IPTV Market by Component (Hardware, Software, Services), Streaming Type, Subscription Type, Transmission Type (Wired, Wireless), Device Type, Application, End User, Vertical, and Region (2022 - 2026)

IPTV Market Size - Global

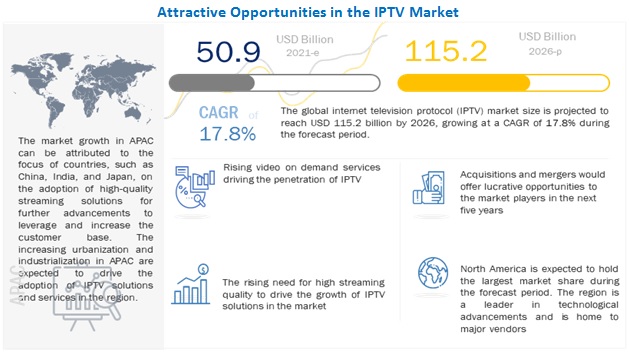

[283 Pages Report] The global IPTV Market size as per revenue was surpassed $50.9 billion in 2021. Throughout the projection period, the IPTV Industry is anticipated to increase at a CAGR of 17.8% to reach a value around $115.2 billion in 2026.

The major factors driving the Internet Protocol Television (IPTV) Market growth are the growing preference for video-on-demand and growing demand for high-definition channels, Increase in internet video advertising, and rising internet penetration.

To know about the assumptions considered for the study, Request for Free Sample Report

IPTV Market Growth Dynamics

Driver: The growing preference for video-on-demand and growing demand for high-definition channels

The demand for value-added services such as high-definition (HD) and video-on-demand (VOD) is driving the growth of the internet protocol television (IPTV) market. Video on Demand (VoD) is one of the innovative features that Internet Protocol TV offers. VoD provides consumers a range of available videos to choose from. The video is transmitted via the real-time streaming protocol. In recent years, VoD has gained tremendous popularity, which has resulted in higher smart TV adoption rates. For instance, in 2019, US providers were the pioneers of VoD users. Amazon Prime Video comes first with 72%, while Netflix is second with 63%. In the same year, 53% of users spent more than USD 11 a month on streaming services; in 2018, the figure was only 43%. Therefore, the growing preference for video-on-demand service is expected to drive the growth of internet protocol television (IPTV). Since there is an increased demand for HD content globally, Internet Protocol Television(IPTV) providers are enhancing their HD offerings to increase their market presence. For instance, IPTV service providers such as AT&T, Verizon, along with the cable video service providers such as Comcast, and Cablevision in the US., are in a fierce race to increase their customer base. Hence, these factors are expected to drive the growth of the global Internet Protocol Television(IPTV)Market during the forecast period.

Restraint: Stringent regulatory norms

The stringent regulatory norms and low content availability are key factors hampering the growth of the IPTV market. Countries have various regulatory frameworks for the quality of video transmission. Regulators have agreed in some jurisdictions that IPTV providers will be subject to the same content regulation levied on paying television providers. For instance, IPTV providers in Singapore are subject to the programming code levied on paying television providers. Internet Protocol Television(IPTV) operators using fixed networks in European countries such as Belgium, France, Sweden, and the UK are subject to “must-carry” regulations that require cable or satellite providers to retransmit local over-the-air television stations signals. Therefore, stringent regulatory norms and low content availability are expected to limit the growth of the IPTV market.

Opportunity: Rising adoption of 5G technology

Rising adoption of 5G technology is expected to drive the market growth during the forecast period. These advanced technologies have leveraged multiple inputs and outputs to ensure maximum utilization of network, reduced distortion, and high precision in signal transmission. In addition, heavy traffic from cloud-based libraries can easily be distributed owing to the high bandwidth capability of 5G technology. The demand for Ultra High Definition (UHD) television is increasing due to an increase in the adoption of 5G technology. These technologies are energy-efficient and provide high-quality video content. The 5G technology also provides ultra-high definition (UHD) viewing experience to the users, thus, in turn, increasing the demand for IPTV.

Challenge: Meeting customer preferences

With the evolution in technology and service offerings, customers are also changing their preferences. Customers are more inclined toward viewing video content rather than television entertainment. The internet has propelled customers to demand high-quality services. The change in technology and customer demand is a challenge faced by service providers and telecommunication operators. To sustain the customer base, content and service providers require proper R&D and capital investments. Customers are volatile, and their requirements are subject to change; therefore, service providers need to address the diversified demands of potential customers to achieve customer satisfaction.

Hardware, by component segment, to account for a larger market size during the forecast period

The Internet Protocol Television(IPTV) Market has been segmented by three components: hardware, software services. The deployment of IPTV has witnessed an increase in adoption, as serves a variety of purposes, such as live streaming and video on demand service. The growing adoption of IPTV across all major verticals, such as media and entertainment, advertising and marketing, telecom and IT, healthcare and medical, gaming, online stores, to fuel the growth of the market. The growing adoption of IPTV across all major verticals, such as retail, manufacturing, telecom and IT, and BFSI, fuel the growth of the Internet Protocol Television(IPTV) Market.

Subscription Free-IPTV, by subscription type segment to account for a larger market size during the forecast period

subscription-free IPTV, service providers must obtain a license for every show or program they choose to provide. Subscription-free IPTV has limited access to content, and in some cases, companies try to make their name in the market by providing free IPTV subscriptions.

Non-linear by application segment to grow at a higher CAGR during the forecast period

The Internet Protocol Television (IPTV) Market has been segmented by application into linear television and non-linear television. Among application, non-linear segment is estimated to account for the largest market during the forecast period. Non-linear TV services deliver media on demand to consumers. They are similar to video on demand services, in which consumers can watch their favourite TV program without waiting for a new episode, unlike traditional TV (linear TV).

