IoT in Education Market by Component (Hardware, Solutions & Services), End User (Academic Institutions & Corporates), Application (Learning Management, Classroom Management, Administration Management & Surveillance), and Region - Global Forecast to 2023

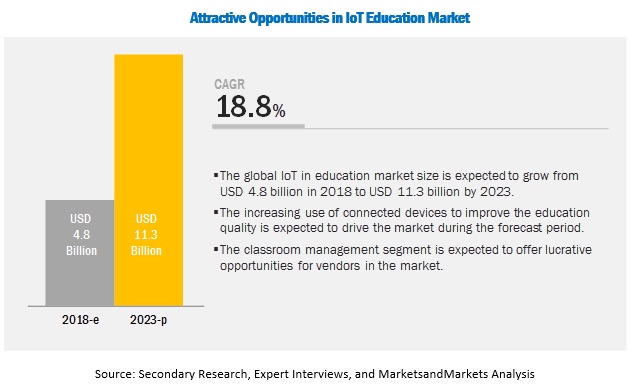

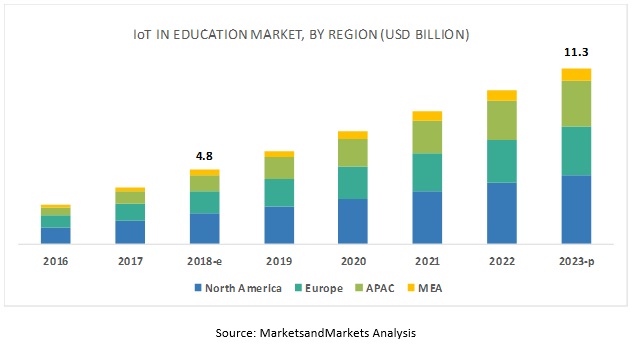

[149 Pages Report] The global IoT in education market size is expected to grow from USD 4.8 billion in 2018 to USD 11.3 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 18.8% during the forecast period. Major growth factors for the market include an increased use of connected devices in the education institutions, rapid adoption of eLearning, and availability of cloud-based solution.

The application management solution to record the highest growth rate during the forecast period

Education institutions have been using various applications for enhancing the learning experience and increasing the interaction between educators and students. This, in turn, has significantly increased the demand for the application management solution. The solution helps education institutions to manage their various applications. The goal of the application management solution is to optimize cost and feasibility in a way that developers and commercial clientele face when developing applications that need to collect, manage, and begin the interpretation of data generated by a wide range of connected endpoints. Education institutions are rapidly incorporating various applications for seamless operations and management that would surge the demand for the application management solution.

Academics to hold the largest market size during the forecast period

Connected technologies have become an influential solution for making learning simpler and easier. IoT solution in academics helps in increasing the interaction between educators, students, and parents. Many connected devices, such as interactive board, digital scanner, projectors, camera, and sensors, have been implemented in academics campuses to regularly track and monitor the student activity and simultaneously manage institutions CapEx and OpEx.

Classroom management application segment to hold the largest market size during the forecast period

Classroom management is one of the key applications for the IoT in education market. It improves learning protocols and management with the help of smart technologies available in a classroom. It also allows to streamline content authoring tools, collaborative groups along with unified content integration. With researches proving social and group learning more productive, organizations are focusing on implementing technology to enable social and collaborative learning. The collaboration feature in classrooms facilitates course sharing, emails, and discussion groups to make learning process engaging and enjoyable.

North America to hold the largest market size during the forecast period

The market by region, North America is projected to hold the largest market share during the forecast period. North America is one of the largest contributors to the IoT space, as it is technologically advanced. Moreover, the startup culture in North America is growing. The rapid digitalization across industry verticals, the increasing adoption of smart connected devices, and technological advancements would further fuel the growth of IoT in education in North America.

Major restraining factor for the market growth may be increasing incidences of cyber-attacks on education institutions and resultant concerns over data security and privacy.

