Propanol Market by Type (N-Propanol, Isopropanol), Application (Direct Solvent, Chemical Intermediate, Pharmaceutical, Household & Personal Care), and Region (North America, APAC, Europe, Middle East & Africa, and South America) - Global Forecast to 2023

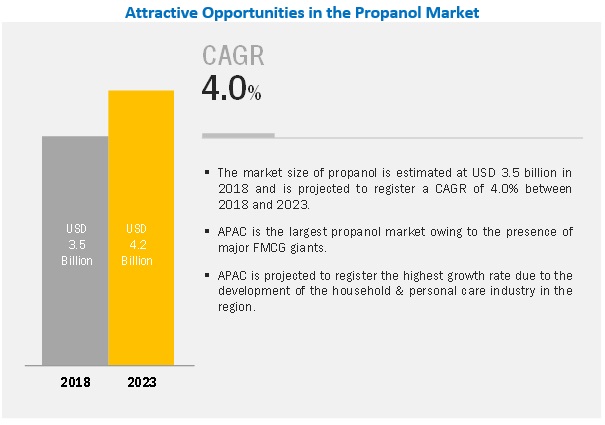

The propanol market is projected to reach USD 4.2 billion by 2023, at a CAGR of 4.0%. The propanol market is majorly driven by the household & personal care and pharmaceutical applications in APAC, mainly from India, China, Japan, South Korea, and Southeast Asian countries. The objective of the report is to define, describe, and forecast the propanol market size based on type (isopropanol, n-propanol), application (isopropanol - direct solvent, chemical intermediates, others), and region.

Isopropanol is estimated to lead the propanol market by type during the forecast period.

Isopropanol is the major type of propanol, which is used as a solvent in diverse applications, such as paints & coatings, pharmaceutical, inks, and household & personal care products, owing to its low cost and easy availability. The increasing demand for these products due to high growth industries such as construction, healthcare, printing, and automotive in the developing regions of APAC, South America, and the Middle East & Africa are expected to drive the demand for propanol.

Direct solvent is estimated to be the largest application of isopropanol.

The direct solvent application is estimated to lead the isopropanol market in 2018. Isopropanol is used as a direct solvent in the manufacturing of paints & coatings, pharmaceuticals, and cosmetics. The increasing consumption of these products owing to the growth of the construction, automotive, healthcare, and beauty care industries is expected to drive the demand for isopropanol. Hence, the increasing demand for isopropanol from these applications is expected to drive the propanol market during the forecast period.

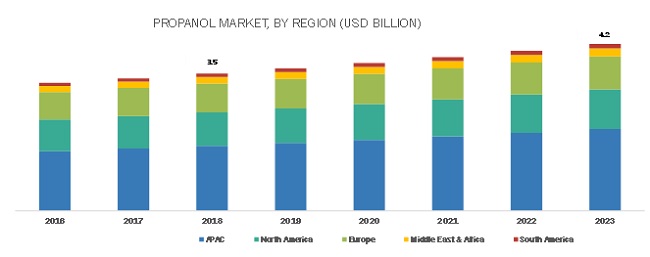

APAC is projected to be the fastest-growing propanol market.

APAC (comprising China, Japan, India, Malaysia, South Korea, and Rest of APAC) is estimated to be the fastest-growing propanol market during the forecast period. The growing construction, automotive, household & personal care, and pharmaceutical industries in the region owing to the growing consumer spending and increasing income levels is expected to boost the demand for propanol. Propanol is commonly used in the construction and automotive industries for paints & coatings applications. Similarly, it is used in household cleaner & beauty products and active pharmaceutical ingredients (API) used in the household & personal care and pharmaceutical industries, respectively.