Smart TV, device type segment, to grow at a higher CAGR during the forecast period

IPTV is segmented based on three device type: Smartphones and tablets, smart TVs, desktop and laptops. Smart TVs are rapidly evolving globally, with providers, broadcasters, and manufacturers such as STC, Orbit Showtime Network (OSN), and Samsung offering consumers increased access to content through smart devices.

SMEs, by organization size segment, to grow at a higher CAGR during the forecast period

Based on organization size, the Internet Protocol Television Market has been segmented into large enterprises and SMEs. The SMEs segment is expected to grow at a higher during the forecast period. The growing market share of SMEs across verticals, such as healthcare and medical and online stores, is expected to drive the adoption of IPTV and services.

Wired, by transmission type segment, to account for a larger market size during the forecast period

The transmission type in the IPTV market includes wired and wireless. The wired mode is estimated to hold a larger market share in 2021, and the trend is expected to continue throughout the forecast period. The wired mode of transmission is still a traditional way of networking and routing IPTV. Wired networks are also less likely to suffer from interference than wireless networks for IPTV.

Media and entertainment by vertical segment, to account for a larger market size during the forecast period

Internet Protocol Television (IPTV) are gaining acceptance among all verticals to improve profitability and reduce overall costs. The major verticals adopting IPTV and services include media and entertainment, advertising and marketing, gaming, online stores, telecommunication and IT, healthcare and medical, and other verticals. Media and entertainment, by vertical segment, to account for a larger market size during the forecast period The need for high quality streaming solution with low latency is expected to drive the market growth across the media and entertainment vertical.

North America, by region, segment to account for a larger market size during the forecast period

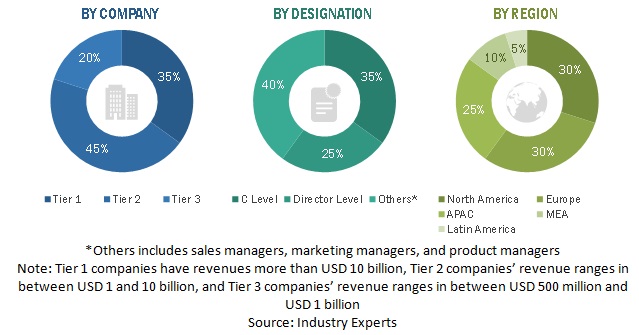

The IPTV market is studied across five major regions: North America, Europe, MEA, APAC, and Latin America. North America is estimated to account for the largest market share during the forecast period. In North America, streaming and video on demand (Vod) services are highly effective by most organizations and verticals. On the other hand, Europe is gradually incorporating these advanced solutions within its enterprises. APAC is witnessing a substantial rise in the adoption of IPTV owing to the increasing digitalization and rising demand for centrally managed systems.

To know about the assumptions considered for the study, download the pdf brochure

Market Interconnection

IPTV Companies

Major IPTV companies include AT&T (US), Verizon Communications (US), Ericsson (Sweden), Akamai Technologies (US), Broadcom Corporation (US), Airtel (India), Deutsche Telekom (Germany), Tripleplay Services (India), MatrixStream Technologies (US), CISCO (US), Huawei (China), Sterlite Technologies (India), Exterity(India), Centurylink (US), Orange S.A (France), Setplex (US), Vytio IPTV Solutions (US), Netup (Russia), Foxtel (Australia), Commscope (US), Teledata (Germany), IQStream IPTV(US), Telebreeze (US), Solid IPTV(Australia), LeezTV (Turkey), Broadpeak TV (France), Aigutech Technologies(India), IPTVPORTAL (Russia). These market players have adopted various growth strategies, such as partnerships, collaborations, and new product launches, to expand have been the most adopted strategies by major players from 2019 to 2021, which helped companies innovate their offerings and broaden their customer base.

Scope of the Report

|

Report Metric |

Details |

|

Market Size in 2021 |

$50.9 billion |

|

Revenue Forecast in 2026 |

$115.2 billion |

|

Largest Market |

North America |

|

CAGR |

17.8% |

|

Growth Drivers |

The growing preference for video-on-demand and growing demand for high-definition channels |

|

Key Opportunities |

Rising adoption of 5G technology |

|

Market Segmentation |

Component (hardware, software, services), streaming type, subscription type(subscription based IPTV and subscription free IPTV), transmission type (wired, wireless), device type, application, end-user, vertical, and region |

|

Market size available for years |

2015–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of IPTV Companies |

AT&T (US), Verizon Communications (US), Ericsson (Sweden), Akamai Technologies (US), Broadcom Corporation (US), Airtel (India), Deutsche Telekom (Germany), Tripleplay Services (India), MatrixStream Technologies (US), CISCO (US), Huawei (China), Sterlite Technologies (India), Exterity(India), Centurylink (US), Orange S.A (France), Setplex (US), Vytio IPTV Solutions (US), Netup (Russia), Foxtel (Australia), Commscope (US), Teledata (Germany), IQStream IPTV(US), Telebreeze (US), Solid IPTV(Australia), LeezTV (Turkey), Broadpeak TV (France), Aigutech Technologies(India), IPTVPORTAL (Russia). |

This research report categorizes the IPTV Market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the IPTV Market has the following segments:

-

Hardware

- Router

- Set-top Box

- Receiver

- Encoder

-

Services

- In-house services

- Managed services

- Software

Based on streaming type, the market has the following segments:

- Non-Video television

- Video television

Based on subscription type, the IPTV Market has the following segments:

- Subscription-based IPTV

- Subscription free IPTV

Based on transmission type, the market has the following segments:

- Wireless

- Wired

Based on device type, the Internet Protocol Television Market has the following segments:

- Smartphones and tablets

- Smart TVs

- Desktops and laptops

Based on application, the market has the following segments:

- Linear Television

- Non-linear Television

Based on end user, the IPTV Market has the following segments:

- SMEs

- Large Enterprises

- Residential customers

Based on vertical, the market has the following segments:

- Advertising and marketing

- Media and entertainment

- Gaming

- Online stores

- Telecom and IT

- Healthcare and medical

- Other Verticals (education and manufacturing).

