Laboratory Freezers Market by Product(Cryopreservation, Plasma Freezer, ExplosionProof Freezer, Enzyme Freezer, Ultra-Low Freezer, Blood Bank Refrigerator, Pharmacy Refrigerator, Chromatography Refrigerator), End User(Hospitals) - Global Forecast to 2026

Market Growth Outlook Summary

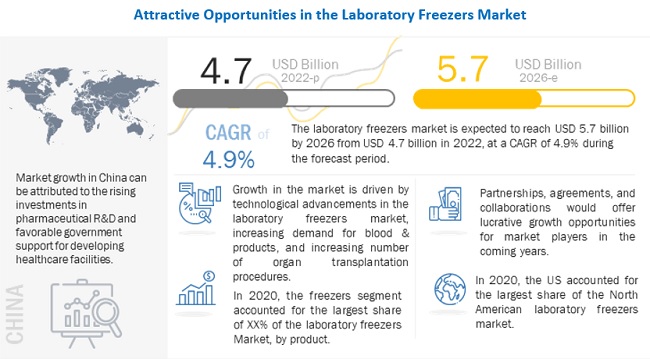

The global laboratory freezers market in terms of revenue was estimated to be worth $4.7 billion in 2022 and is poised to reach $5.7 billion by 2026, growing at a CAGR of 4.9% from 2022 to 2026. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth in this market is driven by increasing demand for blood and blood components for transfusion and for support in cancer therapy. Technological advancements in lab freezers also drive the growth of this market. The laboratory freezers market has shown a significant rise in demand in 2020 and 2021 due to the utility of these products for appropriate temperature-controlled storage of COVID-19 vaccines. The growing use of refurbished laboratory freezers and refrigerators could restrain the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Freezers Market Dynamics

Driver: Increasing demand for blood and blood components for transfusion and for support in cancer therapy

The global demand for blood and blood components is on the rise. According to the American National Red Cross, nearly 21 million blood components are transfused each year in the US alone.

According to the American Cancer Society, in 2020, an estimated 1.8 million new cancer cases were recorded in the US. The requirement of blood and blood components is high for cancer surgery patients as well as for patients suffering from blood cancers, such as leukemia and lymphoma. Moreover, blood donation has increased globally, with the WHO reporting an increase of 7.8 million blood donations from voluntary unpaid donors from 2013 to 2018. This increase in the demand for blood and blood products and rise in blood collection globally will increase the demand for lab freezers & refrigerators in blood banks for their storage.

Restraint: Growing use of refurbished laboratory freezers

Capital investments in the cold storage of biomedical samples are very high for hospitals, laboratories, and blood banks. The average price of ultra-low-temperature freezers ranges between USD 10,000 and USD 25,000, which is expensive for smaller blood banks, hospitals, and laboratories

Refurbished medical devices are generally available at 50–60% lower prices than new instruments. The public healthcare expenditure for infrastructure improvement in many emerging & underdeveloped countries is inadequate; this restricts the adoption of technologically advanced medical devices in healthcare systems across these countries. The high demand for refurbished lab freezers and refrigerators will hamper the growth of the global laboratory freezers market to a certain extent during the forecast period.

Opportunity: Vaccine development for emerging infectious diseases

Vaccine development for emerging infectious diseases has received greater attention due to the COVID-19 pandemic. This rising focus and investments in vaccine development would boost the growth of clinical research trials for vaccines in the coming years. This, in turn, would boost the growth of the lab freezers and refrigerators market as most vaccines are required to be stored at low temperatures at the time of development and distribution. Therefore, the increasing investments and focus on vaccine development for emerging infectious diseases pose an opportunity for players in the laboratory freezers market in the coming years.

Challenge: Lack of awareness of the utility of specialized lab freezers and refrigerators

In certain clinics, laboratories, blood banks, and pharmacies, there is a lack of awareness on the proper use of medical/lab refrigerators. Blood bank providers or small chemist shops may lack awareness of the benefits of using particular refrigerators to store specific specimens. Domestic refrigerators do not provide optimal temperature conditions for the storage of blood and blood components and DNA testing samples, among others. Domestic refrigerators are designed to keep efficiency in mind and sacrifice precision so that a degree of temperature variability is tolerated to reduce the amount of time and frequency that the compressor must run to cool the storage chamber. However, lab freezers are designed with precise temperature control, reliability, and storage capacity as key considerations. If the samples are not stored in under optimum conditions, they may get contaminated, and results may be distorted.

Laboratory freezers, especially ultra-low-temperature freezers, are sensitive lab equipment that require proper maintenance. The common sources of failure of ultra-low-temperature freezers include compressors, electronics, or HVAC malfunction. Therefore, a lack of knowledge regarding the proper storage of medical specimens and maintenance of laboratory refrigerators and freezers could pose a challenge for the growth of this market.

The freezers segment holds the highest market share, by product, in the Laboratory Freezers industry

Based on products, the laboratory freezers market is segmented into freezers, refrigerators, and cryopreservation systems. In 2020, the freezers segment accounted for the largest share of the market. The large share of this segment can be attributed to their utility in pharmaceutical and biotechnology companies and academic and research institutes to support vaccine development and in medical laboratories and hospitals for storing test samples.

The ultra-low-temperature freezers segment to grow at the highest CAGR in the freezers industry, in the forecast period.

Based on type, the freezers market is segmented into ultra-low-temperature freezers, laboratory freezers, plasma freezers, enzyme freezers, explosion-proof freezers, and flammable material freezers. Ultra-low-temperature freezers is growing at the highest CAGR, by type, in the freezers segment. The high growth of this segment can be attributed to the wide application of ultra-low-temperature freezers for biological and biotech storage in research universities, medical centers, and hospitals.

The laboratory refrigerators segment to hold the highest share in the refrigerators industry

Based on type, the refrigerators market is segmented into blood bank refrigerators, chromatography refrigerators, explosion-proof refrigerators, flammable material refrigerators, laboratory refrigerators, and pharmacy refrigerators. In 2020 and 2021 the laboratory refrigerators segment shows high growth due to the extensive use of laboratory refrigerators in the short-term storage of samples for COVID-19 testing in medical laboratories, hospitals, and clinics.

The blood banks segment to grow at the highest CAGR, by end user, in the forecast period

Growth in this end-user segment is mainly driven by the increasing demand for whole blood and blood components as a result of the rising prevalence of blood disorders such as sickle-cell anemia, blood cancer, and hemophilia. The increasing demand for plasma from biopharmaceutical companies for use in plasma fractionation procedures is also driving the demand for plasma freezers in blood banks.