Market Dynamics

Driver: Increasing demand for paint and coating due to the rapidly growing construction and automotive industries

The construction industry in emerging economies is rapidly developing. This has led to the increased demand for paint and coatings, which, in turn, has boosted the propanol market. N-propanol is used as a solvent in the manufacturing process in the paints & coatings industry. The reason for the development of the construction industry is the increasing urban population in most of the developing regions. According to the World Bank, most of the countries in APAC such as India, Myanmar, Nepal, and Afghanistan have less than 35% of their population living in urban areas. The expected growth of these economies at a promising rate will contribute to the development of the construction industry. In the developing countries, there is an increasing shift of population to tier 1 and metro locations, which is creating a demand for residential construction. According to the Institute of Civil Engineers, the construction output will grow by 85% to USD 15.5 trillion by 2030 globally, with three countries—China, the US, and India—accounting for 57% of the global growth. Thus, the increasing construction industry in these economies will boost the demand for paints & coatings, which, in turn, will drive the global propanol market.

Another major consumer of paints and coatings is the automotive industry. The automotive industry is still suffering from the effects of the recession of 2008, and the demand for new cars is not high. However, it is assumed that the emerging markets such as Latvia, Lithuania, Cyprus, and others of the European Union, South America, and APAC are witnessing consistent growth in the sales of vehicles, which is ultimately boosting the demand for propanol solvents. According to the International Organization of Motor Vehicle Manufacturers (OICA), the Europe region witnessed an increase in vehicle sales in 2017 by 3.9% from 2016, while APAC and South America witnessed 4.3% and 12.3% increase, respectively.

Restraint: Shifting focus toward green solvents due to high VOC emission

VOC emissions and other environmental risks associated with the use of petrochemical-based solvents are restraining the propanol market growth. The environmental risks associated with the petroleum-based solvents have led to the increased adoption of substitutes that utilize fewer amounts of petrochemical-based solvents; for example, the use of water-based paints and coatings instead of solvent-based paints and coatings in construction applications. However, water-based paints do not provide the finish that solvent-based paints provide. This problem can be eliminated by the use of bio & green solvents that have the qualities of petrochemical-based solvents and are VOC-free.

Opportunity: Growing demand for industrial solvents in emerging economies

Solvents are used in industries due to their mixing property with different solids, liquids, or gases. Propanol solvents are widely used in industries such as pharmaceuticals, adhesives, and paint. The rapid increase in industrialization in developing economies globally will provide ample growth opportunities to the propanol manufacturers in the coming years. The increasing consumption of adhesives, paints, pharmaceuticals, and other products in the emerging economies due to factors such as development in construction, automobile, healthcare, and other industries will boost the propanol market in the developing economies.

Challenge: Harmful effects of petrochemical-based solvents

Exposure to propanol solvents causes various types of health hazards. Exposure to n-propyl alcohol or n-propanol can produce mild central nervous system depression, cracking skin, drowsiness, headaches, ataxia, gastrointestinal pain, abdominal cramps, nausea, vomiting, diarrhea, and others. On the other hand, exposure to isopropyl alcohol can cause central nervous system depression; liver, kidney, cardiovascular depression; brain damage; and others. It can also act as poison if accidentally consumed by children. N-propanol is considered to be slightly more toxic than isopropyl alcohol. Thus, the harmful effects of propanol solvents can be a challenge for the market.

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year |

2017 |

|

Forecast period |

2018–2023 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

Type (Iso-propanol, N-propanol), Application ( Direct Solvent, Chemical Intermediate, Household & Personal Care, Pharmaceutical), and Region |

|

Regions |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

Royal Dutch Shell Plc (Netherlands), Exxon Mobil Corporation (US), BASF SE (Germany), The Dow Chemical Company (Japan), LG Chem Ltd. (Seoul), Sasol Limited (South Africa), Eastman Chemical Company (US), Tokuyama Corporation (Japan), LCY Chemical Corp. (Taiwan), JXTG Holdings, Inc. (Japan), Deepak Fertilisers and Petrochemicals Corporation Ltd. (India), and OXEA GmbH (Germany) |

This research report categorizes the propanol market based on type, application, and region.

