IoT Professional Services Market by Service type (IoT consulting, IoT Infrastructure, System Designing and Integration, Support and Maintenance, Education and Training), Organization Size, Deployment Type, Application & Region - Global Forecast to 2027

IoT Professional Services Market Size, Share and Forecast

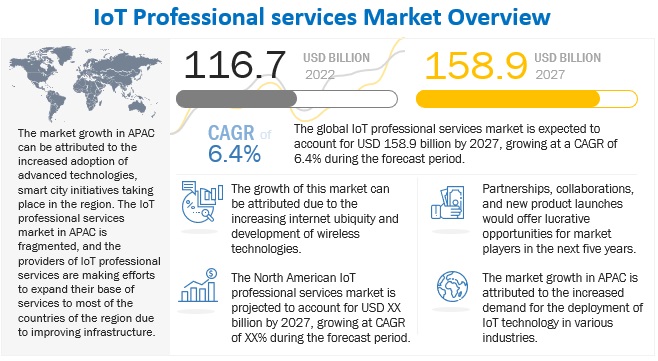

The global IoT professional services market is expected to account for USD 158.9 billion by 2027 from USD 116.7 billion by 2022, growing at a CAGR of 6.4% during the forecast period.

Upcoming technologies driving market for IoT Professional services

The worldwide IoT market is anticipated to develop rapidly with the introduction of 5G, Wi-Fi 6 and IoT based products, opening up new growth opportunities for IoT professional services. According to Ericsson, 160 million 5G devices are anticipated to be in use by 2020. By 2025, there will be 2.6 billion 5G subscriptions, covering up to 65% of the world's population and producing 45% of all mobile data traffic.

Growing requirement of IoT due to upcoming Smart cities

In the forthcoming years, IoT development is anticipated to be driven by smart city initiatives. Infrastructure, utilities, and transportation are all projected to use more IoT devices and systems. Government initiatives are anticipated to increase the use of IoT devices, which will increase the reliance of businesses on professional services for deployment and subsequent maintenance.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing need for IoT and data analytics

The usage of data processing and analytics has grown significantly in recent years. Additionally, IoT is used by big data analytics tools to acquire data. The importance of big data in IoT becomes crucial when the entire IoT system functions as a data processing platform. In the Internet of Things (IoT), big data analytics is a powerful method for analyzing data generated by connected devices that enables individuals take control to enhance decision-making. The demand for real-time data and data on a product's lifecycle in business decision-making is expected to drive the growth of the loT industry.

Restraint: Unavailability of talent

Although IoT technology adoption has accelerated across several industries, one of the primary causes of the technology's disrupted adoption is a shortage of qualified personnel and limited understanding of the IoT ecosystem. The industrial sector is still in the process of discovering and developing IoT. As a result, due to the nature of the technologies, there are extremely limited qualified and experienced experts on these. Understanding these technologies is quite challenging since IoT refers to the synchronicity of every component of the system and the alignment of numerous sensors. As a result, the market's growth is constrained because there aren't many IoT professionals available who are skilled at accommodating these technologies at once.

Opportunity: Increasing demand for IoT-enabled digital transformation of businesses

IoT, a crucial technology for digital transformation, enables companies to improve operational efficiency. The requirement for business digital transformation is being fueled by a few technologies, including edge computing, cloud computing, and big data analytics. IoT professional service providers have been forced to restructure their current IoT professional services offerings in response to the rising demand for business digitization. The growing acceptance of new technologies encourages enterprises to choose IoT-based digital transformation.

Challenge: Changing Regulations

With the rising global demand for connected devices, IoT markets are developing quickly. Numerous startups and business owners have started investing in IoT solutions because of this market's explosive growth. But as data sharing amongst devices continues, it becomes imperative to abide by evolving governmental laws and regulations. Implementing such standards does not come without its challenges for businesses. Regulation complexity, regulatory burden, and organization size can all be hurdles in markets growth and expansion.

Based on deployment type, the cloud segment is projected to account for the highest CAGR during the forecast period

By switching to cloud services from legacy systems, many organizations have seen a significant decrease in licensing and service costs. It has been discovered that switching platforms to the cloud is frequently far less expensive than having their legacy apps' licenses renewed. For businesses these benefits from cloud adoption leads to a very healthy return on investment since these savings could be invested elsewhere for higher returns and is considered a key driving factor for rapid adoption.

Based on application, Smart transport and logistics segment is projected to account for the highest CAGR during the forecast period.

To deliver real-time online information about traffic flow, asset tracking, and passengers/commuters, smart transport and logistics blend upcoming technologies with the already-existing infrastructure of transportation and logistics. Additionally, it is utilized for inventory management, fleet management, passenger information system management, freight management, cargo and container tracking, traffic management, supply chain and logistics management, ticketing administration, and parking management. IoT professional services assist businesses in the logistics and transportation industries to implement IoT technical solutions to achieve efficiency.