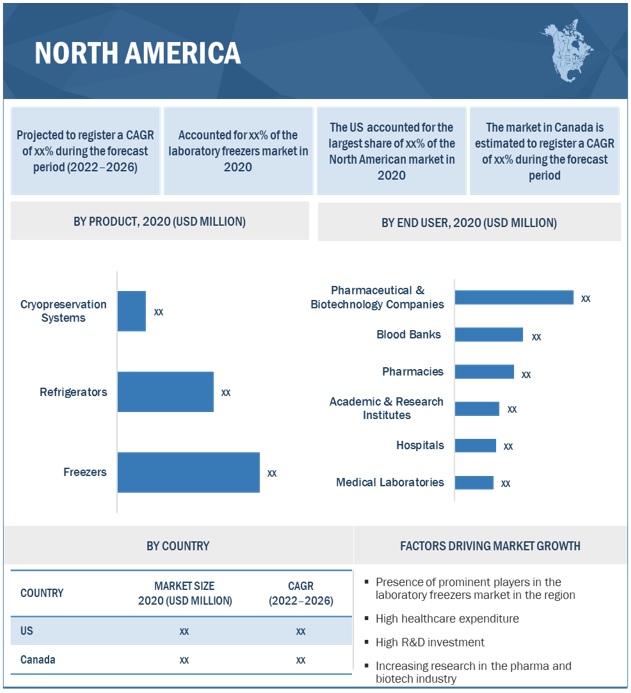

North America holds the largest share in the Laboratory Freezers Industry, by region, in the forecast period

The Laboratory Freezers market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East & Africa. North America accounted for the largest share in the Laboratory Freezers market in 2020. The large share of this regional segment can be attributed to the high healthcare expenditure in the US & Canada and the growing R&D spending on pharmaceuticals & biotechnology in this region. The presence of a large number of laboratory freezer and refrigerator manufacturers in the region also plays a pivotal role in boosting market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key players in the Laboratory Freezers market include Eppendorf AG (Germany), Haier Biomedical (China), Thermo Fisher Scientific, Inc. (US), Helmer Scientific (US), PHC Holdings Corporation (Japan), Liebherr (Switzerland), Middleby Corporation (Follett Products, LLC), Felix Storch, Inc. (US), BioLife Solutions, Inc. (Stirling Ultracold) (US), Blue Star Limited (India), B Medical Systems (Luxembourg), Philipp Kirsch GmbH (Germany), Avantor, Inc. (US), Standex International Corporation (US), Vestfrost Solutions A/S (Denmark), Changhong Meiling Co. Ltd. (China), EVERmed S.R.L. (Italy), ARCTIKO A/S (Denmark), Glen Dimplex Medical Appliances (LEC Medical) (Ireland), So-Low Environmental Equipment Co. Ltd. (US), KW Apparecchi Scientifici SRL (Italy), Jeio Tech (Republic of Korea), Refrigerated Solutions Group (US), Stericox India Private Limited (India), Thalheimer Kühlung (Germany), and Antylia Scientific (US).

Scope of the Laboratory Freezers Industry

|

Report Metrics |

Details |

|

Market Size value 2026 |

USD 5.7 billion |

|

Growth Rate |

4.9% Compound Annual Growth Rate (CAGR) |

|

Largest Market |

North America |

|

Market Dynamics |

Drivers, Opportunities, Restraints & Challenges |

|

Largest Share Segments |

|

|

Table of Content |

|

|

Market Segmentation |

Product Type, End User And Regional. |

|

Laboratory Freezers Market Growth Drivers |

Increasing demand for blood and blood components |

|

Laboratory Freezers Market Growth Opportunities |

Vaccine development for emerging infectious diseases |

|

Report Highlights |

|

|

Geographies Covered |

North America, Europe, APAC, MEA, and Latin America |

The research report categorizes laboratory freezer market to forecast revenue and analyze trends in each of the following submarkets:

Laboratory freezers Market, By Products

-

Freezers

- Ultra Low Temperature Freezers

- Laboratory Freezers

- Plasma Freezers

- Enzyme Freezers

- Explosion-proof Freezers

- Flammable Material Freezers

-

Refrigerators

- Laboratory Refrigerators

- Blood Bank Refrigerators

- Pharmacy Refrigerators

- Flammable Material Refrigerators

- Explosion-proof Refrigerators

- Chromatography Refrigerators

- Cryopreservation Systems

Laboratory Freezers Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Laboratory Freezers Industry:

- In March 2021, Eppendorf AG (Germany) redesigned and upgraded CryoCube F570 to be equipped with future-proof green cooling liquids, green insulation foam, and better performance.

- In March 2021, Helmer Scientific (US) launched the GX Solutions Laboratory & Plasma Freezers for vaccines, medications, blood therapies, and sample storage using the Global Warming Potential (GWP) Technology In January 2021, UnitedHealth Group (US) launched virtual primary care for employees for wellness and routine and chronic condition management.

- In June 2021, B Medical Systems (Luxembourg) partnered with Dr. Reddy’s Laboratories (India) to provide cold chain solutions for the Sputnik V vaccine roll-out in India.

- In May 2021, BioLife Solutions, Inc. (US) acquired Stirling Ultracold (US), a private manufacturer of ultra-low-temperature freezers.

- In February 2021, Follett Products, LLC. (US) entered into a partnership with PHC Corporation of North America (US) to market and sell the PHCbi line of ultra-low-temperature freezers, pharmaceutical-grade refrigerators, and biomedical freezers to Follett’s healthcare customers.

Frequently Asked Questions (FAQ):

What is the size of Laboratory Freezers Market ?

The laboratory freezers market size is projected to reach USD 5.7 billion by 2026, growing at a CAGR of 4.9%.

What are the major growth factors of Laboratory Freezers Market ?

The growth in this market is driven by increasing demand for blood and blood components for transfusion and for support in cancer therapy. Technological advancements in lab freezers also drive the growth of this market.

Who all are the prominent players of Laboratory Freezers Market ?

