IO-Link Market Size, Share & Industry Growth Analysis Report by Type (IO-Link Wired, IO-Link Wireless), Component (IO-Link Masters, IO-Link Devices), Industry (Process Industries, Hybrid Industries), Application (Machine Tools, Intralogistics Solutions) and Region - Global Forecast to 2028

Updated on : July 11, 2025

IO-Link Market Summary

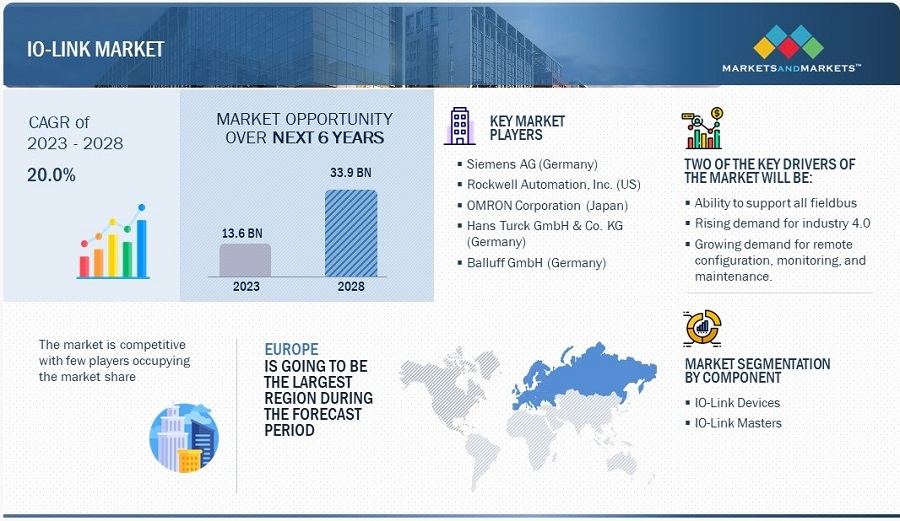

[231 Pages Report] The IO-Link Market Size is projected to reach USD 33.9 billion by 2028 from an estimated USD 13.6 billion in 2023, at a compound annual growth rate (CAGR) of 20.0% from 2023 to 2028.

IO-Link Market Key Takeaways

-

By 2023–2028, the IO-Link market is set to grow significantly, from USD 13.6 billion in 2023 to USD 33.9 billion by 2028, reflecting a strong CAGR of 20.0%.

-

By dynamics – the need for streamlined communication in smart factories is driving IO-Link adoption, enabling simple installation, error-free data exchange, and real-time diagnostics.

-

By dynamics – manufacturers are shifting toward automation, and IO-Link’s plug-and-play capabilities and consistent communication are simplifying integration on factory floors.

-

By challenge – compact machine design limits space for IO-Link components, which can reduce its adoption in minimalistic and space-constrained equipment environments.

-

By opportunity – the automotive industry is embracing IO-Link, especially for real-time diagnostics and reducing equipment downtime in high-volume production environments.

-

By type – wired IO-Link systems dominate, offering robust, reliable two-way communication that fits well with high-uptime industrial operations.

-

By component – IO-Link devices like sensors and actuators lead the market, as they not only collect data but also support remote configuration and maintenance.

-

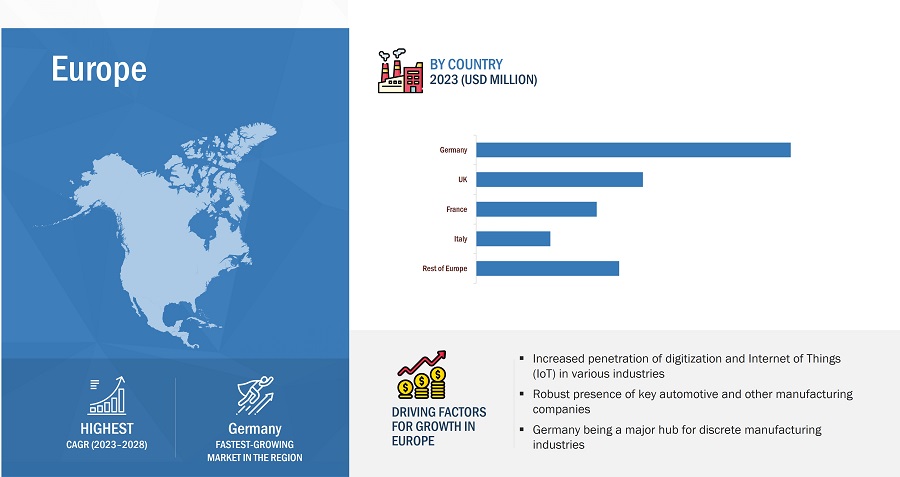

By region – Europe is expected to maintain the largest market share, due to its strong presence in industrial automation, especially in automotive, aerospace, and packaging sectors.

Market Size & Forecast Report

-

2023 Market Size: USD 13.6 Billion

-

2028 Projected Market Size: USD 33.9 Billion

-

CAGR (2023-2028): 20.0%

-

Europe : Largest market share

Ability to support all fieldbus protocols and growing demand for remote configuration, monitoring, and maintenance are among the factors driving the growth of the IO-Link industry.

