Investment Analysis of Construction Industry in GCC Countries – (Contracts, Investments, Underway and Planned Projects (Major Construction Projects, Oil & Gas, Residential) , Raw Material Trade Information, Opportunity Analysis)

Investment Analysis of Construction Industry in GCC Countries Size And Forecast

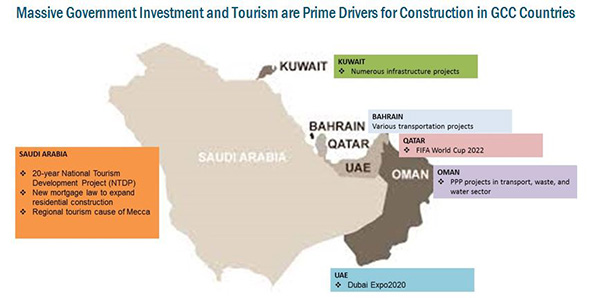

Saudi Arabia in order to boost religious tourism has translated higher budget allocations toward the hospitality, retail, and infrastructure sectors in 2014. This is expected to result in an increase in construction activities across these sectors in the near future. Economic recovery as well as planned or underway infrastructure project as part of the country’s strategic vision 2021 will drive the UAE’s construction sector. Due to healthy population growth and mega events, Qatar’s residential, hospitality, and infrastructure construction industry appear optimistic and are expected to attract foreign investors.

Oman’s construction industry is expected to remain robust due to increase in infrastructure projects planned by the government along with the construction of private and commercial buildings. Kuwait construction industry is set to thrive, due to new projects from the private sector and an increase in demand for residential and commercial units. Bahraini government is focusing on developing its infrastructure and residential construction to reduce housing shortage.

To know about the assumptions considered for the study, download the pdf brochure

This report provides information about the Saudi Arabia, UAE, Qatar, Oman, Kuwait, and Bahrain construction industry. In this report, we have covered trends, market overview, investment analysis, building cost, construction projects, and import export trade data of raw material.

Target Audience in Investment Analysis of Construction Industry in GCC Countries

- GCC construction companies

- International construction companies

- Raw material suppliers

- Government and research organizations

- Associations and industry bodies

- GCC chemical, oil & gas industrial, transport, water, and power companies

- International chemical, oil & gas industrial, transport, water, and power companies

Investment Analysis of Construction Industry in GCC Countries Report Scope

This research report categorizes the GCC construction industry based on country.

Based on country, the industry has been segmented as follows:

- Saudi Arabia

- UAE

- Qatar

- Oman

- Kuwait

- Bahrain

Investment Analysis of Construction Industry in GCC Countries Report Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client-specific needs. The following customization options are available for the report:

Investment Analysis of Construction Industry in GCC Countries Geographic Analysis

- Further breakdown of the Saudi Arabia construction industry

- Further breakdown of the UAE construction industry

- Further breakdown of the Qatar construction industry

- Further breakdown of the Oman construction industry

- Further breakdown of the Kuwait construction industry

- Further breakdown of the Bahrain construction industry

As per IMF, the GCC population is projected to grow at a CAGR of 2.80% from 2015 to 2020 to reach 53.41 million. An expanding population is expected to urge higher demand in residential, commercial, retail, hospitality, healthcare, and infrastructure sectors across the GCC region.

GCC countries are focusing on economic diversification as oil prices are more versatile from the last two years.

GCC countries are witnessing an evolution phase, driven by an increase in government investments in the construction sector. The construction industry is projected to growth at a healthy rate due to numerous factors such as favorable macroeconomics, higher government allocation, positive demographics, and rising tourism activities across the region. This report also provides recent trends in the construction industry of the GCC countries, along with market drivers and challenges. GCC has emerged as a tourist hub for pilgrims, international shoppers, and leisure travelers. In order to satisfy and sustain a large number of tourists, GCC countries are investing heavily in the development of airports, transportation systems, hotels, and retail & leisure sectors. For example, Saudi Arabia is putting in a lot of effort to boost religious tourism, which led to higher budget allocations toward the hospitality, retail, and infrastructure sectors. GCC countries are aiming to attract investors of the construction sector by hosting global events. Dubai has become one of the world’s fastest-growing destinations with a projection of 20 million visitors per year from 2015 to 2020.