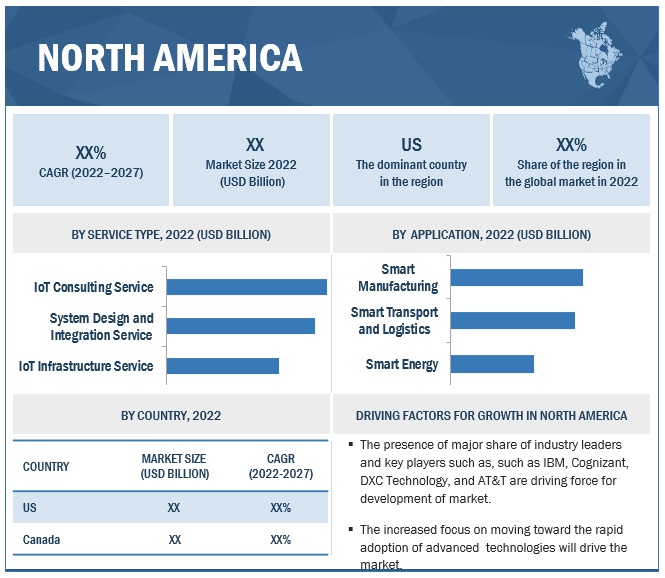

By Region, North America to account for the largest market size during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the largest market size during the forecast period

Several significant manufacturers of IoT hardware, software platforms, and 5G network operators are based in North America. While incumbents in a number of industries and industry verticals, including manufacturing, energy & utilities, and oil & gas, among others, are being compelled by technological innovations to invest aggressively in the latest cutting edge technologies, several governments in the region are also considering smart city projects, which is encouraging for the development of the regional market over the course of the forecast period.

Market Players

The report includes the study of key players offering IoT Professional services market offerings. It profiles major vendors in the global IoT Professional services market. The major vendors include Accenture (Ireland), Atos (France), IBM (US), Cognizant (US), DXC Technology (US), Deloitte (UK), Capgemini (France), TCS (India), NTT DATA (Japan), Infosys (India), AT&T (US), Wipro (India), General Electric (US), Honeywell (US), Oracle (US), HCL Technologies (India), EY (UK), Unisys (US), Vodafone (UK), Tech Mahindra (India), Happiest Minds (India), Mindtree (India), Prodapt (India), Siemens Advanta Consulting ( Germany), ORBCOMM (US), PureSoftware (India), Velvetech (US), Jaarvis (Australia), Eseye (UK), Cuelogic (US). These vendors have a strong foothold in local and global markets due to their strong product portfolios and well-established strategic alliances. Besides, in the unorganized sector, there are several vendors who collectively hold a considerable share in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Service type (IoT consulting, IoT Infrastructure, System Designing and Integration, Support and Maintenance, Education and Training), Organization Size, Deployment Type, Application and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Accenture (Ireland), Atos (France), IBM (US), Cognizant (US), DXC Technology (US), Deloitte (UK), Capgemini (France), TCS (India), NTT DATA (Japan), Infosys (India), AT&T (US), Wipro (India), General Electric (US), Honeywell (US), Oracle (US), HCL Technologies (India), EY (UK), Unisys (US), Vodafone (UK), Tech Mahindra (India), Happiest Minds (India), Mindtree (India), Prodapt (India), Siemens Advanta Consulting ( Germany), ORBCOMM (US), PureSoftware (India), Velvetech (US), Jaarvis (Australia), Eseye (UK), Cuelogic (US). |

This research report categorizes the IoT Professional services market to forecast revenues and analyze trends in each of the following submarkets:

Based on Service type, the IoT Professional services market has the following segments:

- IoT consulting

- IoT Infrastructure

- System Designing and Integration

- Support and Maintenance

- Education and Training

Based on Organization Size, the market has the following segments:

- SMEs

- Large Enterprises

Based on Deployment Type, the IoT Professional services market has the following segments:

- On-Premises

- Cloud

Based on Application, the market has the following segments:

- Smart Buildings

- Smart Manufacturing

- Smart Transport and Logistics

- Smart Healthcare

- Smart Retail

- Smart Energy

Based on regions, the IoT Professional services market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Nordics

- Rest of Europe

-

APAC

- China

- Japan

- India

- ANZ

- SEA

- Rest of APAC

-

MEA

- United Arab Emirates

- Kingdom of Saudi Arabia

- Rest of Middle East

-

South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In Aug 2022, Achieving the Compliance and Privacy distinction in the AWS Security Competency differentiates TCS as an AWS Partner that provides specialized consulting services designed to help the largest global enterprises adopt, develop and deploy security into their AWS environments increasing their overall security posture on AWS.

- In Feb 2021, Cognizant acquired Magenic Technologies, a privately held custom software development services company headquartered in Minneapolis, Minnesota.

- In Nov 2019, DXC Technology launched Managed Multi-Cloud Services, powered by VMware, which transforms managed services delivery across any cloud. The new service provides consistent service management at scale and enables clients to maximize investments in VMware for a significant multi-cloud competitive advantage. The service accelerates time to market, automates managed services and asset delivery, and helps optimize costs.

- In Jan 2021, TCS introduced a curated version of its Cloud Assurance Platform services for organizations embarking on cloud migration or modernization with Microsoft Azure. Complex cloud modernization programs carry risks, ranging from infrastructure configuration and application integration issues to performance bottlenecks. TCS’ Cloud Assurance Platform services address these issues.

- In Dec 2020, AT&T extended its collaboration with Nokia to support global enterprise customers with IoT connectivity using its Worldwide IoT Network Grid (WING) solution and IoT ecosystem.

Frequently Asked Questions (FAQ):

What is the projected market value of the global IoT Professional services market?

The global IoT professional services market is expected to account for USD 158.9 billion by 2027, growing at a CAGR of 6.4% during the forecast period.

Which region has the highest market share in the IoT Professional services market?