The Propanol Market, By Type:

- Isopropanol

- N-Propanol

The Propanol Market, By Application (Isopropanol):

- Direct Solvent

- Chemical Intermediate

- Household & Personal Care

- Pharmaceutical

- Others (inks, pesticide formulations, processing solvent in the production of resins, electronic applications, and chemical reagents)

The Propanol Market, By Application (N-Propanol):

- Chemical Intermediate

- Direct Solvent

- Others (deicing fluids, pharmaceutical solvents, and entrainer in azeotropic distillation)

The Propanol Market, By Region

- APAC

- North America

- Europe

- Middle East & Africa

- South America

Key Market Players in Propanol Market

Royal Dutch Shell Plc (Netherlands), Exxon Mobil Corporation (US), BASF SE (Germany), The Dow Chemical Company (US), LG Chem Ltd. (South Korea), Sasol Limited (South Africa), Eastman Chemical Company (US), Tokuyama Corporation (Japan), LCY Chemical Corp. (Taiwan), JXTG Holdings, Inc. (Japan), Deepak Fertilisers and Petrochemicals Corporation Ltd. (India), and OXEA GmbH (Germany) are the key players operating in the propanol market.

Royal Dutch Shell(Netherlands) is one of the leading players in the propanol market, which provides isopropanol. The company operates through three business segments, namely, upstream, integrated gas and new energies, and downstream. It offers isopropanol products through its chemical sub segment that falls under the downstream business segment. This company is a major player operating in the isopropanol market, which caters to industries such as pharmaceutical and household & personal care.

Recent Developments

- In July 2018, OXEA GmbH inaugurated its new propanol production unit in Texas, US. The new production facility will increase the company’s North American production capacity of n-propanol by 75%.

- In March 2017, Royal Dutch Shell established its new technology center in Bangalore, India. Expansion is a part of the company’s strategy to expand its R&D activities in Asia.

- In August 2015, OXEA GmbH launched a new product, namely, n-propanol (biocide quality). The product is specially designed as a base material for biocidal products.

Critical questions the report answers:

- What are the upcoming hot bets for the propanol market?

- What are the market dynamics for different types of propanol?

- What are the market dynamics for different applications of propanol?

- Who are the major manufacturers of isopropanol and n-propanol?

- What are the major factors impacting market growth during the forecast period?

Frequently Asked Questions (FAQ):

How big is the Propanol Market industry?

The propanol market is projected to reach USD 4.2 billion by 2023, at a CAGR of 4.0%.

Who are the leading market players in Propanol industry?

Royal Dutch Shell Plc (Netherlands), Exxon Mobil Corporation (US), BASF SE (Germany), The Dow Chemical Company (US), LG Chem Ltd. (South Korea), Sasol Limited (South Africa), Eastman Chemical Company (US), Tokuyama Corporation (Japan), LCY Chemical Corp. (Taiwan), JXTG Holdings, Inc. (Japan), Deepak Fertilisers and Petrochemicals Corporation Ltd. (India), and OXEA GmbH (Germany) are the leading market players operating in the propanol industry.

What are the factors Influencing the growth of Propanol market?

Increasing demand for paint and coating due to the rapidly growing construction and automotive industries.

How many types of Propanol are available in the market?

Propanol is available in two different types of isomers, namely, isopropanol and n-propanol which are used in various industrial applications. .

Which region show highest growth?

APAC is the most dominating market for Propanol. The market is witnessing a shift of consumption and production capacity from the developed markets to the emerging markets due to economic growth rate, growing manufacturing industries, low-cost labor, easy availability of raw material, and favorable regulatory policies.

Who are the major manufacturers?

Major manufactures include, Royal Dutch Shell Plc (Netherlands), Exxon Mobil Corporation (US), BASF SE (Germany), The Dow Chemical Company (Japan), LG Chem Ltd. (Seoul), Sasol Limited (South Africa), Eastman Chemical Company (US), Tokuyama Corporation (Japan), LCY Chemical Corp. (Taiwan), JXTG Holdings, Inc. (Japan), Deepak Fertilisers and Petrochemicals Corporation Ltd. (India), and OXEA GmbH (Germany) among others.

What is the major application of isopropanol?

Chemical intermediate is the domination application for Isopropanol. As isopropanol is an important precursor used in manufacturing various chemicals such as isopropyl amine, isopropyl esters, and others that are used in various industries.

What is the biggest Restraint for fabric finishing chemical?

