Ion Milling System Market by Electron Microscopy Type (SEM, TEM, FIB), Sample Material, Application (Semiconductor Manufacturing, Geological Institutes, Medical Research Institutes), and Geography - Global Forecast to 2024-2036

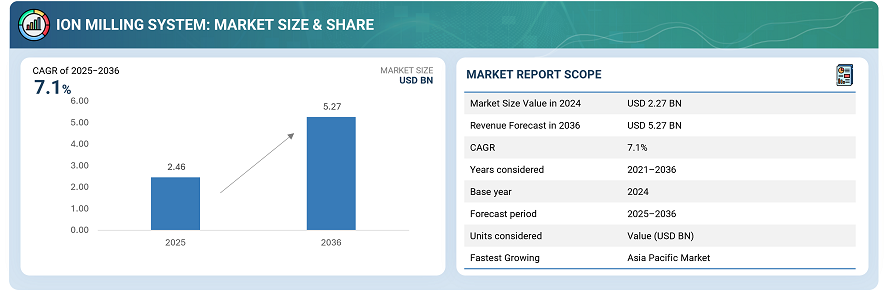

The global ion milling system market was valued at USD 2.27 billion in 2024 and is estimated to reach USD 5.27 billion by 2036, at a CAGR of 7.1% between 2025 and 2036.

The global ion milling system market is growing steadily as precision material processing becomes increasingly important in advanced manufacturing and research. Ion milling systems use focused ion beams to remove surface layers with exceptional accuracy, making them vital for preparing samples for electron microscopy and semiconductor inspection. Demand is rising from sectors such as microelectronics, materials science, and nanotechnology, where high-quality surface finishing and structural analysis are essential. Ongoing advancements in ion source technology, automation, and contamination control are improving performance and consistency. Strong growth in semiconductor fabrication and academic research, particularly in the Asia Pacific region, continues to support the expansion of the global ion milling system market.

Ion milling systems are high-precision instruments that use focused ion beams to remove material surfaces with exceptional accuracy. They are essential for preparing samples for detailed imaging and analysis in semiconductor manufacturing, materials research, and nanotechnology applications. These systems enable smooth, damage-free surfaces that are critical for techniques such as transmission electron microscopy (TEM) and scanning electron microscopy (SEM). Modern ion milling systems feature advanced beam control, adjustable angles, and automated operation, ensuring consistent and reproducible results. Their use supports high-resolution material characterization, quality assurance, and failure analysis across industrial, academic, and research laboratories worldwide.

Market by Application

Semiconductor Manufacturing

The semiconductor manufacturing industry is the largest segment in the ion milling system market, driven by the need for precise surface preparation and defect analysis in advanced chip fabrication. Ion milling systems are widely used in wafer thinning, cross-sectioning, and layer removal to achieve high-quality surfaces for inspection and characterization. These systems ensure accuracy in evaluating microstructures, interfaces, and material integrity in semiconductor devices. Advanced features such as adjustable ion beam angles, low-damage milling, and automated control make them indispensable for high-resolution sample preparation. The growing demand for smaller, more powerful chips, combined with increased research and development (R&D) in semiconductor process optimization, is further enhancing efficiency, reliability, and innovation across semiconductor manufacturing and quality control operations.

Forensic Laboratories

The forensic laboratories segment represents one of the major application areas in the ion milling system market, driven by the growing need for precise surface analysis and microstructural examination in evidence investigation. Ion milling systems are used to prepare samples, such as metals, coatings, and composite materials, without introducing artifacts or distortions, thereby ensuring accurate imaging under electron microscopes. These systems enable forensic experts to analyze trace evidence, tool marks, and material composition at the micro- and nanoscale levels. Features such as controlled ion beam energy, uniform material removal, and contamination-free processing make ion milling a crucial tool for high-precision forensic analysis. The increasing reliance on advanced microscopy and material characterization techniques in criminal investigations is further strengthening the adoption of ion milling systems in forensic laboratories.

