Isoflavones Market by Source (Soy, Red Clover), Application (Pharmaceuticals, Nutraceuticals, Cosmetics, and Food & Beverages), Form (Powder and Liquid), and Region (North America, Europe, Asia Pacific, RoW) – Global Forecast to 2025

Isoflavones are a class of organic compounds related to flavonoids that act as phytoestrogens. They are commonly sourced from soybeans, red clover, chickpeas, green peas, and alfalfa. They find applications in manufacturing cosmetics and various skin care products such as moisturizers and face creams. Isoflavones also find significant applications in the pharmaceutical industry as they are used on a large scale for curing various diseases.

The global isoflavones market is estimated to be valued at USD 1.2 billion in 2019 and is projected to grow at a CAGR of 4.7% to reach USD 1.5 billion during the forecast period. Growth in this market is mainly driven by the increase in incidences of chronic diseases, the rise in the prevalence of cancer, technological advancements in the manufacturing of isoflavones, and the rapidly increasing geriatric population. However, stringent regulatory requirements and unfavorable drug price control policies across various countries are significant factors that are expected to restrain the growth of this market to a certain extent.

By Source, the soy segment is expected to lead the isoflavones market.

Prominent dietary sources of isoflavones include soy milk and plant-based alternatives. Several calcium-fortified soy drinks that are rich in fiber and proteins are given preference in countries such as Germany, France, and Switzerland. The consumption of soy isoflavones as food ingredients or food supplements reduces the risk of breast cancer and growth of cancer cells by reducing the cell mitosis process, which fuels the demand for soy as a major source of isoflavones.

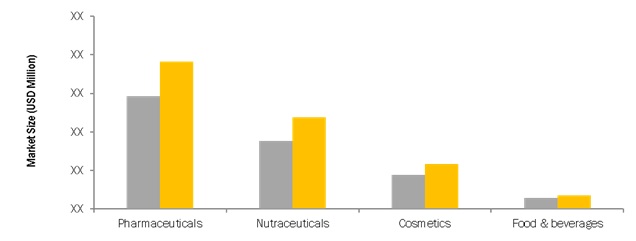

By application, the pharmaceutical segment is projected to account for the largest share during the forecast period.

Based on application, the isoflavones market is segmented into pharmaceuticals, nutraceuticals, cosmetics, and food & beverages. The pharmaceuticals segment accounted for the largest share, owing to its therapeutic and functional properties; isoflavones are used in the treatment for chronic and cardiovascular diseases.

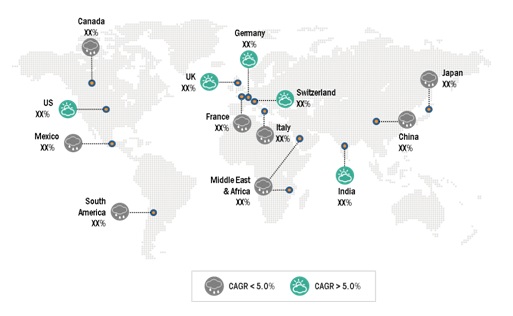

North America to lead the market during the forecast period.

The North American region accounted for the largest share of the isoflavones market. Increasing cases of obesity in North America increase the focus on weight management techniques & attracting consumers toward healthy and natural food products with natural ingredients, thereby propelling the demand for isoflavones in the region.

Market Dynamics

Driver: Prevalence of menopausal issues

Women in their menopause stage experience various issues such as hot flashes, insomnia, and, in numerous cases, sexual dysfunction. Many women prefer supplements containing estrogen, which may significantly increase the risk of blood clots, stroke, or breast or uterine cancer. Thus, estrogen may not be an option for many women, depending on their health and family health history. Women are currently inclining toward supplements with naturally therapeutic ingredients to manage their menopause symptoms with fewer risks. In response to such changing preferences of women, supplement manufacturers have turned to natural alternatives. They have started utilizing soy isoflavones instead of estrogen, as it mimics the estrogen characteristics and provides estrogen effects that aid in reducing menopausal symptoms such as hot flashes and fatigue.

Owing to the rising issues related to menopause and women’s inclination toward supplements with natural alternatives, the demand for isoflavones from the nutraceutical industry is projected to grow in the coming years

Restraint: Stringent regulatory requirements

Isoflavones come under the active pharmaceutical ingredient (API) category; hence, manufacturers have to follow the rules and regulations imposed for all API products.