Falling oil prices is forcing government to reduce dependence on the oil & gas industry. GCC has emerged as an international tourist hub for international shoppers, vacation travelers, and pilgrims. The region’s tourism industry is expected to boom in future, and the rising demand is expected in retail, hospitality, and infrastructure construction. Mega events such as Dubai Expo 2020 and FIFA World Cup, Qatar, will create opportunities across these sectors which will boost construction activities. Other factors driving the growth of the construction industry are new mortgage laws in Saudi Arabia and high bank liquidity. The GCC construction industry faces various challenges such as lack of skilled labor and shortage of raw materials. International companies are entering the GCC construction sector by partnership or joint venture to generate high revenue.

Frequently Asked Questions (FAQ):

Is the construction industry growing 2022?

Yes, GCC has emerged as an international tourist hub for international shoppers, vacation travelers, and pilgrims. The region’s tourism industry is expected to boom in future, and the rising demand is expected in retail, hospitality, and infrastructure construction. Mega events such as Dubai Expo 2020 and FIFA World Cup, Qatar, will create opportunities across these sectors which will boost construction activities. Other factors driving the growth of the construction industry are new mortgage laws in Saudi Arabia and high bank liquidity. The GCC construction industry faces various challenges such as lack of skilled labor and shortage of raw materials. International companies are entering the GCC construction sector by partnership or joint venture to generate high revenue.

What is the market size of the construction industry?

Yes, As per IMF, the GCC population is projected to grow at a CAGR of 2.80% from 2015 to 2020 to reach 53.41 million. An expanding population is expected to urge higher demand in residential, commercial, retail, hospitality, healthcare, and infrastructure sectors across the GCC region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Executive Summary (Page No. - 13)