Market by Product Type

Cross Section Milling

The cross section milling segment is the largest and fastest-growing product type in the ion milling system market, driven by the increasing demand for precise sample preparation in semiconductor, materials science, and nanotechnology applications. Cross-section milling systems enable accurate removal of material layers to reveal internal structures, interfaces, and defects, making them essential for high-resolution imaging and failure analysis. Advanced features, including controlled ion beam angles, low-damage milling, and automated operation, ensure consistent and reproducible sample quality. The rising need for detailed structural characterization, quality assurance, and R&D in microelectronics and advanced materials is driving the global adoption of cross-section milling systems, establishing it as a key growth segment in the market.

Flat Surface Milling

Flat surface milling is a key product type in the ion milling system market and holds a significant share due to its extensive use in semiconductor manufacturing, materials science, and forensic laboratories. It enables uniform removal of surface layers, producing smooth, distortion-free surfaces essential for high-resolution imaging and precise material analysis. Advanced features, including low-energy ion beams, automated operation, and minimal sample damage, ensure consistent and reproducible results. The growing demand for accurate sample preparation, quality assurance, and advanced research in microelectronics, nanotechnology, and materials characterization is driving the adoption of flat surface milling, making it a major contributor to the global ion milling system market.

Market by Geography

The Asia Pacific region is the fastest-growing market for ion milling systems, driven by strong investments in semiconductor manufacturing, electronics, and advanced materials research. Countries such as China, Japan, and South Korea are leading in the adoption of high-precision sample preparation technologies to support next-generation semiconductor fabrication, nanotechnology development, and materials characterization. The presence of a large number of research institutions, growing R&D activities, and increasing demand for high-quality electronic components are fueling market growth. Additionally, government initiatives and industrial expansion in microelectronics and advanced manufacturing are further accelerating the adoption of ion milling systems across the region, making Asia-Pacific a key growth hub in the global market.

Market Dynamics

Driver: Increasing Demand for Precise Sample Preparation in Semiconductor and Materials Research

The rising need for accurate and damage-free sample preparation is driving growth in the ion milling system market. As semiconductor manufacturing, nanotechnology, and materials science research advance, laboratories require precise ion beam milling to achieve smooth surfaces for TEM and SEM analysis. Ion milling systems provide controlled material removal, uniform surface finishing, and reproducible results, ensuring reliable inspection and characterization. Industries such as semiconductors, electronics, aerospace, and forensic laboratories are expanding R&D and quality control operations, leading to higher demand for advanced milling solutions. The need for precise diagnostics, microstructural analysis, and defect detection continues to fuel global market growth.

Restraint: High Costs and Operational Complexity

The significant capital investment required for ion milling systems and their complex operation limit market expansion. Small laboratories and emerging companies often face budget constraints and require specialized personnel to ensure efficient operation. Maintenance, calibration, and adherence to safety standards add further operational challenges. These factors restrict adoption, particularly in cost-sensitive regions and institutions with limited technical expertise, slowing overall market growth.

Opportunity: Growing Applications in Forensic and Advanced Materials Analysis

Expanding applications in forensic laboratories, aerospace materials testing, and nanotechnology research present substantial opportunities. Ion milling enables precise surface preparation for high-resolution imaging and detailed microstructural analysis, which is crucial for criminal investigations, failure analysis, and the characterization of advanced materials. Collaborations between research institutes, industrial R&D centers, and semiconductor manufacturers further enhance market potential. Rising global investments in research and quality assurance are expected to increase the adoption of ion milling systems across diverse sectors.

Challenge: Maintaining Consistency and Minimizing Sample Damage

Ensuring uniform precision while avoiding sample damage remains a key challenge for the ion milling market. Variations in material properties, beam control limitations, and contamination risks can affect reproducibility and accuracy. Continuous innovation in automation, ion beam control, and system stability is required to address these challenges. Maintaining reliable performance across different applications is essential for building user confidence and achieving broader market adoption.