Key players in the Laboratory Freezers market include Eppendorf AG (Germany), Haier Biomedical (China), Thermo Fisher Scientific, Inc. (US), Helmer Scientific (US), PHC Holdings Corporation (Japan), Liebherr (Switzerland), Middleby Corporation (Follett Products, LLC), Felix Storch, Inc. (US), BioLife Solutions, Inc. (Stirling Ultracold) (US), Blue Star Limited (India), B Medical Systems (Luxembourg), Philipp Kirsch GmbH (Germany), Avantor, Inc. (US), Standex International Corporation (US), Vestfrost Solutions A/S (Denmark), Changhong Meiling Co. Ltd. (China), EVERmed S.R.L. (Italy), ARCTIKO A/S (Denmark), Glen Dimplex Medical Appliances (LEC Medical) (Ireland), So-Low Environmental Equipment Co. Ltd. (US), KW Apparecchi Scientifici SRL (Italy), Jeio Tech (Republic of Korea), Refrigerated Solutions Group (US), Stericox India Private Limited (India), Thalheimer Kühlung (Germany), and Antylia Scientific (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 LABORATORY FREEZERS MARKET SEGMENTATION

FIGURE 2 LABORATORY FREEZERS MARKET, BY REGION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES TO USD

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION: LABORATORY FREEZERS MARKET

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 REVENUE ANALYSIS OF THE TOP 3 PUBLIC COMPANIES: LABORATORY FREEZERS MARKET (2020)

FIGURE 8 BOTTOM-UP APPROACH: US END-USER ANALYSIS – ADOPTION OF BLOOD BANK REFRIGERATORS BY BLOOD BANKS

FIGURE 9 BOTTOM-UP APPROACH: US END-USER ANALYSIS – ADOPTION PATTERN OF PLASMA FREEZERS

FIGURE 10 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE LABORATORY FREEZERS MARKET (2022–2026)

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 12 IMPACT OF COVID-19 ON GROWTH RATES (2019 VS. 2020 VS. 2021)

FIGURE 13 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 14 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: LABORATORY FREEZERS MARKET

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 15 LABORATORY FREEZERS MARKET, BY PRODUCT, 2022 VS. 2026 (USD MILLION)

FIGURE 16 FREEZERS MARKET, BY TYPE, 2022 VS. 2026 (USD MILLION)

FIGURE 17 REFRIGERATORS MARKET, BY TYPE, 2022 VS. 2026 (USD MILLION)

FIGURE 18 LABORATORY FREEZERS MARKET, BY END USER, 2022 VS. 2026 (USD MILLION)

FIGURE 19 GEOGRAPHIC SNAPSHOT: LABORATORY FREEZERS MARKET

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 LABORATORY FREEZERS MARKET OVERVIEW

FIGURE 20 GROWTH IN THE LABORATORY FREEZERS MARKET IS MAINLY DRIVEN BY TECHNOLOGICAL ADVANCEMENTS IN LAB FREEZERS

4.2 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY PRODUCT

FIGURE 21 FREEZERS COMMANDED THE LARGEST SHARE OF THE NORTH AMERICAN LABORATORY FREEZERS MARKET, BY PRODUCT, IN 2020

4.3 LABORATORY FREEZERS MARKET: GEOGRAPHIC MIX

FIGURE 22 CHINA TO WITNESS THE HIGHEST GROWTH IN THE LABORATORY FREEZERS MARKET DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: LABORATORY FREEZERS MARKET

FIGURE 23 NORTH AMERICA DOMINATED THE MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 LABORATORY FREEZERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Rollout of COVID-19 vaccines requiring freezer storage

5.2.1.2 Increasing demand for blood and blood components for transfusion and for support in cancer therapy

FIGURE 25 EUROPE: SOURCE PLASMA COLLECTIONS, 2011–2020 (LITERS)

FIGURE 26 US: SOURCE PLASMA COLLECTIONS, 2011–2020 (LITERS)

5.2.1.3 Growing number of organ transplant procedures

FIGURE 27 US: ORGAN TRANSPLANTS FROM DECEASED AND LIVING DONORS, 2010–2020

FIGURE 28 EUROPEAN UNION: NUMBER OF ORGANS TRANSPLANTED, 2010-2018

5.2.1.4 Technological advancements in laboratory freezers and refrigerators

5.2.2 MARKET RESTRAINTS

5.2.2.1 Growing use of refurbished laboratory freezers

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Vaccine development for emerging infectious diseases

5.2.3.2 Rising growth opportunities in developing countries

5.2.4 MARKET CHALLENGES

5.2.4.1 Lack of awareness of the utility of specialized lab freezers and refrigerators

5.3 SCENARIOS: PESSIMISTIC, REALISTIC, AND OPTIMISTIC

5.3.1 LABORATORY FREEZERS MARKET

5.4 COVID-19 IMPACT ANALYSIS

5.4.1 COVID-19 HEALTH ASSESSMENT

5.5 COVID-19 ECONOMIC ASSESSMENT

5.6 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 29 CRITERIA IMPACTING THE GLOBAL ECONOMY

5.7 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO IN THE LABORATORY FREEZERS MARKET

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES (YC-YCC)

5.8.1 LABORATORY FREEZERS MARKET

5.8.1.1 Revenue sources are shifting towards more environmentally friendly and sustainable solutions

FIGURE 30 REVENUE SHIFT IN THE LABORATORY FREEZERS MARKET

5.9 AVERAGE SELLING PRICE TREND

TABLE 3 PRICES OF LAB FREEZERS/REFRIGERATORS (USD)

TABLE 4 AVERAGE PRICING OF LAB FREEZERS, BY REGION (USD)

5.10 ECOSYSTEM/MARKET MAP

TABLE 5 LABORATORY FREEZERS MARKET: ECOSYSTEM

5.11 VALUE CHAIN ANALYSIS

FIGURE 31 VALUE CHAIN ANALYSIS: LABORATORY FREEZERS MARKET

5.12 PATENT ANALYSIS: ULTRA-LOW-TEMPERATURE FREEZERS

FIGURE 32 MAJOR PATENTS FOR ULTRA-LOW-TEMPERATURE FREEZERS

5.13 CASE STUDY ANALYSIS

5.13.1 CASE STUDY: IMPACT OF ULTRA-LOW-TEMPERATURE FREEZER PERFORMANCE AND USE OF RACKING

5.14 TECHNOLOGICAL ANALYSIS: ULTRA-LOW-TEMPERATURE FREEZERS

5.14.1 KEY TECHNOLOGIES

5.14.1.1 Ultra-low-temperature freezer technology

5.14.2 ADJACENT TECHNOLOGIES

5.14.2.1 Cryopreservation

5.15 REGULATORY LANDSCAPE

5.15.1 US

5.15.2 EUROPEAN UNION

5.16 TRADE ANALYSIS: KEY MARKETS FOR IMPORT/EXPORT (ULTRA-LOW-TEMPERATURE FREEZERS)

5.16.1 EXPORT SCENARIO OF ULTRA-LOW-TEMPERATURE FREEZERS

FIGURE 33 EXPORTS OF ULTRA-LOW-TEMPERATURE FREEZERS, BY COUNTRY, 2019–2020 VS. 2020–2021

5.16.2 IMPORT SCENARIO OF ULTRA-LOW-TEMPERATURE FREEZERS

FIGURE 34 IMPORTS OF ULTRA-LOW-TEMPERATURE FREEZERS, BY COUNTRY, 2019–2020 VS. 2020–2021

5.17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 PORTER’S FIVE FORCES ANALYSIS (2020): LABORATORY FREEZERS MARKET