Key IoT in education Market Players

Major vendors covered in the market report include Google (US), Amazon Web Services (US), IBM (US), Microsoft (US), Oracle (US), Intel (US), Cisco (US), SAP (Germany), Huawei (China), Arm (UK), Unit4 (Netherlands), and Samsung (South Korea). These players offer various IoT solutions to cater to the demands and needs of the market space. Major growth strategies adopted by these players are partnerships, collaborations and agreements, and new product launches/product enhancements.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Solutions, Services, End User, Application and Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Google (US), Amazon Web Services (US), IBM (US), Microsoft (US), Oracle (US), Intel (US), Cisco (US), SAP (Germany), Huawei (China), Arm (UK), Unit4 (Netherlands), and Samsung (South Korea). |

This research report categorizes the market to forecast revenues and analyze trends in each of the following submarkets:

On the basis of Component, the IoT in education market has been segmented as follows:

- Solution

- Service

- Hardware

On the basis of Solution, the IoT in education market has been segmented as follows:

- Network management

- Content management and analytics

- Device management

- Application management

- Security management

On the basis of Service, the IoT in education market has been segmented as follows:

- Professional services

- Training and consulting

- Deployment and integration

- Support and maintenance

- Managed services

On the basis of End User, the IoT in education market has been segmented as follows:

- Academic

- K-12

- Higher Education

- Corporate

On the basis of Application, the IoT in education market has been segmented as follows:

- Learning management system

- Classroom management

- Administration management

- Surveillance

- Others (study tools, learning analytics, online to offline, course material management, test preparation management, and online learning)

On the basis of regions, the IoT in education market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific (APAC)

- China

- Australia

- Singapore

- Rest of APAC

- Rest of the World (RoW)

- Brazil

- Mexico

- UAE

- Others

Key questions addressed by the report

- What are the opportunities in the IoT in education market?

- What is the competitive landscape in the market?

- What are the regulations that will impact the market?

- How has smart classroom evolved from the traditional classroom?

- What are the dynamics of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Segmentation

1.3.1 By Component

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Breakup of Primaries

2.1.2 Key Industry Insights

2.2 Data Triangulation

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Global IoT in Education Market

4.2 Market By Component, 2018 vs 2023

4.3 Market By Solution, 2018 vs 2023

4.4 Market By End User, 2018 vs 2023

4.5 Market By Application, 2018 vs 2023

4.6 Market Share Across Regions, 2018

4.7 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Use of Connected Devices in the Education Industry

