Interventional Radiology Imaging Market by Product (MRI System, Ultrasound Imaging System, CT Scanner, Angiography System), Procedures (Angiography, Angioplasty, Biopsy) & Application (Cardiology, Oncology, Urology & Nephrology) - Global Forecast to 2021

[157 Pages Report] The global interventional radiology imaging market is expected to reach USD 23.50 Billion by 2021 from USD 16.99 Billion in 2016, at a CAGR of 6.7%. The market is broadly classified into product, procedure type, and application.

The product segment of the market is further divided into angiography systems, fluoroscopy systems, CT scanners, ultrasound-imaging systems, MRI systems, and other devices (C-arm, contrast media injectors, & imaging catheter guidewires). The MRI system segment is projected to witness the highest growth in this market due to technological advancements and product launches.

Based on procedure, the interventional radiology imaging industry is segmented into angiography, angioplasty, embolization, thrombolysis, vertebroplasty, nephrostomy, and other procedures (biliary drainage, fallopian tube recanalization, cholecystectomy, and carotid-cavernous fistula). Angiography segment is projected to witness the highest growth in this market due to increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures.

Application segment of the market is segmented into cardiology, oncology, urology & nephrology, gastroenterology, and other applications (orthopedics, neurology, and gynecology). The oncology segment is projected to witness the highest CAGR during the forecast period due to increasing incidence of cancer and rising demand for minimally invasive procedures.

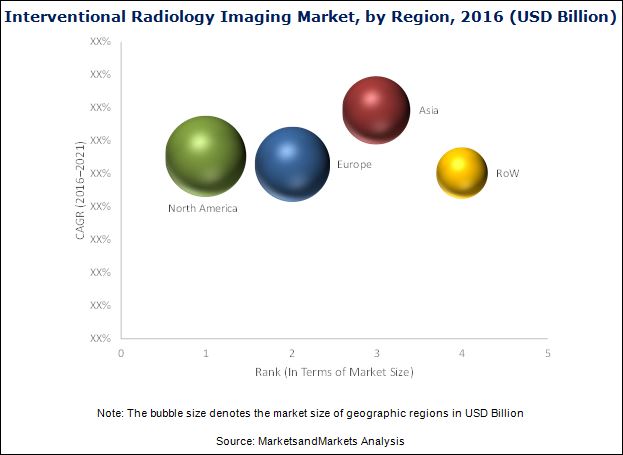

Geographically, the market is dominated by North America, followed by Europe, Asia, and the Rest of the World (RoW). Growth in North America is primarily driven by the increase in the prevalence of chronic diseases and aging population. However, the Asian market is projected to grow at the highest CAGR during the forecast period.

Key players in the Interventional Radiology Imaging Market include GE Healthcare (General Electric Company) (U.K.), Siemens Healthcare GmBH (Siemens AG) (Germany), Koninklijke Philips N.V. (The Netherlands), Toshiba Medical Systems Corporation (Toshiba Corporation) (Japan), Hitachi Medical Corporation (Hitachi Ltd.) (Japan), Carestream Health, Inc. (U.S.), Esaote S.p.A (Italy), Hologic, Inc. (U.S.), Fujifilm Corporation (Japan), Samsung Medison (South Korea), and Shimadzu Corporation (Japan).

Target Audience for this Report:

- Interventional radiology imaging manufacturer and distributors

- Healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies)

- Various research and consulting companies

- Various research associations related to interventional radiology imaging

Value Addition for the Buyer:

This report aims to provide insights into the global interventional radiology imaging market. It provides valuable information on the products, manufacturing type and applications in the market. Furthermore, the information for these segments, by region, is also presented in this report. Leading players in the market are profiled to study their product offerings and understand the strategies undertaken by them to be competitive in this market.

The abovementioned information would benefit buyers by helping them understand the market dynamics. In addition, the forecast provided in the report will enable firms to understand the trends in this market and better position themselves to capitalize on the growth opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

This report categorizes the interventional radiology imaging market into the following segments:

Interventional Radiology Imaging Market, by Product

- MRI System

- Ultrasound Imaging System

- CT Scanner

- Angiography System

- Fluoroscopy System

- Biopsy System

- Other Products

By Procedures

- Angiography

- Angioplasty

- Embolization

- Biopsy

- Vertebroplasty

- Thrombolysis

- Nephrostomy Placement

- Other Procedures

By Application

- Oncology

- Cardiology

- Urology & Nephrology

- Gastroenterology

- Other Applications

By Region

- North America

- Europe

- Asia

- Rest of the World (Australia, New Zealand, Latin America, the Middle East, and Africa)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

The market is expected to reach USD 23.50 Billion by 2021 from USD 16.99 Billion in 2016, at a CAGR of 6.7%. This market is segmented based on product, procedure, and application. A number of factors, such as rising incidence and prevalence of chronic diseases, increasing demand for minimally invasive procedures, technological advancements are expected to drive the growth of this market. The emerging markets have opened an array of opportunities for the interventional radiology imaging market. However, the risk of high radiation exposure is a major concern for MRI manufacturers & healthcare facilities and is expected to restrain the growth of this market to a certain extent during the forecast period.