North America is expected to hold the largest market share in the IoT Professional services market. The region being an early adopter of technologies with major investments in R&D and the advent of upcoming technologies, such as 6G, Wi-Fi 6 and IoT, are factors expected to drive the growth of the IoT Professional services market in the region.

Who are the major vendors in the market?

Major vendors in the IoT Professional services market are Accenture (Ireland), Atos (France), IBM (US), Cognizant (US), DXC Technology (US), Deloitte (UK), Capgemini (France), TCS (India), NTT DATA (Japan), Infosys (India), AT&T (US), Wipro (India), General Electric (US), Honeywell (US), Oracle (US), HCL Technologies (India), EY (UK), Unisys (US), Vodafone (UK), Tech Mahindra (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL IOT PROFESSIONAL SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

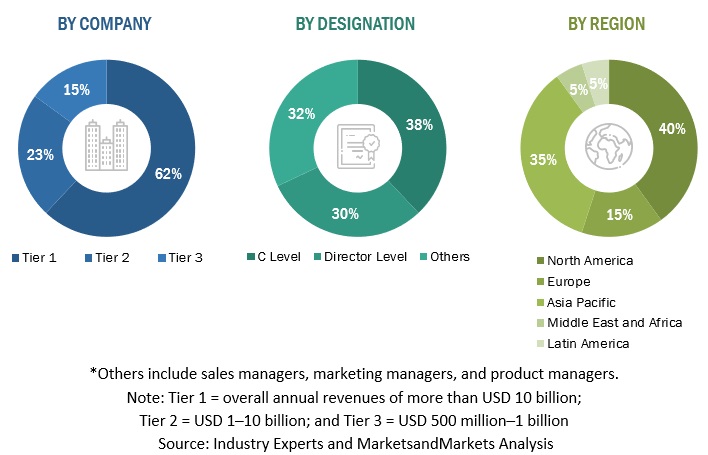

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 (SUPPLY SIDE): REVENUE OF DIFFERENT IOT PROFESSIONAL SERVICE TYPES IN MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF IOT PROFESSIONAL SERVICE TYPES IN IOT PROFESSIONAL SERVICES MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2—BOTTOM-UP (DEMAND SIDE)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 59)

FIGURE 8 IOT CONSULTING SERVICES TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 9 SMALL AND MEDIUM-SIZED ENTERPRISES TO EXHIBIT GROWTH DURING FORECAST PERIOD

FIGURE 10 CLOUD SEGMENT TO SHOW HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 11 SMART TRANSPORT AND LOGISTICS SEGMENT TO DOMINATE MARKET IN 2022

FIGURE 12 IOT PROFESSIONAL SERVICES MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IOT PROFESSIONAL SERVICES MARKET

FIGURE 13 GROWING NUMBER OF IOT CONNECTIONS TO INCREASE DATA TRAFFIC AND DRIVE GROWTH DURING FORECAST PERIOD

4.2 ASIA PACIFIC MARKET, BY SERVICE TYPE AND COUNTRY

FIGURE 14 IOT CONSULTING SERVICES AND CHINA TO ACCOUNT FOR LARGE MARKET SHARES IN ASIA PACIFIC IN 2022

4.3 MARKET: MAJOR COUNTRIES

FIGURE 15 INDIA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 65)

5.1 MARKET OVERVIEW

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IOT PROFESSIONAL SERVICES MARKET

5.2.1 DRIVERS

5.2.1.1 Increased data traffic due to increasing number of IoT connections

5.2.1.2 Increasing internet ubiquity and development of wireless technologies

5.2.1.3 Rising need to increase operational efficiency in various industries

5.2.1.4 Increasing M2M applications across industries to accelerate IoT growth

5.2.1.5 Government initiatives in R&D activities related to IoT

5.2.2 RESTRAINTS

5.2.2.1 High demand and low supply of valuable semiconductor chips

5.2.2.2 Interoperability and lack of common standards

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for IoT-enabled digital transformation of businesses

5.2.3.2 Shift from on-premises to cloud-based data management strategy

5.2.4 CHALLENGES

5.2.4.1 Integration issues of legacy infrastructure and communication networks

5.2.4.2 Concerns associated with data security and privacy

5.3 TECHNOLOGY ANALYSIS

5.3.1 5G

5.3.2 WI-FI

5.3.3 RFID

5.3.4 BLUETOOTH

5.3.5 NB-IOT

5.3.6 ZIGBEE

5.3.7 EDGE COMPUTING

5.3.8 DIGITAL TWIN

5.3.9 MQTT PROTOCOL

5.3.10 WI-FI

5.4 ECOSYSTEM

TABLE 3 ECOSYSTEM: IOT PROFESSIONAL SERVICES MARKET

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 MARKET: VALUE CHAIN

5.6 PORTER’S FIVE FORCES MODEL

FIGURE 18 IOT PROFESSIONAL SERVICES: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES IMPACT ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 AVERAGE SELLING PRICE TREND

5.8 PATENT ANALYSIS

FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 5 TOP 20 PATENT OWNERS (US)