VOC emissions and other environmental risks associated with the use of petrochemical-based solvents are restraining the propanol market growth .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

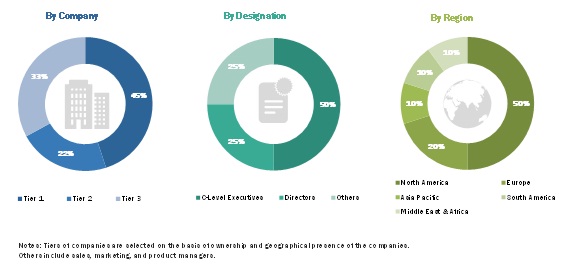

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Propanol Market

4.2 Propanol Market, By Region

4.3 Propanol Market in APAC, By Country and Type

4.4 Propanol Market, Developed vs Developing Economies

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Raw Material Analysis

5.2.1 Ethylene

5.2.2 Syngas

5.2.3 Propylene

5.3 Manufacturing Process

5.3.1 Isopropanol

5.3.2 N-Propanol

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand for Paints and Coatings Due to the Rapidly Growing Construction and Automotive Industries

5.4.1.2 Growing Global Pharmaceutical Industry

5.4.2 Restraints

5.4.2.1 Shifting Focus Toward Green Solvents Due to High Voc Emission

5.4.2.2 Solvent Recycling Technology Affecting the Demand for New Solvents

5.4.3 Opportunities

5.4.3.1 Growing Demand for Industrial Solvents in Emerging Economies

5.4.4 Challenges

5.4.4.1 Harmful Effects of Petrochemical-Based Solvents

5.5 Porter’s Five Forces Analysis

5.5.1 Bargaining Power of Suppliers

5.5.2 Threat of New Entrants

5.5.3 Threat of Substitutes

5.5.4 Bargaining Power of Buyers

5.5.5 Intensity of Competitive Rivalry

5.6 Macroeconomic Indicators

5.6.1 Contribution of the Healthcare Industry to GDP

5.6.2 Contribution of the Construction Industry to GDP

6 Propanol Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Isopropanol

6.2.1 Isopropanol is Expected to Have A High Demand in the Household & Personal Care Application in APAC

6.3 N-Propanol

6.3.1 Increasing Demand for N-Propyl Acetate in APAC is ExpectedTo Affect the Demand for N-Propanol

7 Propanol Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Isopropanol Applications

7.2.1 Direct Solvent

7.2.1.1 Growing Demand for Paints and Coatings is Expected to Boost the Isopropanol Demand as A Direct Solvent

7.2.2 Chemical Intermediate

7.2.2.1 Increasing Demand From Agriculture and Personal Care Industries is Likely to Drive the Chemical Intermediate Segment

7.2.3 Household & Personal Care

7.2.3.1 Growth of the Household & Personal Care Segment is Attributed to the Growing Fmcg Industry

7.2.4 Pharmaceutical

7.2.4.1 The Growing Pharmaceutical Industry is Expected to Increase the Demand for Pharmaceutical Grade Isopropanol

7.2.5 Others

7.3 N-Propanol Applications

7.3.1 Chemical Intermediate

7.3.1.1 Increasing Demand From the Chemical Industry is Expected to Boost the N-Propanol Market

7.3.2 Direct Solvent

7.3.2.1 Growth of the Construction Industry in APAC is Expected to Drive the N-Propanol Market in Its Direct Solvent Application

7.3.3 Others

8 Propanol Market, By Region (Page No. - 59)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Extensive Use of Propanol in the Household & Personal Care Application Will Positively Impact the Market

8.2.2 Japan

8.2.2.1 The Increasing Demand for Beauty and Personal Care Products is Driving the Propanol Market

8.2.3 India

8.2.3.1 The Pharmaceutical and Construction Industries are the Major Consumers of Propanol

8.2.4 Malaysia

8.2.4.1 The Growth of the Construction and Automotive Industries is Expected to Drive the Propanol Market

8.2.5 South Korea

8.2.5.1 The Automotive Industry is the Key Contributor to the Growth of the Propanol Market

8.2.6 Rest of APAC

8.3 North America

8.3.1 US

8.3.1.1 High Demand From the Pharmaceutical, Construction, and Chemical Industries is Propelling the Market

8.3.2 Canada

8.3.2.1 The Household & Personal Care and Chemical Intermediate Applications Have High Demand for Propanol

8.3.3 Mexico

8.3.3.1 The Strong Personal Care Industry in the Country Will Boost the Demand for Isopropanol

8.4 Europe

8.4.1 Germany

8.4.1.1 The Increasing Demand for Propanol in the Chemical Industry is Fueling the Market

8.4.2 France

8.4.2.1 The Increasing Consumption of Paints and Coatings in the Automotive and Aerospace Industries is Augmenting the Propanol Market

