IoT Engineering Services Market by Service Type (Product Engineering, Cloud & Platform Engineering, UI/UX Design, Analytics, Security, Maintenance Services), End User, Vertical (Industrial Manufacturing & Automotive), and Region - Global Forecast to 2022

[135 Pages Report] The IoT engineering services market size is expected to grow from USD 8.37 Billion in 2016 to USD 29.53 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 24.5% during the forecast period. The base year considered for this study is 2016, and the forecast period considered is between 2017 and 2022.

Objectives of the Study

- To describe and forecast the global IoT engineering services based on service types, end users, verticals, and regions

- To forecast the market size of the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments with respect to the individual growth trends, prospects, and contributions to the total market

- To provide a detailed information regarding major factors influencing the IoT engineering services market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of competitive landscape for the major players

- To profile the key players and comprehensively analyze their core competencies and positioning

- To track and analyze the competitive developments, such as mergers and acquisitions; new service developments; and partnerships, agreements, and collaborations in the IoT engineering services market

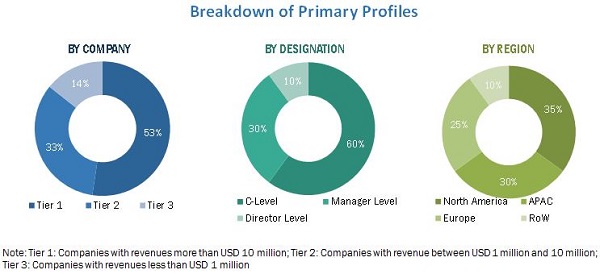

The research methodology used to estimate and forecast the IoT engineering services began with capturing the data on key vendor revenues through secondary research, such as IT services associations, IoT service journals, and databases, including D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the IoT engineering services market. Vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global IoT engineering services from the revenues of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments. The breakdown of primary profiles is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The IoT engineering services ecosystem comprises service providers, such as Aricent (US), Wipro (India), Capgemini (France), IBM (US), TCS (India), Happiest Minds (India), Infosys (India), Cognizant (US), eInfochips (US), RapidValue (US), and Tech Mahindra (India). These IoT Engineering Services Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of IoT Engineering Services.

Key Target Audience

- IoT platform providers

- Cloud service providers

- Device manufacturers

- Government agencies

- IT companies

- Investors and Venture Capitalists (VCs)

- Product engineering service providers

- System integrators

- Value-Added Resellers (VARs) and distributors

The research study answers several questions for the stakeholders, primarily which market segments to focus in the next 25 years for prioritizing the efforts and investments.

Scope of the Report

The research report categorizes the IoT engineering services to forecast the revenues and analyze the trends in each of the following submarkets:

By Service Type

- Product Engineering

- Connected Devices Engineering

- Mobile application development

- Protocol and component development

- Prototype testing and validation

- System integration

- Software Engineering

- Connected Devices Engineering

- Cloud Engineering

- DevOps Engineering

- Cloud Architecture

- Embedded Platform Engineering

- Platform migration

- Middleware development

- Testing and Validation

- Experience Engineering

- User Interface (UI) Design

- Human Machine Interface (HMI) Engineering

- Experience Planning and Assessment

- Analytics Services

- Maintenance Services

- Security Engineering

- Others* (data design, and engineering and simulation)

By End User

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Vertical

- Automotive

- Aerospace and Defense

- Healthcare

- Transportation and Logistics

- IT and Telecom

- Industrial Manufacturing

- Energy and Utilities

- Others* (retail; construction; Banking, Financial Services, and Insurance (BFSI); and agriculture

By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given IoT engineering services market data, MarketsandMarkets offers customizations based on the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries, contributing 75% to the regional market size

- Further breakdown of the North American market into countries, contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries, contributing 75% to the regional market size

- Further breakdown of the MEA market into countries, contributing 75% to the regional market size

- Further breakdown of the European market into countries, contributing 75% to the regional market size

Company Information

Detailed analysis and profiling of additional IoT engineering services market players (up to 5)

The IoT engineering services market size is expected to grow from USD 9.87 Billion in 2017 to USD 29.53 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 24.5% during the forecast period. The growing need for reduced system troubleshooting and enhanced operational efficiency, the increasing requirement of risk mitigation to minimize the data loss, the increasing adoption of micro services, and the accelerating Social, Mobile, Analytics, and Cloud (SMAC) technologies are said to be driving the market growth.

The IoT engineering services market report has been broadly classified on the basis of service types, end users, verticals, and regions.

The security engineering service type is expected to have the fastest growth rate during the forecast period. Security engineering is a process of designing and developing an array of security technologies and monitoring the solutions to detect and prevent attacks. The team develops solutions that help organizations in empowering their security technologies to protect an organizations or a users personal and professional data from cyber threats. These benefits are expected to lead the growth of the IoT engineering services market in the coming years.