1.1 Global Construction Industry Outlook

1.2 Gulf Cooperation Council Construction Industry Outlook

1.3 Industry Outlook By Country

1.4 GCC to Diversify Its Economy

1.5 GCC Construction Market, By Region (Net Project Value Planned Or Underway)

2 Premium Insights (Page No. - 17)

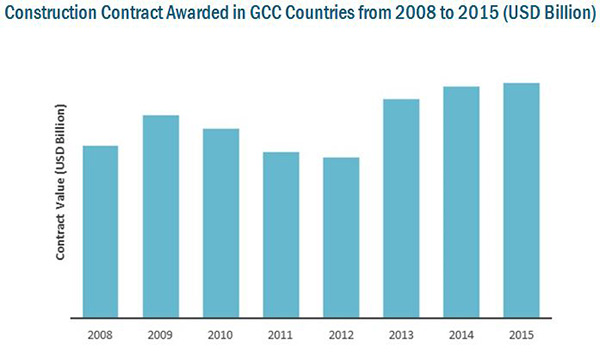

2.1 Construction Contract Awards in GCC Countries (2008 to 2015)

2.2 Quarter Wise Construction Investment in GCC Countries

2.3 Country Wise Planned and Underway Projects

2.4 Top 100 Projects in GCC Countries in 2015

2.5 Cumulative Residential Units Across GCC Regions in 2014

2.6 Attractive Opportunities in the GCC Construction Market

2.7 Mergers & Acquisitions (2013–2014)

3 Market Overview in GCC (Page No. - 21)

3.1 Introduction

3.2 Segmentation of Construction Sector

3.3 Key Drivers for Construction Industry

3.3.1 Rising Tourism Industry

3.3.1.1 International Tourism Statistics in 2013

3.3.2 Destination for Mega-Events

3.3.3 Favorable Macroeconomics

3.3.3.1 GCC Country-Wise GDP (USD Billion)

3.3.3.2 Country Wise Economic Outlook:

3.3.4 Positive Demographics

3.3.5 New Mortgage Law in Saudi Arabia, and High Bank Liquidity

3.4 Growth Trend for Construction in Different Market Segments

3.5 Challenges Faced By GCC Construction Industry

3.5.1 Uncertainty Over Oil Prices

3.5.2 Shortage of Skilled Labor

3.5.3 Extra Scrutiny Over Safety and Quality at Construction Sites

4 Saudi Arabia: Construction Industry (Page No. - 29)

4.1 Introduction

4.2 Saudi Arabia: Macroeconomic Data

4.3 Saudi Arabia: GDP By Expenditure, 2013

4.4 Foreign Direct Investment (FDI) Regime

4.5 Saudi Arabia: Trends in Construction Industry

4.6 Market Overview

4.6.1 Impact of Drivers

4.7 Investment in Construction Industry

4.7.1 Unrivaled Opportunities in Construction, Property, and Infrastructure

4.8 Saudi Arabia: Building Costs, By Category

4.9 Major Construction Projects

4.9.1 King Abdullah Economic City

4.9.1.1 Project Details

4.9.2 Jazan Economic City

4.9.2.1 Project Details

4.9.3 Makkah Grand Mosque Redevelopment

4.9.3.1 Project Details

4.9.4 Riyadh Metro

4.9.4.1 Project Details

4.9.4.2 Metro Details

4.9.5 Al Mozaini - Riyadh East Sub Centre

4.9.5.1 Project Details

4.10 Other Major Projects

4.11 Top Projects of Oil & Gas Awarded in 2015

4.12 Major Residential Projects: Planned Or Underway

4.13 Religious Tourism Will Impact Saudi Arabia’s Construction Market

4.14 Public-Private Partnership (PPP) in Saudi Arabia

4.14.1 PPP in Saudi Arabia (2014-2016)

4.15 Investment Climate in Saudi Arabia

4.15.1 Right to Private Ownership

4.15.2 Tax Rate and Access to Credit

4.15.3 Dispute Settlement

4.15.4 Labor Conditions

4.16 Challenges in Saudi Arabia’s Construction Industry

5 UAE: Construction Sector (Page No. - 45)

5.1 Introduction

5.2 GDP By Expenditure in 2013

5.3 Foreign Direct Investment (FDI) Regime

5.4 Trends in Construction Industry

5.5 Market Overview

5.5.1 Impact of Drivers

5.6 Investment in Construction Industry

5.6.1 Unrivaled Opportunities in Construction, Property, and Infrastructure

5.7 UAE: Building Cost, By Category

5.8 Major Construction Projects

5.8.1 Yas Island Development

5.8.1.1 Project Details

5.8.2 Nakheel Harbor & Tower

5.8.2.1 Project Details

5.8.3 Saadiyat Island Development

5.8.3.1 Project Details

5.8.4 Dubai Metro

5.8.4.1 Project Details

5.8.5 Al Maktoum International Airport

5.8.5.1 Project Details

5.9 Other Major Projects

5.10 Top Projects of Oil & Gas Awarded in 2015

5.11 Major Residential Projects Planned Or Underway

5.12 Dubai's Expo 2020 Will Impact UAE’s Construction Market

5.13 Investment Climate in UAE

5.13.1 Right to Private Ownership