Pharmaceutical API manufacturers across the globe are witnessing a rise in the demand for APIs, which results in a positive outlook for the market. However, the increasing stringency of regulations is considered as a major restraint that may limit the growth prospects of the market. According to the report, “Fine chemicals stringent regulations prompt return of manufacturing to the west,” published by IHS Chemical Week in January 2015, the demand for APIs is expected to grow at a consistent rate, while the supply of APIs manufactured with international Good Manufacturing Practice (GMP) standards and world-class documentation is not keeping pace with this demand.

Opportunity:Emerging technologies

Some of the recent advancements in drug development include the use of nanotechnology for the synthesis of APIs. The emergence of nanoparticle technologies for efficient delivery of APIs shows promising potential as a novel and efficient approach.

Nanobodies are similar to single-domain antibodies that can bind to specific antigens; however, they are much smaller in size than antibodies. Nanobodies are rapidly becoming an attractive technology platform for pharmaceutical development. Chitosan and Eudragit nanoparticles of Genistein, the predominant isoflavone found in soy products for cancer therapy, have been significantly evaluated for the treatment of chronic diseases in the past few years. The delivery of Genistein-loaded Chitosan and Eudragit S100 loaded polymeric nanoparticles has proven to be a feasible approach to treat cancer.

Similarly, bispecific antibodies, which can bind to two different epitopes either on the same or different target, are attracting the attention of market players. Such emerging technologies have the potential to create attractive opportunities for market players.

Challenge: Less efficiency compared to alternatives

Soy isoflavones can take several weeks or more to reach their maximal benefit. For example, as per Healthline Media (US), a 2015 review found that soy isoflavones take more than 13 weeks to reach just half of their maximum effect. Traditional hormones such as estrogen therapy, on the other hand, take about three weeks to show the same benefit. However, possible adverse effects such as heart attacks and strokes associated with conventional estrogen therapy are projected to enable pharmaceutical and nutraceutical manufacturers to opt for isoflavones derived from natural resources.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2025 |

|

Base year considered |

2018 |

|

Forecast period |

2019-2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Source, Application, Form, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

Key market players including, |

The research report categorizes the Isoflavones Market to forecast the revenues and analyze the trends in each of the following sub-segments:

By Source,

- Soy

- Red Clover

- Others (Green peas, chickpeas and alfalfa)

By Application,

- Pharmaceuticals

- Nutraceuticals

- Cosmetics

- Food & Beverages

By Form,

- Powder

- Liquid

By Region,

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Switzerland

- Rest of Europe

-

Asia Pacific

- China

- Australia

- Rest of Asia Pacific

- RoW

Key Market Players

Cargill (Germany), BASF (Germany), DSM (Netherlands), Shanghai Freemen (US), and ADM (US)

Recent Developments

- In September 2019, Frutarom launched a range of soy ingredients named Organic SoyLife Complex, which is rich in isoflavones.

- In January 2018, ADM opened an innovation center in Singapore. This center would facilitate ingredient development and the application of food, feed, industrial, and energy products.

- In 2018, Shanghai Freemen expanded its presence by establishing Shanghai Freemen Australia as its subsidiary.

Critical questions the report answers

- Which are the key players in the isoflavones market and how intense is the competition?

- What kind of competitors and stakeholders, such as isoflavones companies, would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How will the market drivers, restraints and future opportunities affect the market dynamics?

Frequently Asked Questions (FAQ):

Are the regional drivers included within the report scope?

Yes, the regional drivers are provided

-

North America

-

US

- Rise in Cardiovascular Diseases and Menopausal Issues to Drive the Isoflavones Market

-

Canada

- Well-Established and Constantly Growing Pharmaceuticals Market to Drive the Growth

-

Mexico

- Growing Demand for Supplements with Natural Ingredients to Drive the Growth

-

US

Can we have a separate analysis for the mergers & acquisitions of the established players in the market?

Have you included chickpea as an source in the isoflavones market?

What countries are added in RoW?