Future Outlook

Between 2025 and 2036, the global ion milling system market is expected to experience significant growth as industries increasingly require high-precision, damage-free sample preparation for semiconductor manufacturing, materials research, and nanotechnology applications. Advancements in automated ion milling systems, low-damage beam control, and in-situ monitoring will enhance accuracy, reproducibility, and operational efficiency. The expanding demand for high-resolution imaging in TEM and SEM, along with growing applications in forensic analysis, aerospace materials testing, and advanced electronics, will further drive adoption. As the market evolves, ion milling systems will play a crucial role in enabling precise material characterization, quality assurance, and failure analysis, supporting innovation and reliability across industrial, research, and academic applications worldwide.

Key Market Players

Top ion milling system companies include Leica Microsystems (Germany), Hitachi High-Tech Corporation (Japan), Veeco Instruments Inc. (US), Intlvac Thin Film Corporation (US), and AJA International, Inc. (US).

Key Questions addressed in this report:

- What is the current market size of the ion milling system market, and how is it expected to grow between 2025 and 2036?

- Which regions are leading in the adoption of ion milling systems, and which regions are showing the fastest growth?

- What are the key industries and applications driving the demand for ion milling systems?

- Who are the leading players in the ion milling system market, and what strategies are they adopting for expansion?

*This is a tentative table of contents, and there might be a few changes during the study

TABLE 1 Ion Milling System Market, by Product Type (USD Million)

|

Product Type |

2022 |

2024 |

2026 |

2028 |

2030 |

2033 |

2034 |

2036 |

CAGR (2025–2036) |

|

Cross Section Milling |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Flat Surface Milling |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 2 Ion Milling System Market, By Electron Microscopy Type (USD Million)

|

Electron Microscopy Type |

2022 |

2024 |

2026 |

2028 |

2030 |

2033 |

2034 |

2036 |

CAGR (2025–2036) |

|

SEM |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

FIB |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

TEM |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 3 Ion Milling System Market, By sample material (USD Million)

|

Sample Material |

2022 |

2024 |

2026 |

2028 |

2030 |

2033 |

2034 |

2036 |

CAGR (2025–2036) |

|

Ceramics |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Polymers |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Metals |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Composites |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Other Materials |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 4 Ion Milling System MARKET by Application (USD Million)

|

Application |

2022 |

2024 |

2026 |

2028 |

2030 |

2033 |

2034 |

2036 |

CAGR (2025–2036) |

|

Semiconductor Manufacturing |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Forensic Laboratories |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Geological Institutes |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Medical Research Institute |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Food Analysis |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Others |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 5 Ion Milling System Market, By Region (USD Million)

|

Region |

2022 |

2024 |

2026 |

2028 |

2030 |

2033 |

2034 |

2036 |

CAGR (2025–2036) |

|

North America |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Europe |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Asia Pacific |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

RoW |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

The study involved four major activities in estimating the current size of the ion milling system market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the ion milling system market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the ion milling system market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

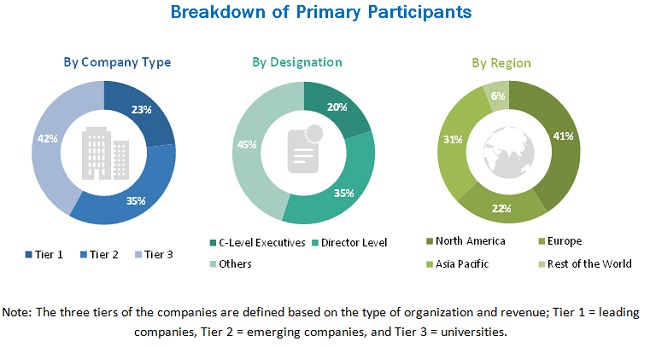

The ion milling system market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of ion milling system; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the ion milling system market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major application areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Research Objective

- To define, describe, and forecast the overall ion milling system market, in terms of value, segmented based on product type, electron microscopy type, sample material, applications, and geography

- To forecast the market size for various segments with regard to 4 regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the ion milling system market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall ion milling system market

- To analyze opportunities in the ion milling system market for stakeholders by identifying the high-growth segments

- To strategically profile key players, comprehensively analyze their market rankings and core competencies, and detail the competitive landscape for market leaders

- To analyze competitive developments such as product launches and development; agreement, partnerships and contacts; and acquisition and R&D in the overall ion milling system market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Ion Milling System Market