions (FAQ):

Can you provide us further bifurcation of other types?

This can be further provided as milk powder, infant milk formula, butter, spreads, and sour cream.

Does the report cover lactose-free confectionery products?

Yes, lactose-free confectionery products are covered in the scope.

Can you provide further bifurcation of countries in South America?

Yes, we can provide further bifurcation of South American countries. Please provide your targeted countries.

How many companies are covered in the market?

The report covers profiles of 20 companies. Additionally, 5 more companies can be given as a customization.

Does the report cover the value chain of lactose-free products?

Yes. The report covers the detailed value chain analysis for lactose-free products. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

FIGURE 1 MARKET SEGMENTATION

1.3 REGIONS COVERED

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017–2019

1.6 VOLUME UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 LACTOSE-FREE PRODUCTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH ONE (BASED ON TYPE, BY REGION)

2.2.2 APPROACH TWO (BASED ON THE GLOBAL MARKET)

2.3 DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.6.1 SCENARIO-BASED MODELLING

2.7 COVID-19: HEALTH ASSESSMENT

FIGURE 4 COVID-19: THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19: ECONOMIC ASSESSMENT

FIGURE 6 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

FIGURE 7 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 8 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 2 LACTOSE-FREE PRODUCTS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 9 MARKET SIZE, BY TYPE, 2020 VS. 2025

FIGURE 10 MARKET SIZE, BY FORM, 2020 VS. 2025

FIGURE 11 MARKET SIZE, BY CATEGORY, 2020 VS. 2025

FIGURE 12 MARKET SHARE & GROWTH (VALUE), BY REGION

FIGURE 13 IMPACT OF COVID-19 ON THE LACTOSE-FREE PRODUCT MARKET, BY KEY SCENARIOS, 2020-2021

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE LACTOSE-FREE PRODUCTS MARKET

FIGURE 14 LACTOSE-FREE PRODUCTS: AN EMERGING MARKET WITH STEADY GROWTH POTENTIAL

4.2 MARKET, BY TYPE

FIGURE 15 MILK TO GROW AT THE HIGHEST RATE IN THE LACTOSE-FREE PRODUCTS MARKET FROM 2020 TO 2025

4.3 MARKET, BY FORM

FIGURE 16 LACTOSE-FREE DOMINATED THE MARKET IN 2020

4.4 MARKET, BY CATEGORY

FIGURE 17 INORGANIC SEGMENT IS PROJECTED TO DOMINATE THE MARKET IN 2020

4.5 NORTH AMERICA: MARKET, BY TYPE AND COUNTRY

FIGURE 18 MILK, ON THE BASIS OF TYPE, ACCOUNTED FOR THE LARGEST SHARE IN THE NORTH AMERICAN LACTOSE-FREE PRODUCTS MARKET IN 2020

4.6 MARKET, BY COUNTRY

FIGURE 19 NORTH AMERICA TO HOLD THE LARGEST SHARE IN THE LACTOSE-FREE PRODUCTS MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

FIGURE 20 PRODUCTION PROCESS: LACTOSE-FREE AND REDUCED LACTOSE MILK

5.2 MARKET DYNAMICS

FIGURE 21 MARKET DYNAMICS: LACTOSE-FREE PRODUCTS MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in population of lactose-intolerant consumers, awareness, and self-diagnosis

FIGURE 22 GLOBAL PREVALENCE OF LACTOSE INTOLERANCE, BY COUNTRY, 2017 (% OF POPULATION WITH LACTOSE INTOLERANCE)

5.2.1.2 Availability of various products and SKUs in the market

5.2.1.3 Technological advancements in product manufacturing and improved labeling protocols

5.2.2 RESTRAINTS

5.2.2.1 High-price of lactose-free products

5.2.2.2 Undesirable taste due to the presence of arylsulfatase in products

5.2.3 OPPORTUNITIES

5.2.3.1 Availability of lactose-free dairy products with added health benefits

5.2.3.2 Expected rise in demand in the horeca industry

5.2.4 CHALLENGES

5.2.4.1 Stiff competition from plant-based alternatives

FIGURE 23 SALES OF PLANT-BASED FOOD PRODUCTS, BY CATEGORY, 2019 (USD MILLION)