Based on regions, the IPTV has the following segments

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

MEA

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2021 Fios TV by Verizon Communications added Spanish language regional content. Customers can pick and choose from Región Caribeña (Caribbean), Región Mexicana (Mexico), Región Sudamericana (South America), and Región Española (Spain) for only USD 10 for the first regional package, and USD 5 for each additional region.

- In August 2021 Orange S.A. launched a new concept: Orange TV Lite makes it possible to combine such a streaming account with the regular TV offer, without having to pay a full subscription. Orange TV Lite allows viewers to stream up to 20 TV channels to their smartphones, tablets, and PCs, including via Google Chromecast, without a decoder.

- In April 2021 Exterity, a VITEC company, launched AvediaStream m9605 Media Player. It comes with 4K video and 4K 60fps graphics and animations capability.

- In, May 2021 Orange S.A. offers Acorn TV for Orange TV subscribers of a wide range of drama, mystery, and comedy series and miniseries from the UK, Australia, New Zealand, Ireland, and Canada, in both their Castilian dubbed and subtitled versions.

- In September 2021 Deutsche Telekom partnered with Sky Originals and series from HBO and Showtime will be available to Telekom subscribers via the Sky Ticket service.

Frequently Asked Questions (FAQ):

What is the future for IPTV Market?

What is the IPTV Market Growth?

What are the key opportunities in the IPTV Market?

Which are the top IPTV Companies included in our report?

Who will be the leading hub for IPTV Market?

What is the IPTV Market Segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 INTRODUCTION TO COVID–19

1.2 COVID–19 HEALTH ASSESSMENT

FIGURE 1 COVID–19: GLOBAL PROPAGATION

FIGURE 2 COVID–19 PROPAGATION: SELECT COUNTRIES

1.3 COVID–19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 6 IPTV MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS WITH EXPERTS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 Internet Protocol Television (IPTV) Market SIZE ESTIMATION

FIGURE 7 MARKET: TOP–DOWN AND BOTTOM–UP APPROACHES

2.3.1 TOP–DOWN APPROACH

2.3.2 BOTTOM–UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES OF THE MARKET

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2— BOTTOM–UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOFTWARE/SERVICES OF THE IPTV MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 3, BOTTOM–UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 4, BOTTOM–UP (DEMAND SIDE): SHARE OF IPTV THROUGH OVERALL IPTV SPENDING

2.4 Internet Protocol Television (IPTV) Market FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

TABLE 4 GLOBAL IPTV MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION, Y–O–Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y–O–Y%)

FIGURE 14 HARDWARE SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 15 IN–HOUSE SERVICES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 16 VIDEO IPTV SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 17 SUBSCRIPTION–FREE IPTV SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 18 WIRED TRANSMISSION SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 19 SMARTPHONES AND TABLETS SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 20 NON–LINEAR TELEVISION TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 21 LARGE ENTERPRISES SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 22 MEDIA & ENTERTAINMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 23 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 BRIEF OVERVIEW OF THE IPTV MARKET

FIGURE 24 INCREASING NEED FOR VIDEO ON DEMAND AND HIGH–QUALITY STREAMING SERVICES TO DRIVE THE GROWTH OF THE INTERNET PROTOCOL TELEVISION MARKET

4.2 MARKET: TOP THREE VERTICALS

FIGURE 25 MEDIA & ENTERTAINMENT SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 26 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2020

4.4 NORTH AMERICA: MARKET, BY APPLICATION AND VERTICAL

FIGURE 27 NON–LINEAR TELEVISION AND MEDIA AND ENTERTAINMENT VERTICAL TO ACCOUNT FOR THE LARGEST MARKET SHARES IN 2021

5 Internet Protocol Television (IPTV) Market OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IPTV MARKET

5.2.1 DRIVERS

5.2.1.1 The growing preference for video–on–demand and growing demand for high–definition channels

5.2.1.2 Increase in internet video advertising

5.2.1.3 Rising internet penetration

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory norms

5.2.2.2 Growing threat of video content privacy

5.2.3 OPPORTUNITIES

5.2.3.1 Rising adoption of 5G technology

5.2.3.2 Rising demand for fiber–to–the–home (FTTH) connections

5.2.4 CHALLENGES

5.2.4.1 Meeting customer preferences

5.2.4.2 Technical challenges related to IPTV

5.3 PATENT ANALYSIS

5.3.1 METHODOLOGY

5.3.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED, 2018–2021

5.3.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 29 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.3.3.1 Top applicants

FIGURE 30 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

5.4 CASE STUDY ANALYSIS

5.4.1 SEVEN WEST MEDIA, A MULTIPLATFORM MEDIA COMPANY, WANTED A SOLUTION TO BROADCAST SPORTS EVENTS FOR A LARGE–SCALE AUDIENCE