IO-Link Market Analysis Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

IO-Link Market Trends & Dynamics:

Driver: Rising demand for industry 4.0

Industry 4.0 aims at fully integrating the communication process used in manufacturing to improve the efficiency of factories and transform them into smart factories. This is achieved through the Industrial Internet of Things (IIoT), industrial automation, data exchange, and deployment of smart field devices. The benefits of Industry 4.0 and IIoT include the integration of IO-Link solutions with overall industrial automation systems, easy replacement of sensors, elimination of manual parameter settings, continuous data monitoring and status diagnostics, and increased uptime.

Restraint: Use of compact machines

IO-Link solutions help reduce cables and wiring for industrial machines. Manufacturing industries demand compact and reliable solutions for their operational processes. This leads to the requirement for compact machines on a factory floor. Apart from being small, such compact machines consume less power and offer better performance than other industrial solutions. Also, the wiring in compact machines is already short. In such cases, deploying IO-link solutions is costlier for IO-Link Industry players. In addition, these machines are efficient and require lesser space than traditional machines and other industrial solutions. Hence, the use of compact machines for industrial automation is a key hurdle for the growth of the IO-Link market.

Opportunity: Increasing adoption of IO-Link in automotive industry

A minor shutdown can result in huge losses in a manufacturing unit in the automotive industry. A fault can hamper the entire production process. IO-Link devices eliminate such downtimes, improve product and production processes, and ensure regular preventive maintenance. IO-Link masters are developed according to AIDA specifications for the automotive industry and provide improved performance. The Automation Initiative of German Domestic Automobile manufacturers (AIDA) has defined a standard for IO-Link masters in the automotive industry. The L-coded power connection with functional earth is to be used for all field modules. Vertical integration in automation for the automotive industry includes the support of EtherCAT and EtherNet/IP. Also, IO-Link products are used for seamless integration with controllers. Thus, the automotive industry is expected to create a huge opportunity for the IO-Link ecosystem players in the near future.

Challenge: Cyber risks associated with automation systems

IO-Link solutions are vulnerable to threats such as cross-site request forgery (CSRF), reflected cross-site scripting (XSS), blind command injection, and denial-of-service (DoS) issues. Other risks associated with IO-Link include spear phishing, watering holes, and database injection. In a phishing assault, a digital criminal can steal data from devices by deceiving them into sharing the security key for an application. Cyber risks threaten industrial automation and control systems (IACS). However, cybersecurity measures are taken to secure IACS against such risks. These assaults are used to threaten manufacturing industries and gain monetary benefits or critical business information. These dangers begin from the web, corporate systems, programming overhauls, and unapproved access.

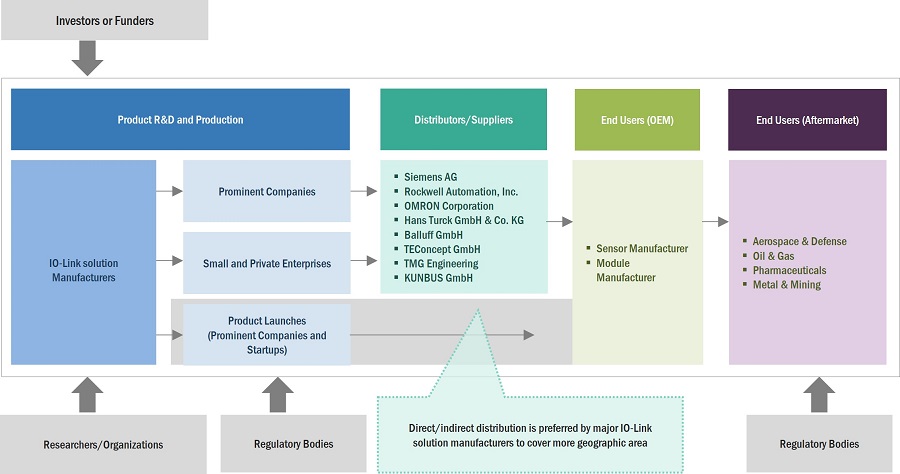

IO-Link Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of IO-Link solutions. These IO-Link Companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Siemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); Sick AG (Germany); Festo SE & Co. KG (Germany); SMC Corporation (Japan). The demand Product R&D and Production Distributors/Suppliers End Users (OEM) Prominent Companies Small- and Medium-sized Enterprise Suppliers & Retailers Prominent Companies Small and Private Enterprises Joint Ventures (Prominent Companies and Startups) Researchers/Organizations Regulatory Bodies IO-Link solution Manufacturers ? Private Contractors End Users (Aftermarket) Regulatory Bodies

By type, IO-Link wireless segment is expected to grow with the highest CAGR during 2022

The IO-Link wireless segment is expected to experience the second highest CAGR of 100.2% during 2022. IO-link wireless supports roaming capabilities and the possibility to include sensors with low energy consumption in real-time networks. IO-Link wireless is compatible with factory and process automation protocols. The rising demand for the IO-Link wireless protocol and increasing adoption of smart manufacturing across industries are expected to create lucrative opportunities for the growth of the IO-Link wireless segment in the near future.

By component, IO-Link masters segment is expected to grow with the second highest CAGR during the forecast period

The IO-Link masters of the IO-Link Market Size is expected to grow at the second highest CAGR of 18.6% during the forecast period. IO-Link masters are gateways for connecting up to 8 or 16 IO-Link devices, such as sensors, valves, and binary input or output modules. They reliably transmit machine data, process parameters, and diagnostic data to the controller using 20−30 V supply voltage. The masters simultaneously exchange data with controllers and automation systems. IO-Link masters are used for field applications and control cabinets. These masters have excellent electromagnetic stability, a wide temperature range, high protection rating, and robust housing. Due to these benefits, these are ideal for harsh industrial environment applications.