5.2.4.2 Impact of COVID-19 on the supply chain of lactose-free products

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: LACTOSE-FREE PRODUCTS MARKET

5.4 CONSUMER FOOD & BEVERAGE ECOSYSTEM/MARKET MAP

FIGURE 25 CONSUMER FOOD & BEVERAGE ECOSYSTEM/LANDSCAPE

FIGURE 26 ECOSYSTEM VIEW

5.5 PATENT LISTING

5.5.1 INTRODUCTION

TABLE 3 PATENTS PERTAINING TO LACTOSE-FREE PRODUCTS

5.6 YC-YCC SHIFT

FIGURE 27 YC-YCC SHIFT: LACTOSE-FREE PRODUCTS MARKET

6 LACTOSE-FREE PRODUCTS MARKET, BY TYPE (Page No. - 58)

6.1 INTRODUCTION

FIGURE 28 LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 4 MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 5 MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 6 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 7 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY TYPE, 2018–2021 (KT)

TABLE 8 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 9 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY TYPE, 2018–2021 (KT)

TABLE 10 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 11 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY TYPE, 2018–2021 (KT)

6.2 MILK

6.2.1 WITH MILK CONTAINING THE HIGHEST AMOUNT OF LACTOSE, THE DEMAND FOR LACTOSE-FREE MILK REMAINS THE HIGHEST

TABLE 12 LACTOSE-FREE MILK MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 LACTOSE-FREE MILK MARKET SIZE, BY REGION, 2018–2025 (KT)

TABLE 14 LACTOSE-FREE MILK MARKET SIZE, BY MILK TYPE, 2018–2025 (USD MILLION)

TABLE 15 LACTOSE-FREE MILK MARKET SIZE, BY MILK TYPE, 2018–2025 (KT)

6.2.1.1 Plain milk

TABLE 16 LACTOSE-FREE PLAIN MILK MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 LACTOSE-FREE PLAIN MILK MARKET SIZE, BY REGION, 2018–2025 (KT)

6.2.1.2 Flavored milk

TABLE 18 LACTOSE-FREE FLAVORED MILK MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 LACTOSE-FREE FLAVORED MILK MARKET SIZE, BY REGION, 2018–2025 (KT)

6.2.1.3 Other milk types

TABLE 20 OTHER LACTOSE-FREE MILK TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 OTHER LACTOSE-FREE MILK TYPES MARKET SIZE, BY REGION, 2018–2025 (KT)

6.3 YOGURT

6.3.1 LACTOSE-FREE YOGURT IS A RICH SOURCE OF PROTEIN AND IMPROVES IMMUNITY

TABLE 22 LACTOSE-FREE YOGURT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 LACTOSE-FREE YOGURT MARKET SIZE, BY REGION, 2018–2025 (KT)

TABLE 24 LACTOSE-FREE YOGURT MARKET SIZE, BY YOGURT TYPE, 2018–2025 (USD MILLION)

TABLE 25 LACTOSE-FREE YOGURT MARKET SIZE, BY YOGURT TYPE, 2018–2025 (KT)

6.3.1.1 Set yogurt

TABLE 26 LACTOSE-FREE SET YOGURT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 LACTOSE-FREE SET YOGURT MARKET SIZE, BY REGION, 2018–2025 (KT)

6.3.1.2 Drinking/ambient yogurt

TABLE 28 LACTOSE-FREE DRINKING/AMBIENT YOGURT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 LACTOSE-FREE DRINKING/AMBIENT YOGURT MARKET SIZE, BY REGION, 2018–2025 (KT)

6.3.1.3 Regular yogurt

TABLE 30 LACTOSE-FREE REGULAR YOGURT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 LACTOSE-FREE REGULAR YOGURT MARKET SIZE, BY REGION, 2018–2025 (KT)

