Ionic Liquids Market by Application (Solvents & Catalysts, Process & Operating Fluids, Plastics, Batteries & Electrochemistry, Bio-Refineries) and by Region (North America, Europe, Asia-Pacific and Rest of World) - Global Forecast to 2021

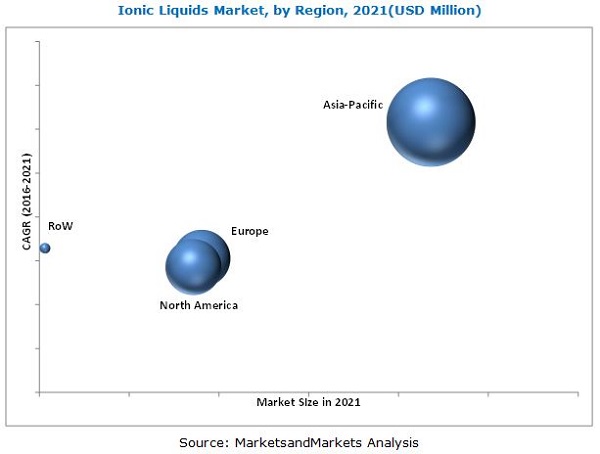

[97 Pages Report] Ionic Liquids Market size is estimated to reach USD 39.6 Million by 2021 at a CAGR of 9.2% between 2016 and 2021. The report segments the market based on application (solvents & catalysts, process & operating fluids, plastics, batteries & electrochemistry, and bio-refineries), and region (Asia-Pacific, North America, Europe, and RoW). The base year considered for the study is 2015, while the forecast period is between 2016 and 2021.

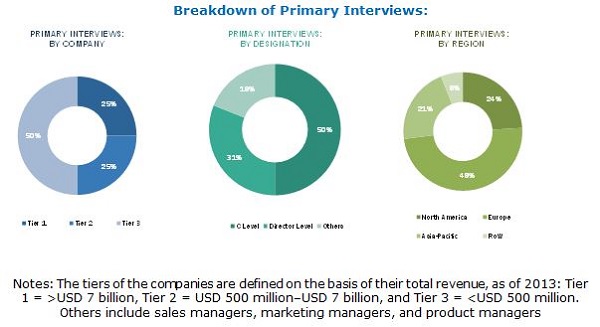

Top-down and bottom-up approaches have been used to estimate and validate the size of the global market and estimate the sizes of various other dependent submarkets in the overall ionic liquids market. The research study involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global ionic liquids market.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of ionic liquids ranges from sourcing of precursors (cations and anions) to delivery for end-use applications such as solvents & catalysts, process & operating fluids, plastics, electrochemistry & batteries, and bio-refineries. The ionic liquids industry is dominated by a few established players. Most of the key suppliers market their products mostly through local and regional distribution channels. Production units in North America and Europe supply ionic liquids globally. Various research institutions are focusing on the development of ionic liquids and their commercialization.

BASF SE (Germany), Evonik Industries AG (Germany), Merck KGaA (Germany), Ionic Liquids Technologies (IoLiTec) GmbH (Germany), The Chemours Company (U.S.), Proionic (Austria), Solvionic SA (France), CoorsTek Specialty Chemicals (U.S.), Jinkai Chemical Co., Ltd. (China), Reinste Nanoventure (India), Tatva Chintan Pharma Chem Pvt. Ltd. (India), and Strem Chemicals Inc. (U.S.) are the key manufacturers and suppliers of ionic liquids.

Ionic liquids are mostly used for laboratory/research applications, with a few companies commercially using them.

Key Target Audience:

- Ionic liquid manufacturers

- Technology providers

- Manufacturers in end-use applications such as solvents & catalysts, process & operating fluids, plastics, batteries & electrochemistry, and bio-refineries

- Industry and government associations

Scope of the Report:

This research report categorizes the global ionic liquids market based on application and region.

On the basis of Application:

- Solvents & catalysts

- Process & operating fluids

- Plastics

- Batteries & electrochemistry

- Bio-refineries

On the basis of Region:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- Belgium

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Malaysia

- Rest of Asia-Pacific

- RoW

- South America

- Middle East & Africa

The market size of ionic liquids is estimated to reach USD 39.6 Million by 2021, registering a CAGR of 9.2% between 2016 and 2021. The market is driven by rising demand for ionic liquids owing to their unique properties along with development and commercialization of ionic liquid applications. The ionic liquids find potential applications in solvents & catalysts, process & operating fluids, plastics, batteries & electrochemistry, and bio-refineries.