By IO-Link Industry, hybrid industries segment is expected to grow with the second highest CAGR during the forecast period

The hybrid industries segment is expected to experience the second highest CAGR of 18.9% during the forecast period. In hybrid industries, automation solution requirements are usually a mix of automation solutions for process and discrete industries. Hybrid industries include metals & mining, food & beverages, pharmaceuticals, cement, and glass. Food & beverages and pharmaceuticals industries are the leading hybrid industries in the IO-Link market.

By application, machine tools segment is expected to grow with the second highest CAGR during the forecast period

The machine tools segment is expected to witness the second highest CAGR of 20.3% during the forecast period. Machine tools contain multiple sensors for detecting pressure, level, and temperature. IO-Link-capable sensors are identifiable through their vendor and device ID. The program set by the user in a controller recognizes the connected sensor, checks it, and sets the sensor parameters using the parameter record. Sensors from different manufacturers can be used on a factory floor. IO-Link can also be used for the standard sensors installed on a machine. The signals from these sensors are collected and used in IO-Link sensor hubs and passed along to the controller.

IO-Link Market by Region

To know about the assumptions considered for the study, download the pdf brochure

In 2028, Europe is projected to hold the largest share of the overall IO-Link market

Europe region is expected to grow at largest share of ~41% during the forecasted year. Europe comprises major growing economies, such as the UK, Germany, and France, which offer significant growth opportunities for the market. The region focuses on developing highly advanced connected cars and autonomous vehicles, thereby accelerating the demand for IO-Link solutions. The region produces a large number of motor vehicles, aerospace parts, and robots. Thus, the robots manufacturing IO-Link Industry and aerospace industry are an integral part of Europe’s economy.

Top IO-Link Companies - Key Market Players

Siemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); SICK AG (Germany); Festo SE & Co. KG (Germany); SMC Corporation (Japan) are some of the key players in the IO-Link companies.

IO-Link Market Report Scope :

|

Report Metric |

Details |

| Market size value in 2023 | USD 13.6 Billion |

| Market size value in 2028 | USD 33.9 Billion |

| CAGR (2023-2028) | 20.0% |

|

Years Considered |

2023–2028 |

|

On Demand Data Available |

2030 |

|

Forecast Period |

2019–2028 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Type, Component, Industry, Application and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Are some of the key players in the IO-Link market. Total 10 Major Players are covered. |

IO-Link Market Highlights

This research report categorizes the IO-Link market based on by type, by industry, by component, by application, and by region.

|

Segment |

Subsegment |

|

Io-Link Market, By Type |

|

|

Io-Link Market, By Component |

|

|

Io-Link Market, By Industry |

|

|

Io-Link Market, By Application |

|

|

Geographic Analysis |

|

Recent Developments

- In August 2022, ifm electronic GmbH acquired a minority share in HiDensity AG, the sole holder of Biel-based HMT microelectronic AG. This acquisition is aimed at future growth potential.

- In June 2022. SICK partners with F1TENTH, which is focused on innovation in the field of autonomous systems for up-and-coming roboticists. This partnership aims at providing students resources in developing autonomous vehicles, including various races throughout the year.

- In June 2022, SICK AG launched Monitoring Box, it is a new Smart Service web application from SICK. It visualizes status data from SICK sensors, offering customers added value from previously unused sensor data. The monitoring box allows for the visualization of internal device parameters to diagnose and monitor fault conditions. It consists of a browser application, server-side data management, an IoT Gateway, and suitable predefined sensor apps for simple connection of SICK sensors.

- In July 2022, Pepperl+Fuchs launched CB10 series I/O hubs that offer the optimal solution for direct integration into the smallest installation spaces. The CB10 modules can be connected directly to an IO-Link master and make push button boxes IO-Link-capable this way.

- March 2022, Balluff GmbH launched BNI IO-Link master and I/O modules are compelling options wherever regular cleaning cycles, among other things, occur in challenging environments. With these new IO-Link devices, the user can better manage difficult conditions.

Frequently Asked Questions (FAQs):

What is the size of the IO-Link market projected growth rate over the next few years?

The market size of IO-Link is growing rapidly, with an estimated market size of $33.9 billion by 2028. The market is expected to grow 20.0% annually over the next 5 years.

What are the key drivers of growth in the IO-Link market, and what are the major trends shaping this industry?

The key drivers of growth in the IO-Link market include increasing demand for automation and industry 4.0 solutions, as well as the need for efficient and flexible communication between sensors, actuators, and controllers. Major trends shaping the industry include the growing adoption of IIoT (Industrial Internet of Things) and advancements in wireless technology.

Who are the leading players in the IO-Link market, and what are their market shares and competitive strategies?

Leading players in the IO-Link market includeSiemens AG (Germany), Rockwell Automation, Inc. (US); OMRON Corporation (Japan); Hans Turck GmbH & Co. KG (Germany); Balluff GmbH (Germany); ifm electronic GmbH (Germany); Pepperl+Fuchs (Germany); SICK AG (Germany); Festo SE & Co. KG (Germany); SMC Corporation (Japan). These players have significant market shares and are adopting competitive strategies such as partnerships, collaborations, and product innovations to maintain their market position.