6.3.1.4 Probiotic yogurt

TABLE 32 LACTOSE-FREE PROBIOTIC YOGURT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 LACTOSE-FREE PROBIOTIC YOGURT MARKET SIZE, BY REGION, 2018–2025 (KT)

6.3.1.5 Other yogurt types

TABLE 34 OTHER LACTOSE-FREE YOGURT TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 OTHER LACTOSE-FREE YOGURT TYPES MARKET SIZE, BY REGION, 2018–2025 (KT)

6.4 CHEESE

6.4.1 LACTOSE-FREE CHEESE ACTS AS A RICH SOURCE OF PROTEIN AND FAT FOR LACTOSE INTOLERANT CONSUMERS

TABLE 36 LACTOSE-FREE CHEESE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 LACTOSE-FREE CHEESE MARKET SIZE, BY REGION, 2018–2025 (KT)

TABLE 38 LACTOSE-FREE CHEESE MARKET SIZE, BY CHEESE TYPE, 2018–2025 (USD MILLION)

TABLE 39 LACTOSE-FREE CHEESE MARKET SIZE, BY CHEESE TYPE, 2018–2025 (KT)

6.4.1.1 Cheddar cheese

TABLE 40 LACTOSE-FREE CHEDDAR CHEESE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 LACTOSE-FREE CHEDDAR CHEESE MARKET SIZE, BY REGION, 2018–2025 (KT)

6.4.1.2 Cottage Cheese

TABLE 42 LACTOSE-FREE COTTAGE CHEESE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 LACTOSE-FREE COTTAGE CHEESE MARKET SIZE, BY REGION, 2018–2025 (KT)

6.4.1.3 Soft cheese

TABLE 44 LACTOSE-FREE SOFT CHEESE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 45 LACTOSE-FREE SOFT CHEESE MARKET SIZE, BY REGION, 2018–2025 (KT)

6.4.1.4 Hard cheese

TABLE 46 LACTOSE-FREE HARD CHEESE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 47 LACTOSE-FREE HARD CHEESE MARKET SIZE, BY REGION, 2018–2025 (KT)

6.4.1.5 Other cheese types

TABLE 48 OTHER LACTOSE-FREE CHEESE TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 49 OTHER LACTOSE-FREE CHEESE TYPES MARKET SIZE, BY REGION, 2018–2025 (KT)

6.5 ICE-CREAM

6.5.1 TOUGH COMPETITION FROM DAIRY-FREE ICE-CREAM THAT ARE MADE OF PLANT-BASED MILK SUCH AS ALMOND MILK AND COCONUT MILK

TABLE 50 LACTOSE-FREE ICE-CREAM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 51 LACTOSE-FREE ICE-CREAM MARKET SIZE, BY REGION, 2018–2025 (KT)

6.6 CONFECTIONERY PRODUCTS

6.6.1 INCREASE IN PREFERENCE FOR LACTOSE-FREE CONFECTIONERY PRODUCTS AMONG LACTOSE INTOLERANT POPULATION TO CREATE GROWTH OPPORTUNITIES FOR MANUFACTURERS

TABLE 52 LACTOSE-FREE CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 53 LACTOSE-FREE CONFECTIONERY PRODUCTS MARKET SIZE, BY REGION, 2018–2025 (KT)

6.6.2 OTHER TYPES

TABLE 54 OTHER LACTOSE-FREE PRODUCT TYPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 55 OTHER LACTOSE-FREE PRODUCT TYPES MARKET SIZE, BY REGION, 2018–2025 (KT)

7 LACTOSE-FREE PRODUCTS MARKET, BY FORM (Page No. - 89)

7.1 INTRODUCTION

FIGURE 33 LACTOSE-FREE PRODUCTS MARKET SIZE, BY FORM, 2020 VS. 2025 (USD MILLION)

TABLE 56 MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 57 MARKET SIZE, BY FORM, 2018–2025 (KT)

TABLE 58 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE LACTOSE-FREE PRODUCTS MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 59 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY FORM, 2018–2021 (KT)

TABLE 60 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 61 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY FORM, 2018–2021 (KT)

TABLE 62 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY FORM, 2018–2021 (USD MILLION)