FIGURE 20 NUMBER OF PATENTS GRANTED YEARLY, 2011–2021

5.9 KEY CONFERENCES AND EVENTS FROM 2022–2023

TABLE 6 IOT PROFESSIONAL SERVICES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.10 REGULATORY LANDSCAPE

5.10.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION

5.10.2 INSTITUTE OF ELECTRICAL AND ELECTRONICS ENGINEERS

5.10.3 GENERAL DATA PROTECTION REGULATION

5.10.4 CEN/ISO

5.10.5 CEN/CENELEC

5.10.6 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

5.10.7 ITU-T

5.10.8 FEDERAL COMMUNICATIONS COMMISSION (FCC)

5.10.9 STATE RADIO REGULATORY COMMISSION (SRRC)

5.10.10 WIRELESS PLANNING & COORDINATION WING (WPC)

5.10.11 MINISTRY OF INTERNAL AFFAIRS AND COMMUNICATIONS (MIC)

5.10.12 EUROPEAN UNION AGENCY FOR NETWORK AND INFORMATION SECURITY (ENISA)LANNING & COORDINATION WING (WPC)

5.10.13 INDUSTRY ASSOCIATIONS AND CONSORTIA

5.10.14 THE NIS DIRECTIVE

5.10.15 GENERAL DATA PROTECTION REGULATION

5.10.16 CALIFORNIA CONSUMER PRIVACY ACT

5.10.17 SERVICE ORGANIZATION CONTROL 2

5.10.18 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.10.19 COMMUNICATIONS DECENCY ACT

5.10.20 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END USERS

5.11.2 BUYING CRITERIA

FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE END USERS

5.12 CASE STUDY ANALYSIS

5.12.1 CASE STUDY 1: NXP AND FORD COLLABORATE TO DELIVER NEXT-GENERATION CONNECTED CAR EXPERIENCES

5.12.2 CASE STUDY 2: INFOSYS TO DELIVER CLOUD-BASED GLOBAL TELEMATICS SOLUTIONS FOR TOYOTA MATERIAL

5.12.3 CASE STUDY 3: ENERGY SAVINGS USING NETWORKED WAREHOUSES

5.12.4 CASE STUDY 4: ACCENTURE HELPS SWISSCOM ADVANCE ITS ENVIRONMENTAL AMBITIONS

6 IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE (Page No. - 87)

6.1 INTRODUCTION

FIGURE 23 IOT CONSULTING SERVICES SEGMENT TO DOMINATE DURING FORECAST PERIOD

TABLE 9 MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 10 MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

6.2 IOT CONSULTING SERVICES

6.2.1 REQUIREMENT FOR ALL-ROUND SOLUTION

6.2.2 IOT CONSULTING SERVICES: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 11 IOT CONSULTING SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 12 IOT CONSULTING SERVICES MARKET, BY TYPE 2022–2027 (USD BILLION)

TABLE 13 IOT CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 14 IOT CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.2.3 TECHNOLOGY CONSULTING SERVICES

6.2.3.1 Technology consulting services: IoT consulting services market drivers

TABLE 15 TECHNOLOGY CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 16 TECHNOLOGY CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.2.4 BUSINESS CONSULTING SERVICES

6.2.4.1 Business consulting services: IoT consulting services market drivers

TABLE 17 BUSINESS CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 18 BUSINESS CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.2.5 OPERATIONAL CONSULTING SERVICES

6.2.5.1 Operational consulting services: IoT consulting services market drivers

TABLE 19 OPERATIONAL CONSULTING SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 20 OPERATIONAL CONSULTING SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3 IOT INFRASTRUCTURE SERVICES

6.3.1 UNAVAILABILITY OF IOT TRAINED PERSONNEL

6.3.2 IOT INFRASTRUCTURE SERVICES: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 21 IOT INFRASTRUCTURE SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 22 IOT INFRASTRUCTURE SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 23 IOT INFRASTRUCTURE SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 24 IOT INFRASTRUCTURE SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3.3 NETWORK SERVICES

6.3.3.1 Network services: IoT infrastructure market drivers

TABLE 25 NETWORK SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 26 NETWORK SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3.4 DEPLOYMENT SERVICES

6.3.4.1 Deployment services: IoT infrastructure market drivers

TABLE 27 DEPLOYMENT SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 28 DEPLOYMENT SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.3.5 CLOUD SERVICES

6.3.5.1 Cloud services: IoT infrastructure market drivers

TABLE 29 CLOUD SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 30 CLOUD SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.4 SYSTEM DESIGNING AND INTEGRATION SERVICES

6.4.1 DIFFICULTY IN DESIGNING AND INSTALLATION

6.4.2 SYSTEM DESIGNING AND INTEGRATION SERVICES: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 31 SYSTEM DESIGNING AND INTEGRATION SERVICES MARKET, BY TYPE, 2016–2021 (USD BILLION)

TABLE 32 SYSTEM DESIGNING AND INTEGRATION SERVICES MARKET, BY TYPE, 2022–2027 (USD BILLION)

TABLE 33 SYSTEM DESIGNING AND INTEGRATION SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 34 SYSTEM DESIGNING AND INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.4.3 PLATFORM DEVELOPMENT AND INTEGRATION

6.4.3.1 Platform development and integration services: system designing and integration services market drivers

TABLE 35 PLATFORM DEVELOPMENT AND INTEGRATION SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 36 PLATFORM DEVELOPMENT AND INTEGRATION SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.4.4 MOBILE AND WEB APPLICATION DEVELOPMENT

6.4.4.1 Mobile and web application development: system designing and integration services market drivers

TABLE 37 MOBILE AND WEB APPLICATION DEVELOPMENT MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 38 MOBILE AND WEB APPLICATION DEVELOPMENT MARKET, BY REGION, 2022–2027 (USD BILLION)