What are the key regulatory and policy issues impacting the IO-Link market, and how are they likely to evolve in the coming years?

The key regulatory and policy issues impacting the IO-Link market include data privacy, cybersecurity, and intellectual property rights. These issues are likely to evolve in the coming years as new regulations and policies are introduced to address these concerns.

How is the IO-Link market likely to be affected by other technology trends, such as the Internet of Things (IoT), Industry 4.0, and digital transformation?

The IO-Link market is likely to be affected by other technology trends such as the Internet of Things (IoT), Industry 4.0, and digital transformation. These trends are expected to drive the adoption of IO-Link technology by enhancing its connectivity and interoperability with other systems.

What are the main customer requirements and preferences in the IO-Link market, and how are suppliers meeting these needs?

The main customer requirements and preferences in the IO-Link market include high reliability, cost-effectiveness, ease of installatio and maintenance, and compatibility with existing systems. Suppliers are meeting these needs by focusing on product innovations, customization, and customer support servicecapitalize on these opportunities.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

$$$##### #####

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for Industry 4.0- Ability to support all fieldbus protocols- Growing demand for remote configuration, monitoring, and maintenanceRESTRAINTS- Use of compact machines- Use of basic sensorsOPPORTUNITIES- Limitations of Ethernet- Increasing adoption of IO-Link in automotive industryCHALLENGES- Cyber risks associated with automation systems

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR IO-LINK MARKET

-

5.5 IO-LINK ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 CASE STUDY ANALYSISBALLUFF REDUCED CHANGEOVER TIME BY 65% WITH GUIDED FORMAT CHANGEHARPAK-ULMA IMPROVES CUSTOMER AGILITY WITH SMART PACKAGING MACHINES FROM ROCKWELL AUTOMATIONPROCECO INTEGRATED CLEANING SYSTEMS WITH CUBE67 AND IO-LINK SOLUTIONSMARSTON’S BREWERY USES IFM IO-LINK DEVICES TO UPDATE TANK-LEVEL CONTROL

-

5.8 TECHNOLOGY ANALYSISCOMPLEMENTARY TECHNOLOGIES- Fieldbus technology- Interface technology

- 5.9 AVERAGE SELLING PRICE OF IO-LINK SOLUTIONS

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSIS, 2020–2022

-

5.12 TARIFFS AND REGULATIONSTARIFFSREGULATORY COMPLIANCESSTANDARDS

- 6.1 INTRODUCTION

- 6.2 IO-LINK WIRED

- 6.3 IO-LINK WIRELESS

- 7.1 INTRODUCTION

-

7.2 IO-LINK MASTERSPROFINET- PROFINET protocol led IO-Link market in 2022ETHERNET/IP- EtherNet/IP ideal for control applications and Industrial Internet of Things (IIoT)MODBUS TCP/IP- Modbus TCP/IP protocol widely used in process industries for factory automationETHERCAT- EtherCAT makes machines and systems faster, simpler, and more cost-effectiveMULTIPROTOCOL- Multiprotocol solutions offer better user experience and support for field upgradesOTHERS

-

7.3 IO-LINK DEVICESSENSOR NODES- Sensor nodes are small and inexpensive devices with limited battery and computation power- Position sensors- Temperature sensors- Pressure sensors- Vibration sensors- OthersMODULES- IO-Link modules enable connection of standard sensors and actuatorsACTUATORS- Actuators help machines achieve physical movementRFID READ HEADS AND OTHERS

- 8.1 INTRODUCTION

-

8.2 DISCRETE INDUSTRIESAUTOMOTIVE- IO-Link solutions help streamline manufacturing processesAEROSPACE & DEFENSE- Increased automation in aerospace & defense industry to boost demand for IO-Link solutionsSEMICONDUCTOR & ELECTRONICS- Decentralization in semiconductor & electronics industry to propel IO-Link market growthMACHINE MANUFACTURING- IO-Link facilitates control architecture modernization to support IIoT and Industry 4.0PACKAGING- Need for high-quality packaging processes to boost demand for IO-Link solutions

-

8.3 HYBRID INDUSTRIESPHARMACEUTICALS- Adoption of IO-Link solutions to make manufacturing operations faster and more cost-effectiveMETALS & MINING- IO-Link solutions to help manage processes better and increase productivityFOOD & BEVERAGES- Need for process reliability and constant product quality to drive demand for IO-Link solutionsCEMENT AND GLASS- Emphasis of manufacturers on conserving natural resources and protecting climate to offer lucrative opportunities for IO-Link solution providers

-

8.4 PROCESS INDUSTRIESOIL & GAS- Rising focus on lowering operational costs in oil & gas industry to increase adoption of IO-Link solutionsCHEMICALS- IO-Link solutions to increase efficiency, sustainability, and safety of chemicals manufacturing and processing plantsENERGY & POWER- IO-Link solutions to help increase flexibility and efficiency of energy & power industry

- 9.1 INTRODUCTION

-

9.2 MACHINE TOOLSRISING NEED FOR AUTOMATIC SETTING OF SENSOR PARAMETERS TO FUEL DEMAND FOR IO-LINK SOLUTIONS IN MACHINE TOOLS

-

9.3 HANDLING AND ASSEMBLY AUTOMATIONINCREASING DEMAND FOR INDUSTRIAL AUTOMATION TO ACCELERATE GROWTH OF HANDLING AND ASSEMBLY AUTOMATION APPLICATION