5.4.2 AFTERBUZZ TV WAS LOOKING FOR A SOLUTION TO DELIVER POSTGAME STREAMING SERVICES

5.4.3 MANCHESTER CITY FOOTBALL CLUB ENHANCING MATCHDAY EXPERIENCE FOR SUPPORTERS

5.4.4 ANSCHUTZ ENTERTAINMENT GROUP (AEG) WAS LOOKING FOR A SOLUTION TO ENHANCE CUSTOMER EXPERIENCE AND TO LOOK FOR MORE REVENUE OPPORTUNITIES

5.4.5 ASTRO WAS LOOKING FOR A SOLUTION THAT WOULD ALLOW CUSTOMERS TO STREAM 4K HDR LIVE SPORTS

5.4.6 MOLA TV WAS LOOKING FOR A SOLUTION THAT WOULD ALLOW CUSTOMERS TO STREAM UHD AND HDR LIVE UEFA EURO 2020 FOOTBALL TOURNAMENT

5.4.7 STARNET WAS LOOKING FOR A SOLUTION THAT WOULD ALLOW USERS TO STREAM HD QUALITY CONTENT

5.4.8 AKNET WAS LOOKING FOR A COST–EFFECTIVE SOLUTION TO DELIVER VALUABLE, AFFORDABLE, AND FLEXIBLE SOLUTIONS TO CUSTOMERS

5.4.9 BRITISH HORSERACING AUTHORITY WAS LOOKING FOR A SOLUTION TO MONITOR CHANNELS EFFECTIVELY

5.4.10 ALVA HOTEL WANTED AN INFOTAINMENT SYSTEM TO DELIVER A SEAMLESS CUSTOMER EXPERIENCE AND ESTABLISH A NEW BENCHMARK IN HOTEL TV EXPERIENCE

5.5 ARCHITECTURE OF A TYPICAL IPTV NETWORK

FIGURE 31 ARCHITECTURE: IPTV NETWORK

5.6 ECOSYSTEM

FIGURE 32 ECOSYSTEM: IPTV MARKET

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 33 SUPPLY CHAIN ANALYSIS

TABLE 7 MARKET: SUPPLY CHAIN

5.8 PRICING MODEL ANALYSIS

TABLE 8 PRICING MODEL

5.9 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 34 Internet Protocol Television (IPTV) Market: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 35 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 9 Internet Protocol Television (IPTV) Market: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 REGULATORY IMPLICATIONS

5.11.1 GENERAL DATA PROTECTION REGULATION

5.11.2 CALIFORNIA CONSUMER PRIVACY ACT

5.11.3 THE TELECOM REGULATORY AUTHORITY OF INDIA ACT, 1997 ACT NO.24 OF 1997

5.11.4 THE TELECOMMUNICATION (BROADCASTING AND CABLE) SERVICES STANDARDS OF QUALITY OF SERVICE AND CONSUMER PROTECTION (ADDRESSABLE SYSTEMS) (THIRD AMENDMENT) REGULATIONS, 2020 (NO. 2 OF 2020)

5.11.5 THE TELECOMMUNICATION (BROADCASTING AND CABLE) SERVICES (EIGHTH) (ADDRESSABLE SYSTEMS) TARIFF (AMENDMENT) ORDER, 2017 (NO. 2 OF 2017)

5.11.6 PERSONAL DATA PROTECTION ACT

5.12 TECHNOLOGY ANALYSIS

5.12.1 ARTIFICIAL INTELLIGENCE, MACHINE LEARNING, AND IPTV

5.12.2 5G AND IPTV

5.13 IPTV MARKET: COVID–19 IMPACT

FIGURE 36 MARKET TO WITNESS GROWTH BETWEEN 2020 AND 2026

6 INTERNET PROTOCOL TELEVISION MARKET, BY COMPONENT (Page No. - 80)

6.1 INTRODUCTION

6.1.1 COMPONENT: COVID–19 IMPACT

FIGURE 37 SOFTWARE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 11 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.1.2 COMPONENT: MARKET DRIVERS

6.2 HARDWARE

TABLE 12 HARDWARE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 13 HARDWARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.1 ROUTER

6.2.2 SET–TOP BOX (STB)

6.2.3 RECEIVER

6.2.4 ENCODER

6.3 SOFTWARE

TABLE 14 SOFTWARE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 15 SOFTWARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 SERVICES

TABLE 16 INTERNET PROTOCOL TELEVISION MARKET SIZE, BY SERVICE TYPE, 2015–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 18 SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 19 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.1 IN–HOUSE SERVICES

TABLE 20 IN–HOUSE SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 IN–HOUSE SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4.2 MANAGED SERVICES

TABLE 22 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 IPTV MARKET, BY STREAMING TYPE (Page No. - 89)

7.1 INTRODUCTION

7.1.1 STREAMING TYPE: COVID–19 IMPACT

FIGURE 38 VIDEO IPTV SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 24 MARKET SIZE, BY STREAMING TYPE, 2015–2020 (USD MILLION)

TABLE 25 MARKET SIZE, BY STREAMING TYPE, 2021–2026 (USD MILLION)

7.1.2 STREAMING TYPE: IPTV MARKET DRIVERS

7.2 NON–VIDEO IPTV

TABLE 26 NON–VIDEO MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 NON–VIDEO MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 VIDEO IPTV

TABLE 28 VIDEO MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 VIDEO MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 IPTV MARKET, BY SUBSCRIPTION TYPE (Page No. - 94)

8.1 INTRODUCTION

8.1.1 SUBSCRIPTION TYPE: COVID–19 IMPACT

FIGURE 39 SUBSCRIPTION–BASED IPTV SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY SUBSCRIPTION TYPE, 2015–2020 (USD MILLION)