The healthcare vertical is expected to grow at the highest CAGR in the IoT engineering services market during the forecast period. Connected healthcare devices enable healthcare organizations to streamline the operations and business processes, and aid in real-time patient care, even from remote locations. These connected devices in the field of healthcare could lead to a savings of 1520% in the health expenditure; thus, there is a large integration of IoT engineering services into healthcare organizations functioning systems and infrastructure. IoT engineering services provide in-depth knowledge about the benefits and features that the new service would offer for the patients and caretakers. IoT engineering services are applied in key areas of the healthcare vertical. The key areas include recording devices, healing or therapeutic appliances, radiology apparatus, respiratory devices, in-vitro devices, and diagnostics and monitoring devices.

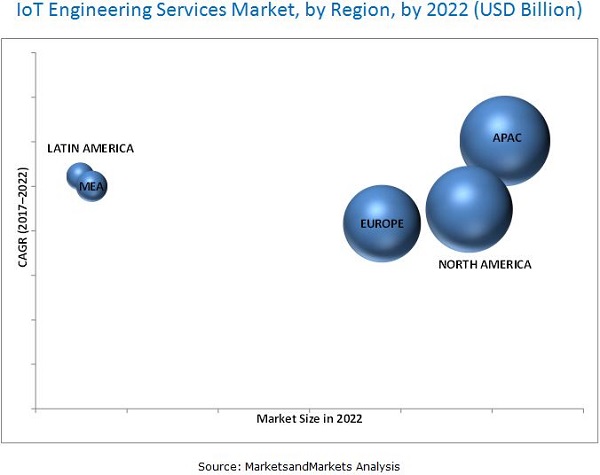

Asia Pacific (APAC) is said to be in its initial growth phase; however, in 2022, it is expected to hold the largest market share in the global IoT engineering services market. The competition among the players in this region is fragmented and the IoT service providers are looking at expanding the base of their services to most of the countries in the region, because of the improving infrastructure and other business strategic moves. Due to the rapid growth in the technological innovations and the increased usage of connected devices, organizations have started investing in advanced security services. This, in turn, is expected to provide growth opportunities for the IoT engineering service vendors during the forecast period.

The market faces challenges in terms of device management across billions of connected devices.

The major vendors providing IoT engineering services are Aricent (US), Wipro (India), Capgemini (France), IBM (US), TCS (India), Happiest Minds (India), Infosys (India), Cognizant (US), eInfochips (US), RapidValue (US), and Tech Mahindra (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the IoT Engineering Services Market

4.2 IoT Engineering Services Market, By Region

4.3 Market, By End User

4.4 Market, By Service Type and Region

4.5 Market, By Vertical

4.6 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Need for Reduced System Troubleshooting and Enhanced Operational Efficiency