-

9.4 PACKAGING AUTOMATION SOLUTIONSNEED TO INCREASE PRODUCTIVITY AND REDUCE MANUFACTURING COSTS TO DRIVE DEMAND FOR PACKAGING AUTOMATION SOLUTIONS

-

9.5 INTRALOGISTICS SOLUTIONSUSE OF IO-LINK SOLUTIONS TO INCREASE OVERALL EFFICACY OF CONVEYOR BELTS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Rising petroleum industry to offer lucrative growth opportunities for IO-Link marketCANADA- Growth in manufacturing sector to drive adoption of IO-Link solutionsMEXICO- Continuous developments in manufacturing industry to boost demand for IO-Link solutions

-

10.3 EUROPEGERMANY- Growing adoption of robotics and automation products to boost demand for IO-Link solutionsUK- Increased adoption of IO-Link solutions by aerospace sector to drive marketFRANCE- Vibrant automotive industry to drive IO-Link marketITALY- IO-Link used to facilitate communication between connected devices in robots industryREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Growing automation in manufacturing industry to drive marketJAPAN- Rising automotive industry to propel IO-Link market growthSOUTH KOREA- Growing electronics industry to boost market growthREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDMIDDLE EAST AND AFRICA (MEA)- Growing automation in oil & gas industry to propel demand for IO-LinkSOUTH AMERICA- Growing mining industry to drive IO-Link market

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE COMPANIES, 2017-2021

- 11.4 MARKET SHARE ANALYSIS: IO-LINK MARKET, 2022

-

11.5 MARKET EVALUATION QUADRANT, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT

-

11.7 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSSIEMENS AG- Business overview- Products offered- Recent developments- MnM viewHANS TURCK GMBH & CO. KG- Business overview- Products offered- Recent developments- MnM viewBALLUFF GMBH- Business overview- Products offered- Recent developments- MnM viewIFM ELECTRONIC GMBH- Business overview- Products offered- Recent developments- MnM viewSICK AG- Business overview- Products offered- Recent developments- MnM viewROCKWELL AUTOMATION, INC.- Business overview- Products offered- Recent developmentsOMRON CORPORATION- Business overview- Products offered- Recent developmentsPEPPERL+FUCHS- Business overview- Products offered- Recent developmentsFESTO SE & CO. KG- Business overview- Products offered- Recent developmentsSMC CORPORATION- Business overview- Products offered

-

12.2 OTHER PLAYERSBOSCH REXROTH AGBAUMERBELDEN INC.BECKHOFF AUTOMATION GMBH & CO. KGBANNER ENGINEERING CORP.WEIDMÜLLER INTERFACE GMBH & CO. KGPHOENIX CONTACT GMBH & CO. KGWENGLOR SENSORIC GMBHCARLO GAVAZZI HOLDING AGDATALOGIC S.P.A.BIHL+WIEDEMANN GMBHMURRELEKTRONIK GMBHJUMO GMBH & CO. KGCORETIGO

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 KEY ASSUMPTIONS: MACRO AND MICRO-ECONOMIC ENVIRONMENT

- TABLE 2 IO-LINK MARKET: COMPANIES AND THEIR ROLE IN SUPPLY CHAIN

- TABLE 3 IO-LINK MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF IO-LINK SOLUTIONS, BY COMPONENT

- TABLE 5 IMPORTS DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 6 EXPORTS DATA, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 7 TOP 20 PATENT OWNERS DURING 2013–2022

- TABLE 8 TARIFF FOR HS CODE 853890 EXPORTED BY US (2021)

- TABLE 9 TARIFF FOR HS CODE 853890 EXPORTED BY INDIA (2021)

- TABLE 10 IO-LINK MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 11 IO-LINK MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 12 IO-LINK MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 13 IO-LINK MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 14 IO-LINK MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 15 IO-LINK MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 16 IO-LINK MARKET, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 17 IO-LINK MARKET, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 18 IO-LINK MASTERS MARKET, BY INTERFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 19 IO-LINK MASTERS MARKET, BY INTERFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 20 IO-LINK MARKET, BY INTERFACE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 21 IO-LINK MARKET, BY INTERFACE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 22 IO-LINK MASTERS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 23 IO-LINK MASTERS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 24 IO-LINK MASTERS MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 25 IO-LINK MASTERS MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 26 IO-LINK MASTERS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 IO-LINK MASTERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 IO-LINK MASTERS MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 29 IO-LINK MASTERS MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 30 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 31 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 32 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2019–2022 (MILLION UNITS)

- TABLE 33 IO-LINK DEVICES MARKET, BY DEVICE TYPE, 2023–2028 (MILLION UNITS)

- TABLE 34 IO-LINK DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 IO-LINK DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 IO-LINK DEVICES MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 37 IO-LINK DEVICES MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 38 IO-LINK DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 IO-LINK DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 IO-LINK DEVICES MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 41 IO-LINK DEVICES MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 42 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 43 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 44 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2019–2022 (MILLION UNITS)

- TABLE 45 IO-LINK SENSOR NODES MARKET, BY SUBTYPE, 2023–2028 (MILLION UNITS)

- TABLE 46 IO-LINK MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 47 IO-LINK MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 48 IO-LINK MARKET, BY INDUSTRY, 2019–2022 (MILLION UNITS)