TABLE 63 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY FORM, 2018–2021 (KT)

7.2 LACTOSE-FREE PRODUCTS

7.2.1 INCREASE IN DEMAND FOR LACTOSE-FREE PRODUCTS DUE TO THE RISE IN AWARENESS ABOUT LACTOSE INTOLERANCE AMONG CONSUMERS

TABLE 64 FREE-FORM LACTOSE-FREE PRODUCTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 65 FREE-FORM MARKET SIZE, BY REGION, 2018–2025 (KT)

7.3 NO ADDED SUGAR PRODUCTS/ REDUCED SUGAR CLAIMS

7.3.1 INCREASE IN HEALTH CONSCIOUSNESS AMONG CONSUMERS TO DRIVE THE DEMAND FOR NO ADDED SUGAR PRODUCTS/ REDUCED SUGAR CLAIMS

TABLE 66 NO ADDED SUGAR PRODUCTS/ REDUCED SUGAR CLAIM MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 67 NO ADDED SUGAR PRODUCTS/ REDUCED SUGAR CLAIM MARKET SIZE, BY REGION, 2018–2025 (KT)

7.4 REDUCED LACTOSE PRODUCTS

7.4.1 GROWING DEMAND FOR REDUCED LACTOSE PRODUCTS AMONG CONSUMERS SUFFERING FROM LOW LEVELS OF LACTOSE INTOLERANCE

TABLE 68 REDUCED MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 69 REDUCED MARKET SIZE, BY REGION, 2018–2025 (KT)

8 LACTOSE-FREE PRODUCTS MARKET, BY CATEGORY (Page No. - 98)

8.1 INTRODUCTION

FIGURE 34 LACTOSE-FREE PRODUCTS MARKET SIZE, BY CATEGORY, 2020 VS. 2025 (USD MILLION)

TABLE 70 MARKET SIZE, BY CATEGORY, 2018–2025 (USD MILLION)

TABLE 71 MARKET SIZE, BY CATEGORY, 2018–2025 (KT)

TABLE 72 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 73 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY CATEGORY, 2018–2021 (KT)

TABLE 74 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 75 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY CATEGORY, 2018–2021 (KT)

TABLE 76 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 77 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY CATEGORY, 2018–2021 (KT)

8.2 ORGANIC

8.3 INORGANIC

9 LACTOSE-FREE PRODUCTS MARKET, BY REGION (Page No. - 103)

9.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC TO BE THE FASTEST-GROWING MARKET FROM 2020 TO 2025

TABLE 78 LACTOSE-FREE PRODUCTS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 79 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 OPTIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY REGION, 2018–2021 (KT)

TABLE 81 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 82 REALISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY REGION, 2018–2021 (KT)

TABLE 83 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 PESSIMISTIC SCENARIO: IMPACT OF COVID-19 ON THE MARKET, BY REGION, 2018–2021 (KT)

9.2 REGULATORY LANDSCAPE

9.2.1 LACTOSE-FREE/LOW-LACTOSE MILK REGULATIONS IN INDIA

9.2.2 REDUCED LACTOSE REGULATIONS IN THE US

9.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA DAIRY PRODUCTS CONSUMPTION, 2017–2020

FIGURE 37 NORTH AMERICA: LACTOSE-FREE PRODUCTS MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY MILK TYPE, 2018–2025 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY MILK TYPE, 2018–2025 (KT)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (KT)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: LACTOSE-FREE PRODUCTS MARKET SIZE, BY CHEESE TYPE, 2018–2025 (KT)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (KT)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

9.3.1 US

9.3.1.1 Innovative products offered by key players to create growth opportunities in the country

TABLE 97 US: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Rising awareness among consumers about health concerns to drive the market growth

TABLE 98 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.3 MEXICO

9.3.3.1 Increase in consumer inclination toward dairy products to drive the market growth for lactose-free products

TABLE 99 MEXICO: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4 EUROPE

FIGURE 38 COUNTRY-WISE FREQUENCY OF LACTASE DEFICIENCY IN EUROPE

TABLE 100 EUROPE: LACTOSE-FREE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 102 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 104 EUROPE: MARKET SIZE, BY MILK TYPE, 2018–2025 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY MILK TYPE, 2018–2025 (KT)