TABLE 31 MARKET SIZE, BY SUBSCRIPTION TYPE, 2021–2026 (USD MILLION)

8.1.2 SUBSCRIPTION TYPE: IPTV MARKET DRIVERS

8.2 SUBSCRIPTION–BASED IPTV

TABLE 32 SUBSCRIPTION–BASED MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 33 SUBSCRIPTION–BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SUBSCRIPTION–FREE IPTV

TABLE 34 SUBSCRIPTION–FREE MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 35 SUBSCRIPTION–FREE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 IPTV MARKET, BY TRANSMISSION TYPE (Page No. - 99)

9.1 INTRODUCTION

9.1.1 TRANSMISSION TYPE: COVID–19 IMPACT

FIGURE 40 WIRELESS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 36 MARKET SIZE, BY TRANSMISSION TYPE, 2015–2020 (USD MILLION)

TABLE 37 MARKET SIZE, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

9.1.2 TRANSMISSION TYPE: IPTV MARKET DRIVERS

9.2 WIRELESS

TABLE 38 WIRELESS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 39 WIRELESS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 WIRED

TABLE 40 WIRED MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 WIRED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 INTERNET PROTOCOL TELEVISION (IPTV) MARKET, BY DEVICE TYPE (Page No. - 104)

10.1 INTRODUCTION

10.1.1 DEVICE TYPE: COVID–19 IMPACT

FIGURE 41 SMART TVS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 42 MARKET SIZE, BY DEVICE TYPE, 2015–2020 (USD MILLION)

TABLE 43 MARKET SIZE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

10.1.2 DEVICE TYPE: MARKET DRIVERS

10.2 SMARTPHONES AND TABLETS

TABLE 44 SMARTPHONES AND TABLETS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 45 SMARTPHONES AND TABLETS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 SMART TVS

TABLE 46 SMART TVS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 47 SMART TVS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 DESKTOPS AND LAPTOPS

TABLE 48 DESKTOPS AND LAPTOPS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 49 DESKTOPS AND LAPTOPS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 INTERNET PROTOCOL TELEVISION MARKET, BY APPLICATION (Page No. - 110)

11.1 INTRODUCTION

11.1.1 APPLICATION: COVID–19 IMPACT

11.1.2 APPLICATION: IPTV MARKET DRIVERS

FIGURE 42 NON–LINEAR TV SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 50 MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 LINEAR TELEVISION

TABLE 52 LINEAR TELEVISION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 53 LINEAR TELEVISION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 NON–LINEAR TELEVISION

TABLE 54 NON–LINEAR TELEVISION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 NON–LINEAR TELEVISION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 IPTV MARKET, BY END USER (Page No. - 115)

12.1 INTRODUCTION

12.1.1 END USER: COVID–19 IMPACT

12.1.2 END USER: MARKET DRIVERS

FIGURE 43 SMALL AND MEDIUM ENTERPRISES TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 56 MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 57 MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

12.2 SMALL AND MEDIUM ENTERPRISES

TABLE 58 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 59 SMALL AND MEDIUM ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.3 LARGE ENTERPRISES

TABLE 60 LARGE ENTERPRISES: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 61 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.4 RESIDENTIAL CUSTOMERS

TABLE 62 RESIDENTIAL CUSTOMERS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 63 RESIDENTIAL CUSTOMERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13 IPTV MARKET, BY VERTICAL (Page No. - 121)

13.1 INTRODUCTION

13.1.1 VERTICAL: COVID–19 IMPACT

13.1.2 VERTICAL: IPTV MARKET DRIVERS

FIGURE 44 TELECOMMUNICATION AND IT VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 64 MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 65 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

13.2 ADVERTISING AND MARKETING

TABLE 66 ADVERTISING AND MARKETING: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 67 ADVERTISING AND MARKETING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.3 MEDIA AND ENTERTAINMENT

TABLE 68 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 69 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.4 GAMING

TABLE 70 GAMING: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 71 GAMING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.5 ONLINE STORES

TABLE 72 ONLINE STORES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 73 ONLINE STORES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.6 HEALTHCARE AND MEDICAL

TABLE 74 HEALTHCARE AND MEDICAL: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 75 HEALTHCARE AND MEDICAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.7 TELECOMMUNICATIONS AND IT

TABLE 76 TELECOMMUNICATION AND IT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 77 TELECOMMUNICATION AND IT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

13.8 OTHER VERTICALS

TABLE 78 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 79 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14 INTERNET PROTOCOL TELEVISION MARKET BY REGION (Page No. - 133)

14.1 INTRODUCTION

FIGURE 45 ASIA PACIFIC IS EXPECTED TO HAVE THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 46 INDIA TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 80 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 81 INTERNET PROTOCOL TELEVISION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14.2 NORTH AMERICA

14.2.1 NORTH AMERICA: IPTV MARKET DRIVERS

14.2.2 NORTH AMERICA: COVID–19 IMPACT

14.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

14.2.3.1 Health Insurance Portability and Accountability Act of 1996

14.2.3.2 California Consumer Privacy Act

14.2.3.3 Health Information Technology for Economic and Clinical Health Act

14.2.3.4 Sarbanes–Oxley Act

14.2.3.5 The United States Securities and Exchange Commission

14.2.3.6 International Organization for Standardization 27001

14.2.3.7 California Consumer Privacy Act

14.2.3.8 Federal Information Security Management Act

14.2.3.9 Payment Card Industry Data Security Standard

14.2.3.10 Federal Information Processing Standards

FIGURE 47 INTERNET PROTOCOL TELEVISION MARKET SNAPSHOT: NORTH AMERICA

TABLE 82 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 2015–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY STREAMING TYPE, 2015–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY STREAMING TYPE, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY SUBSCRIPTION TYPE, 2015–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY SUBSCRIPTION TYPE, 2021–2026 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY TRANSMISSION TYPE, 2015–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY DEVICE TYPE, 2015–2020 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