We have included

- South America

- Middle East

- African regions

We can provide further bifurcation of these regions by country

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Isoflavones Market

4.2 Isoflavones Market, By Region

4.3 Isoflavones Market, By Application

4.4 Asia Pacific: Isoflavones Market, By Source and Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Rising Prevalence of Cancer and Cardiovascular Diseases

5.1.1.2 Rapidly Increasing Geriatric Population

5.1.1.3 Prevalence of Menopausal Issues

5.1.1.4 Growth in Demand for Fortified Food Owing to the Increasing Health-Consciousness Amongst Consumers

5.1.2 Restraints

5.1.2.1 Stringent Regulatory Requirements

5.1.3 Opportunities

5.1.3.1 Emerging Markets

5.1.3.2 Emerging Technologies

5.1.4 Challenges

5.1.4.1 Less Efficiency Compared to Alternatives

5.2 Adjacent Economies – Market Size (Historical/Forecast)

5.3 YC & YCC Shift

6 Isoflavones Market, By Source (Page No. - 41)

6.1 Introduction

6.2 Soy

6.2.1 Owing to the Nutritional and Functional Health-Related Properties, the Soy Segment is Projected to Dominate the Isoflavones Market

6.3 Red Clover

6.3.1 The Wide Applications of Red Clover in Applications Such as Food & Beverages, Pharmaceuticals, and Nutraceuticals to Drive the Demand

6.4 Others

7 Isoflavones Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Pharmaceuticals

7.3 Nutraceuticals

7.4 Cosmetics

7.5 Food & Beverages

8 Isoflavones Market, By Form (Page No. - 53)

8.1 Introduction

8.2 Powder

8.2.1 Owing to Factors Such as Convenience in Handling, Powdered Isoflavones in Pharmaceutical and Nutraceutical Industries to Witness High Demand

8.3 Liquid

8.3.1 Demand for Liquid Isoflavones From Cosmetic and Nutraceutical Industries to Fuel the Market

9 Isoflavones Market, By Region (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Rise in Cardiovascular Diseases and Menopausal Issues to Drive the Isoflavones Market

9.2.2 Canada

9.2.2.1 Well-Established and Constantly Growing Pharmaceuticals Market to Drive the Growth

9.2.3 Mexico

9.2.3.1 Growing Demand for Supplements With Natural Ingredients to Drive the Growth

9.3 Europe

9.3.1 Switzerland

9.3.1.1 Growing Pharmaceutical Industry With Rising R&D Investment

9.3.2 Germany

9.3.2.1 Growing Pharmaceutical and Nutraceutical Industry to Drive the Growth

9.3.3 France

9.3.3.1 Rise in Sales of Beauty Cosmetic Products as Well as Growing Pharmaceutical Industry to Drive the Demand

9.3.4 UK

9.3.4.1 Rise in Investments in Pharmaceutical Therapeutics to Drive the Market

9.3.5 Italy

9.3.5.1 Rising Consumption of Supplement to Drive the Market

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 Growing Incidences of Chronic Diseases to Drive the Market

9.4.2 Japan

9.4.2.1 Growing Aging Population to Opt for Isoflavone Nutraceutical Supplement

9.4.3 India

9.4.3.1 Growing Instances of Chronic Diseases to Drive the Market

9.4.4 Rest of Asia Pacific

9.5 RoW

9.5.1 South America

9.5.1.1 Growing Nutraceutical, and Functional Food & Beverages Market to Drive the Isoflavone Market

9.5.2 Middle East & Africa

9.5.2.1 Growing Lifestyle-Related Health Concerns, Such as Obesity, and Heart Diseases Market to Drive the Isoflavone Market

10 Competitive Landscape (Page No. - 94)

10.1 Overview

10.2 Competitive Leadership Mapping (Overall Market)

10.2.1 Terminology/Nomenclature

10.2.1.1 Visionary Leaders

10.2.1.2 Innovators

10.2.1.3 Dynamic Differentiators

10.2.1.4 Emerging Companies

10.3 Ranking of Key Players, 2018

11 Company Profiles (Page No. - 97)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

11.1 Cargill

11.2 ADM

11.3 International Flavors and Fragrances (Frutarom)

11.4 BASF

11.5 DSM

11.6 Nexira Inc.

11.7 Shanghai Freemen

11.8 SK Bioland

11.9 Biomax

11.1 Avestia Pharma

11.11 Nutrascience Labs

11.12 Tradichem S.L

11.13 Nutra Green Biotechnology

11.14 Herbo Nutra

11.15 Futureceuticals Inc.

11.16 Bio-Gen Extracts Pvt. Ltd

11.17 Xena Bio Herbals Pvt Ltd.

11.18 Sikko Industries Ltd.

11.19 Shaanxi Hongda Phytochemistry Co Ltd

11.20 Lactonova

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 122)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.1 Author Details

List of Tables (121 Tables)