5.2.1.2 Rapid Adoption of eLearning

5.2.1.3 Availability of Cloud-Based Solutions and Applications

5.2.2 Restraints

5.2.2.1 Increasing Cyber-Attacks on Educational Institutes to Raise the Concern for Data Security and Privacy

5.2.2.2 Lack of Industry Standard and Interoperability

5.2.2.3 Lack of Resources and Infrastructure in Developing Industries

5.2.3 Opportunities

5.2.3.1 Gamification of the Educational Industry

5.2.3.2 Increasing Expenditure in the Education Industry as A Percentage of GDP

5.2.3.3 Potential Growth Opportunities for System Integrators

5.2.3.4 Declining Cost of Connectivity and Connected Devices

5.2.4 Challenges

5.2.4.1 Inability to Manage Real-Time and Unstructured Data

5.2.4.2 Reluctance of Adopting New Technologies By Educational Institutes

5.3 Use Cases and Regulatory Implications

5.3.1 IoT in Education Market: Use Cases

5.3.1.1 Use Case: Scenario 1

5.3.1.2 Use Case: Scenario 2

5.3.1.3 Use Case: Scenario 3

5.3.1.4 Use Case: Scenario 4

5.3.1.5 Use Case: Scenario 5

5.4 IoT in Education Ecosystem

5.5 Regulatory Implications

5.5.1 Introduction

5.5.2 Right to Education

5.5.3 National Science Education Standards

5.5.4 International Standard Classification of Education

5.5.5 European Network for Quality Assurance in Higher Education

5.5.6 Australian Education Act

5.5.7 Education Services for Overseas Students Act

5.5.8 Fundamental Law of Education

5.5.9 Compulsory Education Law of the People's Republic of China

5.5.10 South African Schools Act, No. 84 of 1996

5.5.11 The Education Act 2011

5.5.12 Every Student Succeeds Act

5.5.13 Funds for Maintenance and Development of the Fundamental Education and Valorization of Teaching

6 IoT in Education Market, By Component (Page No. - 50)

6.1 Introduction

6.2 Solutions

6.2.1 Rapid Digitalization in Asia Pacific

6.3 Services

6.3.1 Requirement of Highly Customized Solutions and the Need to Focus on Core Operations

7 IoT in Education Market, By Hardware (Page No. - 54)

7.1 Introduction

7.2 Interactive Whiteboards

7.2.1 Need for Engagement Between Teachers and Students to Increase the Use of Interactive Whiteboards

7.3 Tablets and Mobile Devices

7.3.1 Increasing Adoption of BYOD Concept Among Institutes

7.4 Displays

7.4.1 Interactive Learning to Be A Primary Aspect for Educational Institutes

7.5 Security and Video Cameras

7.5.1 Schools to Be Responsible for Safety and Security of Students

7.6 Attendance Tracking Systems

7.6.1 Stringent Attendance Policies of Various Universities to Drive Attendance Tracking Systems

7.7 Others

8 IoT in Education Market, By Solution (Page No. - 57)

8.1 Introduction

8.2 Network Management

8.2.1 Network Management is Used to Enhance Service Delivery, Minimized Risk and Reduced Operating Costs

8.3 Content Management and Analytics

8.3.1 Increasing Significance of Online Education Content in Educational Institutions

8.4 Device Management

8.4.1 Increasing Connected Devices in Classrooms

8.5 Application Management

8.5.1 Need for Managing Various Applications

8.6 Security Management

8.6.1 Increasing Number of Cyber-Attacks on Educational Infrastructure

9 IoT in Education Market, By Service (Page No. - 64)

9.1 Introduction

9.2 Training and Consulting

9.2.1 Lack of Skilled Resources in the Education Industry

9.3 Deployment and Integration

9.3.1 The Need to Ease Complexities While Deploying Solutions in an Educational It Infrastructure

9.4 Support and Maintenance

9.4.1 The Need for 24/7 Access to Learning, Course Content, and Applications

10 IoT in Education Market, By End User (Page No. - 69)

10.1 Introduction

10.2 Academic Institutions

10.2.1 K-12

10.2.1.1 The Need to Reduce Interaction Gaps Between Educators, Students, and Parents

10.2.2 Higher Education

10.2.2.1 High Demand for eLearning in the Higher Education Sector

10.3 Corporates

10.3.1 Inability of Traditional Methods to Effectively Engage Employees

11 IoT in Education Market, By Application (Page No. - 74)

11.1 Introduction

11.2 Learning Management System

11.2.1 Smart Learning to Be A New Important Tool in the Education Industry

11.3 Classroom Management

11.3.1 Interactive Classrooms to Enhance the Learning and Development in the Education Industry

11.4 Administration Management

11.4.1 Administration Management to Improve Planning, Organization, Direction, Coordination, and Evaluation of Strategies

11.5 Surveillance

11.5.1 Security of Students and Academic Building Premises to Be the Foremost Priority in Educational Institutions

11.6 Others

12 IoT in Education Market, By Region (Page No. - 80)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.1.1 Smart Classrooms to Become an Integral Part of the Daily Learning and Teaching Methodologies

12.2.2 Canada

12.2.2.1 Smart Education to Boost the Efficiency of Learning for Students

12.3 Europe

12.3.1 United Kingdom

12.3.1.1 Smart Learning and Development is A Key Aspect for Corporates

12.3.2 Germany

12.3.2.1 Increasing Need for Smart Education in Automobile Corporates

12.3.3 France

12.3.3.1 Big Data in Education is Associated With Collecting Vast Amounts of Data From the Digitized Activities of Students, Parents, Faculty, and Staff