8.4.3 UK

8.4.3.1 The Demand From the Fmcg and Printing Industries is Boosting the Propanol Market

8.4.4 Italy

8.4.4.1 Increased Demand for Propanol From Manufacturing Industries is Likely to Facilitate the Market Growth

8.4.5 Russia

8.4.5.1 Growth in Building & Construction Activities and Chemical Production are Driving the Propanol Market

8.4.6 Turkey

8.4.6.1 Increasing Infrastructure Development Will Drive the Demand for Propanol in the Country

8.4.7 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Growth in the Industrial Sector to Increase the End Uses of Propanol

8.5.2 Iran

8.5.2.1 Increasing Petrochemical Production is Likely to Boost the Demand for Propanol

8.5.3 Rest of the Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Increased Disposable Income and Purchasing Power of Consumers are Boosting the Demand for Personal Care Products, Leading to A High Demand for Propanol

8.6.2 Argentina

8.6.2.1 The Economic Transformation of the Country Will Drive the Demand for Propanol

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 103)

9.1 Introduction

9.2 Market Ranking of Isopropanol Manufacturers

9.3 Market Ranking of N-Propanol Manufacturers

9.4 Competitive Scenario

9.4.1 Expansion

9.4.2 New Product Launch

10 Company Profiles (Page No. - 106)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Royal Dutch Shell Plc

10.2 Exxon Mobil Corporation

10.3 BASF SE

10.4 The Dow Chemical Company

10.5 LG Chem Ltd.

10.6 Sasol Limited

10.7 Eastman Chemical Company

10.8 Tokuyama Corporation

10.9 LCY Chemical Corp.

10.10 JXTG Holdings, Inc.

10.11 Deepak Fertilisers and Petrochemicals Corporation Ltd.

10.12 OXEA GmbH

10.13 Other Companies

10.13.1 Carboclor S.A.

10.13.2 ISU Chemical

10.13.3 Lyondellbasell Industries Holdings B.V.

10.13.4 Solvay

10.13.5 Seqens

10.13.6 Dairen Chemical Corporation (DCC)

10.13.7 Tasco Group

10.13.8 A. B. Enterprises

10.13.9 Wenzhou Huaqiao Chemical Reagent Co., Ltd.

10.13.10 KH Chemicals

10.13.11 Tokyo Chemical Industry Co., Ltd.

10.13.12 Zhejiang Xinhua Chemical Co., Ltd.

10.13.13 Mitsui Chemicals, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 132)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (97 Tables)

Table 1 Contribution of Healthcare Spending to GDP, 2015 and 2016 (Percentage)

Table 2 Trend of Growth in the World GDP Per Capita (2016–2022) (USD)

Table 3 Trends and Forecast of the Construction Industry, By Country, 2014–2021 (USD Billion)

Table 4 Propanol Market Size, By Type, 2016–2023 (USD Million)

Table 5 Propanol Market By Size, By Type, 2016–2023 (Kiloton)

Table 6 Isopropanol Market Size, By Region, 2016–2023 (USD Million)

Table 7 Isopropanol Market Size, By Region, 2016–2023 (Kiloton)

Table 8 N-Propanol Market Size, By Region, 2016–2023 (USD Million)

Table 9 N-Propanol Market Size, By Region, 2016–2023 (Kiloton)

Table 10 Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 11 N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 12 Isopropanol Market Size in Direct Solvent Application, By Region, 2016–2023 (USD Million)

Table 13 Isopropanol Market Size in Chemical Intermediate Application, By Region, 2016–2023 (USD Million)

Table 14 Isopropanol Market Size in Household & Personal Care Application, By Region, 2016–2023 (USD Million)