TABLE 6 LABORATORY FREEZERS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.17.1 THREAT FROM NEW ENTRANTS

5.17.1.1 Large number of local players in the market

5.17.1.2 High capital expenditure

5.17.2 THREAT FROM SUBSTITUTES

5.17.2.1 Use of commercial refrigerators/freezers

5.17.2.2 Dry ice as an alternative to ultra-low-temperature freezers

5.17.3 BARGAINING POWER OF SUPPLIERS

5.17.3.1 Presence of a large number of suppliers & low switching costs

5.17.4 BARGAINING POWER OF BUYERS

5.17.4.1 Buyer focus on quality, sustainability, and maintenance support

5.17.5 INTENSITY OF COMPETITIVE RIVALRY

5.17.5.1 Similar products offered by market players

6 LABORATORY FREEZERS MARKET, BY PRODUCT (Page No. - 86)

6.1 INTRODUCTION

TABLE 7 LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 8 LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 9 LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021(USD MILLION)

TABLE 10 LABORATORY FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.2 FREEZERS

TABLE 11 FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 12 FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

6.2.1 ULTRA-LOW-TEMPERATURE FREEZERS

6.2.1.1 Rising demand for ultra-low-temperature freezers for COVID-19 vaccine storage to drive market growth

TABLE 13 ULTRA-LOW-TEMPERATURE FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 14 ULTRA-LOW-TEMPERATURE FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.2.2 LABORATORY FREEZERS

6.2.2.1 Growing number of diagnostic tests to support the growth of the laboratory freezers market

TABLE 15 LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 16 LABORATORY FREEZERS MARKET, BY REGION, 2022–2026 (USD MILLION)

6.2.3 PLASMA FREEZERS

6.2.3.1 Increasing demand for plasma in therapeutic and research applications to drive growth in this market

TABLE 17 PLASMA FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 18 PLASMA FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.2.4 ENZYME FREEZERS

6.2.4.1 Growing use of enzymes in research and biotechnology applications to drive market growth

TABLE 19 ENZYME FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 20 ENZYME FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.2.5 EXPLOSION-PROOF FREEZERS

6.2.5.1 Growing awareness and safety concerns in hazardous laboratory settings to boost the growth of this market

TABLE 21 EXPLOSION-PROOF FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 22 EXPLOSION-PROOF FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.2.6 FLAMMABLE MATERIAL FREEZERS

6.2.6.1 Need to maintain a safe environment to ensure sample integrity of valuable flammables to boost the growth of this market

TABLE 23 FLAMMABLE MATERIAL FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 24 FLAMMABLE MATERIAL FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3 REFRIGERATORS

TABLE 25 REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 26 REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 27 REFRIGERATORS MARKET, BY COUNTRY, 2019–2021(USD MILLION)

TABLE 28 REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3.1 LABORATORY REFRIGERATORS

6.3.1.1 Need to meet routine laboratory storage requirements and simplify laboratory operations to drive the growth of this market

TABLE 29 LABORATORY REFRIGERATORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 30 LABORATORY REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3.2 BLOOD BANK REFRIGERATORS

6.3.2.1 Need for blood and blood products for transfusion during surgical procedures to promote the growth of this segment

TABLE 31 BLOOD BANK REFRIGERATORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 32 BLOOD BANK REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3.3 PHARMACY REFRIGERATORS

6.3.3.1 Development of an increasing number of innovative drug formulations that require storage under specific temperature conditions is driving the demand for pharmacy refrigerators

TABLE 33 PHARMACY REFRIGERATORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 34 PHARMACY REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3.4 FLAMMABLE MATERIAL REFRIGERATORS

6.3.4.1 Rising awareness on safety standards and practices in the use of flammable materials to drive growth in this market segment

TABLE 35 FLAMMABLE MATERIAL REFRIGERATORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 36 FLAMMABLE MATERIAL REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3.5 EXPLOSION-PROOF REFRIGERATORS

6.3.5.1 Increasing awareness on the importance of maintaining safety in the laboratory workplace to drive the growth of this market

TABLE 37 EXPLOSION-PROOF REFRIGERATORS MARKET, BY COUNTRY, 2019–2021(USD MILLION)

TABLE 38 EXPLOSION-PROOF REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.3.6 CHROMATOGRAPHY REFRIGERATORS

6.3.6.1 Growing number of pharmaceutical and biotechnology companies to propel the growth of the market

TABLE 39 CHROMATOGRAPHY REFRIGERATORS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 40 CHROMATOGRAPHY REFRIGERATORS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

6.4 CRYOPRESERVATION SYSTEMS

6.4.1 NEED FOR APPROPRIATE CRYOPRESERVATION STORAGE SYSTEMS TO ENSURE SAMPLE INTEGRITY TO DRIVE THE GROWTH OF THIS SEGMENT

TABLE 41 CRYOPRESERVATION SYSTEMS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 42 CRYOPRESERVATION SYSTEMS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

7 LABORATORY FREEZERS MARKET, BY END USER (Page No. - 114)

7.1 INTRODUCTION

TABLE 43 LABORATORY FREEZERS MARKET, BY END USER, 2019–2021(USD MILLION)

TABLE 44 LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

7.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

7.2.1 HIGH DEMAND FOR TEMPERATURE-CONTROLLED STORAGE OF PHARMACEUTICALS AND BIOLOGICAL MOLECULES IN THIS END-USER SEGMENT TO DRIVE MARKET GROWTH

TABLE 45 LABORATORY FREEZERS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 46 LABORATORY FREEZERS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2022–2026 (USD MILLION)