The use of ionic liquids in pharmaceuticals as liquid API and in the cosmetic industry are some of the applications, which are in research stage and can be a potential driver for the ionic liquids market in the near future. In 2015, the solvents & catalysts application of ionic liquids accounted for the largest market share, in terms of value, followed by electrochemistry & batteries and bio-refineries. One of the potential applications of these liquids is in the pre-processing of feedstock for bio-refineries. The ability to dissolve cellulose is a major driver of ionic liquids in the bio-refineries application.

In the solvents & catalysts application segment, ionic liquids are widely used as solvents and solvents & catalysts. The use of these liquids improves productivity and yields of a chemical reaction. The ability of these liquids to act both as solvents and catalysts increases their use in a number of industrial reactions. These liquids have low vapor pressures, volatility, and VOC content. With the restrictions laid on the use of VOCs by REACH and EPA, the replacement of solvents by these liquids is expected to drive the market. North America accounted for the second-largest market share of ionic liquids in 2015.

Asia-Pacific is the largest market for ionic liquids. China is the largest and fastest-growing market for ionic liquids. India, China, Japan, and Malaysia are important markets in Asia-Pacific; these countries have been adopting new processes using ionic liquids. Companies have been developing novel ionic liquids according to their application needs. China Ionic Liquids Laboratories and Petronas Ionic Liquids Centre are some of the institutes conducting research on ionic liquid applications. Asia-Pacific is also one of the major chemicals manufacturing regions. It has a large number of refineries, which provide a major potential for use of ionic liquids, as these liquids can be used both as a solvent and a catalyst in various industrial applications.

The factor restraining the growth of the ionic liquids market is its price. As these liquids are manufactured in a small scale, once the demand grows owing to commercialization of applications, the prices are expected to decrease making their use in various processes economic and feasible.

BASF is the largest player in the ionic liquids market. The company’s diversification and R&D activities made it the first one to commercially use ionic liquids in its patented technology BASIL (bi-phasic acid scavenging using ionic liquids). The company is constantly developing new ionic liquids for different applications, and it markets its products through Sigma Aldrich.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities for Ionic Liquids

4.2 Life Cycle Analysis

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application

5.2.2 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Unique Properties of Ionic Liquids

5.3.1.2 Development of Newer Applications

5.3.2 Restraints

5.3.2.1 High Costs

5.3.3 Opportunities

5.3.3.1 Collaborations for Commercialization of Applications

5.3.4 Challenges

5.3.4.1 Commercialization of Ionic Liquids and Its Applications

6 Industry Trends (Page No. - 36)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat From New Entrants

6.3.2 Threat From Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Ionic Liquids Market, By Application (Page No. - 40)

7.1 Introduction

7.2 Solvents & Catalysts

7.3 Process & Operating Fluids

7.4 Plastics

7.5 Electrochemistry & Batteries

7.6 Bio-Refineries

8 Ionic Liquids Market, By Region (Page No. - 48)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 U.K.

8.3.3 Belgium

8.3.4 Rest of Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 Malaysia

8.4.3 Japan

8.4.4 India

8.4.5 Rest of Asia-Pacific

8.5 RoW

8.5.1 South America

8.5.2 Middle East & Africa (MEA)

9 Company Profiles (Page No. - 68)

(Overview, Financial*, Products & Services, Strategy, and Developments)

9.1 BASF SE

9.2 Evonik Industries

9.3 Solvay S.A.

9.4 Merck KGAA

9.5 The Chemours Company

9.6 Proionic

9.7 Solvionic SA

9.8 Ionic Liquids Technologies Gmbh

9.9 Strem Chemicals Inc.

9.10 Coorstek Specialty Chemicals

9.11 Jinkai Chemical Co., Ltd.

9.12 Reinste Nanoventure

9.13 Tatva Chintan Pharma Chem Pvt. Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies

10 Appendix (Page No. - 91)

10.1 Insights From Industry Experts

10.2 Discussion Guide

10.3 Introducing RT: Real-Time Market Intelligence

10.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.5 Related Reports

List of Tables (32 Tables)

Table 1 Ionic Liquids Market, By Application

Table 2 List of Companies Using Ionic Liquids for Different Applications

Table 3 Ionic Liquids Market, By Application, 2014–2021 (USD Thousand)

Table 4 Ionic Liquids Market Size in Solvents & Catalysts, By Region,2014–2021 (USD Thousand)

Table 5 Ionic Liquids Market Size in Process & Operating Fluids, By Region, 2014–2021 (USD Thousand)