Table 15 Isopropanol Market Size in Pharmaceutical Application, By Region, 2016–2023 (USD Million)

Table 16 Isopropanol Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 17 N-Propanol Market Size in Chemical Intermediate Application, By Region, 2016–2023 (USD Million)

Table 18 N-Propanol Market Size in Direct Solvent Application, By Region, 2016–2023 (USD Million)

Table 19 N-Propanol Market Size in Other Applications, By Region, 2016–2023 (USD Million)

Table 20 Propanol Market Size, By Region, 2016–2023 (USD Million)

Table 21 Propanol Market By Size, By Region, 2016–2023 (Kiloton)

Table 22 APAC: Propanol Market Size, By Country, 2016–2023 (USD Million)

Table 23 APAC: Propanol Market By Size, By Country, 2016–2023 (Kiloton)

Table 24 APAC: Propanol Market By Size, By Type, 2016–2023 (USD Million)

Table 25 APAC: Propanol Market By Size, By Type, 2016–2023 (Kiloton)

Table 26 APAC: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 27 APAC: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 28 China: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 29 China: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 30 Japan: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 31 Japan: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 32 India: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 33 India: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 34 Malaysia: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 35 Malaysia: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 36 South Korea: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 37 South Korea: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 38 Rest of APAC: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 39 Rest of APAC: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 40 North America: Propanol Market Size, By Country, 2016–2023 (USD Million)

Table 41 North America: Propanol Market By Size, By Country, 2016–2023 (Kiloton)

Table 42 North America: Propanol Market By Size, By Type, 2016–2023 (USD Million)

Table 43 North America: Propanol Market By Size, By Type, 2016–2023 (Kiloton)

Table 44 North America: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 45 North America: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 46 US: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 47 US: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 48 Canada: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 49 Canada: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 50 Mexico: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 51 Mexico: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 52 Europe: Propanol Market Size, By Country, 2016–2023 (USD Million)

Table 53 Europe: Propanol Market By Size, By Country, 2016–2023 (Kiloton)

Table 54 Europe: Propanol Market By Size, By Type, 2016–2023 (USD Million)

Table 55 Europe: Propanol Market By Size, By Type, 2016–2023 (Kiloton)

Table 56 Europe: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 57 Europe: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 58 Germany: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 59 Germany: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 60 France: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 61 France: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 62 UK: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 63 UK: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 64 Italy: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 65 Italy: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 66 Russia: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 67 Russia: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 68 Turkey: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 69 Turkey: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 70 Rest of Europe: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 71 Rest of Europe: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 72 Middle East & Africa: Propanol Market Size, By Country, 2016–2023 (USD Million)

Table 73 Middle East & Africa: Propanol Market By Size, By Country, 2016–2023 (Kiloton)

Table 74 Middle East & Africa: Propanol Market By Size, By Type, 2016–2023 (USD Million)

Table 75 Middle East & Africa: Propanol Market By Size, By Type, 2016–2023 (Kiloton)

Table 76 Middle East & Africa: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 77 Middle East & Africa: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 78 Saudi Arabia: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 79 Saudi Arabia: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 80 Iran: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 81 Iran: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 82 Rest of the Middle East & Africa: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 83 Rest of the Middle East & Africa: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 84 South America: Propanol Market Size, By Country, 2016–2023 (USD Million)

Table 85 South America: Propanol Market By Size, By Country, 2016–2023 (Kiloton)

Table 86 South America: Propanol Market By Size, By Type, 2016–2023 (USD Million)

Table 87 South America: Propanol Market By Size, By Type, 2016–2023 (Kiloton)

Table 88 South America: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 89 South America: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 90 Brazil: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 91 Brazil: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 92 Argentina: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 93 Argentina: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 94 Rest of South America: Isopropanol Market Size, By Application, 2016–2023 (USD Million)

Table 95 Rest of South America: N-Propanol Market Size, By Application, 2016–2023 (USD Million)

Table 96 Expansion, 2014–2018

Table 97 New Product Launch, 2014–2018s

List of Figures (51 Figures)