7.3 BLOOD BANKS

7.3.1 INCREASING DEMAND FOR WHOLE BLOOD AND BLOOD PRODUCTS DRIVING THE GROWTH OF THIS END-USER SEGMENT

TABLE 47 LABORATORY FREEZERS MARKET FOR BLOOD BANKS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 48 LABORATORY FREEZERS MARKET FOR BLOOD BANKS, BY COUNTRY, 2022–2026 (USD MILLION)

7.4 PHARMACIES

7.4.1 NEED FOR PROPER STORAGE OF VACCINES TO PROPEL THE GROWTH OF THIS END-USER SEGMENT

TABLE 49 LABORATORY FREEZERS MARKET FOR PHARMACIES, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 50 LABORATORY FREEZERS MARKET FOR PHARMACIES, BY COUNTRY, 2022–2026 (USD MILLION)

7.5 ACADEMIC & RESEARCH INSTITUTES

7.5.1 FOCUS ON COVID-19 RESEARCH HAS BOOSTED THE GROWTH OF THIS END-USER SEGMENT

TABLE 51 LABORATORY FREEZERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 52 LABORATORY FREEZERS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2026 (USD MILLION)

7.6 HOSPITALS

7.6.1 INCREASING GOVERNMENT SUPPORT FOR PUBLIC HOSPITALS AND IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO DRIVE GROWTH IN THIS END-USER SEGMENT

TABLE 53 LABORATORY FREEZERS MARKET FOR HOSPITALS, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 54 LABORATORY FREEZERS MARKET FOR HOSPITALS, BY COUNTRY, 2022–2026 (USD MILLION)

7.7 MEDICAL LABORATORIES

7.7.1 RISING VOLUME OF DIAGNOSTIC TESTING IN LABORATORIES TO PROMOTE THE GROWTH OF THIS END-USER SEGMENT

TABLE 55 LABORATORY FREEZERS MARKET FOR MEDICAL LABORATORIES, BY COUNTRY, 2019–2021(USD MILLION)

TABLE 56 LABORATORY FREEZERS MARKET FOR MEDICAL LABORATORIES, BY COUNTRY, 2022–2026 (USD MILLION)

8 LABORATORY FREEZERS MARKET, BY REGION (Page No. - 129)

8.1 INTRODUCTION

TABLE 57 LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 58 LABORATORY FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

FIGURE 36 GEOGRAPHIC SNAPSHOT OF THE LABORATORY FREEZERS MARKET

8.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: LABORATORY FREEZERS MARKET SNAPSHOT

TABLE 59 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 60 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: FREEZERS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 66 NORTH AMERICA: FREEZERS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 67 NORTH AMERICA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 70 NORTH AMERICA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 71 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.2.1 US

8.2.1.1 Growth in the pharmaceutical industry and rising R&D investments to drive market growth in the US

TABLE 73 US: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 74 US: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 75 US: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 76 US: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 77 US: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 78 US: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 79 US: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021(USD MILLION)

TABLE 80 US: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Government funding for research activities and growth in the R&D pharmaceutical sector to boost the laboratory freezers market in Canada

TABLE 81 CANADA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 82 CANADA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 83 CANADA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 84 CANADA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 85 CANADA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 86 CANADA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 87 CANADA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021(USD MILLION)

TABLE 88 CANADA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3 EUROPE

TABLE 89 EUROPE: LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 90 EUROPE: LABORATORY FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

TABLE 91 EUROPE: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 92 EUROPE: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 93 EUROPE: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 94 EUROPE: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 95 EUROPE: FREEZERS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 96 EUROPE: FREEZERS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 97 EUROPE: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 98 EUROPE: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 99 EUROPE: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 100 EUROPE: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 101 EUROPE: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 102 EUROPE: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Favorable public funding and R&D investments to boost the growth of the laboratory freezers market in Germany

TABLE 103 GERMANY: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021(USD MILLION)

TABLE 104 GERMANY: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 105 GERMANY: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 106 GERMANY: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 107 GERMANY: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 108 GERMANY: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 109 GERMANY: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 110 GERMANY: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3.2 FRANCE

8.3.2.1 Growing biotech and pharma industry in the country to promote the growth of the laboratory freezers market

TABLE 111 FRANCE: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 112 FRANCE: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 113 FRANCE: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 114 FRANCE: LABORATORY FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 115 FRANCE: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 116 FRANCE: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 117 FRANCE: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 118 FRANCE: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3.3 UK

8.3.3.1 COVID-19 vaccination programs to boost the growth of the laboratory freezers market in the country

TABLE 119 UK: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 120 UK: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 121 UK: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 122 UK: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 123 UK: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 124 UK: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 125 UK: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 126 UK: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Significant growth of the pharmaceutical industry in the country to propel the growth of the laboratory freezers market

TABLE 127 ITALY: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 128 ITALY: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 129 ITALY: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 130 ITALY: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 131 ITALY: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 132 ITALY: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 133 ITALY: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 134 ITALY: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Economic crisis and debt in the country to inhibit the demand for high-priced lab freezers

TABLE 135 SPAIN: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 136 SPAIN: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 137 SPAIN: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 138 SPAIN: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 139 SPAIN: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 140 SPAIN: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 141 SPAIN: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 142 SPAIN: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 143 ROE: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 144 ROE: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 145 ROE: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 146 ROE: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 147 ROE: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 148 ROE: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 149 ROE: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 150 ROE: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 38 ASIA PACIFIC: LABORATORY FREEZERS MARKET SNAPSHOT

TABLE 151 APAC: LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 152 APAC: LABORATORY FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

TABLE 153 APAC: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 154 APAC: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 155 APAC: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 156 APAC: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 157 APAC: FREEZERS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 158 APAC: FREEZERS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 159 APAC: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 160 APAC: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 161 APAC: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 162 APAC: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 163 APAC: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 164 APAC: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Growing aging population in the country and rapidly growing pharmaceutical industry to propel growth in the laboratory freezers market

TABLE 165 JAPAN: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 166 JAPAN: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 167 JAPAN: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 168 JAPAN: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 169 JAPAN: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 170 JAPAN: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 171 JAPAN: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 172 JAPAN: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.4.2 CHINA

8.4.2.1 Fast-growing pharmaceutical sector and favorable government policies to drive the growth of this market

TABLE 173 CHINA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 174 CHINA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 175 CHINA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 176 CHINA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 177 CHINA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 178 CHINA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 179 CHINA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 180 CHINA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.4.3 INDIA