- TABLE 49 IO-LINK MARKET, BY INDUSTRY, 2023–2028 (MILLION UNITS)

- TABLE 50 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 53 IO-LINK MARKET FOR DISCRETE INDUSTRIES, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 54 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 57 IO-LINK MARKET FOR HYBRID INDUSTRIES, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 58 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 61 IO-LINK MARKET FOR PROCESS INDUSTRIES, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 62 IO-LINK MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 IO-LINK MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 IO-LINK MARKET, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 65 IO-LINK MARKET, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 66 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 67 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 68 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 69 IO-LINK MARKET FOR MACHINE TOOLS, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 70 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 73 IO-LINK MARKET FOR MACHINE TOOLS, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 74 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 75 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 76 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 77 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 78 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2019–2022 (USD MILLION)

- TABLE 79 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 80 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 81 IO-LINK MARKET FOR HANDLING AND ASSEMBLY AUTOMATION, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 82 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 83 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 84 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 85 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 86 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 87 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 88 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 89 IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 90 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 91 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 92 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 93 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 94 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2019–2022 (USD MILLION)

- TABLE 95 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 97 IO-LINK MARKET FOR INTRALOGISTICS SOLUTIONS, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 98 IO-LINK MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 99 IO-LINK MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 100 IO-LINK MARKET, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 101 IO-LINK MARKET, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 102 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 103 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 104 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 105 IO-LINK MARKET IN NORTH AMERICA, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 106 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 109 IO-LINK MARKET IN NORTH AMERICA, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 110 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 111 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 112 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2019–2022 (MILLION UNITS)

- TABLE 113 IO-LINK MARKET IN NORTH AMERICA, BY INDUSTRY, 2023–2028 (MILLION UNITS)

- TABLE 114 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 115 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 117 IO-LINK MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 118 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 119 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 120 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 121 IO-LINK MARKET IN EUROPE, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 122 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 123 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 125 IO-LINK MARKET IN EUROPE, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 126 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 127 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2019–2022 (MILLION UNITS)

- TABLE 129 IO-LINK MARKET IN EUROPE, BY INDUSTRY, 2023–2028 (MILLION UNITS)

- TABLE 130 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 133 IO-LINK MARKET IN EUROPE, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 134 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 135 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 136 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 137 IO-LINK MARKET IN ASIA PACIFIC, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 138 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 139 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 141 IO-LINK MARKET IN ASIA PACIFIC, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 142 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 143 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 144 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2019–2022 (MILLION UNITS)

- TABLE 145 IO-LINK MARKET IN ASIA PACIFIC, BY INDUSTRY, 2023–2028 (MILLION UNITS)

- TABLE 146 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 147 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (MILLION UNITS)

- TABLE 149 IO-LINK MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (MILLION UNITS)

- TABLE 150 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 151 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 152 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2019–2022 (MILLION UNITS)

- TABLE 153 IO-LINK MARKET IN REST OF THE WORLD, BY COMPONENT, 2023–2028 (MILLION UNITS)

- TABLE 154 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 155 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2019–2022 (MILLION UNITS)

- TABLE 157 IO-LINK MARKET IN REST OF THE WORLD, BY APPLICATION, 2023–2028 (MILLION UNITS)

- TABLE 158 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 159 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 160 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2019–2022 (MILLION UNITS)

- TABLE 161 IO-LINK MARKET IN REST OF THE WORLD, BY INDUSTRY, 2023–2028 (MILLION UNITS)

- TABLE 162 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (USD MILLION)

- TABLE 163 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (USD MILLION)

- TABLE 164 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2019–2022 (MILLION UNITS)

- TABLE 165 IO-LINK MARKET IN REST OF THE WORLD, BY REGION, 2023–2028 (MILLION UNITS)

- TABLE 166 OVERVIEW OF STRATEGIES DEPLOYED BY KEY IO-LINK COMPANIES

- TABLE 167 IO-LINK MARKET: MARKET SHARE ANALYSIS (2022)

- TABLE 168 COMPANY FOOTPRINT

- TABLE 169 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 170 APPLICATION FOOTPRINT OF COMPANIES

- TABLE 171 REGIONAL FOOTPRINT OF COMPANIES

- TABLE 172 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN IO-LINK MARKET

- TABLE 173 PRODUCT LAUNCHES (2019–2022)

- TABLE 174 DEALS (2019–2022)

- TABLE 175 SIEMENS AG: BUSINESS OVERVIEW

- TABLE 176 SIEMENS AG: PRODUCTS OFFERED

- TABLE 177 SIEMENS AG: PRODUCT LAUNCHES

- TABLE 178 SIEMENS AG: DEALS

- TABLE 179 HANS TURCK GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 180 HANS TURCK GMBH & CO. KG: PRODUCT OFFERED