Figure 1 Propanol Market: Research Design

Figure 2 Propanol Market Size Estimation: Top-Down Approach

Figure 3 Propanol Market Size Estimation: Bottom-Up Approach

Figure 4 Propanol Market: Data Triangulation

Figure 5 Isopropanol Was the Larger Type in 2017

Figure 6 Direct Solvent Was the Largest Application of Isopropanol in 2017

Figure 7 Chemical Intermediate Was the Largest Application of N-Propanol in 2017

Figure 8 APAC Was the Largest Market for Propanol in 2017

Figure 9 Growing Household & Personal Care Application to Drive the Market During the Forecast Period

Figure 10 APAC to Be the Fastest-Growing Market Between 2018 and 2023

Figure 11 Isopropanol Was the Larger Type Segment in the APAC Market

Figure 12 Propanol Market to Register High Growth in India and China

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Market

Figure 14 Propanol Market: Porter’s Five Forces Analysis

Figure 15 Isopropanol to Be the Larger Type Segment of the Market

Figure 16 APAC to Be the Largest Market for Isopropanol

Figure 17 APAC to Be the Largest Market for N-Propanol

Figure 18 Direct Solvent to Dominate the Isopropanol Market

Figure 19 Chemical Intermediate to Dominate the N-Propanol Market

Figure 20 APAC to Be the Fastest Market in the Direct Solvent Segment

Figure 21 APAC to Be the Fastest Market in the Chemical Intermediate Segment

Figure 22 APAC to Be the Fastest-Growing Market in the Household & Personal Care Segment

Figure 23 APACto Be the Fastest- Growing Market in the Pharmaceutical Segment

Figure 24 North America to Be the Largest Propanol Market in the Others Segment

Figure 25 APAC to Be the Largest Market in the Chemical Intermediate Segment

Figure 26 APAC to Be the Largest Market in the Direct Solvent Segment

Figure 27 APAC to Be the Largest Market in the Others Segment

Figure 28 APAC is Projected to Register the Highest Cagr in the Propanol Market

Figure 29 APAC: Propanol Market Snapshot

Figure 30 North America: Propanol Market Snapshot

Figure 31 Europe: Propanol Market Snapshot

Figure 32 Middle East & Africa: Propanol Market Snapshot

Figure 33 South America: Propanol Market Snapshot

Figure 34 Ranking of Key Isopropanol Manufacturers in 2017

Figure 35 Ranking of Key N-Propanol Manufacturers in 2017

Figure 36 Royal Dutch Shell Plc: Company Snapshot

Figure 37 Royal Dutch Shell Plc: SWOT Analysis

Figure 38 Exxon Mobil Corporation: Company Snapshot

Figure 39 Exxon Mobil Corporation: SWOT Analysis

Figure 40 BASF SE: Company Snapshot

Figure 41 BASF SE: SWOT Analysis

Figure 42 The Dow Chemical Company: Company Snapshot

Figure 43 The Dow Chemical Company: SWOT Analysis

Figure 44 LG Chem Ltd.: Company Snapshot

Figure 45 LG Chem Ltd.: SWOT Analysis

Figure 46 Sasol Limited: Company Snapshot

Figure 47 Eastman Chemical Company: Company Snapshot

Figure 48 Tokuyama Corporation: Company Snapshot

Figure 49 LCY Chemical Corp.: Company Snapshot

Figure 50 JXTG Holdings, Inc.: Company Snapshot

Figure 51 Deepak Fertilisers and Petrochemicals Corporation Ltd.: Company Snapshot

The study involved four major activities in estimating the current market size for propanol. The exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and sub segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The propanol market comprises several stakeholders such as raw material suppliers, end product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in drug manufacturing, paints & coatings, cosmetics, and FMCG industries. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the propanol market. These methods were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides.

Objectives of the Study:

- To define, describe, and forecast the global propanol market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the propanol market on the basis of type and application

- To analyze and forecast the market size, on the basis of five key regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as expansion and new product launch in the market

- To strategically identify and profile the key market players and analyze their core competencies1 in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the propanol market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Propanol Market

Supply demand scenario of IsoPrapanol maket under Propanol market

Data on market breakdown by product type - 6 Isopropanol Market by application in the APAC region.

Specific information on isopropanol

General information on propanol market