8.4.3.1 Flourishing pharma and biotech industry to encourage the growth of the laboratory freezers market in India

TABLE 181 INDIA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 182 INDIA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 183 INDIA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 184 INDIA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 185 INDIA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 186 INDIA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 187 INDIA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 188 INDIA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.4.4 REST OF ASIA PACIFIC

TABLE 189 ROAPAC: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 190 ROAPAC: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 191 ROAPAC: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 192 ROAPAC: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 193 ROAPAC: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 194 ROAPAC: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 195 ROAPAC: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 196 ROAPAC: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.5 LATIN AMERICA

TABLE 197 LATIN AMERICA: LABORATORY FREEZERS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 198 LATIN AMERICA: LABORATORY FREEZERS MARKET, BY COUNTRY, 2022–2026 (USD MILLION)

TABLE 199 LATIN AMERICA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 200 LATIN AMERICA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 201 LATIN AMERICA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 202 LATIN AMERICA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 203 LATIN AMERICA: FREEZERS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 204 LATIN AMERICA: FREEZERS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 205 LATIN AMERICA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 206 LATIN AMERICA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 207 LATIN AMERICA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 208 LATIN AMERICA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 209 LATIN AMERICA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Growth in scientific research and increasing public investments to drive market growth in Brazil

TABLE 211 BRAZIL: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 212 BRAZIL: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 213 BRAZIL: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 214 BRAZIL: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 215 BRAZIL: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 216 BRAZIL: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 217 BRAZIL: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 218 BRAZIL: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.5.2 MEXICO

8.5.2.1 Large number of hospitals and healthcare facilities to boost the growth of the laboratory freezers market in Mexico

TABLE 219 MEXICO: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 220 MEXICO: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 221 MEXICO: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 222 MEXICO: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 223 MEXICO: REFRIGERATORS MARKET, BY TYPE, 2019–2021(USD MILLION)

TABLE 224 MEXICO: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 225 MEXICO: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 226 MEXICO: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.5.3 REST OF LATIN AMERICA (ROLA)

TABLE 227 ROLA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 228 ROLA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 229 ROLA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 230 ROLA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 231 ROLA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 232 ROLA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 233 ROLA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 234 ROLA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

8.6.1 GROWING AWARENESS OF HEALTHCARE AND RISING HEALTHCARE EXPENDITURE TO ENCOURAGE MARKET GROWTH

TABLE 235 MIDDLE EAST & AFRICA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

TABLE 236 MIDDLE EAST & AFRICA: LABORATORY FREEZERS MARKET, BY PRODUCT, 2022–2026 (USD MILLION)

TABLE 237 MIDDLE EAST & AFRICA: FREEZERS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 238 MIDDLE EAST & AFRICA: FREEZERS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 239 MIDDLE EAST & AFRICA: FREEZERS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 240 MIDDLE EAST & AFRICA: FREEZERS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 241 MIDDLE EAST & AFRICA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (USD MILLION)

TABLE 242 MIDDLE EAST & AFRICA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (USD MILLION)

TABLE 243 MIDDLE EAST & AFRICA: REFRIGERATORS MARKET, BY TYPE, 2019–2021 (THOUSAND UNITS)

TABLE 244 MIDDLE EAST & AFRICA: REFRIGERATORS MARKET, BY TYPE, 2022–2026 (THOUSAND UNITS)

TABLE 245 MIDDLE EAST & AFRICA: LABORATORY FREEZERS MARKET, BY END USER, 2019–2021 (USD MILLION)

TABLE 246 MIDDLE EAST & AFRICA: LABORATORY FREEZERS MARKET, BY END USER, 2022–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 206)

9.1 INTRODUCTION

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE LABORATORY FREEZERS MARKET

9.3 REVENUE SHARE ANALYSIS

9.3.1 REVENUE ANALYSIS FOR KEY PLAYERS IN THE LABORATORY FREEZERS MARKET

FIGURE 39 REVENUE ANALYSIS FOR KEY PLAYERS IN THE LABORATORY FREEZERS MARKET IN THE PAST 5 YEARS

9.4 MARKET SHARE ANALYSIS

9.4.1 LABORATORY FREEZERS MARKET (2020)

FIGURE 40 SHARE OF LEADING COMPANIES IN THE GLOBAL LABORATORY FREEZERS MARKET (2020)

TABLE 247 LABORATORY FREEZERS MARKET: DEGREE OF COMPETITION

9.5 COMPANY EVALUATION QUADRANT

9.5.1 COMPANY EVALUATION QUADRANT: LABORATORY FREEZERS MARKET

FIGURE 41 GLOBAL LABORATORY FREEZERS MARKET: COMPANY EVALUATION MATRIX, 2020

9.5.1.1 Stars

9.5.1.2 Pervasive players

9.5.1.3 Emerging leaders

9.5.1.4 Participants

9.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2020)

9.6.1 PROGRESSIVE COMPANIES

9.6.2 DYNAMIC COMPANIES

9.6.3 STARTING BLOCKS

9.6.4 RESPONSIVE COMPANIES

FIGURE 42 LABORATORY FREEZERS MARKET: SME/START-UP COMPANY EVALUATION MATRIX, 2020

9.7 COMPETITIVE BENCHMARKING

9.7.1 COMPANY PRODUCT/SERVICE FOOTPRINT (20 COMPANIES)

TABLE 248 COMPANY PRODUCT FOOTPRINT (20 COMPANIES)

TABLE 249 COMPANY END-USER FOOTPRINT (20 COMPANIES)

TABLE 250 COMPANY REGION FOOTPRINT (20 COMPANIES)

9.8 COMPETITIVE SITUATIONS AND TRENDS

9.8.1 PRODUCT LAUNCHES & APPROVALS

TABLE 251 PRODUCT LAUNCHES & APPROVALS (2018–JUNE 2021)

9.8.2 DEALS

TABLE 252 DEALS (2018–JUNE 2021)

9.8.3 OTHER DEVELOPMENTS

TABLE 253 OTHER DEVELOPMENTS (2018–JUNE 2021)

10 COMPANY PROFILES (Page No. - 222)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 THERMO FISHER SCIENTIFIC, INC.

TABLE 254 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 43 COMPANY SNAPSHOT: THERMO FISHER SCIENTIFIC, INC. (2020)