12.3.4 Rest of Europe

12.4 Asia Pacific

12.4.1 Australia and New Zealand

12.4.1.1 Need to Increase Technological Spending

12.4.2 China

12.4.2.1 Increasing Focus on Adopting Advanced Technologies in the Education Industry

12.4.3 Japan

12.4.3.1 The Country to Adopt Smart Education Environments

12.4.4 Singapore

12.4.4.1 Increasing Initiatives for Smart Cities

12.4.5 Rest of Asia Pacific

12.5 Middle East and Africa

12.5.1 Israel

12.5.1.1 Increasing Number of Innovations in IoT Technology

12.5.2 Qatar

12.5.2.1 Government to Increase Its Investment for Enhancing Citizen Services

12.5.3 United Arab Emirates

12.5.3.1 Increasing Need for Students Safety and Security

12.5.4 South Africa

12.5.4.1 IoT Innovation Set to Overcome Africa's Infrastructure Challenges

12.5.5 Rest of Middle East and Africa

12.6 Latin America

12.6.1 Brazil

12.6.1.1 The Increasing Need to Create Public Policies and Identify Opportunities for Applying IoT Technologies

12.6.2 Mexico

12.6.2.1 The Need to Increase Educational Performance and Attainment in Compulsory Education

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 104)

13.1 Overview

13.2 Top Players in the Market

13.3 Competitive Scenario

13.3.1 New Service/Product Launches

13.3.2 Agreements, Collaborations, and Partnerships

13.3.3 Business Expansions

14 Company Profiles (Page No. - 107)

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.1 IBM

14.2 Cisco

14.3 Intel

14.4 Google

14.5 AWS

14.6 Oracle

14.7 Microsoft

14.8 Huawei

14.9 Samsung

14.10 SAP

14.11 Arm

14.12 Unit4

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Key App Providers (Page No. - 133)

15.1 Introduction

15.2 School Administration

15.2.1 Learnzillion

15.2.2 Brightwheel

15.2.3 Certica Solutions

15.2.4 Examity

15.3 Next-Generation Schools

15.3.1 Knowre

15.3.2 Altschool

15.3.3 Quad Learning

15.3.4 Cuemath

15.4 Learning Solution

15.4.1 Galvanize

15.4.2 Littlebits

15.4.3 Itutorgroup

15.4.4 Voxy

15.5 Career Development

15.5.1 Fullbridge

15.5.2 Simplilearn

15.5.3 Grovo

15.5.4 Edupristine

15.6 Learning Analytics Vendors

15.6.1 Echo360

15.6.2 Brightbytes

15.6.3 Vitalsource

15.6.4 Panorama Education

15.7 Learning Management System Vendors

15.7.1 Knewton

15.7.2 Smart Sparrow

15.7.3 Freshgrade

15.7.4 Schoology

15.8 Course Materials and Study Tools

15.8.1 Grammarly

15.8.2 Quizlet

15.8.3 Newsela

15.8.4 Betterlesson

16 Appendix (Page No. - 143)

16.1 Discussion Guide

16.2 Knowledge Store: MarketsandMarkets Subscription Portal

16.3 Available Customizations

16.4 Related Reports

16.5 Author Details

List of Tables (69 Tables)

Table 1 United States Dollar Exchange Rate, 20152017

Table 2 Factors Analysis

Table 3 Education Spending, Percent of GDP - Country Rankings

Table 4 IoT in Education Market Size, By Component, 20162023 (USD Million)

Table 5 Solutions: Market Size By Region, 20162023 (USD Million)

Table 6 Services: Market Size By Region, 20162023 (USD Million)

Table 7 IoT in Education Market Size, By Solution, 20162023 (USD Million)

Table 8 Solutions: Market Size By Region, 20162023 (USD Million)

Table 9 Network Management: Market Size By Region, 20162023 (USD Million)

Table 10 Content Management and Analytics: Market Size By Region, 20162023 (USD Million)

Table 11 Device Management: Market Size By Region, 20162023 (USD Million)

Table 12 Application Management: Market Size By Region, 20162023 (USD Million)

Table 13 Security Management: Market Size By Region, 20162023 (USD Million)

Table 14 IoT in Education Market Size, By Service, 20162023 (USD Million)

Table 15 Services: Market Size By Region, 20162023 (USD Million)

Table 16 Training and Consulting: Market Size By Region, 20162023 (USD Million)

Table 17 Deployment and Integration: Market Size By Region, 20162023 (USD Million)

Table 18 Support and Maintenance: Market Size By Region, 20162023 (USD Million)

Table 19 IoT in Education Market Size, By End User, 20162023 (USD Million)

Table 20 Market Size By Academic Institution, 20162023 (USD Million)

Table 21 Academic Institutions: Market Size By Region, 20162023 (USD Million)

Table 22 K-12: Market Size By Region, 20162023 (USD Million)