6.5 SUPPORT AND MAINTENANCE SERVICES

6.5.1 RAPID EXPANSION TO FUEL NEED FOR MAINTENANCE SERVICES

6.5.2 SUPPORT AND MAINTENANCE SERVICES: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 39 SUPPORT AND MAINTENANCE SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 40 SUPPORT AND MAINTENANCE SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

6.6 EDUCATION AND TRAINING SERVICES

6.6.1 NEED FOR TRAINED STAFF TO OPERATE IOT DEVICES

6.6.2 EDUCATION AND TRAINING: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 41 EDUCATION AND TRAINING SERVICES MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 42 EDUCATION AND TRAINING SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

7 IOT PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZE (Page No. - 106)

7.1 INTRODUCTION

FIGURE 24 LARGE ENTERPRISES TO LEAD MARKET DURING FORECAST PERIOD

TABLE 43 IOT PROFESSIONAL MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 44 IOT PROFESSIONAL MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

7.2 LARGE ENTERPRISES

7.2.1 GROWING INVESTMENTS AND COST SAVINGS BY LARGE ENTERPRISES

7.2.2 LARGE ENTERPRISES: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 45 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 46 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD BILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 GROWING OPPORTUNITIES FOR SMALL VENDORS

7.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 47 SMALL AND MEDIUM-SIZED: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 48 SMALL AND MEDIUM-SIZED: MARKET, BY REGION, 2022–2027 (USD BILLION)

8 IOT PROFESSIONAL SERVICES MARKET, BY DEPLOYMENT TYPE (Page No. - 112)

8.1 INTRODUCTION

FIGURE 25 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 50 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

8.2 ON-PREMISES

8.2.1 HIGHLY CUSTOMIZABLE SOLUTIONS

8.2.2 ON-PREMISES: MARKET DRIVERS

TABLE 51 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 52 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD BILLION)

8.3 CLOUD

8.3.1 EASY TO DEPLOY AND PAY AS YOU GO SERVICE

8.3.2 CLOUD: MARKET DRIVERS

TABLE 53 CLOUD: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 54 CLOUD: MARKET, BY REGION, 2022–2027 (USD BILLION)

9 IOT PROFESSIONAL SERVICES MARKET, BY APPLICATION (Page No. - 117)

9.1 INTRODUCTION

FIGURE 26 SMART TRANSPORT AND LOGISTICS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 55 MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 56 MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

9.2 SMART BUILDINGS

9.2.1 SUPPORT OF GOVERNMENT AUTHORITIES

9.2.2 SMART BUILDINGS: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 57 SMART BUILDINGS: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 58 SMART BUILDINGS: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.3 SMART MANUFACTURING

9.3.1 ADOPTION OF AUTOMATION IN MANUFACTURING

9.3.2 SMART MANUFACTURING: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 59 SMART MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 60 SMART MANUFACTURING: IOT PROFESSIONAL SERVICES MARKET, BY REGION, 2022–2027 (USD BILLION)

9.4 SMART TRANSPORT AND LOGISTICS

9.4.1 DECREASED COSTS OF SMART LOGISTICS CONSUMERS

9.4.2 SMART TRANSPORT AND LOGISTICS: MARKET DRIVERS

TABLE 61 SMART TRANSPORT AND LOGISTICS: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 62 SMART TRANSPORT AND LOGISTICS: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.5 SMART HEALTHCARE

9.5.1 GROWING INTEREST IN WEARABLE HEALTHCARE DEVICES

9.5.2 SMART HEALTHCARE: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 63 SMART HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 64 SMART HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.6 SMART RETAIL

9.6.1 PERSONALIZED MARKETING BASED ON IOT-COLLECTED DATA

9.6.2 SMART RETAIL: IOT PROFESSIONAL SERVICES MARKET DRIVERS

TABLE 65 SMART RETAIL: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 66 SMART RETAIL: MARKET, BY REGION, 2022–2027 (USD BILLION)

9.7 SMART ENERGY

9.7.1 GREEN ENERGY PROMOTION UTILIZING IOT

9.7.2 SMART ENERGY: MARKET DRIVERS

TABLE 67 SMART ENERGY: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 68 SMART ENERGY: MARKET, BY REGION, 2022–2027 (USD BILLION)

10 IOT PROFESSIONAL SERVICES MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

FIGURE 27 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 69 MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 70 MARKET, BY REGION, 2022–2027 (USD BILLION)

10.2 NORTH AMERICA

10.2.1 PESTLE ANALYSIS: NORTH AMERICA

10.2.2 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: IOT PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 72 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 73 NORTH AMERICA: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 74 NORTH AMERICA: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 75 NORTH AMERICA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 76 NORTH AMERICA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 77 NORTH AMERICA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 78 NORTH AMERICA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 79 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 80 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 81 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 82 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 83 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 84 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.2.3 US

10.2.3.1 Presence of key players to drive market

10.2.3.2 US: IoT professional services market drivers

TABLE 87 US: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 88 US: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 89 US: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 90 US: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 91 US: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 92 US: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 93 US: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 94 US: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 95 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 96 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 97 US: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 98 US: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 99 US: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 100 US: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

10.2.4 CANADA

10.2.4.1 Upcoming smart cities and innovative technologies

10.2.4.2 Canada: IoT professional services market drivers

TABLE 101 CANADA: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 102 CANADA: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 103 CANADA: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 104 CANADA: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 105 CANADA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 106 CANADA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 107 CANADA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 108 CANADA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 109 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 110 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 111 CANADA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 112 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 113 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 114 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