10.1.2 HAIER BIOMEDICAL

TABLE 255 HAIER BIOMEDICAL: BUSINESS OVERVIEW

10.1.3 PHC HOLDINGS CORPORATION

TABLE 256 PHC HOLDINGS CORPORATION: BUSINESS OVERVIEW

10.1.4 EPPENDORF AG

TABLE 257 EPPENDORF AG: BUSINESS OVERVIEW

FIGURE 44 COMPANY SNAPSHOT: EPPENDORF AG (2020)

10.1.5 AVANTOR, INC.

TABLE 258 AVANTOR, INC.: BUSINESS OVERVIEW

FIGURE 45 COMPANY SNAPSHOT: AVANTOR, INC. (2020)

10.1.6 HELMER SCIENTIFIC

TABLE 259 HELMER SCIENTIFIC: BUSINESS OVERVIEW

10.1.7 MIDDLEBY CORPORATION (FOLLETT PRODUCTS, LLC)

TABLE 260 MIDDLEBY CORPORATION: BUSINESS OVERVIEW

FIGURE 46 COMPANY SNAPSHOT: MIDDLEBY CORPORATION (2020)

10.1.8 LIEBHERR

TABLE 261 LIEBHERR: BUSINESS OVERVIEW

FIGURE 47 COMPANY SNAPSHOT: LIEBHERR (2020)

10.1.9 FELIX STORCH, INC.

TABLE 262 FELIX STORCH, INC.: BUSINESS OVERVIEW

10.1.10 BIOLIFE SOLUTIONS, INC. (STIRLING ULTRACOLD)

TABLE 263 BIOLIFE SOLUTIONS, INC.: BUSINESS OVERVIEW

FIGURE 48 COMPANY SNAPSHOT: BIOLIFE SOLUTIONS, INC. (2020)

10.1.11 BLUE STAR LIMITED

TABLE 264 BLUE STAR LIMITED: BUSINESS OVERVIEW

FIGURE 49 COMPANY SNAPSHOT: BLUE STAR LIMITED (2020)

10.1.12 PHILIPP KIRSCH GMBH

TABLE 265 PHILIPP KIRSCH GMBH: BUSINESS OVERVIEW

10.1.13 B MEDICAL SYSTEMS

TABLE 266 B MEDICAL SYSTEMS: BUSINESS OVERVIEW

10.1.14 STANDEX INTERNATIONAL CORPORATION

TABLE 267 STANDEX INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

FIGURE 50 COMPANY SNAPSHOT: STANDEX INTERNATIONAL CORPORATION (2020)

10.1.15 EVERMED S.R.L.

TABLE 268 EVERMED S.R.L.: BUSINESS OVERVIEW

10.1.16 ARCTIKO A/S

TABLE 269 ARCTIKO A/S: BUSINESS OVERVIEW

FIGURE 51 COMPANY SNAPSHOT: ARCTIKO A/S (2019)

10.1.17 VESTFROST SOLUTIONS A/S

TABLE 270 VESTFROST SOLUTIONS A/S: BUSINESS OVERVIEW

10.1.18 GLEN DIMPLEX MEDICAL APPLIANCES (LEC MEDICAL)

TABLE 271 GLEN DIMPLEX MEDICAL APPLIANCES: BUSINESS OVERVIEW

10.2 OTHER EMERGING PLAYERS

10.2.1 SO-LOW ENVIRONMENTAL EQUIPMENT CO. LTD.

TABLE 272 SO-LOW ENVIRONMENTAL CO. LTD.: BUSINESS OVERVIEW

10.2.2 CHANGHONG MEILING CO. LTD.

TABLE 273 CHANGHONG MEILING CO. LTD.: BUSINESS OVERVIEW

FIGURE 52 COMPANY SNAPSHOT: CHANGHONG MEILING CO. LTD. (2020)

10.2.3 KW APPARECCHI SCIENTIFICI SRL

TABLE 274 KW APPARECCHI SCIENTIFICI SRL: BUSINESS OVERVIEW

10.2.4 JEIO TECH

10.2.5 REFRIGERATED SOLUTIONS GROUP

10.2.6 STERICOX INDIA PRIVATE LIMITED

10.2.7 THALHEIMER KÜHLUNG

10.2.8 ANTYLIA SCIENTIFIC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 283)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

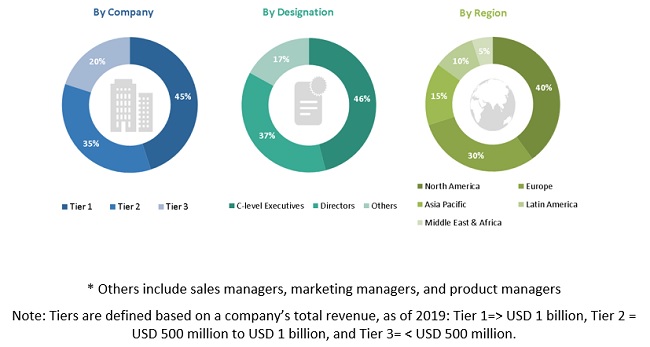

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

Secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the laboratory freezers market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The laboratory freezers market comprises several stakeholders such as laboratory freezers manufacturers, suppliers, and distributors. The demand side of this market includes pharmaceutical & biotechnology companies, medical laboratories, hospitals and clinics, pharmacies, blood banks and research facilities.

Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents for the laboratory freezers market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, by service offering, by end user and by region.

Data Triangulation

After arriving at the market size, the total laboratory freezers market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, analyze, and forecast the size of the laboratory freezers market on the basis of service offering, end user, and region.

- To provide detailed information on the major factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the market segments with respect to North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, expansions, partnerships, agreements, collaborations, acquisitions and other developments in the market.

- To benchmark players within the laboratory freezers market using the Competitive Leadership Mapping framework which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Laboratory freezers market into South Korea, New Zealand, and other countries

Top 10 medical freezers companies involved in the manufacturing and distribution process

- Thermo Fisher Scientific Inc.

- Haier Biomedical

- Eppendorf AG

- Panasonic Healthcare Co., Ltd.

- Philipp Kirsch GmbH

- Helmer Scientific

- Arctiko A/S

- B Medical Systems S.à r.l.

- Labcold Ltd.

- Liebherr-International AG

Top 5 use cases and strategies that the Thermo Fisher Scientific Inc. is employing to grow its business in the medical freezer market

Biobanking and Biopreservation: Thermo Fisher Scientific is targeting the growing demand for biobanking and biopreservation solutions with its range of ultra-low temperature (ULT) freezers, including the Thermo Scientific TSX Series and the Thermo Scientific Forma Series. These freezers are designed to maintain the integrity of biological samples and ensure their long-term preservation, making them ideal for use in research labs, clinical settings, and biobanks.