On the basis of product, the market is segmented into angiography systems, fluoroscopy systems, CT scanners, ultrasound-imaging systems, MRI systems, and other devices (C-arm, contrast media injectors, & imaging catheter guidewires). MRI system segment is expected to account for the largest share of the market in 2016. Factors such as technological advancements and product launches are driving this market.

Based on procedures, the market is segmented into angiography, angioplasty, embolization, thrombolysis, vertebroplasty, nephrostomy, and other procedures (biliary drainage, fallopian tube recanalization, cholecystectomy, and carotid-cavernous fistula). Angiography segment is expected to account for the largest share of the market during the forecast period. Growth in this segment is driven by factors such as increasing prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures.

Based on application, the market is segmented into cardiology, oncology, urology & nephrology, gastroenterology, and other applications (orthopedics, neurology, and gynecology). Cardiology segment is expected to account for the largest share of the market during the forecast period. Growth in this segment is driven by factors such as demand for interventional radiology procedures.

Based on geography, the market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). However, Asia is expected to witness the highest CAGR. Rising incidence and prevalence of chronic diseases and the growing focus of market leaders, as well as domestic players in this region, are expected to drive market growth in the coming years.

Major players in the Interventional Radiology Imaging Market include GE Healthcare (General Electric Company) (U.K.), Siemens Healthcare GmBH (Siemens AG) (Germany), Koninklijke Philips N.V. (The Netherlands), Toshiba Medical Systems Corporation (Toshiba Corporation) (Japan), Hitachi Medical Corporation (Hitachi Ltd.) (Japan), Carestream Health, Inc. (U.S.), Esaote S.p.A (Italy), Hologic, Inc. (U.S.), Fujifilm Corporation (Japan), Samsung Medison (South Korea), and Shimadzu Corporation (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Secondary Data

2.1.1 Key Data From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 25)

3.1 Introduction

3.2 Conclusion

4 Premium Insights (Page No. - 30)

4.1 Interventional Radiology: Market Overview

4.2 Interventional Radiology Imaging Market, By Product and Region (2016)

4.3 Life Cycle Analysis, By Region

5 Industry Insights (Page No. - 33)

5.1 Introduction

5.2 Porter’s Five Forces Analysis

5.2.1 Threat of New Entrants

5.2.2 Threat of Substitutes

5.2.3 Bargaining Power of Buyers

5.2.4 Bargaining Power of Suppliers

5.2.5 Intensity of Rivalry

5.3 Supply Chain Analysis

5.4 Key Influencers

6 Market Overview (Page No. - 38)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Rising Incidence and Prevalence of Chronic Diseases

6.2.1.2 Increasing Demand for Minimally Invasive Procedures

6.2.1.3 Technological Advancements in Interventional Radiology Devices

6.2.2 Restraints

6.2.2.1 Risk of High Radiation Exposure to Limit the Use of CT Scanners

6.2.2.2 Shortage of Helium - A Major Concern for MRI Manufacturers and Healthcare Facilities

6.2.3 Opportunities

6.2.3.1 Emerging Markets

6.2.4 Challenges

6.2.4.1 Entry Barriers for New Players

6.2.4.2 Hospital Budget Cuts

6.2.4.3 Increasing Adoption of Refurbished Interventional Radiology Systems

7 Interventional Radiology Imaging Market, By Product (Page No. - 46)

7.1 Introduction

7.2 MRI Systems

7.3 Ultrasound Imaging Systems

7.4 CT Scanners

7.5 Angiography Systems

7.6 Fluoroscopy Systems

7.7 Biopsy Devices

7.8 Other Devices

8 Interventional Radiology Imaging Market, By Procedure (Page No. - 56)

8.1 Introduction

8.2 Angiography

8.3 Angioplasty

8.4 Biopsy and Drainage

8.5 Embolization

8.6 Thrombolysis

8.7 Vertebroplasty

8.8 Nephrostomy

8.9 Other Procedures

9 Interventional Radiology Imaging Market, By Application (Page No. - 66)

9.1 Introduction

9.2 Cardiology

9.3 Urology & Nephrology

9.4 Oncology

9.5 Gastroenterology

9.6 Other Applications

10 Interventional Radiology Market, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 U.K.

10.3.4 Italy

10.3.5 Rest of Europe

10.4 Asia

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 108)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Situation and Trends