5.13.2 Tax Rate and Access to Credit

5.13.3 Dispute Settlement

5.13.4 Labor Condition

5.14 Challenges in UAE Construction Industry

5.14.1 Impact of Challenges

6 Qatar: Construction Industry (Page No. - 58)

6.1 Introduction

6.2 Qatar: Macroeconomic Data

6.3 Qatar: GDP, By Expenditure, 2013

6.4 Foreign Direct Investment (FDI) Regime

6.5 Trends in the Construction Industry

6.6 Market Overview

6.6.1 Impact of Drivers

6.7 Investment in the Construction Industry

6.7.1 Unrivaled Opportunities in Construction, Property & Infrastructure

6.8 Qatar: Building Cost, By Category

6.9 Major Construction Projects

6.9.1 Qatar Rail Development Programme

6.9.1.1 Project Details

6.9.2 New Doha International Airport (NDIA)

6.9.3 Education City

6.9.4 New Doha Port

6.9.5 Lusail Development

6.9.6 Pearl-Qatar

6.10 Other Major Projects

6.11 Sports-Related Events Will Impact the Qatari Construction Market

6.12 Top Projects of Oil & Gas Awarded in 2015

6.13 Major Residential Projects Planned Or Underway

6.14 Top Contractors in 2013

6.15 Biggest Clients, By Project Value, 2014

6.16 Investment Climate in Qatar

6.16.1 Right to Private Ownership

6.16.2 Tax Rate & Access to Credit

6.16.3 Dispute Settlement

6.16.4 Labor Condition

6.17 Challenges in the Qatar Construction Industry

6.17.1 Shortage of Raw Material

6.17.2 Reforming Labor Condition

6.17.3 Impact of Challenges

7 Oman: Construction Industry (Page No. - 74)

7.1 Introduction

7.2 Oman: Macroeconomic Data

7.3 Oman: GDP By Expenditure, 2013

7.4 Foreign Direct Investment (FDI) Regime

7.5 Oman: Trends in Construction Industry

7.6 Market Overview

7.6.1 Impact of Drivers

7.7 Investment in Construction Industry

7.7.1 Unrivaled Opportunities in Construction, Property, and Infrastructure

7.8 Oman: Building Costs, By Category

7.9 Major Construction Projects

7.9.1 Oman National Railway Project

7.9.1.1 Project Details

7.9.2 Khazzan & Makarem Gas Fields Development

7.9.2.1 Project Details

7.9.3 Duqm Oil Refinery Development Project - Phase 1

7.9.3.1 Project Details

7.9.4 Batinah Expressway Construction Project

7.9.4.1 Project Details

7.9.5 Liwa Plastics Project

7.9.5.1 Project Details

7.10 Top Projects of Oil & Gas Awarded in 2015

7.11 Major Residential Projects: Planned Or Underway

7.12 Public-Private Partnerships (PPP) in Omani Construction Market

7.13 Investment Climate in Oman

7.13.1 Right to Private Ownership

7.13.2 Tax Rate and Access to Credit

7.13.3 Dispute Settlement

7.13.4 Labor Conditions

7.14 Challenges in Oman’s Construction Industry

7.14.1 Impact of Challenges

8 Kuwait: Construction Industry (Page No. - 88)

8.1 Introduction

8.2 Kuwait: Macroeconomic Data

8.3 Kuwait: GDP, By Expenditure, 2013

8.4 Foreign Direct Investment (FDI) Regime

8.5 Trend in the Construction Industry

8.6 Market Overview

8.6.1 Impact of Drivers

8.7 Investment in the Construction Industry

8.7.1 Unrivaled Opportunities in Construction, Property & Infrastructure

8.8 Major Construction Projects

8.8.1 Madinat Al Hareer (City of Silk)

8.8.1.1 Project Details

8.8.2 Al Zour Refinery

8.8.2.1 Project Details

8.8.3 Kuwait Metro

8.8.3.1 Project Details

8.8.4 Al Khiran Pearl City

8.8.4.1 Project Details

8.8.5 Kuwait International Airport Expansion

8.8.5.1 Project Details

8.9 Other Major Projects

8.10 Top Projects of Oil & Gas Awarded in 2015

8.11 Major Residential Project Planned Or Underway

8.12 PPP in Kuwait

8.13 Investment Climate in Kuwait

8.13.1 Right to Private Ownership

8.13.2 Tax Rate & Access to Credit

8.13.3 Dispute Settlement

8.13.4 Labor Condition

8.14 Challenges in Kuwait Construction Industry

8.14.1 Impact of Challenges