5.2.1.2 Increasing Requirement of Risk Mitigation to Minimize Data Loss

5.2.1.3 Micro Services Driving the Development of Enhanced IoT Applications

5.2.1.4 Acceleration in the SMAC Technologies

5.2.2 Restraints

5.2.2.1 High Initial Upfront Cost in Designing the New IoT Ecosystem Model

5.2.2.2 Varying IoT Standards and Protocols for Interconnectivity and Interoperability

5.2.3 Opportunities

5.2.3.1 Proliferation of IoT Technology Among Smes

5.2.3.2 Increase in the Number of Smart City Projects

5.2.4 Challenges

5.2.4.1 Device Management Across the Billions of Connected Devices

5.2.4.2 Mismatch on Enterprise Requirements Could Affect Business Process

5.3 Industry Trends

5.3.1 IoT Engineering Services: Use Cases

5.3.1.1 Need to Monitor the Health of an Electric Vehicle

5.3.1.2 Need to Observe Patients Outside the Conventional Clinical Setting

5.3.1.3 Need to Monitor and Control Engine Performance

5.3.1.4 Need to Have A Strong One-Way Communication During Emergency Events at Educational Organization

6 IoT Engineering Services Market Analysis, By Service Type (Page No. - 37)

6.1 Introduction

6.2 Product Engineering

6.2.1 Connected Devices Engineering

6.2.1.1 Mobile Application Development

6.2.1.2 Protocol and Component Development

6.2.1.3 Prototype Testing and Validation

6.2.1.4 System Integration

6.2.2 Software Engineering

6.3 Cloud Engineering

6.3.1 Devops Engineering

6.3.2 Cloud Architecture

6.3.3 Embedded Platform Engineering

6.3.3.1 Platform Migration

6.3.3.2 Middleware Development

6.3.4 Testing and Validation

6.4 Experience Engineering

6.4.1 User Interface Design

6.4.2 Human Machine Interface Engineering

6.4.3 Experience Planning and Assessment

6.5 Analytics Services

6.6 Maintenance Services

6.7 Security Engineering

6.8 Others

7 IoT Engineering Services Market Analysis, By End User (Page No. - 55)

7.1 Introduction

7.2 Small and Medium-Sized Enterprises

7.3 Large Enterprises

8 IoT Engineering Services Market Analysis, By Vertical (Page No. - 59)

8.1 Introduction

8.2 Automotive

8.3 Aerospace and Defense

8.4 Healthcare

8.5 Transportation and Logistics

8.6 IT and Telecom

8.7 Industrial Manufacturing

8.8 Energy and Utilities

8.9 Others

9 Geographic Analysis (Page No. - 68)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Middle East and Africa

9.6 Latin America

10 Competitive Landscape (Page No. - 93)

10.1 Market Ranking Analysis, By Company

11 Company Profiles (Page No. - 94)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

11.1 Aricent

11.2 Wipro

11.3 Capgemini

11.4 IBM

11.5 TCS

11.6 Happiest Minds

11.7 Infosys

11.8 Cognizant

11.9 Einfochips

11.10 Rapidvalue

11.11 Tech Mahindra

11.12 Prodapt Solutions

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 128)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (83 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 IoT Engineering Services Market Size, By Service Type, 20152022 (USD Million)

Table 3 Product Engineering: IoT Engineering Services Market Size, By Type, 20152022 (USD Million)

Table 4 Product Engineering: Market Size, By Region, 20152022 (USD Million)

Table 5 Connected Devices Engineering Market Size, By Type, 20152022 (USD Million)

Table 6 Connected Devices Engineering Market Size, By Region, 20152022 (USD Million)

Table 7 Mobile Application Development Market Size, By Region, 20152022 (USD Million)

Table 8 Protocol and Component Development Market Size, By Region, 20152022 (USD Million)

Table 9 Prototype Testing and Validation Market Size, By Region, 20152022 (USD Million)

Table 10 System Integration Market Size, By Region, 20152022 (USD Million)

Table 11 Software Engineering Market Size, By Region, 20152022 (USD Million)

Table 12 Cloud Engineering: IoT Engineering Services Market Size, By Type, 20152022 (USD Million)

Table 13 Cloud Engineering: Market Size, By Region, 20152022 (USD Million)

Table 14 Devops Engineering Market Size, By Region, 20152022 (USD Million)

Table 15 Cloud Architecture Market Size, By Region, 20152022 (USD Million)

Table 16 Embedded Platform Engineering Market Size, By Type, 20152022 (USD Million)

Table 17 Embedded Platform Engineering Market Size, By Region, 20152022 (USD Million)

Table 18 Platform Migration Market Size, By Region, 20152022 (USD Million)

Table 19 Middleware Development Market Size, By Region, 20152022 (USD Million)

Table 20 Testing and Validation Market Size, By Region, 20152022 (USD Million)

Table 21 Experience Engineering: IoT Engineering Services Market Size, By Type, 20152022 (USD Million)

Table 22 Experience Engineering: Market Size, By Region, 20152022 (USD Million)

Table 23 User Interface Design Market Size, By Region, 20152022 (USD Million)

Table 24 Human Machine Interface Engineering Market Size, By Region, 20152022 (USD Million)

Table 25 Experience Planning and Assessment Market Size, By Region, 20152022 (USD Million)

Table 26 Analytics Services: Market Size, By Region, 20152022 (USD Million)

Table 27 Maintenance Services: Market Size, By Region, 20152022 (USD Million)

Table 28 Security Engineering: Market Size, By Region, 20152022 (USD Million)

Table 29 Others: Market Size, By Region, 20152022 (USD Million)

Table 30 IoT Engineering Services Market Size, By End User, 20152022 (USD Million)

Table 31 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 32 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 33 IoT Engineering Services Market Size, By Vertical, 20152022 (USD Million)

Table 34 Automotive: Market Size, By Region, 20152022 (USD Million)

Table 35 Aerospace and Defense: Market Size, By Region, 20152022 (USD Million)

Table 36 Healthcare: Market Size, By Region, 20152022 (USD Million)

Table 37 Transportation and Logistics: Market Size, By Region, 20152022 (USD Million)

Table 38 IT and Telecom: Market Size, By Region, 20152022 (USD Million)

Table 39 Industrial Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 40 Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 41 Others: Market Size, By Region, 20152022 (USD Million)

Table 42 IoT Engineering Services Market Size, By Region, 20152022 (USD Million)

Table 43 North America: IoT Engineering Services Market Size, By Service Type, 20152022 (USD Million)

Table 44 North America: Product Engineering Market Size, By Type, 20152022 (USD Million)

Table 45 North America: Connected Devices Engineering Market Size, By Type, 20152022 (USD Million)

Table 46 North America: Cloud Engineering Market Size, By Type, 20152022 (USD Million)