Table 23 Higher Education: Market Size By Region, 20162023 (USD Million)

Table 24 Corporates: Market Size By Region, 20162023 (USD Million)

Table 25 IoT in Education Market Size, By Application, 20162023 (USD Million)

Table 26 Learning Management System: Market Size By Region, 20162023 (USD Million)

Table 27 Classroom Management: Market Size By Region, 20162023 (USD Million)

Table 28 Administration Management: Market Size By Region, 20162023 (USD Million)

Table 29 Surveillance: Market Size By Region, 20162023 (USD Million)

Table 30 Others: Market Size By Region, 20162023 (USD Million)

Table 31 IoT in Education Market Size, By Region, 20162023 (USD Million)

Table 32 North America: Market Size, By Component, 20162023 (USD Million)

Table 33 North America: Market Size By Solution, 20162023 (USD Million)

Table 34 North America: Market Size By Service, 20162023 (USD Million)

Table 35 North America: Market Size By End User, 20162023 (USD Million)

Table 36 North America: Market Size By Academic Institution, 20162023 (USD Million)

Table 37 North America: Market Size By Application, 20162023 (USD Million)

Table 38 North America: Market Size By Country, 20162023 (USD Million)

Table 39 Europe: IoT in Education Market Size, By Component, 20162023 (USD Million)

Table 40 Europe: Market Size By Solution, 20162023 (USD Million)

Table 41 Europe: Market Size By Service, 20162023 (USD Million)

Table 42 Europe: Market Size By End User, 20162023 (USD Million)

Table 43 Europe: Market Size By Academic Institution, 20162023 (USD Million)

Table 44 Europe: Market Size By Application, 20162023 (USD Million)

Table 45 Europe: Market Size By Country, 20162023 (USD Million)

Table 46 Asia Pacific: IoT in Education Market Size, By Component, 20162023 (USD Million)

Table 47 Asia Pacific: Market Size By Solution, 20162023 (USD Million)

Table 48 Asia Pacific: Market Size By Service, 20162023 (USD Million)

Table 49 Asia Pacific: Market Size By End User, 20162023 (USD Million)

Table 50 Asia Pacific: Market Size By Academic Institution, 20162023 (USD Million)

Table 51 Asia Pacific: Market Size By Application, 20162023 (USD Million)

Table 52 Asia Pacific: Market Size By Country, 20162023 (USD Million)

Table 53 Middle East and Africa: IoT in Education Market Size, By Component, 20162023 (USD Million)

Table 54 Middle East and Africa: Market Size By Solution, 20162023 (USD Million)

Table 55 Middle East and Africa: Market Size By Service, 20162023 (USD Million)

Table 56 Middle East and Africa: Market Size By End User, 20162023 (USD Million)

Table 57 Middle East and Africa: Market Size By Academic Institution, 20162023 (USD Million)

Table 58 Middle East and Africa: Market Size By Application, 20162023 (USD Million)

Table 59 Middle East and Africa: Market Size By Country, 20162023 (USD Million)

Table 60 Latin America: IoT in Education Market Size, By Component, 20162023 (USD Million)

Table 61 Latin America: Market Size By Solution, 20162023 (USD Million)

Table 62 Latin America: Market Size By Service, 20162023 (USD Million)

Table 63 Latin America: Market Size By End User, 20162023 (USD Million)

Table 64 Latin America: Market Size By Academic Institution, 20162023 (USD Million)

Table 65 Latin America: Market Size By Application, 20162023 (USD Million)

Table 66 Latin America: Market Size By Country, 20162023 (USD Million)

Table 67 New Service/Product Launches, 20162018

Table 68 Agreements, Collaborations, and Partnerships, 20162018

Table 69 Business Expansions, 20162018

List of Figures (46 Figures)

Figure 1 IoT in Education Market: Research Design

Figure 2 Research Methodology

Figure 3 IoT in Education Market: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology Top-Down Approach

Figure 5 Market Size, 20162023

Figure 6 Market Analysis

Figure 7 Fastest-Growing Segments in the IoT in Education Market, 20182023

Figure 8 IoT in Education Market: Regional Analysis, 2018

Figure 9 Growing Use of Connected Devices for Improving the Educational Quality to Drive the IoT in Education Market During the Forecast Period