Table 6 Ionic Liquids Market Size in Plastics, By Region,2014–2021 (USD Thousand)

Table 7 Ionic Liquids Market Size in Electrochemistry & Batteries, By Region, 2014–2021 (USD Thousand)

Table 8 Ionic Liquids Market Size in Bio-Refineries, By Region,2014–2021 (USD Thousand)

Table 9 Ionic Liquids Market Size in Top Countries, 2014–2021 (USD Thousand)

Table 10 Ionic Liquids Market Size, By Region, 2014–2021 (USD Thousand)

Table 11 North America: Ionic Liquids Market Size, By Country,2014–2021 (USD Thousand)

Table 12 North America: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 13 U.S.: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 14 Canada: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 15 Mexico: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 16 Europe: Ionic Liquids Market Size, By Country,2014–2021 (USD Thousand)

Table 17 Europe: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 18 Germany: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 19 U.K.: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 20 Belgium: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 21 Rest of Europe: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 22 Asia-Pacific: Ionic Liquids Market Size, By Country,2014–2021 (USD Thousand)

Table 23 Asia-Pacific: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 24 China: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 25 Malaysia: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 26 Japan: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 27 India: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 28 Rest of Asia-Pacific: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 29 RoW: Ionic Liquids Market Size, By Region, 2014–2021 (USD Thousand)

Table 30 RoW: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 31 South America: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

Table 32 MEA: Ionic Liquids Market Size, By Application,2014–2021 (USD Thousand)

List of Figures (37 Figures)

Figure 1 Market Segmentation: Ionic Liquids

Figure 2 Ionic Liquids Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Data Triangulation: Ionic Liquids Market

Figure 6 Solvents & Catalysts Segment Projected to Be the Dominant Application of Ionic Liquids Between 2016 and 2021 (Thousand USD)

Figure 7 Asia-Pacific Projected to Dominate the Ionic Liquids Market Between 2016 and 2021 (Thousand USD)

Figure 8 Asia-Pacific Led the Ionic Liquids Market in 2015

Figure 9 Bio-Refineries and Electrochemsitry & Batteries Offer Attractive Opportunities in the Ionic Liquids Market

Figure 10 Asia-Pacific: Largest Market for Ionic Liquids

Figure 11 Ionic Liquids Market Growth, By Regions, 2016-2021

Figure 12 Ionic Liquids Market: Life Cycle Analysis

Figure 13 Ionic Liquids Market, By Region

Figure 14 Ionic Liquids Market Dynamics

Figure 15 Ionic Liquids Market: Value-Chain Analysis

Figure 16 Porter’s Five Forces Analysis

Figure 17 Bio-Refineries to Be the Fastest Growing Application of Ionic Liquids Between 2016 and 2021

Figure 18 Solvents & Catalysts Was the Largest Application of Ionic Liquids in 2015

Figure 19 Asia-Pacific to Witness the Highest Growth in Solvents & Catalysts Application for Ionic Liquids

Figure 20 Asia-Pacific Dominates the Ionic Liquids Market in Process & Operating Fluids Application

Figure 21 Asia-Pacific Leads Plastics Application of Ionic Liquids

Figure 22 Asia-Pacific Leads the Ionic Liquids Market for Electrochemistry & Batteries Application

Figure 23 Asia-Pacific: Fastest-Growing Market for Bio-Refineries Applications of Ionic Liquids

Figure 24 Asia-Pacific to Account for the Major Share of Growth

Figure 25 North American Market Snapshot: Solvents & Catalysts to Dominate the North American Ionic Liquids Market

Figure 26 Europe Market Snapshot: Solvents & Catalysts Accounted for A Major Share of the Ionic Liquids Market, 2015

Figure 27 Solvents & Catalysts to Account for A Major Share of the Ionic Liquids Market in Asia-Pacific, 2015

Figure 28 Asia-Pacific Snapshot: China Dominates the Ionic Liquids Market in Asia-Pacific

Figure 29 China to Account for the Largest Share of the Ionic Liquids Market in Asia-Pacific

Figure 30 BASF SE: Company Snapshot

Figure 31 BASF SE: SWOT Analysis

Figure 32 Evonik Industries: Company Snapshot

Figure 33 Evonik Industries: SWOT Analysis

Figure 34 Solvay S.A.: Company Snapshot

Figure 35 Solvay S.A.: SWOT Analysis

Figure 36 Merck KGAA: Company Snapshot

Figure 37 Chemours: Company Snapshot

Growth opportunities and latent adjacency in Ionic Liquids Market