TABLE 106 EUROPE: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (KT)

TABLE 108 EUROPE: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (KT)

TABLE 110 EUROPE: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY FORM, 2018–2025 (KT)

9.4.1 UK

9.4.1.1 Increase in trend of buying free-form products to drive the growth of the lactose-free products market

FIGURE 39 MILK USAGE IN DIFFERENT PRODUCTS IN THE UK: 2018

TABLE 112 UK: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.2 GERMANY

9.4.2.1 Increase in awareness about lactose intolerance conditions and easy availability of lactose-free products encourages its demand among infants

TABLE 113 GERMANY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.3 SPAIN

9.4.3.1 Increase in application of lactose-free condensed milk in the preparation of bakery & confectionery products to drive the growth of the market

TABLE 114 SPAIN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Increase in consumption of lactose-free cheese and fortified lactose-free products to drive the market growth

TABLE 115 ITALY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.5 FRANCE

9.4.5.1 Growing consumer preference for organic lactose-free products to drive the growth of the market significantly

TABLE 116 FRANCE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.6 REST OF EUROPE

TABLE 117 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: LACTOSE-FREE MARKET SNAPSHOT

TABLE 118 ASIA PACIFIC: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY MILK TYPE, 2018–2025 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY MILK TYPE, 2018–2025 (KT)

TABLE 122 ASIA PACIFIC: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (KT)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (KT)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY FORM, 2018–2025 (KT)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

9.5.1 CHINA

9.5.1.1 Changes in consumer lifestyles in urban areas to drive the growth of the lactose-free products market in china

TABLE 130 CHINA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.2 INDIA

9.5.2.1 Availability of traditional lactose-free products to drive the demand for lactose-free products in the country

FIGURE 41 PRODUCTION OF MILK IN INDIA (2015–2019)

TABLE 131 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.3 JAPAN

9.5.3.1 Health benefits provided by lactose-free products to drive its demand among Japanese consumers

TABLE 132 JAPAN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.4 AUSTRALIA & NEW ZEALAND

9.5.4.1 Increase in health consciousness among consumers to drive the market growth

TABLE 133 AUSTRALIA & NEW ZEALAND: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.5 REST OF ASIA PACIFIC

TABLE 134 REST OF ASIA PACIFIC: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.6 SOUTH AMERICA

TABLE 135 SOUTH AMERICA: LACTOSE-FREE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 136 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 137 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 138 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 139 SOUTH AMERICA: MARKET SIZE, BY MILK TYPE, 2018–2025 (USD MILLION)

TABLE 140 SOUTH AMERICA: MARKET SIZE, BY MILK TYPE, 2018–2025 (KT)

TABLE 141 SOUTH AMERICA: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (USD MILLION)

TABLE 142 SOUTH AMERICA: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (KT)

TABLE 143 SOUTH AMERICA: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (USD MILLION)

TABLE 144 SOUTH AMERICA: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (KT)

TABLE 145 SOUTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET SIZE, BY FORM, 2018–2025 (KT)

9.6.1 BRAZIL

9.6.1.1 Increase in awareness, self-diagnosis among people, and high demand for lactose-free products in various flavors to drive the market growth

TABLE 147 BRAZIL: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.6.2 ARGENTINA

9.6.2.1 Increase in the consumption of lactose-free yogurt and fermented milk products among children to drive the growth of the lactose-free products market

TABLE 148 ARGENTINA: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.6.3 REST OF SOUTH AMERICA

TABLE 149 REST OF SOUTH AMERICA: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.7 REST OF THE WORLD

TABLE 150 ROW: LACTOSE-FREE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 151 ROW: MARKET SIZE, BY COUNTRY, 2018–2025 (KT)

TABLE 152 ROW: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 153 ROW: MARKET SIZE, BY TYPE, 2018–2025 (KT)

TABLE 154 ROW: MARKET SIZE, BY MILK TYPE, 2018–2025 (USD MILLION)