Vaccine Storage: The company is also focused on serving the needs of vaccine manufacturers and healthcare providers by providing medical freezers that are specifically designed for vaccine storage. These freezers are equipped with advanced temperature control and monitoring features, which help to ensure the safety and efficacy of vaccines.

Laboratory Research: Thermo Fisher Scientific's medical freezers are also used in laboratory research, where they play a critical role in maintaining the integrity of samples and reagents. The company's range of general-purpose and laboratory freezers are designed to provide reliable temperature control, energy efficiency, and sample security.

Blood Bank Storage: Thermo Fisher Scientific is catering to the growing demand for blood bank storage solutions with its range of plasma freezers, platelet storage freezers, and blood bank refrigerators. These products are designed to meet the stringent storage requirements of blood banks, ensuring the safety and efficacy of blood products.

Environmental Sustainability: Thermo Fisher Scientific is committed to reducing the environmental impact of its medical freezers by designing products that are energy-efficient and environmentally friendly. The company's range of energy-efficient medical freezers, such as the Thermo Scientific Revco PLUS Series and the Thermo Scientific HERAfreeze HFC Series, are designed to reduce energy consumption and minimize the use of ozone-depleting refrigerants.

Industries that are expected to impact heavily on the medical freezers market in the future include

Biopharmaceutical industry: The biopharmaceutical industry relies heavily on the use of medical freezers for the storage of various biological materials, such as cell lines, tissues, and reagents. With the growing demand for biologics and personalized medicine, the biopharmaceutical industry is expected to drive the growth of the medical freezers market in the future.

Clinical research organizations (CROs): CROs conduct various clinical trials and research studies that require the use of medical freezers for the storage of biological samples. With the increasing number of clinical trials being conducted globally, the demand for medical freezers is expected to rise in the coming years.

Blood banks: Blood banks require the use of medical freezers to store blood products and other biological samples. As the demand for blood products continues to rise globally, the demand for medical freezers is also expected to increase.

Hospitals and diagnostic laboratories: Hospitals and diagnostic laboratories use medical freezers for the storage of various biological samples, such as serum, plasma, and tissue samples. With the growing number of hospitals and diagnostic laboratories globally, the demand for medical freezers is expected to rise in the future.

Academic and research institutions: Academic and research institutions use medical freezers for the storage of various biological samples, such as DNA, RNA, and proteins. With the increasing focus on research and development activities in the life sciences industry, the demand for medical freezers is expected to rise in academic and research institutions as well.

Hypothetical growth opportunities in the medical freezers market

Increasing demand for personalized medicine: As personalized medicine becomes more prevalent, the need for specialized storage conditions for biological samples will increase, driving the demand for medical freezers.

Growing biobanking industry: The biobanking industry is growing rapidly, with an increasing number of biobanks being established globally. Medical freezers are critical for the storage of biological samples in these biobanks, creating a significant growth opportunity for medical freezer manufacturers.

Expansion of pharmaceutical and biotech industries: The pharmaceutical and biotech industries are expanding rapidly, and there is a growing need for the storage of various drugs, vaccines, and biological samples. This expansion is expected to drive the demand for medical freezers.

Advancements in regenerative medicine: The regenerative medicine field is rapidly growing, and there is a need for specialized storage conditions for stem cells and other biological samples. Medical freezers play a crucial role in the storage of these samples, creating a growth opportunity for manufacturers.

Increasing demand for blood and plasma storage: The demand for blood and plasma storage is expected to increase due to the rising prevalence of chronic diseases and the increasing number of surgeries. Medical freezers are required to maintain the integrity of blood and plasma samples, creating a growth opportunity for manufacturers.

Niche growth drivers for the medical freezers market

Growing demand for personalized medicine: The rise in demand for personalized medicine is increasing the need for high-quality biological samples for research and testing. This is driving the demand for medical freezers, as they provide a reliable and stable storage environment for these samples.

Advancements in technology: The development of new technologies, such as automated sample handling and monitoring systems, are improving the functionality and efficiency of medical freezers. This is making it easier to maintain the quality and integrity of samples, and is increasing the adoption of these systems in research and healthcare settings.

Increasing prevalence of chronic diseases: Chronic diseases, such as cancer and diabetes, are on the rise globally. This is driving the need for more research and development in these areas, which requires the use of high-quality biological samples. Medical freezers are critical for the storage and preservation of these samples.

Growing demand for regenerative medicine: Regenerative medicine is a rapidly growing field that requires the use of high-quality biological samples for research and development. Medical freezers are essential for the storage and preservation of these samples, and the increasing demand for regenerative medicine is driving the growth of the medical freezers market.

Rising demand for blood and blood products: The demand for blood and blood products is increasing globally, and medical freezers are critical for the storage and preservation of these products. This is driving the growth of the medical freezers market, as healthcare facilities and blood banks require high-quality freezers to store these products safely and effectively.

Potential niche threats and restraints that could impact the medical freezers market

Cost: Medical freezers can be expensive, particularly those that offer advanced features such as ultra-low temperatures or precise temperature control. This can make them unaffordable for smaller healthcare facilities or research labs with limited budgets.

Regulatory compliance: Medical freezers are often used to store sensitive materials such as vaccines, blood samples, and tissue samples, and as such, they are subject to strict regulations regarding temperature monitoring, validation, and documentation. Meeting these requirements can be complex and time-consuming, adding to the cost of operating a medical freezer.

Maintenance and repair: Medical freezers require regular maintenance to ensure that they continue to operate correctly and maintain the required temperature ranges. Any malfunction or breakdown can result in the loss of valuable samples or medications, which can be costly and have serious consequences.

Limited storage capacity: Medical freezers come in a range of sizes, but even the largest units have limited storage capacity. This can be a particular issue for healthcare facilities or research labs that need to store large quantities of samples or medications.

Energy consumption: Medical freezers are energy-intensive appliances, which can result in high energy bills. This can be a significant constraint for facilities with limited budgets or those trying to reduce their carbon footprint.

Transportation and logistics: Moving medical freezers can be challenging due to their size, weight, and temperature requirements. This can be a particular issue for facilities that need to transport freezers to remote locations or across borders.

Competition: There are many companies that manufacture medical freezers, which can result in intense competition for market share. This can make it difficult for newer or smaller companies to establish themselves in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Freezers Market