Table 1 USD Exchange Rates Considered, 2014–2018

Table 2 Global Geriatric Population Statistics

Table 3 Asia: Pharmaceutical Spending Growth, By Country, 2013–2017

Table 4 Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 5 Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 6 Soy Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 7 Soy Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 8 Red Clover Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 9 Red Clover Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 10 Other Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 11 Other Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 12 Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 13 Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 14 Pharmaceuticals: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 15 Pharmaceuticals: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 16 Nutraceuticals: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 17 Nutraceuticals: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 18 Cosmetics: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 19 Cosmetics: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 20 Food & Beverages: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 21 Food & Beverages: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 22 Isoflavones Market Size, By Form, 2017–2025 (USD Million)

Table 23 Isoflavones Market Size, By Form, 2017–2025 (Ton)

Table 24 Powder: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 25 Powder: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 26 Liquid: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 27 Liquid: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 28 Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 29 Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 30 North America: Isoflavones Market Size, By Country, 2017–2025 (USD Million)

Table 31 North America: Isoflavones Market Size, By Country, 2017–2025 (Ton)

Table 32 North America: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 33 North America: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 34 North America: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 35 North America: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 36 North America: Isoflavones Market Size, By Form, 2017–2025 (USD Million)

Table 37 North America: Isoflavones Market Size, By Form, 2017–2025 (Ton)

Table 38 US: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 39 US: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 40 US: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 41 US: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 42 Canada: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 43 Canada: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 44 Canada: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 45 Canada: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 46 Mexico: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 47 Mexico: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 48 Mexico: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 49 Mexico: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 50 Europe: Isoflavones Market Size, By Country, 2017–2025 (USD Million)

Table 51 Europe: Isoflavones Market Size, By Country, 2017–2025 (Ton)

Table 52 Europe: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 53 Europe: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 54 Europe: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 55 Europe: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 56 Europe: Isoflavones Market Size, By Form, 2017–2025 (USD Million)

Table 57 Europe: Isoflavones Market Size, By Form, 2017–2025 (Ton)

Table 58 Switzerland: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 59 Switzerland: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 60 Switzerland: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 61 Switzerland: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 62 Germany: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 63 Germany: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 64 Germany: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 65 Germany: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 66 France: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 67 France: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 68 France: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 69 France: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 70 UK: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 71 UK: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 72 UK: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 73 UK: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 74 Italy: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 75 Italy: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 76 Italy: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 77 Italy: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 78 Rest of Europe: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 79 Rest of Europe: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 80 Rest of Europe: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 81 Rest of Europe: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 82 Asia Pacific: Isoflavones Market Size, By Country, 2017–2025 (USD Million)

Table 83 Asia Pacific: Isoflavones Market Size, By Country, 2017–2025 (Ton)

Table 84 Asia Pacific: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 85 Asia Pacific: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 86 Asia Pacific: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 87 Asia Pacific: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 88 Asia Pacific: Isoflavones Market Size, By Form, 2017–2025 (USD Million)

Table 89 Asia Pacific: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 90 China: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 91 China: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 92 China: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 93 China: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 94 Japan: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 95 Japan: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 96 Japan: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 97 Japan: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 98 India: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 99 India: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 100 India: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 101 India: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 102 Rest of Asia Pacific: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 103 Rest of Asia Pacific: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 104 Rest of Asia Pacific: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 105 Rest of Asia Pacific: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 106 Row: Isoflavones Market Size, By Region, 2017–2025 (USD Million)

Table 107 Row: Isoflavones Market Size, By Region, 2017–2025 (Ton)

Table 108 Row: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 109 Row: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 110 Row: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 111 Row: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 112 Row: Isoflavones Market Size, By Form, 2017–2025 (USD Million)

Table 113 Row: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 114 South America: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 115 South America: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 116 South America: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 117 South America: Isoflavones Market Size, By Application, 2017–2025 (Ton)

Table 118 Middle East & Africa: Isoflavones Market Size, By Source, 2017–2025 (USD Million)

Table 119 Middle East & Africa: Isoflavones Market Size, By Source, 2017–2025 (Ton)

Table 120 Middle East & Africa: Isoflavones Market Size, By Application, 2017–2025 (USD Million)

Table 121 Middle East & Africa: Isoflavones Market Size, By Application, 2017–2025 (Ton)

List of Figures (45 Figures)

Figure 1 Isoflavones Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Isoflavones Market: Research Design