10.3 EUROPE

10.3.1 PESTLE ANALYSIS: EUROPE

10.3.2 EUROPE: IOT PROFESSIONAL SERVICES MARKET REGULATORY IMPLICATIONS

TABLE 115 EUROPE: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 116 EUROPE: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 117 EUROPE: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 118 EUROPE: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 119 EUROPE: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 120 EUROPE: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 121 EUROPE: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 122 EUROPE: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 123 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 124 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 125 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 126 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 127 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 128 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 129 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 130 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.3.3 UK

10.3.3.1 UK to protect IoT devices

10.3.3.2 UK: IoT professional services market drivers

TABLE 131 UK: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 132 UK: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 133 UK: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 134 UK: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 135 UK: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 136 UK: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 137 UK: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 138 UK: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 139 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 140 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 141 UK: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 142 UK: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 143 UK: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 144 UK: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

10.3.4 GERMANY

10.3.4.1 Healthcare sector to opt for wearable devices

10.3.4.2 Germany: IoT professional services market drivers

TABLE 145 GERMANY: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 146 GERMANY: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 147 GERMANY: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 148 GERMANY: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 149 GERMANY: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 150 GERMANY: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 151 GERMANY: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 152 GERMANY: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 153 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 154 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 155 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 156 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 157 GERMANY: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 158 GERMANY: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

10.3.5 FRANCE

10.3.5.1 France to lead in smart home devices

10.3.5.2 France: IoT professional services market drivers

10.3.6 SPAIN

10.3.6.1 IoT-based smart security

10.3.6.2 Spain: market drivers

10.3.7 ITALY

10.3.7.1 Upcoming smart cities

10.3.7.2 Italy: market drivers

10.3.8 NORDICS

10.3.8.1 IoT based manufacturing

10.3.8.2 Nordics: IoT professional services market drivers

10.3.9 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

10.4.2 ASIA PACIFIC: IOT PROFESSIONAL SERVICES MARKET REGULATORY IMPLICATIONS

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 159 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 165 ASIA PACIFIC: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 166 ASIA PACIFIC: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 169 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 170 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 173 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 174 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.4.3 CHINA

10.4.3.1 Growth of modules and transmitters market

10.4.3.2 China: IoT professional services market drivers

10.4.4 JAPAN

10.4.4.1 Major sensor market share

10.4.4.2 Japan: market drivers

10.4.5 INDIA

10.4.5.1 Increasing adoption of smart devices

10.4.5.2 India: market drivers

10.4.6 ANZ

10.4.6.1 Changing policies and government support

10.4.6.2 ANZ: market drivers

10.4.7 SEA

10.4.7.1 Growing need for uhf data transmission devices

10.4.7.2 SEA: market drivers

10.4.8 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 PESTLE ANALYSIS: MIDDLE EAST AND AFRICA

10.5.2 MIDDLE EAST AND AFRICA: IOT PROFESSIONAL SERVICES MARKET REGULATORY IMPLICATIONS

TABLE 175 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 183 MIDDLE EAST AND AFRICA: IOT PROFESSIONAL SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 184 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 185 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 186 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 187 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 188 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 189 MIDDLE EAST AND AFRICA: MARKET, BY REGION, 2016–2021 (USD BILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 191 MIDDLE EAST: IOT PROFESSIONAL SERVICES MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 192 MIDDLE EAST: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 193 AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 194 AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.5.3 KSA

10.5.3.1 Government initiatives to develop networked logistics

10.5.3.2 KSA: market drivers

10.5.4 UAE

10.5.4.1 Adoption of smart technology

10.5.4.2 UAE: market drivers

10.5.5 REST OF MIDDLE EAST

10.5.6 SOUTH AFRICA

10.5.6.1 Incremental spending on it infrastructure to drive market

10.5.6.2 South africa: IoT professional services market drivers

10.5.7 EGYPT

10.5.7.1 Booming smart healthcare sector

10.5.7.2 Egypt: market drivers

10.5.8 NIGERIA

10.5.8.1 Preparation for IoT regulation

10.5.8.2 Nigeria: market drivers

10.5.9 REST OF AFRICA

10.6 LATIN AMERICA

10.6.1 PESTLE ANALYSIS: LATIN AMERICA

10.6.2 LATIN AMERICA: IOT PROFESSIONAL SERVICES MARKET REGULATORY IMPLICATIONS

TABLE 195 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2016–2021 (USD BILLION)

TABLE 196 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD BILLION)

TABLE 197 LATIN AMERICA: MARKET, BY IOT CONSULTING SERVICE, 2016–2021 (USD BILLION)

TABLE 198 LATIN AMERICA: MARKET, BY IOT CONSULTING SERVICE, 2022–2027 (USD BILLION)

TABLE 199 LATIN AMERICA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2016–2021 (USD BILLION)

TABLE 200 LATIN AMERICA: MARKET, BY IOT INFRASTRUCTURE SERVICE, 2022–2027 (USD BILLION)

TABLE 201 LATIN AMERICA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2016–2021 (USD BILLION)

TABLE 202 LATIN AMERICA: MARKET, BY SYSTEM DESIGNING AND INTEGRATION SERVICE, 2022–2027 (USD BILLION)

TABLE 203 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

TABLE 204 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

TABLE 205 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD BILLION)

TABLE 206 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD BILLION)

TABLE 207 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD BILLION)