Table 47 North America: Embedded Platform Engineering Market Size, By Type, 20152022 (USD Million)

Table 48 North America: Experience Engineering Market Size, By Type, 20152022 (USD Million)

Table 49 North America: Market Size, By End User, 20152022 (USD Million)

Table 50 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 51 Europe: IoT Engineering Services Market Size, By Service Type, 20152022 (USD Million)

Table 52 Europe: Product Engineering Market Size, By Type, 20152022 (USD Million)

Table 53 Europe: Connected Devices Engineering Market Size, By Type, 20152022 (USD Million)

Table 54 Europe: Cloud Engineering Market Size, By Type, 20152022 (USD Million)

Table 55 Europe: Embedded Platform Engineering Market Size, By Type, 20152022 (USD Million)

Table 56 Europe: Experience Engineering Market Size, By Type, 20152022 (USD Million)

Table 57 Europe: Market Size, By End User, 20152022 (USD Million)

Table 58 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 59 Asia Pacific: IoT Engineering Services Market Size, By Service Type, 20152022 (USD Million)

Table 60 Asia Pacific: Product Engineering Market Size, By Type, 20152022 (USD Million)

Table 61 Asia Pacific: Connected Devices Engineering Market Size, By Type, 20152022 (USD Million)

Table 62 Asia Pacific: Cloud Engineering Market Size, By Type, 20152022 (USD Million)

Table 63 Asia Pacific: Embedded Platform Engineering Market Size, By Type, 20152022 (USD Million)

Table 64 Asia Pacific: Experience Engineering Market Size, By Type, 20152022 (USD Million)

Table 65 Asia Pacific: Market Size, By End User, 20152022 (USD Million)

Table 66 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 67 Middle East and Africa: IoT Engineering Services Market Size, By Service Type, 20152022 (USD Million)

Table 68 Middle East and Africa: Product Engineering Market Size, By Type, 20152022 (USD Million)

Table 69 Middle East and Africa: Connected Devices Engineering Market Size, By Type, 20152022 (USD Million)

Table 70 Middle East and Africa: Cloud Engineering Market Size, By Type, 20152022 (USD Million)

Table 71 Middle East and Africa: Embedded Platform Engineering Market Size, By Type, 20152022 (USD Million)

Table 72 Middle East and Africa: Experience Engineering Market Size, By Type, 20152022 (USD Million)

Table 73 Middle East and Africa: Market Size, By End User, 20152022 (USD Million)

Table 74 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 75 Latin America: IoT Engineering Services Market Size, By Service Type, 20152022 (USD Million)

Table 76 Latin America: Product Engineering Market Size, By Type, 20152022 (USD Million)

Table 77 Latin America: Connected Devices Engineering Market Size, By Type, 20152022 (USD Million)

Table 78 Latin America: Cloud Engineering Market Size, By Type, 20152022 (USD Million)

Table 79 Latin America: Embedded Platform Engineering Market Size, By Type, 20152022 (USD Million)

Table 80 Latin America: Experience Engineering Market Size, By Type, 20152022 (USD Million)

Table 81 Latin America: Market Size, By End User, 20152022 (USD Million)

Table 82 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 83 Market Ranking for the Market, 2017

List of Figures (28 Figures)

Figure 1 IoT Engineering Services Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Global IoT Engineering Services Market, 2015-2022

Figure 8 Market Share of Top 3 Leading Segments in the Market in 2017

Figure 9 IoT Engineering Services Regional Market Scenario

Figure 10 Increase in the Adoption of SMAC Technologies is Driving the Market Growth

Figure 11 Asia Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 12 Large Enterprises Segment is Expected to Be the Major Contributor of Market During the Forecast Period

Figure 13 North America to Lead the IoT Engineering Service Type in 2017

Figure 14 Industrial Manufacturing Vertical is Expected to Lead the IoT Engineering Services Market in Terms of Market Share During the Forecast Period

Figure 15 IoT Engineering Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Product Engineering Service Type is Expected to Continue to Hold the Largest Market Size in the Market

Figure 17 Large Enterprises is Expected to Hold the Major Market Share in the Market

Figure 18 Industrial Manufacturing Vertical is Expected to Dominate the Market

Figure 19 Asia Pacific is Projected to Hold the Largest Market Share in the IoT Engineering Services Market By 2022

Figure 20 North America: Market Snapshot

Figure 21 Asia Pacific: Market Snapshot

Figure 22 Wipro: Company Snapshot

Figure 23 Capgemini: Company Snapshot

Figure 24 IBM: Company Snapshot

Figure 25 TCS: Company Snapshot

Figure 26 Infosys: Company Snapshot

Figure 27 Cognizant: Company Snapshot

Figure 28 Tech Mahindra: Company Snapshot

Growth opportunities and latent adjacency in IoT Engineering Services Market