- TABLE 181 HANS TURCK GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 182 HANS TURCK GMBH & CO. KG: DEALS

- TABLE 183 BALLUFF: BUSINESS OVERVIEW

- TABLE 184 BALLUFF GMBH: PRODUCTS OFFERED

- TABLE 185 BALLUFF GMBH: PRODUCTS LAUNCHES

- TABLE 186 IFM ELECTRONIC GMBH: BUSINESS OVERVIEW

- TABLE 187 IFM ELECTRONIC GMBH: PRODUCTS OFFERED

- TABLE 188 IFM ELECTRONIC GMBH: DEALS

- TABLE 189 SICK AG: BUSINESS OVERVIEW

- TABLE 190 SICK AG: PRODUCTS OFFERED

- TABLE 191 SICK AG: PRODUCTS LAUNCHES

- TABLE 192 SICK AG: DEALS

- TABLE 193 ROCKWELL AUTOMATION, INC.: BUSINESS OVERVIEW

- TABLE 194 ROCKWELL AUTOMATION, INC.: PRODUCTS OFFERED

- TABLE 195 ROCKWELL AUTOMATION, INC.: PRODUCT LAUNCHES

- TABLE 196 OMRON CORPORATION: BUSINESS OVERVIEW

- TABLE 197 OMRON CORPORATION: PRODUCTS OFFERED

- TABLE 198 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 199 PEPPERL+FUCHS: BUSINESS OVERVIEW

- TABLE 200 PEPPERL+FUCHS: PRODUCTS OFFERED

- TABLE 201 PEPPERL+FUCHS: PRODUCT LAUNCHES

- TABLE 202 PEPPERL+FUCHS: DEALS

- TABLE 203 FESTO SE & CO. KG COMPANY: BUSINESS OVERVIEW

- TABLE 204 FESTO SE & CO. KG: PRODUCTS OFFERED

- TABLE 205 FESTO SE & CO. KG: DEALS

- TABLE 206 SMC CORPORATION: BUSINESS OVERVIEW

- TABLE 207 SMC CORPORATION: PRODUCTS OFFERED

- FIGURE 1 IO-LINK MARKET SEGMENTATION

- FIGURE 2 IO-LINK MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)—REVENUE GENERATED BY COMPANIES FROM SALES OF IO-LINK SOLUTIONS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE)–ILLUSTRATIVE EXAMPLE OF COMPANY OPERATING IN IO-LINK MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (DEMAND SIDE)—DEMAND FOR IO-LINK FOR MACHINE TOOLS APPLICATION

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 LIMITATIONS: IO-LINK MARKET

- FIGURE 10 IO-LINK WIRELESS SEGMENT TO REGISTER HIGHER CAGR THAN IO-LINK WIRED SEGMENT DURING FORECAST PERIOD

- FIGURE 11 PACKAGING AUTOMATION SOLUTIONS SEGMENT TO WITNESS HIGHEST GROWTH FROM 2023 TO 2028

- FIGURE 12 DISCRETE INDUSTRIES SEGMENT TO WITNESS HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 14 PRE- AND POST-RECESSION IMPACT ON IO-LINK MARKET

- FIGURE 15 RISING NEED FOR INDUSTRY 4.0 TO FUEL DEMAND FOR IO-LINK SOLUTIONS IN COMING YEARS

- FIGURE 16 IO-LINK WIRED SEGMENT TO CAPTURE LARGER MARKET SHARE BY 2028

- FIGURE 17 IO-LINK DEVICES SEGMENT TO CAPTURE LARGER MARKET SHARE BY 2028

- FIGURE 18 PACKAGING AUTOMATION SOLUTIONS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 HANDLING AND ASSEMBLY AUTOMATION, AND EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 20 IO-LINK MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 INDUSTRY 4.0 TRANSFORMING FACTORIES INTO SMART FACTORIES

- FIGURE 22 IO-LINK MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 23 IO-LINK MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 24 IO-LINK MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 25 IO-LINK MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 26 IO-LINK MARKET: SUPPLY CHAIN

- FIGURE 27 REVENUE SHIFT IN IO-LINK MARKET

- FIGURE 28 IO-LINK ECOSYSTEM

- FIGURE 29 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS FROM 2012 TO 2021

- FIGURE 31 PATENTS GRANTED WORLDWIDE, 2012–2021

- FIGURE 32 IO-LINK MARKET, BY TYPE

- FIGURE 33 IO-LINK WIRED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 IO-LINK WIRED

- FIGURE 35 IO-LINK WIRELESS

- FIGURE 36 IO-LINK DEVICES SEGMENT TO REGISTER HIGHER CAGR FROM 2023 TO 2028

- FIGURE 37 IO-LINK MASTERS MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 EUROPE TO LEAD IO-LINK DEVICES MARKET FROM 2023 TO 2028

- FIGURE 39 DISCRETE INDUSTRIES TO DOMINATE IO-LINK MARKET DURING FORECAST PERIOD

- FIGURE 40 EUROPE TO LEAD IO-LINK MARKET FOR DISCRETE INDUSTRIES FROM 2023 TO 2028

- FIGURE 41 EUROPE TO LEAD IO-LINK MARKET FOR PROCESS INDUSTRIES DURING FORECAST PERIOD

- FIGURE 42 HANDLING AND ASSEMBLY AUTOMATION SEGMENT ESTIMATED TO LEAD IO-LINK MARKET IN 2023

- FIGURE 43 EUROPE TO LEAD IO-LINK MARKET FOR MACHINE TOOLS DURING FORECAST PERIOD

- FIGURE 44 IO-LINK DEVICES TO LEAD IO-LINK MARKET FOR PACKAGING AUTOMATION SOLUTIONS DURING FORECAST PERIOD

- FIGURE 45 EUROPE TO HOLD LARGEST SHARE OF IO-LINK MARKET FROM 2023 TO 2028

- FIGURE 46 NORTH AMERICA: IO-LINK MARKET SNAPSHOT

- FIGURE 47 EUROPE: IO-LINK MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: IO-LINK MARKET SNAPSHOT

- FIGURE 49 HANDLING AND ASSEMBLY AUTOMATION SEGMENT TO LEAD MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 50 CHINA TO DOMINATE ASIA PACIFIC IO-LINK MARKET DURING FORECAST PERIOD