11.3.1 Product Launches

11.3.2 Agreements, Collaborations & Partnerships

11.3.3 Approvals

11.3.4 Expansions

11.3.5 Acquisitions

11.3.6 Other Developments

12 Company Profile (Page No. - 116)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 GE Healthcare (A Fully Owned Subsidiary of General Electric Company)

12.3 Siemens AG

12.4 Koninklijke Philips N.V.

12.5 Toshiba Medical Systems Corporation (Toshiba Corporation)

12.6 Hitachi Medical Corporation (Hitachi Ltd.)

12.7 Carestream Health

12.8 Esaote S.P.A.

12.9 Hologic Inc.

12.10 Shimadzu Corporation

12.11 Samsung Medison

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 147)

13.1 Industry Insights

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (66 Tables)

Table 1 Market Summary

Table 2 Market Size, By Product, 2014–2021 (USD Million)

Table 3 Market Size for MRI Systems, By Region, 2014–2021 (USD Million)

Table 4 Interventional Radiology Products Market Size for Ultrasound Systems, By Region, 2014–2021 (USD Million)

Table 5 Market Size for CT Scanners, By Region, 2014–2021 (USD Million)

Table 6 Market Size for Angiography Systems, By Region, 2014–2021 (USD Million)

Table 7 Market Size for Fluoroscopy Systems, By Region, 2014–2021 (USD Million)

Table 8 Market Size for Biopsy Devices, By Region, 2014–2021 (USD Million)

Table 9 Market Size for Other Devices, By Region, 2014–2021 (USD Million)

Table 10 Market Size, By Procedure, 2014–2021 (USD Million)

Table 11 Market Size for Angiography, By Region, 2014–2021 (USD Million)

Table 12 Market Size for Angioplasty, By Region, 2014–2021 (USD Million)

Table 13 Market Size for Biopsy and Drainage, By Region, 2014–2021 (USD Million)

Table 14 Market Size for Embolization, By Region, 2014–2021 (USD Million)

Table 15 Market Size for Thrombolysis, By Region, 2014–2021 (USD Million)

Table 16 Market Size for Vertebroplasty, By Region, 2014–2021 (USD Million)

Table 17 Market Size for Nephrostomy, By Region, 2014–2021 (USD Million)

Table 18 Market Size for Other Procedures, By Region, 2014–2021 (USD Million)

Table 19 Market Size, By Application, 2014–2021 (USD Million)

Table 20 Market Size for Cardiology Applications, By Region, 2014–2021 (USD Million)

Table 21 Market Size for Urology & Nephrology Applications, By Region, 2014–2021 (USD Million)

Table 22 Market Size for Oncology Applications, By Region, 2014–2021 (USD Million)

Table 23 Market Size for Gastroenterology Applications, By Region, 2014–2021 (USD Million)

Table 24 Market Size for Other Applications, By Region, 2014–2021 (USD Million)

Table 25 Market Size, By Region, 2014–2021 (USD Million)

Table 26 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 27 North America: Market Size, By Product, 2014–2021 (USD Million)

Table 28 North America: Market Size, By Procedure, 2014–2021 (USD Million)

Table 29 North America: Market Size, By Application, 2014–2021 (USD Million)

Table 30 U.S.: Market Size, By Product, 2014–2021 (USD Million)

Table 31 U.S.: Market Size, By Procedure, 2014–2021 (USD Million)

Table 32 U.S.: Market Size, By Application, 2014–2021 (USD Million)

Table 33 Canada: Market Size, By Product, 2014–2021 (USD Million)

Table 34 Canada: Market Size, By Procedure, 2014–2021 (USD Million)

Table 35 Canada: Market Size, By Application, 2014–2021 (USD Million)

Table 36 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 37 Europe: Market Size, By Product, 2014–2021 (USD Million)

Table 38 Europe: Market Size, By Procedure, 2014–2021 (USD Million)

Table 39 Europe: Market Size, By Application, 2014–2021 (USD Million)

Table 40 Germany: Market Size, By Product, 2014–2021 (USD Million)

Table 41 Germany: Market Size, By Procedure, 2014–2021 (USD Million)

Table 42 Germany: Market Size, By Application, 2014–2021 (USD Million)