TABLE 208 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 209 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD BILLION)

TABLE 210 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

10.6.3 BRAZIL

10.6.3.1 Growing volume of smart medical devices

10.6.3.2 Brazil: IoT professional services market drivers

10.6.4 MEXICO

10.6.4.1 Digital transformation to drive market growth

10.6.4.2 Mexico: market drivers

10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 194)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 30 MARKET EVALUATION FRAMEWORK

11.3 MARKET RANKING

FIGURE 31 MARKET RANKING IN 2022

11.4 MARKET SHARE ANALYSIS

FIGURE 32 IOT PROFESSIONAL SERVICES MARKET SHARE ANALYSIS

TABLE 211 MARKET: DEGREE OF COMPETITION

FIGURE 33 MARKET SHARE ANALYSIS OF COMPANIES IN IOT PROFESSIONAL SERVICES MARKET

11.5 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 34 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021

11.6 KEY MARKET DEVELOPMENTS

FIGURE 35 KEY DEVELOPMENTS IN MARKET FOR 2018–2022

11.6.1 PRODUCT LAUNCHES

TABLE 212 MARKET: PRODUCT LAUNCHES (2019–2022)

11.6.2 DEALS

TABLE 213 MARKET: DEALS (2019–2022)

11.7 COMPETITIVE BENCHMARKING

TABLE 214 COMPANY TOP THREE FUNCTIONALITY VERTICAL FOOTPRINT

TABLE 215 COMPANY REGION FOOTPRINT

11.8 COMPANY EVALUATION MATRIX

11.8.1 DEFINITIONS AND METHODOLOGY

TABLE 216 COMPANY EVALUATION MATRIX: CRITERIA AND WEIGHTAGE

11.8.2 STARS

11.8.3 EMERGING LEADERS

11.8.4 PERVASIVE PLAYERS

11.8.5 PARTICIPANTS

FIGURE 36 IOT PROFESSIONAL SERVICES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

11.9 SMALL AND MEDIUM ENTERPRISE /STARTUP EVALUATION MATRIX

11.9.1 DEFINITIONS AND METHODOLOGY

TABLE 217 SMALL AND MEDIUM ENTERPRISE/STARTUP EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.9.2 PROGRESSIVE COMPANIES

11.9.3 RESPONSIVE COMPANIES

11.9.4 DYNAMIC COMPANIES

11.9.5 STARTING BLOCKS

FIGURE 37 IOT PROFESSIONAL SERVICES MARKET (GLOBAL): SME/START UP EVALUATION MATRIX, 2022

12 COMPANY PROFILES (Page No. - 211)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM View, Key strengths, Strategic choices, and Weaknesses and competitive threats)*

12.2.1 ACCENTURE

TABLE 218 ACCENTURE: BUSINESS OVERVIEW

FIGURE 38 ACCENTURE: COMPANY SNAPSHOT

TABLE 219 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 220 IOT PROFESSIONAL SERVICES MARKET: DEALS

12.2.2 ATOS

TABLE 221 ATOS: BUSINESS OVERVIEW

FIGURE 39 ATOS: COMPANY SNAPSHOT

TABLE 222 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 223 MARKET: PRODUCT LAUNCHES, (JANUARY 2019)

TABLE 224 MARKET: DEALS (MAY 2020– JANUARY 2021)

12.2.3 IBM

TABLE 225 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: COMPANY SNAPSHOT

TABLE 226 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 227 MARKET: PRODUCT LAUNCHES (NOVEMBER 2019)

TABLE 228 MARKET: DEALS (AUGUST 2020–JUNE 2020)

12.2.4 COGNIZANT

TABLE 229 COGNIZANT: BUSINESS OVERVIEW

FIGURE 41 COGNIZANT: COMPANY SNAPSHOT

TABLE 230 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 231 IOT PROFESSIONAL SERVICES MARKET: DEALS (AUGUST 2020–FEBRUARY 2021)

12.2.5 DXC TECHNOLOGY

TABLE 232 DXC TECHNOLOGY: BUSINESS OVERVIEW

FIGURE 42 DXC TECHNOLOGY: COMPANY SNAPSHOT

TABLE 233 DXC TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 234 MARKET: PRODUCT LAUNCHES (NOVEMBER 2019)

TABLE 235 MARKET: DEALS (JUNE 2019–DECEMBER 2020)

12.2.6 DELOITTE

TABLE 236 DELOITTE: BUSINESS OVERVIEW

FIGURE 43 DELOITTE: COMPANY SNAPSHOT

TABLE 237 DELOITTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 238 IOT PROFESSIONAL SERVICES MARKET: DEALS (DECEMBER 2020)

12.2.7 CAPGEMINI

TABLE 239 CAPGEMINI: BUSINESS OVERVIEW

FIGURE 44 CAPGEMINI: COMPANY SNAPSHOT

TABLE 240 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 241 CAPGEMINI: DEALS

12.2.8 TCS

TABLE 242 TCS: BUSINESS OVERVIEW

FIGURE 45 TCS: COMPANY SNAPSHOT

TABLE 243 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 244 TCS: DEALS

12.2.9 NTT DATA

TABLE 245 NTT DATA: BUSINESS OVERVIEW

FIGURE 46 NTT DATA: COMPANY SNAPSHOT

TABLE 246 NTT DATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 247 NTT DATA: DEALS