14.2.4 UNITED STATES

TABLE 102 UNITED STATES: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

14.2.5 CANADA

TABLE 106 CANADA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

14.3 EUROPE

14.3.1 EUROPE: IPTV MARKET DRIVERS

14.3.2 EUROPE: COVID–19 IMPACT

14.3.3 EUROPE: REGULATIONS

14.3.3.1 General Data Protection Regulation

14.3.3.2 European Committee for Standardization

14.3.3.3 European Technical Standards Institute

14.3.3.4 Israeli Privacy Protection Regulations (Data Security), 5777–2017

14.3.3.5 Cloud Computing Framework

14.3.3.6 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

14.3.3.7 Protection of Personal Information Act

TABLE 110 EUROPE: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY SERVICE TYPE, 2015–2020 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY STREAMING TYPE, 2015–2020 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY STREAMING TYPE, 2021–2026 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY SUBSCRIPTION TYPE, 2015–2020 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SUBSCRIPTION TYPE, 2021–2026 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY TRANSMISSION TYPE, 2015–2020 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY DEVICE TYPE, 2015–2020 (USD MILLION)

TABLE 121 EUROPE: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

14.3.4 GERMANY

TABLE 130 GERMANY: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 131 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 132 GERMANY: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 133 GERMANY: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

14.3.5 UNITED KINGDOM

14.3.6 FRANCE

14.3.7 REST OF EUROPE

14.4 ASIA PACIFIC

14.4.1 ASIA PACIFIC: IPTV MARKET DRIVERS

14.4.2 ASIA PACIFIC: COVID–19 IMPACT

14.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

14.4.3.1 The Infocomm Media Development Authority (IMDA)

14.4.3.2 The Broadcasting Services Act, 1992 (BSA) Protection of Personal Information

14.4.3.3 India’s Ministry of Information and Broadcasting

14.4.3.4 Advertising Law in China

14.4.3.5 Cyberspace Administration of China

14.4.3.6 National Broadcasting and Telecommunications Commission (NBTC) – Thailand

14.4.3.7 Inland Revenue Authority of Singapore (IRAS)

14.4.3.8 Internet Broadcasting and Section 31D Of Copyright Act 1957 – India

FIGURE 48 INTERNET PROTOCOL TELEVISION MARKET SNAPSHOT: ASIA PACIFIC

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 2015–2020 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY STREAMING TYPE, 2015–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY STREAMING TYPE, 2021–2026 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY SUBSCRIPTION TYPE, 2015–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY SUBSCRIPTION TYPE, 2021–2026 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY TRANSMISSION TYPE, 2015–2020 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

TABLE 144 ASIA PACIFIC: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY DEVICE TYPE, 2015–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

14.4.4 CHINA

TABLE 154 CHINA: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 155 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 156 CHINA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 157 CHINA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

14.4.5 JAPAN

14.4.6 INDIA

14.4.7 REST OF APAC

14.5 MIDDLE EAST AND AFRICA

14.5.1 MIDDLE EAST AND AFRICA: IPTV MARKET DRIVERS

14.5.2 MIDDLE EAST AND AFRICA: COVID–19 IMPACT

14.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

14.5.3.1 Protection of Personal Information (POPI) Act, South Africa

14.5.3.2 Cloud Computing Regulatory Framework, Saudi Arabia

14.5.3.3 The large Telecommunications Regulatory Authority (TRA) – UAE

14.5.3.4 National Media Council (NMC)

14.5.3.5 The Media Zone Authority– Abu Dhabi

TABLE 158 MIDDLE EAST AND AFRICA: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 2015–2020 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY STREAMING TYPE, 2015–2020 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY STREAMING TYPE, 2021–2026 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUBSCRIPTION TYPE, 2015–2020 (USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SUBSCRIPTION TYPE, 2021–2026 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY TRANSMISSION TYPE, 2015–2020 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

TABLE 168 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEVICE TYPE, 2015–2020 (USD MILLION)

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 170 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 171 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: SION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

14.5.4 MIDDLE EAST

14.5.5 AFRICA

14.6 LATIN AMERICA

14.6.1 LATIN AMERICA: IPTV MARKET DRIVERS

14.6.2 LATIN AMERICA: COVID–19 IMPACT

14.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

14.6.3.1 Brazil Data Protection Law

14.6.3.2 Argentina Personal Data Protection Law No. 25.326

14.6.3.3 Federal Law on Protection of Personal Data Held by Individuals

TABLE 178 LATIN AMERICA: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 2015–2020 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY STREAMING TYPE, 2015–2020 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY STREAMING TYPE, 2021–2026 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET SIZE, BY SUBSCRIPTION TYPE, 2015–2020 (USD MILLION)

TABLE 185 LATIN AMERICA: MARKET SIZE, BY SUBSCRIPTION TYPE, 2021–2026 (USD MILLION)

TABLE 186 LATIN AMERICA: MARKET SIZE, BY TRANSMISSION TYPE, 2015–2020 (USD MILLION)

TABLE 187 LATIN AMERICA: INTERNET PROTOCOL TELEVISION MARKET SIZE, BY TRANSMISSION TYPE, 2021–2026 (USD MILLION)

TABLE 188 LATIN AMERICA: MARKET SIZE, BY DEVICE TYPE, 2015–2020 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET SIZE, BY DEVICE TYPE, 2021–2026 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