TABLE 155 ROW: MARKET SIZE, BY MILK TYPE, 2018–2025 (KT)

TABLE 156 ROW: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (USD MILLION)

TABLE 157 ROW: MARKET SIZE, BY YOGURT TYPE, 2018–2025 (KT)

TABLE 158 ROW: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (USD MILLION)

TABLE 159 ROW: MARKET SIZE, BY CHEESE TYPE, 2018–2025 (KT)

TABLE 160 ROW: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 161 ROW: MARKET SIZE, BY FORM, 2018–2025 (KT)

9.7.1 MIDDLE EAST

9.7.1.1 Availability of a wide range of lactose-free products to drive the market growth

TABLE 162 MIDDLE EAST: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.7.2 AFRICA

9.7.2.1 Increase in awareness of lactose intolerance among consumers to drive the market growth

FIGURE 42 AFRICAN DAIRY CONSUMPTION, 2017–2020

TABLE 163 AFRICA: LACTOSE-FREE PRODUCTS MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

10 LACTASE INCLUSION CONTENT/DOSAGE LEVELS BY CATEGORY (Page No. - 155)

10.1 INCLUSION/DOSAGE LEVELS

FIGURE 43 LACTASE INCLUSION/DOSAGE LEVELS IN LACTOSE-FREE PRODUCTS

10.2 LACTOSE-FREE PRODUCTS: MAJOR FACTORS IMPACTING PRODUCTION PERFORMANCE

10.3 IMPACT OF CURRENT TRENDS IN THE LACTASE MARKET FOR LACTOSE-FREE PRODUCTS

11 COMPETITIVE LANDSCAPE (Page No. - 157)

11.1 MARKET EVALUATION FRAMEWORK

FIGURE 44 MARKET EVALUATION FRAMEWORK: 2017 TO 2020

11.2 RANKING OF KEY PLAYERS, 2020

FIGURE 45 THE COCA-COLA COMPANY DOMINATED THE LACTOSE-FREE PRODUCTS MARKET IN 2019

11.3 KEY MARKET DEVELOPMENTS

11.3.1 NEW PRODUCT LAUNCHES

TABLE 164 NEW PRODUCT LAUNCHES, 2017–2020

11.3.2 ACQUISITIONS

TABLE 165 ACQUISITIONS, 2017–2020

11.3.3 EXPANSIONS

TABLE 166 EXPANSIONS, 2017–2020

11.3.4 JOINT VENTURES

TABLE 167 JOINT VENTURES, 2017–2020

12 COMPANY PROFILES AND PRODUCTION MARKET ANALYSIS (Page No. - 161)

12.1 OVERVIEW

12.2 COMPETITIVE EVALUATION: MATRIX DEFINITIONS & METHODOLOGY

12.2.1 STARS

12.2.2 EMERGING LEADER

12.2.3 PERVASIVE

12.2.4 EMERGING COMPANIES

12.3 COMPANY EVALUATION MATRIX

12.4 TOP REGIONS PRODUCING LACTOSE-FREE PRODUCTS

12.5 LIST OF KEY COMPANIES, BY REGION

12.6 LIST OF KEY PRODUCT CATEGORIES, BY COMPANY

TABLE 168 KEY PRODUCT CATEGORIES, BY COMPANY

12.7 MANUFACTURING LOCATIONS OF TOP PLAYERS

TABLE 169 MANUFACTURING LOCATIONS, BY COMPANY

12.8 COMPANY PROFILES

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.8.1 THE COCA-COLA COMPANY

FIGURE 46 THE COCA-COLA COMPANY: COMPANY SNAPSHOT

12.8.2 GUJARAT COOPERATIVE MILK MARKETING FEDERATION (GCMMF)

FIGURE 47 GUJARAT COOPERATIVE MILK MARKETING FEDERATION: COMPANY SNAPSHOT

12.8.3 NESTLÉ

FIGURE 48 NESTLÉ: COMPANY SNAPSHOT

12.8.4 DANONE COMPANY S.A.

FIGURE 49 DANONE COMPANY S.A.: COMPANY SNAPSHOT

12.8.5 VALIO LTD

FIGURE 50 VALIO LTD: COMPANY SNAPSHOT

12.8.6 JOHNSON & JOHNSON SERVICES, INC.

FIGURE 51 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT

12.8.7 GENERAL MILLS, INC.

FIGURE 52 GENERAL MILLS, INC.: COMPANY SNAPSHOT

12.8.8 LIFEWAY FOODS, INC.

FIGURE 53 LIFEWAY FOODS, INC.: COMPANY SNAPSHOT

12.8.9 LALA U.S., INC.

FIGURE 54 LALA U.S., INC.: COMPANY SNAPSHOT

12.8.10 ORGANIC VALLEY

12.8.11 DAIRY FARMERS OF AMERICA, INC.