- FIGURE 51 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN IO-LINK MARKET

- FIGURE 52 COMPANY EVALUATION QUADRANT, 2022

- FIGURE 53 STARTUP/SME EVALUATION QUADRANT, 2022

- FIGURE 54 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 55 SICK AG: COMPANY SNAPSHOT

- FIGURE 56 ROCKWELL AUTOMATION, INC.: COMPANY SNAPSHOT

- FIGURE 57 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 SMC CORPORATION: COMPANY SNAPSHOT

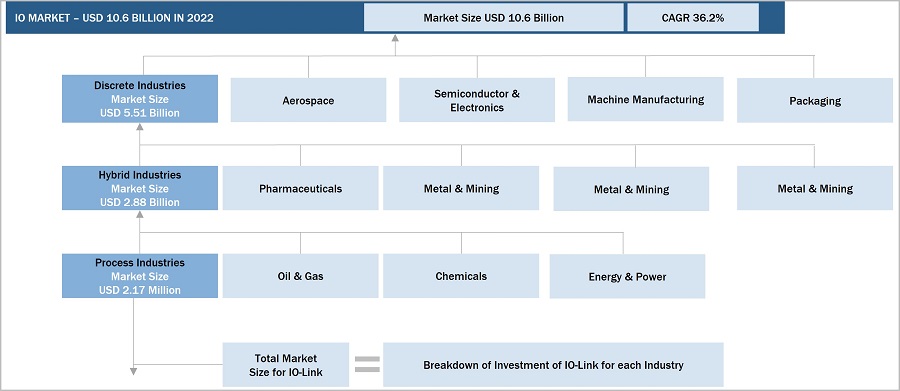

The study involved four major activities in estimating the size of the IO-Link market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering IO-Link solutions have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the IO-Link market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of IO-Link solutions to identify key players based on their products and prevailing industry trends in the IO-Link market by type, by industry, by component, application, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

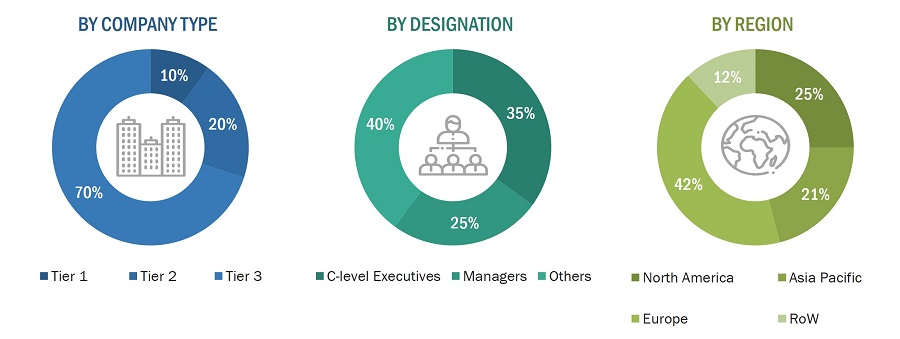

Extensive primary research has been conducted after understanding and analyzing the current scenario of the IO-Link market through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—the North America, Europe, Asia Pacific, and Rest of Europe. Approximately 25% of the primary interviews have been conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with io-link industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the IO-Link market.

- Identifying various IO-Link products

- Analyzing the penetration of each product through secondary and primary research

- Analyzing the penetration of IO-Link in different industries and applications through secondary and primary research

- Conducting multiple discussions with key opinion leaders to understand the detailed working of IO-Link and their implementation in multiple industries and applications; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the IO-Link market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the IO-Link market, further splitting the market based on io-link industry, application, and region, and listing the key developments

- Identifying the leading players in the IO-Link market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with io-link industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the IO-Link market.

Market Definition

IO-Link is a point-to-point network communications standard for sensors and actuators. It is used to improve digital or analog sensor interfaces by providing more information, configurability, and control to simplify an automation system’s installation, operation, and maintenance. The advantages of IO-Link include simplified installation, automated parameter assignment, and expanded diagnostics. Due to low implementation and component costs, an IO-Link interface can be integrated even in price-sensitive field devices such as photoelectric sensors and position sensors.

Key Stakeholders

- Providers of components and materials for IO-Link

- Distributors, suppliers, and service providers for IO-Link

- Technology standards organizations, forums, alliances, and associations

- End users from discrete, process, and hybrid industries

- Research organizations

- Analysts and strategic business planners

- Venture capitalists, private equity firms, and startup companies

Report Objectives

- To describe and forecast the IO-Link market, by type, component, io-link industry, application, and region, in terms of value and volume

- To describe and forecast the market for four key regions — North America, Europe, Asia Pacific, and the Rest of the World (RoW) — in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and io-link industry-specific challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the IO-Link ecosystem, along with the average selling price of IO-Link components

- To strategically analyze the ecosystem, tariff and regulations, patent landscape, trade landscape, and case studies pertaining to the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile key players, comprehensively analyze their position in the market in terms of their ranking and core competencies2, and provide the competitive landscape of the market

- To analyze competitive developments, such as product launches, collaborations, acquisitions, expansions, and partnerships, in the market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IO-Link Market