14.6.4 BRAZIL

14.6.5 MEXICO

14.6.6 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE (Page No. - 194)

15.1 OVERVIEW

15.2 KEY PLAYER STRATEGIES

15.3 MARKET SHARE ANALYSIS

FIGURE 49 IPTV MARKET SHARE ANALYSIS

TABLE 198 MARKET: DEGREE OF COMPETITION

15.4 REVENUE ANALYSIS

FIGURE 50 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

15.5 COMPANY EVALUATION QUADRANT

15.5.1 STARS

15.5.2 EMERGING LEADERS

15.5.3 PERVASIVE PLAYERS

15.5.4 PARTICIPANTS

FIGURE 51 KEY IPTV MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

15.6 COMPETITIVE BENCHMARKING

TABLE 199 COMPANY PRODUCT FOOTPRINT

TABLE 200 COMPANY REGION FOOTPRINT

15.7 STARTUP/SME EVALUATION QUADRANT

15.7.1 PROGRESSIVE COMPANIES

15.7.2 RESPONSIVE COMPANIES

15.7.3 DYNAMIC COMPANIES

15.7.4 STARTING BLOCKS

FIGURE 52 STARTUP/SME IPTV MARKET EVALUATION MATRIX, 2021

15.8 COMPETITIVE SCENARIO

15.8.1 PRODUCT LAUNCHES

TABLE 201 PRODUCT LAUNCHES, JUNE 2019–AUGUST 2021

15.8.2 DEALS

TABLE 202 DEALS, AUGUST 2018– AUGUST 2021

16 COMPANY PROFILES (Page No. - 210)

16.1 INTRODUCTION

16.2 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, COVID-19 Impact, MnM View)*

16.2.1 AT&T

TABLE 203 AT&T: BUSINESS OVERVIEW

FIGURE 53 AT&T: FINANCIAL OVERVIEW

TABLE 204 AT&T: PRODUCTS OFFERED

TABLE 205 AT&T: SERVICES OFFERED

TABLE 206 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 207 AT&T: DEALS

16.2.2 VERIZON COMMUNICATIONS

TABLE 208 VERIZON COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 54 VERIZON COMMUNICATIONS: FINANCIAL OVERVIEW

TABLE 209 VERIZON COMMUNICATIONS: PRODUCTS OFFERED

TABLE 210 VERIZON COMMUNICATIONS: SERVICES OFFERED

TABLE 211 VERIZON COMMUNICATIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 212 VERIZON COMMUNICATIONS: DEALS

16.2.3 ERICSSON

TABLE 213 ERICSSON: BUSINESS OVERVIEW

FIGURE 55 ERICSSON: FINANCIAL OVERVIEW

TABLE 214 ERICSSON: PRODUCTS OFFERED

TABLE 215 ERICSSON: SERVICES OFFERED

TABLE 216 ERICSSON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 217 ERICSSON: DEALS

16.2.4 AKAMAI TECHNOLOGIES

TABLE 218 AKAMAI TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 56 AKAMAI TECHNOLOGIES: FINANCIAL OVERVIEW

TABLE 219 AKAMAI TECHNOLOGIES: PRODUCTS OFFERED

TABLE 220 AKAMAI TECHNOLOGIES: SERVICES OFFERED

TABLE 221 AKAMAI TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 222 AKAMAI TECHNOLOGIES: DEALS

16.2.5 BROADCOM CORPORATION

TABLE 223 BROADCOM CORPORATION: BUSINESS OVERVIEW

FIGURE 57 BROADCOM: FINANCIAL OVERVIEW

TABLE 224 BROADCOM CORPORATION: PRODUCTS OFFERED

TABLE 225 BROADCOM CORPORATION: SERVICES OFFERED

TABLE 226 BROADCOM CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 227 BROADCOM CORPORATION: DEALS

16.2.6 AIRTEL

TABLE 228 AIRTEL: BUSINESS OVERVIEW

FIGURE 58 AIRTEL: FINANCIAL OVERVIEW

TABLE 229 AIRTEL: PRODUCTS OFFERED

TABLE 230 AIRTEL: SERVICES OFFERED

TABLE 231 AIRTEL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 232 AIRTEL: DEALS

16.2.7 DEUTSCHE TELEKOM

TABLE 233 DEUTSCHE TELEKOM: BUSINESS OVERVIEW

FIGURE 59 DEUTSCHE TELEKOM: FINANCIAL OVERVIEW

TABLE 234 DEUTSCHE TELEKOM: PRODUCTS OFFERED

TABLE 235 DEUTSCHE TELEKOM: SERVICES OFFERED

TABLE 236 DEUTSCHE TELEKOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 237 DEUTSCHE TELEKOM: DEALS

16.2.8 TRIPLE PLAY SERVICES

TABLE 238 TRIPLE PLAY SERVICES: BUSINESS OVERVIEW

TABLE 239 TRIPLE PLAY SERVICES: PRODUCTS OFFERED

TABLE 240 TRIPLE PLAY SERVICES: SERVICES OFFERED

16.2.9 MATRIXSTREAM TECHNOLOGIES

TABLE 241 MATRIXSTREAM TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 242 MATRIXSTREAM TECHNOLOGIES: PRODUCTS OFFERED