FIGURE 55 DAIRY FARMERS OF AMERICA, INC.: COMPANY SNAPSHOT

12.8.12 DEAN FOODS

FIGURE 56 DEAN FOODS: COMPANY SNAPSHOT

12.8.13 SHAMROCK FOODS

12.8.14 SAPUTO INC.

FIGURE 57 SAPUTO INC.: COMPANY SNAPSHOT

12.8.15 PRAIRIE FARMS DAIRY

12.8.16 AGRI-MARK, INC.

12.8.17 SMITHFOODS, INC.

12.8.18 GRANLATTA SOCIETA COOPERATIVE AGRICOLA ARL

12.8.19 MEGGLE GROUP GMBH

FIGURE 58 MEGGLE GROUP GMBH: COMPANY SNAPSHOT

12.8.20 DRUMS FOOD INTERNATIONAL PVT LTD

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 197)

13.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.2 AVAILABLE CUSTOMIZATIONS

13.3 RELATED REPORTS

13.4 AUTHOR DETAILS

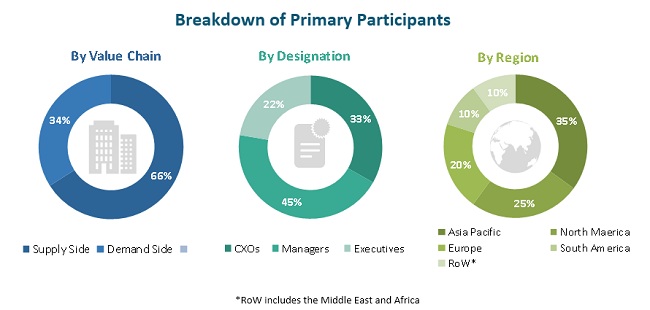

The study involved four major activities in estimating the lactose-free products market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), Organisation for Economic Co-operation and Development (OECD), and European Food Safety Authority (EFSA) were referred to, to identify and collect information for this study. The secondary sources also include clinical studies and journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers and lactose-free products manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include exogenous lactose-free product manufacturers. In addition, technology providers were interviewed during the process. The primary sources from the demand-side include distributors, wholesalers, importers, and exporters of lactose-free products.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lactose-free products market. These approaches were also used extensively to determine the size of various subsegments in the market for the base year (2019) in terms of value. The research methodology used to estimate the market size include the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the lactose-free products market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall lactose-free products market size and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the lactose-free products market, in terms of type, form, category and region

- To describe and forecast the lactose-free products market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the lactose-free products market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the lactose-free products market

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as acquisitions & divestments, expansions, product launches & approvals, and agreements, in the lactose-free products market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Geographic Analysis

- Further breakdown of the Rest of Europe lactose-free products market into Poland, the Netherlands, Denmark, Russia, and other EU and non-EU countries.

- Further breakdown of the Rest of Asia Pacific includes South Korea, Indonesia, Vietnam, the Philippines, Malaysia, Singapore, and Thailand.

- Further breakdown of the Rest of South America includes Colombia, Peru and Chile.

Segment Analysis

- Further breakdown of the lactose-free products market by type, into milk powder, infant milk formula, butter, spreads, and sour cream.

Growth opportunities and latent adjacency in Lactose-Free Products Market