Figure 10 Solutions Segment to Hold A Larger Market Share During the Forecast Period

Figure 11 Content Management and Analytics Segment to Hold the Largest Market Share During the Forecast Period

Figure 12 Academic Institutions Segment to Hold A Larger Market Share During the Forecast Period

Figure 13 Classroom Management Application to Hold the Largest Market Share During the Forecast Period

Figure 14 Singapore to Hold the Highest CAGR During the Forecast Period

Figure 15 Asia Pacific to Emerge as the Best Market for Investments During the Forecast Period

Figure 16 IoT in Education Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 K-12 Mobile Computing Shipments, 20162017

Figure 18 Cloud Computing in Education

Figure 19 Cyber-Attacks, Targeted Industries, March 2018

Figure 20 Growth in the Number of Connected Devices is Supported By Falling Device Costs

Figure 21 IoT in Education Ecosystem of App Providers

Figure 22 Solutions Segment to Grow at A Higher CAGR During the Forecast Period

Figure 23 Application Management Segment to Grow at the Highest CAGR During the Forecast Period

Figure 24 Deployment and Integration Segment to Grow at the Highest CAGR During the Forecast Period

Figure 25 Corporates Segment to Grow at the Highest CAGR During the Forecast Period

Figure 26 Learning Management System Segment to Grow at the Highest CAGR During the Forecast Period

Figure 27 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 28 North America: Market Snapshot

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Key Developments By Leading Players in the IoT in Education Market During 20152018

Figure 31 Market Top Players, 2018

Figure 32 IBM: Company Snapshot

Figure 33 SWOT Analysis: IBM

Figure 34 Cisco: Company Snapshot

Figure 35 SWOT Analysis: Cisco

Figure 36 Intel: Company Snapshot

Figure 37 SWOT Analysis: Intel

Figure 38 SWOT Analysis: Google

Figure 39 AWS: Company Snapshot

Figure 40 SWOT Analysis: AWS

Figure 41 Oracle: Company Snapshot

Figure 42 SWOT Analysis: Oracle

Figure 43 Microsoft: Company Snapshot

Figure 44 Huawei: Company Snapshot

Figure 45 Samsung: Company Snapshot

Figure 46 SAP: Company Snapshot

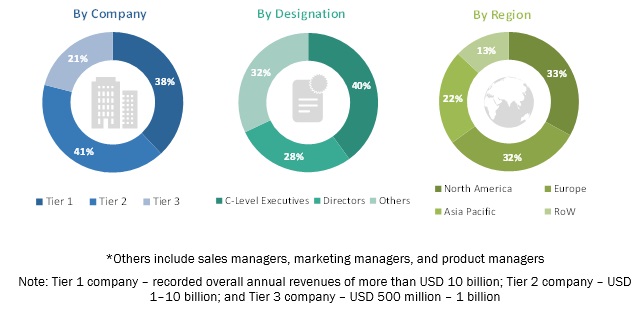

The study involved 4 major activities to estimate the current market size for IoT in education market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The IoT in education market comprises several stakeholders, such as service providers, solution vendors, service providers, system integrators, technology partners, consulting firms, research organizations, managed service providers, government agencies, financial bodies, resellers and distributors, enterprise users, and technology providers. The demand-side of the market consists of education institutions, such as k-12 and higher education providers. The supply side includes vendors of IoT in education solutions. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global IoT in education market and various other dependent submarkets in the overall market. While using the top-down approach, an exhaustive list of all the vendors offering solution and services in the market was prepared. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their solutions by technology, product type, and applications. The aggregate of all companies revenue was extrapolated to reach at the overall market size. Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from demand and supply sides.

Report Objectives

- To determine and forecast the global IoT in education market by component, hardware, solutions, service, end user, application, and region from 2018 to 2023, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to 5 main regions, namely, North America, Europe, Latin America, Asia Pacific (APAC), and Middle East and Africa (MEA)

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the IoT in education market

- To profile the key market players; generate a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials; and provide companies the in-house statistical tools required to understand the competitive landscape

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities in the market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which offers a detailed comparison of product portfolio of each company

- Further breakdown of the IoT in education market, by hardware

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in IoT in Education Market