TABLE 243 MATRIXSTREAM TECHNOLOGIES: SERVICES OFFERED

TABLE 244 MATRIXSTREAM TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 245 MATRIXSTREAM TECHNOLOGIES: DEALS

16.2.10 CISCO

TABLE 246 CISCO: BUSINESS OVERVIEW

FIGURE 60 CISCO: FINANCIAL OVERVIEW

TABLE 247 CISCO: PRODUCTS OFFERED

TABLE 248 CISCO: SERVICES OFFERED

TABLE 249 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 250 CISCO: DEALS

16.2.11 HUAWEI

TABLE 251 HUAWEI: BUSINESS OVERVIEW

FIGURE 61 HUAWEI: FINANCIAL OVERVIEW

TABLE 252 HUAWEI: PRODUCTS OFFERED

TABLE 253 HUAWEI: SERVICES OFFERED

TABLE 254 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 255 HUAWEI: DEALS

16.2.12 STERLITE TECHNOLOGIES

TABLE 256 STERLITE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 62 STERLITE TECHNOLOGIES: FINANCIAL OVERVIEW

TABLE 257 STERLITE TECHNOLOGIES: PRODUCTS OFFERED

TABLE 258 STERLITE TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 259 STERLITE TECHNOLOGIES: DEALS

16.2.13 EXTERITY

TABLE 260 EXTERITY: BUSINESS OVERVIEW

TABLE 261 EXTERITY: PRODUCTS OFFERED

TABLE 262 EXTERITY: SERVICES OFFERED

TABLE 263 EXTERITY: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 264 EXTERITY: DEALS

16.2.14 CENTURYLINK (LUMEN TECHNOLOGIES)

TABLE 265 CENTURYLINK: BUSINESS OVERVIEW

TABLE 266 CENTURYLINK: PRODUCTS OFFERED

TABLE 267 CENTURYLINK: SERVICES OFFERED

TABLE 268 CENTURY LINK: PRODUCT LAUNCHES AND ENHANCEMENTS

16.2.15 ORANGE S.A.

TABLE 269 ORANGE S.A.: BUSINESS OVERVIEW

FIGURE 63 ORANGE S.A.: FINANCIAL OVERVIEW

TABLE 270 ORANGE: PRODUCTS OFFERED

TABLE 271 ORANGE S.A.: SERVICES OFFERED

TABLE 272 ORANGE S.A.: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 ORANGE S.A.: DEALS

16.2.16 SETPLEX

16.2.17 VYTIO IPTV SOLUTIONS

16.2.18 NETUP

16.2.19 FOXTEL

16.2.20 COMMSCOPE

16.2.21 TELEDATA

16.2.22 IQSTREAM IPTV

16.2.23 TELEBREEZE

16.2.24 SOLID IPTV

16.2.25 LEEZTV

16.2.26 BROADPEAK TV

16.2.27 AIGUTECH TECHNOLOGIES

16.2.28 IPTVPORTAL

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, COVID-19 Impact, MnM View might not be captured in case of unlisted companies.

17 ADJACENT AND RELATED MARKETS (Page No. - 269)

17.1 VIDEO ON DEMAND MARKET—GLOBAL FORECAST TO 2024

17.1.1 MARKET DEFINITION

17.1.2 MARKET OVERVIEW

17.1.2.1 Video on demand market, by component

TABLE 274 VIDEO ON DEMAND MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

17.1.2.2 Video on demand market, by monetization model

TABLE 275 VIDEO ON DEMAND MARKET SIZE, BY MONETIZATION MODEL, 2017–2024 (USD MILLION)

17.1.2.3 Video on demand market, by industry vertical

TABLE 276 VIDEO ON DEMAND MARKET SIZE, BY INDUSTRY VERTICAL, 2017–2024 (USD MILLION)

17.1.2.4 Video on demand market, by region

TABLE 277 VIDEO ON DEMAND MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

17.2 OVER–THE–TOP (OTT) SERVICES MARKET

17.2.1 MARKET DEFINITION

17.2.2 MARKET OVERVIEW

17.2.2.1 OTT services market, by monetization model

TABLE 278 OVER–THE–TOP SERVICES MARKET SIZE, BY MONETIZATION MODEL, 2017–2024 (USD MILLION)

17.2.2.2 OTT services market, by streaming device

TABLE 279 OVER–THE–TOP SERVICES MARKET SIZE, BY STREAMING DEVICE, 2017–2024 (USD MILLION)

17.2.2.3 OTT services market, by type

TABLE 280 OVER–THE–TOP SERVICES MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

17.2.2.4 OTT services market, by service vertical

TABLE 281 OVER–THE–TOP SERVICES MARKET SIZE, BY SERVICE VERTICAL, 2017–2024 (USD MILLION)

17.2.2.5 OTT services market, by region

TABLE 282 OVER–THE–TOP SERVICES MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

18 APPENDIX (Page No. - 275)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORTS

18.5 AUTHOR DETAILS

The research study for the IPTV tools market report involved the use of extensive secondary sources, directories, as well as several journals and magazines, to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering IPTV and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of IPTV vendors; white papers, certified publications, and articles from recognized industry associations; statistics bureaus; and government publishing sources. The secondary research was carried out to obtain key information about the industry’s value and supply chain, the total pool of key players, market classifications, and segmentations from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the IPTV market ecosystem were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives of various vendors providing IPTV, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global IPTV market and estimate the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research and their revenue contributions in the respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global IPTV Market with COVID-19 Impact Analysis, By Component (Hardware, Software, Services), Streaming Type, Subscription Type, transmission type (Wired, Wireless), device type, application, end User, vertical, and region from 2021 to 2026, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall IPTV market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IPTV Market

which factors drives growth in iptv market?

Report contain all statistical data on IPTV market, and covers the market trends and growth factors with respect to IPTV. It also covers competitive landscape. IPTV Market report would help you in gauging economic feasibility of your project plans for entry/expansion, compare past growth to the projections and the factors influencing it, and conducting a competitive analysis.