12.2.10 INFOSYS

TABLE 248 INFOSYS: BUSINESS OVERVIEW

FIGURE 47 INFOSYS: COMPANY SNAPSHOT

TABLE 249 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 250 INFOSYS: DEALS

12.2.11 AT&T

TABLE 251 AT&T: BUSINESS OVERVIEW

FIGURE 48 AT&T: COMPANY SNAPSHOT

TABLE 252 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 253 AT&T: DEALS

12.2.12 WIPRO

TABLE 254 WIPRO: BUSINESS OVERVIEW

FIGURE 49 WIPRO: COMPANY SNAPSHOT

TABLE 255 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 256 WIPRO: DEALS

12.2.13 GENERAL ELECTRIC

TABLE 257 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 50 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 258 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 259 GENERAL ELECTRIC: DEALS

12.2.14 HONEYWELL

TABLE 260 HONEYWELL: BUSINESS OVERVIEW

FIGURE 51 HONEYWELL: COMPANY SNAPSHOT

TABLE 261 HONEYWELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 262 HONEYWELL: DEALS

12.2.15 ORACLE

TABLE 263 ORACLE: BUSINESS OVERVIEW

FIGURE 52 ORACLE: COMPANY SNAPSHOT

TABLE 264 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 265 ORACLE: DEALS

12.2.16 HCL

TABLE 266 HCL: BUSINESS OVERVIEW

FIGURE 53 HCL: COMPANY SNAPSHOT

TABLE 267 HCL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 HCL: DEALS

12.2.17 EY

TABLE 269 EY: BUSINESS OVERVIEW

FIGURE 54 EY: COMPANY SNAPSHOT

TABLE 270 EY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 271 EY: DEALS

12.2.18 UNISYS CORP

TABLE 272 UNISYS: BUSINESS OVERVIEW

FIGURE 55 UNISYS CORP: COMPANY SNAPSHOT

TABLE 273 UNISYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 274 UNISYS: DEALS

12.2.19 VODAFONE

12.2.20 TECH MAHINDRA

12.3 STARTUP AND SMES

12.3.1 HAPPIEST MINDS

12.3.2 MINDTREE

12.3.3 PRODAPT

12.3.4 SIEMENS ADVANTA CONSULTING

12.3.5 ORBCOMM

12.3.6 PURESOFTWARE

12.3.7 VELVETECH

12.3.8 JAARVIS

12.3.9 ESEYE

12.3.10 CUELOGIC

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM View, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 281)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.2 IOT SECURITY MARKET – GLOBAL FORECAST TO 2026

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 IOT SECURITY MARKET, BY COMPONENT

TABLE 275 IOT SECURITY MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 276 IOT SECURITY MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

13.2.4 IOT SECURITY MARKET, BY TYPE

TABLE 277 IOT SECURITY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 278 IOT SECURITY MARKET, BY TYPE, 2021–2026 (USD MILLION)

13.2.5 IOT SECURITY MARKET, BY DEPLOYMENT MODE

TABLE 279 IOT SECURITY MARKET, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 280 IOT SECURITY MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

13.2.6 IOT SECURITY MARKET, BY APPLICATION AREA

TABLE 281 IOT SECURITY MARKET, BY APPLICATION AREA, 2017–2020 (USD MILLION)

TABLE 282 IOT SECURITY MARKET, BY APPLICATION AREA, 2021–2026 (USD MILLION)

13.3 IIOT PLATFORM MARKET – GLOBAL FORECAST TO 2026

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 IIOT PLATFORM MARKET, BY OFFERING

TABLE 283 IIOT PLATFORM MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 284 IIOT PLATFORM MARKET, BY OFFERING, 2020–2026 (USD MILLION)

13.3.4 IIOT PLATFORM MARKET, BY VERTICAL

TABLE 285 IIOT PLATFORM MARKET, BY VERTICAL, 2016–2019 (USD MILLION)

TABLE 286 IIOT PLATFORM MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

13.3.5 IIOT PLATFORM MARKET, BY REGION

TABLE 287 IIOT PLATFORM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 288 IIOT PLATFORM MARKET, BY REGION, 2020–2026 (USD MILLION)

13.4 5G IOT MARKET – GLOBAL FORECAST TO 2026

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 5G IOT MARKET, BY COMPONENT

TABLE 289 5G IOT MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

13.4.4 5G IOT MARKET, BY NETWORK TYPE

TABLE 290 5G IOT MARKET, BY NETWORK TYPE, 2020–2026 (USD MILLION)

13.4.5 5G IOT MARKET, BY END USER

TABLE 291 5G IOT MARKET, BY END USER, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 291)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the usage of extensive secondary sources, directories, and databases such as D&B Hoovers and Bloomberg BusinessWeek to identify and collect information useful for this technical, market-oriented, and commercial study of the global IoT Professional services market. The primary sources were mainly several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects. The following illustration shows the market research methodology applied in making this report on the IoT Professional services market.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing experts; related key executives from IoT Professional service providers, system integrators, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Professional services demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using IoT Professional services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of IoT Professional services impacting the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the IoT Professional services market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each offering of various vendors was evaluated based on the breadth of services, deployment modes, interaction types, business functions, applications, and verticals. The aggregate revenue of all companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Report Objectives

- To determine and forecast the global IoT Professional services Market, By Service type (IoT consulting, IoT Infrastructure, System Designing and Integration, Support and Maintenance, Education and Training), By Organization Size, By Deployment Type, By Application and By Region from 2022 to 2027, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the IoT Professional services market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Professional Services Market