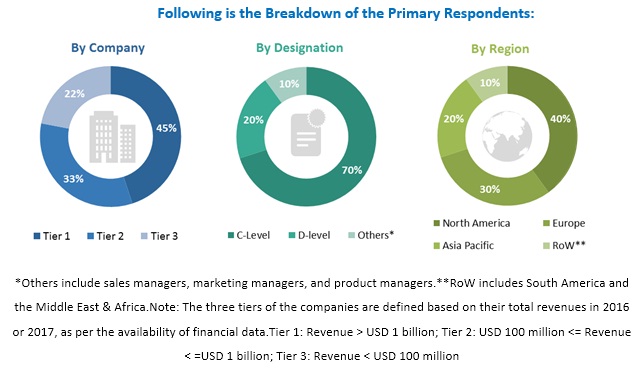

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Isoflavones Market Snapshot, 2017–2025 (USD Million)

Figure 9 Soy Segment to Dominate the Isoflavones Market Through 2025 (USD Million)

Figure 10 Soy Segment is Projected to Dominate the Isoflavones Market Through 2025 (Tons)

Figure 11 Pharmaceuticals Segment to Dominate the Isoflavones Market Through 2025 (USD Million)

Figure 12 Pharmaceuticals Segment to Dominate the Isoflavones Market Through 2025 (Tons)

Figure 13 Powder Segment to Dominate the Isoflavones Market Through 2025 (USD Million)

Figure 14 Powder Segment to Dominate the Isoflavones Market Through 2025 (Tons)

Figure 15 Isoflavones Market Share and Growth (Value), By Region

Figure 16 Growing Instances of Chronic Diseases to Drive the Isoflavones Market

Figure 17 North America to Dominate the Isoflavones Market From 2019 to 2025

Figure 18 Pharmaceuticals Segment to Be the Largest From 2019 to 2025

Figure 19 Soy Segment Accounted for the Largest Share of the Asia Pacific Isoflavones Market in 2018

Figure 20 US, UK, Germany, Switzerland, and India are Projected to Grow at the High Rates During the Forecast Period

Figure 21 Market Dynamics: Isoflavones Market

Figure 22 European Pharmaceuticals Market, 2010–2016

Figure 23 Global Dietary Supplements Market, 2015 vs. 2020

Figure 24 Global Functional Food Market, 2018 vs. 2024

Figure 25 Global Cosmetic Active Ingredients Market, 2013 vs. 2018

Figure 26 YC & YCC Shift – for ADM Company

Figure 27 Soy Segment is Projected to Dominate the Market During the Forecast Period (USD Million)

Figure 28 Pharmaceuticals Segment Projected to Dominate the Market During the Forecast Period (USD Million)

Figure 29 Powder Segment to Dominate the Market During the Forecast Period (USD Million)

Figure 30 Geographic Snapshot: Market Share in Terms of Value, 2019

Figure 31 North America: Market Snapshot

Figure 32 Europe: Market Snapshot

Figure 33 Asia Pacific: Market Snapshot

Figure 34 Global Isoflavones Market: Competitive Leadership Mapping, 2018

Figure 35 Cargill Dominated the Isoflavones Market in 2018

Figure 36 Cargill: Company Snapshot

Figure 37 Cargill Inc.: SWOT Analysis

Figure 38 ADM: Company Snapshot

Figure 39 ADM: SWOT Analysis

Figure 40 International Flavors and Fragrances (Frutarom): Company Snapshot

Figure 41 International Flavors and Fragrances: SWOT Analysis

Figure 42 BASF: Company Snapshot

Figure 43 BASF: SWOT Analysis

Figure 44 DSM: Company Snapshot

Figure 45 DSM: SWOT Analysis

The study involves four major activities to estimate the current market size for isoflavones. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The isoflavones market comprises several stakeholders such as raw material suppliers, Regulatory bodies, including government agencies and NGOs, food importers and exporters, intermediary suppliers (traders and distributors of plant-based sources such as soy , pea, red clover and alfalfa), government and research organizations, associations and industry bodies, venture capitalists and investors.

The rising demand for isoflavones sources characterizes the demand-side of this market. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the isoflavones market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size-using the market size estimation processes, as explained above-the market was split into several segments and subsegments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food industry.

Report Objectives

- To define, segment, and project the global market size for the isoflavones market

- To understand the structure of the isoflavones market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total plant-based beverages market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific isoflavones market, by country

- Further breakdown of other Rest of Europe isoflavones market, by country

- Further breakdown of other Rest of the World isoflavones market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Isoflavones Market

What are the recent changes and developments across the application areas of this Isoflavones market?