9 Bahrain: Construction Industry (Page No. - 99)

9.1 Introduction

9.2 Bahrain: Macroeconomic Data

9.3 Bahrain: GDP By Expenditure, 2013

9.4 Foreign Direct Investment (FDI) Regime

9.5 Trends in Construction Industry

9.6 Market Overview

9.6.1 Impact of Drivers

9.7 Investment in Construction Industry

9.7.1 Unrivaled Opportunities in Construction, Transport, and Power Industry

9.8 Bahrain: Building Costs, By Category

9.9 Major Construction Projects

9.9.1 Water Garden City

9.9.1.1 Project Details

9.9.2 Qatar-Bahrain Causeway

9.9.2.1 Project Details

9.9.3 Bahrain International Airport Expansion Project

9.9.3.1 Project Details

9.10 Other Major Projects

9.11 Biggest Clients By Project Value in 2014

9.12 Top Projects of Oil & Gas Awarded in 2015

9.13 Major Residential Projects: Planned Or Underway

9.14 Investment Climate in Bahrain

9.14.1 Right to Private Ownership

9.14.2 Tax Rate and Access to Credit

9.14.3 Dispute Settlement

9.14.4 Labor Condition

9.15 Challenges in Bahrain Construction Industry

9.15.1 Shortage of Skilled Labor

9.15.2 Impact of Challenges

10 Raw Material Analysis (Page No. - 111)

10.1 Cement

10.1.1 Cement Import Trade Data in GCC Region

10.1.2 Cement Export Trade Data in GCC Region

10.1.3 Cement: Import & Export Trade Data By Country

10.1.3.1 Saudi Arabia: Import & Export Trade Data

10.1.3.2 UAE: Import & Export Trade Data

10.1.3.3 Qatar: Import & Export Trade Data

10.1.3.4 Oman: Import & Export Trade Data

10.1.3.5 Kuwait: Import & Export Trade Data

10.1.3.6 Bahrain: Import & Export Trade Data

10.2 Steel & Iron

10.2.1 Steel & Iron Import Trade Data in GCC Region

10.2.2 Steel & Iron Export Trade Data in GCC Region

10.2.3 Steel & Iron: Import & Export Trade Data By Country

10.2.3.1 Saudi Arabia: Import & Export Trade Data

10.2.3.2 UAE: Import & Export Trade Data

10.2.3.3 Qatar: Import & Export Trade Data

10.2.3.4 Oman: Import & Export Trade Data

10.2.3.5 Kuwait: Import & Export Trade Data

10.2.3.6 Bahrain: Import & Export Trade Data

List of Tables (4 Tables)

Table 1 List of Events in GCC From 2016 to 2020

Table 2 Qatar’s World Cup Stadium Details

Table 3 Cement: Import & Export Trade Data, 2004-2014 (USD Million)

Table 4 Cement: Import & Export Trade Data, 2000-2014 (USD Million)

List of Figures (82 Figures)

Figure 1 Global Construction Market (2010–2020)

Figure 2 Total Contract Awards in the GCC, 2008–2014 (USD Billion)

Figure 3 Saudi Arabia Dominates the GCC Construction Market in 2014

Figure 4 Construction Contract Awards in GCC Countries From 2008 to 2015 (USD Billion)

Figure 5 Quarter Wise Construction Investment in GCC Countries (USD Billion)

Figure 6 Country Wise Planned and Underway Projects in 2014 (USD Million)

Figure 7 Market Share of Top 100 Projects in the GCC Region By Sector and By Country in 2015

Figure 8 Cumulative Residential Units Across GCC Regions in 2014 (‘000 Units)

Figure 9 Opportunities in the GCC Construction Market

Figure 10 Minority Stake Purchases and Acquisitions are Top Deals (2013–2014)

Figure 11 Construction Market Segmentation

Figure 12 Market Dynamics

Figure 13 Region-Wise Share in International Tourism

Figure 14 International Tourist Arrivals, 2010 to 2014

Figure 15 Strong Economic Growth is Projected in GCC Countries

Figure 16 Population Segmentation in GCC

Figure 17 Variation in Oil Price From November 2014 to January 2016

Figure 18 Saudi Arabia: Macroeconomic Data

Figure 19 Saudi Arabia: Trade Industry Snapshot

Figure 20 Saudi Arabia: GDP By Expenditure, 2013

Figure 21 Saudi Arabia: FDI Inflow and Outflow

Figure 22 Saudi Arabia: Trends in Construction Industry

Figure 23 Sector-Wise Construction Investment in 2014 (USD Million)