Table 43 France: Market Size, By Product, 2014–2021 (USD Million)

Table 44 France: Market Size, By Procedure, 2014–2021 (USD Million)

Table 45 France: Market Size, By Application, 2014–2021 (USD Million)

Table 46 U.K.: Market Size, By Product, 2014–2021 (USD Million)

Table 47 U.K.: Market Size, By Procedure, 2014–2021 (USD Million)

Table 48 U.K.: Market Size, By Application, 2014–2021 (USD Million)

Table 49 Italy: Market Size, By Product, 2014–2021 (USD Million)

Table 50 Italy: Market Size, By Procedure, 2014–2021 (USD Million)

Table 51 Italy: Market Size, By Application, 2014–2021 (USD Million)

Table 52 RoE: Market Size, By Product, 2014–2021 (USD Million)

Table 53 RoE: Market Size, By Procedure, 2014–2021 (USD Million)

Table 54 RoE: Market Size, By Application, 2014–2021 (USD Million)

Table 55 Asia: Market Size, By Product, 2014–2021 (USD Million)

Table 56 Asia: Market Size, By Procedure, 2014–2021 (USD Million)

Table 57 Asia: Market Size, By Application, 2014–2021 (USD Million)

Table 58 RoW: Market Size, By Product, 2014–2021 (USD Million)

Table 59 RoW: Market Size, By Procedure, 2014–2021 (USD Million)

Table 60 RoW: Market Size, By Application, 2014–2021 (USD Million)

Table 61 Recent Product Launches

Table 62 Recent Agreements, Collaborations & Partnerships

Table 63 Recent Approvals

Table 64 Recent Expansions

Table 65 Recent Acquisitions

Table 66 Other Developments

List of Figures (42 Figures)

Figure 1 Global Market Segmentation

Figure 2 Research Design

Figure 3 Interventional Radiology Market: Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 MRI System are Expected to Be the Fastest Growing Segment in the Forecast Period

Figure 7 Angiogrpahy has the Largest Share of the Market

Figure 8 Cardiology Command the Largest Share of Interventional Radiology Market

Figure 9 North America to Dominate the Market

Figure 10 Rising Prevalence of Chronic Diseases, the Key Driver of Market Growth

Figure 11 MRI Systems Product Segment to Account for the Largest Market Share in 2016

Figure 12 Asia to Register the Highest CAGR During the Forecast Period

Figure 13 North America and Europe—Mature Markets for Interventional Radiology

Figure 14 Market: Porter’s Five Forces Analysis

Figure 15 Interventional Radiology: Supply Chain Analysis

Figure 16 Market: Drivers, Restraints, Opportunities, & Challenges

Figure 17 Global Incidence of Cancer, By Type (2012–2035)

Figure 18 MRI Systems Products Segment to Dominate the Market During the Forecast Period

Figure 19 Angiography Procedures Segment to Dominate the Market in 2016

Figure 20 Cardiology Segment to Dominate the Interventional Radiology Applications Market During the Forecast Period

Figure 21 Global Cancer Incidence, By Region, 2012-2020

Figure 22 North America to Dominate the Market in 2016

Figure 23 North America: Global Market Snapshot

Figure 24 MRI Systems Segment to Hold Largest Share of the North American Market

Figure 25 Europe : Market Snapshot

Figure 26 Europe: MRI Systems to Hold the Largest Market Share, By Product

Figure 27 Asia: Global Market Snapshot

Figure 28 MRI Systems, the Fastest-Growing Product Segment in the Asian Market

Figure 29 RoW: Market Snapshot

Figure 30 MRI Systems to Dominate the RoW Market During the Forecast Period

Figure 31 Product Launches, the Most Adopted Growth Strategy From 2013 to 2016

Figure 32 Global Interventional Radiology Imaging Market Share, By Key Player, 2015

Figure 33 Battle for Market Share: New Product Launches Was the Key Strategy Pursued By Market Players Between 2013 & 2016

Figure 34 Geographic Revenue Mix of Top Market Players

Figure 35 GE Healthcare: Company Snapshot (2015)

Figure 36 Siemens AG: Company Snapshot (2015)

Figure 37 Koninklijke Philips N.V.: Company Snapshot (2015)

Figure 38 Toshiba Medical Systems Corporation: Company Snapshot (2015)

Figure 39 Hitachi Ltd: Company Snapshot (2015)

Figure 40 Hologic Inc.: Company Snapshot (2015)

Figure 41 Shimadzu Corporation: Company Snapshot (2015)

Figure 42 Samsung Electronics: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Interventional Radiology Imaging Market