Figure 24 Sector-Wise Share of Building Cost, 2014

Figure 25 Planned Or Underway Projects in Saudi Arabia

Figure 26 Impact of Religious Tourism

Figure 27 Impact of Challenges

Figure 28 UAE: Macroeconomic Data

Figure 29 UAE: Snapshot

Figure 30 UAE: GDP By Expenditure in 2013

Figure 31 UAE: FDI Inflow and Outflow

Figure 32 UAE: Trends in Construction Industry

Figure 33 Sector-Wise Construction Investment in 2014 (USD Million)

Figure 34 Sector-Wise Building Cost

Figure 35 Dubai Metro Lines in Operation, Under Development, Or Planned

Figure 36 Planned Or Underway Projects in UAE

Figure 37 Qatar: Macroeconomic Data

Figure 38 Qatar: Trade Snapshot

Figure 39 Qatar: GDP Share, By Expenditure, 2013

Figure 40 Qatar: FDI Inflow and Outflow

Figure 41 Trends in the Construction Industry

Figure 42 Sector-Wise Construction Investment in 2014 (USD Million)

Figure 43 Sector-Wise Building Cost in 2014

Figure 44 RDP Project Details

Figure 45 Oman: Macroeconomic Data

Figure 46 Oman: Trade Snapshot

Figure 47 Oman: GDP By Expenditure, 2013

Figure 48 Oman: FDI Inflow and Outflow

Figure 49 Oman: Trends in Construction Industry

Figure 50 Sector-Wise Construction Investment in 2014 (USD Million)

Figure 51 Sector Wise Share of Building Cost, 2014

Figure 52 Oman National Railway Project

Figure 53 Planned Or Underway Projects in Oman

Figure 54 Kuwait: Macroeconomic Data

Figure 55 Kuwait: Snapshot

Figure 56 Kuwait: GDP, By Expenditure, 2013

Figure 57 Kuwait: FDI Inflow & Outflow

Figure 58 Kuwait: Trends in the Construction Industry

Figure 59 Sector-Wise Construction Investment, 2014 (USD Million)

Figure 60 Planned Or Underway Projects in Kuwait

Figure 61 Bahrain: Macroeconomic Data

Figure 62 Bahrain: Trade Snapshot

Figure 63 Bahrain: GDP By Expenditure, 2013

Figure 64 Bahrain: FDI Inflow and Outflow

Figure 65 Bahrain: Trends in the Construction Industry

Figure 66 Sector-Wise Construction Investment in 2014 (USD Million)

Figure 67 Sector-Wise Share of Building Costs, 2014

Figure 68 Planned Or Underway Projects in Bahrain

Figure 69 Cement: Import Trade Data, 2009-2013 (USD Million)

Figure 70 Cement: Export Trade Data, 2009-2013 (USD Million)

Figure 71 Cement: Import & Export Data, 2004-2013 (USD Million)

Figure 72 Cement: Import & Export Trade Data, 2004-2013 (USD Million)

Figure 73 Cement: Import & Export Trade Data, 2005-2014 (USD Million)

Figure 74 Cement: Import & Export Trade Data, 2008-2013 (USD)

Figure 75 Steel & Iron: Import Trade Data, 2009-2013 (USD Million)

Figure 76 Steel & Iron: Export Trade Data, 2009-2013 (USD Million)

Figure 77 Steel & Iron: Import & Export Data, 2004-2013 (USD Million)

Figure 78 Steel & Iron: Import & Export Trade Data, 2004-2014 (USD Million)

Figure 79 Steel & Iron: Import & Export Trade Data, 2004-2014 (USD Million)

Figure 80 Steel & Iron: Import & Export Trade Data, 2004-2014 (USD Million)

Figure 81 Steel & Iron: Import & Export Trade Data, 2000-2014 (USD Million)

Figure 82 Steel & Iron: Import & Export Trade Data, 2004-2014 (USD Million)

Growth opportunities and latent adjacency in Investment Analysis of Construction Industry in GCC Countries